USD/JPY Retraces as Fed's Dovish Signals Impact Dollar

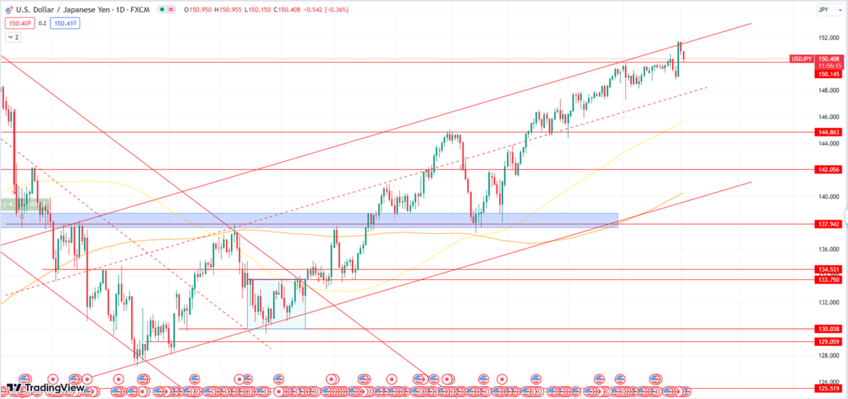

The USD/JPY pair, which recently touched a high near 151.70, has retraced and is now hovering just above the 150.00 psychological level, down by over 0.50% for the day. This decline comes as expectations of the Federal Reserve nearing the end of its tightening policy weigh on the US Dollar (USD). Despite the Fed leaving key interest rates unchanged and indicating the possibility of future rate hikes due to unexpected US economic resilience, Fed Chair Jerome Powell's remarks about the impact of rising borrowing costs have led to speculations that rate cuts may begin by June next year.

Furthermore, speculation of Japanese intervention to prevent the yen's depreciation and the Bank of Japan's (BoJ) dovish stance contribute to the negative sentiment surrounding the USD/JPY pair. The BoJ's minor policy adjustments suggest a slow shift away from massive stimulus, contrasting with the relatively hawkish Fed. However, the attractiveness of Japanese government bonds remains low.

The market is keeping an eye on upcoming US economic data, including Weekly Initial Jobless Claims and Factory Orders, as well as US bond yields, for further direction. Additionally, broader risk sentiment and the highly anticipated US Non-Farm Payrolls (NFP) report on Friday will influence short-term trading opportunities for the USD/JPY pair.

The USDJPY corrects back toward the 150.1 level from the 151.70 resistance level as the dollar is weak and also as BoJ's possibility of intervention is high. Volatility is still possible to be high especially as the price is beyond 150.00.

|

Resistance 3 |

Resistance 2 |

Resistance 1 |

Support 1 |

Support 2 |

Support 3 |

|

155.00 |

153.50 |

152.00 |

150.00 |

148.00 |

146.50 |