The EUR/USD hovered near $1.177 on Monday in cautious trade as markets awaited the upcoming Fed minutes for rate cut signals, with uncertainty around U.S. trade policy weighing on sentiment.

The dollar found mild support while gold and silver slipped as improved U.S. trade talks and extended tariff exemptions reduced safe-haven demand. Meanwhile, the yen eased on weaker wage data, and the pound dipped ahead of the U.S. tariff deadline, leaving markets on edge for potential volatility as August approaches.

| Time | Cur. | Event | Forecast | Previous |

| 06:00 | GBP | Halifax House Price Index (MoM) (Jun) | -0.1% | -0.4% |

| 10:00 | EUR | Eurogroup Meetings | ||

| 20:30 | USD | Fed's Balance Sheet | 6,622B |

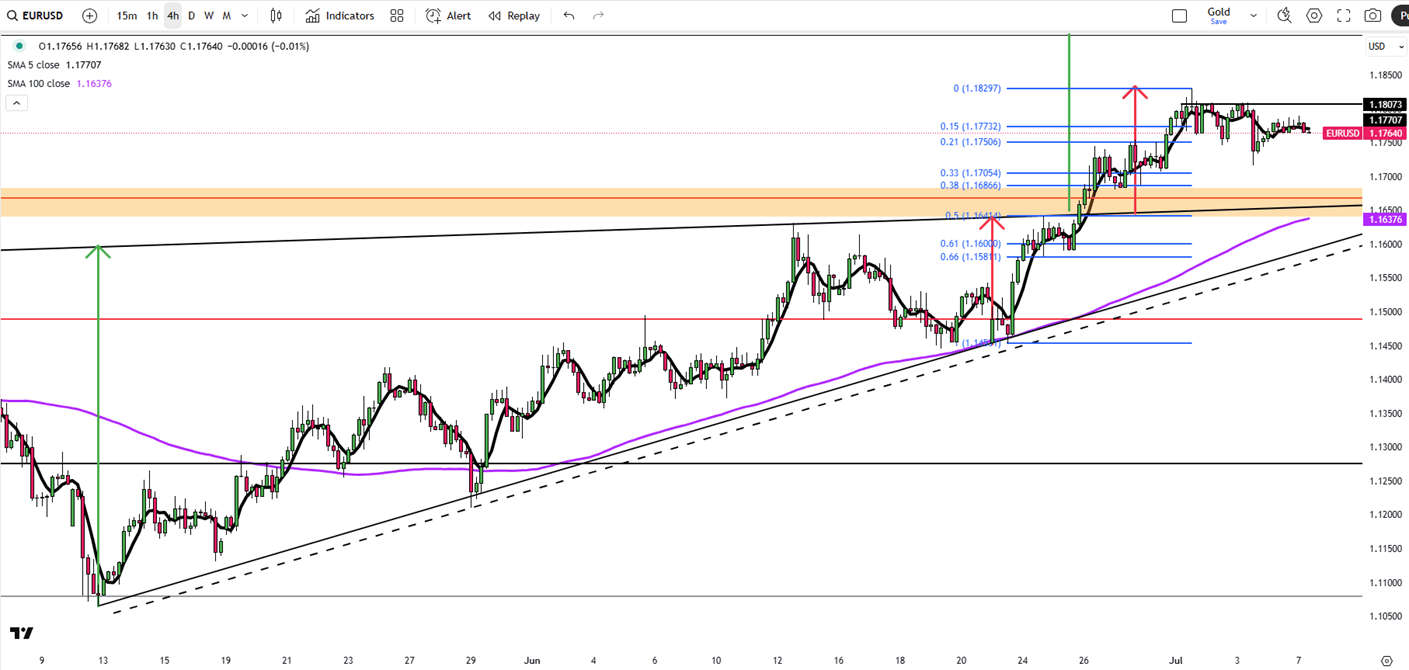

EUR/USD hovered around $1.177 on Monday, staying just under last week’s peak of $1.1830, as cautious sentiment and mixed dollar moves kept the pair within a tight range. Uncertainty over U.S. trade policy and its effects on growth and inflation weighed on the dollar, lending some support to the euro. However, gains were limited as the dollar index rose to 97.071. With a light economic calendar and few Fed speakers ahead, markets are looking to Fed minutes for signals on potential rate cuts, while the ECB maintains its current stance.

Resistance for the pair is at 1.1830, while support is at 1.1730.

| R1: 1.1830 | S1: 1.1730 |

| R2: 1.1910 | S2: 1.1690 |

| R3: 1.2015 | S3: 1.1630 |

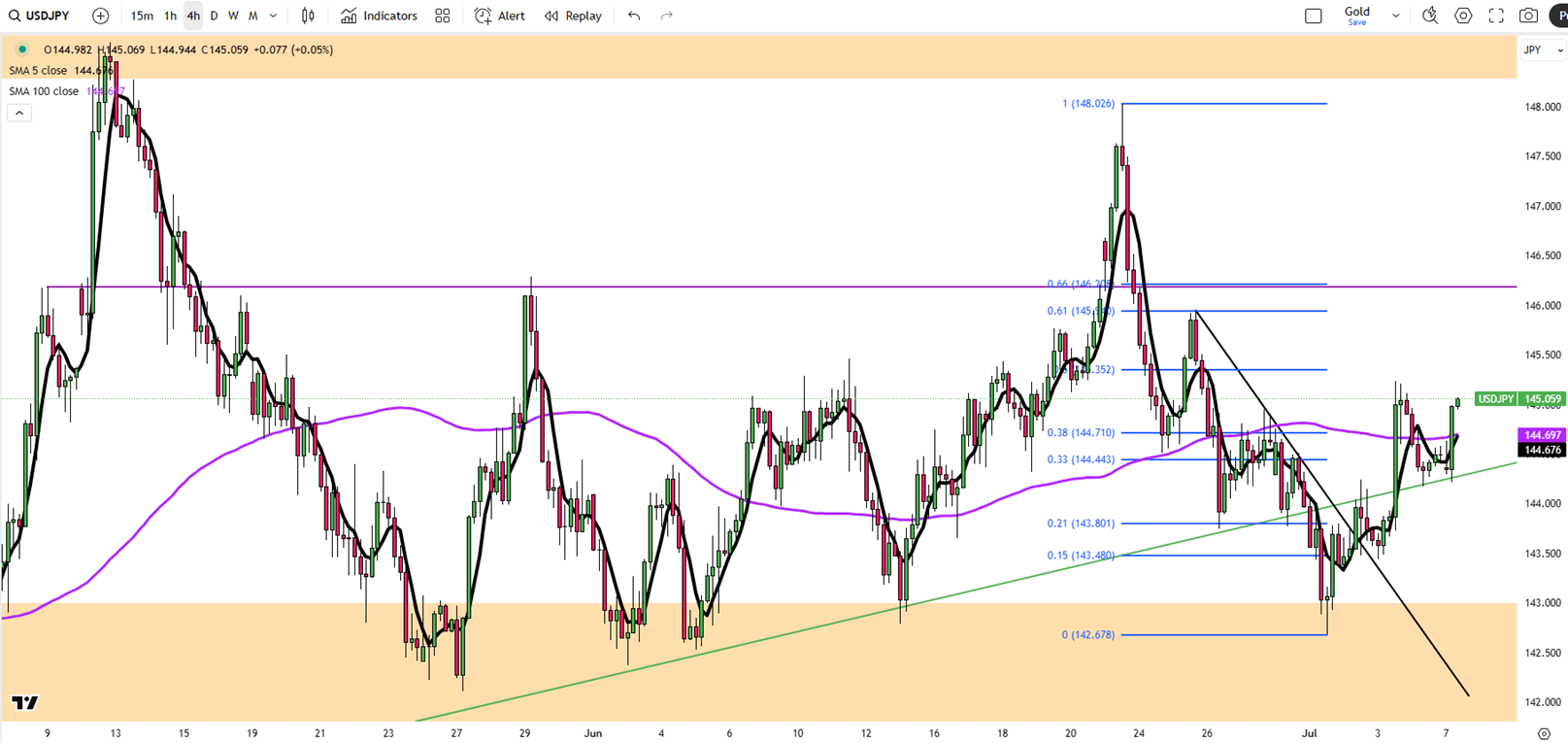

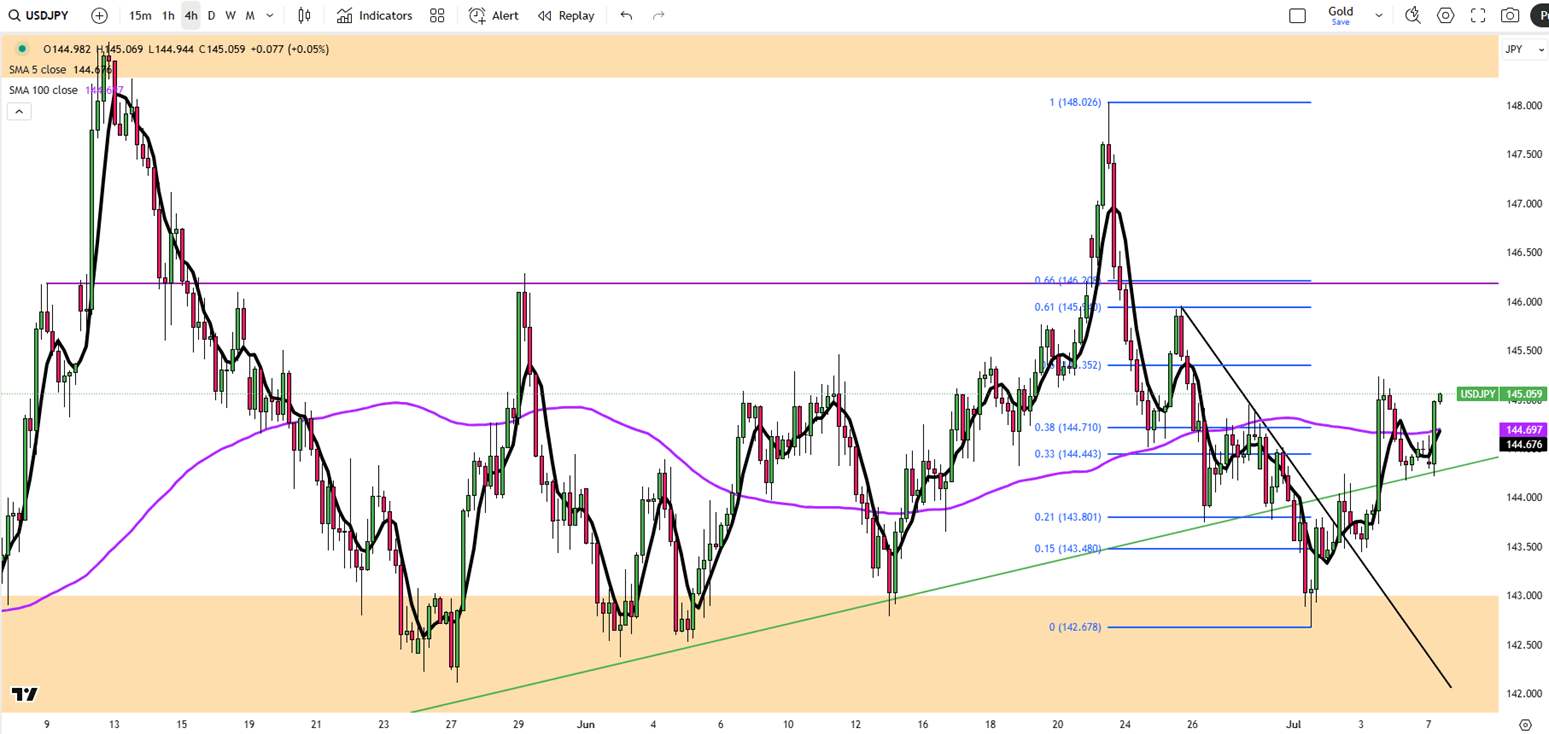

The Japanese yen eased toward 145 per dollar on Monday, giving back earlier gains after wage data came in weaker compared to the forecasts. This reduced prospects for additional Bank of Japan rate hikes. Nominal wages rose only 1% in May, below forecasts, while real wages fell 2.9%, marking the steepest decline in nearly two years. The data does not yet capture the record pay increases from this year’s labor agreements, as smaller firms are slower to adjust. Meanwhile, Prime Minister Ishiba said he would not "easily compromise" in U.S. trade discussions, as Japan aims to avoid tariffs of up to 35% on its exports.

The key resistance is at $145.35, meanwhile the major support is located at $143.55.

| R1: 145.35 | S1: 143.55 |

| R2: 146.20 | S2: 142.45 |

| R3: 147.00 | S3: 141.00 |

Gold slipped below $3,310 per ounce on Monday, a one-week low, as safe-haven demand eased amid progress in U.S. trade talks and extended tariff exemptions. The U.S. is close to finalizing several trade deals, with updated tariff rates expected by July 9 and implementation on August 1, leaving room for continued negotiations. Meanwhile, strong U.S. jobs data reduced the chances of a Fed rate cut in July, with markets now expecting only two cuts this year. Geopolitical tensions persisted as indirect ceasefire talks between Hamas and Israel in Qatar ended without progress.

Resistance is at $3,365, while support holds at $3,300.

| R1: 3365 | S1: 3300 |

| R2: 3395 | S2: 3250 |

| R3: 3430 | S3: 3200 |

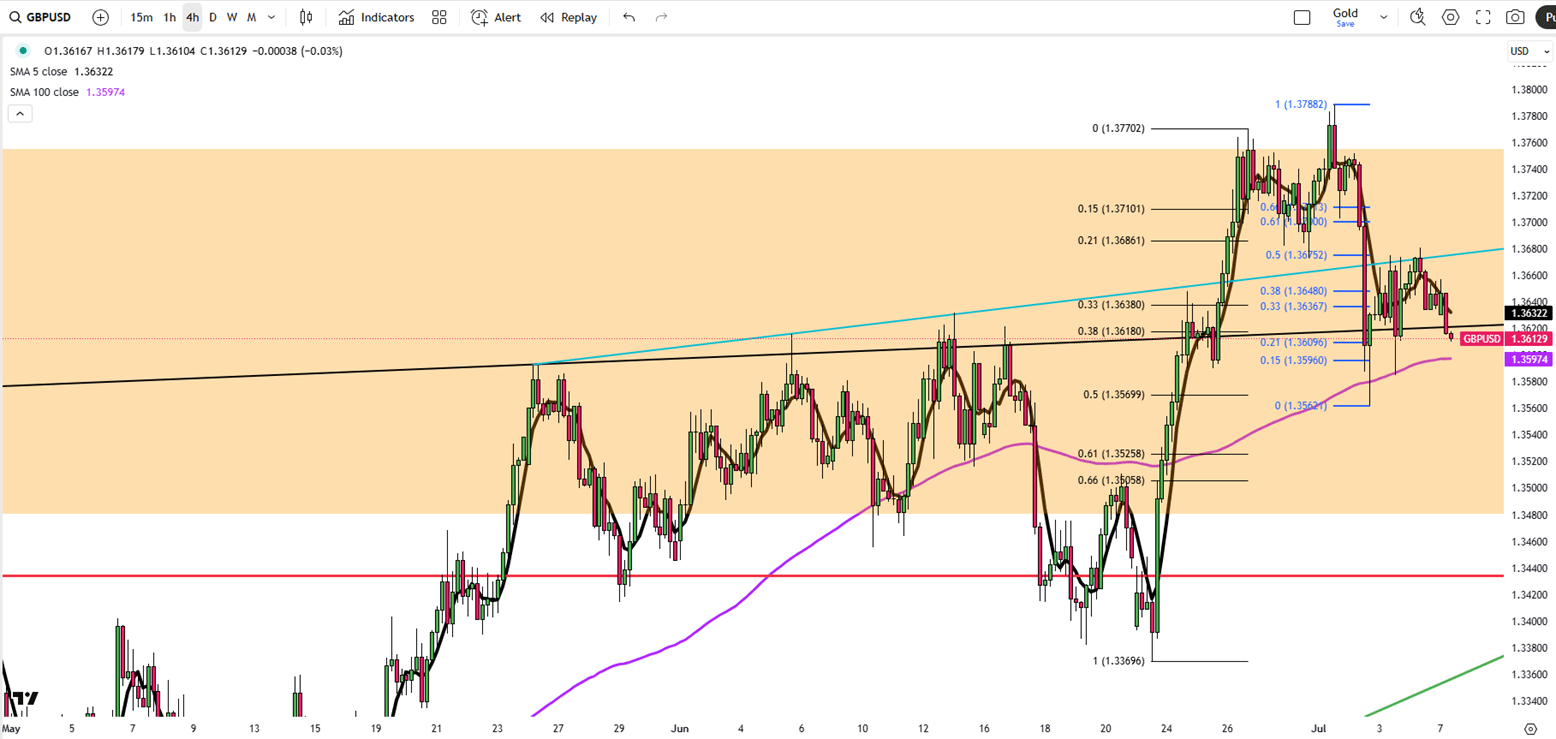

GBP/USD slipped to around 1.3628 on Monday, tracking declines in other major currencies as traders stayed cautious ahead of the upcoming U.S. tariff deadline. Although the dollar has recently been weaker, it found support as markets prepared for potential volatility with President Trump set to announce new trade levies taking effect from August 1. The pound also faced pressure from broader risk sentiment and a lack of new UK data, leaving it sensitive to trade and U.S. policy updates.

Resistance is at 1.3700, while support holds at 1.3600.

| R1: 1.3700 | S1: 1.3600 |

| R2: 1.3760 | S2: 1.3500 |

| R3: 1.3800 | S3: 1.3430 |

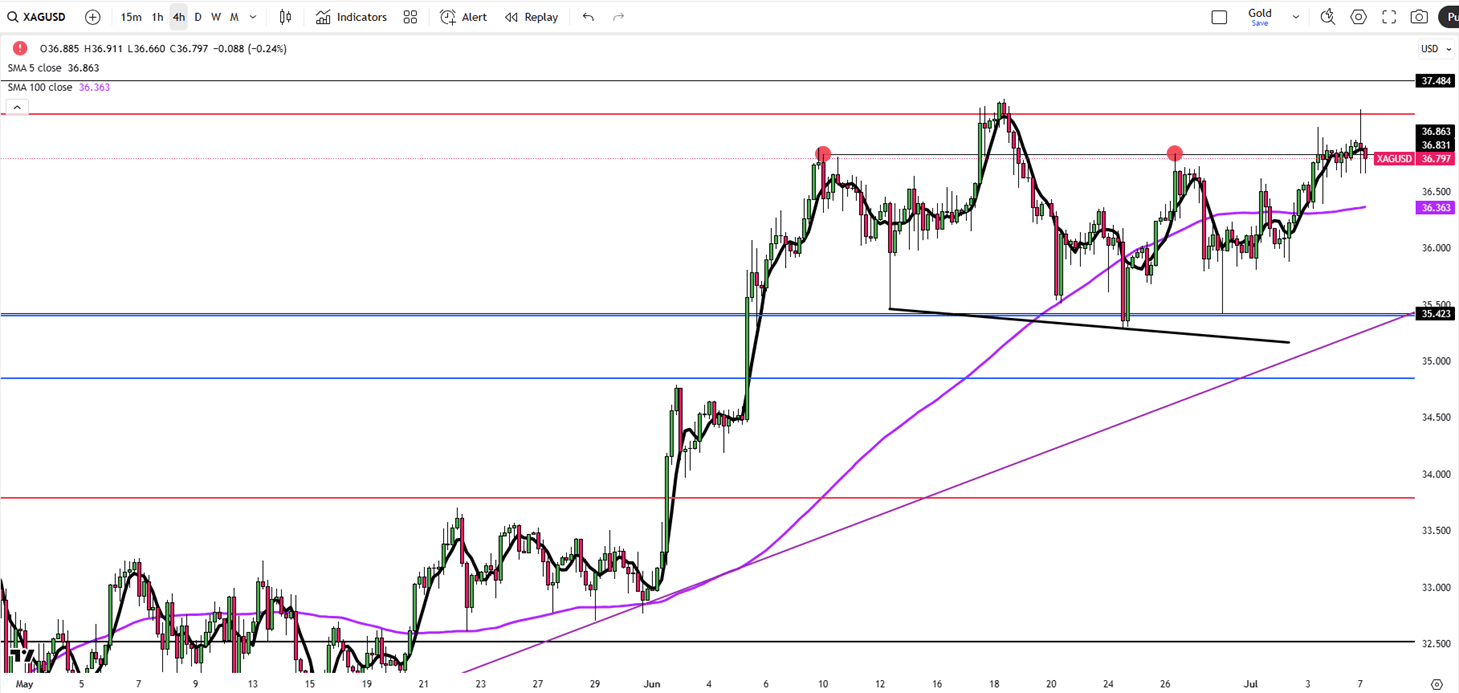

Silver edged down to $36.75 per ounce on Monday, moving slightly lower with gold as better trade sentiment and extended U.S. tariff exemptions eased safe-haven demand. However, losses were limited by silver’s strong industrial demand prospects and persistent market deficits. A softer U.S. dollar, which lowers costs for international buyers, also helped limit the decline. Despite the dip, silver remains supported by ongoing geopolitical risks and inflation concerns.

Resistance is at 37.50, while support holds at 35.40.

| R1: 37.50 | S1: 35.40 |

| R2: 39.00 | S2: 34.85 |

| R3: 41.00 | S3: 33.80 |

Días festivos de verano en el Reino Unido (25 y 26 de agosto de 2025)

Días festivos de verano en el Reino Unido (25 y 26 de agosto de 2025)Nos gustaría informarle de los ajustes en el calendario de negociación de los instrumentos que se indican a continuación con motivo de los días festivos de verano en Inglaterra y Gales los días 25 y 26 de agosto de 2025.

Detalle El euro cae ante la cautela de la Fed, la libra esterlina espera el IPC (20/08/2025)El euro cayó cerca de 1,1640 antes del discurso de Powell en Jackson Hole y las conversaciones de paz en Ucrania, mientras que el yen se fortaleció hasta 147,5 a pesar de las débiles cifras comerciales.

Detalle La libra se acerca a un máximo de cinco semanas por sólidos datos del Reino Unido (08.19.2025)El euro cayó hasta 1,1660 dólares, ya que las conversaciones de paz entre Trump, Zelenskiy y los líderes de la UE suscitaron preocupación, mientras que la atención se centró en el discurso de Powell en Jackson Hole y las actas de la Fed, con una probable bajada de tipos en septiembre.

DetalleÚnase a nuestro canal de Telegram y suscríbase gratis a nuestro boletín de señales de trading.

Únete a nosotros en Telegram