The dollar weakened further on Tuesday as concerns over the Fed’s independence and mounting U.S.-China trade tensions rattled investors.

EUR/USD remained firm above 1.15, while the Japanese yen surged to seven-month highs and gold hit a record above $3,460 on safe-haven flows. The British pound extended gains despite softer inflation data, and silver rebounded toward $33 amid geopolitical risks. Markets now await central bank commentary and trade policy clarity amid rising political noise.

| Time | Cur. | Event | Forecast | Previous |

| 5:00 | JPY | BoJ Core CPI (YoY) | 2.40% | 2.20% |

| 13:30 | USD | FOMC Member Harker Speaks | | |

| 14:00 | EUR | ECB President Lagarde Speaks | | |

| 17:00 | EUR | ECB's De Guindos Speaks | | |

| 18:00 | USD | FOMC Member Kashkari Speaks | | |

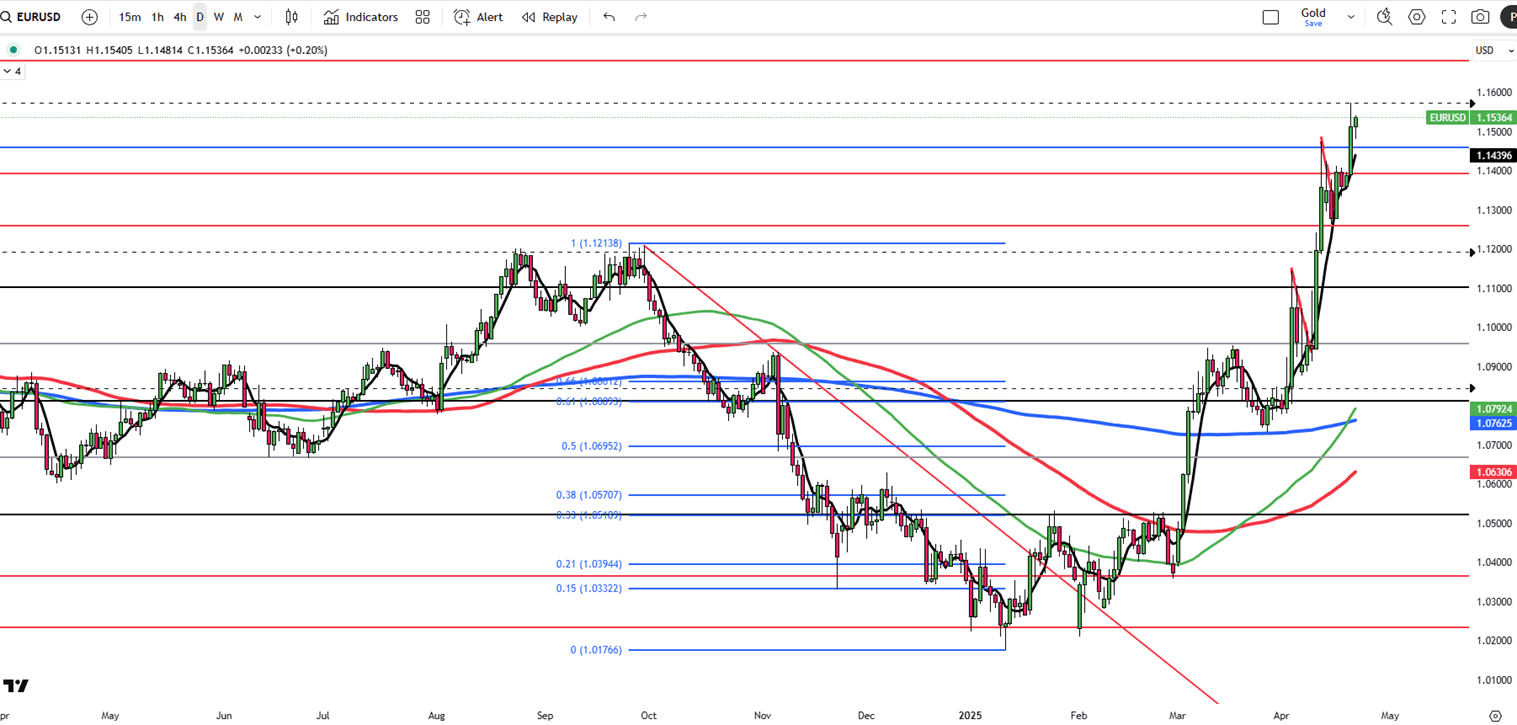

EUR/USD traded around 1.1530 on Tuesday, while the dollar index remained around 98.4, weighed down by concerns about the Federal Reserve’s independence and escalating trade tensions. President Trump called for swift rate cuts and suggested removing Fed Chair Jerome Powell, fueling worries over political influence on monetary policy. The sentiment was further impacted by stalled US-China negotiations and China’s warnings to countries aligning with Washington.

Key resistance is at 1.1550, followed by 1.1600 and 1.1680. Support lies at 1.1400, then 1.1260 and 1.1180.

| R1: 1.1550 | S1: 1.1400 |

| R2: 1.1600 | S2: 1.1260 |

| R3: 1.1680 | S3: 1.1180 |

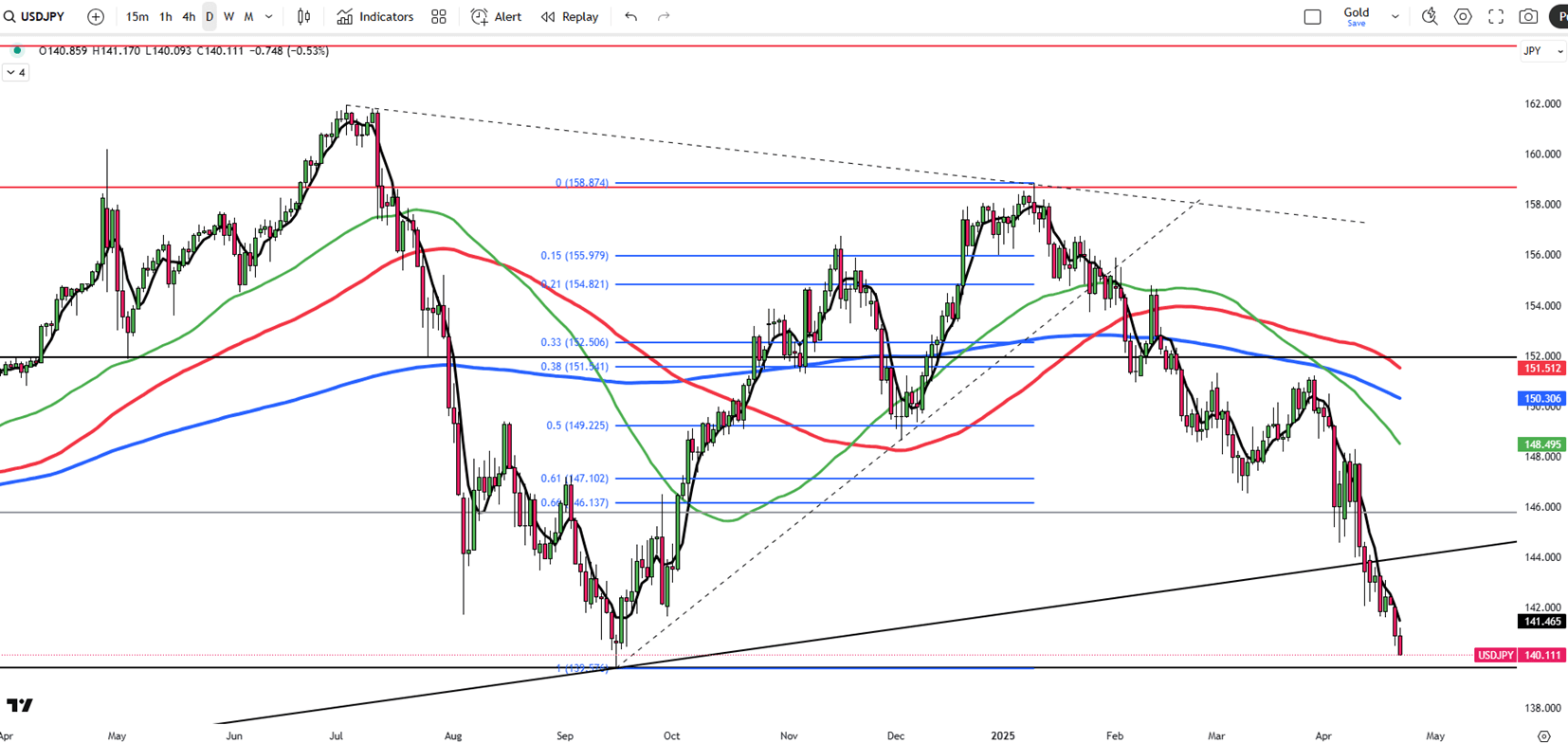

The Japanese yen strengthened to approximately 140.5 per dollar on Tuesday, marking its strongest level in seven months, as investors sought safe-haven assets amid heightened global trade tensions and concerns over U.S. economic stability. Market sentiment declined following stalled trade talks, with China resisting President Trump's tariff demands. Confidence further eroded after Trump renewed calls to remove Fed Chair Powell over delayed rate cuts. Attention now turns to the upcoming Bank of Japan meeting, where rates are likely to remain at 0.5%, though the central bank may lower its growth forecast due to mounting external pressures.

Key resistance is at 142.00, with further levels at 144.00 and 145.90. Support stands at 139.70, followed by 137.00 and 135.00.

| R1: 142.00 | S1: 139.70 |

| R2: 144.00 | S2: 137.00 |

| R3: 145.90 | S3: 135.00 |

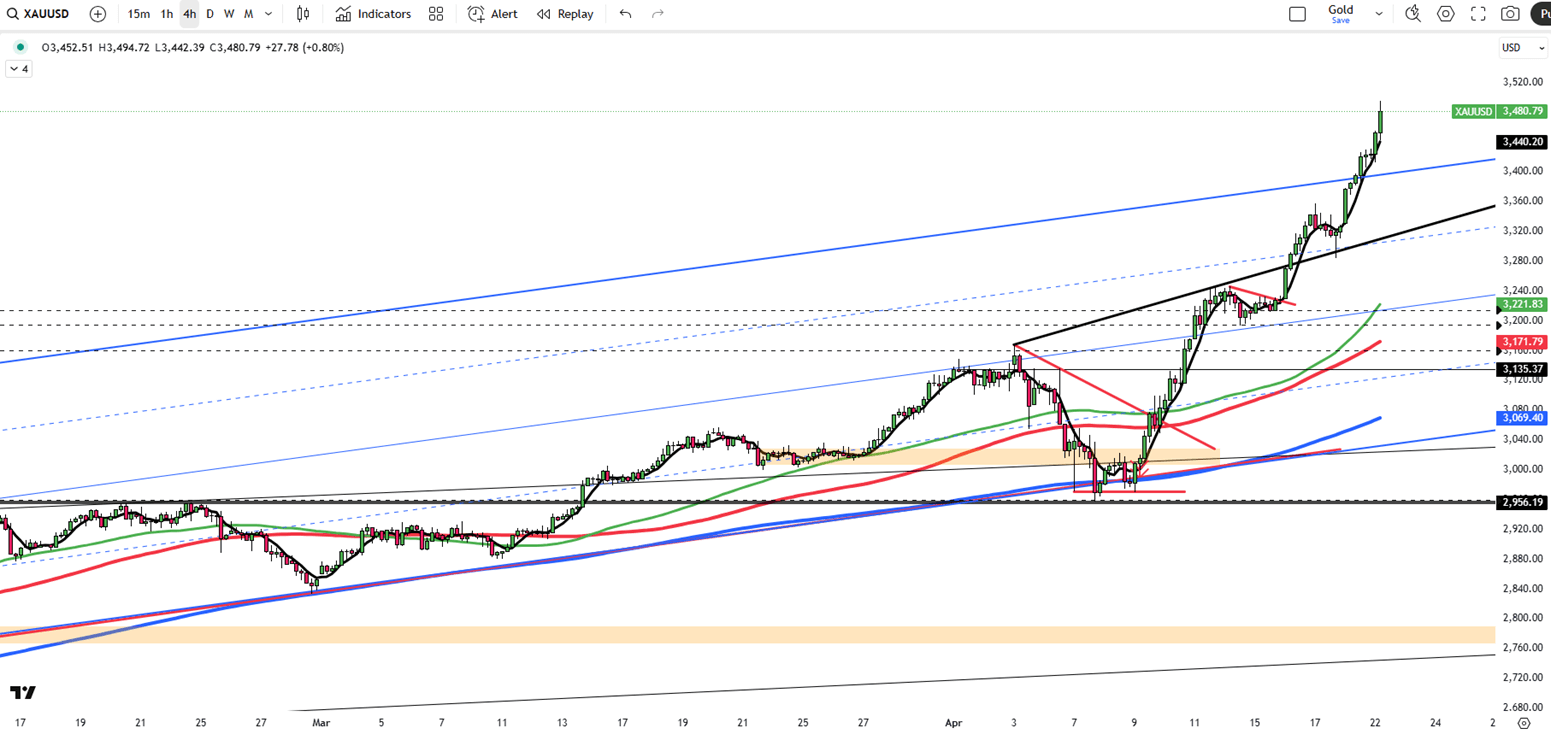

Gold surged past $3,460 per ounce on Tuesday, reaching a new record as demand for safe-haven assets intensified amid growing economic uncertainty. The rally followed President Trump’s renewed criticism of Fed Chair Powell, including remarks about his possible removal and calls for immediate rate cuts—raising concerns about political interference and Fed independence. Continued U.S.-China trade tensions, including a new probe into mineral tariffs, added to market anxiety. Gold is now up over 30% for the year.

Key resistance is at $3500, followed by $3,550 and $3,600. Support stands at $3400, then $3356 and $3300.

| R1: 3400 | S1: 3400 |

| R2: 3550 | S2: 3356 |

| R3: 3600 | S3: 3300 |

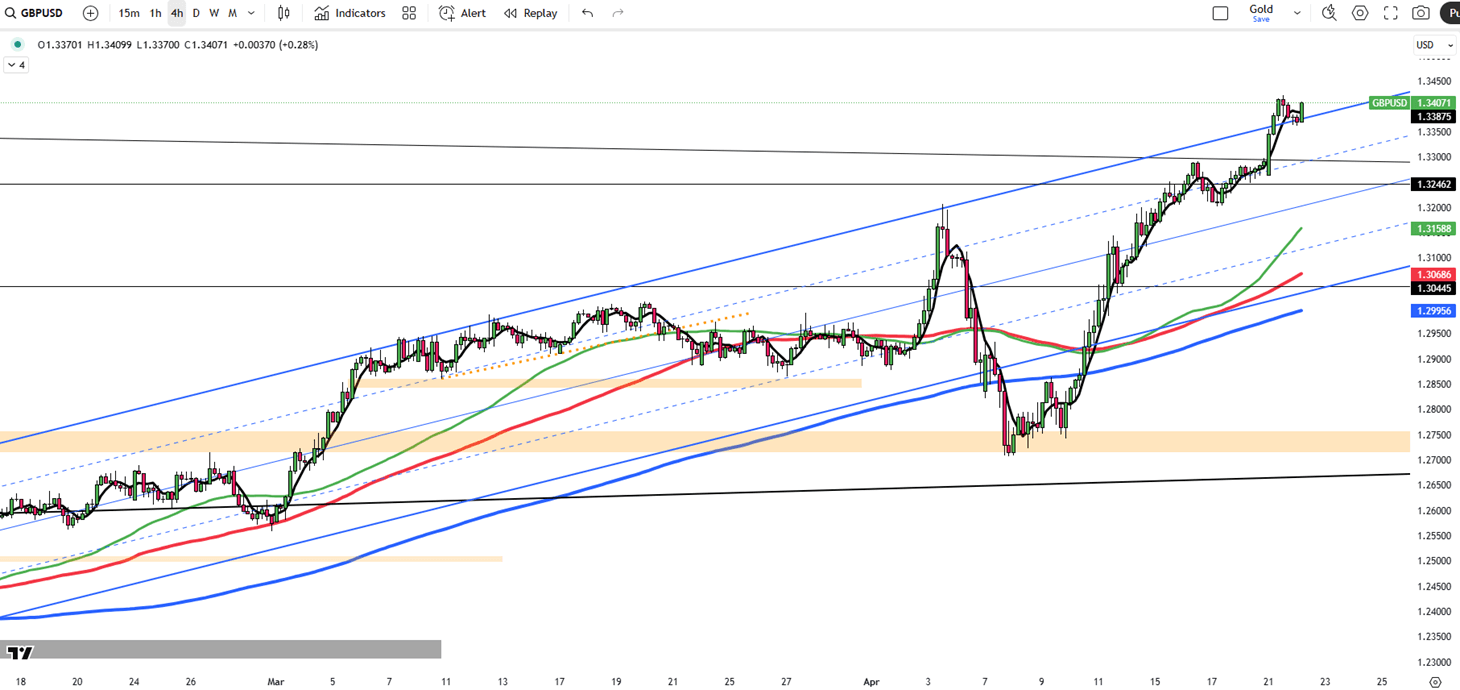

The British Pound rose above $1.34 on Tuesday, its highest level in seven months, supported by broad dollar weakness. This gain came despite UK inflation softening more than expected, with headline CPI at 2.6% and services inflation down to 4.7%. Easing price pressures led markets to raise expectations for Bank of England rate cuts, now pricing in 86 basis points of easing by year-end, with a fourth cut increasingly likely.

If GBP/USD breaks above 1.3430, resistance levels are at 1.3500 and 1.3550. Support is at 1.3300, followed by 1.3200 and 1.3050.

| R1: 1.3430 | S1: 1.3300 |

| R2: 1.3500 | S2: 1.3200 |

| R3: 1.3550 | S3: 1.3050 |

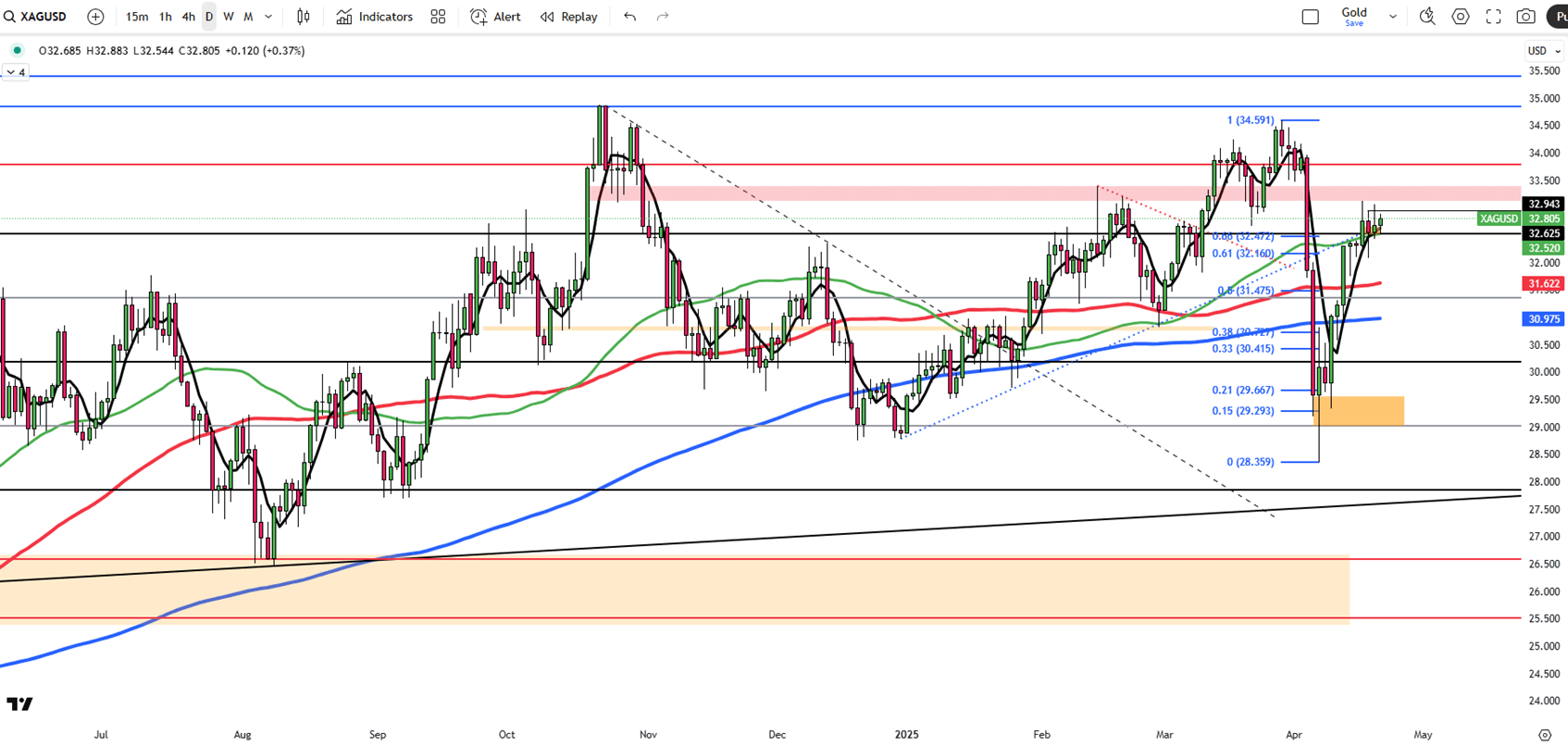

Silver climbed nearly 1% to around $32.80 per ounce on Tuesday, rebounding from last week’s losses as a weaker US dollar and rising geopolitical risks lifted safe-haven demand. The dollar slipped amid growing concerns over the Fed’s independence after President Trump suggested removing Chair Powell. Heightened tensions with China also added to market caution.

On the technical side, resistance stands at $33.15, followed by $33.80 and $34.20 if the rally continues. Support is seen at $31.40, with $30.20 and $29.00 as lower levels to watch.

| R1: 33.15 | S1: 31.40 |

| R2: 33.80 | S2: 30.20 |

| R3: 34.20 | S3: 29.00 |

Días festivos de verano en el Reino Unido (25 y 26 de agosto de 2025)

Días festivos de verano en el Reino Unido (25 y 26 de agosto de 2025)Nos gustaría informarle de los ajustes en el calendario de negociación de los instrumentos que se indican a continuación con motivo de los días festivos de verano en Inglaterra y Gales los días 25 y 26 de agosto de 2025.

Detalle El euro cae ante la cautela de la Fed, la libra esterlina espera el IPC (20/08/2025)El euro cayó cerca de 1,1640 antes del discurso de Powell en Jackson Hole y las conversaciones de paz en Ucrania, mientras que el yen se fortaleció hasta 147,5 a pesar de las débiles cifras comerciales.

Detalle La libra se acerca a un máximo de cinco semanas por sólidos datos del Reino Unido (08.19.2025)El euro cayó hasta 1,1660 dólares, ya que las conversaciones de paz entre Trump, Zelenskiy y los líderes de la UE suscitaron preocupación, mientras que la atención se centró en el discurso de Powell en Jackson Hole y las actas de la Fed, con una probable bajada de tipos en septiembre.

DetalleÚnase a nuestro canal de Telegram y suscríbase gratis a nuestro boletín de señales de trading.

Únete a nosotros en Telegram