Markets reacted sharply after the U.S. announced sweeping tariffs on global imports.

The euro surged past $1.10 and the pound reached a six-month high, while the yen climbed on safe-haven demand. Gold held near record levels amid trade fallout fears, even as silver tumbled over 4% in a broader commodity selloff. With global growth now under pressure and the Fed’s next move uncertain, all eyes are on the U.S. payrolls report for further direction.

| Time | Cur. | Event | Forecast | Previous |

| 12:30 | USD | Nonfarm Payrolls | 137K | 151K |

| 12:30 | USD | Average Hourly Earnings (MoM) (Mar) | 0.3% | 0.3% |

| 12:30 | USD | Unemployment Rate (Mar) | 4.1% | 4.1% |

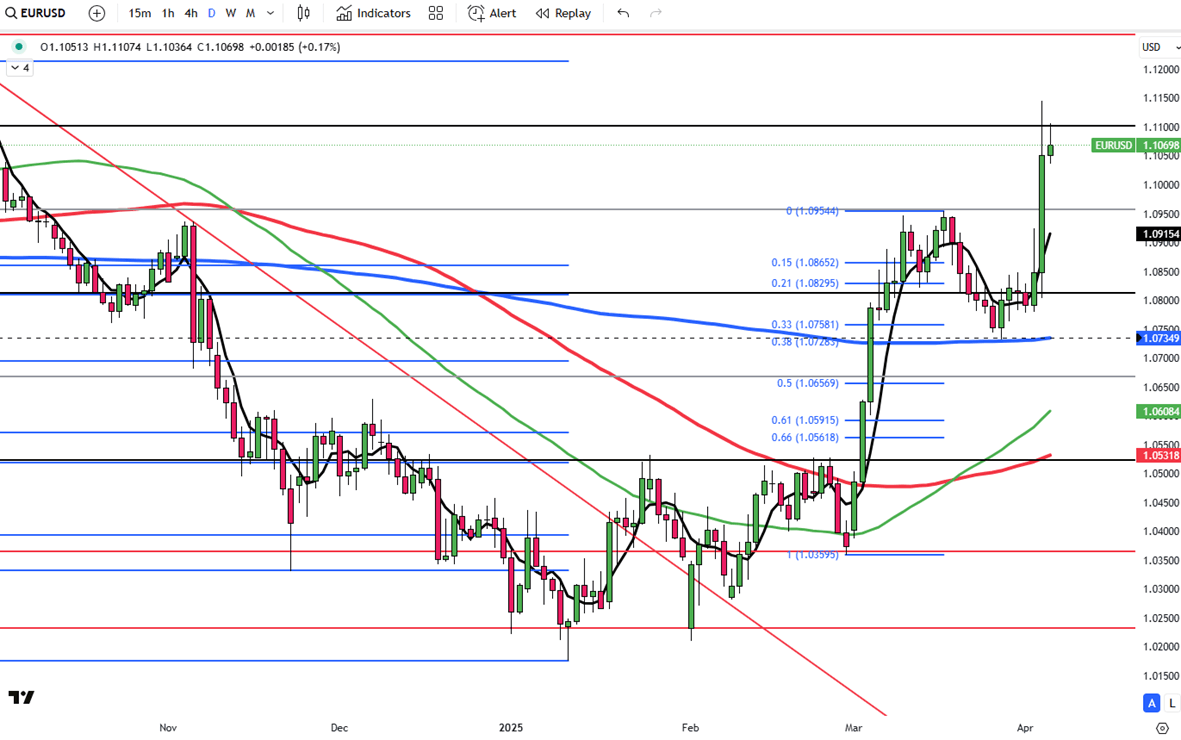

The euro surged over 2%, breaking above $1.10 for the first time since October 2024, as the U.S. dollar weakened after Trump’s tariff announcement. The U.S. will impose a 10% tariff on all imports, with rates up to 20% on the EU.

EU chief von der Leyen warned of a “major blow” to the global economy and confirmed retaliation plans. With 20% of EU exports heading to the U.S., Germany is expected to be hit hardest.

Markets now price in a 90% chance of a 25bps ECB rate cut in April, with the deposit rate expected to fall to 1.82% by year-end, down from 2.5% currently.

Key resistance is at 1.1100, followed by 1.1150 and 1.1215. Support lies at 1.1000, then 1.0850 and 1.0730.

| R1: 1.1100 | S1: 1.1000 |

| R2: 1.1150 | S2: 1.0850 |

| R3: 1.1215 | S3: 1.0730 |

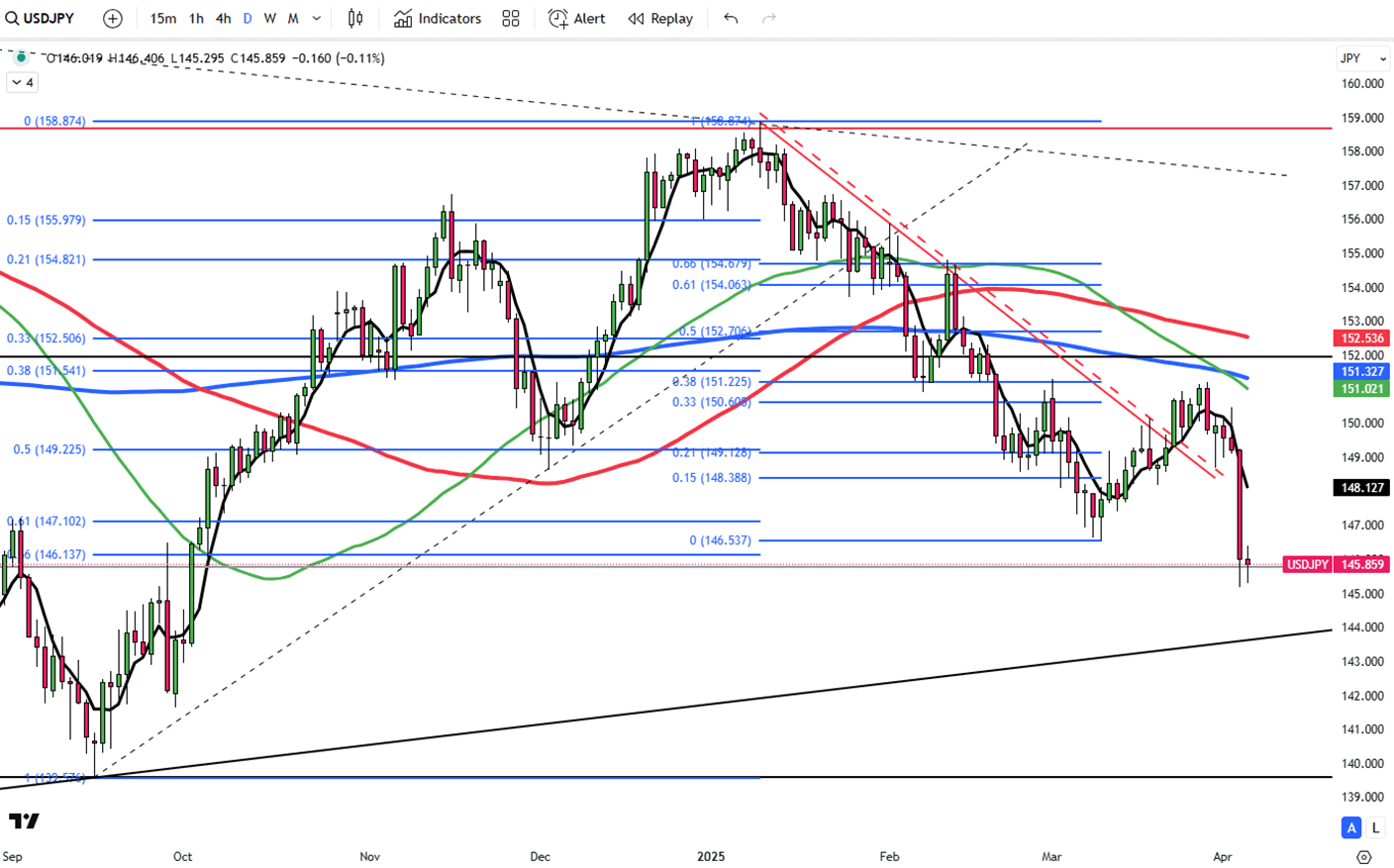

The yen traded near a six-month high of around 146 on Friday, after a 2% gain in the previous session, as Trump’s broad tariffs increased safe-haven demand. A 10% base tariff on all imports takes effect April 5, with higher rates on 60 countries—China (54%), EU (20%), Japan (24%), India (27%), and Vietnam (46%). Global growth fears and inflation concerns triggered a market sell-off, lifting the yen. Japan's data offered some support, with personal spending falling less than expected in February. The BoJ is still expected to raise rates this year, though trade and domestic uncertainties cloud the outlook.

Key resistance is at 147.00, with further levels at 151.70 and 152.70. Support stands at 145.80, followed by 143.00 and 141.80.

| R1: 147.00 | S1: 145.80 |

| R2: 151.70 | S2: 143.00 |

| R3: 152.70 | S3: 141.80 |

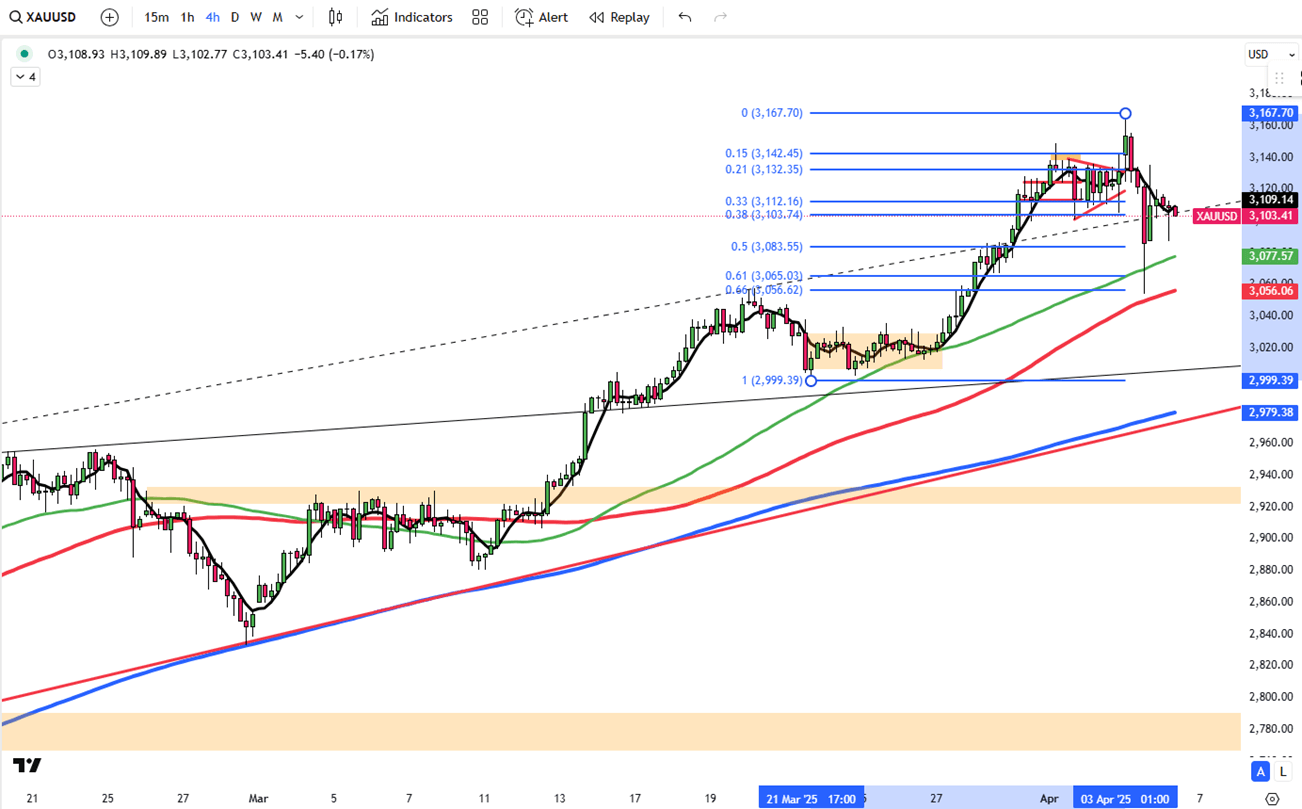

Gold held above $3,110 on Friday, heading for a fifth straight weekly gain after repeatedly hitting record highs, driven by risk aversion following Trump’s tariff rollout. The U.S. imposed a 10% base tariff on all imports, with higher rates for top trade partners, sparking global retaliation. Gold briefly dipped Thursday on profit-taking and news that precious metals were excluded from the tariff list. Still, strong safe-haven demand, Fed rate cut expectations, central bank buying, and rising ETF inflows supported gold. Investors now await the U.S. non-farm payrolls report for Fed policy signals.

Key resistance is at $3,150, followed by $3,200 and $3,250. Support stands at $3,085, then $3,055 and $3000.

| R1: 3150 | S1: 3085 |

| R2: 3200 | S2: 3055 |

| R3: 3250 | S3: 3000 |

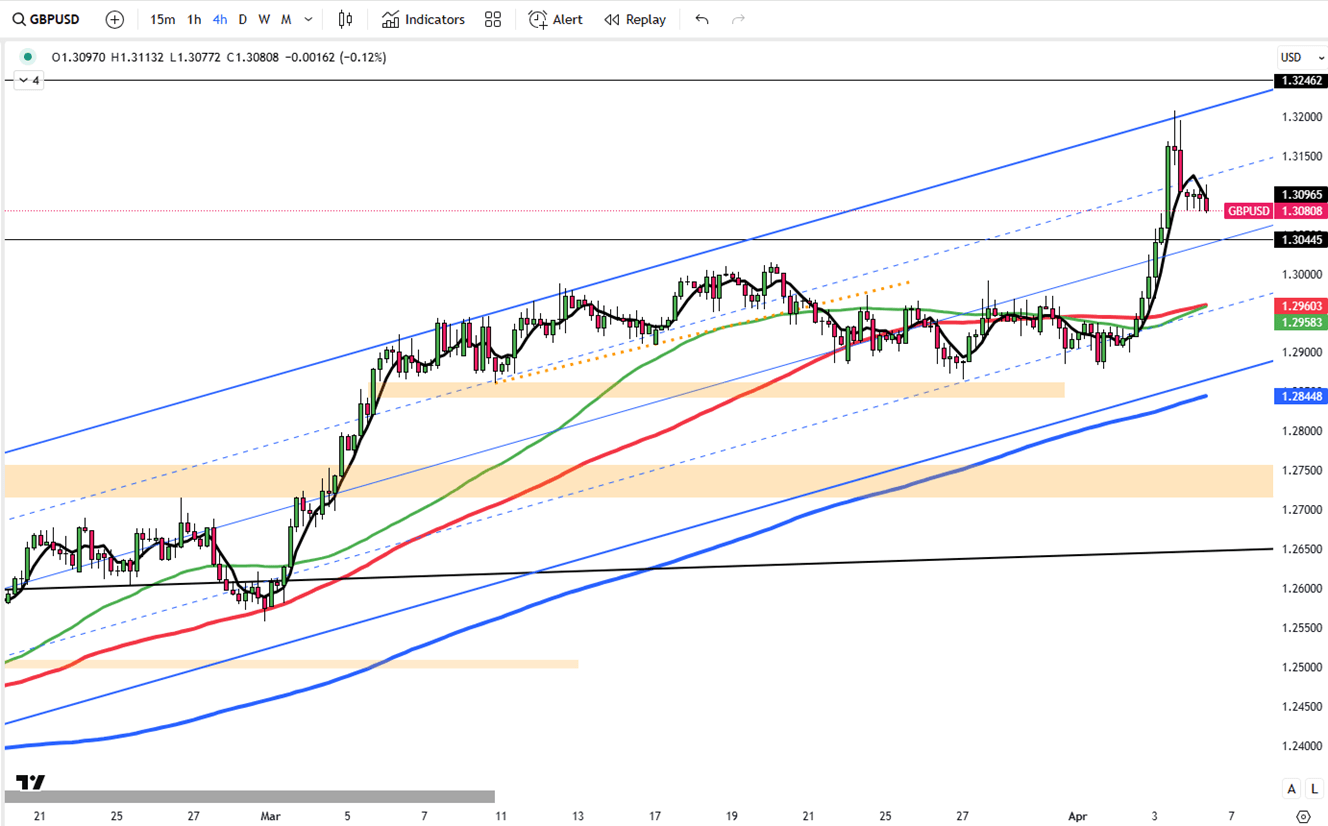

The British pound rose to $1.30, a six-month high, after a sharp drop in the U.S. dollar following Trump’s new reciprocal tariffs. The U.S. will apply a 10% tariff on all imports, including goods from the UK. The move sparked concerns over global economic stability, pushing investors toward safer assets. UK PM Starmer urged a calm response, saying the UK would focus on its own interests. Markets now expect the BoE to cut rates by 62bps by December, up from 54bps previously forecast on Wednesday.

If GBP/USD breaks above 1.3120, resistance levels are at 1.3150 and 1.3200. Support is at 1.3000, followed by 1.2950 and 1.2900.

| R1: 1.3120 | S1: 1.3000 |

| R2: 1.3150 | S2: 1.2950 |

| R3: 1.3200 | S3: 1.2900 |

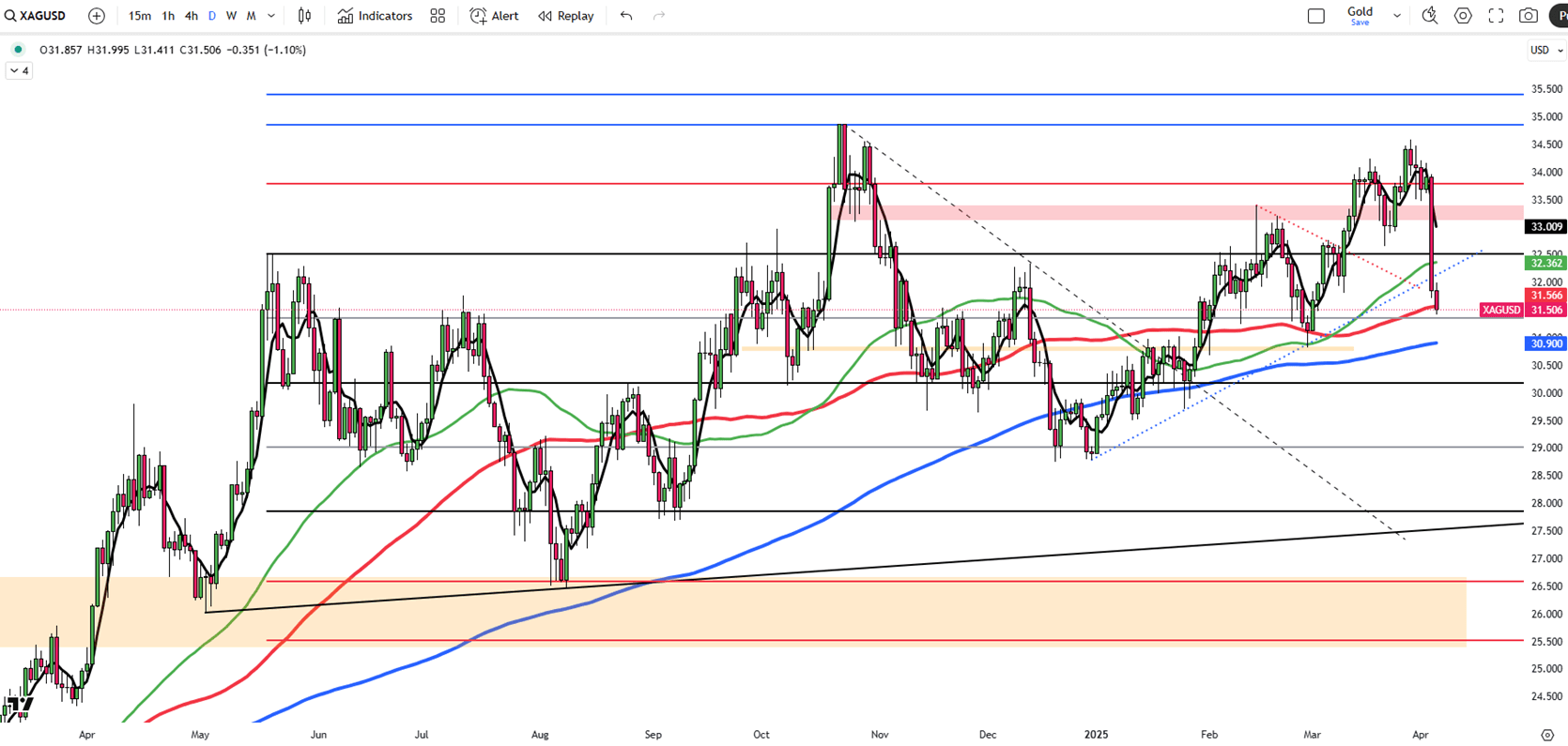

Silver fell over 4% to below $31.90 on Thursday, hitting a one-week low as Trump’s sweeping tariffs fueled market uncertainty. A 10% base tariff on all imports was announced, with higher rates for China (34%), the EU (20%), and Japan (24%), along with an immediate 25% levy on foreign-made cars. Trump defended the move as a way to support U.S. manufacturing and cut trade deficits. While gold hit a new record, silver declined amid a broader commodity selloff. U.S. data showed March manufacturing contracted, and February job openings fell to 7.57 million. Markets now turn to Friday’s nonfarm payrolls for economic signals.

If silver breaks above $32.50, resistance levels are at $33.00 and $33.80. Support stands at $30.85, followed by $30.20 and $29.00.

| R1: 32.50 | S1: 30.85 |

| R2: 33.00 | S2: 30.20 |

| R3: 33.80 | S3: 29.00 |

Días festivos de verano en el Reino Unido (25 y 26 de agosto de 2025)

Días festivos de verano en el Reino Unido (25 y 26 de agosto de 2025)Nos gustaría informarle de los ajustes en el calendario de negociación de los instrumentos que se indican a continuación con motivo de los días festivos de verano en Inglaterra y Gales los días 25 y 26 de agosto de 2025.

Detalle El euro cae ante la cautela de la Fed, la libra esterlina espera el IPC (20/08/2025)El euro cayó cerca de 1,1640 antes del discurso de Powell en Jackson Hole y las conversaciones de paz en Ucrania, mientras que el yen se fortaleció hasta 147,5 a pesar de las débiles cifras comerciales.

Detalle La libra se acerca a un máximo de cinco semanas por sólidos datos del Reino Unido (08.19.2025)El euro cayó hasta 1,1660 dólares, ya que las conversaciones de paz entre Trump, Zelenskiy y los líderes de la UE suscitaron preocupación, mientras que la atención se centró en el discurso de Powell en Jackson Hole y las actas de la Fed, con una probable bajada de tipos en septiembre.

DetalleÚnase a nuestro canal de Telegram y suscríbase gratis a nuestro boletín de señales de trading.

Únete a nosotros en Telegram