The euro held near 1.1550 on Friday after two days of declines, struggling to gain traction as the U.S. dollar consolidated near multi-month highs following the Fed’s hawkish tone.

The yen strengthened modestly on upbeat Tokyo inflation and retail data, while the pound slid below $1.32 amid renewed fiscal concerns. Gold slipped as risk appetite improved, though uncertainty from the prolonged U.S. government shutdown provided some support. Silver stayed firm near $49, maintaining momentum despite easing Fed cut expectations.

| Time | Cur. | Event | Forecast | Previous |

| 10:00 | EUR | CPI(YoY) | 2.1% | 2.2% |

| 13:45 | USD | Chicago PMI(Oct) | 42.3 | 40.6 |

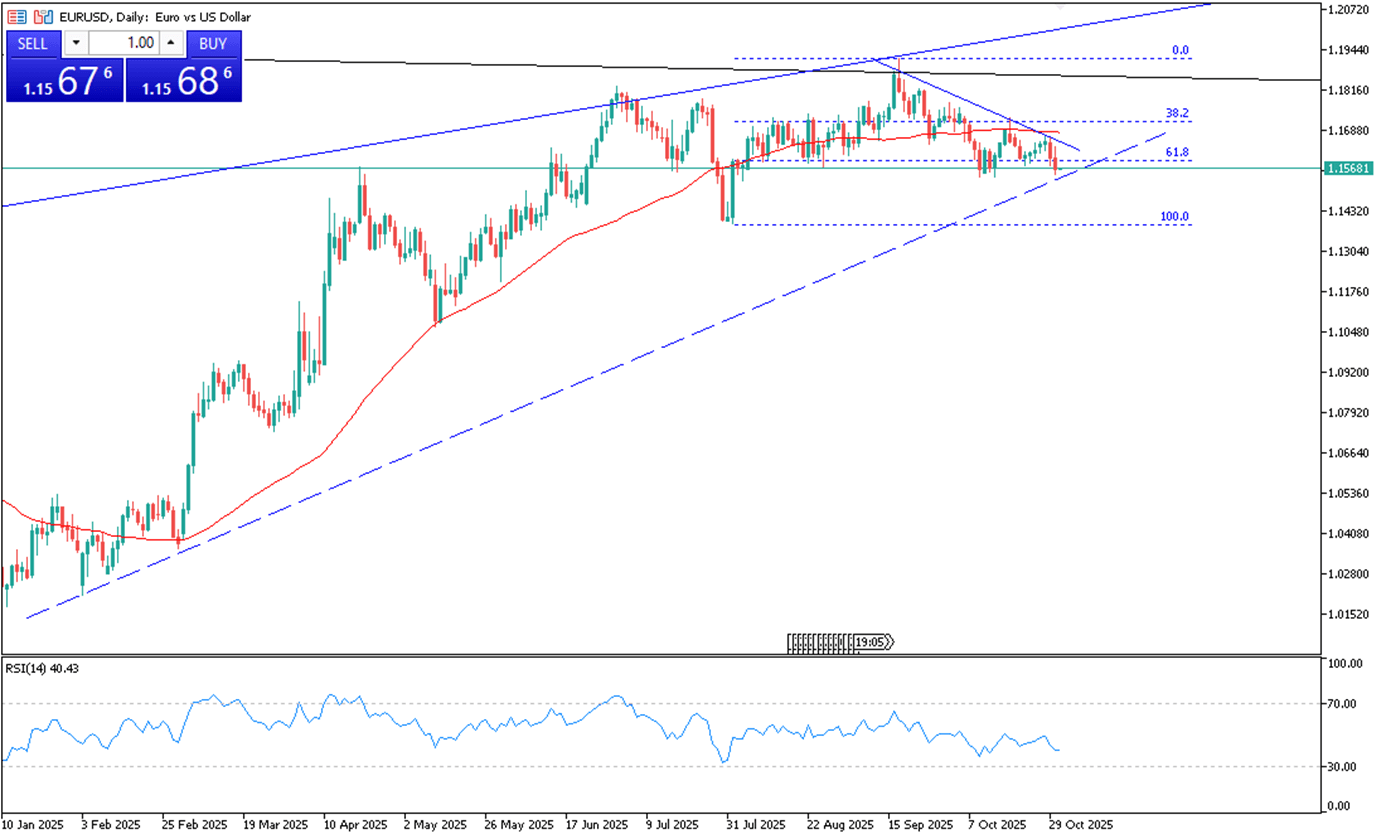

EUR/USD saw mild buying in Friday’s Asian session, edging up after a two-day drop but staying near its monthly low around 1.1550–1.1540. The pair traded near 1.1575, up less than 0.10%, lacking strong momentum. The dollar’s consolidation near its highest since early August continues to pressure the euro, with a notable USD pullback unlikely amid the Fed’s hawkish stance.

Technically, 1.1560 is the key support, while resistance is seen at 1.1600.

| R1: 1.1600 | S1: 1.1560 |

| R2: 1.1680 | S2: 1.1540 |

| R3: 1.1750 | S3: 1.1510 |

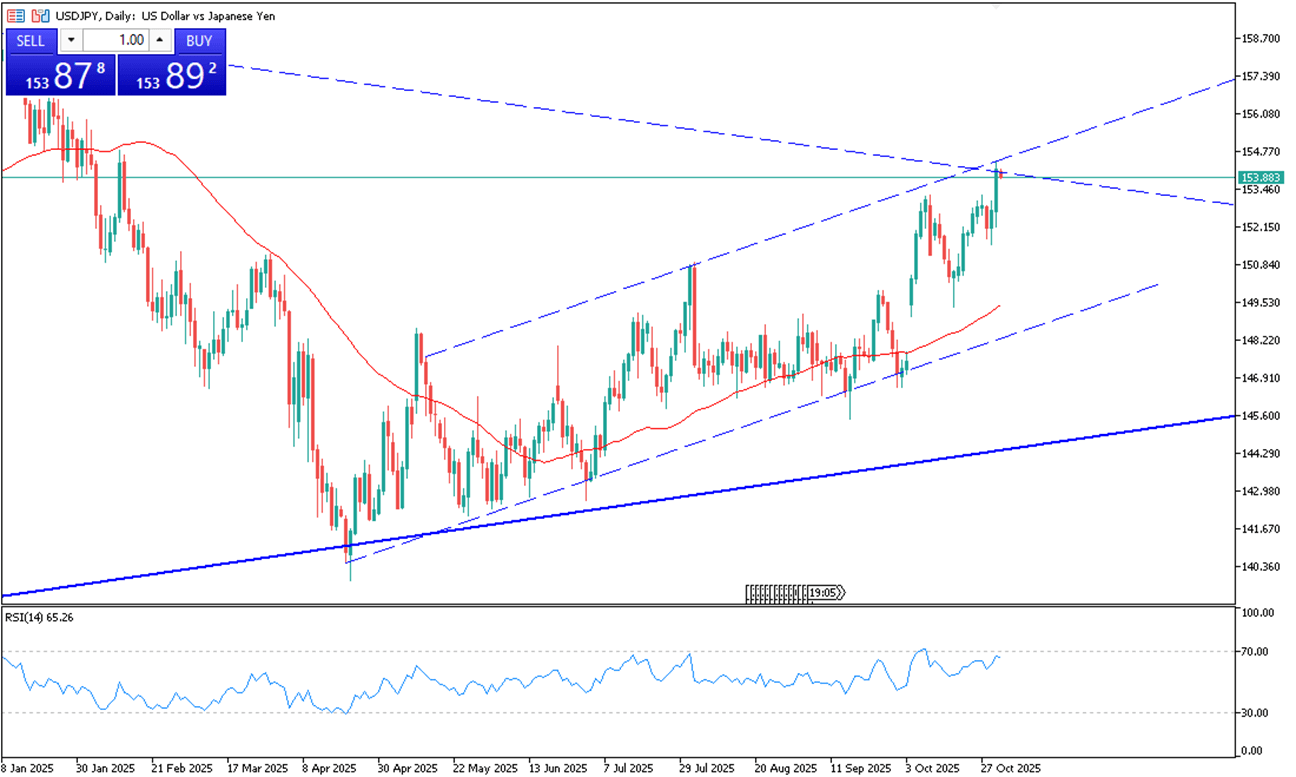

USD/JPY eased on Friday, trading around 153.80 after reaching an eight-month high of 154.45 in the previous session. The pair retreated as the Japanese yen gained strength following the release of Tokyo’s CPI and retail sales data.

Technically, resistance stands near 154.80, while support is firm at 153.60.

| R1: 154.80 | S1: 153.60 |

| R2: 155.10 | S2: 152.75 |

| R3: 155.90 | S3: 142.40 |

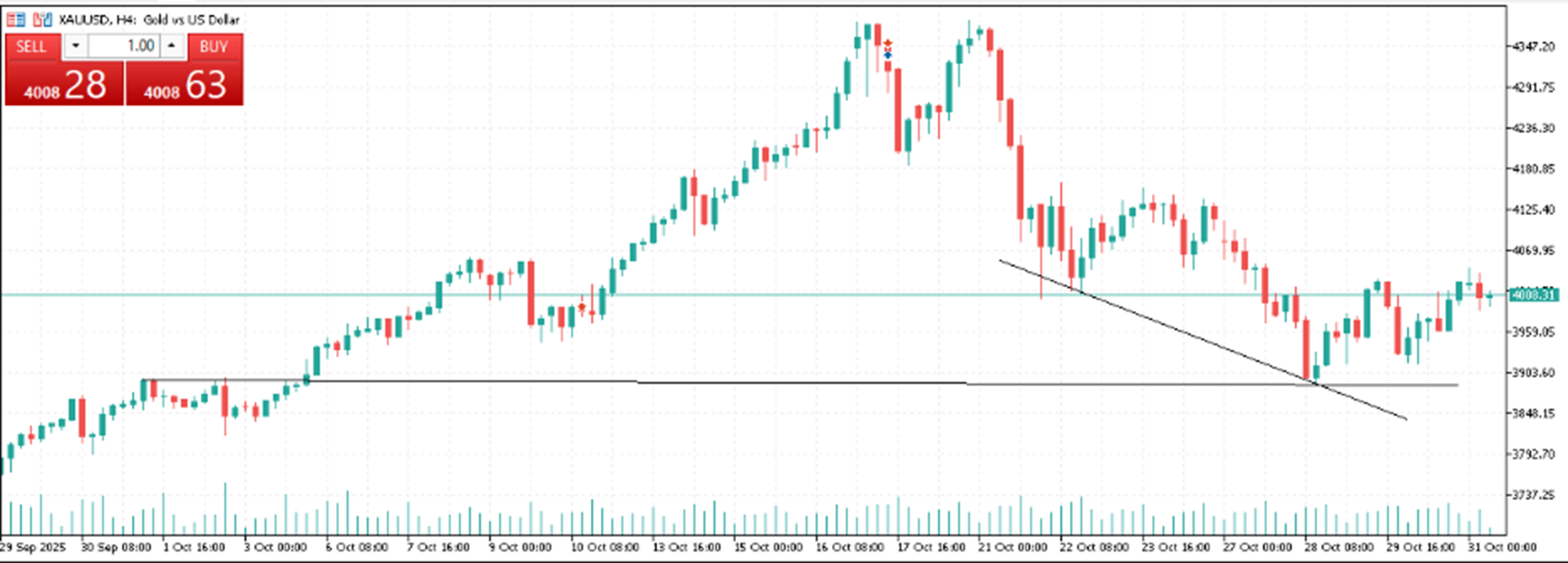

Gold (XAU/USD) slipped after reaching around $4,046 in Asian trading, pausing its rebound from early October lows. The metal came under pressure as the US dollar held near a three-month high following the Fed’s hawkish stance, while optimism over improving US–China relations reduced safe-haven demand. However, persistent uncertainty from the prolonged US government shutdown may limit further dollar gains and offer some support to gold.

From a technical perspective, support is around 3990, and resistance is at 4030.

| R1: 4030 | S1: 3990 |

| R2: 4055 | S2: 3975 |

| R3: 4071 | S3: 3945 |

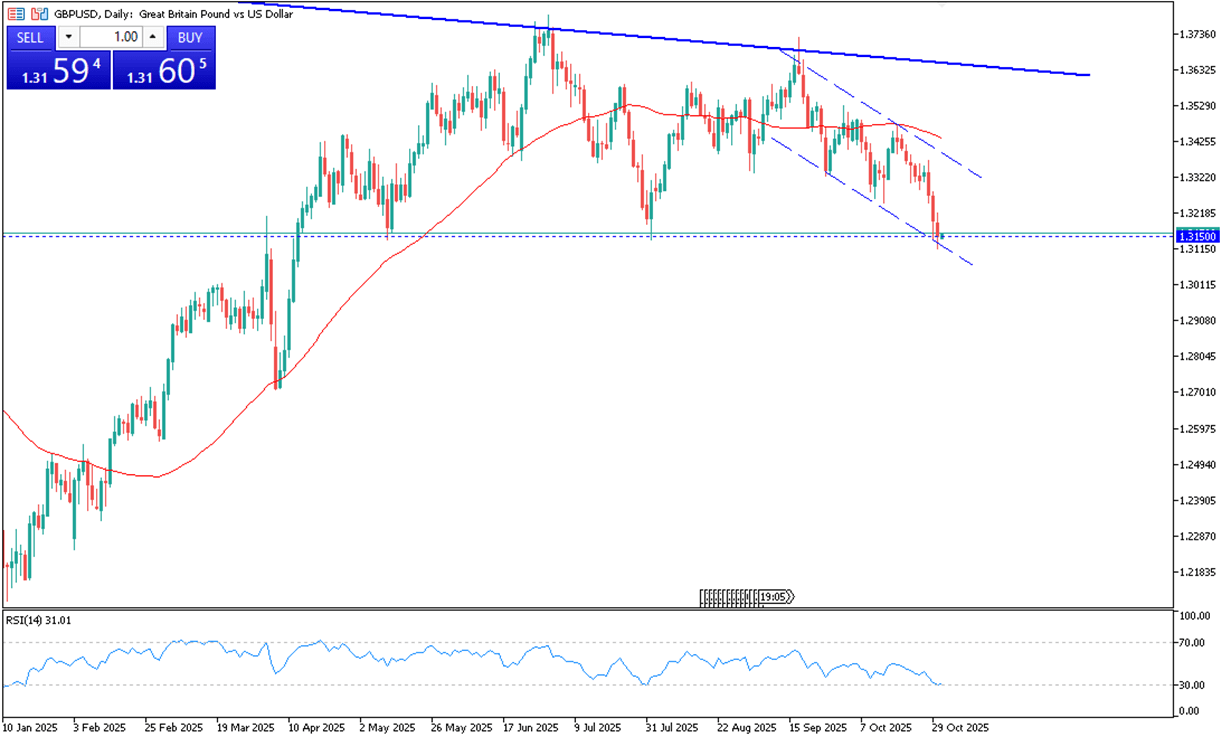

The British pound fell below $1.32, its lowest since April, as the U.S. dollar strengthened after the Fed’s expected 25-basis-point rate cut. Chair Powell’s comments that another cut this year is uncertain kept the dollar firm. Sterling also faced pressure from rising expectations of BoE rate cuts and concerns that the November budget could further weigh on growth.

From a technical view, support stands near 1.3140, with resistance around 1.3320.

| R1: 1.3320 | S1: 1.3140 |

| R2: 1.3390 | S2: 1.3100 |

| R3: 1.3480 | S3: 1.3000 |

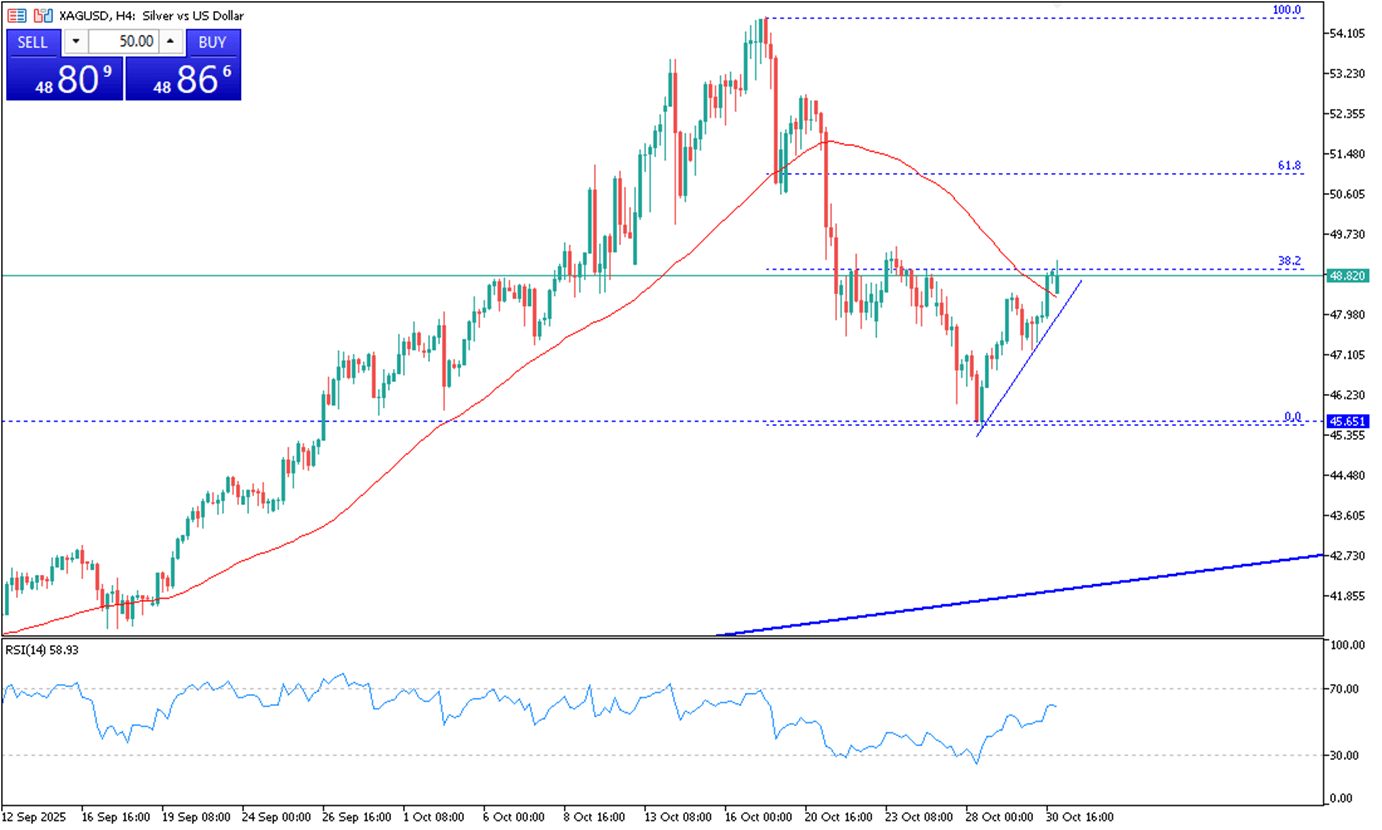

Silver (XAG/USD) hovered near Thursday’s peak of around $49.00 during Friday’s Asian session, holding its strong momentum despite easing expectations for another Fed rate cut this year. Data from the CME FedWatch tool shows the probability of a 25 bps cut in December has fallen to 72.8% from 91.1% a week earlier.

From a technical view, resistance stands near $49.20, while support is located around $48.30.

| R1: 49.20 | S1: 48.30 |

| R2: 49.50 | S2: 47.60 |

| R3: 49.90 | S3: 47.15 |

Hormuz Blockade Rattles Markets (09 - 13 March)

Hormuz Blockade Rattles Markets (09 - 13 March)Global sentiment was dominated this week by the second week of the war with Iran and the effective blockade of the Strait of Hormuz, driving Brent crude prices above $100/barrel. Despite a catastrophic US labor report showing a loss of 92,000 jobs in February, safe-haven demand pushed the US Dollar Index to 99.1. The energy shock has ignited fears of "stagflation," particularly in Europe and Japan, as soaring fuel costs threaten to reverse recent disinflationary trends.

Detail Oil Shock Drives Dollar Higher (03.09.2026)Global markets opened the week under pressure as escalating Middle East tensions and disruptions in the Strait of Hormuz pushed oil prices above $100 per barrel.

Trump Signals Extended Military Campaign

Trump Signals Extended Military CampaignGeopolitical tensions in the Middle East have intensified following recent remarks from Donald Trump suggesting that the ongoing military campaign against Iran may last longer than anticipated. While Trump stated that early operational objectives were achieved ahead of schedule, he acknowledged that broader strategic goals could require additional time and sustained military pressure.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!