The euro held near 1.1630 after President Trump claimed to dismiss Fed Governor Lisa Cook, a move she rejected.

The yen steadied around 147 as BoJ Governor Ueda signaled conditions for a rate hike, citing wage growth and a tight labor market. Gold traded near $3,385 before easing, supported by rate-cut bets but capped by upcoming US data. The pound hovered around $1.3450, strengthened by dollar weakness despite neutral technical signals. Silver remained elevated near $38.80, underpinned by Fed easing expectations and strong industrial demand, while Trump’s threats of steep tariffs on Chinese goods added a layer of conflict to market sentiment.

| Time | Cur. | Event | Forecast | Previous |

| 05:00 | JPY | BoJ Core CPI (YoY) | 2.4% | 2.3% |

| 12:30 | USD | Durable Goods Orders (MoM) (Jul) | -4.0% | -9.4% |

| 14:00 | USD | CB Consumer Confidence (Aug) | 96.3 | 97.2 |

| 15:30 | USD | Atlanta Fed GDPNow (Q3) | 2.3% | 2.3% |

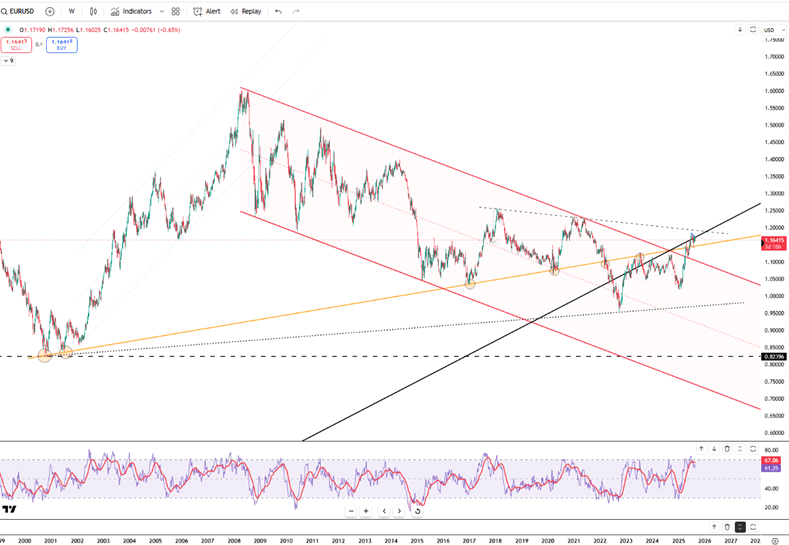

EUR/USD hovered near 1.1630 in Asia on Tuesday after a 0.75% advance in the prior session. The dollar stayed weak amid political and policy uncertainty. Pressure on the Fed’s independence grew after President Trump announced via social media that he was dismissing Fed Governor Lisa Cook. Cook rejected the claim, saying there was no legal basis and that she would continue her duties.

Trade tensions also resurfaced as Trump threatened a 200% tariff on Chinese goods if magnet supplies are withheld, while warning of further restrictions on technology and semiconductors in response to digital services taxes. These developments kept the USD under pressure, helping the euro sustain support.

Resistance is at 1.1740, with key support at 1.1575.

| R1: 1.1740 | S1: 1.1575 |

| R2: 1.1830 | S2: 1.1520 |

| R3: 1.1930 | S3: 1.1395 |

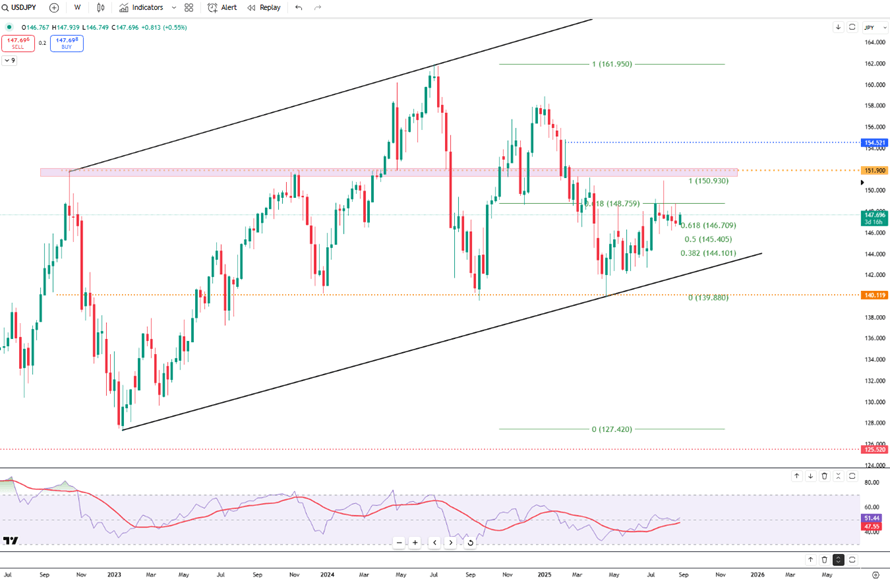

USD/JPY traded around 147 on Tuesday, rebounding after earlier losses as the dollar weakened following Trump’s announcement to remove Fed Governor Lisa Cook over alleged mortgage fraud. The move raised concerns over central bank independence. At the same time, BOJ Governor Kazuo Ueda signaled growing confidence in another rate hike, citing rising wages and a tighter labor market.

The BOJ held rates steady in July but raised inflation projections and upgraded its economic outlook, reinforcing expectations of a future hike. Investors now look to Japan’s industrial production, retail sales, and consumer confidence data due later this week.

Resistance stands at 148.80, with support at 146.25.

| R1: 148.80 | S1: 146.25 |

| R2: 150.90 | S2: 145.40 |

| R3: 154.50 | S3: 144.10 |

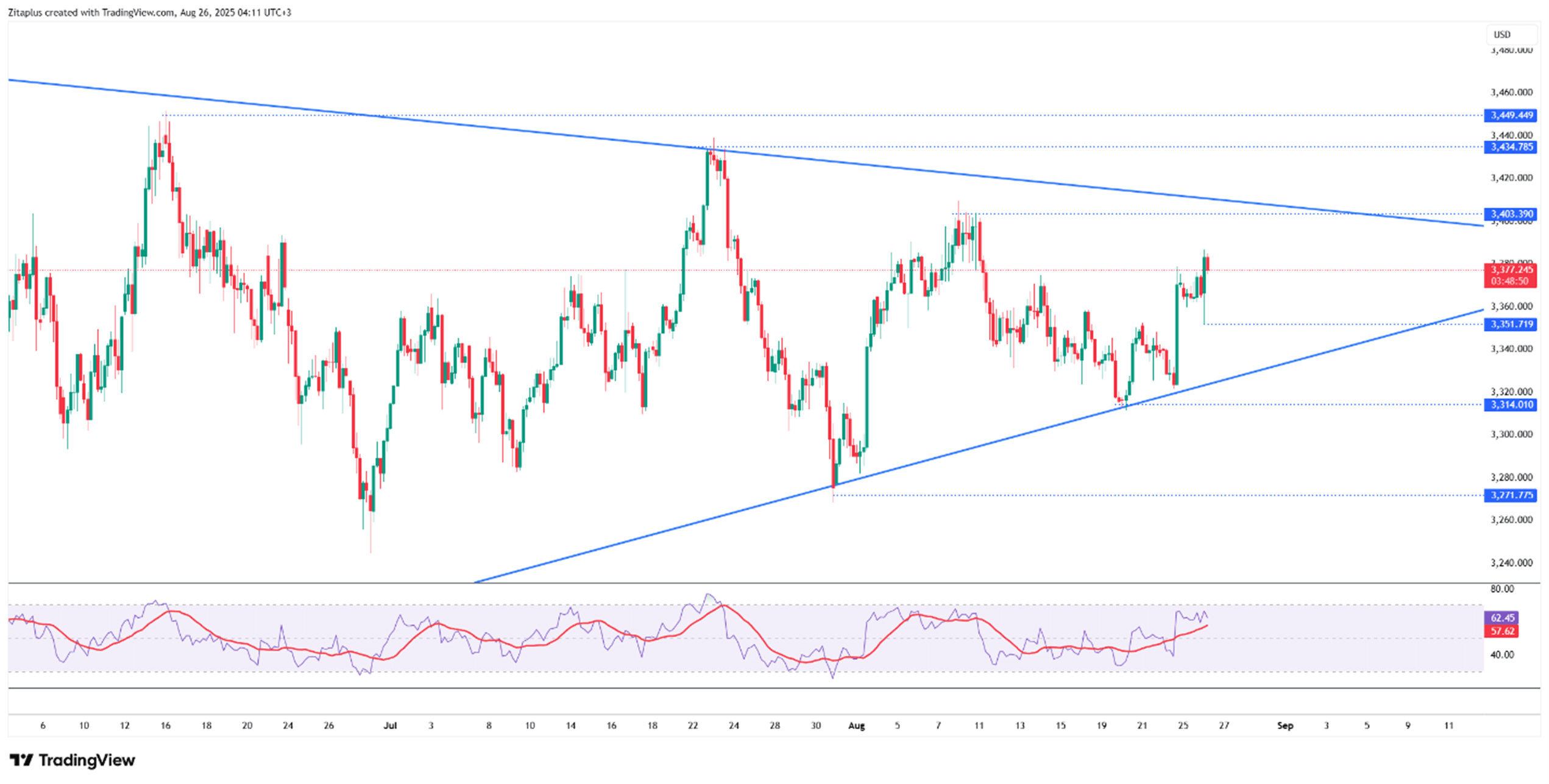

Gold hit a two-week high near $3,385 in early European trade Tuesday, lifted by concerns over Fed independence after Trump claimed he was dismissing Fed Governor Lisa Cook. Growing expectations of rate cuts also boosted demand for the metal, which benefits when yields fall. Traders now await US data, including Consumer Confidence, Durable Goods Orders, and the Richmond Fed Index, followed by Q2 GDP and July’s PCE inflation data later this week. Stronger growth or higher inflation could strengthen the dollar and cap gold’s upside.

Gold faces resistance at $3,403, with support at $3,351.

| R1: 3403 | S1: 3351 |

| R2: 3434 | S2: 3314 |

| R3: 3450 | S3: 3271 |

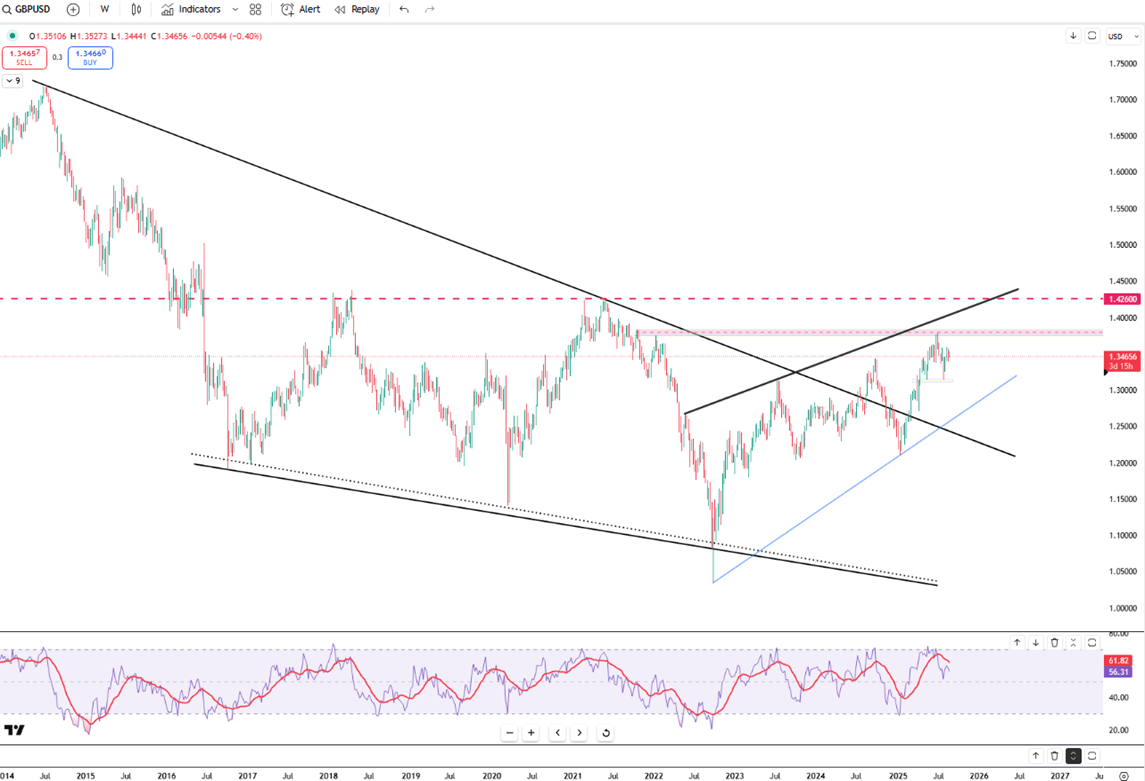

GBP/USD traded around 1.3450 in early European hours on Tuesday. Losses were limited as Trump’s claim of firing Fed Governor Lisa Cook raised concerns over Fed independence, weighing on the dollar. From a technical perspective, the pair remains constructive above the 100-day EMA, though the RSI near neutral levels suggests a consolidation phase before further direction emerges.

Resistance is seen at 1.3595, with support at 1.3370.

| R1: 1.3595 | S1: 1.3370 |

| R2: 1.3650 | S2: 1.3320 |

| R3: 1.3770 | S3: 1.3145 |

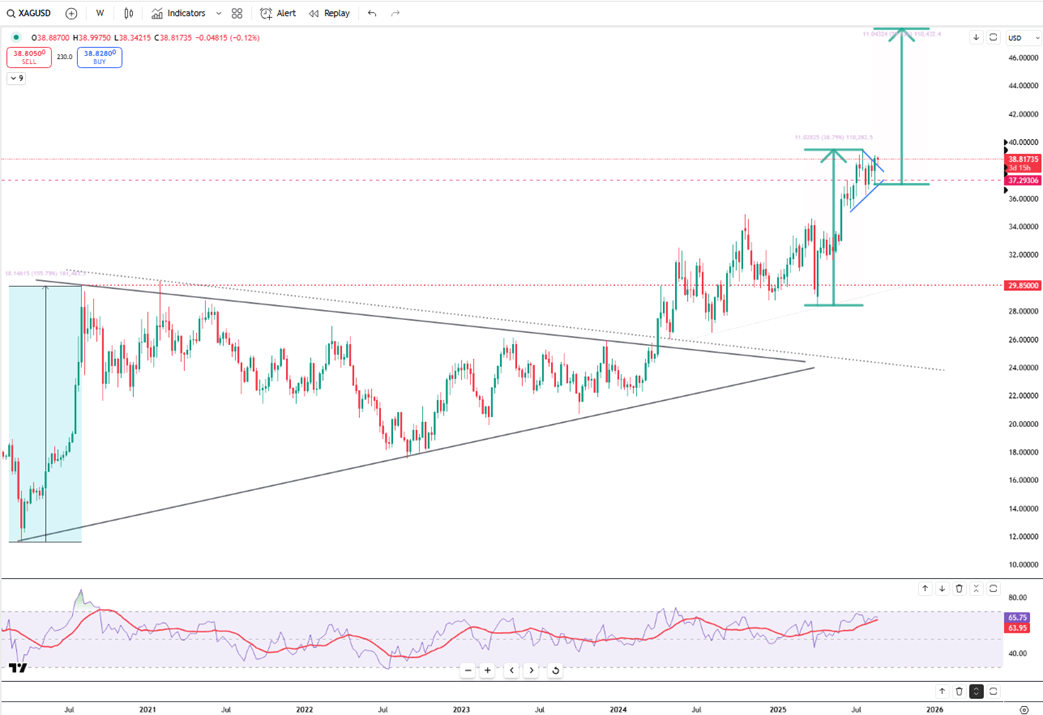

Silver hovered near $38.80 per ounce in Tuesday’s Asian session after rebounding from Monday’s losses. Concerns over Fed independence following Trump’s move against Governor Lisa Cook, which Cook rejected, supported expectations of faster Fed easing and underpinned silver prices.

Trump threatened a 200% tariff on Chinese goods if magnet supplies were withheld, and signaled further measures targeting semiconductors and tech in response to digital services taxes. These geopolitical and policy tensions reinforced silver’s safe-haven demand.

Resistance is at $39.01, with support at $38.24.

| R1: 39.01 | S1: 38.24 |

| R2: 39.46 | S2: 37.75 |

| R3: 40.34 | S3: 36.99 |

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

Detail March Starts With Geopolitical Turmoil (2-6 March)

March Starts With Geopolitical Turmoil (2-6 March)Global markets began the week in a state of high alert following coordinated US and Israeli strikes on Iran over the weekend, which resulted in the death of Supreme Leader Ayatollah Ali Khamenei.

Detail Geopolitical Shock Triggers Risk-Off Move (03.02.2026)President Trump stated that operations against Iran could last up to four weeks, though he added that developments are proceeding as planned and could wrap up sooner.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!