The euro held firm near $1.1735 after weaker U.S. jobs data and ongoing government shutdown pressures weighed on the dollar. The yen steadied around 147 per dollar following a four-day rally, while speculation about future BOJ tightening kept investors cautious.

Gold hovered close to record highs above $3,870 as safe-haven demand persisted, and silver traded near $47.20 amid expectations of another global supply deficit. Sterling extended its rally above $1.3470, supported by steady BoE policy and a softer U.S. dollar.

| Time | Cur. | Event | Forecast | Previous |

| All Day | CNY | China - National Day | ||

| 09:00 | EUR | Unemployment Rate (Aug) | 6.2% | 6.2% |

| 20:30 | USD | Fed’s Balance Sheet | 6.602B |

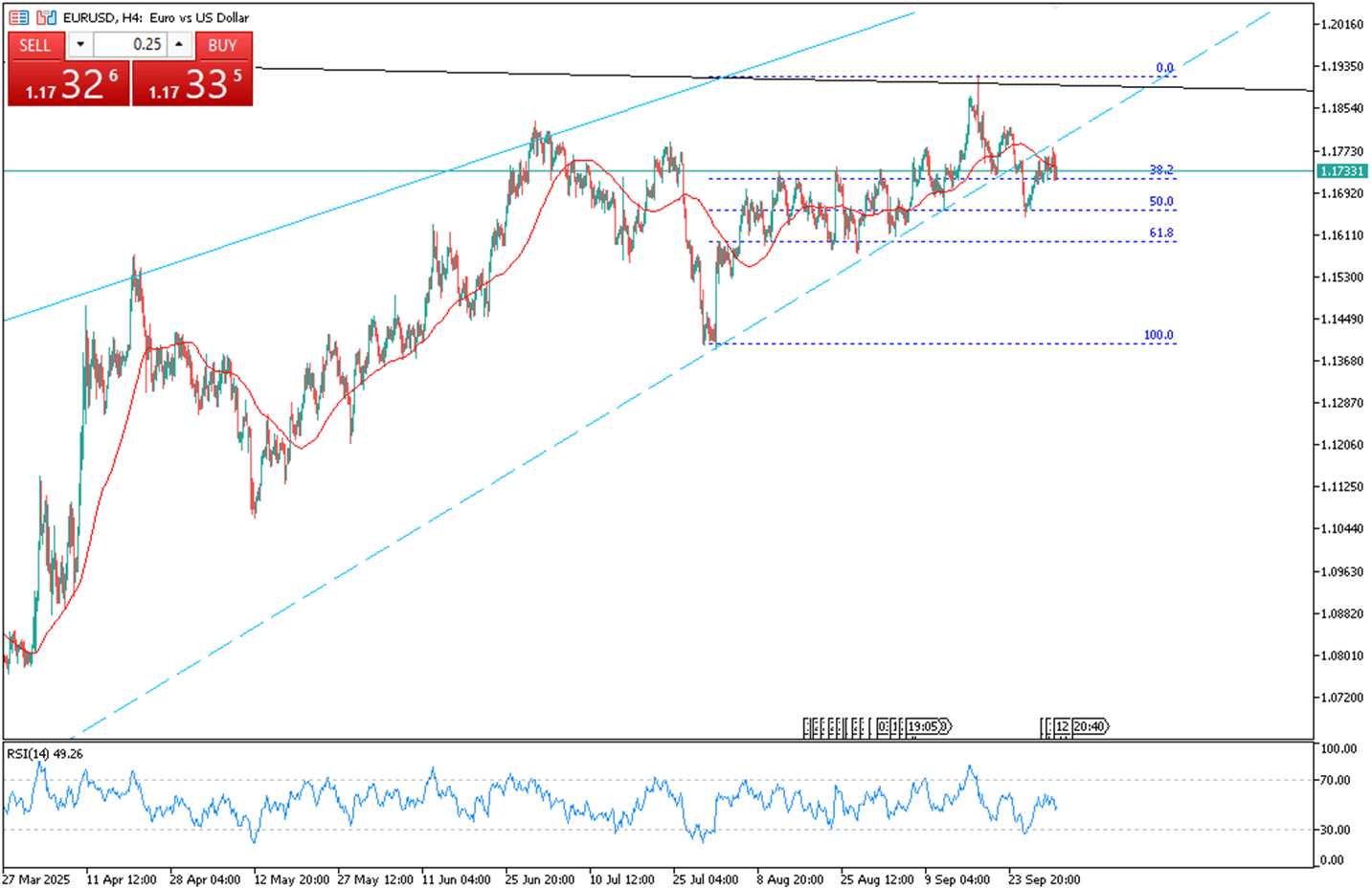

EUR/USD held near 1.1735 late in the Asian session as traders digested weaker US employment data and looked beyond the government shutdown. The prolonged standoff between the White House and Democrats risks extending the closure and delaying key economic reports. The US dollar weakened after ADP figures fell short of forecasts while the nation entered its first shutdown in seven years.

Technically, 1.1690 is the key support, while resistance is seen at 1.1770 and then 1.1810.

| R1: 1.1770 | S1: 1.1690 |

| R2: 1.1810 | S2: 1.1570 |

| R3: 1.1850 | S3: 1.1520 |

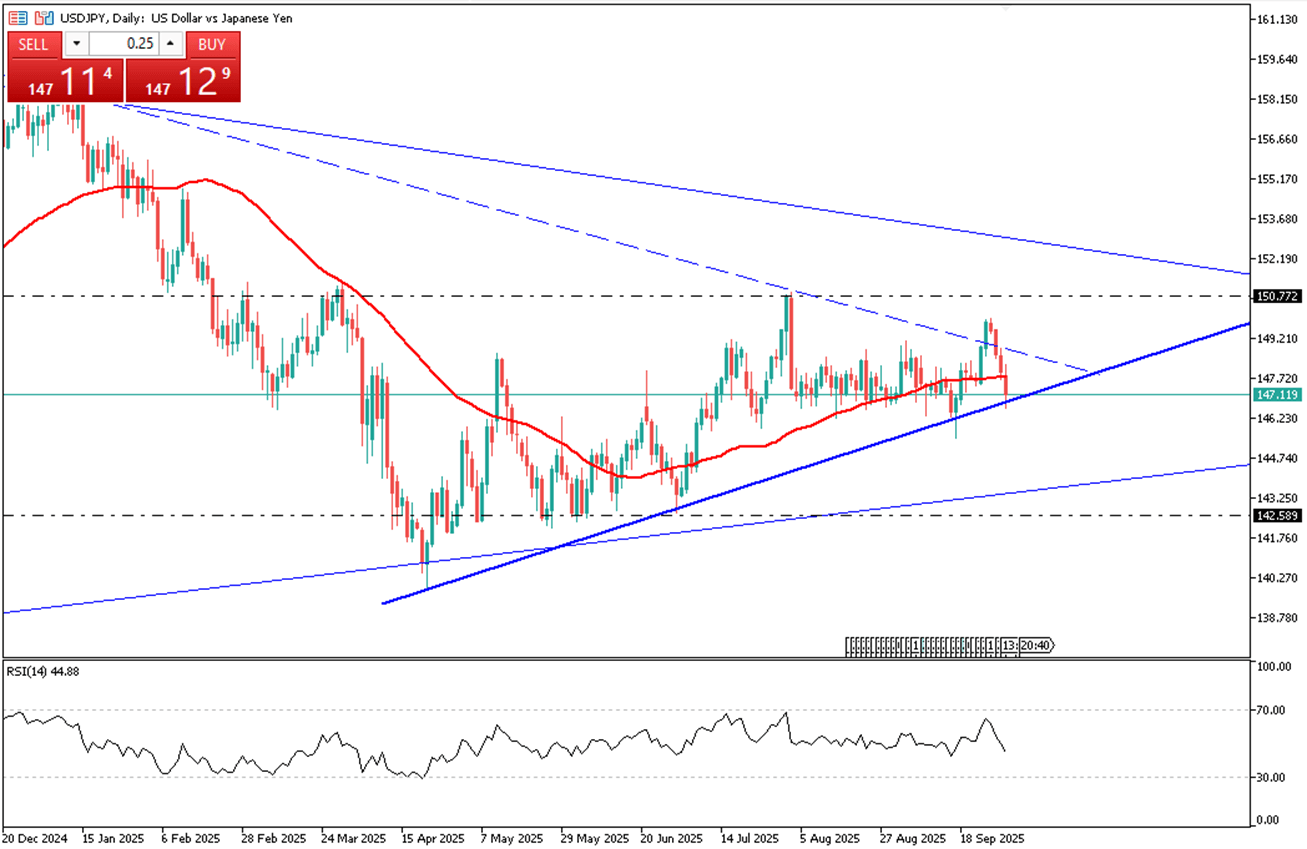

The yen hovered near 147 per dollar on Thursday after four straight sessions of gains, supported by safe-haven demand and a softer dollar following the US government shutdown. The political impasse, expected to last at least three days, will delay key data releases including September’s nonfarm payrolls. At the same time, speculation that the Bank of Japan could resume policy normalization later this year provided further backing, with markets pricing a 40% probability of a quarter-point hike at this month’s meeting.

Resistance is at 148.50, while support holds at 146.80.

| R1: 148.50 | S1: 146.80 |

| R2: 150.90 | S2: 145.20 |

| R3: 154.50 | S3: 142.30 |

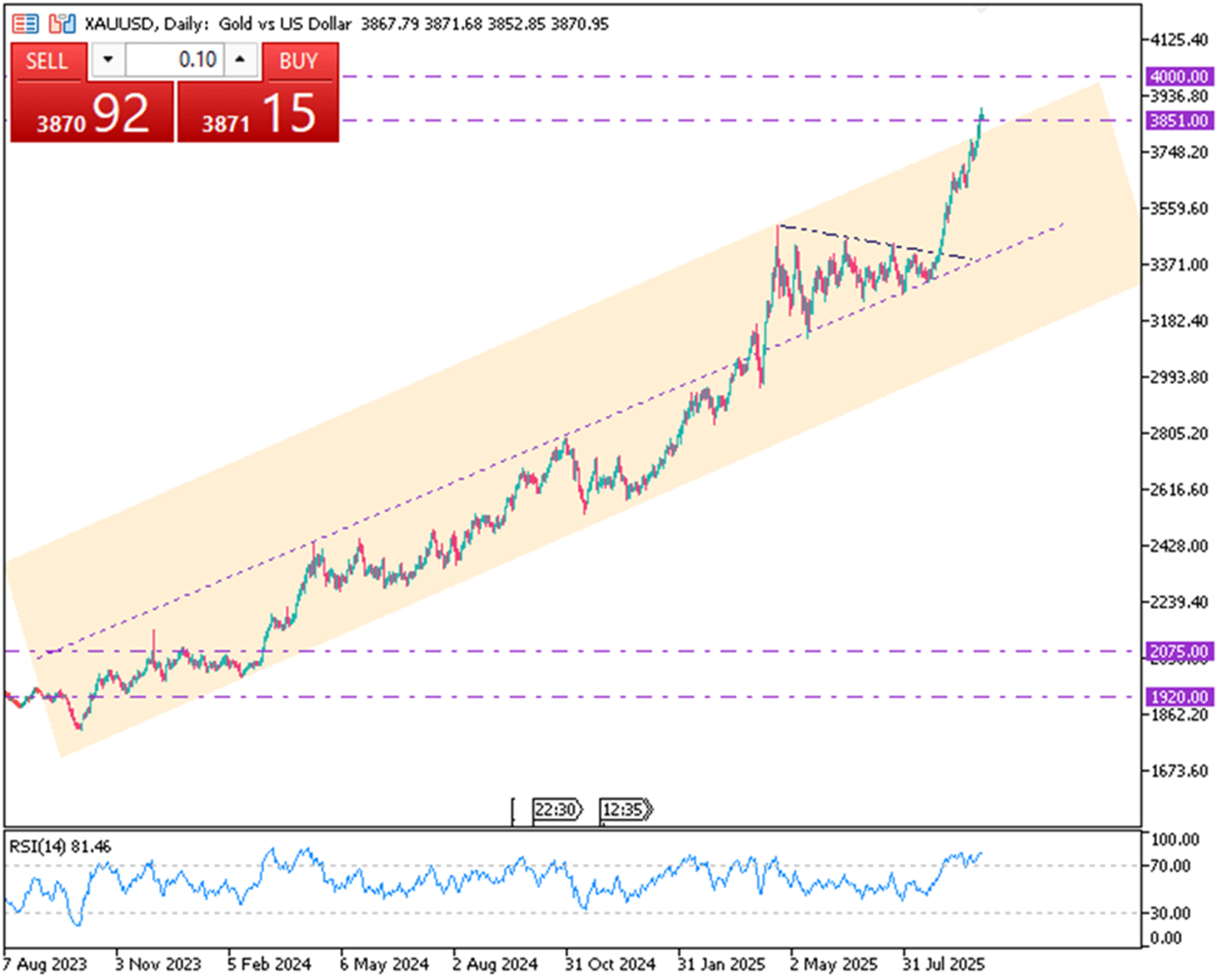

Gold held near $3,870 per ounce on Thursday, staying close to its record high as investors turned to safety and anticipated further Federal Reserve rate cuts. ADP data showed a decline in US private-sector jobs in September, marking a second consecutive drop and the steepest since March 2023, reinforcing expectations for additional easing by the Fed this year.

From a technical perspective, support is around 3792, and resistance is at 3880.

| R1: 3880 | S1: 3792 |

| R2: 3910 | S2: 3770 |

| R3: 4000 | S3: 3700 |

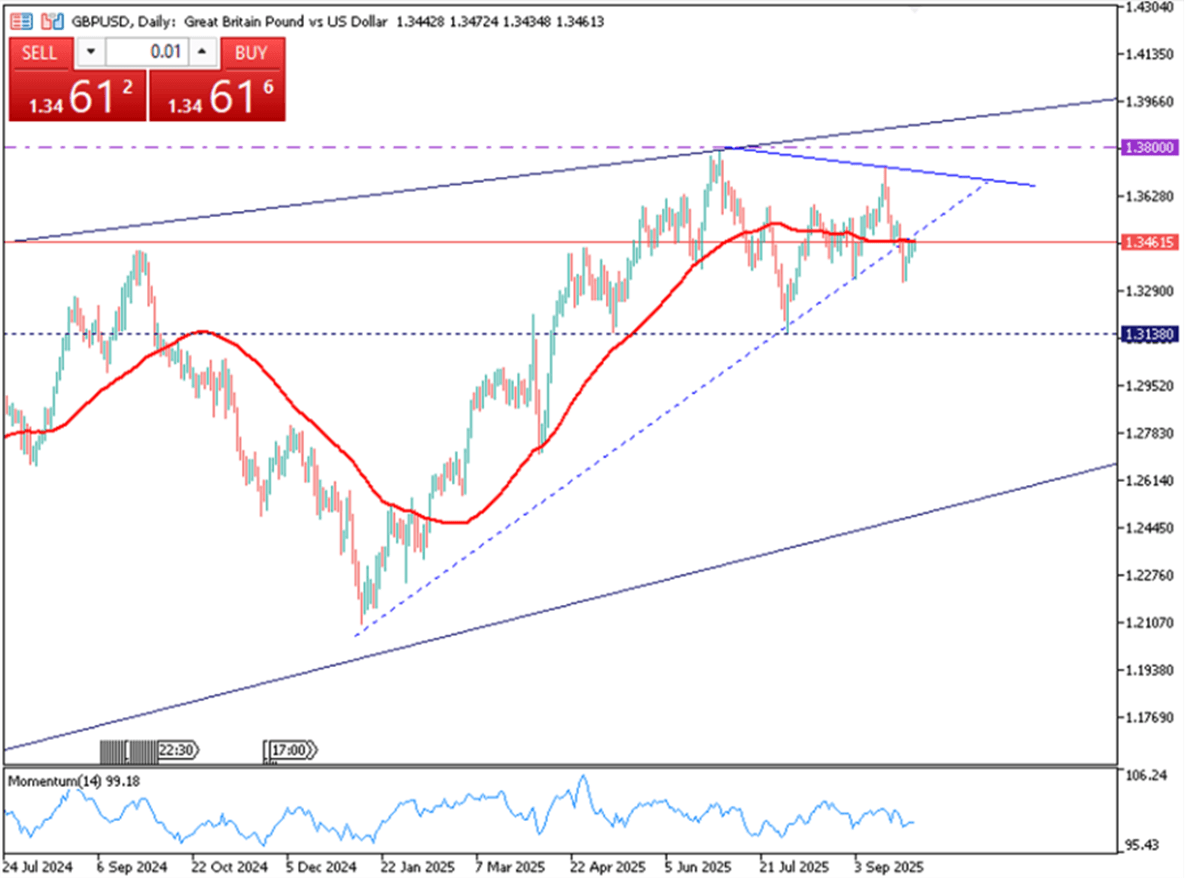

The British pound climbed to $1.3477 on Thursday, extending its rally for a fourth straight session and marking the longest run since August. The move was supported by a softer US dollar as the Trump-era government shutdown weighed on sentiment. Additional backing came from the Bank of England’s decision to keep rates unchanged in September, with markets not anticipating the next cut until 2026.

Technically, support is at 1.3420, with a break lower exposing 1.3325. Resistance sits at 1.3495 and 1.3525.

| R1: 1.3495 | S1: 1.3420 |

| R2: 1.3525 | S2: 1.3325 |

| R3: 1.3595 | S3: 1.3260 |

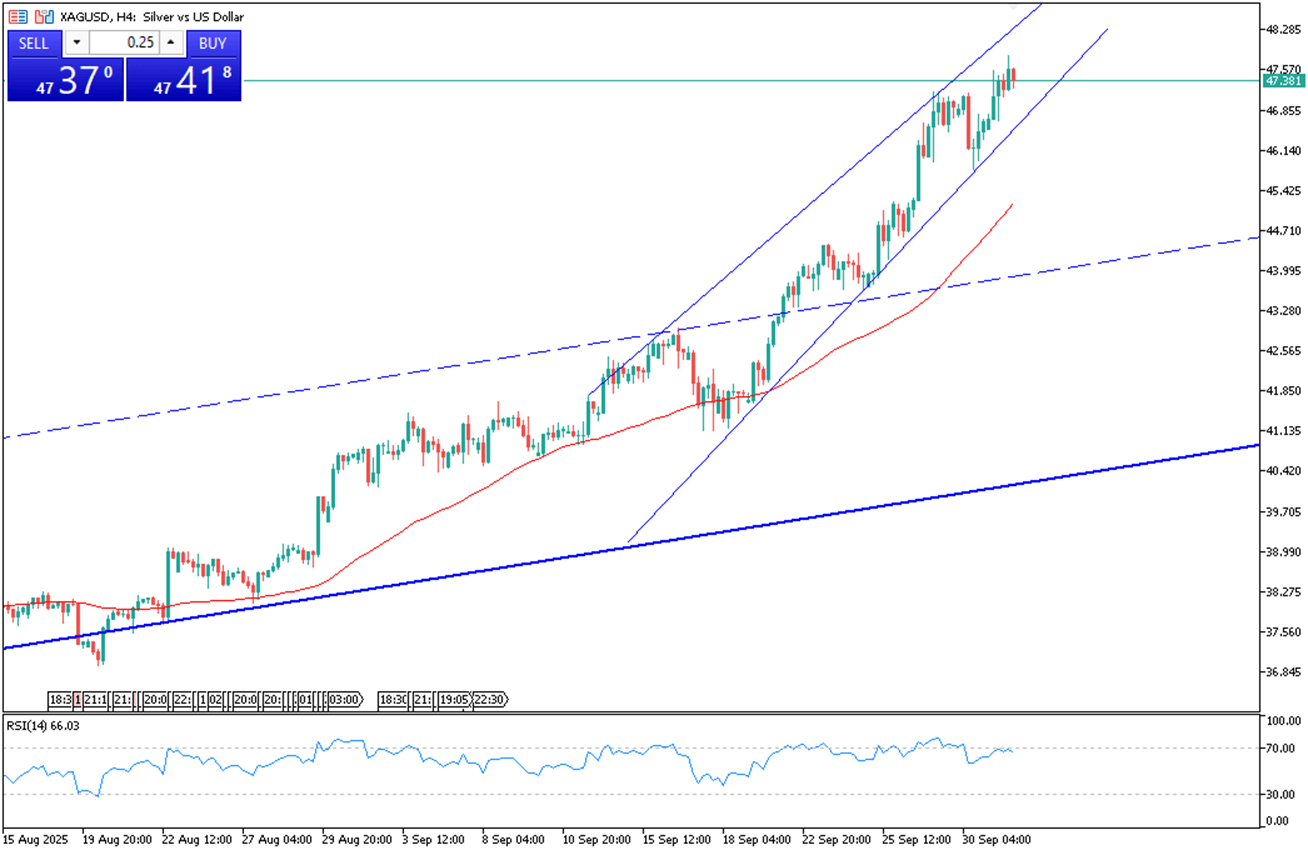

Silver steadied near $47.20 per ounce in Thursday’s Asian session, staying close to the record high hit a day earlier after the US government shut down following the Senate’s rejection of a short-term funding bill. Supporting the bullish outlook, the Silver Institute projected a global market deficit for a fifth straight year in 2025, with expected output of 844 million ounces trailing demand by roughly 100 million ounces.

From a technical perspective, resistance is observed at 47.75, while support is located at 45.95.

| R1: 47.75 | S1: 45.95 |

| R2: 48.70 | S2: 45.20 |

| R3: 50.00 | S3: 44.50 |

Hormuz Blockade Rattles Markets (09 - 13 March)

Hormuz Blockade Rattles Markets (09 - 13 March)Global sentiment was dominated this week by the second week of the war with Iran and the effective blockade of the Strait of Hormuz, driving Brent crude prices above $100/barrel. Despite a catastrophic US labor report showing a loss of 92,000 jobs in February, safe-haven demand pushed the US Dollar Index to 99.1. The energy shock has ignited fears of "stagflation," particularly in Europe and Japan, as soaring fuel costs threaten to reverse recent disinflationary trends.

Detail Oil Shock Drives Dollar Higher (03.09.2026)Global markets opened the week under pressure as escalating Middle East tensions and disruptions in the Strait of Hormuz pushed oil prices above $100 per barrel.

Trump Signals Extended Military Campaign

Trump Signals Extended Military CampaignGeopolitical tensions in the Middle East have intensified following recent remarks from Donald Trump suggesting that the ongoing military campaign against Iran may last longer than anticipated. While Trump stated that early operational objectives were achieved ahead of schedule, he acknowledged that broader strategic goals could require additional time and sustained military pressure.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!