The euro slipped near 1.1640 ahead of Powell’s Jackson Hole speech and Ukraine peace talks, while the yen strengthened to 147.5 despite weak trade figures.

Gold fell toward $3,310, its lowest in three weeks, as dollar strength and easing geopolitical risks weighed on the metal. Sterling stayed below 1.3500 awaiting UK CPI and Fed minutes, and silver extended its slide to $37.20, with technicals signaling further bearish pressure.

| Time | Cur. | Event | Forecast | Previous |

| 06:00 | GBP | United Kingdom Inflation Rate | 3.8% | 3.6% |

| 06:00 | GBP | United Kingdom Core Inflation Rate | 3.8% | 3.7% |

| 06:00 | GBP | United Kingdom Inflation Rate MoM | 0.2% | 0.3% |

| 07:10 | EUR | ECB Lagarde Speech | ||

| 09:00 | EUR | Euro Area Inflation Rate | 2% | 2% |

| 18:00 | USD | FOMC Minutes | ||

| 19:00 | USD | Fed Bostic Speech |

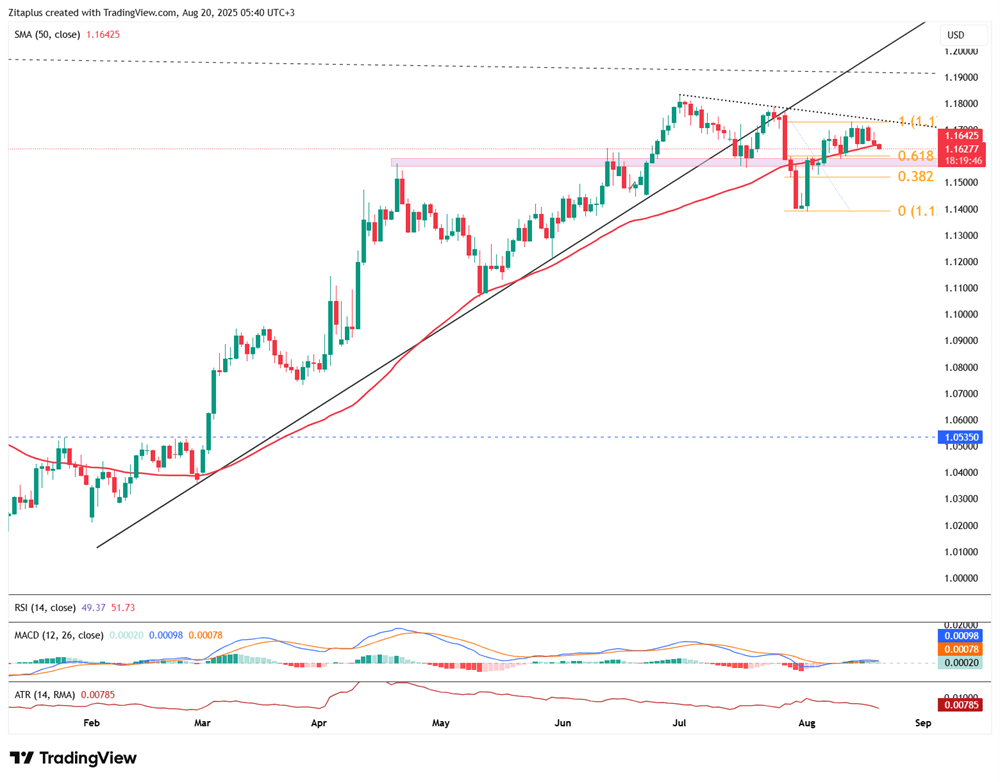

EUR/USD hovered near 1.1640 in North America on Wednesday, down 0.12% but still holding above 1.1600. Traders await Fed Chair Powell’s speech at Jackson Hole and developments in Ukraine-Russia peace talks. U.S. housing data drew little market reaction, while mixed inflation prints left rate-cut expectations uncertain.

Resistance is at 1.1770, with key support at 1.1600.

| R1: 1.1770 | S1: 1.1600 |

| R2: 1.1830 | S2: 1.1520 |

| R3: 1.1900 | S3: 1.1350 |

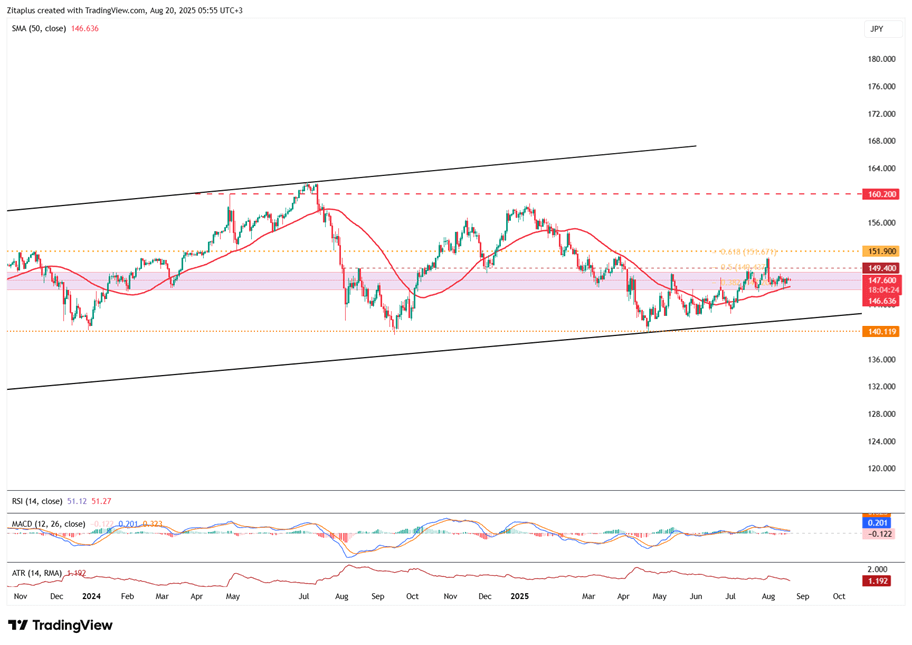

The yen climbed to around 147.5 per dollar, extending gains even as exports fell 2.6% YoY in July, the steepest drop in over four years. Imports also declined 7.5%, though less than the 10.4% forecast. Core machinery orders unexpectedly rose in June after two months of declines, hinting at firmer investment. Markets remain split on the BoJ’s next move amid mixed policy signals.

For USD/JPY, the nearest resistance is at 148.00, while the immediate support is at 145.00.

| R1: 148.00 | S1: 145.00 |

| R2: 151.50 | S2: 143.00 |

| R3: 152.40 | S3: 140.00 |

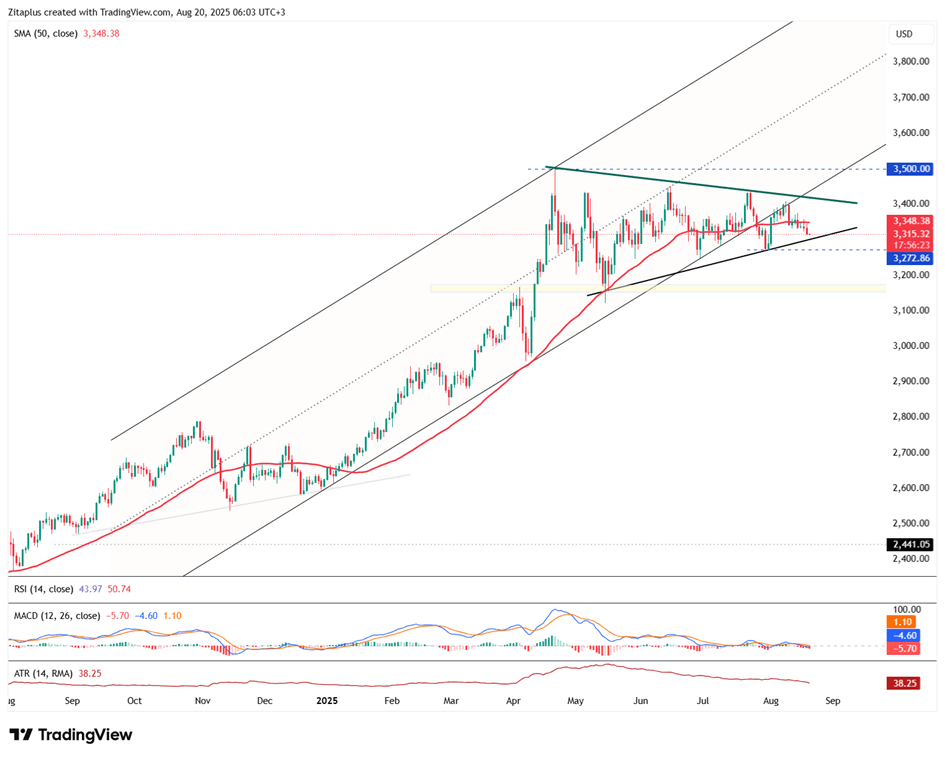

Gold slid toward $3,310 per ounce, its weakest in three weeks, pressured by a stronger dollar and easing geopolitical risks. Trump ruled out U.S. ground forces in Ukraine but suggested air support, while Zelensky welcomed the talks as a step toward potential negotiations with Putin. Traders now await Powell’s Jackson Hole remarks for Fed policy cues.

Gold is currently facing resistance around $3,385, with strong support near $3,300.

| R1: 3385 | S1: 3300 |

| R2: 3420 | S2: 3275 |

| R3: 3500 | S3: 3230 |

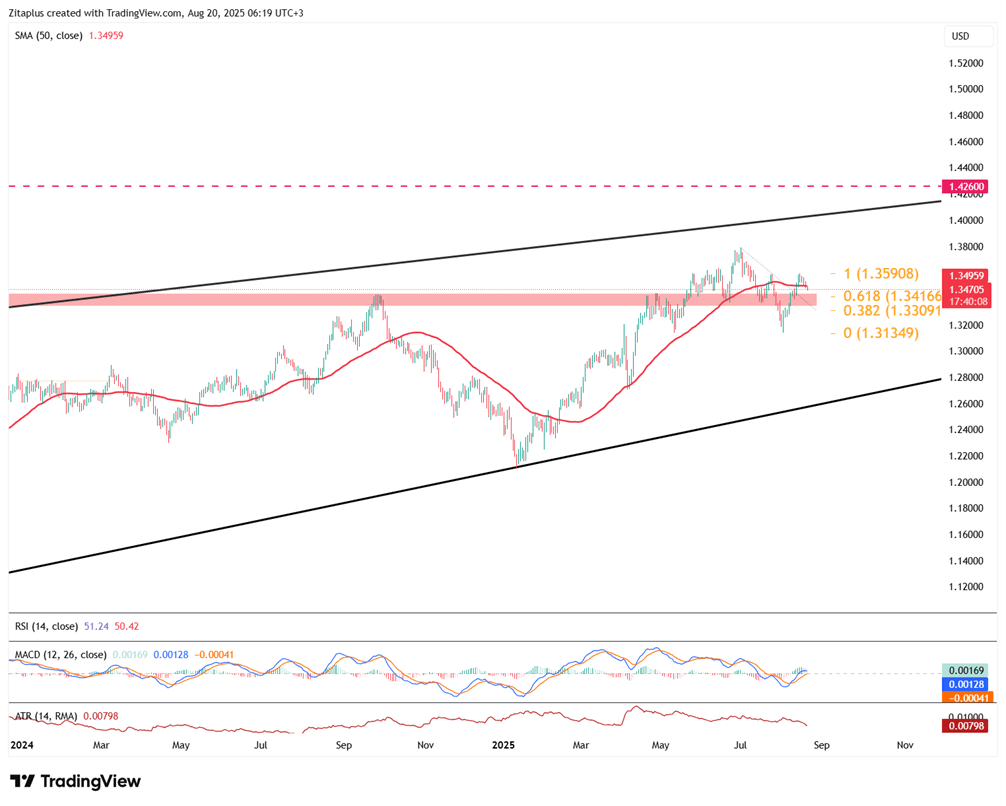

Sterling held below 1.3500 in quiet trade as markets awaited key data. UK CPI inflation figures are due in London’s session, followed by Fed meeting minutes in New York.

The first resistance is seen at 1.3620, with nearby support beginning at 1.3340.

| R1: 1.3620 | S1: 1.3340 |

| R2: 1.3750 | S2: 1.3260 |

| R3: 1.3850 | S3: 1.3000 |

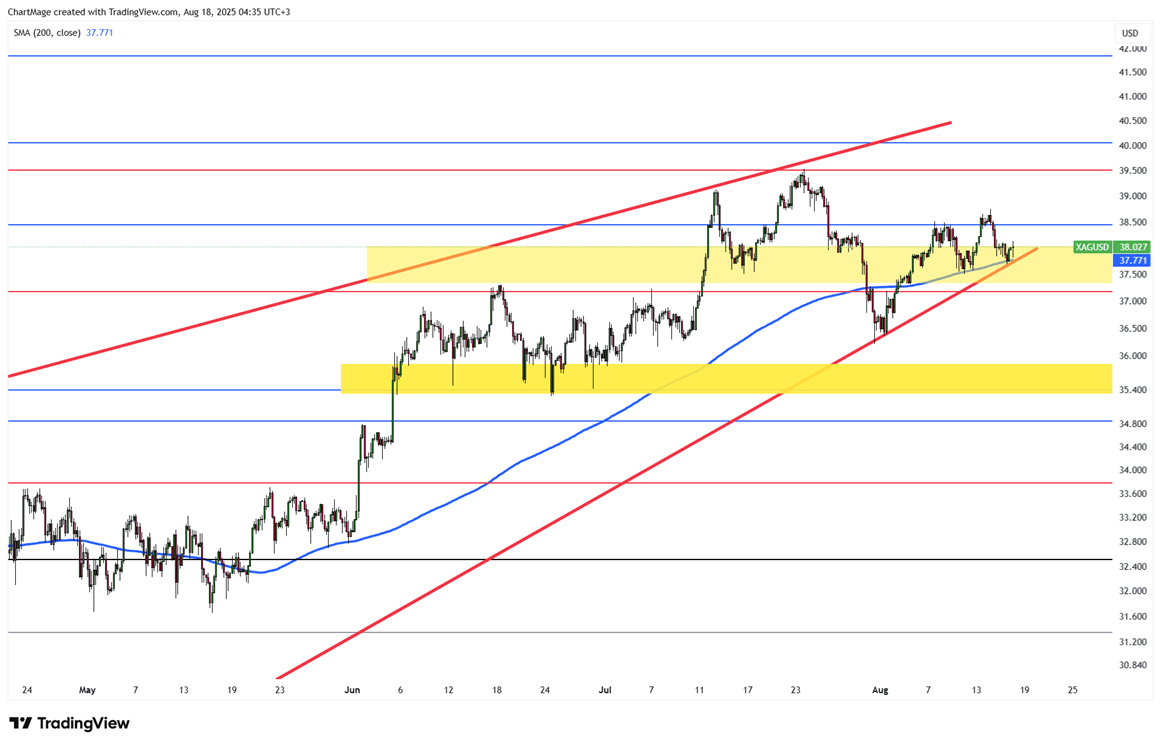

Silver extended its losing streak to a fifth session, trading around $37.20 per ounce in Asia. The metal remains under pressure within a descending channel, with RSI below 50 and prices under the 9-day EMA.

Outlook stays bearish, with resistance at $39.50 and support at $36.75.

| R1: 39.50 | S1: 36.75 |

| R2: 40.50 | S2: 35.50 |

| R3: 41.20 | S3: 33.90 |

Markets traded cautiously ahead of key inflation data and amid ongoing trade and geopolitical uncertainty.

Markets remained cautious as a new 10% U.S. global tariff weighed on risk sentiment. The euro and pound stayed under pressure near recent lows, while the yen rebounded on renewed speculation around Bank of Japan tightening.

Global markets remained cautious as a new 10% U.S. global tariff came into force, keeping trade uncertainty at the center of investor focus.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!