Income strategies are under pressure as lower yields reduce the appeal of short-term Treasuries, pushing investors toward riskier segments such as high yield, emerging-market debt, private credit, and catastrophe bonds.

Donald Trump said a decision on the next Fed chair is nearing. Kevin Hassett is seen as the leading candidate, with Kevin Warsh also in consideration. An announcement may come in early 2026, with discussion of a shorter-term role for Hassett. Firm labor data kept inflation concerns in play, even as markets continued to price a single 25-bp move this year.

The dollar index held near 99.2 after a two-day rise. Job openings increased to 7.67 million in October, and ADP data showed a modest pickup in private hiring, adding uncertainty around the policy outlook.

| Time | Cur. | Event | Forecast | Previous |

| 10:55 | EUR | ECB President Lagarde Speaks | ||

| 13:30 | USD | Employment Cost Index (QoQ) (Q3) | 0.9% | 0.9% |

| 15:30 | USD | Crude Oil Inventories | 0.574M | |

| 19:00 | USD | FOMC Economic Projections | ||

| 19:00 | USD | FOMC Statement | ||

| 19:00 | USD | Fed Interest Rate Decision | 3.75% | 4.00% |

| 19:00 | USD | FOMC Press Conference |

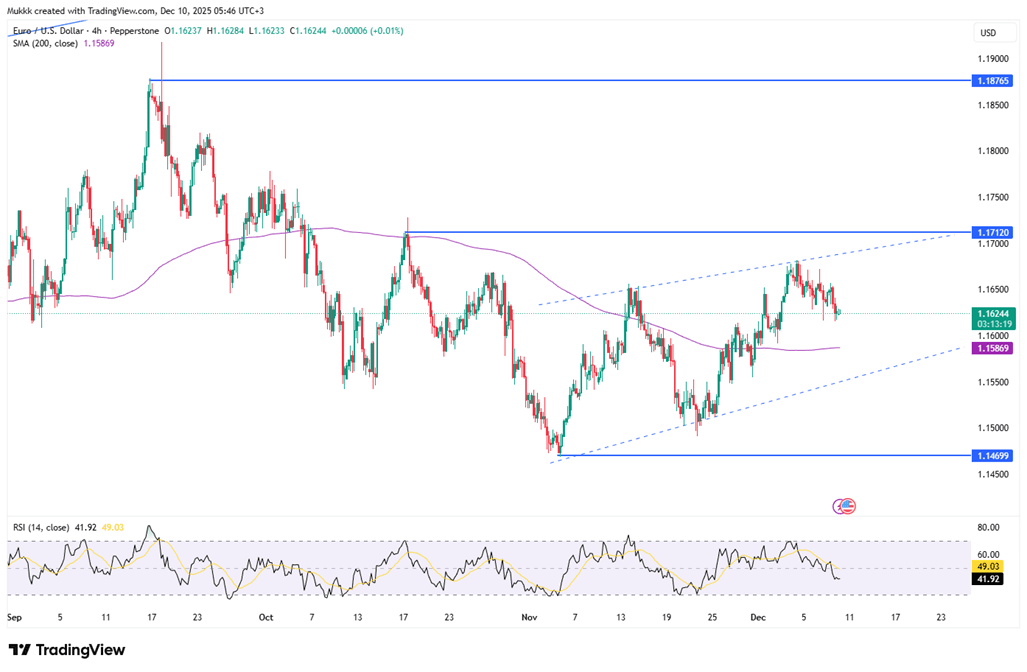

The euro traded near $1.1626, staying range-bound as attention shifted to the Federal Reserve’s policy decision and Jerome Powell’s guidance on 2026. Despite firmer US labor readings, pricing still reflects an 88% probability of a 25-bp cut. Support also came from Germany’s stronger-than-expected €16.9 billion trade surplus, while ECB officials struck a measured tone. With EUR/USD capped below 1.1650, direction hinges on how the Fed’s updated dot plot frames the road beyond this week.

EUR/USD holds support at 1.1600, while initial resistance stands at 1.1670.

| R1: 1.1670 | S1: 1.1600 |

| R2: 1.1710 | S2: 1.1550 |

| R3: 1.1760 | S3: 1.1510 |

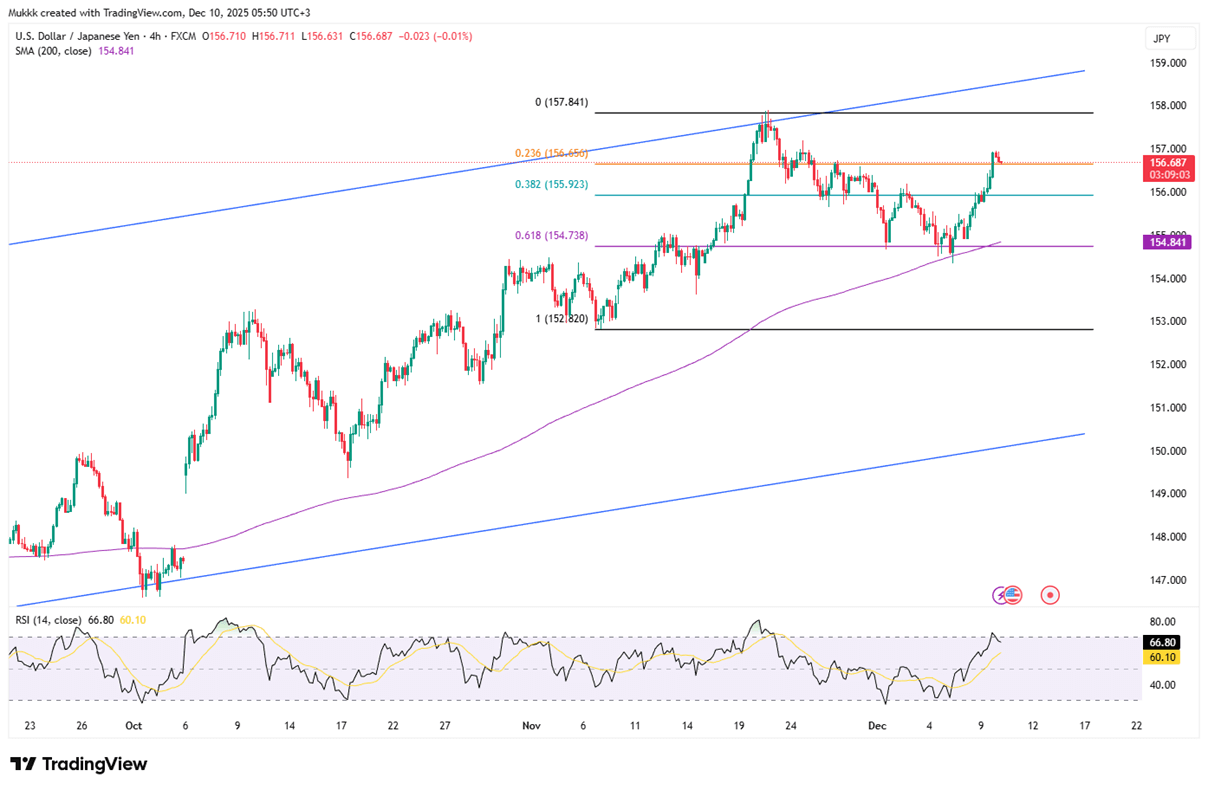

The yen steadied near 156.7 per dollar, pausing after a sharp three-day slide. Governor Kazuo Ueda noted that inflation is moving closer to target, reviving debate around a possible rate increase next week and keeping focus on the longer-term policy path into 2026. At the same time, the currency remained under strain from mounting fiscal concerns tied to Prime Minister Sanae Takaichi’s spending agenda and wide rate differentials, which have kept bearish positioning elevated and pushed the yen to fresh lows against the euro.

USD/JPY faces resistance near 157.00, with support holding at 156.10.

| R1: 157.00 | S1: 156.10 |

| R2: 157.40 | S2: 155.40 |

| R3: 157.90 | S3: 154.50 |

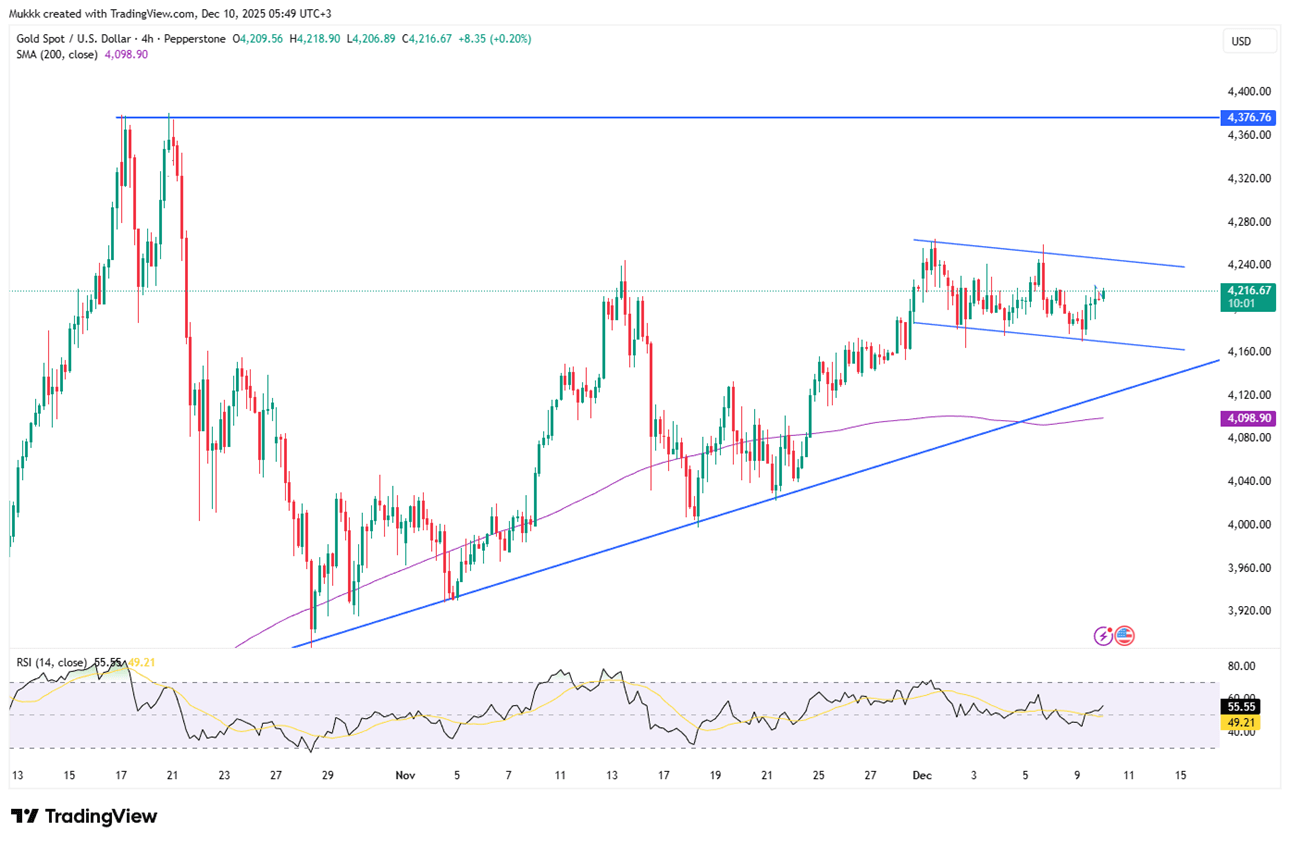

Gold hovered around $4,210 per ounce, moving within a tight range as the Fed’s rate decision and its implications for 2026 come into focus. Markets lean toward a cautious, hawkish-style cut, with Powell expected to emphasize restraint while inflation remains persistent. Recent US data showed continued labor resilience through stronger job openings and ADP hiring.

On the demand side, central-bank buying stayed supportive, led by China’s 13th monthly increase in gold reserves, reinforcing the metal’s strong performance this year.

Gold finds support near $4,170, while first resistance is seen around $4,250.

| R1: 4250 | S1: 4170 |

| R2: 4300 | S2: 4110 |

| R3: 4380 | S3: 4000 |

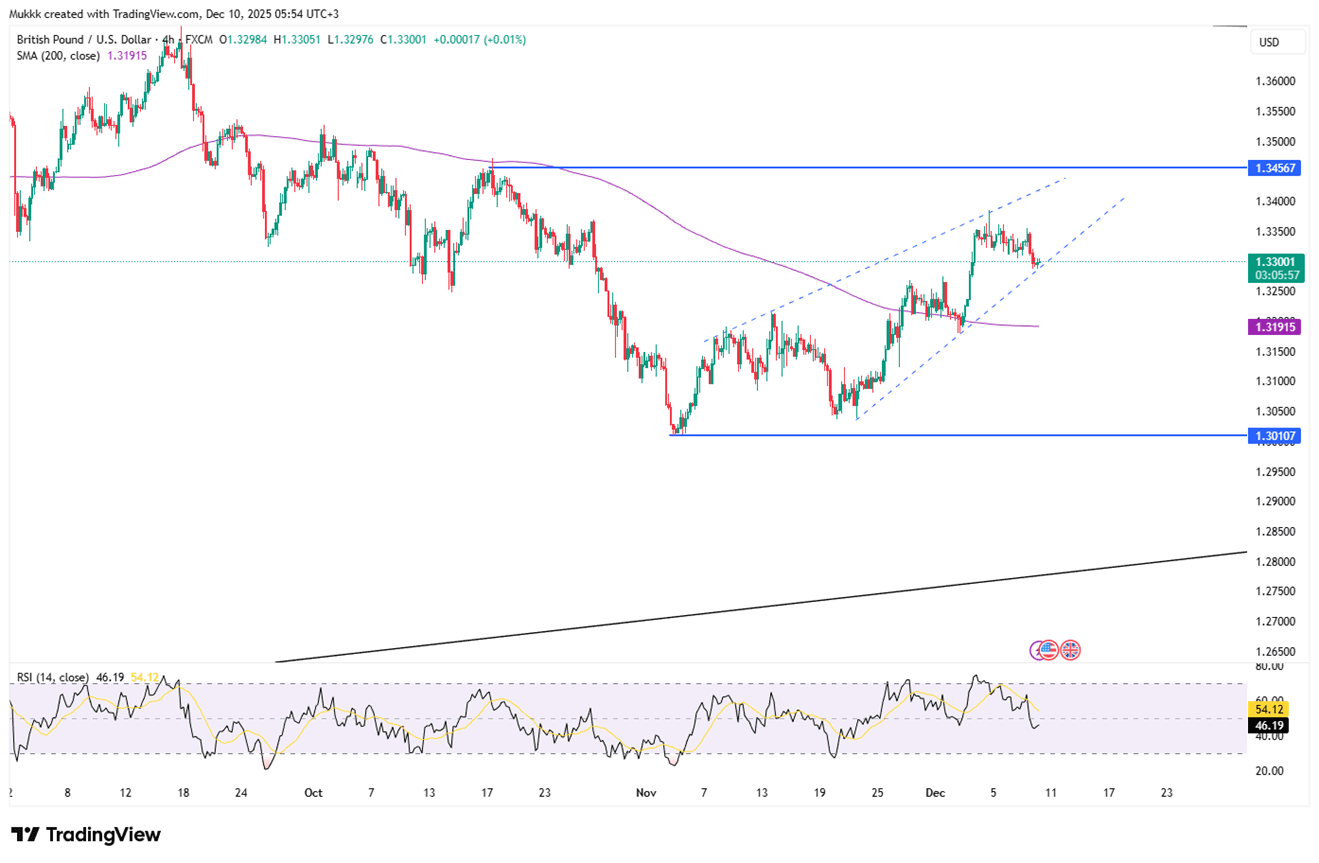

GBP/USD hovered close to $1.33, easing roughly 0.2% after slipping from the 1.3350 area and settling just above the 200-day EMA near 1.3250. A third 25-bp Fed cut is fully priced in, though Powell’s messaging will shape near-term direction. Uneven inflation trends, delayed data releases, and an upcoming leadership transition in 2026 have kept clarity limited. On the UK side, attention shifts toward next week’s BoE events, where growing rate-cut discussions continue to influence expectations.

GBP/USD holds support near 1.3250, with resistance aligned around 1.3340.

| R1: 1.3340 | S1: 1.3250 |

| R2: 1.3420 | S2: 1.3170 |

| R3: 1.3470 | S3: 1.3100 |

Silver traded near $61, extending its advance on persistent tightness in physical markets and firm expectations for a 25-bp Fed cut. Industrial demand from solar, EVs, and electronics continues to outpace weak mine supply, creating a structural deficit visible in falling inventories, constrained London liquidity, and strong ETF inflows. Technical momentum remains constructive, with the break above $59 opening the door toward $62. While a firmer Fed tone or a sudden supply response could slow the move, scarcity and institutional demand remain the dominant forces behind the rally.

Silver meets resistance near $61.50, while support holds around $60.00.

| R1: 61.50 | S1: 60.00 |

| R2: 62.70 | S2: 58.90 |

| R3: 64.00 | S3: 57.40 |

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

Detail March Starts With Geopolitical Turmoil (2-6 March)

March Starts With Geopolitical Turmoil (2-6 March)Global markets began the week in a state of high alert following coordinated US and Israeli strikes on Iran over the weekend, which resulted in the death of Supreme Leader Ayatollah Ali Khamenei.

Detail Geopolitical Shock Triggers Risk-Off Move (03.02.2026)President Trump stated that operations against Iran could last up to four weeks, though he added that developments are proceeding as planned and could wrap up sooner.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!