US stock futures were flat on Monday ahead of the Fed’s meeting, with markets pricing an 88% chance of a 25 bp cut on Wednesday.

Earnings from AutoZone, Oracle, Adobe, Broadcom, Costco and Lululemon will shape sentiment, while Tuesday’s delayed October JOLTS report is the last major labor signal before the decision. All three major indexes logged a second week of gains after softer September PCE data.

The 10-year yield climbed above 4.1%, a two-week high, as investors reassessed the 2026 policy path. Michigan sentiment improved, easing consumption worries despite weaker hiring. Debate continues over next year’s trajectory, especially with questions surrounding President Trump’s expected Fed Chair nominee and how deeply they may push for cuts.

Globally, policy decisions in Australia, Brazil, Canada and Switzerland are on deck, with no major rate changes anticipated. Meanwhile, long-term Treasury yields continue rising despite the Fed’s 1.5% in cumulative cuts since 2024, a divergence tied to inflation concerns, heavier bond supply, fiscal pressures and a higher term premium.

| Time | Cur. | Event | Forecast | Previous |

| 19:00 | USD | Nonfarm Productivity (QoQ) (Q3) | 3.3% | |

| 19:00 | USD | Unit Labor Costs (QoQ) (Q3) | 1.0% |

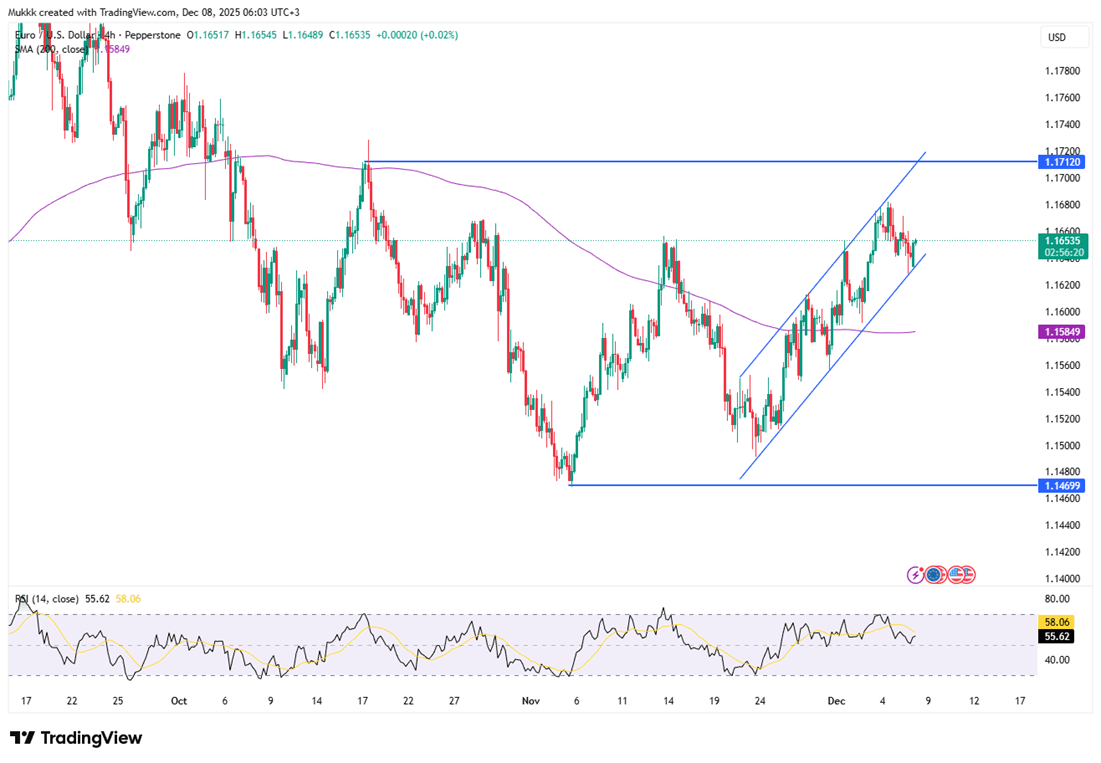

EUR/USD edged toward 1.1645 as attention turned to Wednesday’s Fed meeting, where markets assign an 87% probability to a 25 bp cut. A softer stance could weigh on the dollar, although a firmer tone from the Fed may offer near-term support. Monday’s Germany Industrial Production and Eurozone Sentix figures will guide the euro’s early-week direction, while steady inflation and expectations of an unchanged ECB stance on December 18 keep the broader backdrop supportive for the currency.

Technically, 1.1600 is the key support, while resistance comes in at 1.1680.

| R1: 1.1680 | S1: 1.1600 |

| R2: 1.1710 | S2: 1.1550 |

| R3: 1.1760 | S3: 1.1510 |

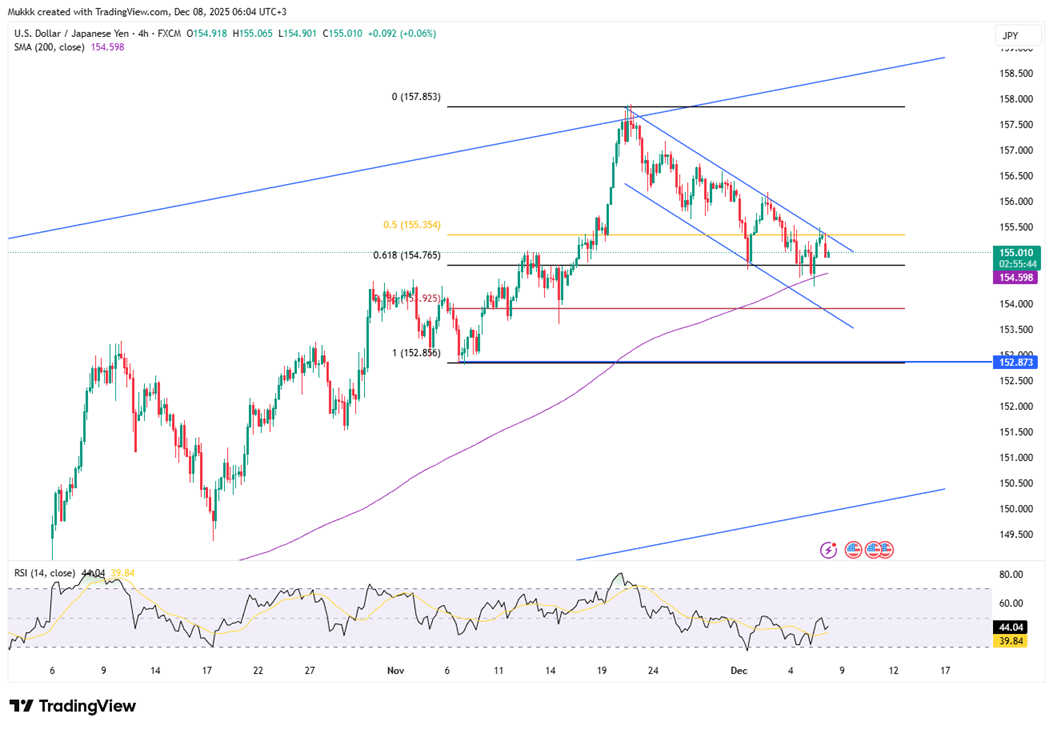

The yen advanced beyond 155 per dollar, reaching a three-week high as speculation intensified that the BOJ may lift rates next week. Recent comments from policymakers, combined with views that Prime Minister Takaichi’s administration prefers a firmer currency, helped reinforce the move. Weak real wages and a deeper Q3 contraction complicate Japan’s outlook, but broad USD softness ahead of the Fed meeting added an extra tailwind for the yen.

Technically, resistance is near 155.50, while support rests around 154.40.

| R1: 155.50 | S1: 154.40 |

| R2: 156.40 | S2: 153.60 |

| R3: 157.60 | S3: 152.80 |

Gold traded close to 4,200 per ounce, stabilizing after last week’s decline as focus shifted to the Fed’s final meeting of the year, where a rate cut is widely expected. Softer labor trends and firm core inflation strengthened the case for easing, with markets pricing an 88% chance of a 25-bp move and anticipating additional reductions in 2026. Updated Fed projections and Tuesday’s JOLTS report will shape expectations further. Meanwhile, China extended its official gold purchases for a thirteenth consecutive month.

Gold finds support near 4175, while resistance appears around 4260.

| R1: 4260 | S1: 4170 |

| R2: 4320 | S2: 4110 |

| R3: 4380 | S3: 4000 |

GBP/USD hovered around 1.3340 on Monday, staying near late-October highs as markets positioned for this week’s Fed decision. UK sentiment improved after a stronger services PMI reading, while Chancellor Reeves’ fiscal framework offered stability. Markets currently assign roughly an 86% probability to a Fed cut and expect further easing next year. The Bank of England remains divided before its December 18 meeting, yet pricing still leans toward a 25-bp reduction as domestic growth and employment indicators soften.

From a technical perspective, 1.3250 acts as support, with resistance at 1.3390.

| R1: 1.3390 | S1: 1.3250 |

| R2: 1.3440 | S2: 1.3170 |

| R3: 1.3500 | S3: 1.3040 |

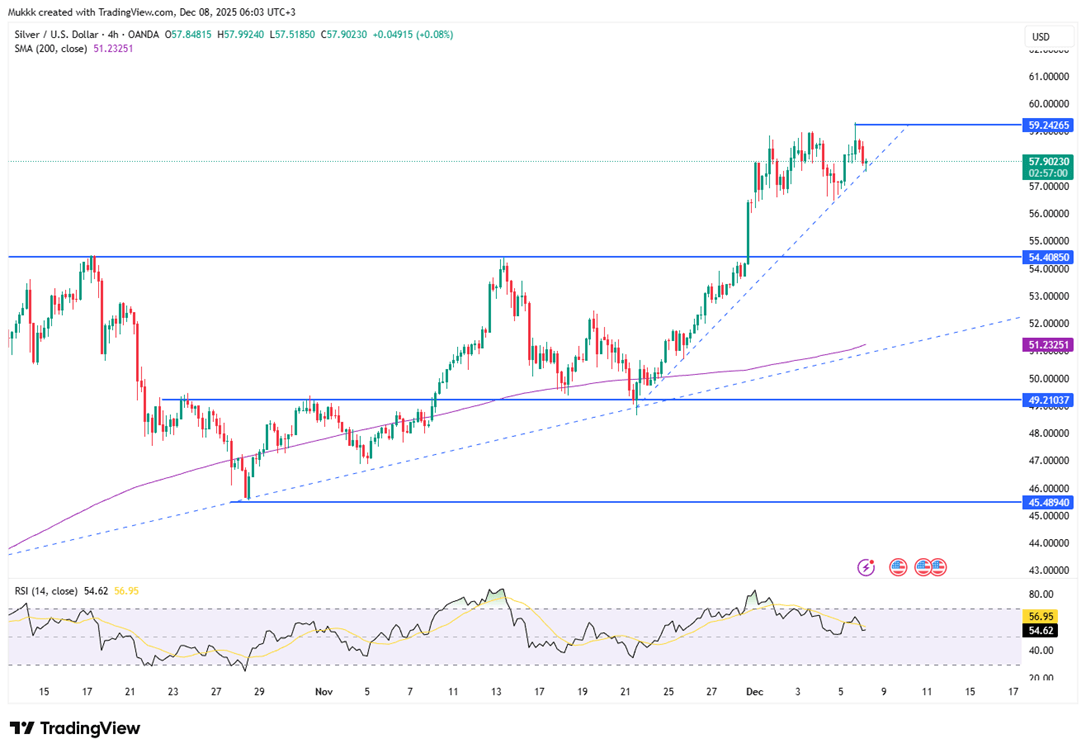

Silver climbed back above $58 on Monday, returning toward record levels after last week’s brief pullback faded quickly. The delayed September PCE release and Michigan sentiment data kept expectations for an upcoming Fed cut intact, improving the appeal of non-yielding metals. Cooling private-sector hiring and an uptick in layoffs added to the case for policy easing. The metal also drew support from tight inventories, renewed ETF inflows, expectations of a 2025 supply deficit, and firm industrial demand tied to solar and green-tech production.

Technically, resistance is near $59.30, while support holds around $56.90.

| R1: 59.30 | S1: 56.90 |

| R2: 60.20 | S2: 54.50 |

| R3: 61.00 | S3: 52.40 |

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

Detail March Starts With Geopolitical Turmoil (2-6 March)

March Starts With Geopolitical Turmoil (2-6 March)Global markets began the week in a state of high alert following coordinated US and Israeli strikes on Iran over the weekend, which resulted in the death of Supreme Leader Ayatollah Ali Khamenei.

Detail Geopolitical Shock Triggers Risk-Off Move (03.02.2026)President Trump stated that operations against Iran could last up to four weeks, though he added that developments are proceeding as planned and could wrap up sooner.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!