EUR/USD edged higher but remained constrained by USD strength, with the Fed maintaining a hawkish stance while the ECB prepared for a rate cut.

The Japanese yen strengthened past 154.5 per dollar, anticipating BOJ Deputy Governor Himino’s comments following the central bank’s recent rate hike. Gold held steady at $2,760 per ounce, supported by dovish moves from other central banks despite the Fed’s firm stance on inflation.

The British pound hovered near $1.24, with traders eyeing the BoE’s potential rate cut and concerns over UK debt levels. Meanwhile, silver remained flat at $30.40 per ounce, as traders focused on the Fed’s decision and the impact of possible US tariffs on Canada, Mexico, and China.

| Time | Cur. | Event | Forecast | Previous |

| 13:15 | EUR | Deposit Facility Rate (Jan) | 2.75% | 3.00% |

| 13:15 | EUR | ECB Interest Rate Decision (Jan) | 2.90% | 3.10% |

| 13:30 | USD | GDP (QoQ) (Q4) | 2.7% | 3.1% |

| 13:30 | USD | Initial Jobless Claims | 224K | 223K |

| 13:45 | EUR | ECB Press Conference | - | - |

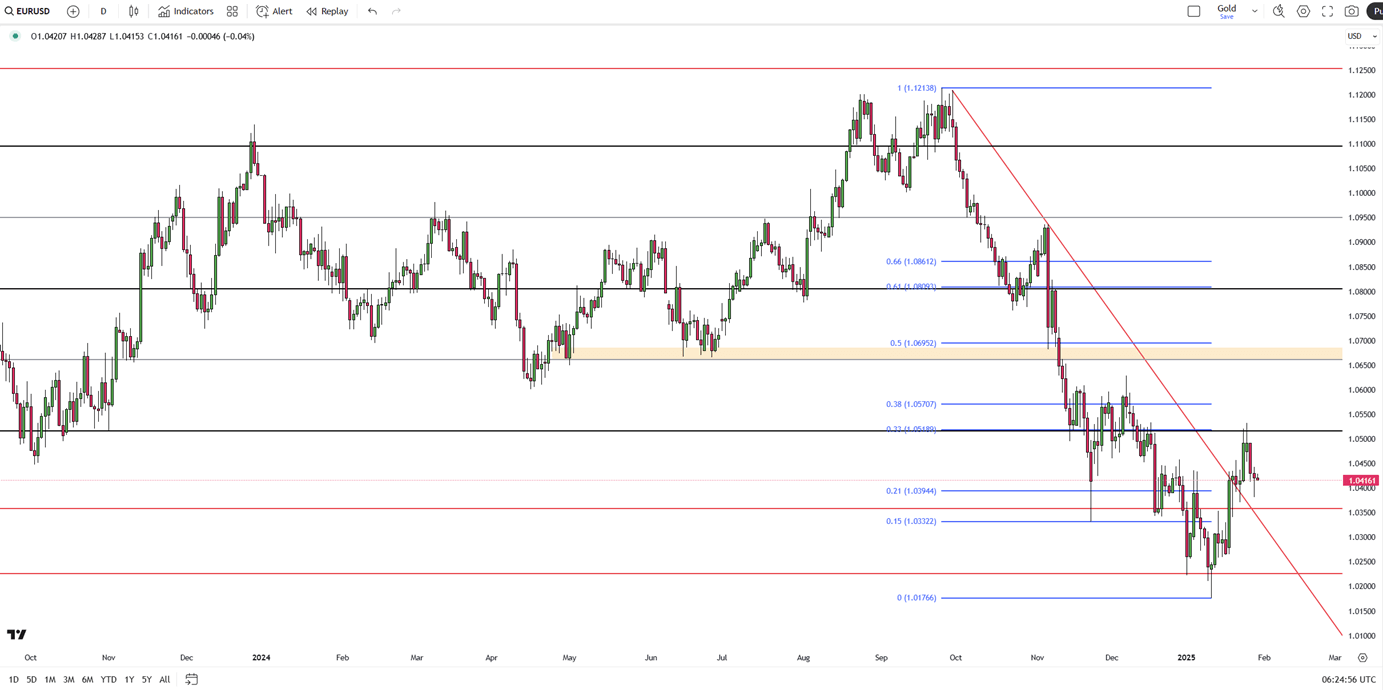

EUR/USD edges higher after three losses, trading around 1.0420 in Thursday’s Asian session, driven by a technical USD rebound. The US Dollar Index (DXY) remains just under 108.00.

Further EUR/USD gains may be limited as the Fed maintains a hawkish stance, removing confidence in inflation reaching 2%. Fed Chair Powell stated policy changes require "real progress on inflation or labor market weakness." As expected, the Fed held rates at 4.25%-4.50% in January after three cuts since September 2024, totaling a 1% reduction.

Meanwhile, the ECB is expected to cut rates by 25 basis points on Thursday, lowering the Deposit Rate to 2.75%, with further cuts anticipated, pressuring the Euro. Traders await Eurozone and German Q4 GDP data, followed by the US GDP report later.

Technically, resistance levels are at 1.0450, 1.0515, and 1.0550, while support levels are at 1.0355, 1.0270, and 1.0225.

| R1: 1.0450 | S1: 1.0355 |

| R2: 1.0515 | S2: 1.0270 |

| R3: 1.0550 | S3: 1.0225 |

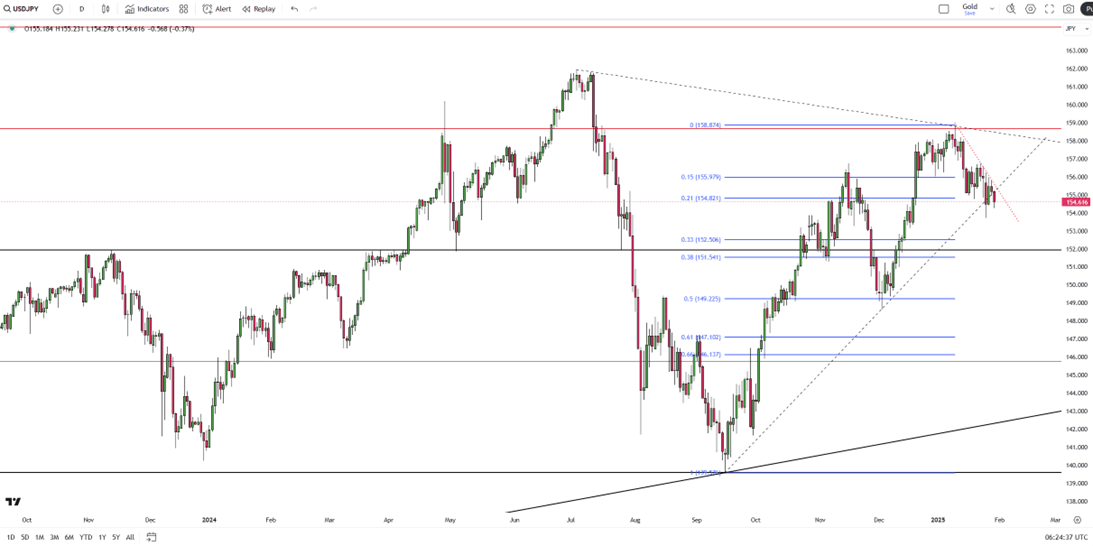

The Japanese yen strengthened past 154.5 per dollar on Thursday, marking a second straight gain as investors awaited BOJ Deputy Governor Ryozo Himino’s remarks. Earlier this month, Himino signaled the January 24 rate hike, fueling speculation of a continued hawkish stance. The BOJ raised rates and upgraded inflation forecasts in January but remains cautious, with future decisions depending on inflation, wages, and global risks. Meanwhile, the Fed paused its rate cuts, noting inflation remains “somewhat elevated.”

Key resistance is at 155.60, with targets at 158.70 and 160.00. Support stands at 153.80, followed by 151.90 and 149.20.

| R1: 155.60 | S1: 153.80 |

| R2: 158.70 | S2: 151.90 |

| R3: 160.00 | S3: 149.20 |

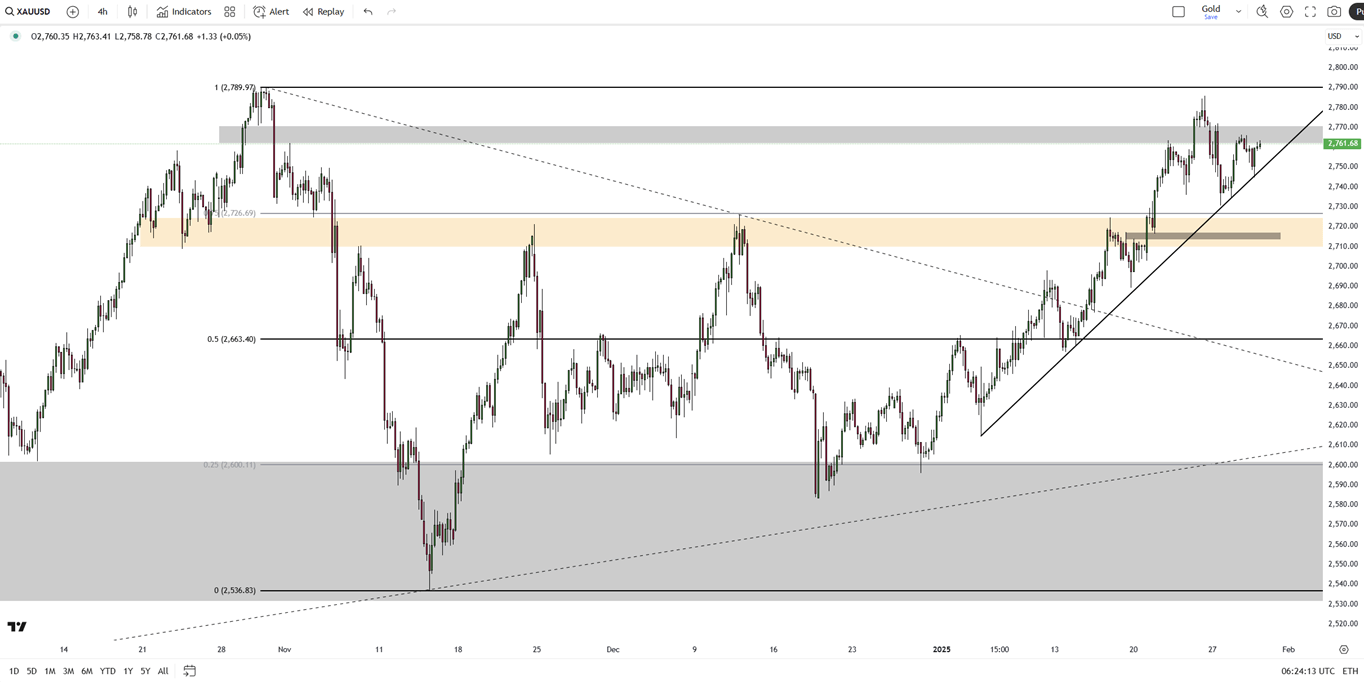

Gold held around $2,760 per ounce on Thursday after a slight decline, as investors reassessed the Fed’s hawkish stance. Policymakers reaffirmed that inflation remains elevated, removing references to progress toward 2%, which weighs on gold by increasing the opportunity cost of holding non-yielding assets.

Dovish moves from other central banks supported the precious metal. The BoC ended quantitative tightening, the Riksbank cut rates, and the ECB is expected to follow. The RBI and PBoC also signaled rate cuts.

Technically, resistance is at 2,790, with further levels at 2,800 and 2,820. Support stands at 2,730, followed by 2,660 and 2,630.

| R1: 2790 | S1: 2730 |

| R2: 2800 | S2: 2660 |

| R3: 2820 | S3: 2630 |

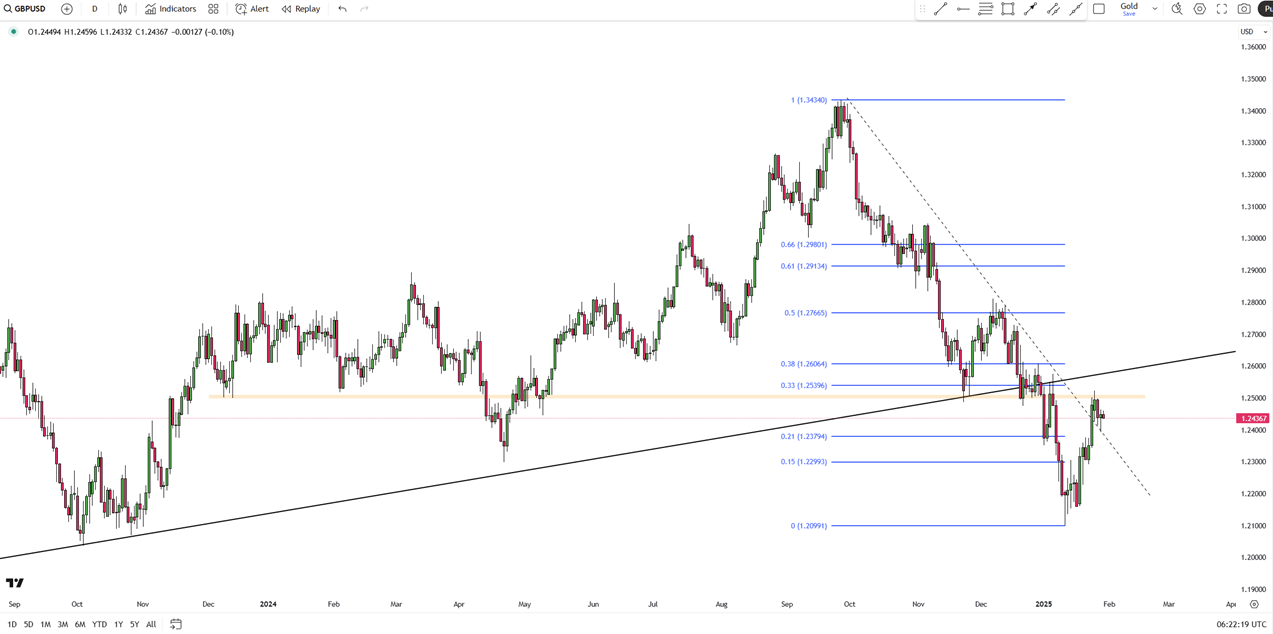

The British pound hovered around $1.24, just below a three-week high, as traders assessed central bank decisions and the UK economic outlook. The Fed held rates steady with a cautious tone on cuts, while the ECB is expected to lower rates by 25bps, following similar moves by the BoC and Riksbank.

In the UK, the BoE is likely to cut rates by 25bps in February, though stronger data may slow the pace. Meanwhile, Finance Minister Rachel Reeves outlined growth plans, including a third Heathrow runway, while debt sustainability remains a concern.

Key resistance is at 1.2460, with further levels at 1.2500 and 1.2600. Support stands at 1.2400, followed by 1.2350 and 1.2265.

| R1: 1.2460 | S1: 1.2400 |

| R2: 1.2500 | S2: 1.2350 |

| R3: 1.2600 | S3: 1.2265 |

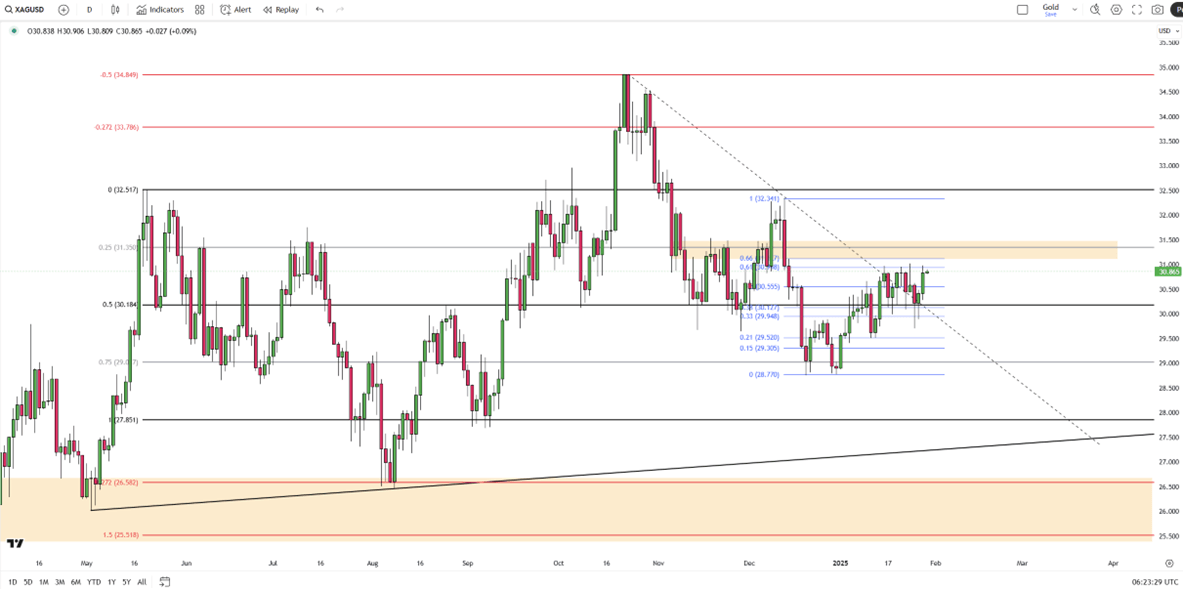

Silver remained steady at around $30.40 per ounce on Wednesday as traders awaited the Fed’s policy decision. The central bank is expected to keep rates unchanged despite pressure from President Trump to lower borrowing costs.

Investors also assessed potential US tariffs, with Trump planning levies on Canada and Mexico by Saturday, while tariffs on China remain under consideration. Meanwhile, overcapacity in China’s solar panel industry may dampen silver demand.

Key resistance is at 31.00, with further levels at 31.80 and 32.50. Support stands at 29.85, followed by 28.80 and 28.50.

| R1: 31.00 | S1: 29.85 |

| R2: 31.80 | S2: 28.80 |

| R3: 32.50 | S3: 28.50 |

Global markets remained dominated by dollar strength as geopolitical tensions and rising energy prices reshaped monetary expectations.

Oil Tanker Attacks Create Volatility

Oil Tanker Attacks Create VolatilityRecent strikes on oil tankers in the Persian Gulf have exposed the extreme vulnerability of global energy supplies. Footage of burning vessels near the Iraqi coastline has saturated financial media, serving as a reminder to market participants of the risks inherent in the region. Whenever tensions escalate in this region, energy traders immediately begin pricing in the possibility of supply disruptions.

Detail Dollar Leads as Markets Reprice Risk (03.12.2026)Currency markets remained under pressure as energy-driven inflation concerns and ongoing geopolitical tensions continued to support the U.S. dollar.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!