On Tuesday, precious metals and oil started the day with an increase due to geopolitical tensions.

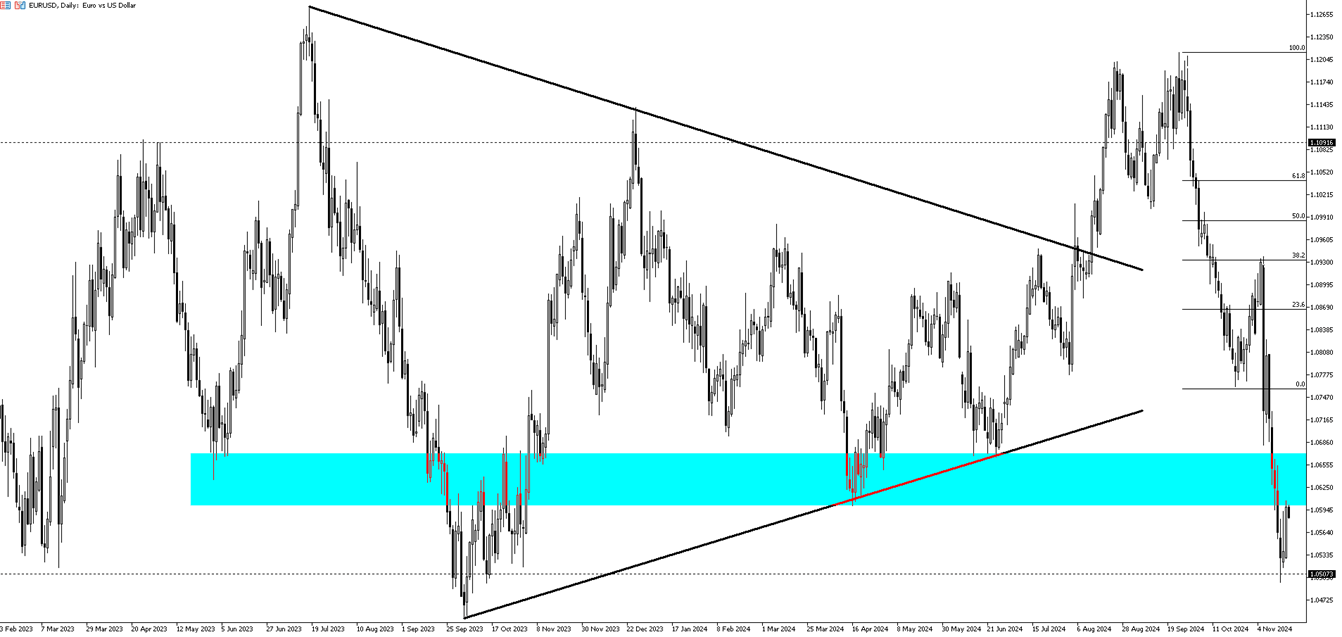

In the dollar market, however, we see that after a significant rally, the pairs are beginning to rise again as profit-taking continues. In the Eurozone, we will see whether the rise in the EUR/USD pair continues with the release of the upcoming CPI data today.

| Time | Cur. | Event | Forecast | Previous |

| 10:00 | EUR | Core CPI (YoY) (Oct) | 2.7% | 2.7% |

| 10:00 | EUR | CPI (MoM) (Oct) | 0.3% | 0.3% |

| 10:00 | EUR | CPI (YoY) (Oct) | 2.0% | 2.0% |

| 16:30 | US | Atlanta Fed GDPNow (Q4) | 2.5% | 2.5% |

| 23:50 | JPY | Exports (YoY) (Oct) | -360.4B | -294.1B |

The euro rose to $1.0594, recovering from last week’s one-year low of $1.0496, as investors assessed market shifts after Trump’s U.S. presidential win. Concerns remain over potential tariffs on the EU and China, while Trump’s Treasury Secretary pick, potentially Kevin Warsh or Marc Rowan, is closely watched. Analysts expect Trump’s policies, like tariffs and debt-funded tax cuts, to drive inflation, reducing the need for further Fed rate cuts. A weak European economic outlook keeps ECB policy expectations unchanged, with euro area CPI data awaited.

The dollar index held at 106.2 after two days of declines but remains 6% higher than its September low, supported by fewer Fed rate cut expectations and optimism for the U.S. economy under Trump.

EUR/USD resistance levels are 1.0600, 1.0650, and 1.0700, with support at 1.0550, 1.0500, and 1.0450.

| R1: 1.0600 | S1: 1.0550 |

| R2: 1.0650 | S2: 1.0500 |

| R3: 1.0700 | S3: 1.0450 |

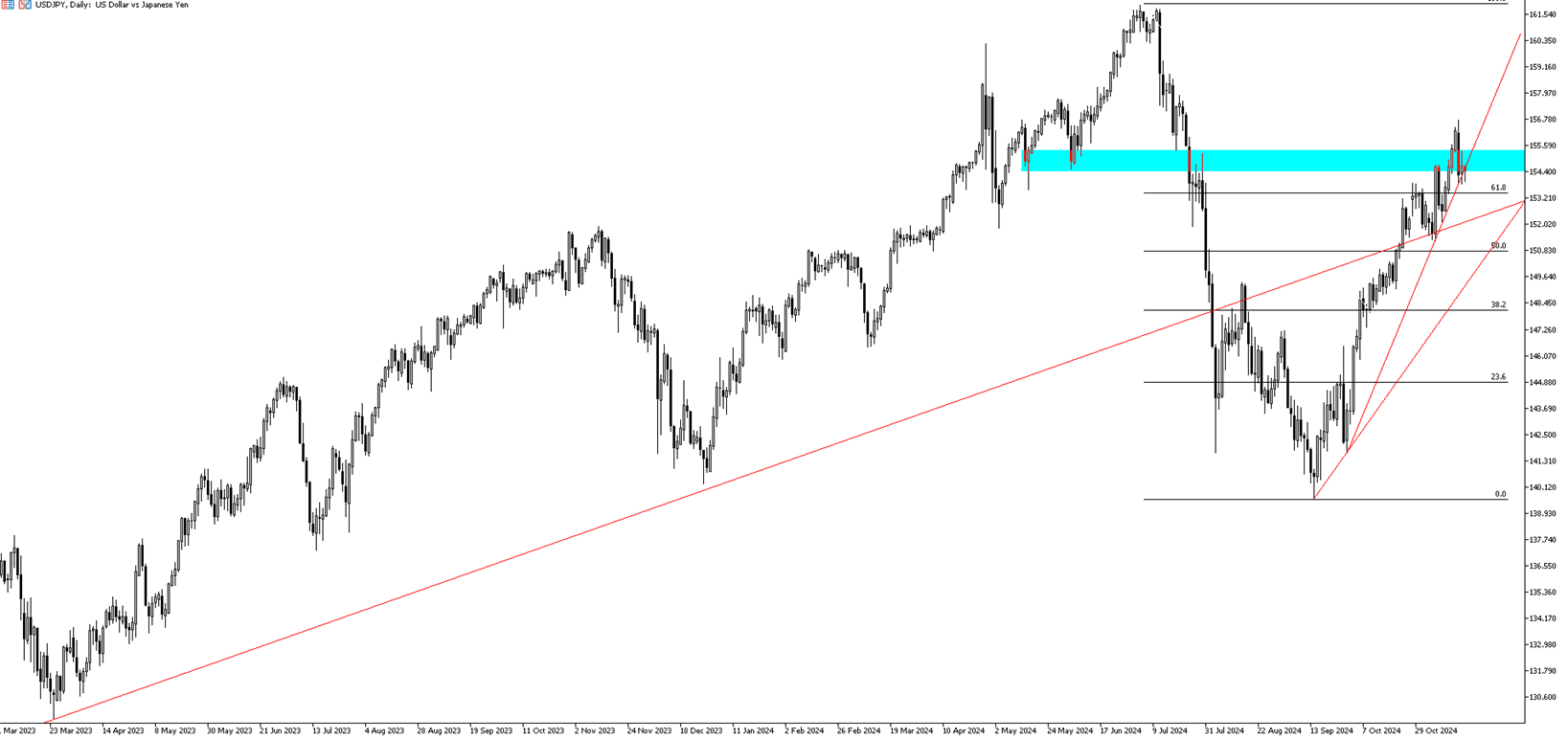

The Japanese yen strengthened to around 154 per dollar on Tuesday, recovering from four-month lows, as authorities issued warnings against excessive forex moves. Finance Minister Katsunobu Kato emphasized the government would monitor exchange rates and take action if needed. MUFG also suggested Japan could accelerate interest rate hikes due to persistent inflation. However, BOJ Governor Kazuo Ueda said any rate increases would be gradual, without giving a specific timeline. The yen has dropped over 10% since September, impacted by uncertainty over BOJ policy and a stronger dollar driven by expectations of fewer Fed rate cuts.

In the USD/JPY pair, the first support level is at 153.80. If this level is broken, the next support levels to monitor are 152.50 and 151.80. On the upside, resistance levels are at 156.10, 157.50, and 158.00, respectively.

| R1: 156.10 | S1: 153.80 |

| R2: 157.50 | S2: 152.50 |

| R3: 158.00 | S3: 151.80 |

Gold surged above $2,620 per ounce on Tuesday, reaching its highest point in a week, primarily due to a weakening US dollar. Market focus has now shifted to remarks from Federal Reserve officials, as investors seek more insight into the central bank’s stance on monetary easing. Expectations for a rate cut of 0.25% at the Fed’s December meeting have fallen to just below 59%, a decrease from 62% the previous day and over 65% a week earlier, according to CME FedWatch. Investors are also closely tracking President-elect Donald Trump’s cabinet picks. Additionally, growing geopolitical uncertainties are driving increased demand for safe-haven assets like gold, as tensions continue to rise in the Middle East and between Russia and Ukraine.

The first support level for gold is at $2,575, followed by $2,545 and $2,525 while $2,635 serves as a key resistance level, with $2,691 and $2,711 as the next levels to monitor if this resistance is surpassed.

| R1: 2635 | S1: 2575 |

| R2: 2691 | S2: 2545 |

| R3: 2711 | S3: 2525 |

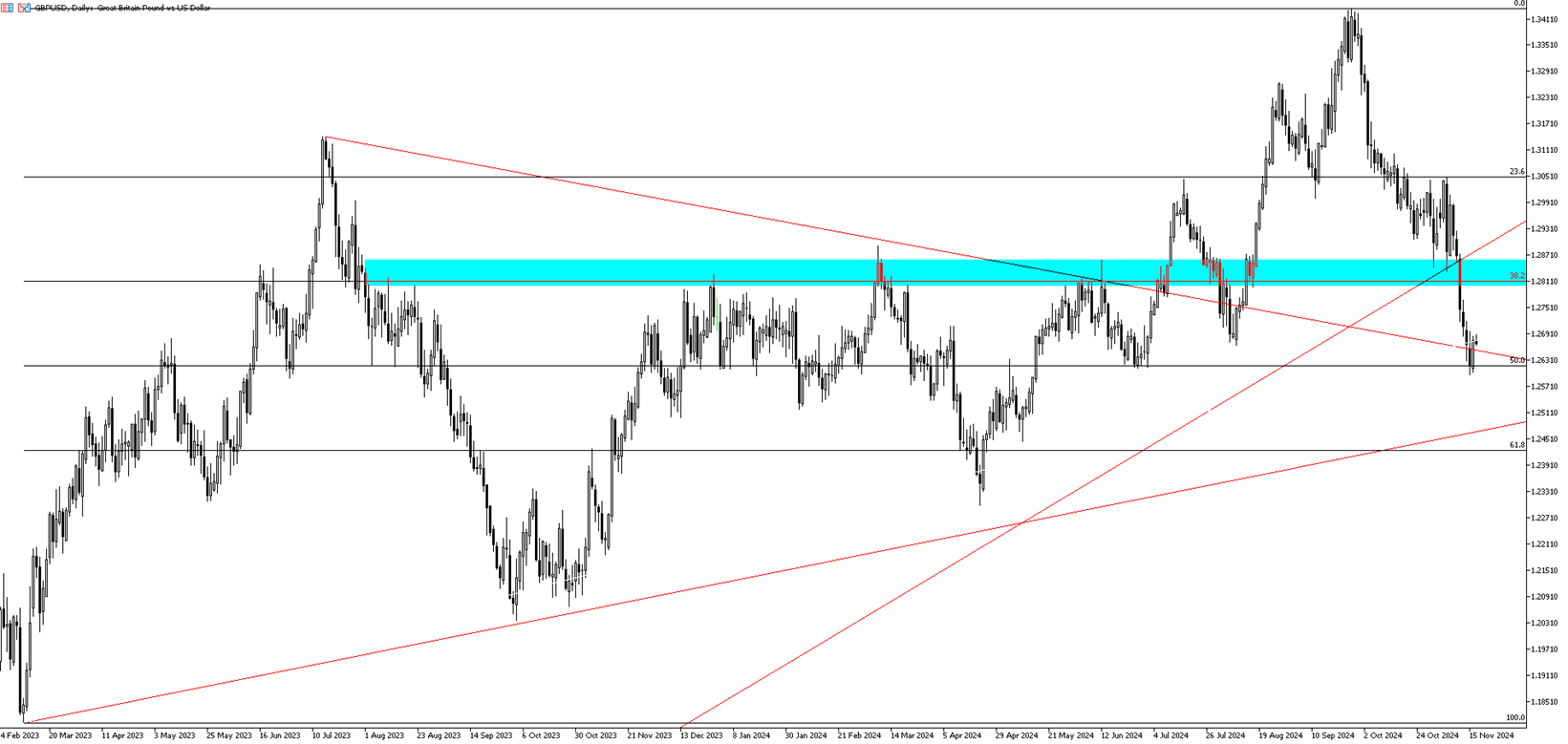

The British pound remained stable at $1.268 on Tuesday, staying close to its lowest point since mid-May, as the dollar strengthened following Donald Trump’s win in the US presidential election. Investors expected Trump’s policies, such as trade tariffs and tax cuts to boost growth and inflation. This potentially reduces the need for further interest rate cuts by the Federal Reserve. Although the pound has dropped 2.7% since the election, it has performed better than the euro, which may be more impacted by tariffs targeting China, the EU, and Mexico. On the monetary policy side, traders see an 80% chance of another rate cut by the Bank of England (BoE) next month, with rates likely to fall slightly above 4% by the end of 2025. Recent data showed the UK economy unexpectedly contracted in September, with third-quarter growth slowing to just 0.1%.

Key support levels for the GBP/USD pair are at 1.2595, 1.2520, and 1.2475. On the upside, resistance levels to watch are at 1.2680, 1.2740, and 1.2820.

| R1: 1.2680 | S1: 1.2595 |

| R2: 1.2740 | S2: 1.2520 |

| R3: 1.2820 | S3: 1.2475 |

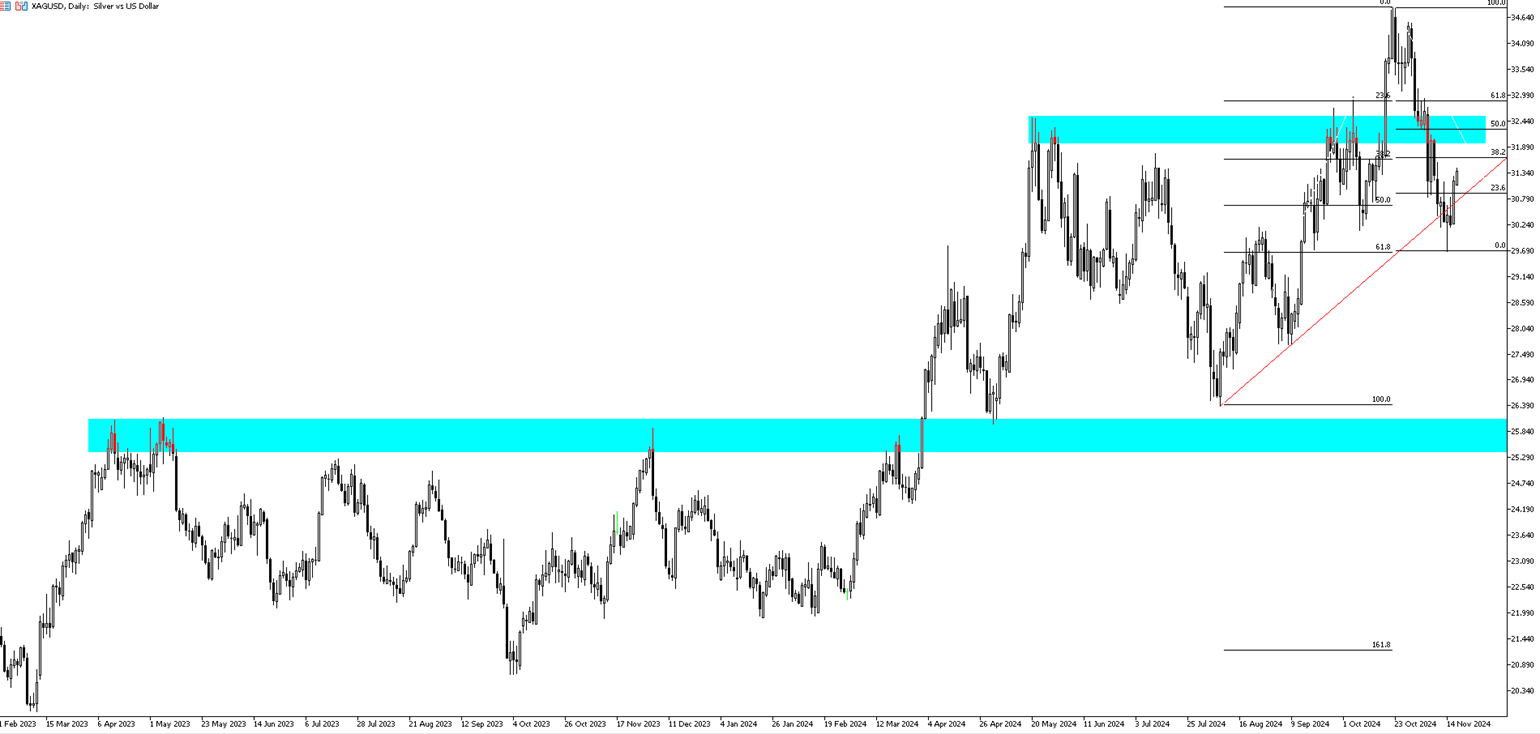

Silver prices rose above $31.35 per ounce on Tuesday, recovering from two-month lows as the recent dollar rally lost momentum and investors re-evaluated the outlook for Federal Reserve policy. The dollar saw profit-taking after its recent gains, fueled by expectations of fewer Fed rate cuts and optimism about the US economy's performance under President-elect Trump. Markets are also focusing on China’s upcoming decision on the Loan Prime Rate (LPR), hoping for additional stimulus measures to support economic growth. Meanwhile, geopolitical tensions increased as US President Joe Biden authorized Ukraine to use US-made weapons for strikes deep within Russia, raising concerns about a potential global conflict and driving renewed demand for safe-haven assets like silver.

On the upside, the critical resistance levels to watch are 31.60, 32.10, and 32.50. On the downside, 30.80 remains a significant first support level. If this level is breached, the next support levels to monitor are 30.20 and 29.80, respectively.

| R1: 31.60 | S1: 30.80 |

| R2: 32.50 | S2: 30.20 |

| R3: 32.80 | S3: 29.80 |

Currency markets remained volatile as ongoing Middle East tensions continued to shape global sentiment.

Hormuz Blockade Rattles Markets (09 - 13 March)

Hormuz Blockade Rattles Markets (09 - 13 March)Global sentiment was dominated this week by the second week of the war with Iran and the effective blockade of the Strait of Hormuz, driving Brent crude prices above $100/barrel. Despite a catastrophic US labor report showing a loss of 92,000 jobs in February, safe-haven demand pushed the US Dollar Index to 99.1. The energy shock has ignited fears of "stagflation," particularly in Europe and Japan, as soaring fuel costs threaten to reverse recent disinflationary trends.

Detail Oil Shock Drives Dollar Higher (03.09.2026)Global markets opened the week under pressure as escalating Middle East tensions and disruptions in the Strait of Hormuz pushed oil prices above $100 per barrel.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!