The euro strengthens against the dollar, targeting resistance levels at 1.1230 and 1.1252, driven by dollar weakness and yen volatility. GBP/USD is at a pivotal trend line, with the potential to either break out or retreat to support at 1.3012. The yen faces critical tests as USD/JPY continues its downtrend, approaching key support levels at 143 and 140. Gold hovers near significant support at 2489, with expectations for an uptrend continuation if this level holds. Silver encounters resistance around 30, with potential declines if it fails to break through this barrier.

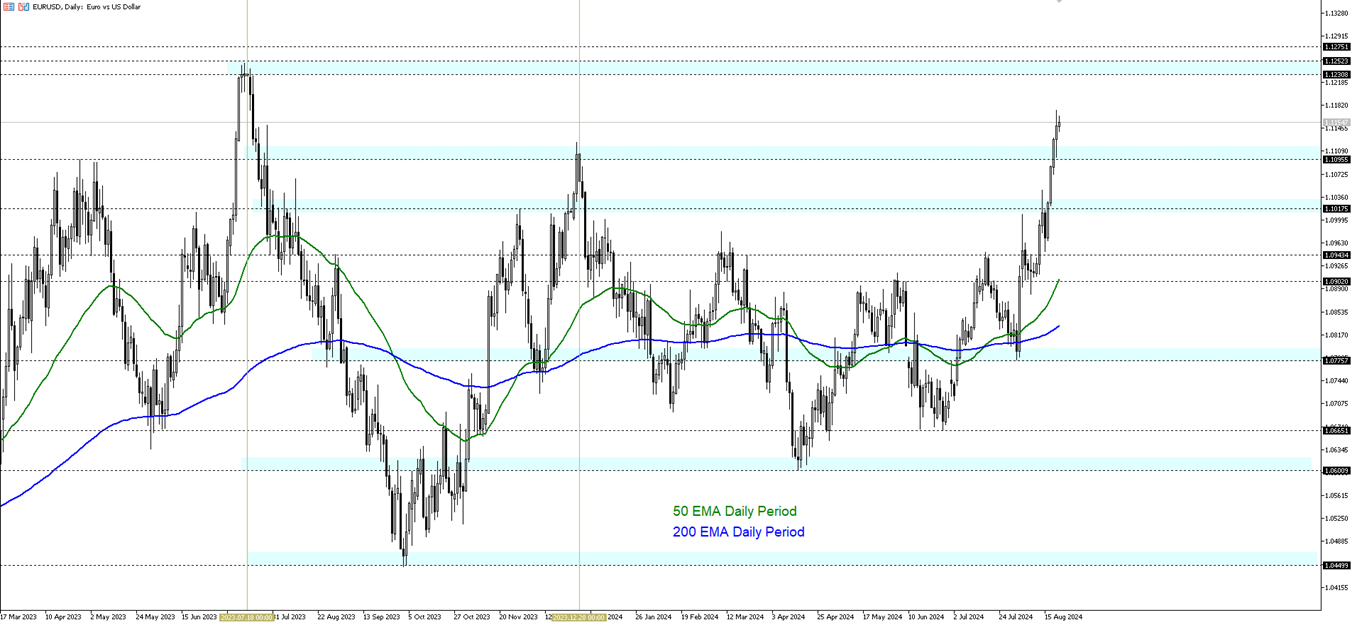

In essence, with the dollar weakening and volatility rising due to the yen's monetary policy, market participants are shifting their focus to the euro. From a technical standpoint, as long as the price remains above 1.1117, buying pressure is likely to persist. Consequently, the price might begin testing the range between 1.1230 and 1.1252.

| R1: 1.1230 | S1: 1.1117 |

| R2: 1.1252 | S2: 1.1095 |

| R3: 1.1275 | S3: 1.1032 |

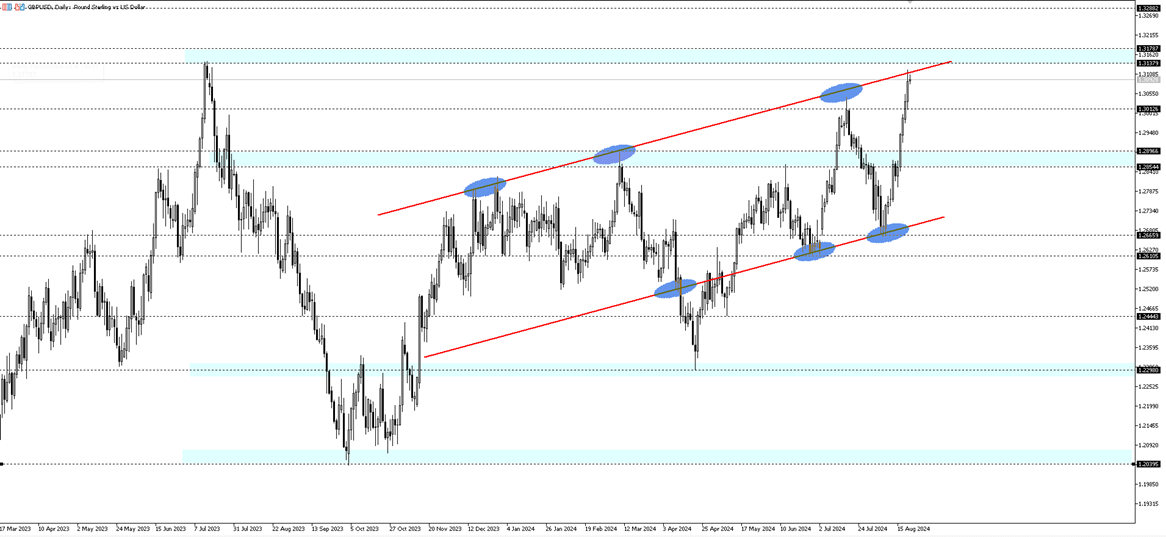

GBP/USD is in a critical area. The upward trend that has been ongoing since the beginning of the year is very close to its upper boundary and is at a decision point. The effort to break above the trend line is ongoing. As long as it remains below this level, it could return to support levels around 1.3012."

| R1: 1.3137 | S1: 1.3012 |

| R2: 1.3178 | S2: 1.2896 |

| R3: 1.3288 | S3: 1.2854 |

With the end of the rebound buying, USD/JPY has continued its downtrend since the beginning of the week. It is preparing to test the rising trend line for the fourth time. If this rising trend zone is broken to the downside, we could see a rapid movement towards 143 and 140 levels."

| R1: 146 | S1: 143 |

| R2: 149 | S2: 140 |

| R3: 151 | S3: 137 |

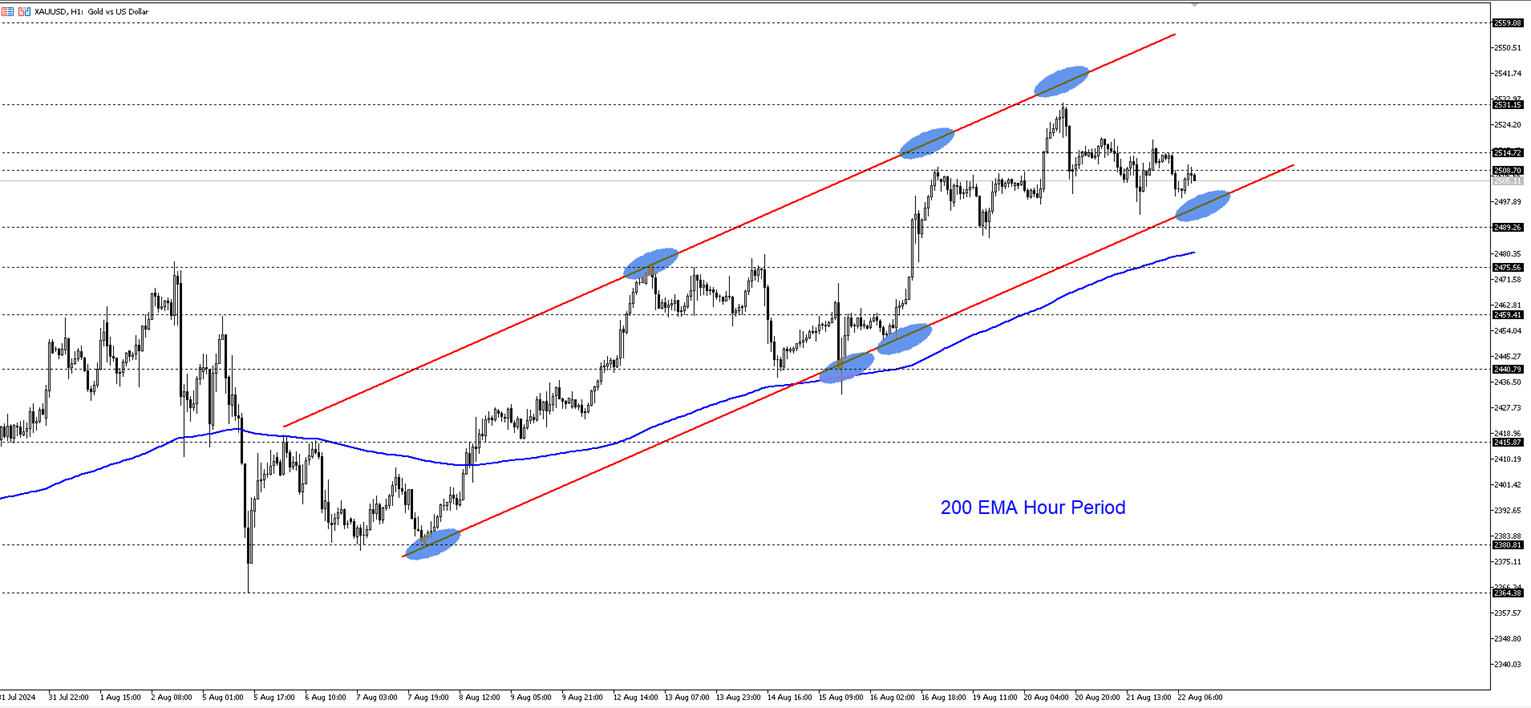

XAU/USD is approaching the lower part of the uptrend channel. It is very close to testing the lower line of the uptrend for the fourth time. As long as it stays above this trend line, the middle of the channel at 2524 and the upper boundary at 2550 could be targeted. Geopolitical risks are increasing the significance of these levels. The expectation is for the general uptrend to continue.

| R1: 2514 | S1: 2489 |

| R2: 2531 | S2: 2475 |

| R3: 2559 | S3: 2459 |

Since the uptrend that began on August 6th, the movement has slowed down as it encountered reactionary selling from the 30 level. It is now testing the second ascending trend line. As long as it does not break above the 29.83 – 30.25 channel, continued reactionary selling and a potential drop below the 29.06 – 28.56 channel can be expected. However, news related to geopolitical risks could lead to a rapid break of technical levels and cause more pronounced movements. The overall expectation is for the uptrend to continue along with gold.

| R1: 29.83 | S1: 29.06 |

| R2: 30.25 | S2: 28.56 |

| R3: 30.85 | S3: 28.16 |

Global markets on Friday leaned cautiously constructive as traders positioned for a possible Fed rate cut next week, persistent tightness in precious metals, and rising expectations of a BOJ shift.

Detail Dovish Wave Lifts Metals as Yen Tightens (12.04.2025)Markets on Thursday leaned toward a dovish global outlook, lifting precious metals and reshaping major currency moves.

Detail Gold Climbs, Yen Recovers on Soft US Signals (12.03.2025)Rate-cut expectations overtook Wednesday trading.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!