Markets remained cautious on Tuesday as investors weighed slowing Eurozone growth, firm U.S. data, and rising global trade tensions.

The euro hovered near $1.08 after ECB officials hinted at possible rate cuts, while the dollar gained ground and the yen weakened amid BoJ rate hike speculation. Gold held near record highs above $3,020 on safe-haven demand, while silver rebounded above $33 as traders assessed the potential impact of Trump’s upcoming tariff decisions. The pound stayed resilient at nearly $1.2920, which is ahead of the UK’s spring budget update.

| Time | Cur. | Event | Forecast | Previous |

| 07:00 | GBP | CPI (YoY) (Feb) | 2.9% | 3.0% |

| 10:00 | GBP | Spring Forecast Statements | - | - |

| 12:30 | USD | Durable Goods Orders (MoM) | -0.6% | 3.1% |

| 13:30 | USD | Crude Oil Inventories | 1.745M |

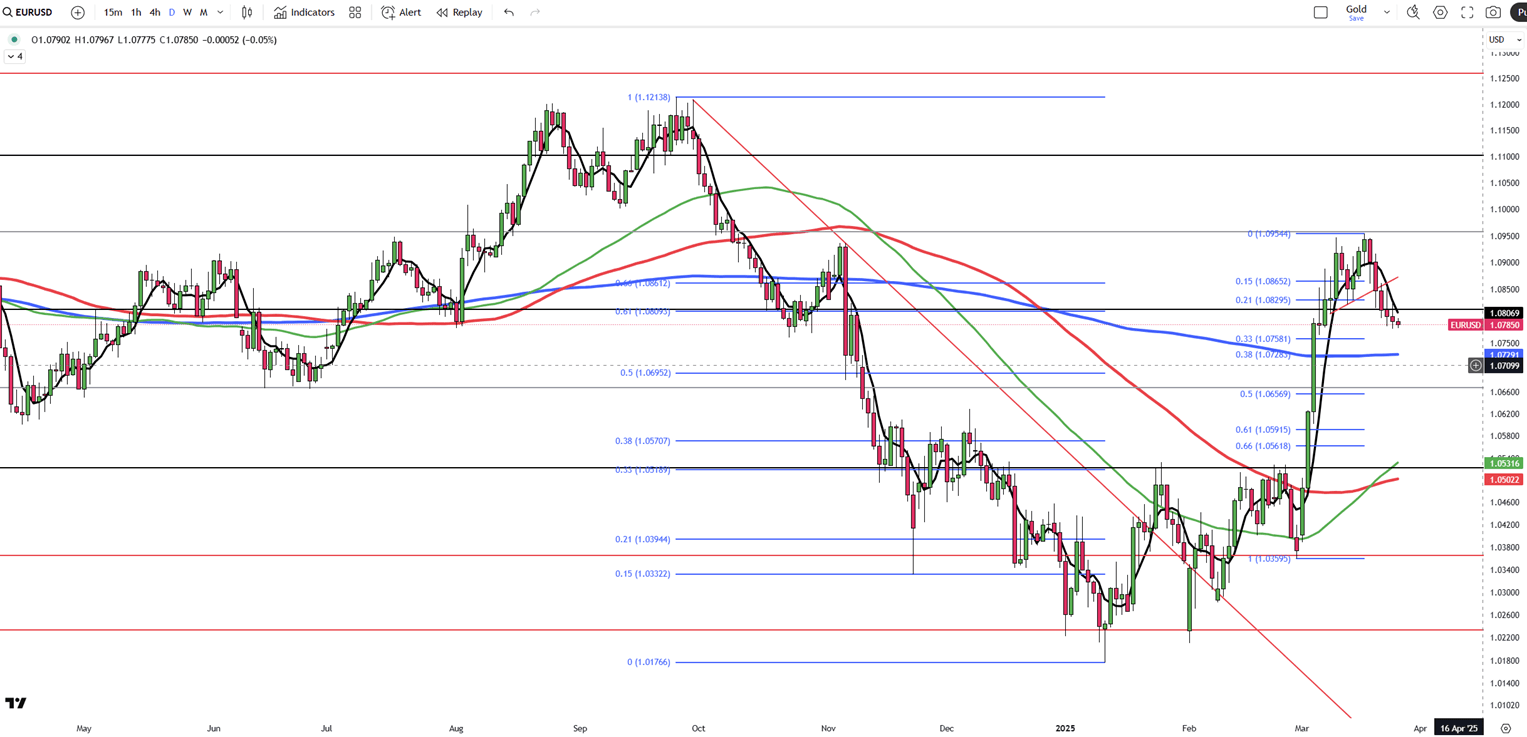

The euro hovered near $1.08, its weakest since March 6, as investors digested PMI data and ECB comments. Eurozone private sector activity grew at its fastest pace since August but missed expectations, with manufacturing rebounding and services slowing.

ECB’s Cipollone and Stournaras signaled growing support for a rate cut, possibly in April, citing faster disinflation. Lagarde warned of weaker growth but downplayed inflation risks from EU-U.S. trade tensions, suggesting no rate hikes. De Galhau also noted room for further easing.

Key resistance is at 1.0860, followed by 1.0950 and 1.1000. Support stands at 1.0730, with further levels at 1.0660 and 1.0600.

| R1: 1.0860 | S1: 1.0730 |

| R2: 1.0950 | S2: 1.0660 |

| R3: 1.1000 | S3: 1.0600 |

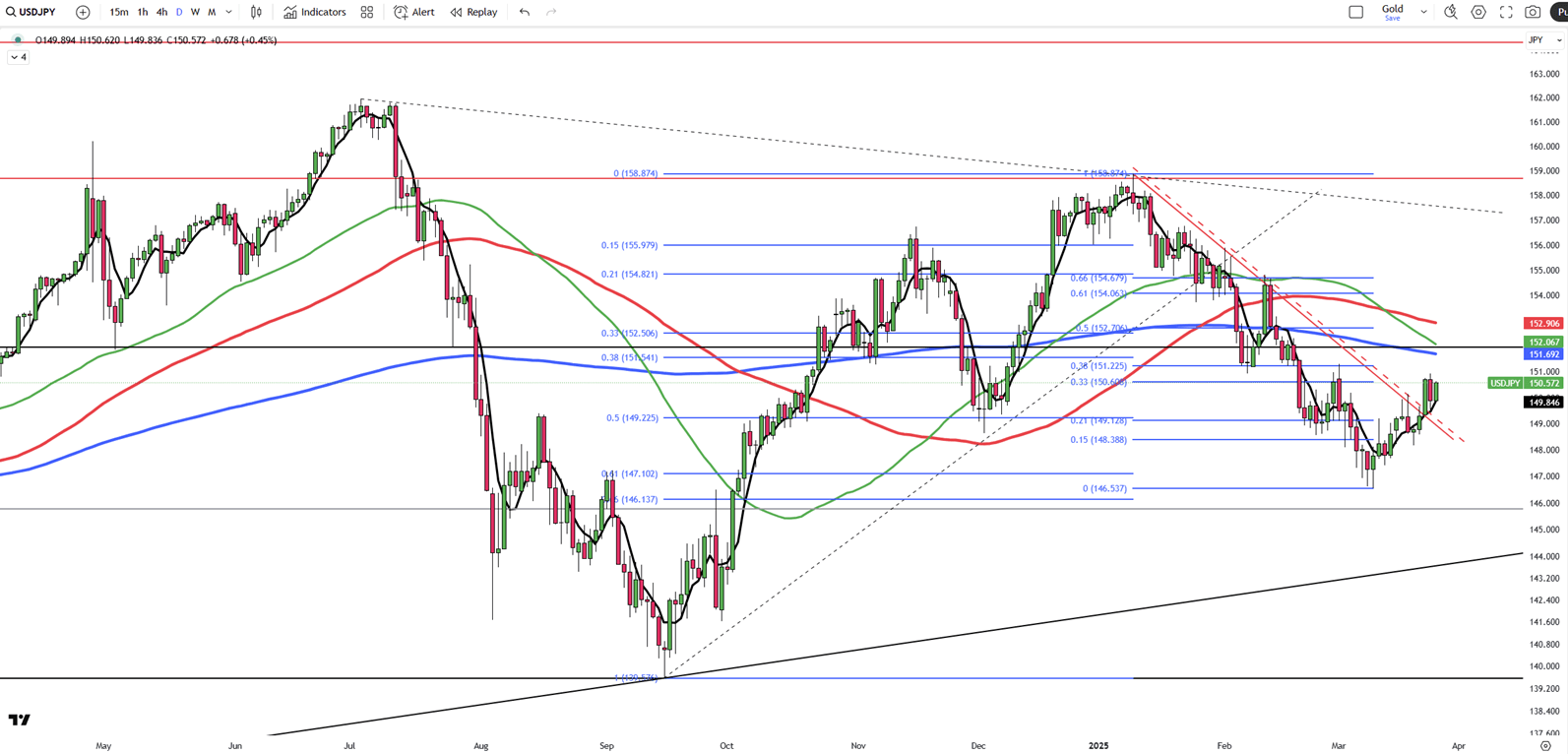

The Japanese yen hovered near 150.7 per dollar on Tuesday as the U.S. dollar strengthened. Concerns grew over Japan’s exports following Trump’s proposed tariffs on autos and pharmaceuticals. BOJ minutes showed officials remain open to future rate hikes, with one member suggesting a 1% rate by late FY2025. The central bank kept rates steady at 0.5% last week, citing global uncertainties.

Key resistance is at 151.70, with further levels at 152.70 and 154.00. Support stands at 147.00, followed by 145.80 and 143.00.

| R1: 151.70 | S1: 147.00 |

| R2: 152.70 | S2: 145.80 |

| R3: 154.00 | S3: 143.00 |

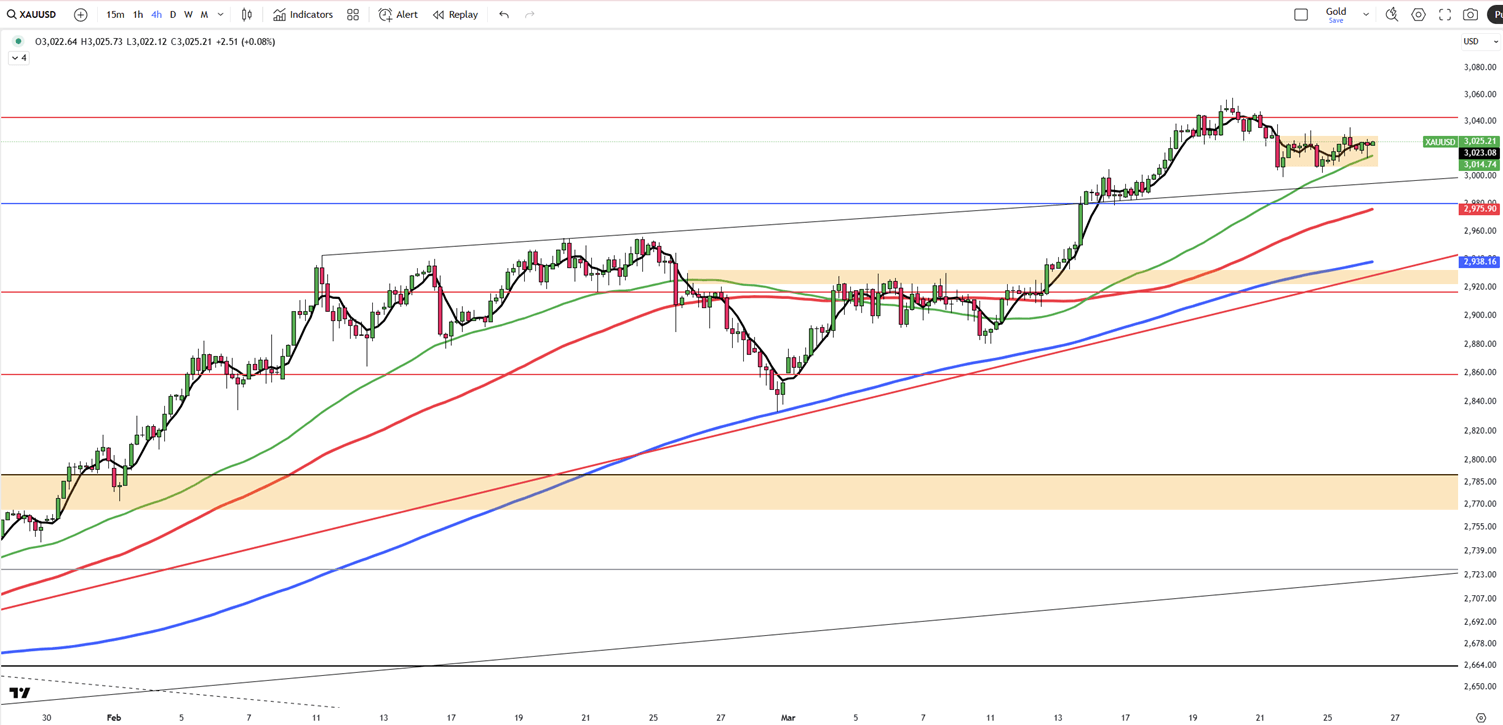

Gold edged above $3,020 on Wednesday, near record highs, supported by safe-haven demand amid uncertainty over upcoming US reciprocal tariffs. Trump's April 2 tariff plan is expected to be more targeted than past proposals but still signals a major escalation in trade tensions.

Markets now await Fed officials’ speeches and Friday’s US PCE data for policy clues. Meanwhile, a U.S.-brokered pause in sea and energy attacks between Ukraine and Russia, along with possible sanctions relief for Moscow, slightly eased bullion's appeal.

Key resistance stands at $3082, with further levels at $3100 and $3,150. Support is at $3000, followed by $2,980 and $2,916.

| R1: 3082 | S1: 3000 |

| R2: 3100 | S2: 2980 |

| R3: 3150 | S3: 2916 |

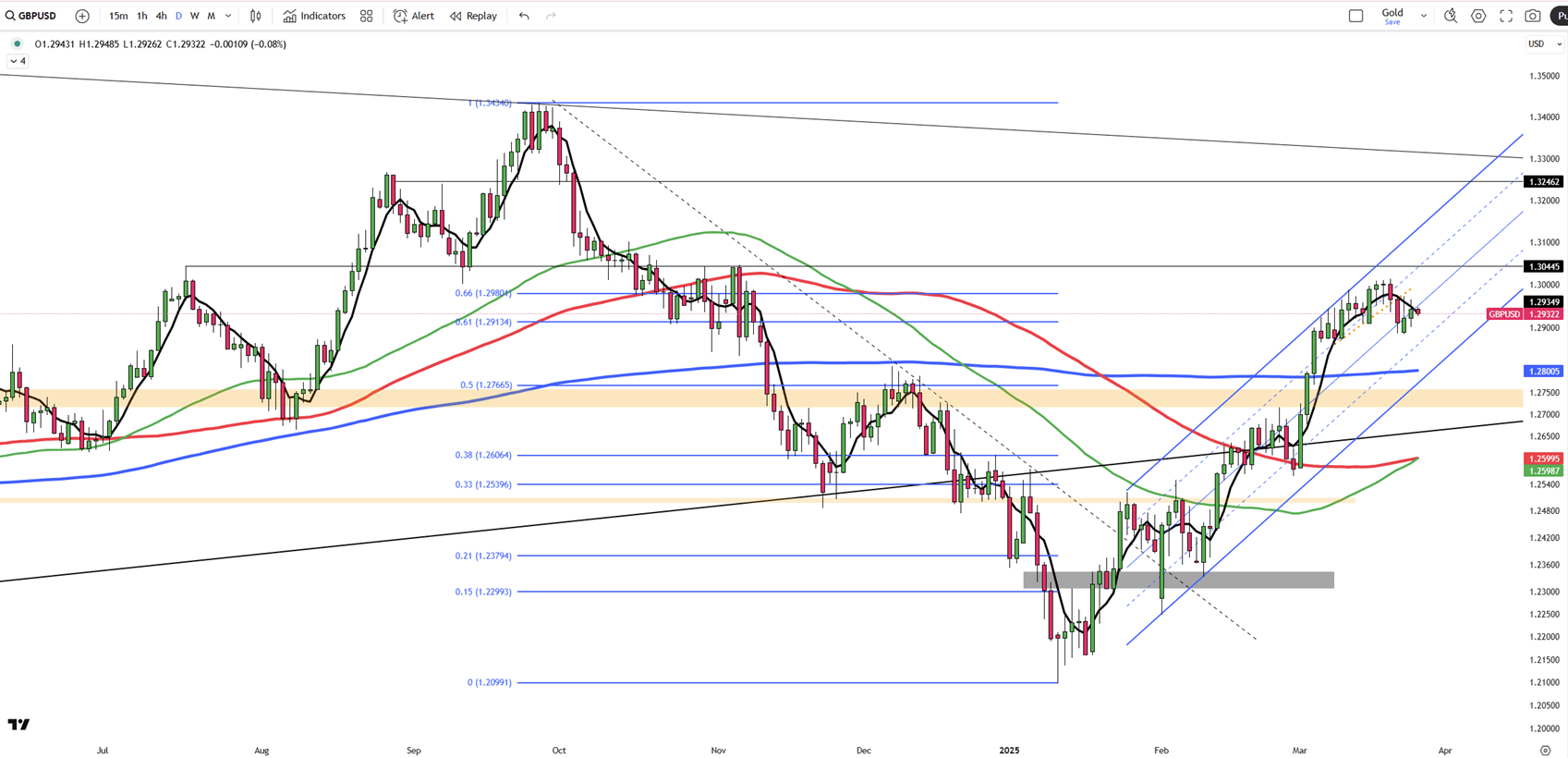

GBP/USD is trading steadily around $1.2920 as markets await British finance minister Rachel Reeves’ spring budget update. Despite dollar strength from solid U.S. data and rising Treasury yields, the pound remains resilient, supported by cautious optimism over the UK’s fiscal outlook. Traders are watching the upcoming budget for clues on spending and economic forecasts, which could impact GBP/USD in the near term.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

| R1: 1.3050 | S1: 1.2860 |

| R2: 1.3100 | S2: 1.2800 |

| R3: 1.3150 | S3: 1.2715 |

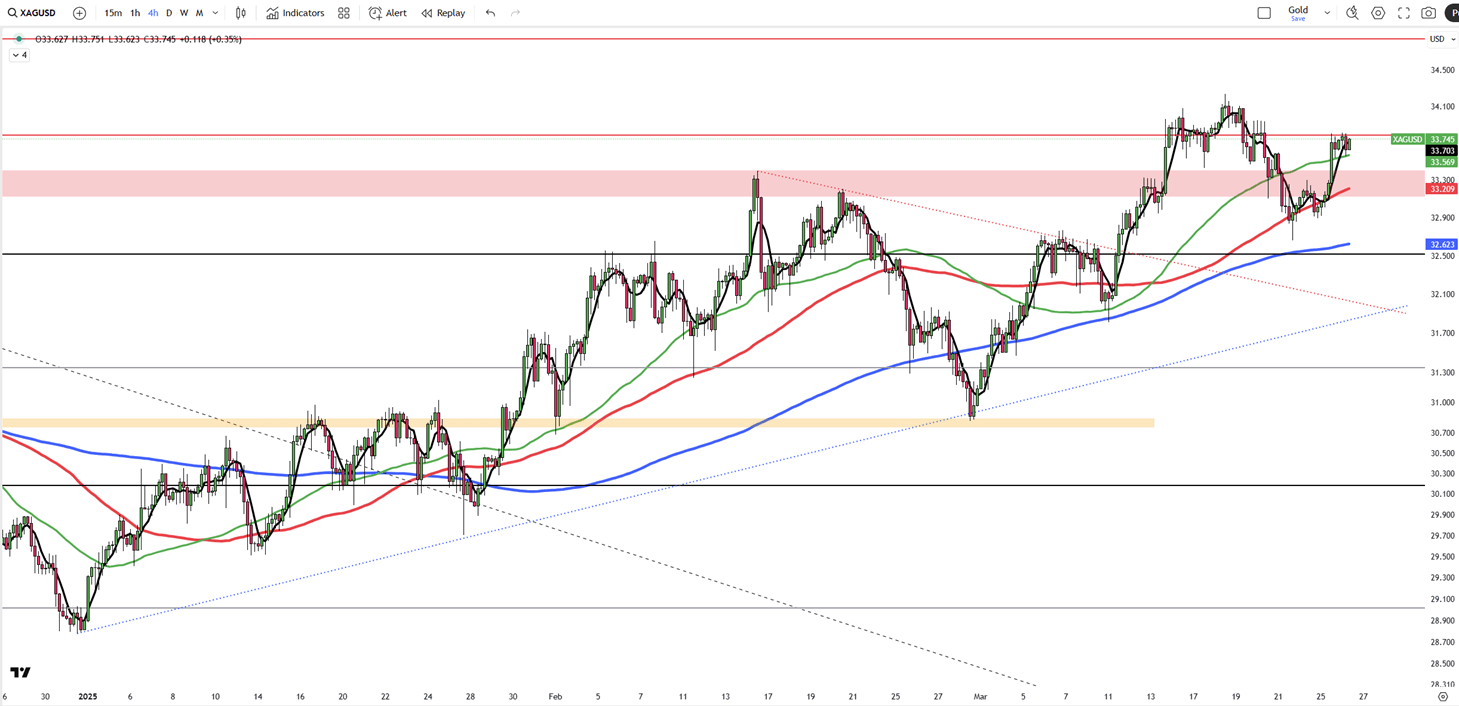

Silver rose above $33 on Tuesday, rebounding as trade and economic concerns supported safe-haven demand. Hopes that Trump may adopt a more targeted tariff plan ahead of the April 2 deadline offered some relief, though his new pledges to tax autos and pharmaceuticals added uncertainty. Expectations of further Fed rate cuts also supported silver. Markets now anticipate one cut in June, another in September, and growing chances of a third in December.

If silver breaks above $33.80, the next resistance levels are $34.05 and $34.85. On the downside, support is at $33.10, with further levels at $32.50 and $32.15 if selling pressure increases.

| R1: 33.80 | S1: 33.10 |

| R2: 34.05 | S2: 32.50 |

| R3: 34.85 | S3: 32.15 |

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

Detail March Starts With Geopolitical Turmoil (2-6 March)

March Starts With Geopolitical Turmoil (2-6 March)Global markets began the week in a state of high alert following coordinated US and Israeli strikes on Iran over the weekend, which resulted in the death of Supreme Leader Ayatollah Ali Khamenei.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!