The euro slipped to 1.1415 as ECB rate cut bets strengthened, while the pound fell on growing BoE easing expectations.

The yen edged toward 144 ahead of the BoJ meeting, and gold retreated below $3,330 amid easing trade tensions and a firmer dollar. Silver softened to $33.00 as optimism grew around U.S.-China tariff negotiations. All eyes are now on key U.S. economic data, including Q1 GDP, PCE inflation, and nonfarm payrolls, for clues on Fed policy direction.

| Time | Cur. | Event | Forecast | Previous |

| 12:30 | USD | Goods Trade Balance (Mar) | -143.70B | -147.85B |

| 14:00 | USD | CB Consumer Confidence (Apr) | 87.4 | 92.9 |

| 14:00 | USD | JOLTS Job Openings (Mar) | 7.480M | 7.568M |

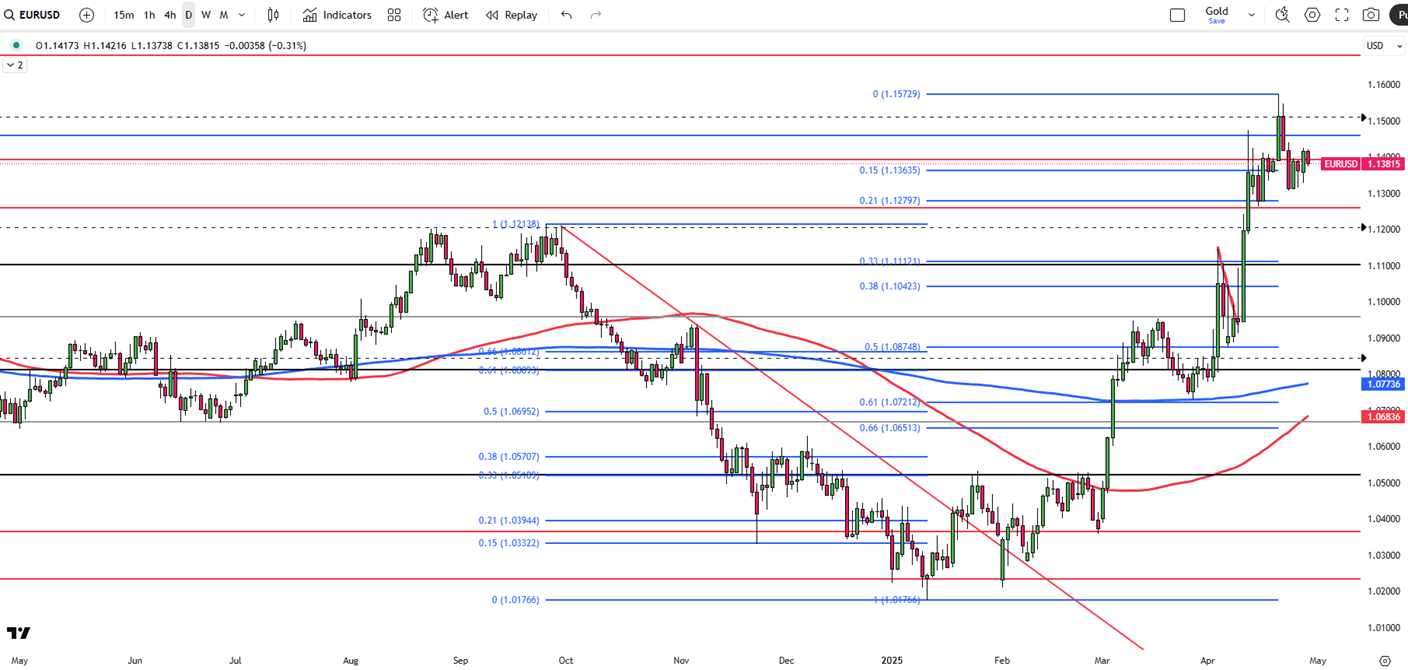

The EUR/USD dipped to around 1.1415 in early Asian trading Tuesday as the Euro weakened on rising expectations of an ECB rate cut in June. Reuters cited growing confidence among policymakers, with Olli Rehn suggesting rates could fall below neutral.

Investors are also watching US-China trade developments ahead of Friday’s Nonfarm Payrolls. President Trump claimed progress, but Beijing denied active talks. Treasury Secretary Bessent confirmed recent contact but said China must act. Trade tensions continue to pressure the dollar, potentially supporting the Euro.

Key resistance is at 1.1460, followed by 1.1580 and 1.1680. Support lies at 1.1260, then 1.1200 and 1.1150.

| R1: 1.1460 | S1: 1.1260 |

| R2: 1.1580 | S2: 1.1200 |

| R3: 1.1680 | S3: 1.1150 |

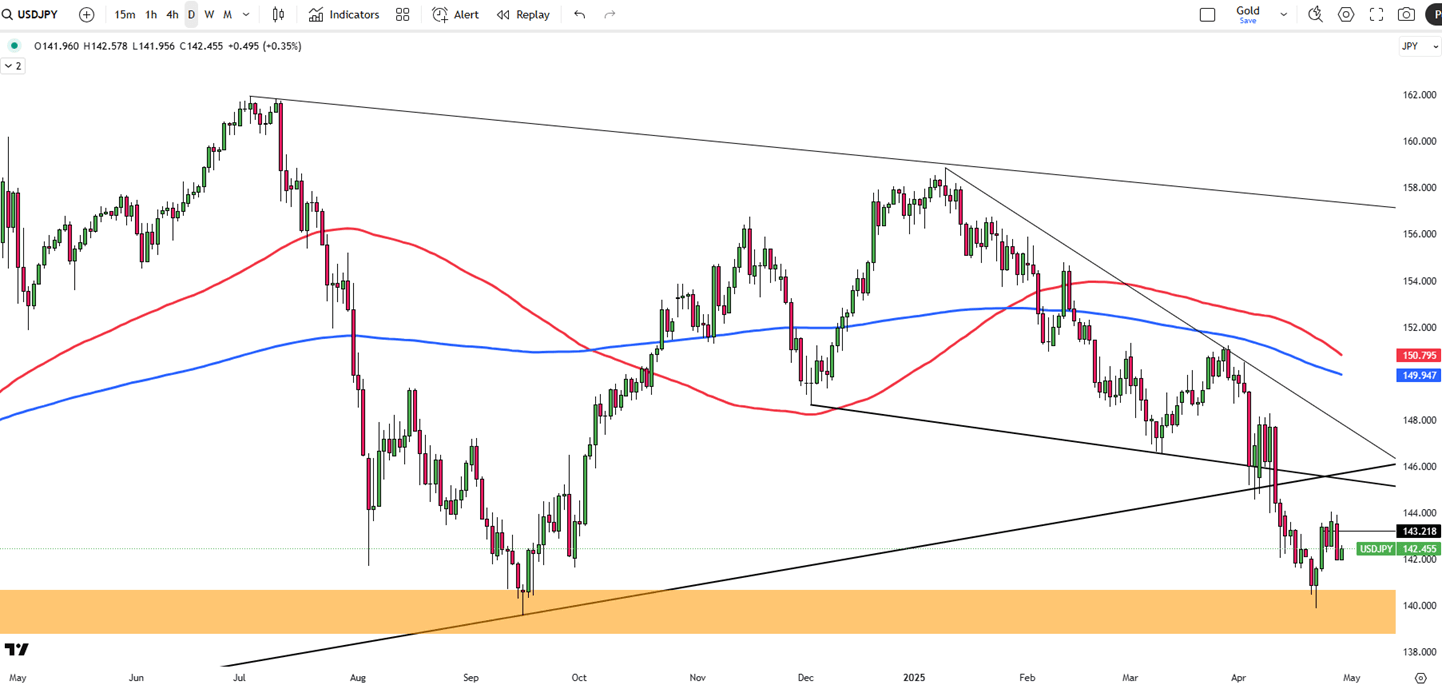

The Japanese yen edged closer to 144 per dollar on Monday, continuing last week’s decline as global trade sentiment improved and the dollar strengthened. Markets responded to a private meeting between Japan’s Finance Minister Kato and U.S. Treasury Secretary Bessent, during which both parties stressed the importance of ongoing discussions on currency matters. Meanwhile, Japan’s trade negotiator is set to visit Washington this week, as the Bank of Japan is expected to maintain interest rates at 0.5%, amid concerns over the economic impact of U.S. tariffs.

Key resistance is at 144.00, with further levels at 145.90 and 146.75. Support stands at 139.70, followed by 137.00 and 135.00.

| R1: 144.00 | S1: 139.70 |

| R2: 145.90 | S2: 137.00 |

| R3: 146.75 | S3: 135.00 |

Gold fell below $3,330 per ounce on Tuesday as investors monitored tariff talks and awaited key economic data. Treasury Secretary Scott Bessent said many top U.S. trading partners made "very good" tariff proposals and noted China’s tariff exemptions signal de-escalation efforts. He stressed it is now up to China to act. A modest rebound in the U.S. dollar also pressured gold. Markets are focused on upcoming reports, including Q1 GDP, March PCE inflation, and April nonfarm payrolls, for clues on the economy and Fed policy.

Key resistance is at $3365, followed by $3,405 and $3,500. Support stands at $3250, then $3165 and $3050.

| R1: 3365 | S1: 3250 |

| R2: 3405 | S2: 3165 |

| R3: 3500 | S3: 3050 |

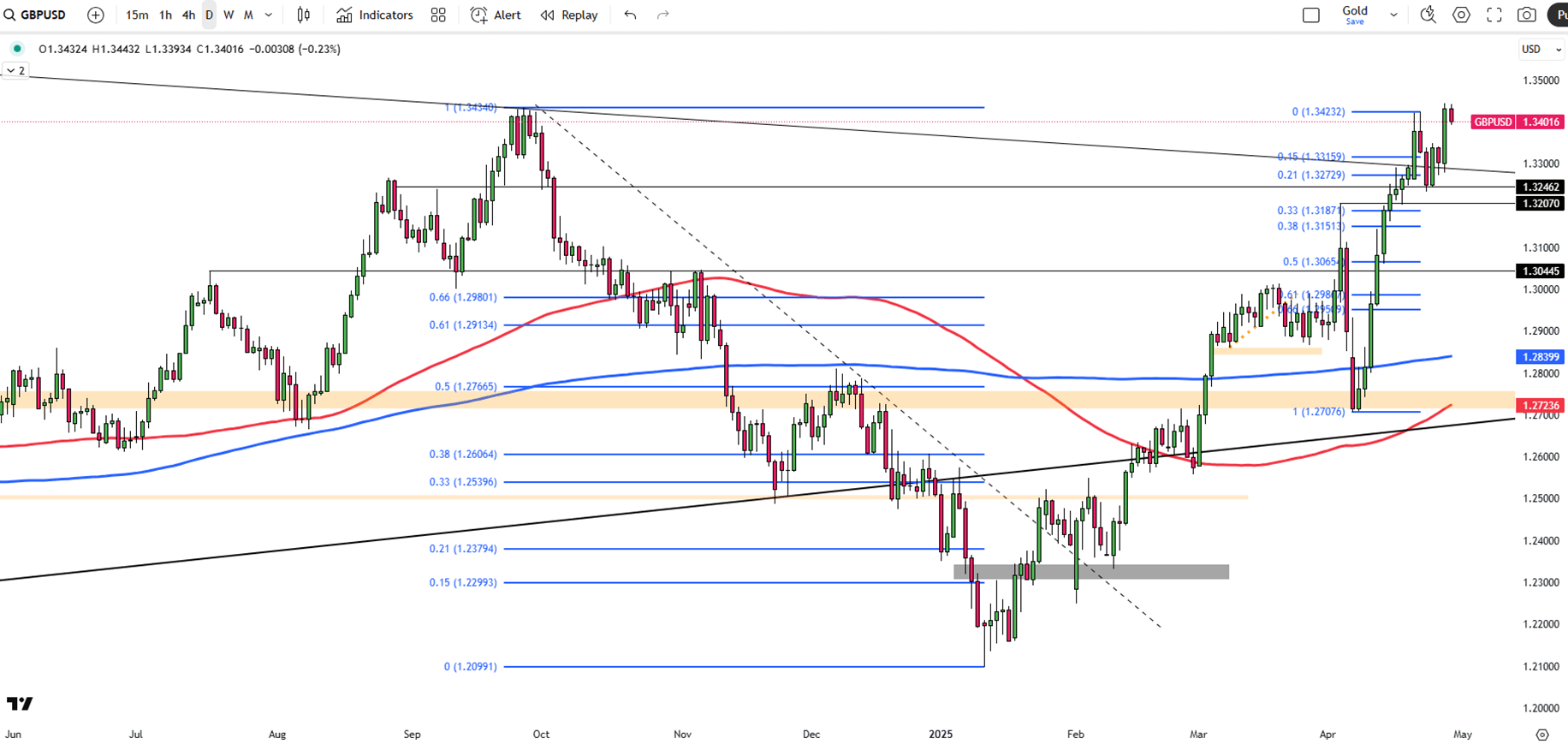

GBP/USD dipped to approximately 1.3425 during early Asian trading on Tuesday, as a slight rebound in the U.S. dollar put pressure on the pair. The dollar was supported by easing U.S.-China trade tensions, following China’s decision to exempt certain U.S. imports from tariffs, despite its denial of ongoing negotiations.

Meanwhile, expectations of a 25 basis point rate cut by the Bank of England in May continue to weigh on the pound. Markets are now focused on an upcoming speech by BoE Deputy Governor Dave Ramsden, with any dovish remarks likely to add further downside pressure on the GBP.

If GBP/USD breaks above 1.3430, resistance levels are at 1.3500 and 1.3550. Support is at 1.3200, followed by 1.3050 and 1.2960.

| R1: 1.3430 | S1: 1.3200 |

| R2: 1.3500 | S2: 1.3050 |

| R3: 1.3550 | S3: 1.2960 |

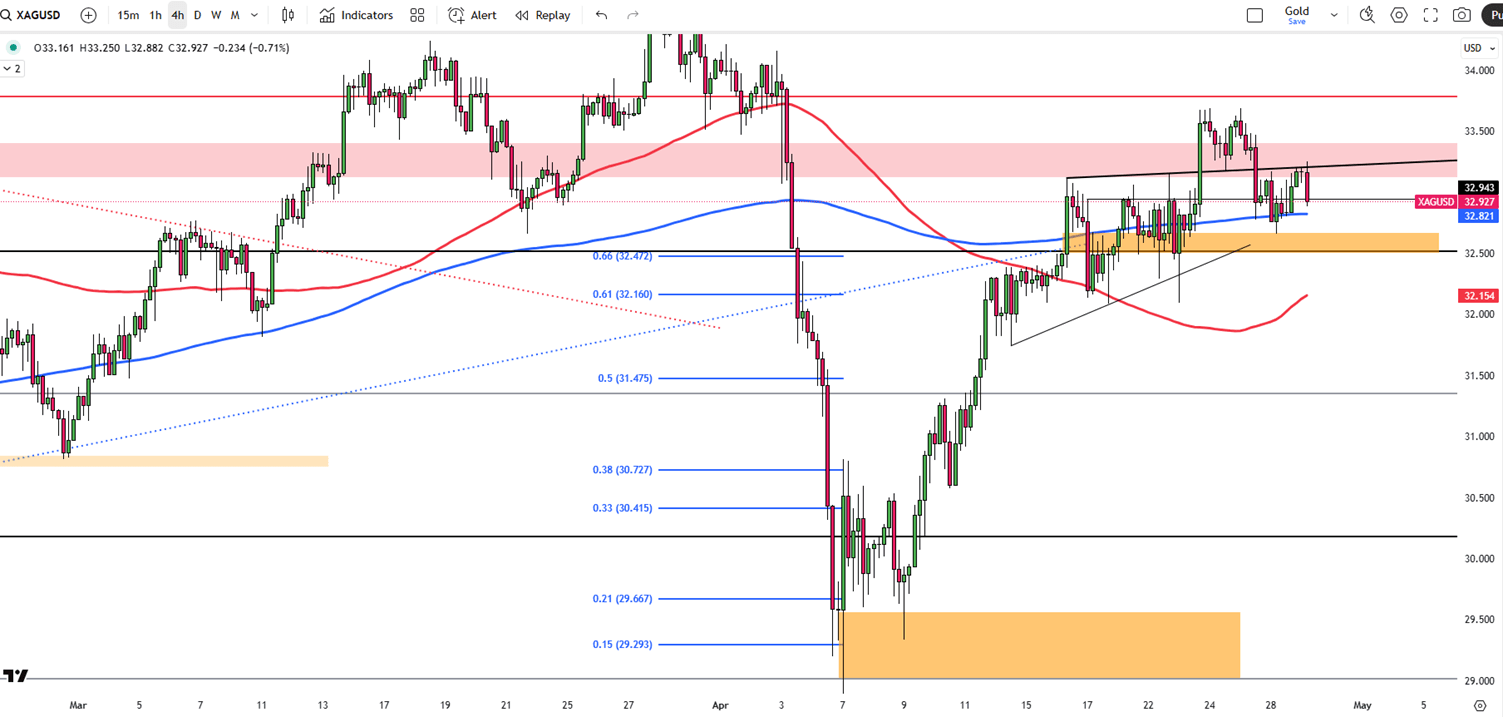

Silver (XAG/USD) slipped to around $33.00 on Tuesday as safe-haven demand eased amid improving U.S.-China trade sentiment and a stronger U.S. dollar. Optimism grew after Trump suggested tariff rollbacks and China granted exemptions. Treasury Secretary Bessent confirmed ongoing talks and positive proposals. Markets now await key US data, Q1 GDP, PCE inflation, and Nonfarm Payrolls for clues on Fed policy.

Technically, the first resistance level is located at 33.80. In case of its breach 34.20 and 34.85 could be monitored respectively. On the downside, first support is at 32.50. 31.40 and 30.20 would become the next support levels if this level is passed.

| R1: 33.80 | S1: 32.50 |

| R2: 34.20 | S2: 31.40 |

| R3: 34.85 | S3: 30.20 |

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

Detail March Starts With Geopolitical Turmoil (2-6 March)

March Starts With Geopolitical Turmoil (2-6 March)Global markets began the week in a state of high alert following coordinated US and Israeli strikes on Iran over the weekend, which resulted in the death of Supreme Leader Ayatollah Ali Khamenei.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!