The EUR/USD reached 1.0885 on Friday as the dollar softened. Attention is on the US Nonfarm Payrolls (NFP) report, with stronger data potentially lifting the dollar. In Japan, the yen strengthened near 152.2 following hints at a rate hike from BOJ’s Governor Ueda. Gold held at $2,750, balanced between Fed signals and geopolitical tensions.

Meanwhile, the GBP/USD dipped to 1.2895 amid UK tax hike plans, while silver traded near $30.75, impacted by dollar strength. Key US economic data today will guide expectations for future Fed moves, shaping sentiment across currencies and commodities.

Time (GMT) | Event | Asset | Survey | Previous |

| 12:30 | Average Hourly Earnings (MoM) (Oct) | USD | 0.30% | 0.40% |

| 12:30 | Nonfarm Payrolls (Oct) | USD | 106K | 254K |

| 12:30 | Unemployment Rate (Oct) | USD | 4.10% | 4.10% |

| 13:45 | S&P Global US Manufacturing PMI (Oct) | USD | 47.8 | 47.8 |

| 14:00 | ISM Manufacturing PMI (Oct) | USD | 47.6 | 47.2 |

| 14:00 | ISM Manufacturing Prices (Oct) | USD | 49.9 | 48.3 |

| 18:00 | Atlanta Fed GDPNow (Q4) | USD | 2.70% | 2.70% |

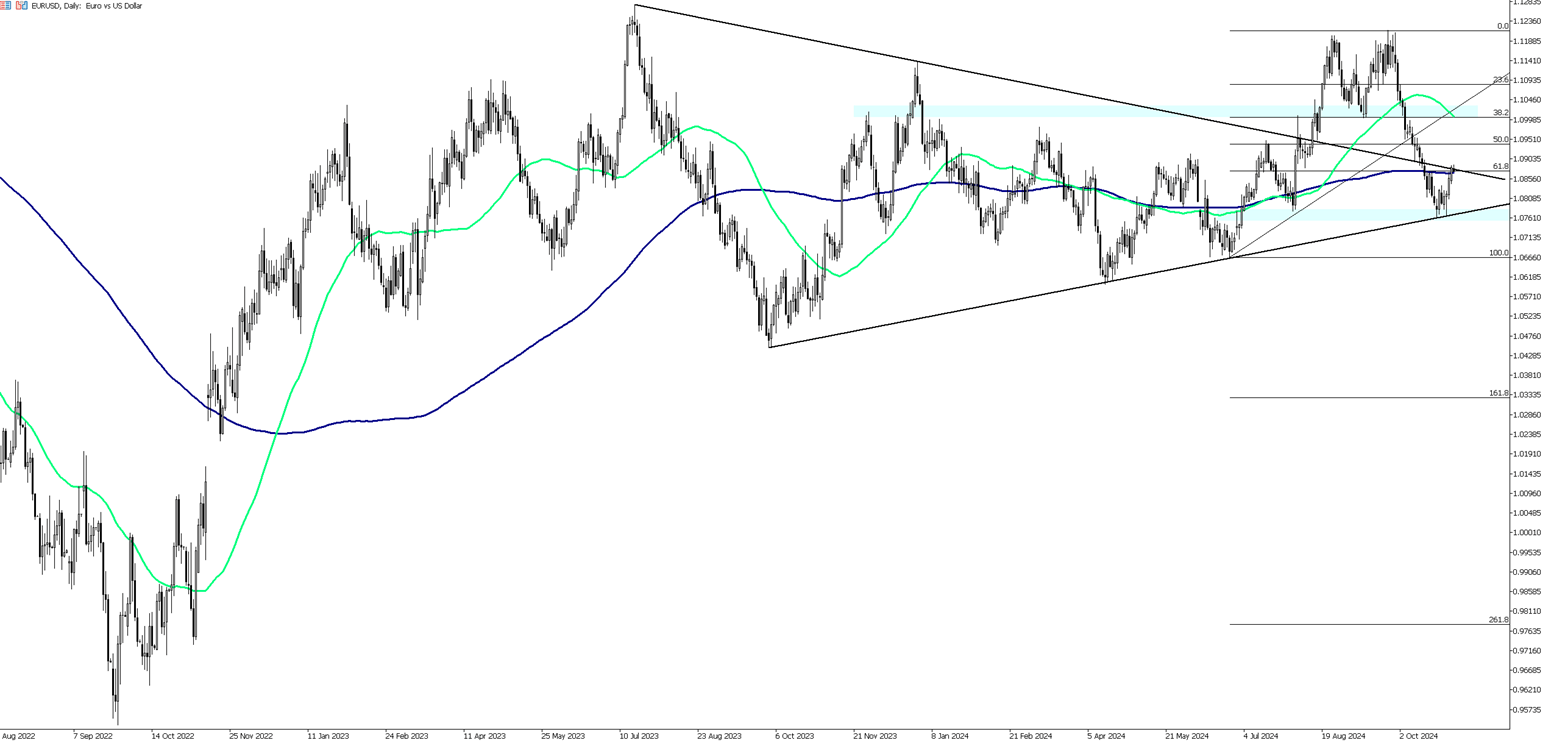

The EUR/USD pair has risen to 1.0885 in the early Asian session on Friday, supported by a decline in the US Dollar (USD). Attention is now focused on the upcoming US Nonfarm Payrolls (NFP) report, which is set to be released later today.

The US Personal Consumption Expenditures (PCE) Price Index increased by 2.1% yearly in September, slightly down from 2.2% in August, according to the US Bureau of Economic Analysis (BEA). This figure aligned with market expectations. On a monthly basis, the PCE rose by 0.2%, also as anticipated.

In addition, the core PCE Price Index, which excludes the more volatile food and energy sectors, surged by 2.7% during the same period, matching the increase seen in August and exceeding the projected rise of 2.6%. Monthly, the core PCE increased by 0.3%, consistent with forecasts.

The focus is on the US employment data to be released today, which will include the Nonfarm Payrolls, Unemployment Rate, and Average Hourly Earnings. A stronger report could reduce expectations for significant US Federal Reserve (Fed) rate cuts, potentially strengthening the Greenback against the Euro (EUR).

Meanwhile, the European Central Bank (ECB) has highlighted ongoing inflationary pressures, driven by wage growth. In its recent October meeting, the ECB reiterated a "data-dependent and meeting-by-meeting" approach to future policy decisions. Current money market pricing reflects a 34 basis points (bps) rate cut, a decrease from 42 bps the previous day, indicating that the likelihood of a larger 0.5% cut is lessening.

In the EUR/USD pair, the initial resistance level is at 1.0880, followed by 1.0910 and 1.0940 as subsequent resistance points. On the downside, the first support level is 1.0870, which aligns with the 200-day moving average. If this level is breached, the next support levels to watch will be 1.0830 and 1.0800.

| R1: 1.0880 | S1: 1.0850 |

| R2: 1.0910 | S2: 1.0825 |

| R3: 1.0940 | S3: 1.0770 |

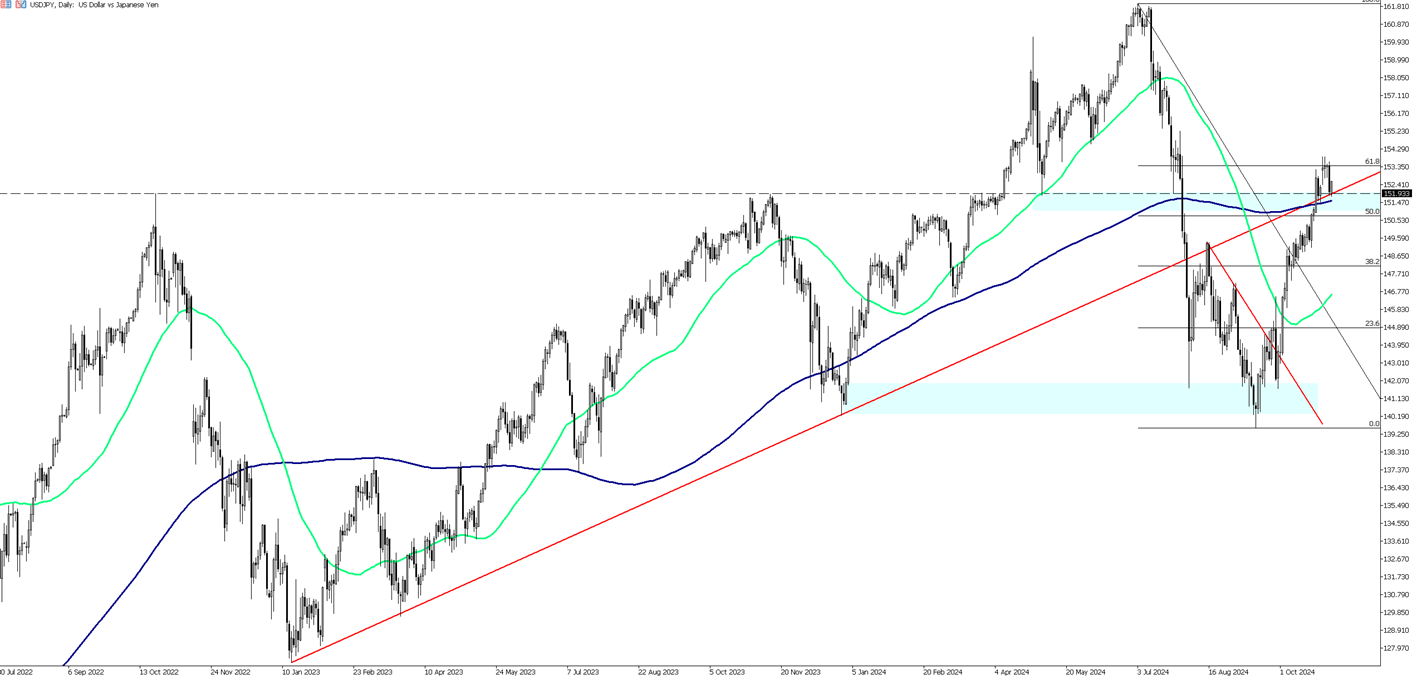

On Friday, the Japanese yen appreciated to around 152.2 per dollar, rising nearly 1% following the previous session. This gain was fueled by less dovish remarks from Bank of Japan (BOJ) Governor Kazuo Ueda. The BOJ decided to maintain its policy rate at 0.25% on Thursday, a widely expected move amid a political shake-up in Japan that has created uncertainty about fiscal and monetary policies. During the post-meeting briefing, Ueda indicated that economic risks in the US appear to be easing, hinting at the possibility of a future rate hike. Market speculation suggests the BOJ could raise rates to 0.5% as early as January, although currency fluctuations and inflation data will significantly influence this decision. Despite the yen's recent strength, it remains close to its lowest point in three months, as the dollar continues to benefit from signs of resilience in the US economy and expectations of a Trump victory in the upcoming election.

In the USD/JPY pair, the first support level is at 151.50, which coincides with the 200-day moving average. If this level is broken, the next support levels to monitor are 150.60 and 150.00. On the upside, resistance levels are at 153.30, 154.50, and 156.60, respectively.

| R1: 153.30 | S1: 152.40 |

| R2: 154.40 | S2: 151.40 |

| R3: 156.60 | S3: 150.60 |

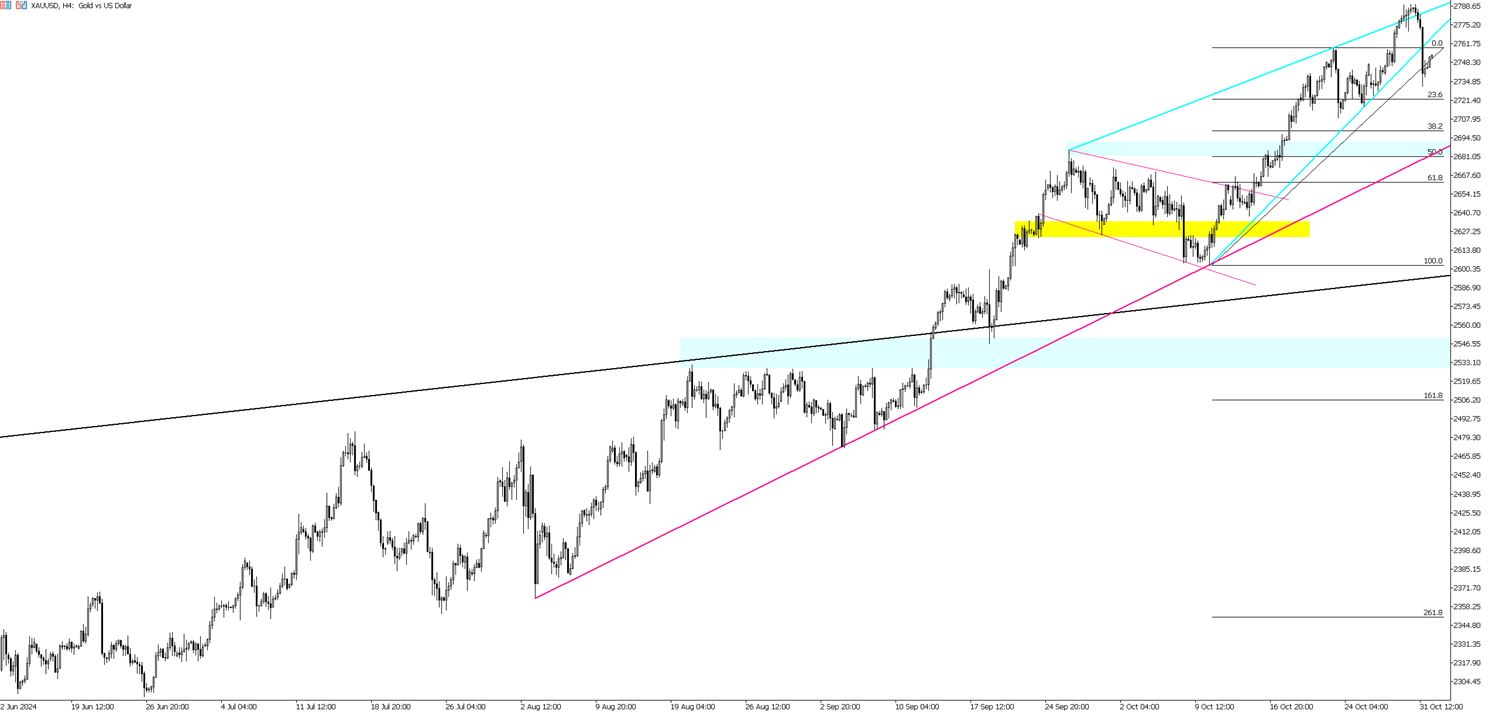

Gold stabilized around $2,750 per ounce on Friday after a more than 1% decline in the previous session, as markets weighed the demand for safety against pressure from a less dovish Federal Reserve. Recent US economic data showed strong personal income and spending figures, a rise in underlying inflation above target levels, and an unexpected decline in jobless claims. This supported the view that the US economy can withstand higher borrowing costs, giving the Fed more leeway to avoid aggressive rate cuts.

However, political uncertainty in the US continued to support gold prices, as the possibility of another Trump presidency raised expectations for expansionary fiscal policies and higher tariffs. This prompted investors to seek gold as a hedge against long-term inflation risks. Additionally, ongoing tensions in the Middle East and the war in Ukraine further increased gold's attractiveness as a safe-haven asset.

On the downside, the first support level for gold is at $2,735, followed by $2,714 and $2,685. On the upside, $2,758 serves as a key resistance level, with $2,770 and $2,790 as the next levels to monitor if this resistance is surpassed.

| R1: 2790 | S1: 2780 |

| R2: 2800 | S2: 2770 |

| R3: 2820 | S3: 2758 |

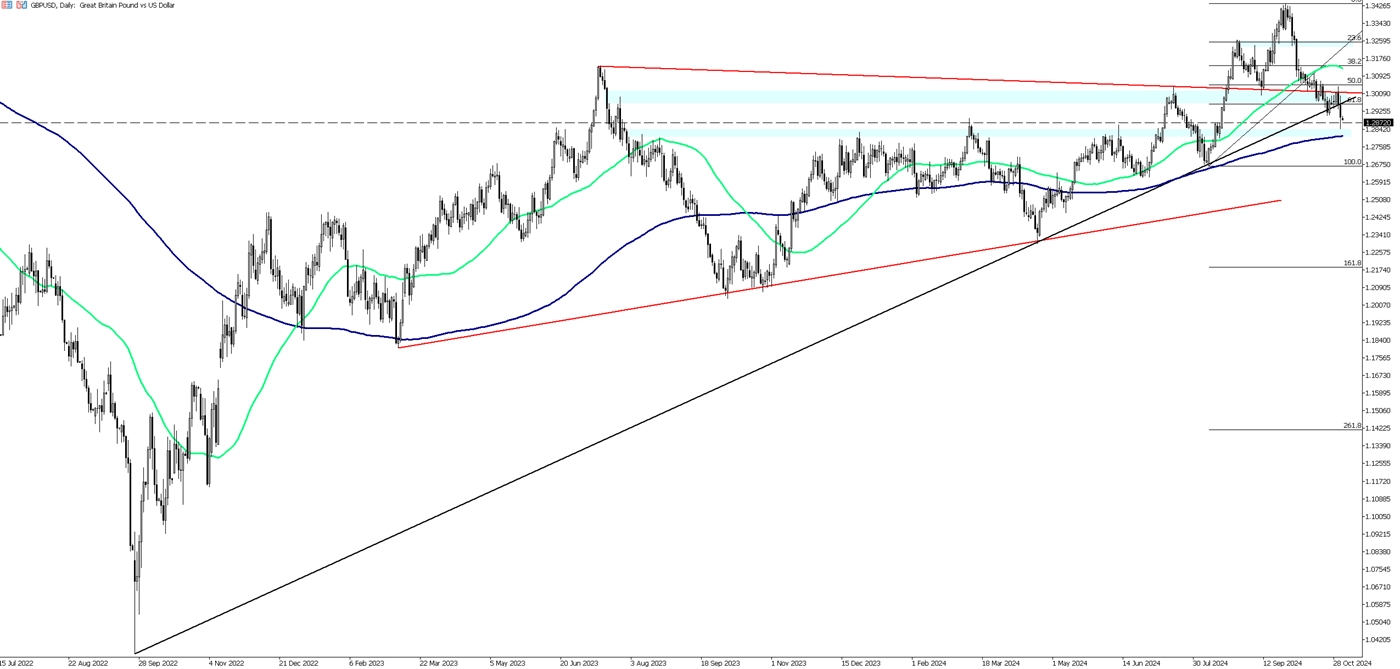

The GBP/USD pair trades defensively around 1.2895 in early Asian hours on Friday, marking a low since August 16. The pair has softened following the UK Labour government’s Autumn Forecast Statement, which announced £40 billion in tax hikes to address public finance gaps and support public services.

In the U.S., the Personal Consumption Expenditure (PCE) Price Index for September slightly exceeded expectations, with headline PCE rising 2.1% year-on-year, while core PCE rose 2.7%, above the forecasted 2.6%. Markets expect the Fed to implement 25 basis point rate cuts in both November and December.

Investors await the US Nonfarm Payrolls (NFP) report, expected to add 113,000 jobs, with the Unemployment Rate anticipated to hold at 4.1%.

In the UK, the Office for Business Responsibility revised its 2024 inflation forecast to 2.5% from 2.2%, leading markets to expect fewer BoE rate cuts, which may support the Pound.

For GBP/USD, key support levels are 1.2865, 1.2810, and 1.2750, while resistance levels stand at 1.2910, 1.2945, and 1.2980.

| R1: 1.2985 | S1: 1.2945 |

| R2: 1.3015 | S2: 1.2865 |

| R3: 1.3040 | S3: 1.2810 |

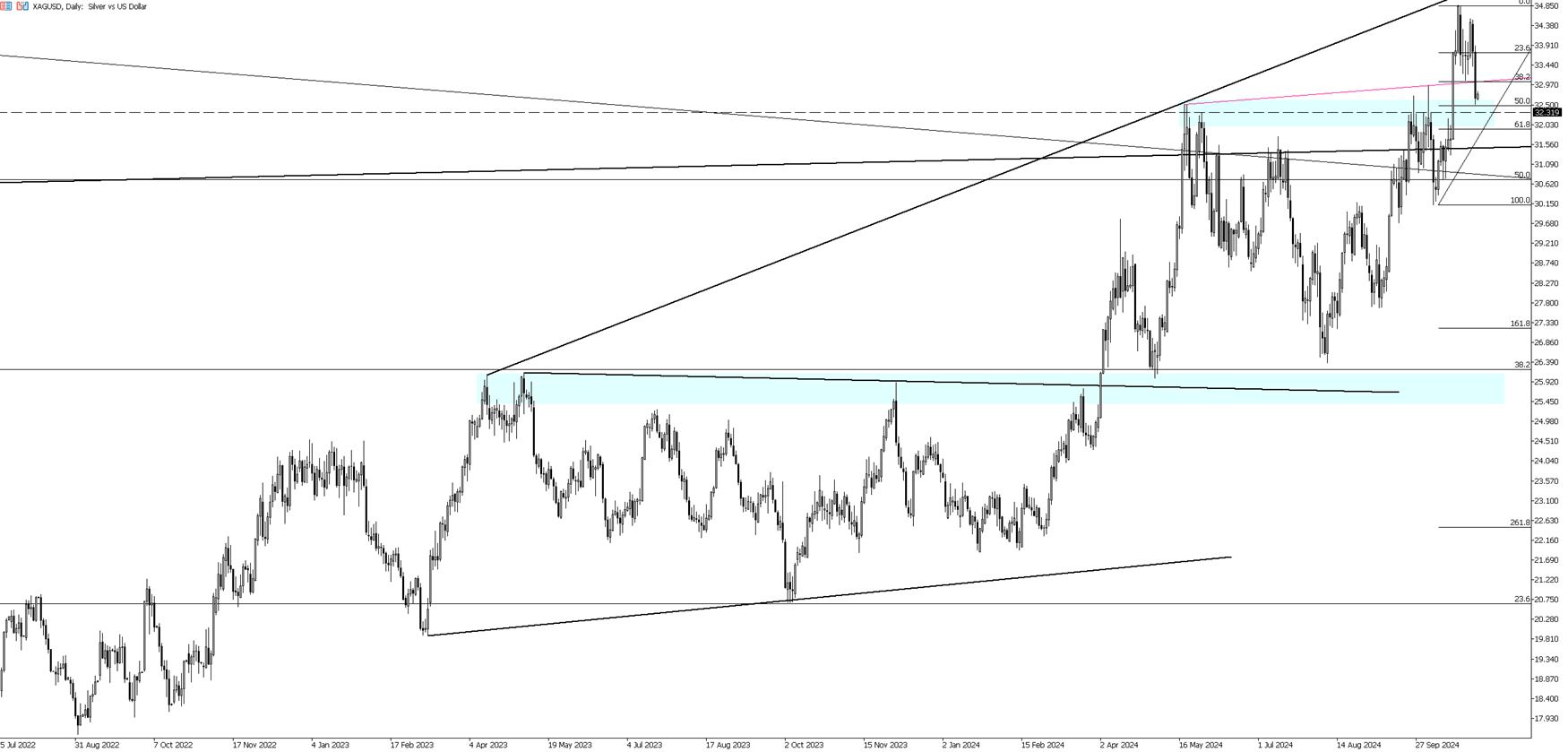

Silver is trading around $30.75 on Friday morning following yesterday's sell-off. Despite stronger manufacturing data from China, hawkish economic indicators suggest that the Federal Reserve may not need to expedite rate cuts due to a resilient labor market and inflation figures exceeding targets. This has contributed to a decline in non-yielding metals. Today's Nonfarm Payrolls (NFP) and Purchasing Managers' Index (PMI) data will be critical in determining the direction of silver and other metals.

On the upside, the critical resistance levels to watch are at 33.00, 33.50, and 34.00. On the downside, yesterday's sell-off at 32.50 remains a significant first support level. If this level is breached, the next support levels to monitor are 32.00 and 31.00, respectively.

| R1: 34.00 | S1: 33.50 |

| R2: 34.50 | S2: 33.00 |

| R3: 34.90 | S3: 32.00 |

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

Detail March Starts With Geopolitical Turmoil (2-6 March)

March Starts With Geopolitical Turmoil (2-6 March)Global markets began the week in a state of high alert following coordinated US and Israeli strikes on Iran over the weekend, which resulted in the death of Supreme Leader Ayatollah Ali Khamenei.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!