Global markets remained steady on Wednesday as investors awaited key inflation reports and monitored U.S. political developments. The euro hovered near 1.1580 ahead of Germany’s CPI and HICP data, while the yen and dollar were supported by optimism over a deal to end the U.S. government shutdown.

Gold eased slightly as shutdown relief offset Fed rate-cut bets, and silver paused after a five-day rally amid a stronger dollar. Meanwhile, the pound weakened toward 1.3140 as expectations for a December Bank of England rate cut grew.

| Time | Cur. | Event | Forecast | Previous |

| 07:00 | EUR | German CPI (MoM)(Oct) | 0.3% | 0.2% |

| 18:00 | USD | US 10-Year Note Auction | 4.117% |

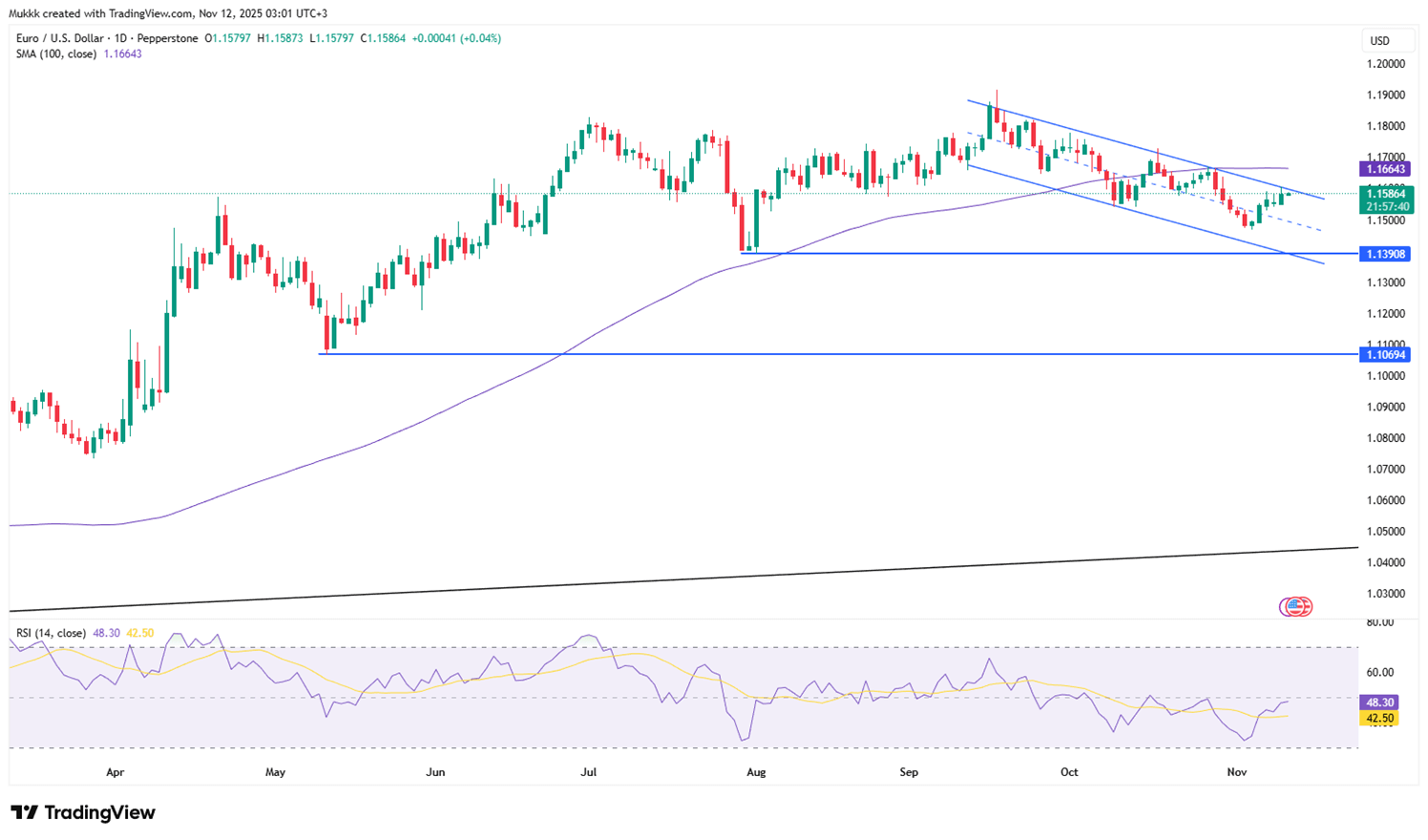

EUR/USD hovered around 1.1580 in Asian trading after five consecutive gains, supported by expectations that the ECB will maintain rates amid steady growth and near-target inflation. Traders now await Germany’s October CPI and HICP data for further direction. The pair also drew support from improved sentiment over a possible end to the U.S. government shutdown, as the Senate approved a reopening bill pending House and presidential approval.

Technically, 1.1490 is the key support, while resistance is seen at 1.1600.

| R1: 1.1600 | S1: 1.1490 |

| R2: 1.1670 | S2: 1.1430 |

| R3: 1.1710 | S3: 1.1360 |

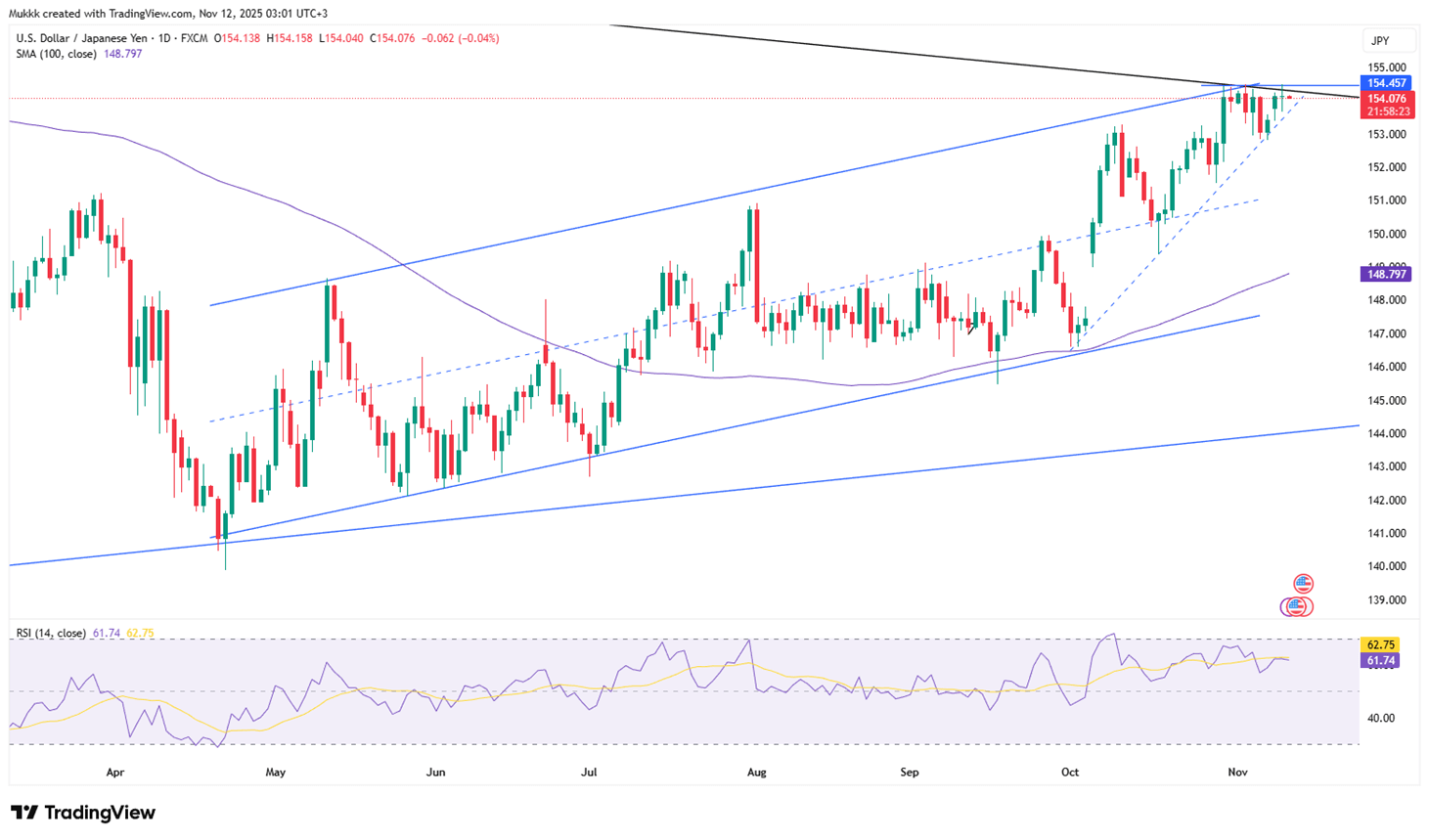

USD/JPY traded near 154.10 in early Asian hours, supported by optimism that the U.S. government shutdown will soon end. Bloomberg reported that the Senate passed a temporary funding bill expected to keep most operations running until January 30, with final approval due Wednesday. The news lifted the U.S. Dollar against the Yen, while traders awaited comments from Fed officials John Williams and Christopher Waller for additional policy signals.

Technically, resistance stands near 155.20, while support is firm at 152.50.

| R1: 155.20 | S1: 152.50 |

| R2: 156.20 | S2: 151.60 |

| R3: 158.20 | S3: 150.70 |

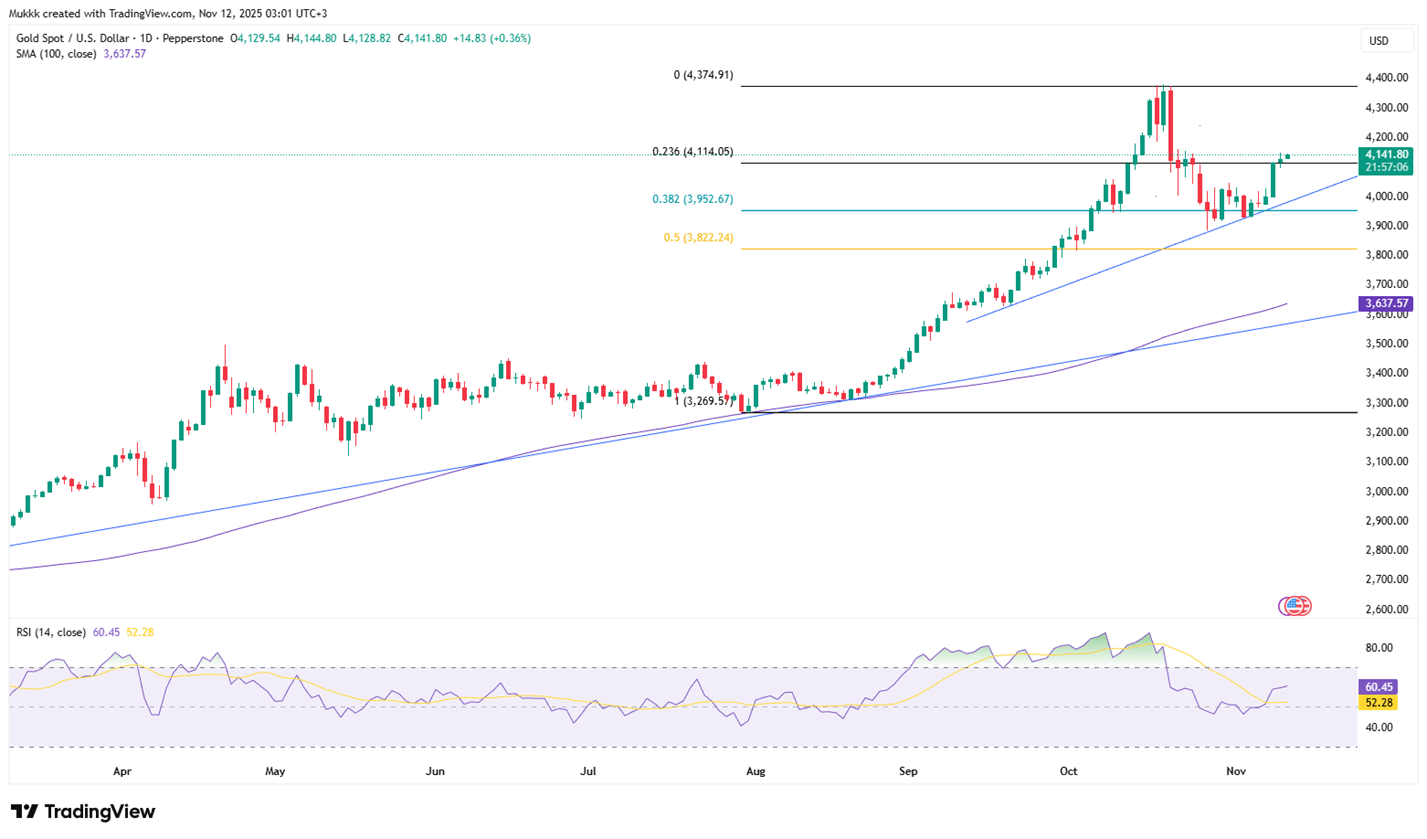

Gold slipped toward $4,100 per ounce on Wednesday but held near a two-week high as traders balanced Fed rate-cut expectations with signs the U.S. shutdown is ending. Private data showed firms cut about 11,250 jobs weekly through October 25, reinforcing economic weakness and a likely 25 bps cut next month. With the government set to reopen after Senate approval of a funding bill, easing uncertainty may trim safe-haven demand, though gold remains on track for its best yearly gain since 1979.

From a technical perspective, support is around 4095, and resistance is at 4160.

| R1: 4160 | S1: 4095 |

| R2: 4210 | S2: 4070 |

| R3: 4245 | S3: 4040 |

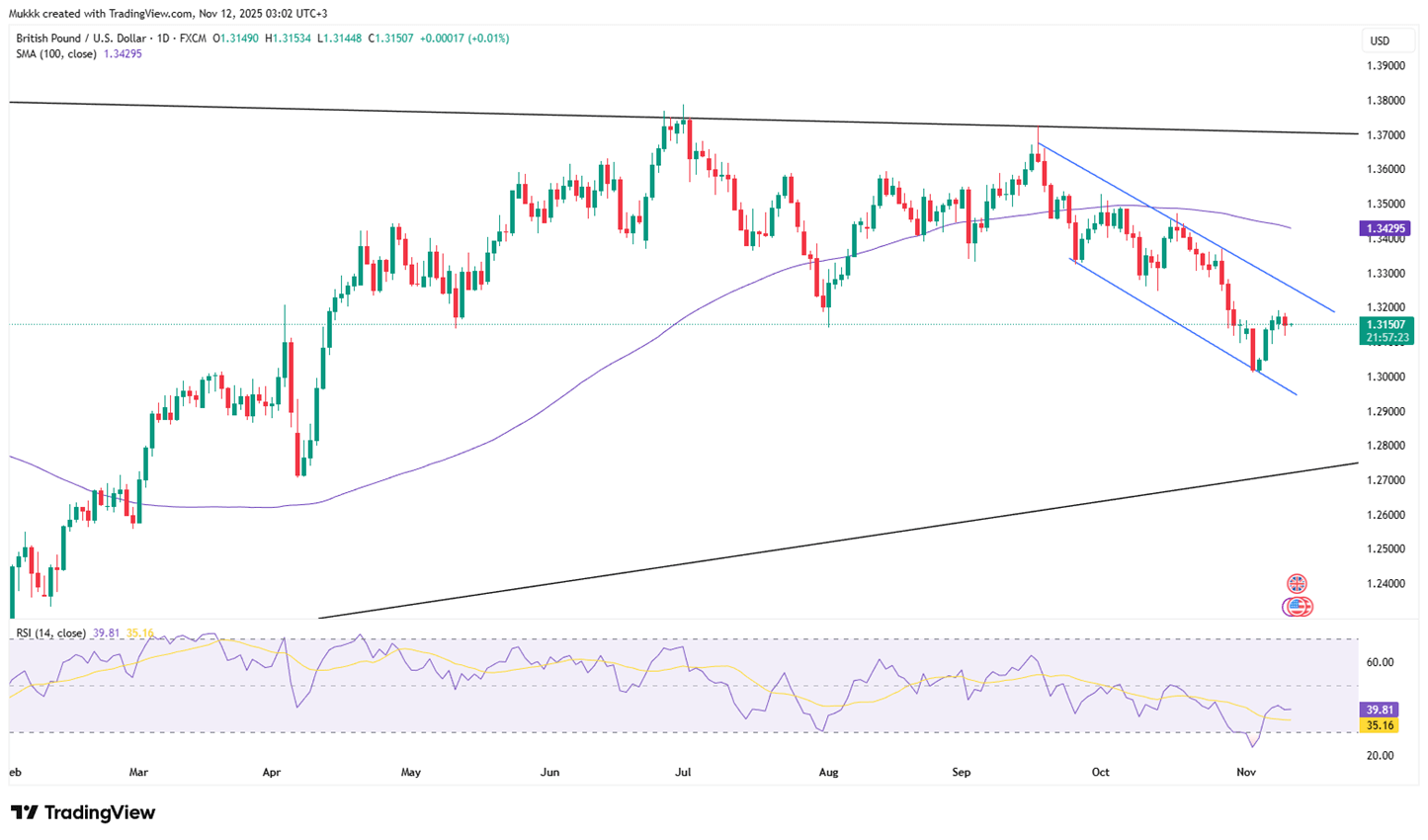

GBP/USD hovered around 1.3140 in Asian trading, extending its decline for a second session amid rising expectations of a December Bank of England rate cut. Major banks such as Morgan Stanley, Citigroup, and UBS now project a 25 bps reduction to 3.75%. BoE policymaker Megan Greene noted that current policy may not be sufficiently restrictive, pointing to persistent wage pressures and inflation, and stressed the need to manage inflation risks, Reuters reported.

From a technical view, support stands near 1.3050, with resistance around 1.3190.

| R1: 1.3190 | S1: 1.3050 |

| R2: 1.3260 | S2: 1.2990 |

| R3: 1.3350 | S3: 1.2870 |

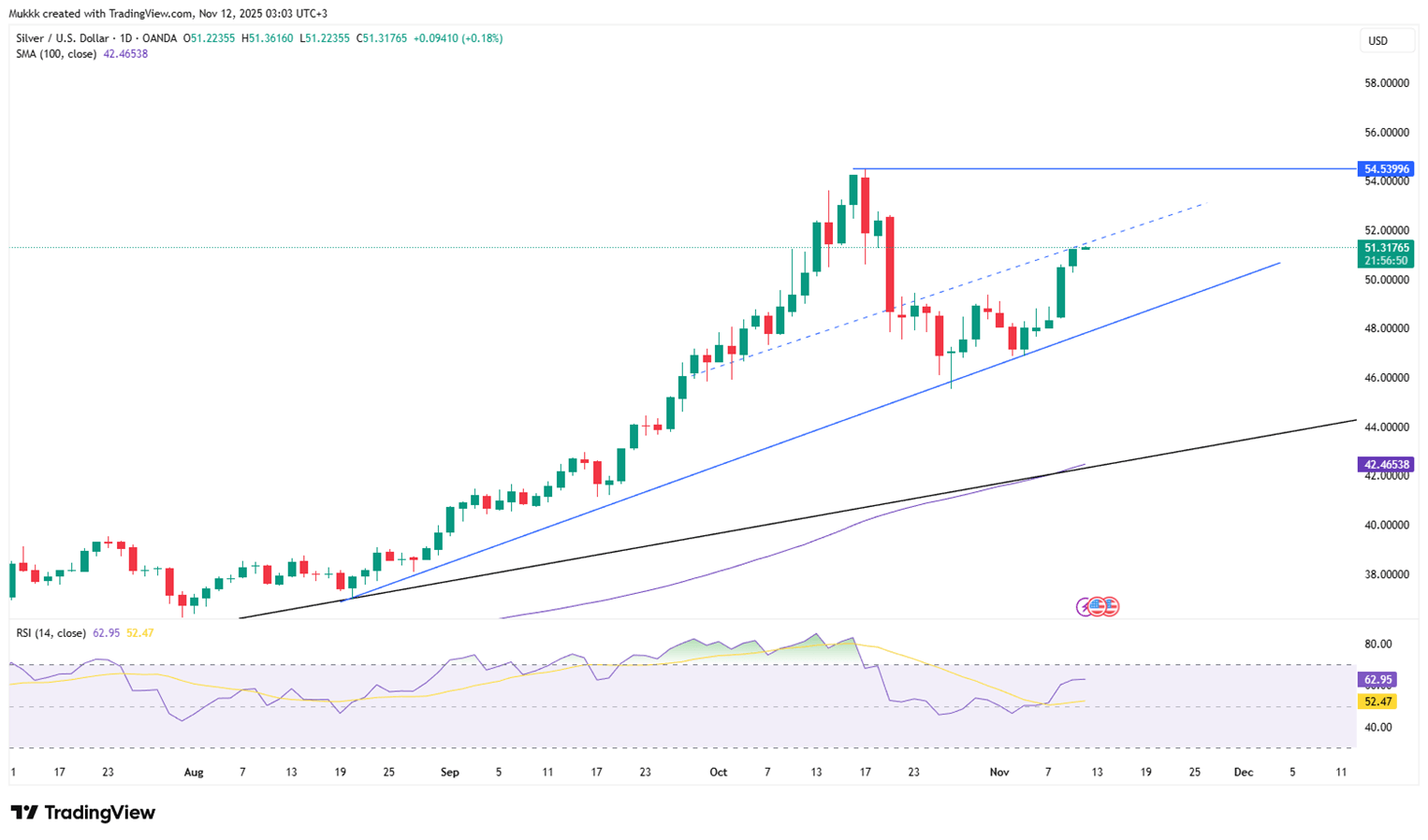

Silver (XAG/USD) slipped to around $51.10 in early European trading, halting a five-day advance as renewed demand for the U.S. Dollar weighed on prices. The DXY held near 99.55, supported by optimism over a deal to end the U.S. government shutdown after the Senate approved a temporary funding bill, with a House vote expected soon. According to Kitco’s Jim Wyckoff, traders expect upcoming U.S. data, once released, to reveal economic weakness that could justify a Fed rate cut in December.

From a technical view, resistance stands near $52.50, while support is located around $47.70.

| R1: 52.50 | S1: 47.70 |

| R2: 54.40 | S2: 45.70 |

| R3: 56.40 | S3: 44.00 |

Hormuz Blockade Rattles Markets (09 - 13 March)

Hormuz Blockade Rattles Markets (09 - 13 March)Global sentiment was dominated this week by the second week of the war with Iran and the effective blockade of the Strait of Hormuz, driving Brent crude prices above $100/barrel. Despite a catastrophic US labor report showing a loss of 92,000 jobs in February, safe-haven demand pushed the US Dollar Index to 99.1. The energy shock has ignited fears of "stagflation," particularly in Europe and Japan, as soaring fuel costs threaten to reverse recent disinflationary trends.

Detail Oil Shock Drives Dollar Higher (03.09.2026)Global markets opened the week under pressure as escalating Middle East tensions and disruptions in the Strait of Hormuz pushed oil prices above $100 per barrel.

Trump Signals Extended Military Campaign

Trump Signals Extended Military CampaignGeopolitical tensions in the Middle East have intensified following recent remarks from Donald Trump suggesting that the ongoing military campaign against Iran may last longer than anticipated. While Trump stated that early operational objectives were achieved ahead of schedule, he acknowledged that broader strategic goals could require additional time and sustained military pressure.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!