The euro dipped to its lowest level in nearly a year amid political challenges in major Eurozone economies and softer data, even as the ECB signaled cautious policy.

The yen fell on wavering expectations for a BOJ rate hike, while gold stabilized after a modest U.S. inflation print tempered the dollar’s rally. The British pound traded narrowly on lingering dovish BoE signals, and silver hit three-month lows, pressured by a hawkish Fed outlook and weaker Chinese demand. Investors now watch key data and central bank policy moves to gauge market direction.

| Time | Cur. | Event | Forecast | Previous |

| 07:00 | GBP | U.K. (GDP) QoQ | 0.1% | 0.5% |

| 08:00 | EUR | Spain (GDP) QoQ | 0.8% | 0.8% |

| 18:00 | USD | U.S. CB Consumer Confidence | 112.9 | 111.7 |

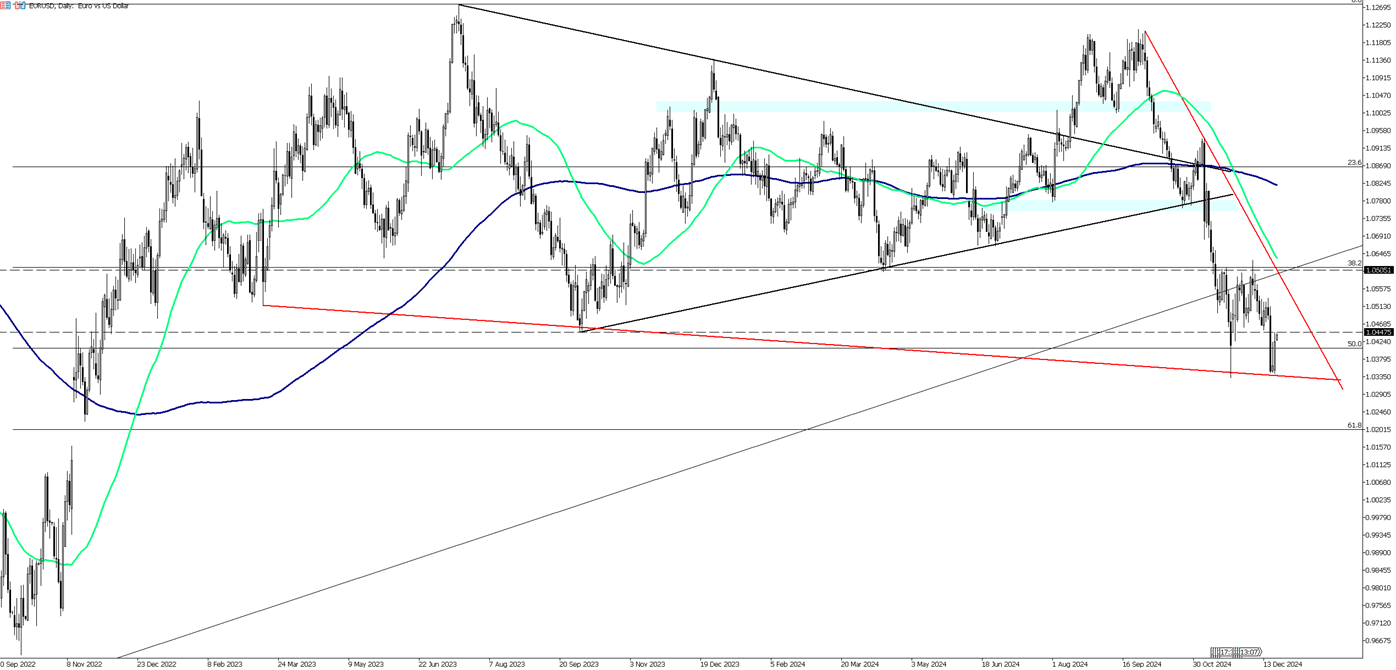

The euro fell to $1.04, near its lowest since November 2022, as the dollar strengthened on the Fed's hawkish 2025 outlook. The Fed cut rates by 25bps but signaled just 50bps of cuts next year, half the previous forecast. Meanwhile, the ECB, after four rate cuts this year, maintained a cautious stance, though analysts believe faster easing may be needed to support the Eurozone economy. Preliminary PMIs showed slower private sector contraction, with Germany and France lagging. Inflation rose to 2.2%, below the 2.3% estimate. Political uncertainty added pressure, with Germany’s Chancellor losing a confidence vote and France's government facing 2025 budget challenges.

From a technical perspective, the first resistance level is at 1.0465, with further resistance levels at 1.0515 and 1.0575 if the price breaks above. On the downside, the initial support is at 1.0330, followed by additional support levels at 1.0300 and 1.0230.

| R1: 1.0400 | S1: 1.0335 |

| R2: 1.0460 | S2: 1.0230 |

| R3: 1.0520 | S3: 1.0200 |

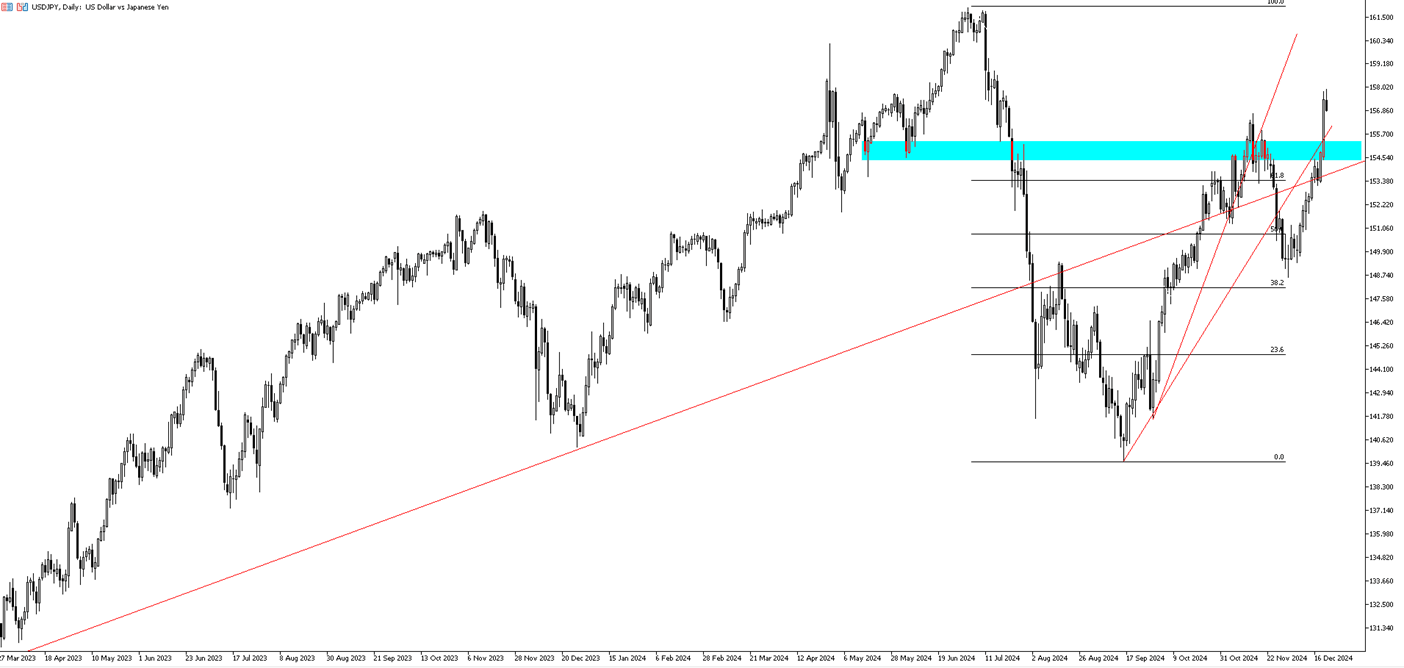

The Japanese yen fell below 156 per dollar on Monday, a nearly five-month low, raising the likelihood of intervention by Japanese authorities. Despite Friday's rebound on strong inflation data, the yen remains pressured by uncertainty over the Bank of Japan's next rate hike. In its December meeting, the BOJ kept rates steady, citing wage trends, global risks, and incoming US policies. The yen also struggled to gain from a weaker US dollar after softer US PCE inflation eased concerns about the pace of Fed rate cuts.

The key resistance level appears to be 157.30, with a break above it potentially targeting 158.30 and 160.00. On the downside, 153.90 is the first major support, followed by 152.70 and 151.00 if the price moves lower.

| R1: 157.30 | S1: 153.90 |

| R2: 158.30 | S2: 152.70 |

| R3: 160.00 | S3: 151.00 |

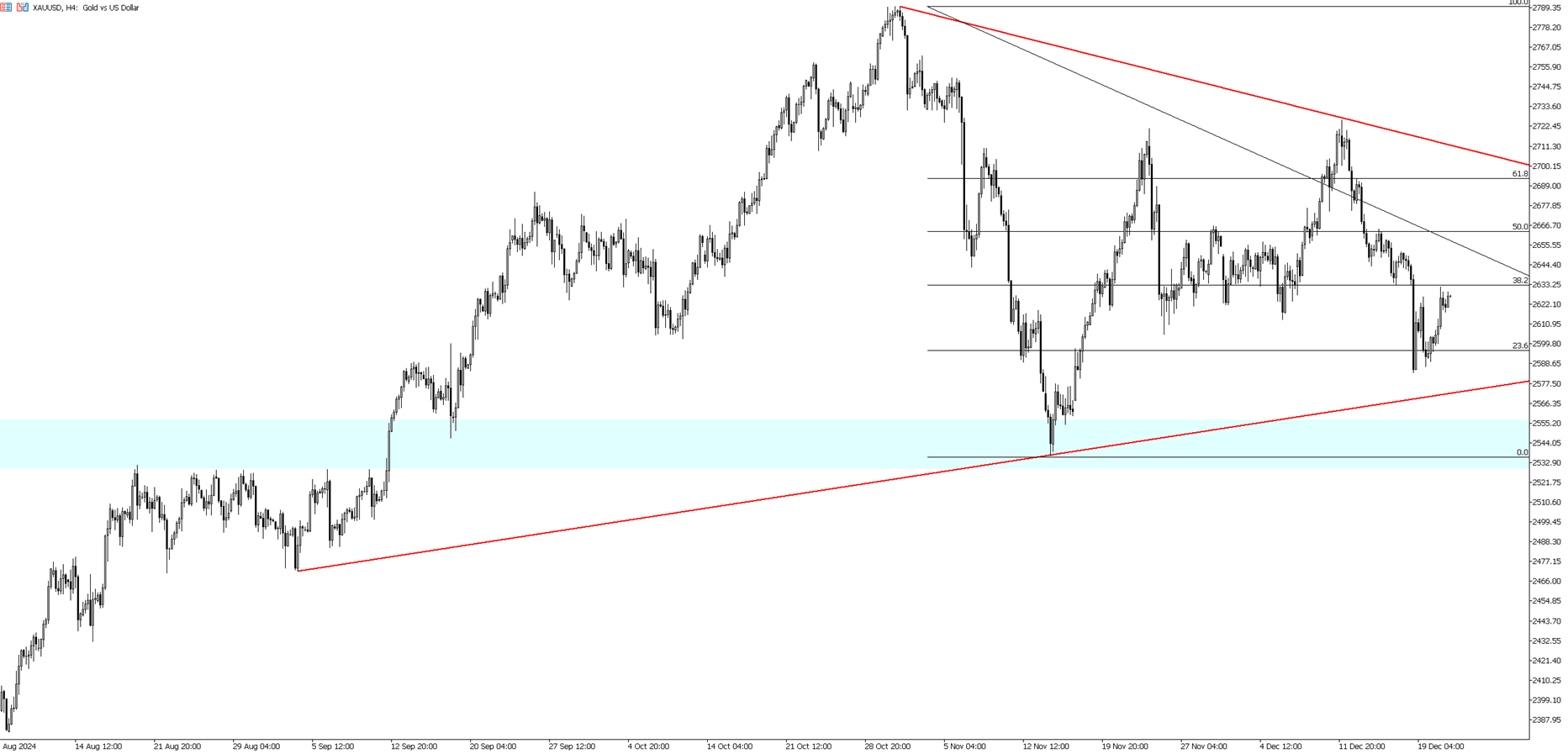

Gold held around $2,620 per ounce on Monday, supported by a weaker US dollar after modest PCE inflation data renewed expectations for Fed easing next year. Earlier, the Fed’s cautious rate cut signals briefly pushed gold to a one-month low. Short-term pressures remain from declining physical demand in India, where officials forecast a significant drop in December imports. Despite challenges, gold is up over 27% this year, its best annual performance since 2010, driven by US policy easing, safe-haven demand, and central bank purchases.

Technically, the first resistance level will be 2635 level. In case of this level’s breach, next levels to watch would be 2670and 2710 consequently. On the downside 2605 will be the first support level. 2575 and 2545 are next levels to monitor if the first support level is breached.

| R1: 2625 | S1: 2575 |

| R2: 2635 | S2: 2530 |

| R3: 2660 | S3: 2500 |

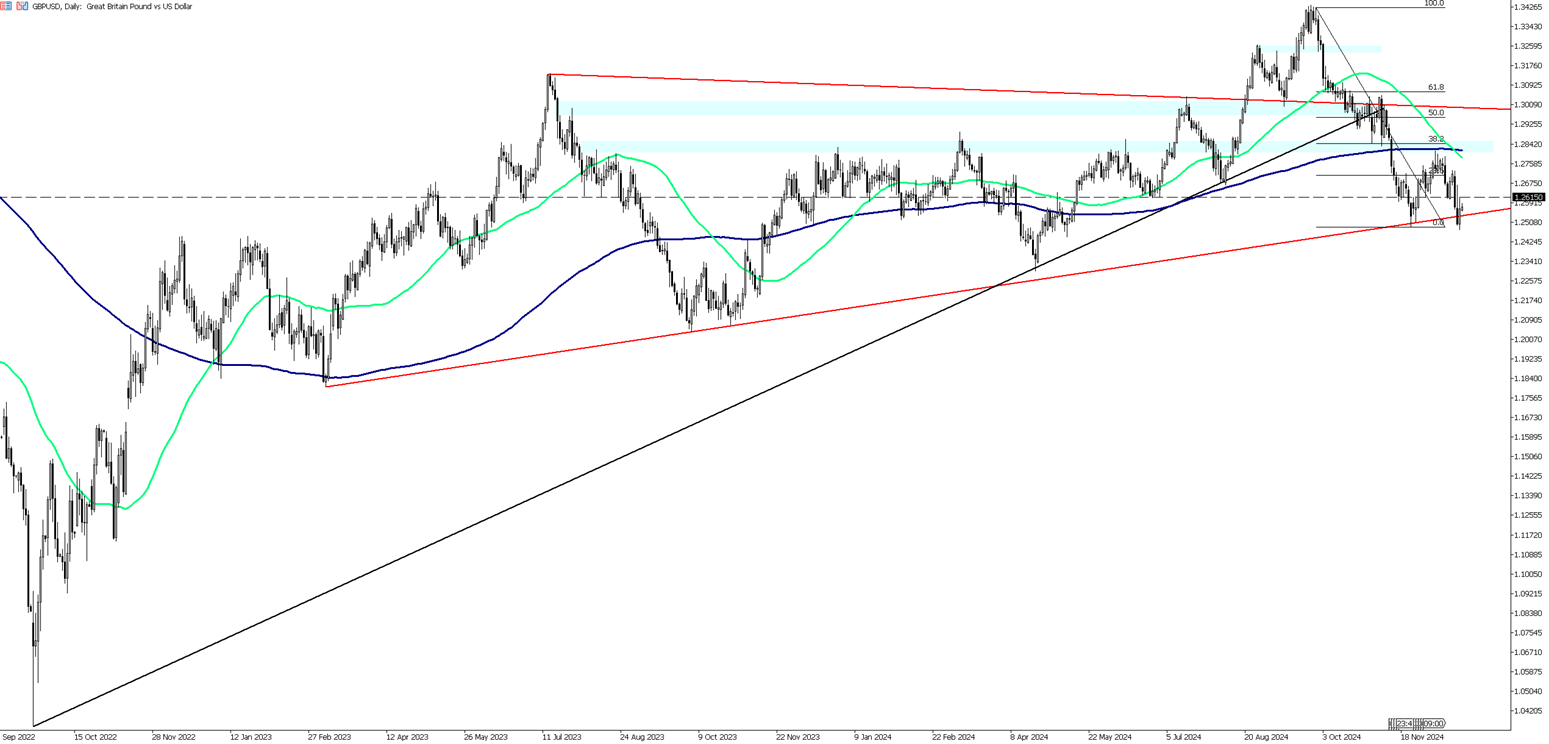

The GBP/USD pair traded within a narrow range above the mid-1.2500s during the Asian session, showing little momentum after Friday's rebound from a 1.2475 low, the weakest since May. The Fed's 25bps rate cut last week, paired with signals of slower rate cuts in 2025, kept US Treasury yields high and supported USD dip-buying, limiting GBP/USD gains. Geopolitical risks and the Bank of England’s dovish stance, including rate hold decisions and a downgraded Q4 economic outlook, added further pressure on the British Pound. Traders await the BoE's Quarterly Bulletin and US Consumer Confidence Index for further direction.

The first resistance level for the pair will be 1.2600. In case of this level's breach, the next levels to watch would be 1.2680 and 1.2750. On the downside 1.2475 will be the first support level. 1.2400 and 1.2350 are the next levels to monitor if the first support level is breached.

| R1: 1.2550 | S1: 1.2475 |

| R2: 1.2600 | S2: 1.2400 |

| R3: 1.2680 | S3: 1.2350 |

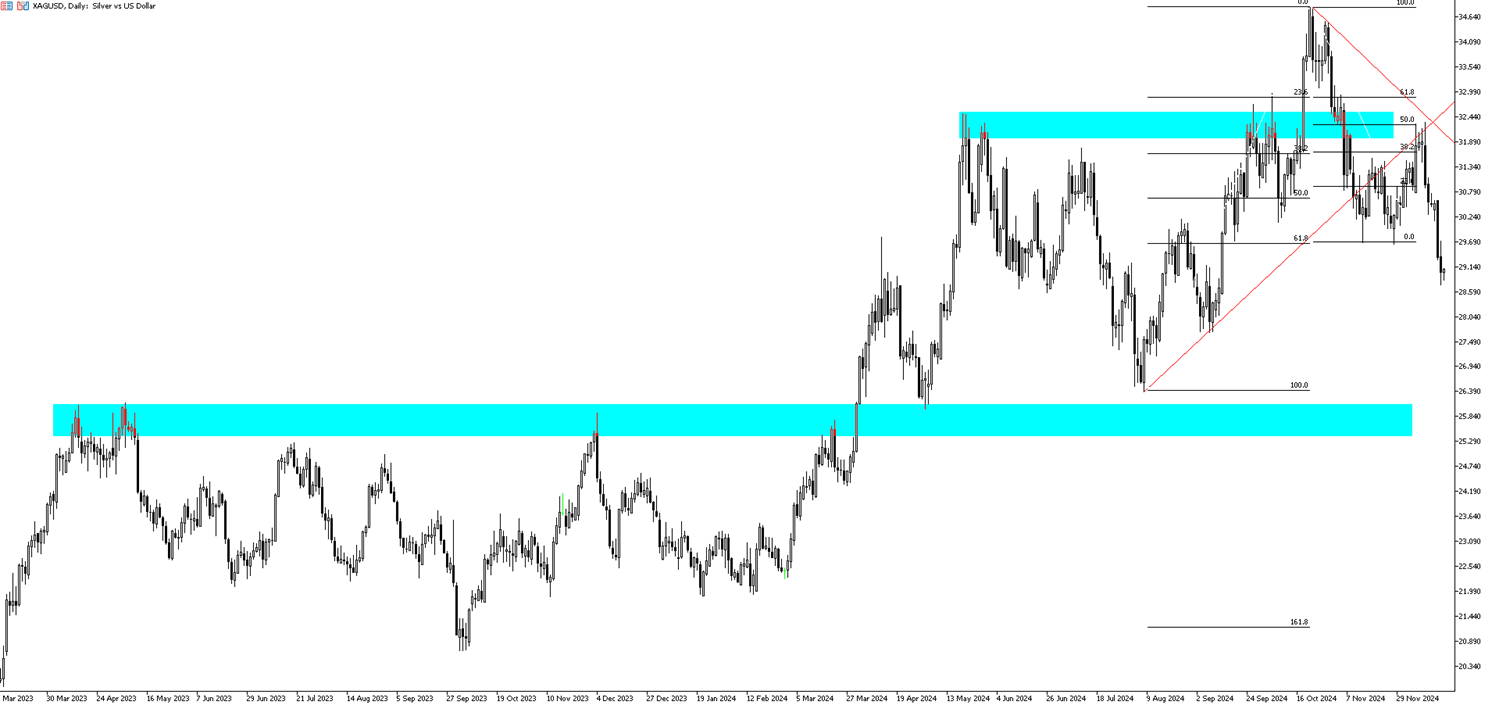

Silver fell toward $29 per ounce in mid-December, hitting a three-month low, as a hawkish Federal Reserve and weak industrial demand weighed on prices. The Fed signaled fewer rate cuts in 2025, citing persistent core inflation and potential inflationary risks under the incoming Trump administration. Concerns over weak industrial use, particularly in China’s solar panel sector, where a government-led supply regulation program is in place, further pressured silver. Additionally, risks of a yuan devaluation due to China’s loose monetary policies reduced export prices from the world's largest silver exporter.

Technically, the first resistance level will be 29.85 level. In case of this level’s breach, the next levels to watch would be 30.20 and 30.70 consequently. On the downside 28.75 will be the first support level. 28.00 and 27.00 are the next levels to monitor if the first support level is breached.

| R1: 29.85 | S1: 28.75 |

| R2: 30.20 | S2: 28.00 |

| R3: 30.70 | S3: 27.00 |

Global markets remain dominated by geopolitical risk as escalating conflict between the United States, Israel, and Iran fuels a strong shift toward safe-haven assets. The dollar index hit 99.3 Wednesday, rising for a third day as conflict concerns fueled inflation and shifted Fed rate cut expectations from July to September.

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!