The EUR/USD holds above 1.0800 as it faces downside risk from expectations of smaller Fed rate cuts and subdued Eurozone growth.

USD/JPY stabilizes near 152 ahead of Japan’s general election, with the yen under pressure due to dollar strength and Japan's weak inflation data. Gold dips below $2,730 as a strong dollar offsets safe-haven demand, while the GBP/USD recovers to 1.2960 on potential borrowing plans by the UK Finance Minister. Silver trades near $33.50, pressured by dollar gains but supported by ongoing geopolitical tensions and safe-haven demand.

Time (GMT) | Event | Asset | Survey | Previous |

| 12:30 | Durable Goods Orders (MoM) (Sep) | USD | -1.1% | 0.0% |

14:00 | Michigan 1-Year Inflation Expectations | USD | 2.9% | 2.7% |

14:00 | Michigan 5-Year Inflation Expectations (Oct) | USD | 3.0% | 3.1% |

| 14:00 | Michigan Consumer Sentiment (Oct) | USD | 68.9 | 70.1 |

14:30 | Atlanta Fed GDPNow (Q3) | USD | 3.4% | 3.4% |

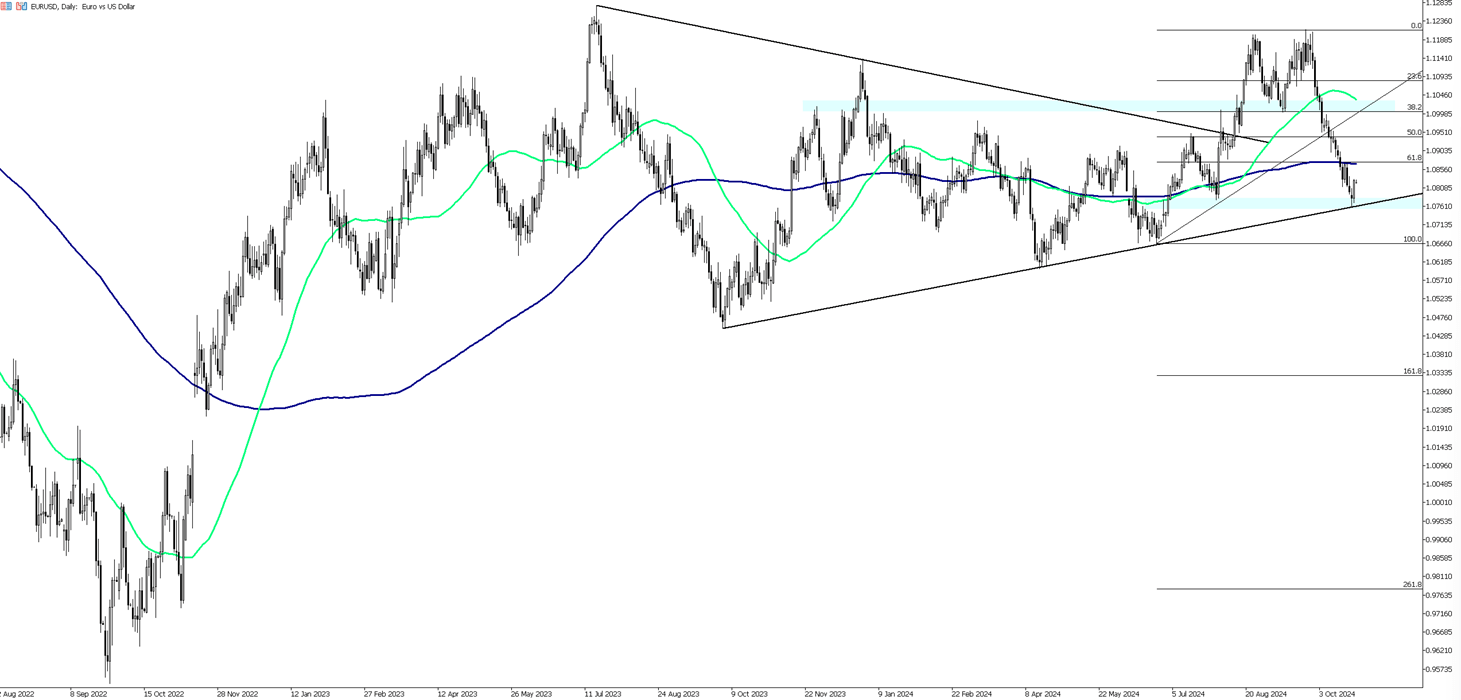

The EUR/USD pair is struggling to build on the previous day's rise of about 60 pips and is exhibiting a slight negative bias during the Asian session on Friday. However, it remains comfortably above the 1.0800 level, despite reaching a nearly four-month low earlier in the week, as US dollar movements are subdued. The USD Index (DXY), which measures the dollar against a basket of currencies, is consolidating after retreating from its highest point since July 30, influenced by softer US Treasury yields. Additionally, signs of stability in the equity markets are undermining the dollar's safe-haven appeal, helping to limit losses for the EUR/USD pair. Nevertheless, increasing expectations that the Federal Reserve will implement smaller rate cuts, coupled with concerns about deficit spending following the US presidential election, support US bond yields. Furthermore, ongoing geopolitical tensions in the Middle East tend to favor the dollar, which may cap any gains for the EUR/USD pair. On the Eurozone front, Thursday's flash PMI data indicated that the economy stalled for the second consecutive month in October, alongside slowing inflation. This supports the European Central Bank's view that the disinflationary trend is well underway and raises prospects for further policy easing, which could weaken the euro and limit the EUR/USD pair's upward movement. Market participants are now awaiting the release of the German Ifo Business Climate Index for additional direction, along with key US macroeconomic data, Durable Goods Orders and the revised Michigan Consumer Sentiment Index. These factors, along with US bond yields and broader risk sentiment, will influence dollar dynamics and provide traders with short-term opportunities in the EUR/USD pair.

In the pair, the first support level is at 1.0790. If this level is breached, the next supports to watch will be 1.0760 and 1.0700. On the upside, the first resistance is at 1.0830; if this level is surpassed, the next targets will be 1.0875 and 1.0920.

| R1: 1.0830 | S1: 1.0790 |

| R2: 1.0875 | S2: 1.0760 |

| R3: 1.0920 | S3: 1.0700 |

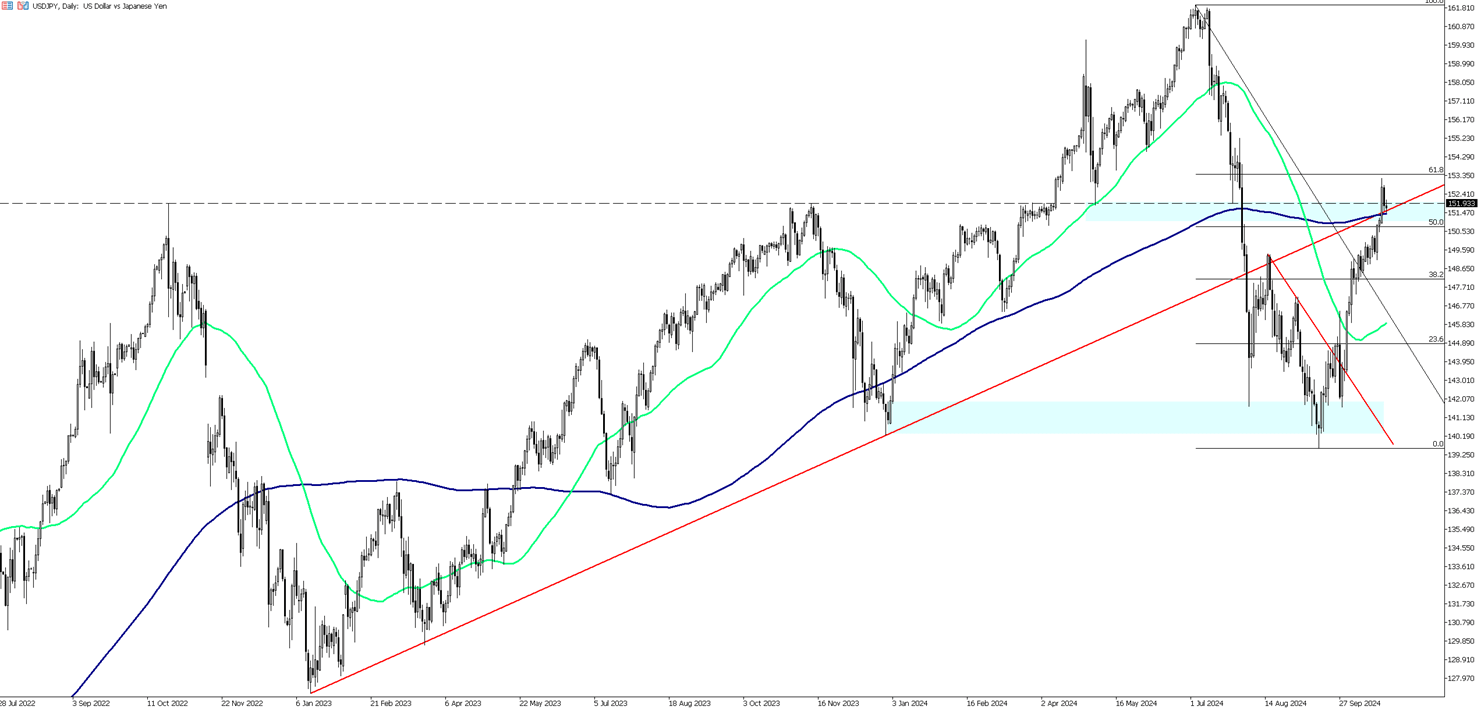

The Japanese yen stabilized around 152 per dollar on Friday as investors prepared for Japan's general election this weekend, where the ruling coalition may lose its parliamentary majority. This potential outcome adds political uncertainty, complicating the Bank of Japan's plans for normalization. On the economic front, data indicated that Tokyo's core inflation is an early indicator of national price trends. It slowed to a six-month low of 1.8% in October, falling below the BOJ's 2% target. Additionally, Japan's economy minister, Akazawa, mentioned that a weak yen has various effects on the economy but refrained from commenting on specific exchange rate levels. Markets are also on alert for a possible currency intervention from authorities following the yen's drop below 150 per dollar. Externally, the yen continues to face pressure from a strong dollar, driven by expectations of more cautious rate cuts from the Federal Reserve and speculation about Trump's potential victory in November.

From a technical perspective, the first resistance level is at 153.20. If this level is surpassed, the next targets will be 154.40 and 155.20. On the downside, the initial support is at 151.30; if this level is breached, the next supports to watch will be 150.20 and 148.60.

| R1: 153.20 | S1: 151.30 |

| R2: 154.40 | S2: 150.20 |

| R3: 155.20 | S3: 148.60 |

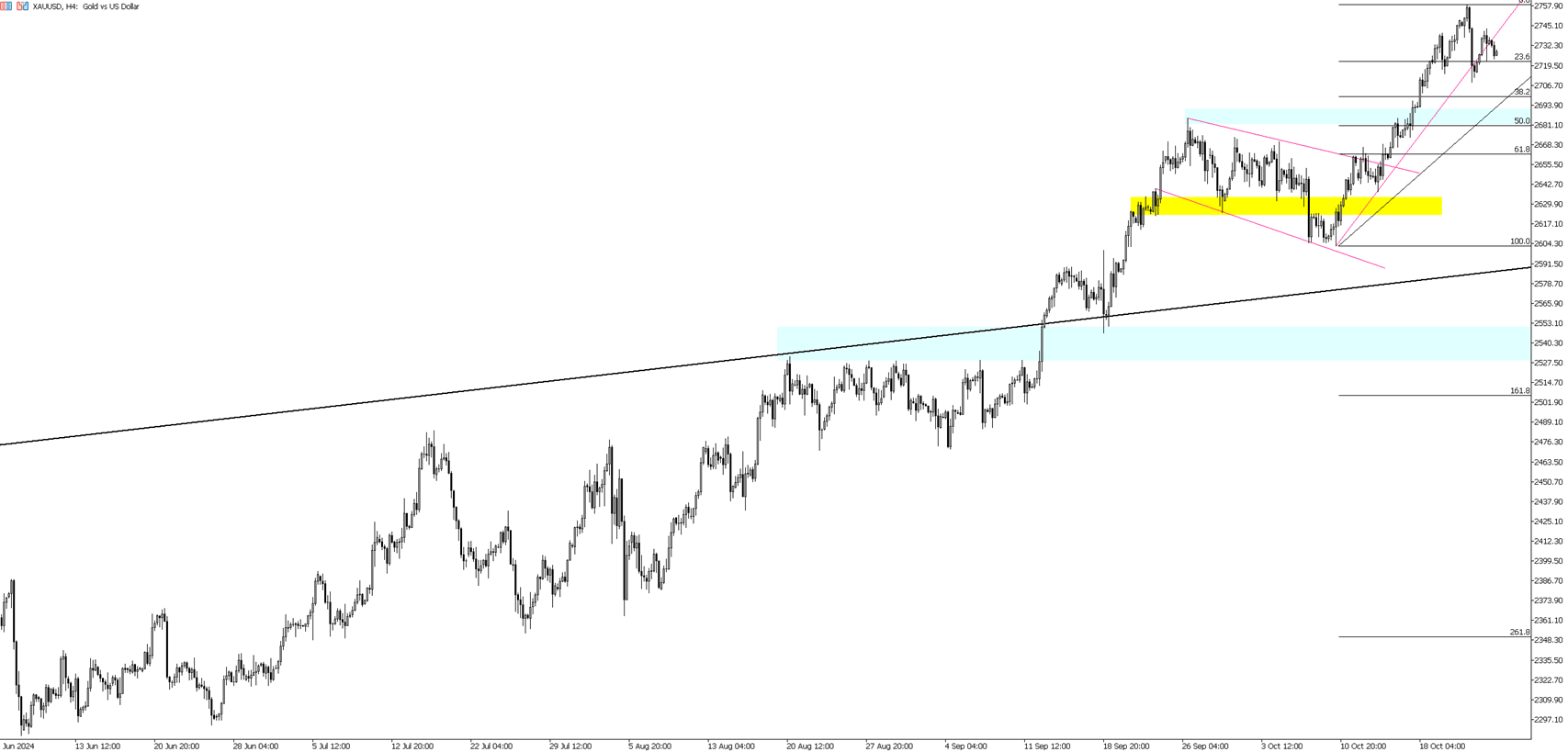

Gold dipped below $2,730 per ounce on Friday after a rise in the previous session, as the ongoing strength of the US dollar and Treasury yields overshadowed the metal's safe-haven appeal. This change followed robust US economic data that intensified expectations that the Federal Reserve's rate-cutting approach will be less aggressive than anticipated. Recent figures revealed a significant drop in US unemployment claims in late October, indicating a resilient labor market, while an increase in the S&P PMI suggested strong momentum in the private sector. Despite this, geopolitical tensions in the Middle East and worries about a wider conflict, along with uncertainties surrounding the US election and easing from major central banks, continued to provide some support for gold. Overall, gold is on track to post slight gains for the week.

Technically the first support level is at 2,725. If this level is breached, the next supports to watch will be 2,714 and 2,685. On the upside, the initial resistance is at 2,735; if this level is surpassed, the next targets will be 2,757 and 2,800.

| R1: 2735 | S1: 2725 |

| R2: 2757 | S2: 2714 |

| R3: 2800 | S3: 2685 |

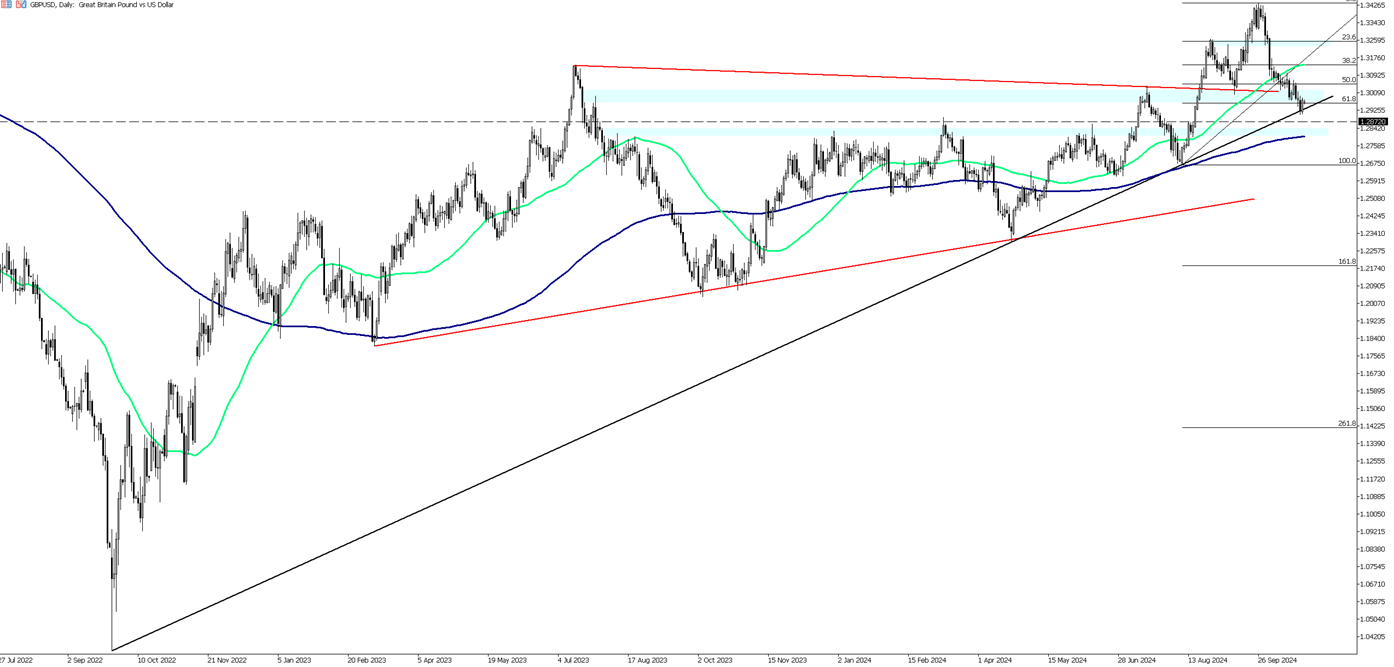

The British Pound is trading at 1.2960 on Friday morning, recovering from a two-month low following reports that Finance Minister Rachel Reeves may permit increased borrowing in the upcoming budget, potentially delaying rate cuts by the Bank of England. Reeves aims to revise fiscal rules to focus on public sector net financial liabilities (PSNFL), which could free up tens of billions for capital expenditure. The Institute for Fiscal Studies suggested this change could have allowed for an additional £53 billion in borrowing last March, although the Treasury has indicated it won't utilize this capacity right away. Bank of England Governor Andrew Bailey expressed concerns about ongoing inflation, noting that while inflation is lower than anticipated, structural economic changes and high inflation in services are still pressing issues. Consequently, market expectations for a rate cut by the BoE in November have fallen from 100% to 86%. Additionally, flash PMI data indicated slower growth in the UK manufacturing and services sectors for October.

For GBP/USD, the initial support lies at 1.2920, followed by 1.2865 and 1.2805 below. On the upside, the first resistance is at 1.2985, with subsequent levels at 1.3050 and 1.3100 if the pair breaks above this resistance.

| R1: 1.2985 | S1: 1.2920 |

| R2: 1.3050 | S2: 1.2865 |

| R3: 1.3100 | S3: 1.2805 |

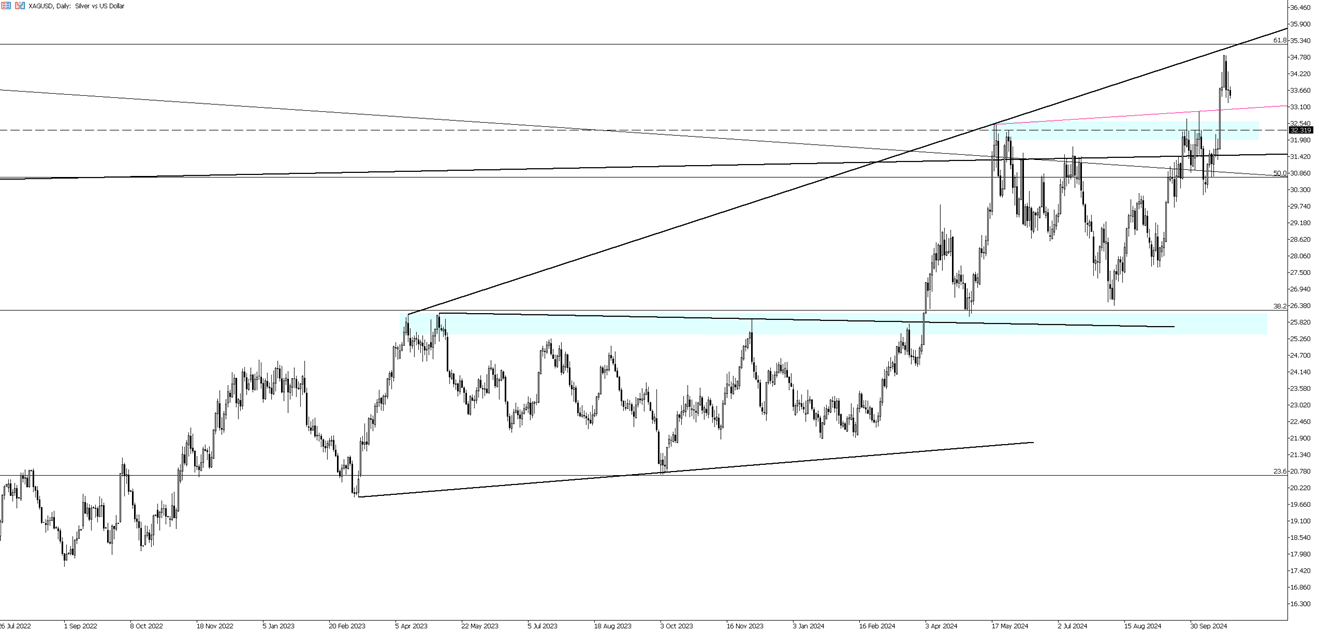

Silver prices (XAG/USD) are on a downward trend for the third straight session, currently trading around $33.50 during Friday’s Asian hours. This decline is largely attributed to the strong performance of the US dollar and rising Treasury yields. However, silver may find some support from safe-haven demand due to uncertainties surrounding the upcoming US presidential election. A recent Reuters/Ipsos poll shows Vice President Kamala Harris with a narrow lead over former President Donald Trump, at 46% to 43%. Additionally, safe-haven silver could benefit from ongoing uncertainties in the Middle East. Traders are closely watching Israel's potential response to Iran's missile attack on October 1. US and Israeli officials are also preparing to resume talks regarding a possible ceasefire and the release of hostages in Gaza in the coming days. US Secretary of State Antony Blinken stated on Thursday that the United States does not support a prolonged Israeli military campaign in Lebanon, while France has called for an immediate ceasefire and renewed diplomatic efforts.

From a technical perspective, the first resistance level to watch is at 34.00. If silver breaks above this level, the next resistance levels to watch will be 34.90 and 35.20, respectively. On the downside, the initial support level is at 33.05, with subsequent support levels at 32.00 and 31.50.

| R1: 34.00 | S1: 33.05 |

| R2: 34.90 | S2: 32.00 |

| R3: 35.20 | S3: 31.50 |

Oil Tanker Attacks Create Volatility

Oil Tanker Attacks Create VolatilityRecent strikes on oil tankers in the Persian Gulf have exposed the extreme vulnerability of global energy supplies. Footage of burning vessels near the Iraqi coastline has saturated financial media, serving as a reminder to market participants of the risks inherent in the region. Whenever tensions escalate in this region, energy traders immediately begin pricing in the possibility of supply disruptions.

Detail Dollar Leads as Markets Reprice Risk (03.12.2026)Currency markets remained under pressure as energy-driven inflation concerns and ongoing geopolitical tensions continued to support the U.S. dollar.

Global markets remained cautious as investors weighed the economic impact of the ongoing Middle East conflict and volatile energy prices.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!