Russia-Ukraine peace efforts remain stalled.

Trump backed a possible security framework but criticized the slow pace, while Zelenskiy floated the idea of a Donbas vote even as he opposed territorial concessions. Talks continue with U.S., European, and regional partners seeking a workable plan. The dollar index hovered near a two-month low after rising jobless claims reinforced expectations for further Fed easing, while relatively firmer signals from Australia, Canada, and Europe added pressure, especially against the euro.

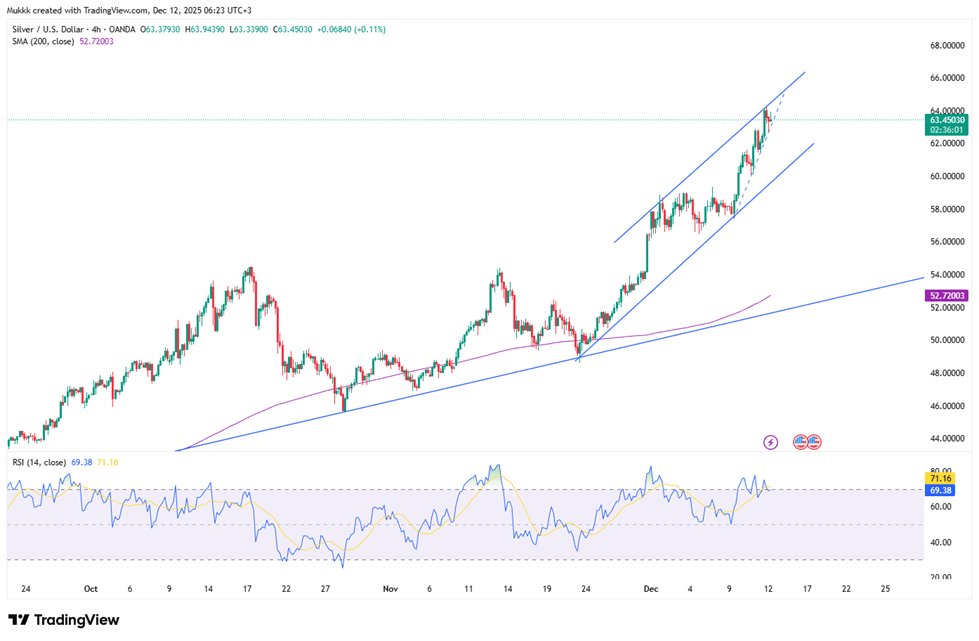

Markets reacted to the Fed’s rate cut as silver hit a record $64.30/oz, up nearly 4% on the day and more than double year-to-date, driven by lower U.S. rates.

| Time | Cur. | Event | Forecast | Previous |

| 07:00 | GBP | GDP (MoM) (Oct) | 0.1% | -0.1% |

| 07:00 | EUR | German CPI (MoM) (Nov) | -0.2% | -0.2% |

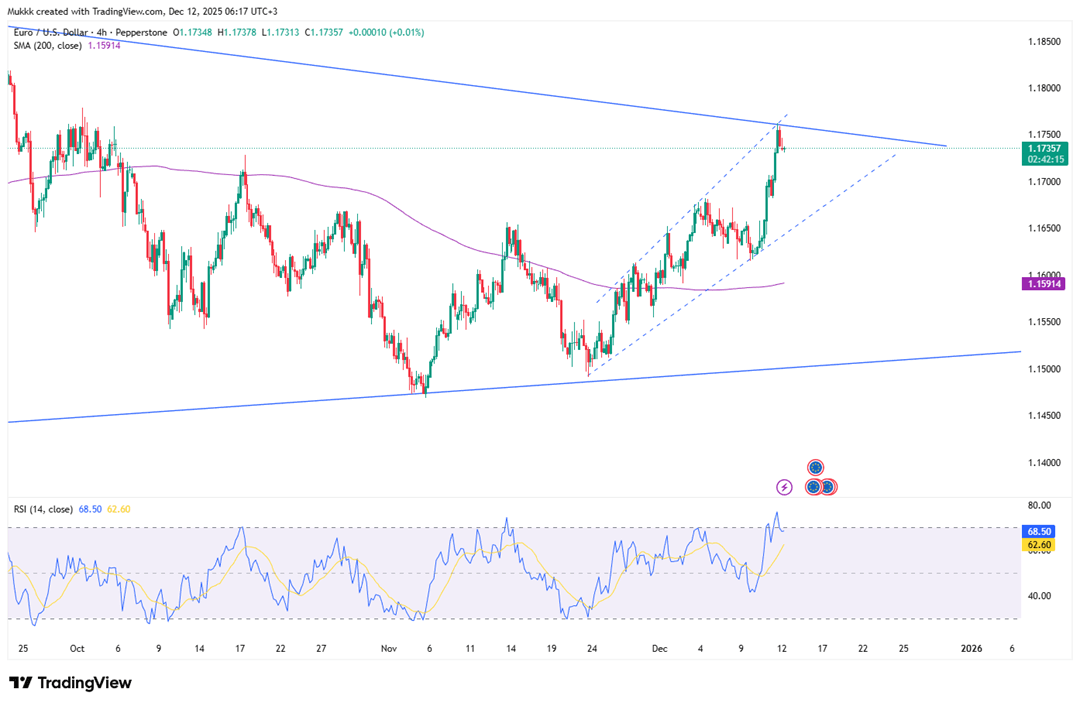

EUR/USD pushed up to 1.173 on Friday, marking its strongest level since mid-October, supported by broad dollar softness and firmer messaging from ECB officials. The dollar stayed under pressure following the Federal Reserve’s latest rate cut and signals that policymakers may pause in January, keeping focus on upcoming US data.

At the same time, expectations for further ECB easing faded after officials suggested additional cuts may not be needed next year. Christine Lagarde said Eurozone growth projections are likely to be revised higher, while France’s approval of its 2026 social-security budget briefly eased political concerns.

From a technical perspective, the pair holds support at 1.1680, while resistance is located near 1.1770.

| R1: 1.1770 | S1: 1.1680 |

| R2: 1.1840 | S2: 1.1600 |

| R3: 1.1910 | S3: 1.1510 |

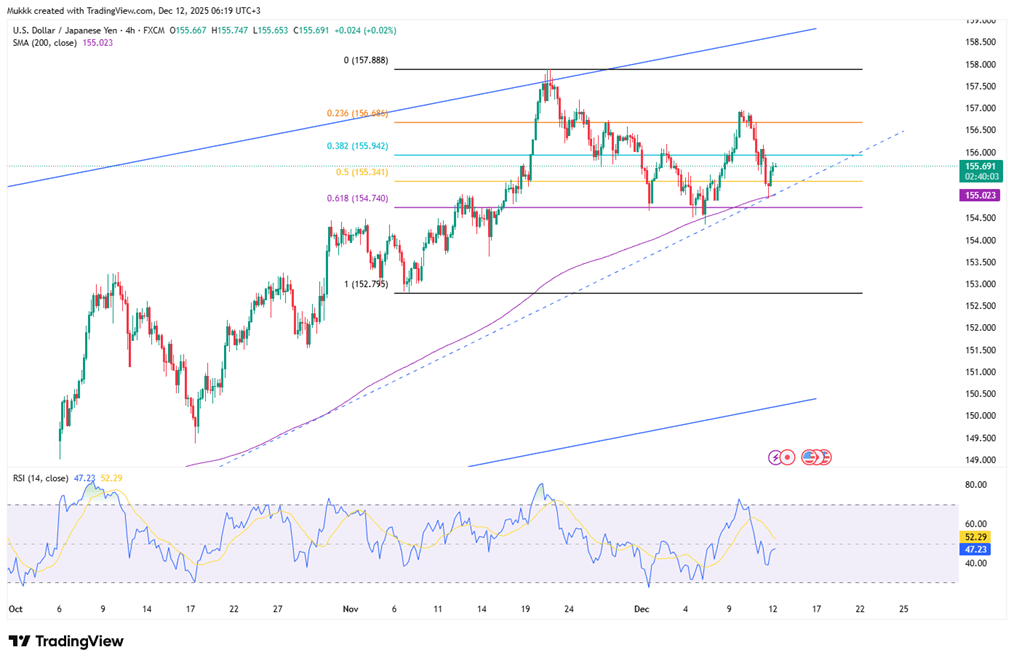

The Japanese yen traded around 155.6 on Friday, holding recent gains as discussion builds around a potential Bank of Japan rate increase next week and further tightening into 2026. Governor Kazuo Ueda said inflation is moving closer to the target, reinforcing expectations for a policy adjustment. Reports also suggest Prime Minister Sanae Takaichi’s cabinet is unlikely to push back against tighter settings, while recent dollar weakness after the Fed’s modest cut added support.

Technically, resistance sits near 156.00, with support firm around 155.10.

| R1: 156.00 | S1: 155.10 |

| R2: 156.50 | S2: 154.40 |

| R3: 157.10 | S3: 153.70 |

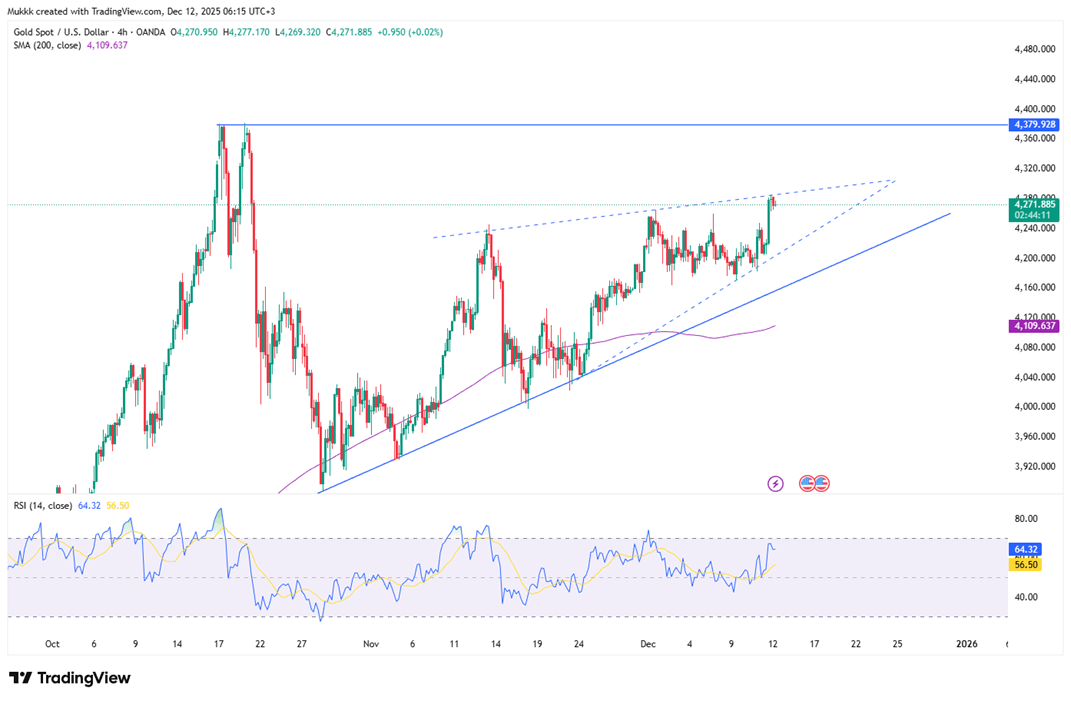

Gold hovered around $4,270 per ounce on Friday, staying close to its strongest level in seven weeks and setting up for a weekly gain. Signs of a cooling US labor market helped underpin prices, with jobless claims for the week of December 6 rising to their highest level in more than two months. That shift revived speculation around two rate cuts in 2026, following the Fed’s third 25-bp cut of the year, Powell’s softer tone, and the announcement of a $40 billion Treasury bill purchase plan aimed at easing funding pressures.

On the charts, support emerges near $4,240, while resistance stands around $4,300.

| R1: 4300 | S1: 4240 |

| R2: 4380 | S2: 4170 |

| R3: 4450 | S3: 4110 |

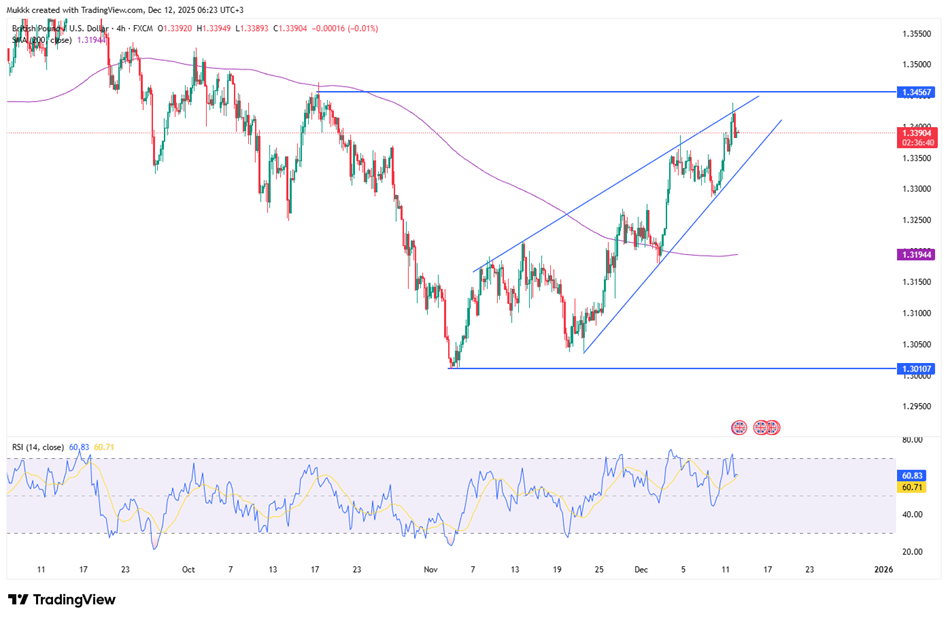

GBP/USD steadied near 1.3400 on Friday, preserving upward momentum despite running into resistance at that level. The pair stayed supported after the Federal Reserve’s third cut weighed on the dollar, even as Powell struck a careful tone. Softer US jobless claims added to the currency’s pressure. With the current week relatively quiet, attention shifts to a busy UK calendar next week, including labor data, PMI readings, CPI inflation, the Bank of England’s rate decision, and retail sales.

Technically, support is found near 1.3320, while resistance aligns around 1.3450.

| R1: 1.3450 | S1: 1.3320 |

| R2: 1.3520 | S2: 1.3250 |

| R3: 1.3580 | S3: 1.3170 |

Silver traded near $63.45 during Friday’s Asian session, extending its advance as industrial demand and dollar weakness continued to support prices. The metal is closing in on a retest of its all-time high, driven by rising use in solar technology, electric vehicles, data centers, and AI, sectors expected to fuel demand well into 2030. Momentum strengthened after the US added silver to its critical minerals list, increasing the likelihood of future tariff involvement and tightening global supply conditions. The Fed’s latest 25-bp cut further weighed on the dollar, improving silver’s appeal for international buyers.

From a technical standpoint, resistance is seen near $64.50, while support is positioned around $62.30.

| R1: 64.50 | S1: 62.30 |

| R2: 65.70 | S2: 61.40 |

| R3: 66.50 | S3: 60.00 |

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

Detail March Starts With Geopolitical Turmoil (2-6 March)

March Starts With Geopolitical Turmoil (2-6 March)Global markets began the week in a state of high alert following coordinated US and Israeli strikes on Iran over the weekend, which resulted in the death of Supreme Leader Ayatollah Ali Khamenei.

Detail Geopolitical Shock Triggers Risk-Off Move (03.02.2026)President Trump stated that operations against Iran could last up to four weeks, though he added that developments are proceeding as planned and could wrap up sooner.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!