Global markets are locked on the Federal Reserve as softer U.S. jobs and services data reignite hopes for rate cuts, lifting the euro above $1.1570 and driving gold and silver to multi-week highs.

The euro’s advance remains capped below $1.16 with skepticism over an imbalanced U.S.-EU trade deal, while sterling struggles to regain momentum ahead of the BoE’s upcoming policy decision. Precious metals are gaining traction, with gold testing $3,400 and silver surging past $37.70, as traders increasingly price in two Fed cuts by year-end.

| Time | Cur. | Event | Forecast | Previous |

| 14:30 | USD | Crude Oil Inventories | - | 7.698M |

| 17:00 | USD | 10-Year Note Auction | - | 4.362% |

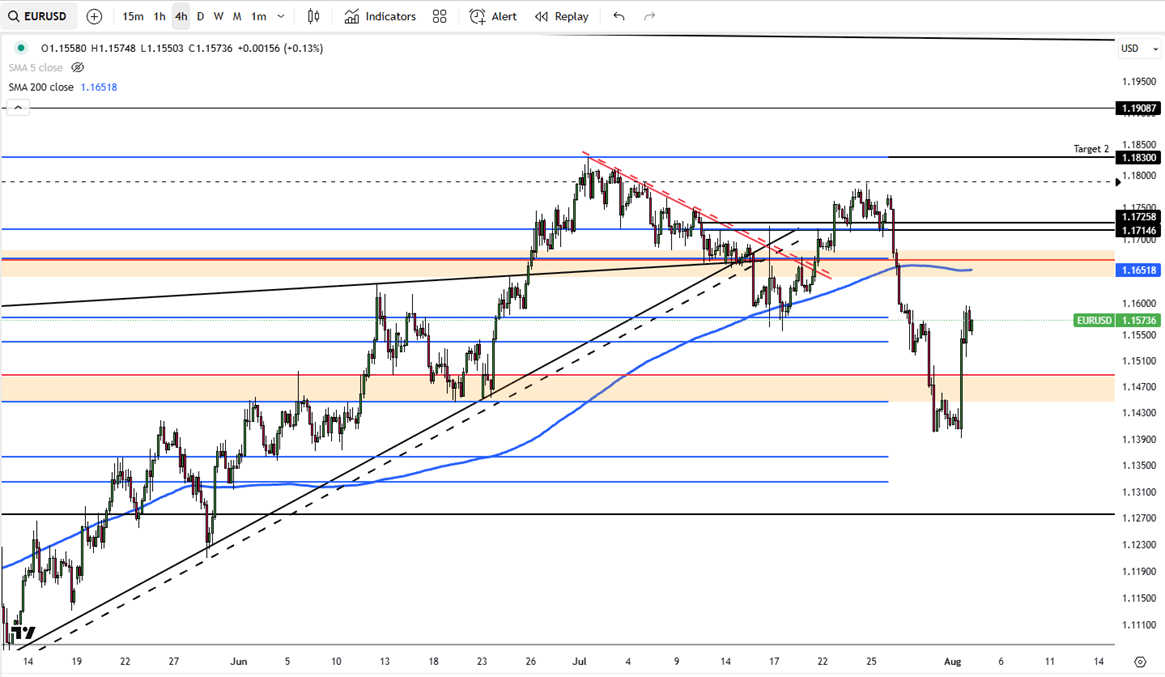

The euro reclaimed ground above $1.1570 in early August, bouncing back from a seven-week low of $1.139 as markets positioned for policy easing from both the Fed and ECB. However, the Fed is expected to move faster and more decisively. Softer U.S. payroll numbers for July and significant downward revisions for prior months fueled bets on a Fed rate cut in September, with a second likely by year-end. In contrast, ECB easing remains a slower story, with markets pricing a 60% chance of a cut by December and 80% by March 2026.

EUR/USD now eyes resistance at 1.1660, while support holds at 1.1500.

| R1: 1.1660 | S1: 1.1500 |

| R2: 1.1725 | S2: 1.1350 |

| R3: 1.1830 | S3: 1.1275 |

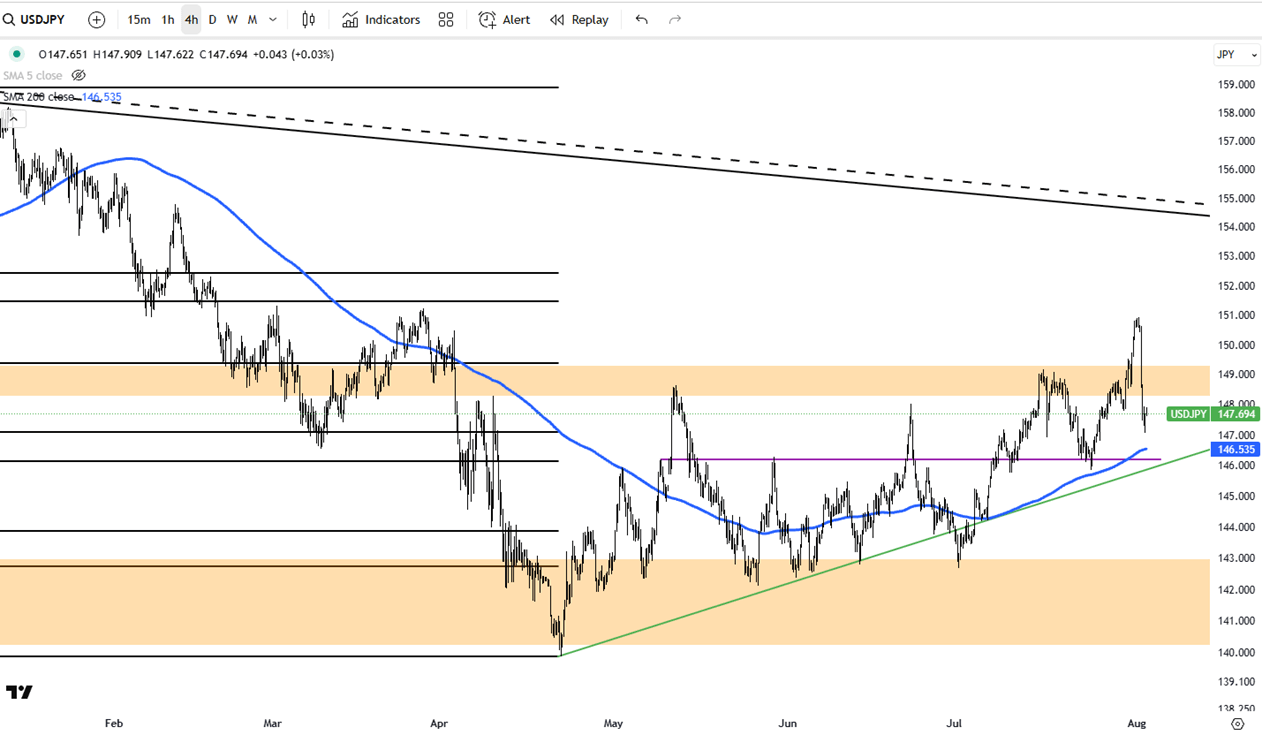

The Japanese yen hovered near 147 per dollar, holding its recent strength after the Bank of Japan's June minutes suggested openness to further rate hikes, if global trade tensions cool. Despite this, policymakers emphasized keeping current rates for now with ongoing uncertainty. A Ministry of Finance official also stressed the need for flexibility in managing bond purchases to maintain market stability.

USD/JPY faces resistance at 148.50, with support at 146.00.

| R1: 148.50 | S1: 146.00 |

| R2: 151.50 | S2: 143.00 |

| R3: 152.40 | S3: 140.00 |

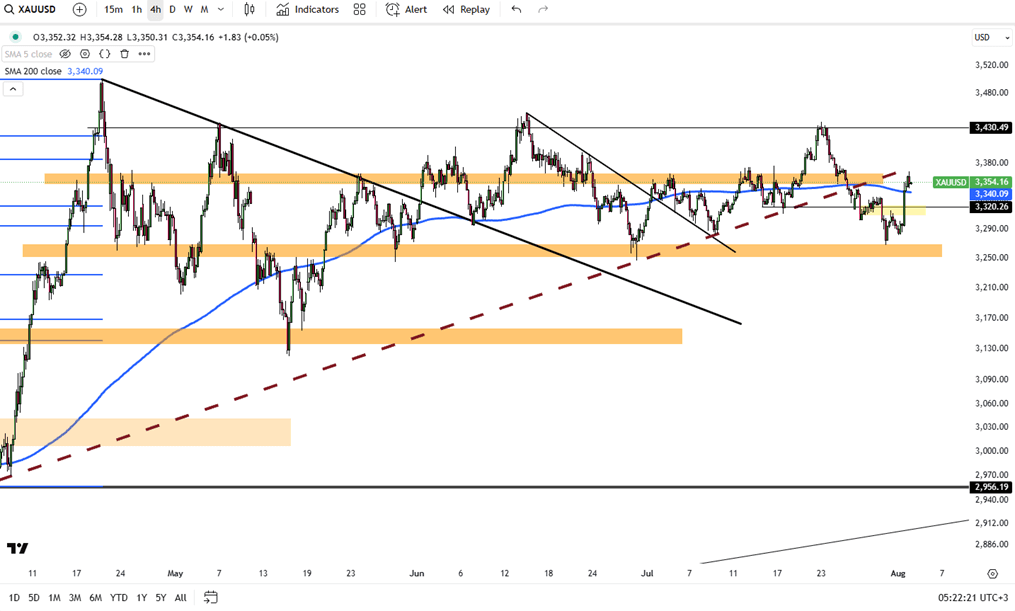

Gold rallied to a two-week high with weaker U.S. services data and rising expectations of Fed rate cuts. July's ISM Services PMI came in below forecasts, showing stalled growth, job losses, and persistent inflation, adding to evidence of a cooling labor market. Traders now expect two rate cuts by the Fed this year, with September in focus.

Gold is testing resistance at $3,400, with support at $3,340.

| R1: 3400 | S1: 3340 |

| R2: 3440 | S2: 3270 |

| R3: 3500 | S3: 3250 |

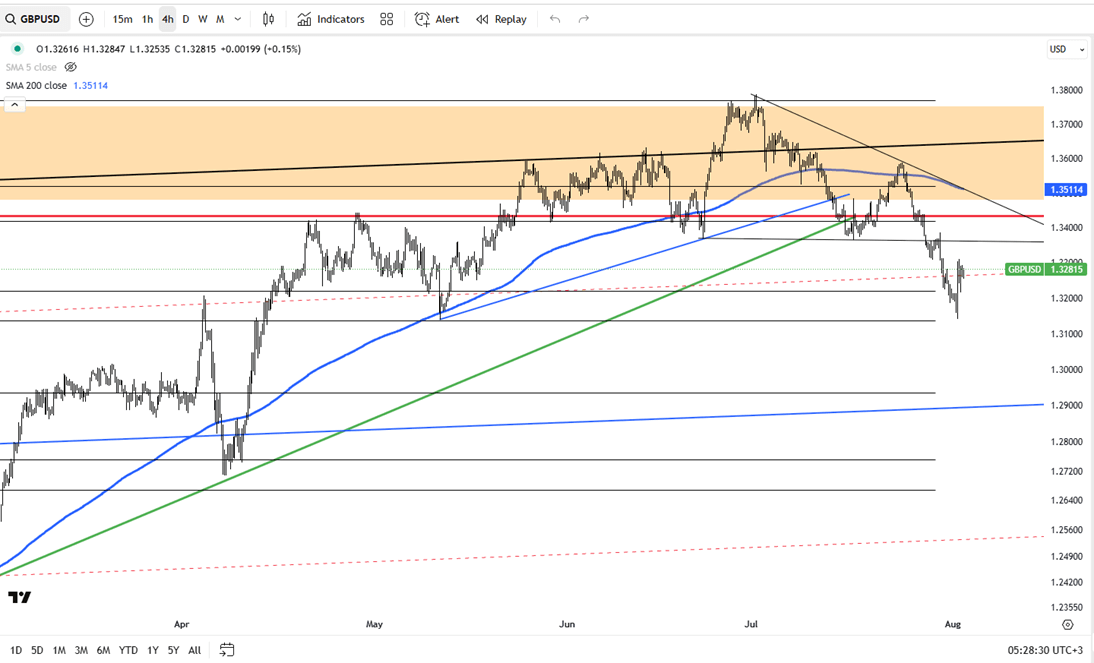

GBP/USD fluctuated below the 1.3300 level as shifting sentiment kept the pair directionless. The U.S. dollar struggled to build momentum due to growing expectations of a Fed rate cut in September, while the British pound remained under pressure with investors cautious ahead of upcoming Bank of England policy decisions later this week.

GBP/USD is seeing resistance at 1.3330, with initial support at 1.3240.

| R1: 1.3330 | S1: 1.3240 |

| R2: 1.3480 | S2: 1.3140 |

| R3: 1.3600 | S3: 1.3000 |

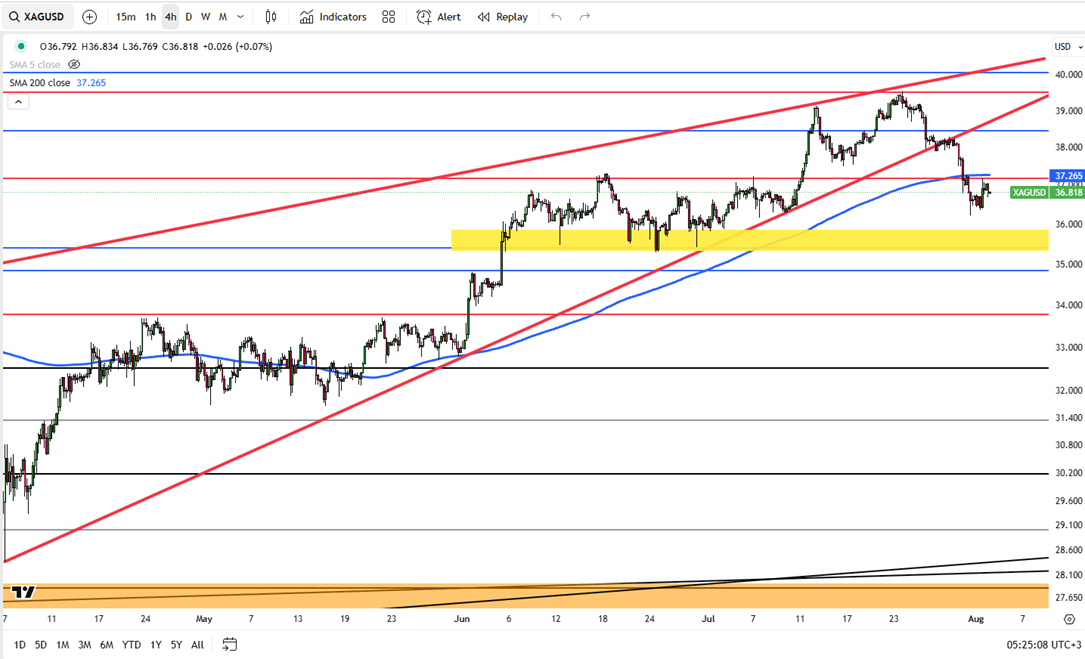

Silver soared past $37.70 per ounce, hitting its highest level since July 29, as soft U.S. services data reinforced Fed rate cut expectations. The ISM Services PMI report showed slowing growth, falling employment, and rising input prices, amplifying concerns over an already fragile labor market after weak payroll figures. Markets are now betting on two Fed cuts this year, the first as soon as September.

Silver is now testing resistance at $38.20, with support holding around $36.50.

| R1: 38.20 | S1: 36.50 |

| R2: 39.50 | S2: 35.50 |

| R3: 40.10 | S3: 33.90 |

Markets traded cautiously ahead of key inflation data and amid ongoing trade and geopolitical uncertainty.

Markets remained cautious as a new 10% U.S. global tariff weighed on risk sentiment. The euro and pound stayed under pressure near recent lows, while the yen rebounded on renewed speculation around Bank of Japan tightening.

Global markets remained cautious as a new 10% U.S. global tariff came into force, keeping trade uncertainty at the center of investor focus.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!