The euro slipped to $1.1660 as peace talks between Trump, Zelenskiy, and EU leaders raised concerns, while attention turned to Powell’s Jackson Hole speech and Fed minutes, with a September rate cut likely.

The yen weakened near 148 as the dollar firmed, though BoJ Governor Ueda stayed cautious with inflation still below 2%. Gold held above $3,330 with markets pricing an 84% chance of a 25bps cut, while silver dipped below $38 on softer haven demand. Sterling eased to $1.35 but stayed near five-week highs after strong UK GDP and labor data curbed BoE cut bets.

| Time | Cur. | Event | Forecast | Previous |

| 15:30 | USD | Building Permits | 1.390M | 1.393M |

| 15:30 | USD | Housing Starts | - | 4.6% |

| 18:30 | USD | Atlanta Fed GDP Now | 1.290M | 1.321M |

| 21:10 | USD | FOMC Member Bowman Speaks | 2.5% | 2.5% |

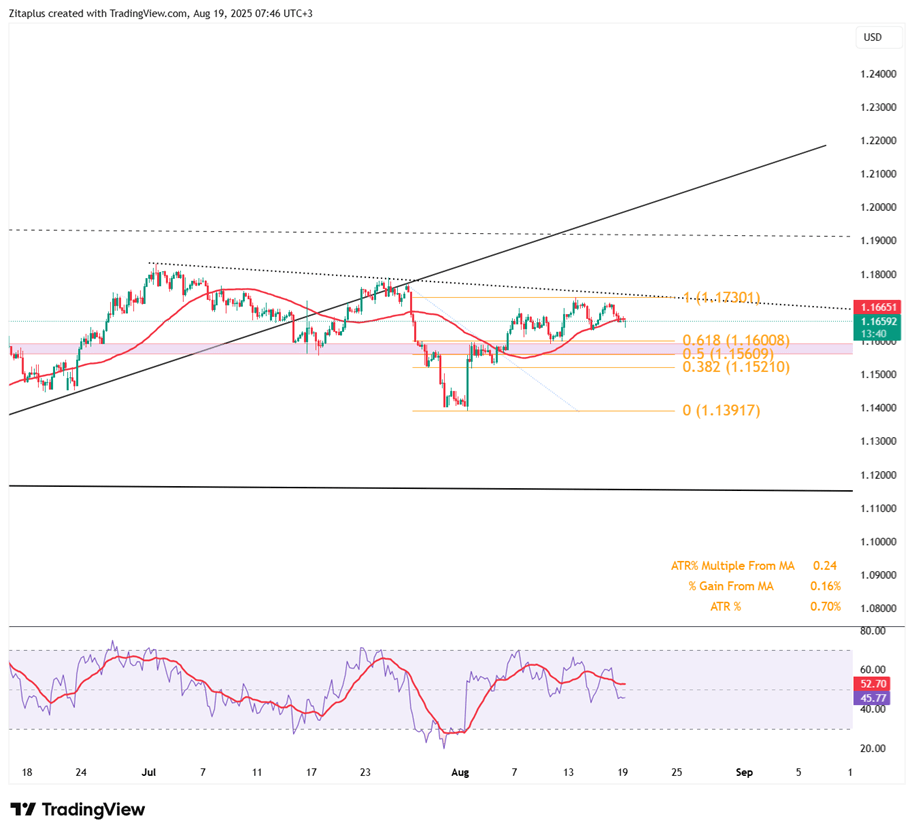

The euro fell around $1.1660 as markets reacted to peace discussions between Trump, Zelenskiy, and EU leaders over a potential Russia-Ukraine deal. The talks floated an Article 5-style security guarantee for Ukraine, excluding NATO membership but obligating allies to respond to attacks, which raised concerns. Trump pledged to press Zelenskiy for a swift agreement after meeting Putin, who signaled limited openness to US-European security guarantees.

In the US, focus shifted to Fed Chair Jerome Powell’s Jackson Hole remarks and Fed minutes, with markets leaning toward a September rate cut. In Europe, the ECB ended its easing cycle in July after eight cuts since 2022, though future moves remain possible. Flash PMIs, Q2 GDP growth of 0.1%, and steady 2% inflation also weigh on sentiment, alongside looming 15% US tariffs on EU exports.

For EUR/USD, the first resistance is seen at 1.1770, while the nearest support stands at 1.1600.

| R1: 1.1770 | S1: 1.1600 |

| R2: 1.1830 | S2: 1.1520 |

| R3: 1.1900 | S3: 1.1350 |

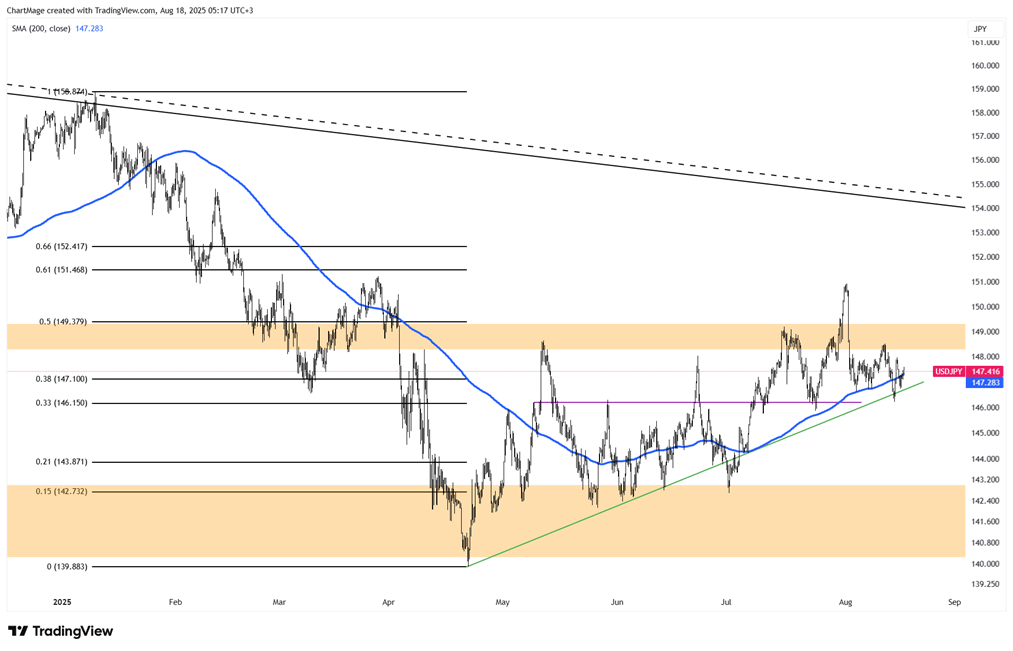

The yen traded near 148 per dollar after a 0.5% decline the prior day, pressured by a stronger dollar on optimism around Ukraine peace efforts. Trump met EU leaders to push for security guarantees for Ukraine and floated a Zelenskiy-Putin summit, possibly followed by a trilateral meeting.

The yen also weakened after Japan rejected US Treasury Secretary Scott Bessent’s claim that the BoJ was “behind the curve.” BoJ Governor Kazuo Ueda struck a cautious note, stressing core inflation remains below the 2% target despite external pressure to hike rates.

For USD/JPY, the nearest resistance is at 148.00, while the immediate support is at 145.00.

| R1: 148.00 | S1: 145.00 |

| R2: 151.50 | S2: 143.00 |

| R3: 152.40 | S3: 140.00 |

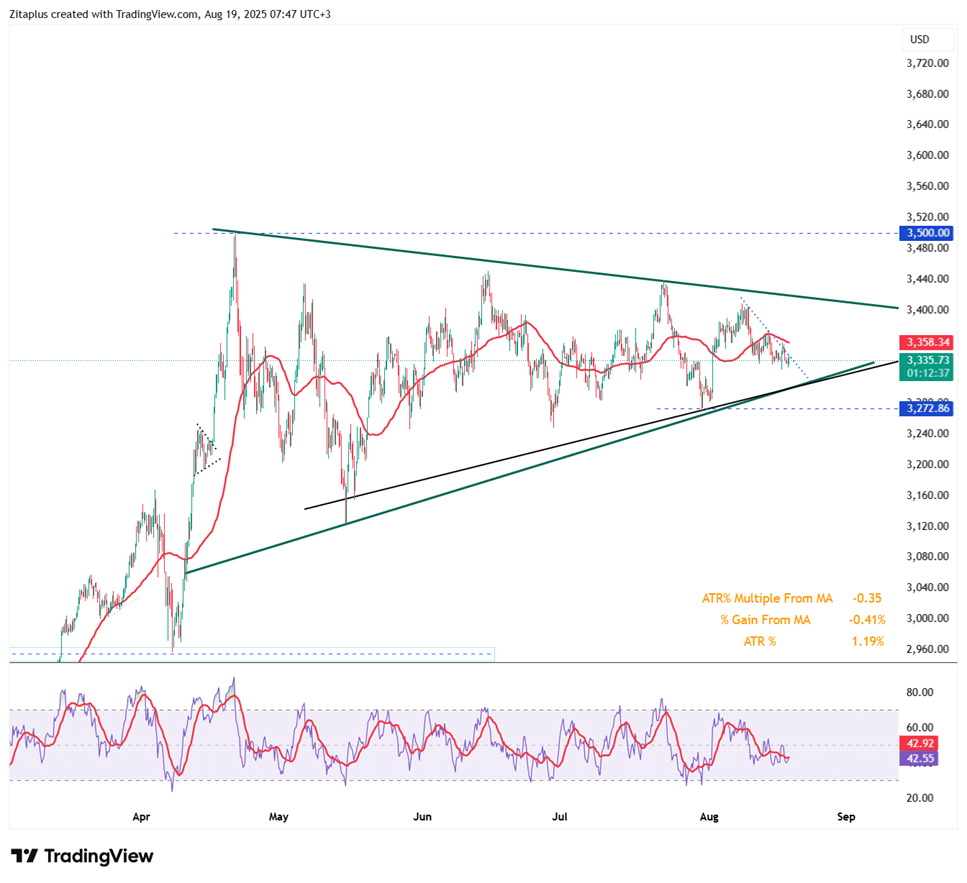

Gold traded above $3,330 per ounce on Tuesday as investors balanced US-led peace efforts with anticipation for the Fed’s Jackson Hole symposium. Trump confirmed plans for a Zelenskiy-Putin meeting, possibly followed by a trilateral summit, boosting cautious optimism. Markets now assign an 84% probability to a 25bps September rate cut.

Gold is currently facing resistance around $3,385, with strong support near $3,320.

| R1: 3385 | S1: 3320 |

| R2: 3420 | S2: 3275 |

| R3: 3500 | S3: 3230 |

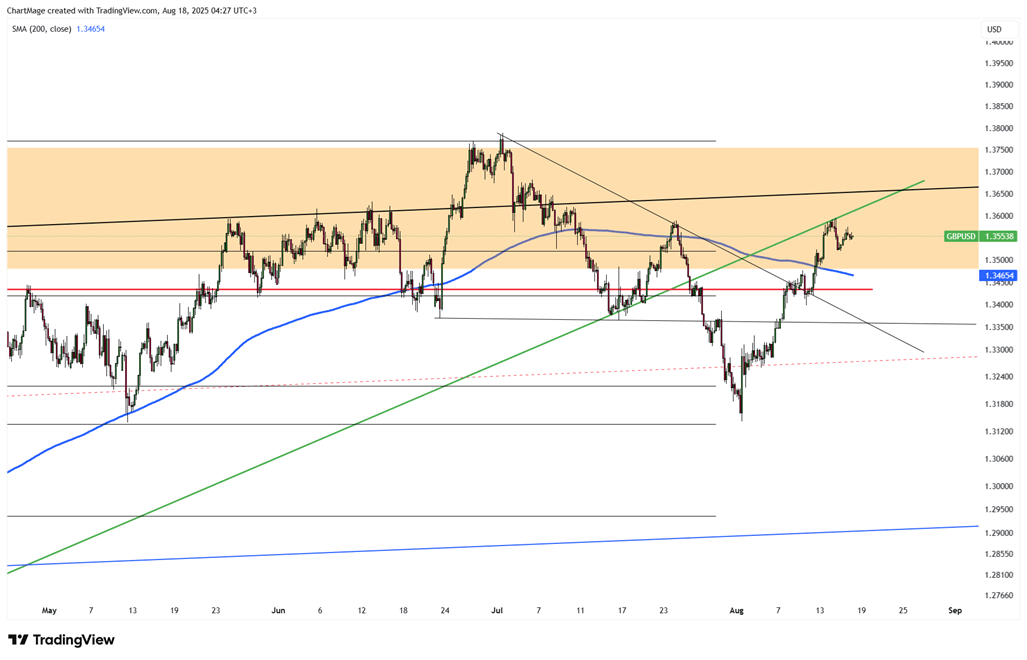

Sterling eased to $1.35 but stayed close to five-week highs, supported by stronger UK data. Q2 GDP rose 0.3% (vs. 0.1% forecast), with annual growth at 1.2%, while June GDP gained 0.4%. Labor data also beat expectations as payrolls fell only 8,000 (vs. 20,000 est.), unemployment held at 4.7%, and wage growth slowed to 4.8%.

The strong figures lessen the chances of further BoE cuts after last week’s narrow 5-4 vote for a 25bps reduction. Meanwhile, a softer dollar after weak US inflation data also supported the pound.

The first resistance is seen at 1.3620, with nearby support beginning at 1.3340.

| R1: 1.3620 | S1: 1.3340 |

| R2: 1.3750 | S2: 1.3260 |

| R3: 1.3850 | S3: 1.3000 |

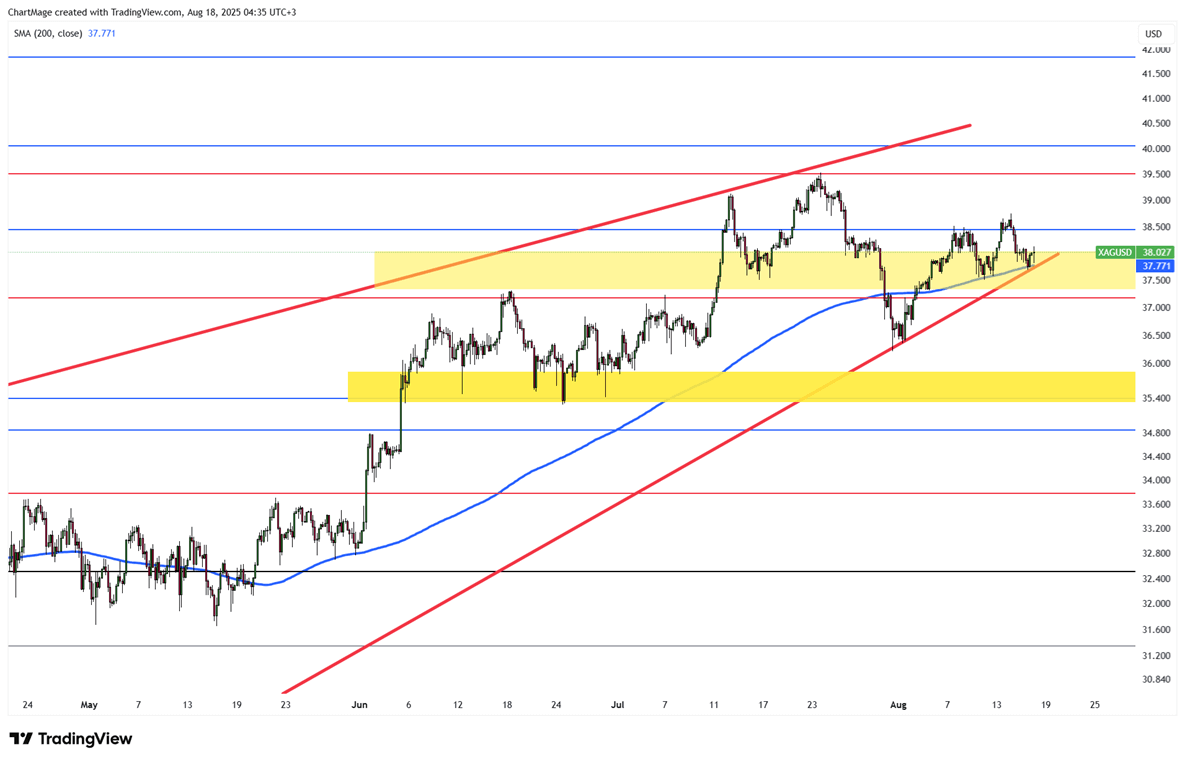

Silver fell under $38 per ounce, reversing the prior day’s gains as optimism over peace talks curbed demand for havens. Trump said he was working to arrange a Putin-Zelenskiy meeting, possibly followed by a trilateral summit. Attention also turned to the Fed’s Jackson Hole symposium and July FOMC minutes, which revealed rare dissent over the policy path.

For silver, the first resistance level is at 39.50, while the closest support is found at 36.75.

| R1: 39.50 | S1: 36.75 |

| R2: 40.50 | S2: 35.50 |

| R3: 41.20 | S3: 33.90 |

Markets traded cautiously ahead of key inflation data and amid ongoing trade and geopolitical uncertainty.

Markets remained cautious as a new 10% U.S. global tariff weighed on risk sentiment. The euro and pound stayed under pressure near recent lows, while the yen rebounded on renewed speculation around Bank of Japan tightening.

Global markets remained cautious as a new 10% U.S. global tariff came into force, keeping trade uncertainty at the center of investor focus.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!