Global markets are navigating renewed tariff uncertainty and mixed central bank signals. Trump's proposal for gradual tariff increases is supporting the euro despite persistent dollar strength, while the yen gains on strong BOJ signals amid strong domestic inflation.

Gold and silver have rallied as safe-haven demand rises, with investors now turning to upcoming US inflation data and central bank meetings for further guidance.

| Time | Cur. | Event | Forecast | Previous |

| 15:00 | USD | Factory Orders (MoM) (Dec) | -0.7% | -0.4% |

| 15:00 | USD | JOLTS Job Openings (Dec) | 7.880M | 8.098M |

| 21:30 | USD | API Weekly Crude Oil Stock | 2.860M |

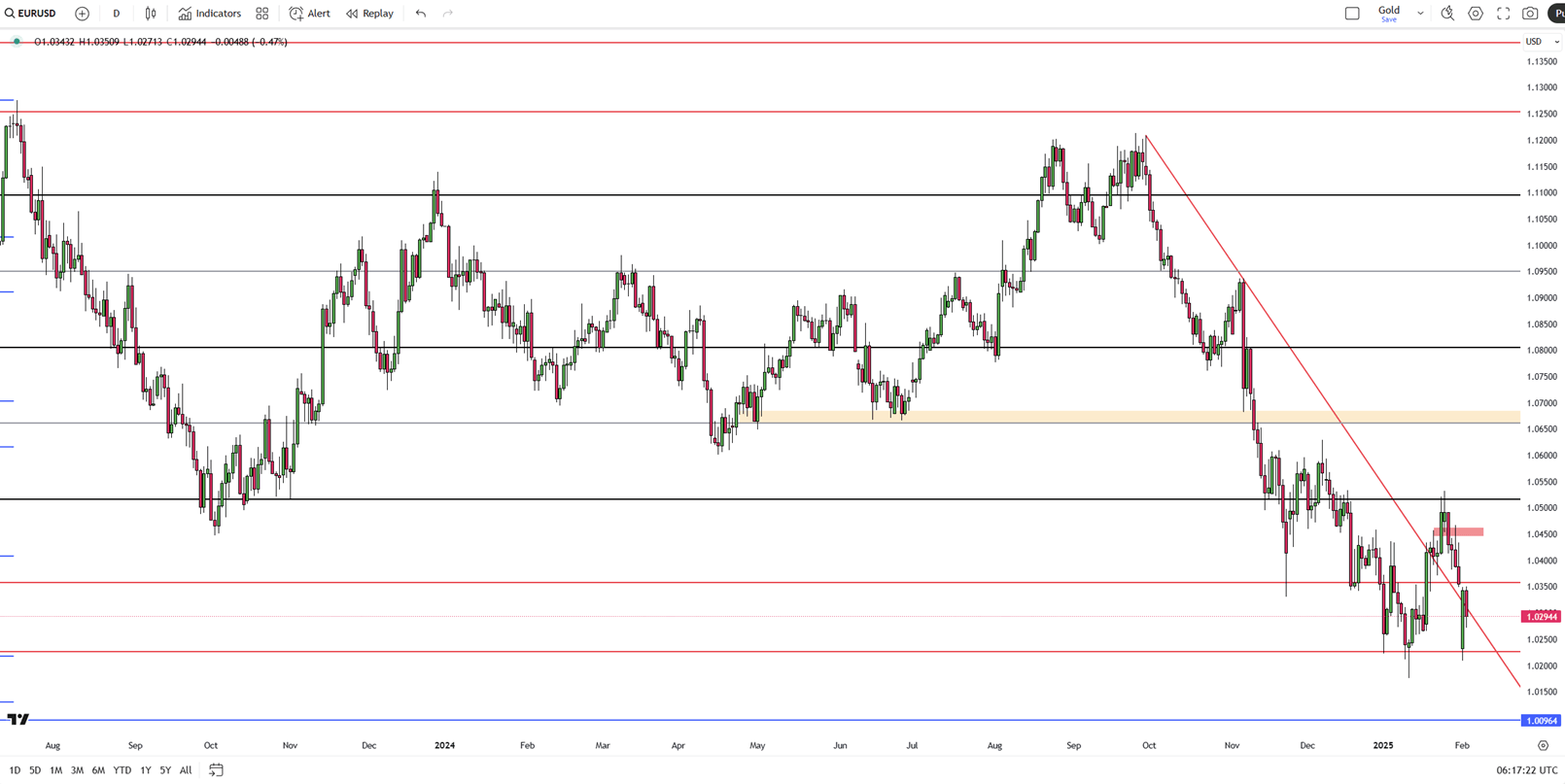

The euro edged up but stayed pressured around $1.03 amid uncertainty over Trump’s tariff policies. Over the weekend, Trump confirmed a 25% tariff on Mexican and Canadian imports, a 10% duty on Chinese goods, and threatened EU tariffs, citing the U.S. trade deficit. However, Mexico secured a one-month delay by agreeing to deploy 10,000 troops to curb fentanyl trafficking. The euro also faced pressure from the ECB’s dovish stance and prospects of further rate cuts after last week’s expected 25bps reduction. Meanwhile, Euro Area inflation rose to 2.5% in January, above the 2.4% forecast, while core inflation held at 2.7%, defying expectations of a slight dip.

From a technical perspective, the first resistance level is at 1.0305, with further resistance levels at 1.0360 and 1.0460 if the price breaks above. On the downside, the initial support is at 1.0220, followed by additional support levels at 1.0180 and 1.0120.

| R1: 1.0305 | S1: 1.0220 |

| R2: 1.0360 | S2: 1.0180 |

| R3: 1.0460 | S3: 1.0120 |

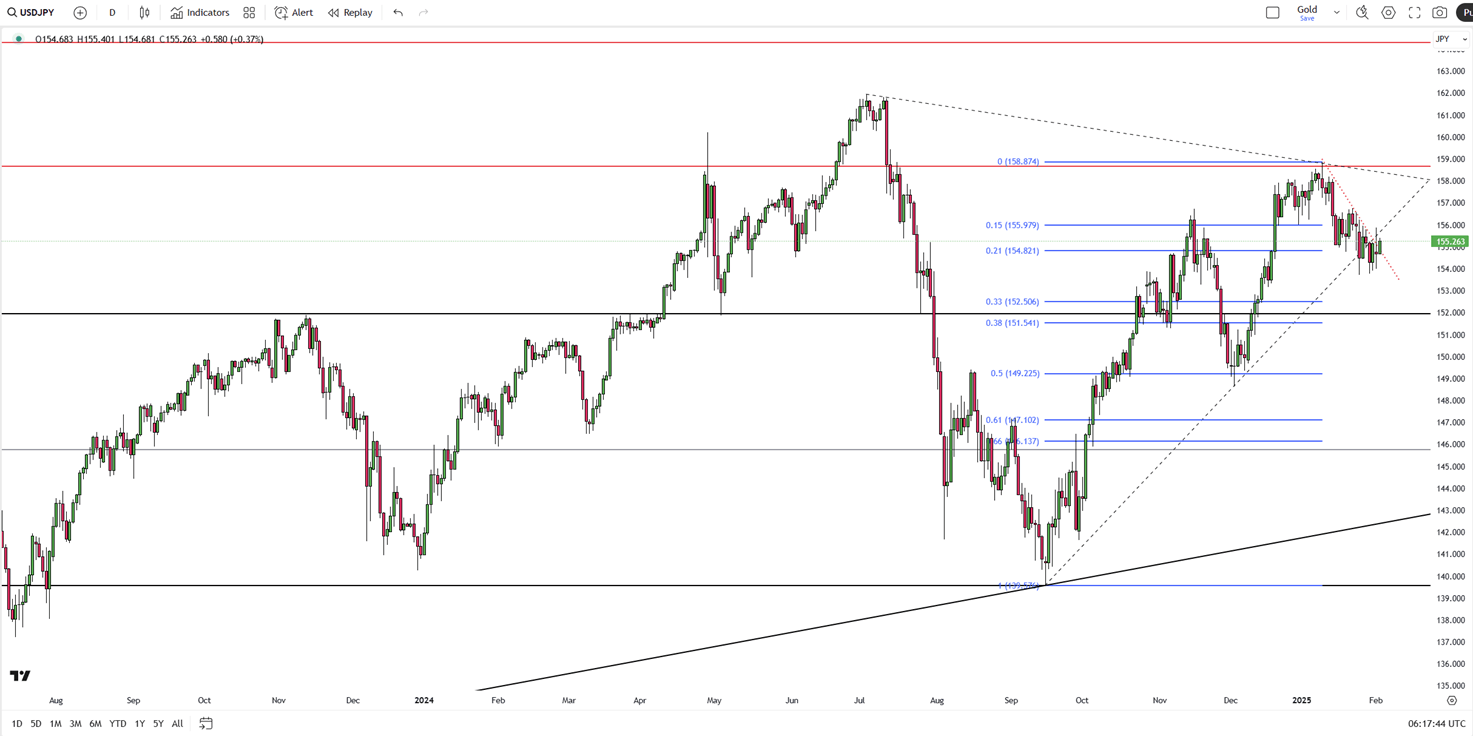

The Japanese yen fell below 155 per dollar on Tuesday as the suspension of U.S. tariffs on Mexico and Canada reduced safe-haven demand. On Monday, Trump agreed to pause the tariffs for a month after talks with both nations. Optimism is also rising over a possible U.S.-China deal to prevent the 10% tariffs set for today. In Japan, investors await Wednesday’s wage data, which could impact the BOJ’s policy outlook. The central bank raised rates in January and signaled readiness for further hikes if economic conditions support it.

The key resistance level appears to be 155.90, with a break above it potentially targeting 158.70 and 160.00. On the downside, 153.80 is the first major support, followed by 151.90 and 149.20 if the price moves lower.

| R1: 155.90 | S1: 153.80 |

| R2: 158.70 | S2: 151.90 |

| R3: 160.00 | S3: 149.20 |

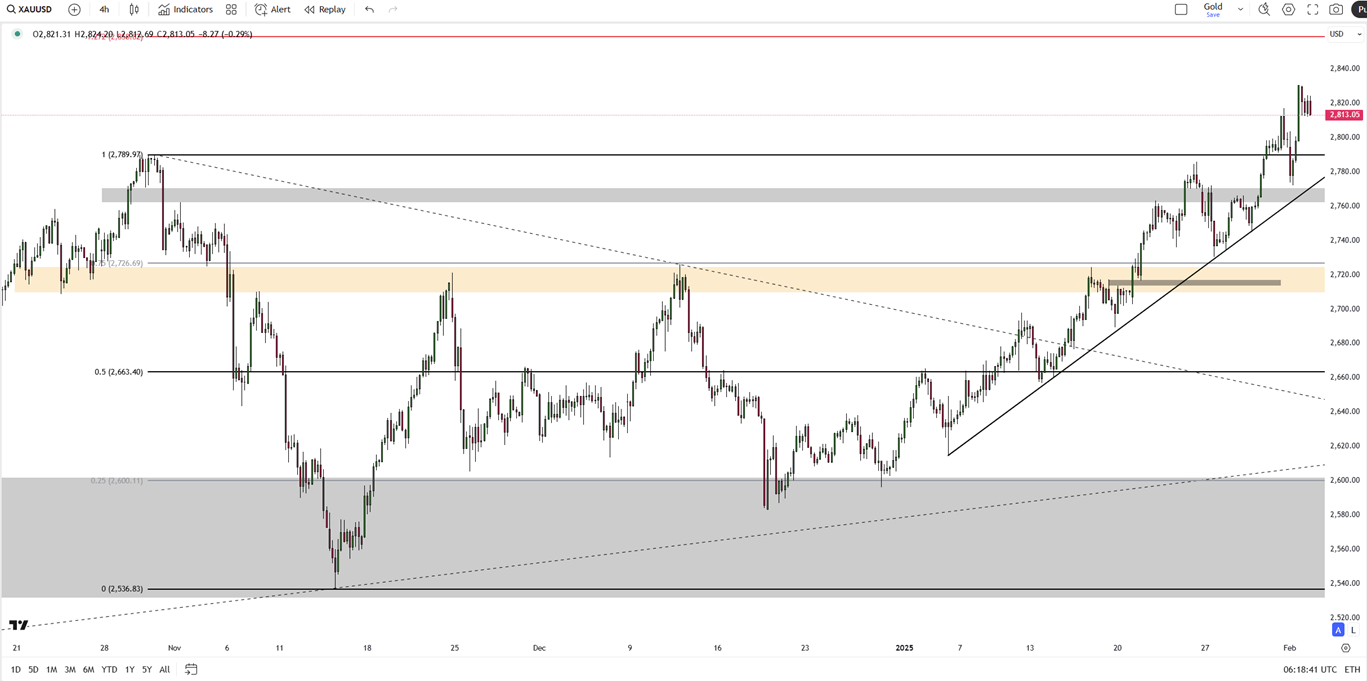

Gold held above $2,810 per ounce on Tuesday, near its record high, as safe-haven demand stayed strong amid global trade uncertainties. Trump postponed tariffs on Mexico and Canada for a month after steps to address border security and drug trafficking, while 10% tariffs on China are still set for today. These tariffs could increase gold's appeal as an inflation hedge but might lead to higher interest rates, weighing on non-yielding gold. Investors are also focused on this week’s U.S. labor data, especially Friday’s nonfarm payrolls, for economic insights.

Technically, the first resistance level will be 2830 level. In case of this level’s breach, the next levels to watch would be 2858 and 2900. On the downside, 2760 will be the first support level. 2727 and 2710 are the next levels to monitor if the first support level is breached.

| R1: 2830 | S1: 2760 |

| R2: 2858 | S2: 2727 |

| R3: 2900 | S3: 2710 |

The British pound rebounded above $1.24 after falling to $1.225, following Trump’s deal with Mexico’s President Sheinbaum to pause tariffs for a month. Uncertainty remains as Trump imposed 25% tariffs on Canada and Mexico, 10% on China, and threatened the EU and UK. Growing trade tensions have fueled expectations of Bank of England rate cuts, with markets pricing in 81bps of cuts by December and a 95% chance of a 25bps cut to 4.5% this Thursday.

The first resistance level for the pair will be 1.2450. In the event of this level's breach, the next levels to watch would be 1.2500 and 1.2600. On the downside 1.2265 will be the first support level. 1.2100 and 1.1900 are the next levels to monitor if the first support level is breached.

| R1: 1.2450 | S1: 1.2265 |

| R2: 1.2500 | S2: 1.2100 |

| R3: 1.2600 | S3: 1.1900 |

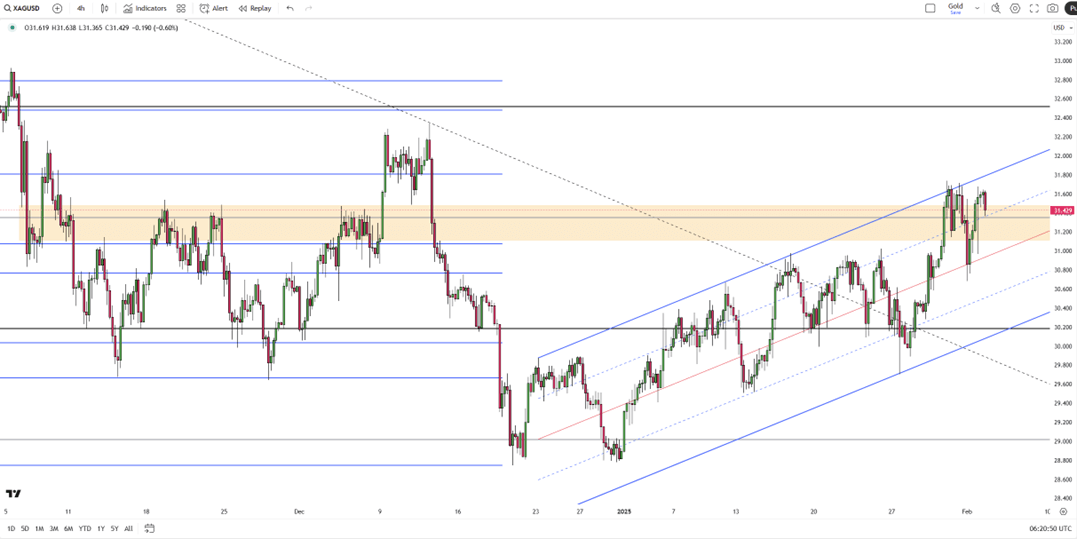

Silver rose above $31.5 per ounce, staying near its highest level since early December, as easing trade war fears and strong manufacturing data increased demand. While Trump imposed 10% tariffs on China and 25% on Canada and Mexico, a delay in Mexico’s tariffs reduced concerns over protectionist policies. The ISM reported improving U.S. factory activity, strengthening silver’s outlook as a key industrial metal. Meanwhile, the Silver Institute projected a fifth consecutive market deficit in 2025, driven by strong industrial demand and retail investment, outweighing weaker jewelry and silverware demand.

Technically, the first resistance level will be 31.80 level. In case of this level’s breach, the next levels to watch would be 32.50 and 32.90. On the downside, 30.90 will be the first support level. 30.20 and 29.30 are the next levels to observe if the first support level is breached.

| R1: 31.80 | S1: 30.90 |

| R2: 32.50 | S2: 30.20 |

| R3: 32.90 | S3: 29.30 |

Russia-Ukraine peace efforts remain stalled.

Detail Trump Pressures Fed as Dollar Slips After Cut (12.11.2025)The Federal Reserve ended 2025 with a 25-bps cut to 3.50-3.75%, maintaining guidance for one cut in 2026.

Detail Fed Day Takes Shape, Chair Decision Nears (12.10.2025)Income strategies are under pressure as lower yields reduce the appeal of short-term Treasuries, pushing investors toward riskier segments such as high yield, emerging-market debt, private credit, and catastrophe bonds.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!