The dollar weakened as easing trade tensions and expectations of a softer PCE price index pressured the currency, strengthening the yen and commodities like gold and silver.

The Japanese yen strengthened after Trump delayed reciprocal tariffs, while gold remained steady despite inflation concerns. The British pound rose following well-performing GDP data, though economic tensions persist. Meanwhile, silver surged on rising Asian demand, and EUR/USD hovered near 1.0460 with shifting market sentiment.

| Time | Cur. | Event | Forecast | Previous |

| 8:00 | EUR | Spanish CPI (YoY) (Jan) | 3.00% | 2.80% |

| 8:00 | EUR | Spanish HICP (YoY) (Jan) | 2.90% | 2.80% |

| 10:00 | EUR | GDP (QoQ) (Q4) | 0.00% | 0.40% |

| 10:00 | EUR | GDP (YoY) (Q4) | 0.90% | 0.90% |

| 13:30 | USD | Core Retail Sales (MoM) (Jan) | 0.30% | 0.40% |

| 13:30 | USD | Retail Sales (MoM) (Jan) | -0.20% | 0.40% |

| 14:15 | USD | Industrial Production (MoM) (Jan) | 0.30% | 0.90% |

| 14:15 | USD | Industrial Production (YoY) (Jan) | | 0.55% |

| 18:00 | USD | Atlanta Fed GDPNow (Q1) | 2.90% | 2.90% |

EUR/USD is hovering around 1.0460 on Friday morning, while the dollar index remains near 107, poised for a 1% weekly decline. The drop is driven by easing trade tensions and expectations of a softer personal consumption expenditures (PCE) price index later this month. The dollar weakened 0.8% on Thursday after President Trump directed his administration to explore reciprocal tariffs on countries with unfair trade practices. However, since these tariffs are not expected immediately, concerns over retaliation and inflation eased, reducing uncertainty around the Fed's ability to lower borrowing costs.

Meanwhile, producer inflation data exceeded expectations, following strong consumer inflation figures from the previous day. Despite this, components of the report suggest that core PCE inflation, the Fed's key focus, may come in lower than anticipated.

Technically, 1.0460 is the first resistance level, with further barriers at 1.0515 and 1.0600 if the pair moves higher. On the downside, initial support is at 1.0350, followed by 1.0275 and 1.0220.

| R1: 1.0460 | S1: 1.0350 |

| R2: 1.0515 | S2: 1.0275 |

| R3: 1.0600 | S3: 1.0220 |

The Japanese yen traded around 153 per dollar on Friday, following a 1% gain in the previous session. The yen strengthened as the dollar retreated sharply after President Trump delayed reciprocal tariffs, easing concerns over escalating trade tensions. The latest US PPI report also hinted that core PCE inflation, the Fed’s key metric due later this month, could come in lower than expected.

Japan’s Economy Minister Ryosei Akazawa stated that Japan would respond appropriately to any US reciprocal tariffs, while the Bank of Japan’s hawkish stance continued to support the yen. Although uncertainty remains about a potential rate hike in March, the central bank is widely expected to introduce further increases later this year.

Technically, 154.90 is the key resistance level, with further targets at 156.00 and 157.00. On the downside, 151.90 is the first major support, followed by 151.25 and 149.20 if the pair moves lower.

| R1: 154.90 | S1: 151.90 |

| R2: 156.00 | S2: 151.25 |

| R3: 157.00 | S3: 149.20 |

Gold traded at $2,930 per ounce, maintaining its position for a seventh weekly gain. On Thursday, President Trump instructed federal agencies to explore ways to align U.S. tariffs with those of other countries, though without immediate implementation. While the delay eased some concerns, fears of escalating global trade tensions persisted, driving investors toward gold.

Meanwhile, U.S. producer inflation exceeded expectations, following strong consumer inflation data earlier in the week. This reinforced the view that the Fed is unlikely to cut interest rates soon. Despite this, gold remained resilient, supported by trade war uncertainties and a weaker dollar, which made the metal more affordable for foreign buyers.

The first resistance is at $2,949, with further levels at $2,975 and $3,000 if the price moves higher. On the downside, $2,885 is the first support level, followed by $2,830 and $2,760 if selling pressure increases.

| R1: 2949 | S1: 2885 |

| R2: 2975 | S2: 2830 |

| R3: 3000 | S3: 2760 |

The British pound climbed to $1.2560 after preliminary data showed the UK economy grew by 0.1% in the final quarter of 2024, defying expectations of a 0.1% contraction and outperforming the Bank of England’s forecasts. This puts the economy slightly ahead of where it was when Labour took office in July, offering some relief to the government.

However, challenges remain as the Office for Budget Responsibility is set to release an updated economic and fiscal outlook on March 26, with reports indicating a lowered growth forecast. Meanwhile, the Bank of England cut interest rates by 25bps to 4.5% last week, its third reduction since beginning its easing cycle in August 2024, while also downgrading its 2025 GDP growth forecast to 0.7%.

1.2600 is the first resistance level, with further targets at 1.2650 and 1.2700 if the pair moves higher. On the downside, 1.2340 serves as the first support level, followed by 1.2265 and 1.2100 if selling pressure intensifies.

| R1: 1.2600 | S1: 1.2340 |

| R2: 1.2650 | S2: 1.2265 |

| R3: 1.2700 | S3: 1.2100 |

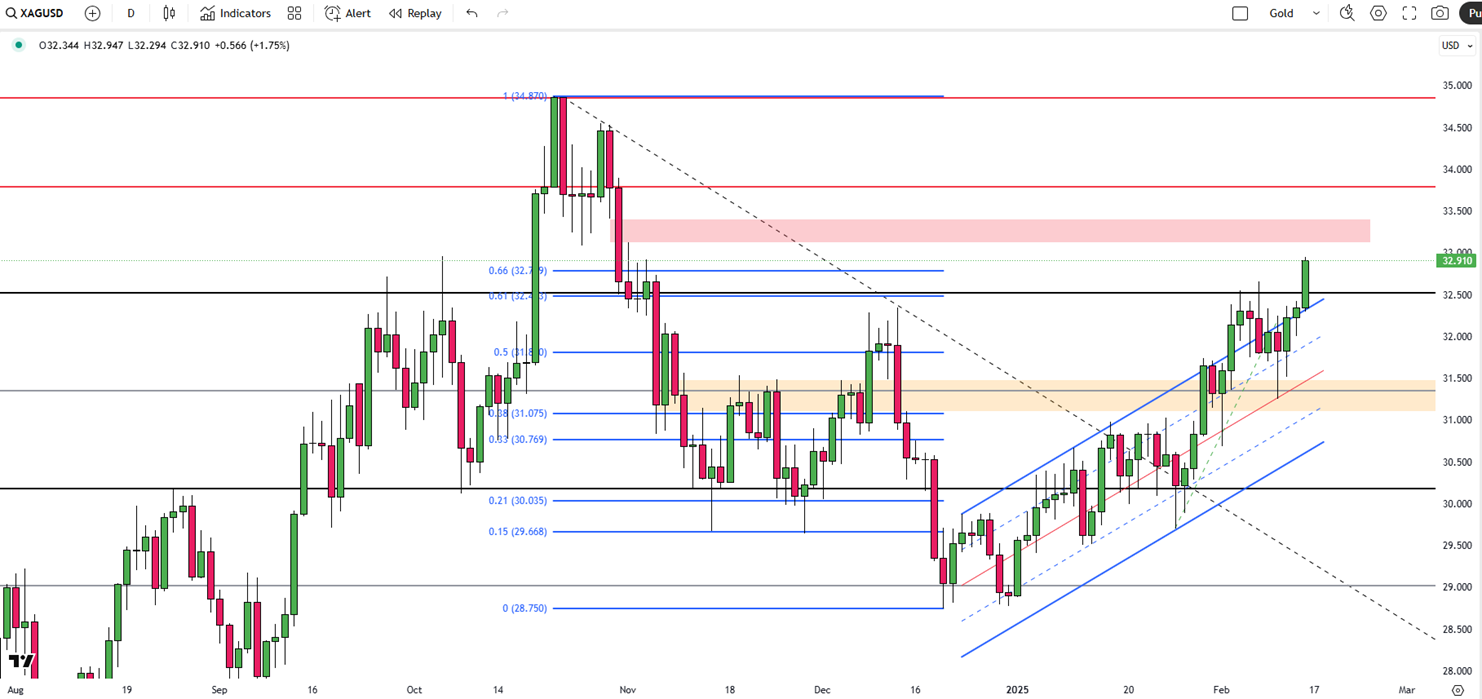

Silver jumped to $32.90 on Friday morning, fueled by increased demand for safe-haven assets amid rising trade tensions and geopolitical risks. Additionally, strong demand from China and other Asian markets has further supported silver prices.

From a technical perspective, $33.15 is the first resistance level, with further targets at $33.80 and $34.50 if the price breaks higher. On the downside, $31.40 serves as the first support level, followed by $30.90 and $30.20 if selling pressure intensifies.

| R1: 33.15 | S1: 31.40 |

| R2: 33.80 | S2: 30.90 |

| R3: 34.50 | S3: 30.20 |

Trump Signals Extended Military Campaign

Trump Signals Extended Military CampaignGeopolitical tensions in the Middle East have intensified following recent remarks from Donald Trump suggesting that the ongoing military campaign against Iran may last longer than anticipated. While Trump stated that early operational objectives were achieved ahead of schedule, he acknowledged that broader strategic goals could require additional time and sustained military pressure.

Detail US DST Change March 8 2026

US DST Change March 8 2026Daylight Saving Time will change in the United States on Sunday, March 8, 2026. The trading schedule for various financial instruments will be adjusted to align with U.S. exchange hours.

Detail Dollar Leads Risk-Off (03.06.2026)Global markets remained under pressure as escalating Middle East tensions and rising energy prices strengthened the US dollar and unsettled major currencies.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!