The dollar index remains steady at around 103.9 as uncertainty from the U.S. presidential election influences trading positions.

With a close race between Kamala Harris and Donald Trump, investors are also cautious before the Federal Reserve's expected 25-basis-point rate cut. In Japan, the yen weakened to 152.3 per dollar following the Bank of Japan's decision to maintain its interest rate, while speculation about a future rate hike persists. Gold holds above $2,730 as a hedge against inflation, while silver trades around $32.50 with attention on potential stimulus from China. The British pound is trading at 1.2960, with the election outcome expected to impact its direction.

Time | Cur. | Event | Forecast | Previous |

10:00 | USD | U.S. Presidential Election | | |

10:00 | EUR | Eurogroup Meetings | | |

14:30 | EUR | ECB President Lagarde Speaks | | |

14:45 | USD | S&P Global Composite PMI (Oct) | 54.3 | 54 |

14:45 | USD | S&P Global Services PMI (Oct) | 55.3 | 55.2 |

15:00 | USD | ISM Non-Manufacturing Employment (Oct) | | 48.1 |

15:00 | USD | ISM Non-Manufacturing PMI (Oct) | 53.7 | 54.9 |

15:00 | USD | ISM Non-Manufacturing Prices (Oct) | | 59.4 |

18:00 | USD | 10-Year Note Auction | | 4.07% |

18:00 | USD | Atlanta Fed GDP Now (Q4) | 2.30% | 2.30% |

The dollar index hovered around 103.9 on Tuesday, holding onto losses from the previous session as uncertainty surrounding the U.S. presidential election prompted traders to scale back some of their “Trump trade” positions. Recent polls show a tighter race between Kamala Harris and Donald Trump than initially expected, with market focus also on the balance of power in Congress. A potential sweep by one party could lead to major shifts in spending and tax policies. On the monetary policy front, the Federal Reserve is widely expected to announce a more cautious 25-basis-point rate cut on Thursday, as it faces the challenge of managing persistent inflation while responding to a slowing labor market. Markets are also factoring in the possibility of another quarter-point cut in December.

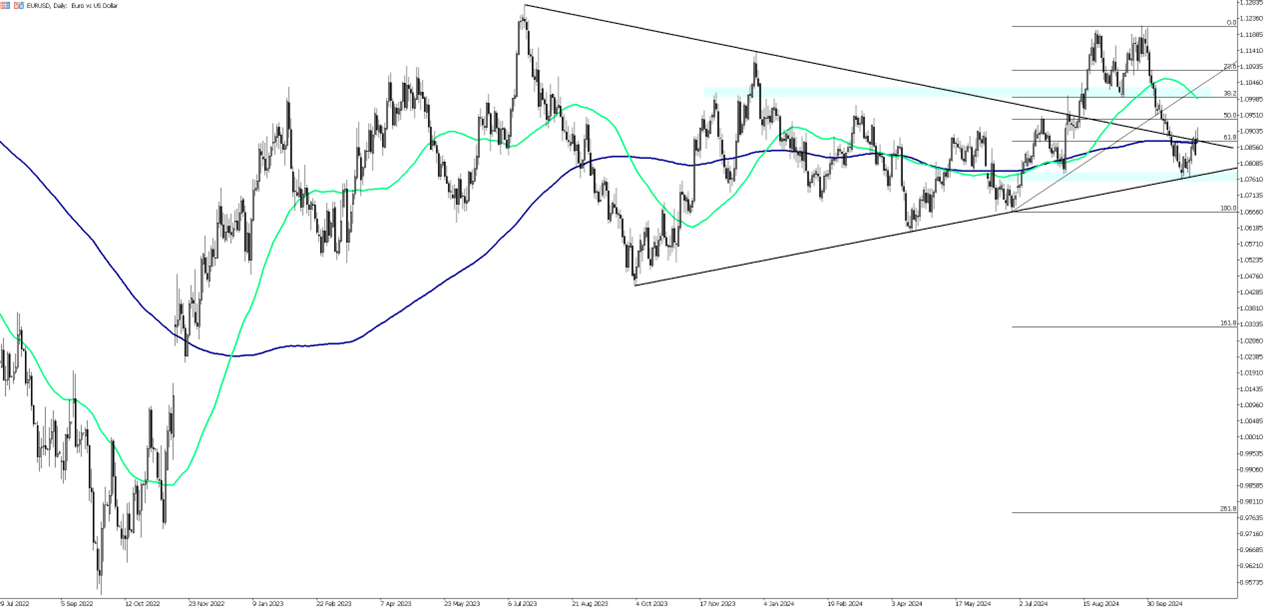

For the EUR/USD pair, the initial resistance level is at 1.0910, followed by 1.0940 and 1.0990 as subsequent resistance points. On the downside, the first support level is 1.0870, which aligns with the 200-day moving average. If this level is breached, the next support levels to watch will be 1.0830 and 1.0800.

| R1: 1.0910 | S1: 1.0870 |

| R2: 1.0940 | S2: 1.0830 |

| R3: 1.0990 | S3: 1.0800 |

The Japanese yen weakened to around 152.3 per dollar on Tuesday, giving back some of the previous session's gains as market sentiment turned cautious ahead of the closely watched U.S. presidential election. Investors are also preparing for the Federal Reserve's policy decision later this week, with a more measured 25-basis-point rate cut expected. Domestically, the Bank of Japan kept its policy rate unchanged at 0.25% last week as it navigates political uncertainty in Japan, raising concerns about the future direction of the country's fiscal and monetary policies. In a post-meeting briefing, BoJ Governor Kazuo Ueda indicated that U.S. economic risks seemed to be easing, suggesting that the conditions might be right for a potential rate hike. Market speculation points to a possible rate increase to 0.5% as early as January, though fluctuations in the yen and inflation trends will be key factors in determining the timing.

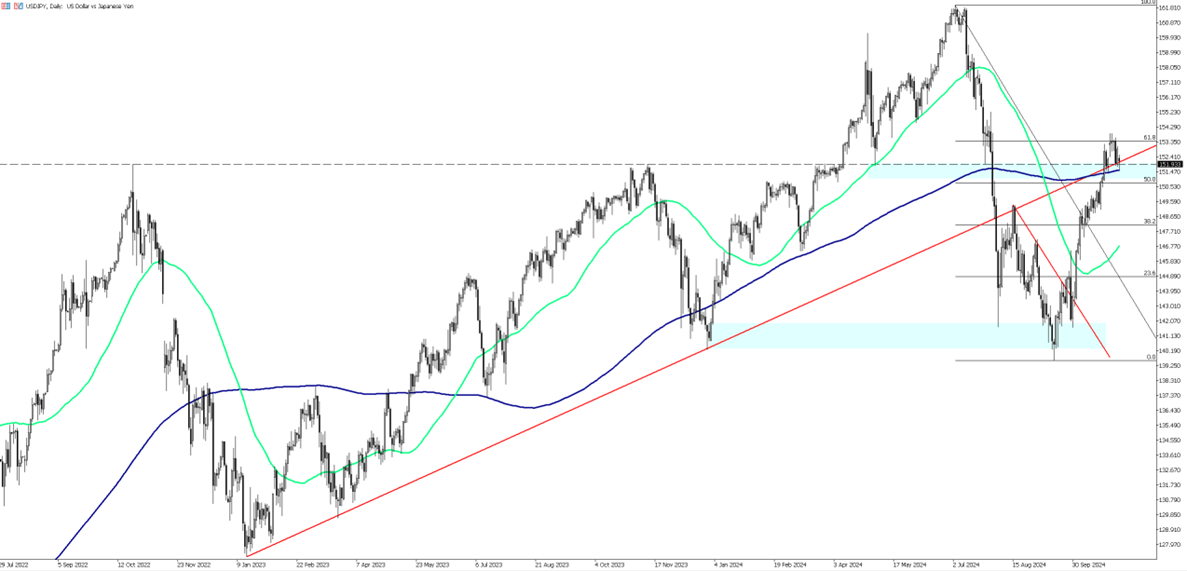

In the USD/JPY pair, the first support level is at 151.50, which coincides with the 200-day moving average. If this level is broken, the next support levels to monitor are 150.60 and 150.00. On the upside, resistance levels are at 153.30, 154.50, and 156.60, respectively.

| R1: 153.30 | S1: 151.50 |

| R2: 154.40 | S2: 150.60 |

| R3: 156.60 | S3: 150.00 |

Gold remained steady above $2,730 per ounce on Tuesday, showing limited movement as markets awaited the U.S. presidential election results later in the day. The uncertainty surrounding the election has recently provided support for gold, with speculation that a Trump presidency could fuel inflation due to his plans to increase trade tariffs significantly. This has led investors to view gold as a hedge against long-term inflation risks. However, the tightness of the race has moderated some of these expectations. In addition, the Federal Reserve's upcoming monetary policy decision on Thursday is in focus, with markets widely expecting a quarter-point rate cut. This has provided further support for gold, as lower interest rates reduce the opportunity cost of holding non-yielding assets like bullion. Expectations of similar rate cuts from other major central banks are also adding to gold's appeal.

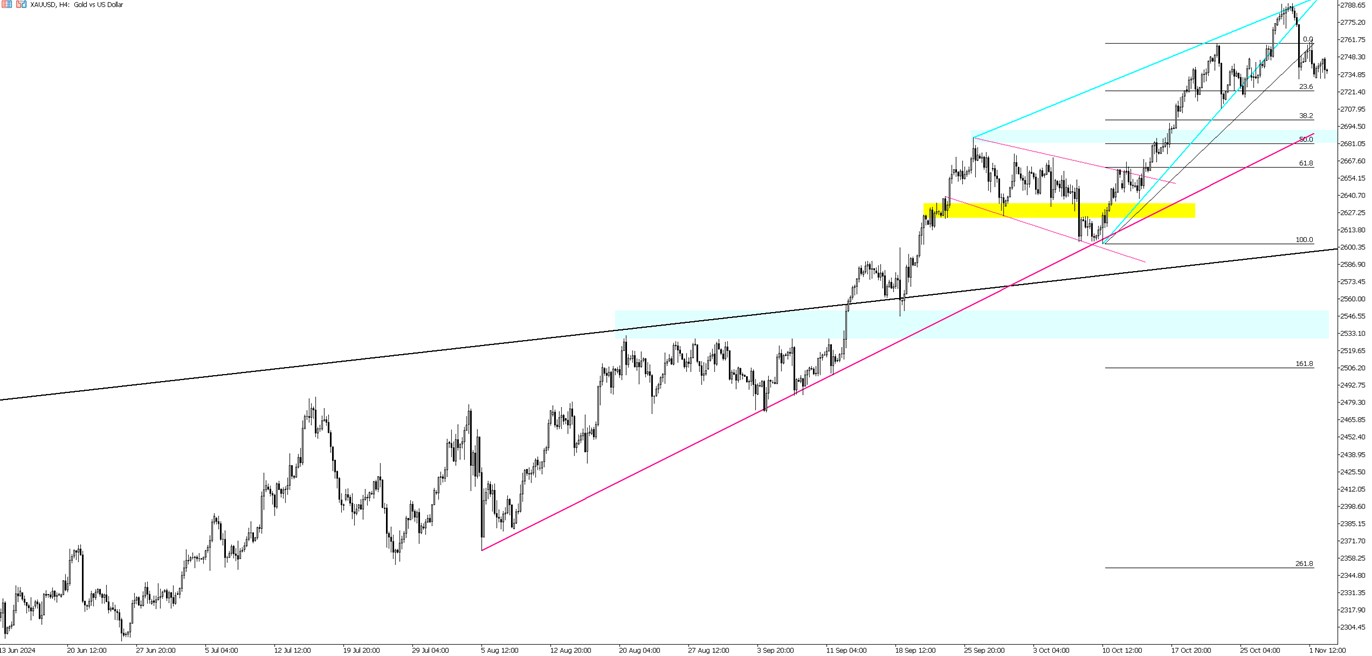

On the downside, the first support level for gold is at $2,725, followed by $2,714 and $2,685. On the upside, $2,747 serves as a key resistance level, with $2,758 and $2,770 as the next levels to monitor if this resistance is surpassed.

| R1: 2747 | S1: 2725 |

| R2: 2758 | S2: 2714 |

| R3: 2770 | S3: 2685 |

GBP/USD is trading around 1.2960 on Tuesday morning, just ahead of the U.S. elections. The market focus will be on the election outcome, as it will likely influence the direction of the DXY and precious metals. Additionally, the Bank of England's interest rate decision on Thursday will be a key factor in determining the direction of GBP/USD.

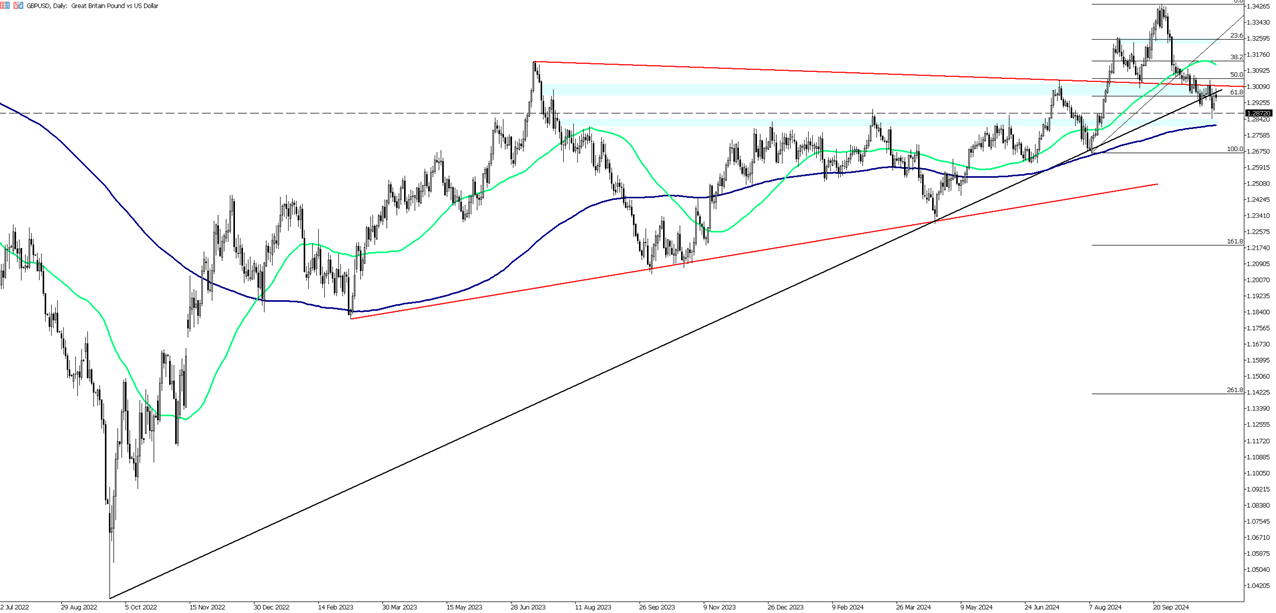

On the downside, key support levels for the GBP/USD pair are at 1.2945, 1.2885, and 1.2840. On the upside, resistance levels to watch are at 1.3010, 1.3045, and 1.3080.

| R1: 1.3010 | S1: 1.2945 |

| R2: 1.3045 | S2: 1.2885 |

| R3: 1.3080 | S3: 1.2840 |

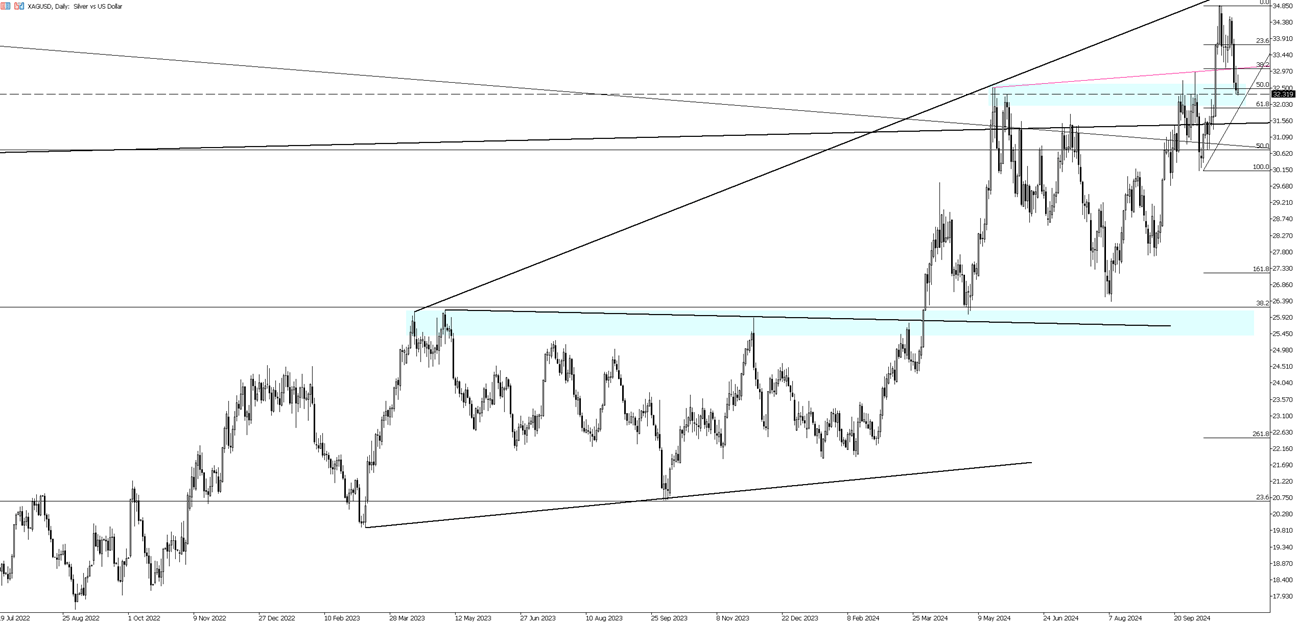

Silver was trading around $32.50 on Tuesday morning, with investors closely watching the U.S. presidential election. Market speculation is that a Trump victory could spark a broader risk-on rally, while a win for Harris might reduce tariff concerns, potentially increasing demand for metals. Additionally, investors are focused on the Federal Reserve's policy announcement later this week, where a cautious 25-basis-point rate cut is widely anticipated. Attention is also on the ongoing National People's Congress in China, where authorities are expected to provide more details on potential fiscal stimulus measures. Media reports suggest China could be considering a stimulus package exceeding 10 trillion yuan to stimulate its economy.

On the upside, the critical resistance levels to watch are 33.00, 33.50, and 34.00. On the downside, 32.00 remains a significant first support level. If this level is breached, the next support levels to monitor are 31.30 and 30.85, respectively.

| R1: 33.00 | S1: 32.00 |

| R2: 33.50 | S2: 31.30 |

| R3: 34.00 | S3: 30.85 |

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

Detail March Starts With Geopolitical Turmoil (2-6 March)

March Starts With Geopolitical Turmoil (2-6 March)Global markets began the week in a state of high alert following coordinated US and Israeli strikes on Iran over the weekend, which resulted in the death of Supreme Leader Ayatollah Ali Khamenei.

Detail Geopolitical Shock Triggers Risk-Off Move (03.02.2026)President Trump stated that operations against Iran could last up to four weeks, though he added that developments are proceeding as planned and could wrap up sooner.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!