Explore daily and long-term trading ideas, buy and sell opportunities for forex and CFD products on zForex. Stay informed with expert insights, strategies, and forecasts!

| TRADE COUNT | OPEN DATE | STARTING EQUITY | ASSET | REASON | POSITION SIZE | DIRECTION | OPEN PRICE | SL | TP | RISK REWARD RATIO | CLOSE DATE | CLOSE PRICE | PROFIT | DURATION | LAST EQUITY |

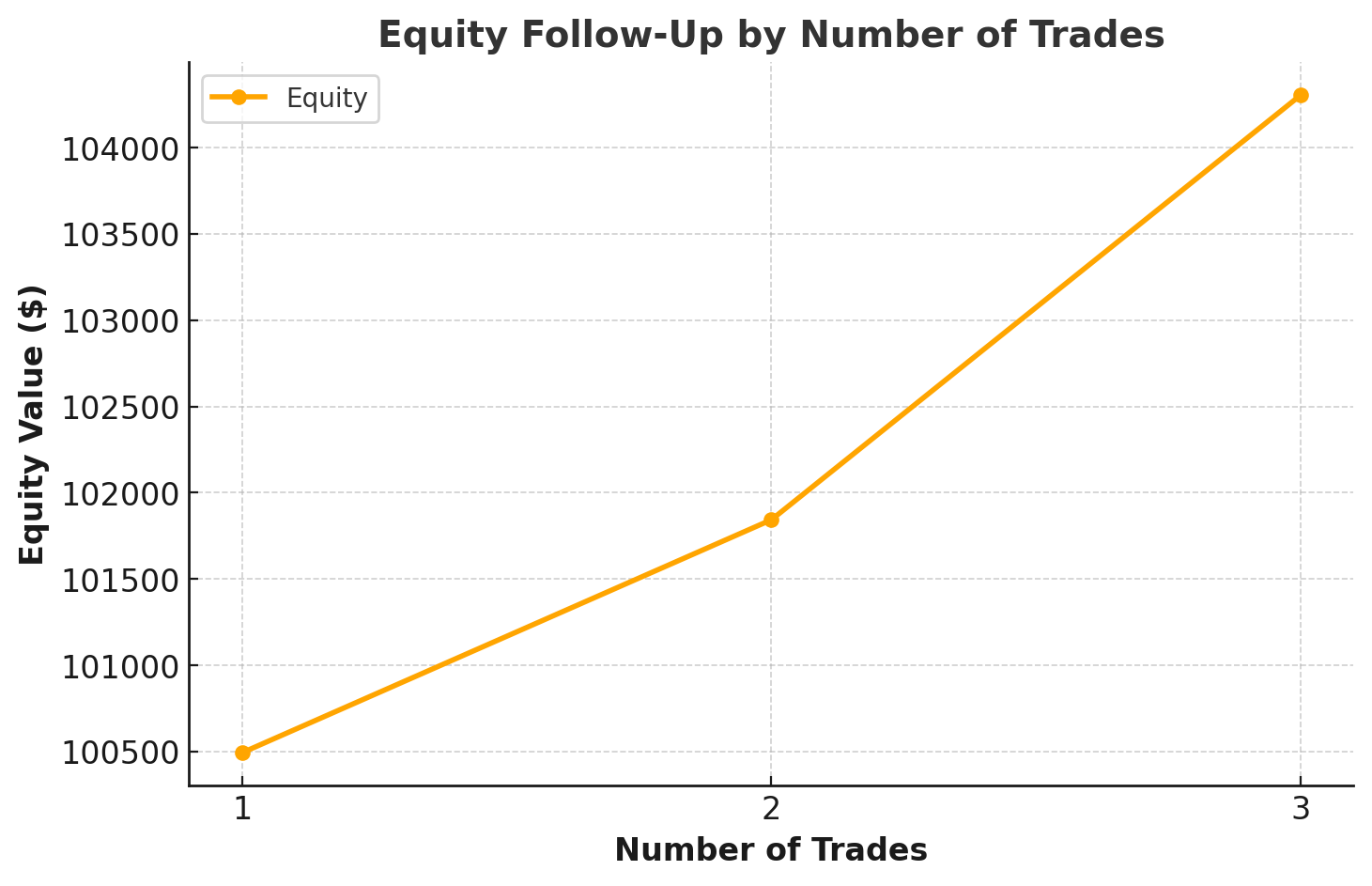

| 0 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | $100.000,00 |

| 1 | 25.11.2024 | $100.000,00 | EURCHF | Triangle Breakout | 1 lot ( 100.000 Euro) | Short | 0,9330 | 0,9370 | 0,9285 | 1,12 | 11.12.2024 | 0,9285 | $493,00 | 10 Days | $100.493,00 |

| 2 | 02.01.2025 | $100.493,00 | EURUSD | Economic slowdown , political uncertanities and continuing downtrend | 1 lot ( 100.000 Euro) | Short | 1,0360 | * | 1,0225 | * | 02.01.2025 | 1,0225 | $1.350,00 | 1 Day | $101.843,00 |

| 3 | 03.02.2025 | $101.843,00 | USDCAD | Both the range and inverse head & shoulders targets are met, and the 2016 peak is tested. | 1 lot | Short | 1.4690 | 1.4880 | 1.4340 | 2 | 04.02.2025 | 1,434 | $2.461,00 | 1 Day | $104.304,00 |

We provide both long-term and short-term trade ideas. Naturally, long-term positions involve larger stop-loss and take-profit levels. When taking partial profits from our long-term positions, referencing the larger stop-loss levels already shared in our daily bulletins could create confusion regarding the risk-to-reward ratio. Therefore, we choose not to specify stop-loss levels in such situations

Markets traded cautiously ahead of key inflation data and amid ongoing trade and geopolitical uncertainty.

Markets remained cautious as a new 10% U.S. global tariff weighed on risk sentiment. The euro and pound stayed under pressure near recent lows, while the yen rebounded on renewed speculation around Bank of Japan tightening.

Global markets remained cautious as a new 10% U.S. global tariff came into force, keeping trade uncertainty at the center of investor focus.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!