Throughout history, silver has played a key role in currency, jewelry, and industrial applications. In modern financial markets, it offers various opportunities for investors. Compared to other precious metals like gold, silver has a broader range of industrial uses, which causes its price to fluctuate based on global economic developments and industrial demand.

Silver trading can be conducted through various financial instruments such as futures, options, ETFs (Exchange-Traded Funds), and CFDs (Contracts for Difference). These different trading instruments allow traders to profit from price movements with various strategies in both the short and long term.

In this article, we provide a detailed examination of silver trading.

Silver trading is a type of investment where investors aim to profit from price movements. Known as a valuable metal, this commodity holds an important place in financial markets due to its use in various fields such as industry and jewelry.

Trading allows investors to directly buy and sell in spot markets, as well as trade through derivative instruments such as futures, options, ETFs, and CFDs. Investors can take a long (buy) position when they expect prices to rise, or a short (sell) position when they anticipate a drop in prices.

Silver trading typically works as follows: Traders take positions based on the current market conditions and economic developments, predicting the direction in which prices will move.

For example, a trader who expects prices to rise opens a long (buy) position, and if prices move as expected, they make a profit. Similarly, if prices are expected to fall, a short (sell) position can be opened to profit from the decline.

Key factors influencing trading include the global economic situation, supply-demand balance, industrial demand, and market expectations of investors. During periods of high volatility, silver prices can change rapidly, making it important to trade at the right time and employ risk management strategies.

There are several different methods and tools available for trading silver. Some of the main ones are as follows:

The spot market allows traders to buy and sell silver instantly. Here, trades are made at the current market price, and the physical metal is delivered immediately. It is generally preferred by investors looking to capitalize on short-term price movements.

Trading on the spot market can offer short-term profit opportunities for investors, especially during periods of volatility. For example, a sudden rise or fall in silver prices can be quickly capitalized on by spot market traders.

Silver futures contracts are agreements where investors commit to buying or selling silver at a specific price on a set future date. These contracts are speculative and allow investors to open large positions using leverage. However, the use of leverage also brings additional risks.

One of the key factors that traders need to pay attention to in futures trading is the expiration date of the contracts. Every futures contract has an expiration date, and on this date, traders must either close their positions or proceed with physical delivery. Therefore, futures trading may be more suitable for short-term trading strategies.

Additionally, the supply and demand balance in the futures market can have an impact on silver prices.

Silver options give investors the right, but not the obligation, to buy or sell silver at a specific price. Call options are used when expecting a price increase, while put options are used when expecting a price decrease.

Options can also serve as an effective strategy for limiting risk. Traders do not incur losses beyond the premium they pay for the option contract. Therefore, in the event that the market moves unexpectedly against them, their losses remain limited.

Silver ETFs offer investors the opportunity to invest in silver through a fund that tracks its price. These funds typically trade on stock exchanges at lower costs and provide a way to trade without the need to physically store silver.

One of the biggest advantages of ETFs is that investors don't have to deal with logistical issues like storing or insuring physical silver. ETFs can be bought and sold on exchanges just like stocks, giving investors the opportunity to benefit from price fluctuations throughout the day.

Another important feature of silver ETFs is the diversification they offer. With a single ETF, investors can gain exposure to both silver mining companies' stocks and physical silver.

Silver CFDs allow investors to profit from price movements without owning the physical metal. It is possible to use leverage in CFD trading. It enables traders to open larger positions with a smaller initial capital outlay. However, leverage also increases risk.

Another advantage of CFDs is the ability to profit from both rising and falling markets. If traders believe prices will increase, they can open a long (buy) position. If they expect prices will fall, they can take a short (sell) position. This dual trading capability can offer opportunities in volatile markets.

However, there are some costs to be mindful of when trading CFDs. For example, if you hold your position overnight, you may encounter additional fees such as overnight financing costs (swap). Therefore, it's important to factor in these potential costs when engaging in CFD trading.

Silver trading is a type of transaction that can be conducted 24 hours a day in global markets. However, each exchange has its own trading hours, and during these times, trading volume, market liquidity, and price movements may vary.

Popular exchanges for silver trading and their trading hours are as follows:

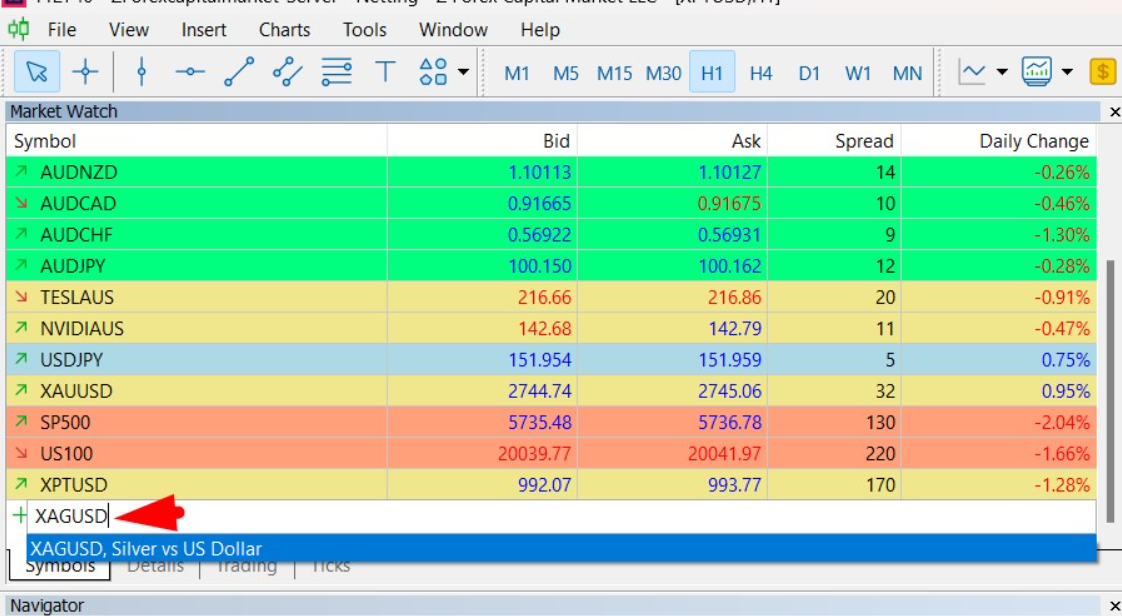

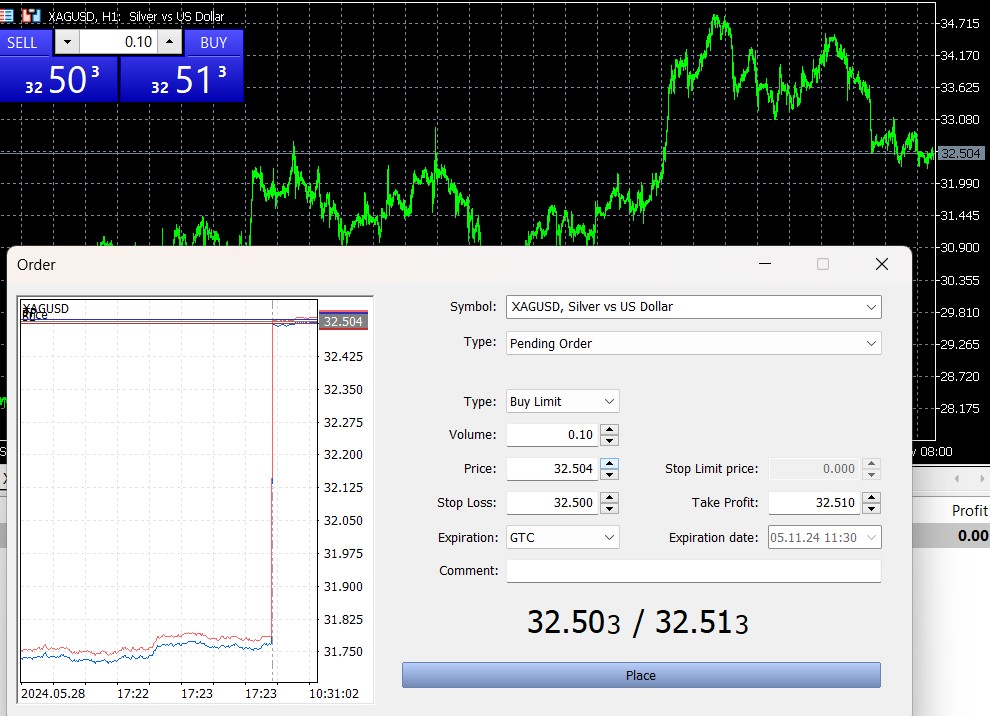

Trading silver at zForex is a seamless and easy process that allows you to access the precious metals market easily. Here's how:

What is the highest price of silver in history?

Silver reached an all-time high of $49.76 per ounce in April 2011. Before that, the highest price it reached was $49.45 in 1980.

Can I trade silver on MetaTrader?

Yes, you can trade silver and other precious metals on MetaTrader 5, using CFDs to profit from price fluctuations.

Silver or gold, which is better?

Gold is considered a more stable investment, while silver has a broader industrial use, making it more volatile. Those seeking short-term opportunities might prefer silver, whereas gold is typically the choice for those looking for a safe haven.

What is the biggest risk affecting silver prices?

One of the biggest risks for silver prices is global economic uncertainty. Industrial demand fluctuations, supply limitations, and geopolitical events significantly influence silver's price. Additionally, fluctuations in the US dollar and interest rates are major risks affecting silver.

Should I think long-term or short-term when trading silver?

The strategy depends on the trader’s goals. Short-term traders aim to benefit from daily or weekly price movements, while long-term investors hold onto silver over extended periods to profit from its appreciation.

How much capital do I need to start trading silver?

The capital needed depends on the financial instrument you choose. Leverage products like CFDs require less capital, while physical silver purchases or futures contracts may require more capital.

Is silver trading suitable for beginners?

Yes, silver trading can be suitable for beginners, but it's important to note that the market can be volatile. New traders should prioritize risk management, start with small positions, and closely monitor the factors affecting silver prices. Practicing with a demo account is also advisable to gain experience.

Silver Rally Ahead? Supply Deficit Meets Rising Demand

Silver Rally Ahead? Supply Deficit Meets Rising Demand

A new silver rally may be forming as supply deficits deepen and China’s demand grows. Here’s what is driving the momentum.

Detail Fed Rate Cuts 2026: How to Position Now

Fed Rate Cuts 2026: How to Position Now

Fed rate cuts in 2026 could reshape markets. See expectations, asset impact, and positioning strategies for bonds, gold, stocks, and USD.

Detail Analyzing the U.S. Labor Market Outlook for 2026

Analyzing the U.S. Labor Market Outlook for 2026

Year’s first jobs report looked reassuring. A closer breakdown, however, tells a more layered story about the direction of the labor market.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!