Financial independence and access to global markets make trading an attractive option, but the question of “how much capital do I need to start trading?” is a common concern for beginners. The answer depends on various factors and differs for each trader.

Starting trading is not just about capital; it also requires an understanding of market dynamics, the ability to develop strategies, and proficiency in managing risks. Certain types of trading, such as forex or stock CFDs, allow traders to begin with smaller amounts of capital thanks to leverage, whereas options or futures trading often demand a larger initial investment.

In this article, we explore the question of how much starting capital might be needed to step into the world of trading.

Understanding trading capital can make things easier before you start your journey. Capital refers not only to the amount of money required to trade but also to a budget you need to allocate based on your financial goals, risk tolerance, and trading strategy.

Trading capital varies depending on your personal financial situation, trade objectives, and the type of market you plan to trade in. For example, in the Forex market, leverage allows you to trade with a small amount of capital, while stock or commodity trading may require a larger initial investment.

When determining the amount of capital, it’s important to trade only with funds you can afford to lose. Otherwise, emotional decisions may interfere with your trading process and negatively impact your performance.

To make a successful start, you should not only consider the requirements of the market you plan to trade in but also take into account your personal goals and risk tolerance. Below, we have listed the factors you should consider when determining your initial trading capital:

Will you engage in short-term trades or prefer long-term investments? The answers to these questions will shape your trading plan and, consequently, the amount of capital you’ll need.

For instance, if you adopt a trading style like scalping, which involves short-term and high-frequency trades, you may need to allocate a portion of your capital to cover rapid transaction costs. On the other hand, if you follow a swing trading strategy you’ll require a different approach to capital planning.

Factors such as leverage usage vary depending on your trading style. In the Forex market, you can open positions with lower capital by utilizing high leverage. However, if you trade in markets like stocks or commodities, you will typically need a larger initial capital.

When deciding on your trading style, it’s important to consider not only market dynamics but also your trading frequency, the amount of risk you’re willing to take per trade, and how effectively your capital will support your trading processes. This way, you can build a more realistic and effective trading plan.

| Trading Strategies | Definition | Typical Time Frame | Minimum Capital Suggested | Typical Number of Trades |

| Buy and Hold | Long-term strategy focused on holding assets to benefit from market growth. | Months to Years | $1,000 -$5,000 | Low |

| Day Trading | Intraday strategy to capitalize on small price movements. | Minutes to Hours | $25,000 (for US stock markets) | High |

| Forex Trading | Trading currency pairs using leverage to profit from price fluctuations. | Seconds to Hours | $500 - $1,000 | Medium to High |

| Options Trading | Derivatives trading with contracts giving the right to buy or sell an asset. | Days to Weeks | $2,000 - $5,000 | Medium |

| Position Trading | Long-term approach aiming to profit from major market trends. | Weeks to Months | $1,000 - $3,000 | Low |

| Scalping | Very short-term strategy focusing on quick, small profits. | Seconds to Minutes | $500 - $2,000 | Very High |

| Swing Trading | Medium-term strategy using technical analysis to identify price swings. | Days to Weeks | $2,000 - $5,000 | Medium |

Starting trading is a unique experience for every trader. Some may already have knowledge and experience in financial markets, while others are completely new to this world. Accurately assessing your starting level can help you create a plan and capital strategy that meets your needs.

If you are new to the trading world, it is recommended to learn the basics and understand the risks first. At this stage, you can use demo accounts to familiarize yourself with market dynamics and gain experience with minimal risk. Starting with a smaller initial capital can limit your losses.

One important factor to consider when starting trading is the minimum account requirements. These requirements vary depending on the type of market you plan to trade in, the policies of your broker, and the asset class you intend to trade.

For instance, if you are considering trading in the Forex market, many brokers offer low minimum deposit requirements. These typically range from $50 to $500, making it ideal for traders looking to start with a small capital. However, in other markets like stocks or futures, these requirements can be significantly higher, often reaching several thousand dollars.

It is important to consider the minimum investment requirements for different account types, such as standard and VIP accounts. VIP accounts usually offer benefits like lower trading fees or access to exclusive analysis tools but require a higher initial capital investment.

zForex offers super low minimum deposit options in its different account types. The Standard and the ECN Trading accounts require a minimum deposit of $10. In the ECN account, the commission is $7 for forex and $15 for metals, while the commission in the Standard account is $0. zForex also offers a Swap Free account with a minimum deposit of $2500 with the same commissions as the ECN account.

Transaction costs directly affect your overall profitability and are an important factor to consider when determining your trading strategy. These costs typically vary depending on the market type, the asset being traded, and the policies of your brokerage:

Many countries have regulatory bodies overseeing financial transactions. Under these guidelines, brokers may require customers to provide identification documents, proof of income sources, and trading history.

For instance, zForex Capital Market LLC is licensed by the Mwali International Services Authority (MISA) to operate as an international brokerage and clearing house. Their financial services activities are authorized in various countries under MISA's jurisdiction with the Brokerage License number T2023321.

Before starting trading, it is advisable to establish an emergency fund to ensure your financial stability. An emergency fund represents savings that keep you financially secure in unexpected situations.

There is always a certain level of risk involved when trading in the markets. Unanticipated market movements, technical issues, or financial difficulties in your personal life can put pressure on your trading capital. An emergency fund acts as a safety net against such uncertainties and provides a financial buffer for your daily living expenses.

The capital you allocate for trading should never come from your emergency fund. The emergency fund should only be used for situations such as job loss, medical expenses, or unforeseen costs. By maintaining this distinction, you can minimize the emotional stress you might encounter while trading.

Many people stepping into the world of trading dream of making profits in a short period. However, such expectations are often unrealistic and can lead to disappointment. Developing realistic expectations is critical for starting successfully and building a sustainable trading journey.

When addressing the question of how much capital you need to start trading. You should consider not just how much you aim to earn but also the risks you might face. Setting your capital at a level where you can tolerate potential losses from market fluctuations helps you avoid emotional decisions and maintain a disciplined approach.

Another critical aspect of forming realistic expectations is recognizing that trading is a learning process. It’s natural to make mistakes or incur losses in the initial stages. Viewing these as learning opportunities and using them to refine your strategies is key to long-term success.

Starting with a small capital base and gradually growing your portfolio through accumulated profits is a healthier approach. During this process, align your profit expectations with factors such as trading costs, market conditions, and your learning curve. Realistic expectations help you stay motivated throughout your trading journey and move closer to achieving your financial goals.

When determining your initial trading capital, you should consider all aspects of your financial situation. Not only should you focus on the amount you can allocate for trading, but also take into account your long-term financial stability.

Below are the key factors to consider when calculating your initial trading capital:

Before determining your initial trading capital, it's important to have a clear understanding of your current financial situation. The first step is to calculate the total value of all your assets and subtract your existing debts.

Net worth is obtained by subtracting your total liabilities from the sum of your assets. This assessment helps you understand the health of your finances and assists in determining an appropriate amount you can allocate for trading.

When calculating your assets, consider the following items:

When calculating your debts, take into account:

Net worth calculation serves as a guide to clarify the amount of risk you can afford to take for trading. If your debts exceed your assets, you should carefully plan the capital you allocate for trading and prioritize reducing your debts. Remember, the funds set aside for trading should be planned in a way that does not affect your daily living expenses or emergency needs.

When determining your initial trading capital, it is important to analyze your monthly income and expenses in detail. This evaluation helps you understand not only the amount you can allocate for trading but also how to maintain your financial stability.

The first step is to identify your fixed and additional income sources. Fixed income refers to consistent earnings, such as a salary or regular rental income. Additional income includes freelance work, side jobs, or returns from investments. These income sources set the upper limit for the amount you can potentially allocate to trading.

When analyzing your expenses, it’s essential to separate fixed and variable costs. Fixed expenses include rent, utility bills, and loan repayments that occur regularly each month. Variable expenses, on the other hand, cover costs such as food, entertainment, and vacations, which can fluctuate monthly.

By organizing these elements into a table, you can clearly see your total expenses. Below is an example table for reference:

|

Category |

Details |

Amount (USD) |

|---|---|---|

| Income | ||

| Salary | Full-time job | $4,000 |

| Rental Income | Apartment rent | $1,000 |

| Freelance Work | Graphic design projects | $500 |

| Total Income | $5,500 | |

| Expenses | ||

| Rent | Monthly apartment rent | $1,500 |

| Utilities | Electricity, water, etc. | $200 |

| Groceries | Monthly food expenses | $400 |

| Transportation | Fuel and public transit | $150 |

| Entertainment | Movies, dining out | $250 |

| Debt Repayment | Loan and credit card | $500 |

| Insurance | Health and car insurance | $300 |

| Savings Contribution | Emergency fund | $600 |

| Total Expenses | $3,900 | |

| Remaining Budget | $1,600 | |

| Trading Capital | ||

| Portion Allocated for Trading | 50% of the remaining budget | $800 |

| Reserve for Other Goals | Savings or investments | $800 |

An emergency fund is a financial reserve set aside to cover unexpected situations such as job loss, unforeseen medical expenses, or major urgent costs. This fund helps you meet your financial obligations while also protecting your trading capital.

During trading, unexpected market movements, technical issues, or strategic mistakes can put pressure on your capital. In such situations, it provides psychological relief and allows you to manage your daily living expenses without tapping into your trading funds.

As a general rule, your emergency fund should cover at least 3 to 6 months of essential expenses. This includes rent, utilities, food, and other fixed costs. For example, if your monthly essential expenses are $2,000, it is recommended to have at least $6,000 to $12,000.

It is important to maintain a clear separation between your emergency fund and your trading capital. Your trading capital should be allocated solely for financial market activities. Mixing these two funds could jeopardize your financial stability and negatively impact both your daily life and trading process.

Finally, once established, it’s important to keep it in an accessible account. Bank savings accounts or short-term liquid investment vehicles are suitable options for storing this fund, ensuring you can quickly access it when needed.

Starting trading at a young age provides the opportunity to gain more experience over time and develop a deeper understanding of market dynamics. At this stage, you might have a higher risk tolerance since you have more time to recover from potential losses.

The middle age group usually adopts a more conservative approach. At this point, your financial goals, such as saving for retirement, are likely more defined. Your risk tolerance might be lower, and losses could make it harder to achieve your goals. When allocating your trading capital, it’s critical to create a plan that maintains your financial stability.

For those beginning trading at an older age, it is usually recommended to focus on lower-risk asset classes. At this stage, you may have less time to recover from losses. Additionally, it’s essential to avoid risking your retirement savings.

In addition to your age, clearly defining your financial goals can help you plan your trading capital more effectively. For example, while you might opt for more aggressive strategies for short-term goals, you could prioritize balanced and low-risk strategies for long-term objectives.

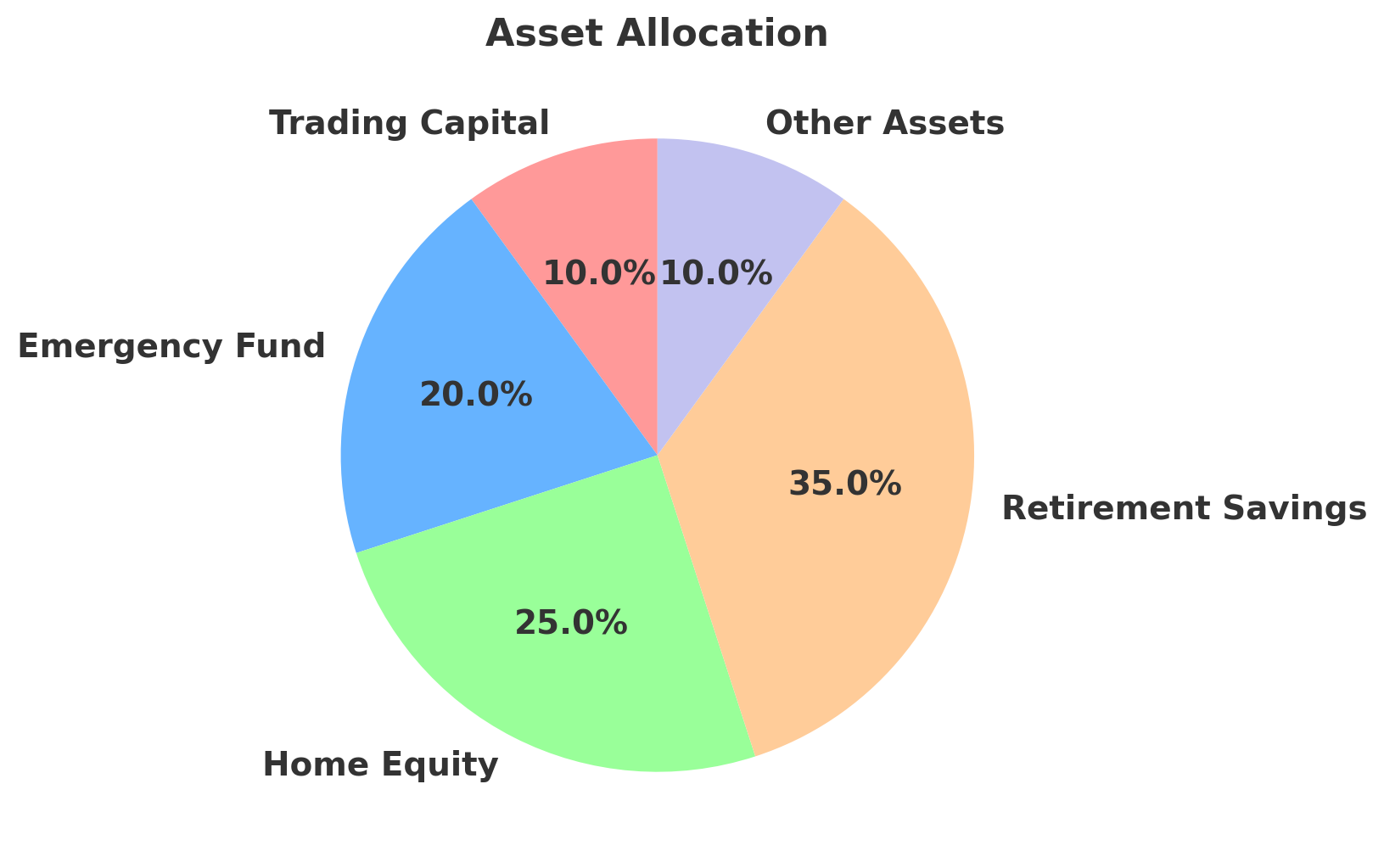

When planning your trading capital, you should only allocate a specific percentage of your total assets for this purpose. The chart above illustrates an example asset allocation strategy to manage your finances securely:

How Much Money Do You Need to Trade Forex?

The minimum capital required to trade Forex depends on the leverage offered by your broker and the size of your trades. For instance, zForex requires a minimum deposit of $10 to start trading.

How Is the Starting Capital for Commodity Trading Determined?

Trading popular commodities like gold or oil through CFDs usually requires a capital of $500-$1,000. However, if you’re trading futures, which tend to have higher costs, you may need several thousand dollars to start.

Can You Start Trading with No Money Using Demo Accounts or Simulators?

Yes, demo accounts and simulators allow you to practice trading without risking real money. These accounts use virtual funds to help you understand markets, develop strategies, and improve your trading skills.

Can I Start Trading With Only $10?

Yes, you can trade with a small capital of $10 in leveraged markets like Forex. However, leveraged positions can result in major losses even with small price movements.

Silver Rally Ahead? Supply Deficit Meets Rising Demand

Silver Rally Ahead? Supply Deficit Meets Rising Demand

A new silver rally may be forming as supply deficits deepen and China’s demand grows. Here’s what is driving the momentum.

Detail Fed Rate Cuts 2026: How to Position Now

Fed Rate Cuts 2026: How to Position Now

Fed rate cuts in 2026 could reshape markets. See expectations, asset impact, and positioning strategies for bonds, gold, stocks, and USD.

Detail Analyzing the U.S. Labor Market Outlook for 2026

Analyzing the U.S. Labor Market Outlook for 2026

Year’s first jobs report looked reassuring. A closer breakdown, however, tells a more layered story about the direction of the labor market.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!