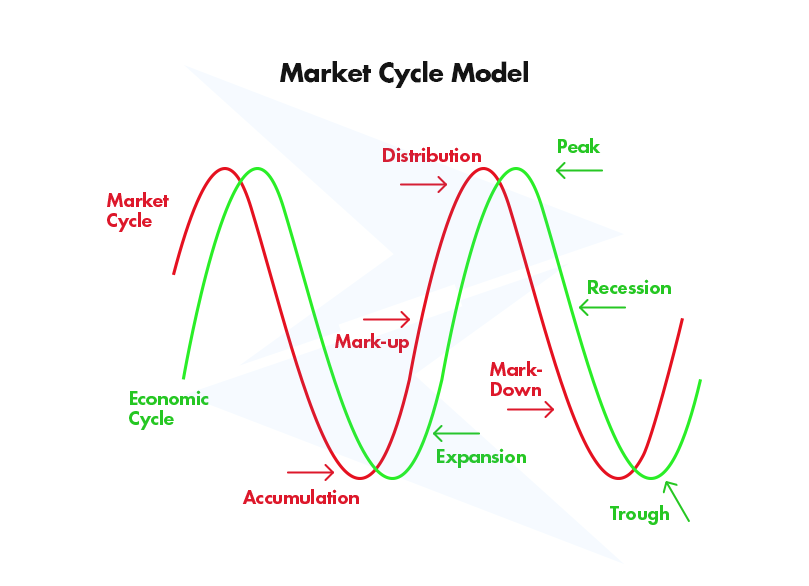

Just like the seasons change, markets move through cycles. These cycles represent the natural ebb and flow of economic and business conditions, impacting everything from stock prices to investor sentiment.

A market cycle typically refers to the period between a high and a low in a market benchmark, like the S&P 500, or broader economic indicators.

Different assets and sectors respond differently at various stages of a cycle. For example, technology stocks might surge during an expansion phase, while defensive sectors like utilities tend to perform better during a downturn.

Market cycles move through distinct phases, each with its own characteristics and behaviors. The four key stages of a stock market cycle are expansion, peak, contraction, and trough. Let’s start with the expansion phase.

The expansion phase is often marked by increasing economic activity, rising employment rates, and growing consumer confidence. During this stage, businesses tend to experience higher demand for their products and services. So, it may lead to more profits.

Investors typically see steady gains in the value of stocks, and asset prices across various markets tend to rise.

In this phase, central banks may maintain lower interest rates to encourage borrowing and investment, further stimulating economic growth.

Sectors like technology, consumer discretionary, and industrials often perform well during an expansion as companies in these industries capitalize on favorable conditions. For investors, this phase usually presents opportunities for growth-oriented investments

The peak phase represents the highest point of the market cycle, where growth slows down and economic activity begins to reach its limit. During this stage, asset prices are at their highest, and the optimism that fueled the expansion starts to wane. Consumer spending may begin to cool off, and companies may find it harder to maintain the same level of growth.

At this point, inflation pressures can build up, and central banks might respond by raising interest rates to prevent the economy from overheating. Investors often notice increased market volatility during this phase as sentiment shifts from bullish to cautious.

While some assets may continue to perform well, others may begin to show signs of slowing momentum. This is usually the point where savvy investors start to prepare for a potential downturn, shifting towards more defensive investments.

The contraction phase, also known as the downturn, occurs when economic activity begins to decline. Consumer confidence falls, businesses experience reduced demand, and unemployment may start to rise.

This phase is marked by falling asset prices, lower corporate earnings, and generally negative market sentiment. Investors may start selling off riskier assets in favor of more stable or defensive options.

During this stage, central banks often step in to lower interest rates to stimulate borrowing and spending. However, despite these measures, the contraction phase can be prolonged, especially if the downturn is driven by broader economic issues.

For investors, this is a time to focus on capital preservation, and many may seek safe-haven assets such as bonds, gold, or defensive stocks like utilities.

The trough marks the lowest point of the market cycle, where economic activity bottoms out and starts to stabilize. During this phase, asset prices are often at their lowest, and the mood in the markets is generally pessimistic. Unemployment rates may remain high, and consumer confidence is weak. However, while the trough may seem bleak, it also presents the groundwork for recovery.

This phase is where forward-thinking investors start positioning themselves for the next expansion. Valuations are often attractive, and opportunities arise for those willing to take a calculated risk. Central banks may continue to maintain low interest rates or introduce stimulus measures to encourage growth.

Sectors like consumer staples or utilities, which provide essential services, may perform relatively well as they are less affected by broader economic downturns.

The trough phase is often the calm before the storm of a recovery, making it an ideal time for long-term investors to start planning their next moves.

Market cycles play a role in shaping investment strategies. Each phase of the cycle offers different opportunities and risks.

Here are some examples:

Expansion Phase

During the expansion phase, the economy is growing, and markets are trending upward. Investors tend to favor growth-oriented assets, such as tech stocks, as companies expand and profits rise.

Example: During the 2010s, the U.S. economy was in expansion, and tech giants like Apple and Amazon saw significant stock price increases as their businesses thrived in a growing economy.

Peak Phase

As markets approach the peak, asset prices are high, and growth slows. Savvy investors often begin to rotate into more defensive sectors like utilities or healthcare to preserve gains.

Example: In 2007, as the U.S. housing market bubble reached its peak, many investors started shifting their portfolios to safer assets before the financial crisis hit.

Contraction Phase

In the contraction phase, asset prices fall, and investors look for safety. Bonds, gold, and defensive stocks become more attractive as investors aim to minimize losses.

Example: During the 2008 financial crisis, gold prices surged as investors sought a haven amid the stock market crash, and government bonds gained favor due to their stability.

Trough Phase

The trough represents a time of maximum pessimism, but it can also present the best buying opportunities. Long-term investors begin accumulating undervalued stocks.

Example: After the market bottomed out in March 2009 following the financial crisis, investors who bought into companies like Ford and Bank of America saw strong returns in the years that followed as the market recovered.

Market cycles and investor psychology are closely intertwined. Understanding this relationship can help investors anticipate shifts in the market.

Below are some common scenarios that illustrate how market cycles influence both market sentiment and investor psychology:

| Scenario | Market Sentiment | Investor Psychology |

| Stock prices are rising steadily during an expansion phase. | Optimistic, bullish | Investors become confident, often increasing risk exposure to maximize earnings. |

| Asset prices reach all-time highs during a peak. | Overconfident, euphoric | Investors may experience "fear of missing out" (FOMO) and continue buying, ignoring warning signs of an upcoming downturn. |

| Economic data shows slowing growth, signaling the start of a contraction. | Cautious, uncertain | Investors may begin to pull back from riskier assets, shifting to safer investments or holding cash. |

| Market begins a sharp decline, and prices drop significantly. | Pessimistic, fearful | Panic sets in, leading many investors to sell off assets at a loss to avoid further declines. |

| Central banks intervene by lowering interest rates to support the economy. | Hopeful, recovery-oriented | Investors may start looking for buying opportunities, believing the worst is over and that markets will soon recover. |

| Asset prices hit a trough, and the economy shows signs of stabilization. | Cautiously optimistic | Savvy investors begin accumulating undervalued assets, expecting a rebound as the market starts to recover. |

| Market begins to rise again after a prolonged downturn. | Positive, opportunistic | Investors who weathered the downturn start to regain confidence and gradually re-enter the market |

Market cycles are not random; they are influenced by various factors that drive economic conditions and investor behavior.

Here are some of these key indicators:

Monetary policy plays a major role in shaping market cycles. By adjusting interest rates and controlling the money supply, central banks aim to influence inflation, employment, and overall economic growth.

Example:

After the 2008 financial crisis, the U.S. Federal Reserve slashed interest rates to near zero and initiated quantitative easing to stimulate borrowing and investment. This monetary stimulus fueled a period of economic expansion, pushing stock markets higher, as seen in the long bull market from 2009 to 2020.

Conversely, in 2022, rising inflation led the Federal Reserve to hike interest rates aggressively, which slowed down the economy and contributed to the contraction in market cycles.

Fiscal policy directly affects market cycles by influencing consumer demand, business investment, and overall economic activity. Changes in fiscal policy can either stimulate or cool down an economy.

Example:

The massive government spending packages during the COVID-19 pandemic, such as the U.S. CARES Act, injected trillions of dollars into the economy. This fiscal policy approach helped to prevent a prolonged economic depression and supported stock markets. It drove a rapid recovery and expansion phase in 2021.

On the other hand, austerity measures in Europe following the 2010 debt crisis led to slower growth and a prolonged contraction in some European economies.

Global events, such as wars, natural disasters, and pandemics, can disrupt cycles by creating uncertainty, affecting supply chains, and altering consumer behavior.

Example:

Geopolitical events like the 2014 Russian annexation of Crimea and the 2022 Russia-Ukraine conflict disrupted global markets, especially in energy sectors, causing fluctuations in these cycles.

New technologies can create expansion phases by introducing efficiencies, new industries, and productivity gains.

Example:

The rise of the internet and the dot-com boom of the late 1990s is a prime example of how technological innovation can drive an entire market cycle. Companies like Amazon and Google flourished during this expansion phase.

However, when overvaluation and speculation outpaced actual growth, the cycle peaked and led to the dot-com bubble burst in 2000, resulting in a sharp contraction.

When consumers feel optimistic about the economy, they are more likely to spend, which fuels business revenues and economic growth. On the other hand, a drop in consumer sentiment can trigger a slowdown in spending.

Example:

The U.S. Consumer Confidence Index dropped sharply during the 2008 financial crisis, reflecting public fear and anxiety about the economy. As confidence weakened, consumer spending declined, which deepened the economic downturn.

In contrast, high consumer confidence in the mid-2010s, boosted by a strong job market and rising wages, contributed to an extended expansion phase.

Strong earnings reports can drive up stock prices during an expansion, while declining profits can trigger contractions.

Example:

In 2020, companies like Amazon, Apple, and Netflix reported record earnings as consumers shifted to online services. These positive earnings reports helped lift the broader market, contributing to the rapid recovery after the initial pandemic-driven downturn.

Conversely, during the 2001 recession, corporate earnings fell sharply across many sectors, contributing to the contraction in stock markets.

What are the most common indicators used to identify market cycles?

Market cycles can be identified using technical indicators such as moving averages, the Relative Strength Index (RSI), and the MACD (Moving Average Convergence Divergence).

How long does a typical market cycle last?

There is no fixed duration for a cycle. It can last anywhere from a few months to several years, depending on economic conditions, global events, and market sentiment.

Can different asset classes follow different market cycles?

Yes, different asset classes like stocks, bonds, and commodities can follow their own distinct cycles. For example, while the stock market might be in a contraction phase, commodities like gold may be in an expansion phase due to their role as safe-haven assets.

How do market cycles affect long-term investments?

Long-term investments are less impacted by short-term cycles. Investors who hold through both expansions and contractions can often benefit from the overall upward trajectory of the market.

Are market cycles predictable?

While market cycles follow certain patterns, they are not fully predictable. External factors such as geopolitical events or sudden economic changes can shift cycles unexpectedly, making it difficult to forecast their movements.

How can individual investors protect themselves during a market downturn?

During a market downturn, investors can protect themselves by diversifying their investments, holding safe-haven assets like bonds or gold, and avoiding panic selling.

Silver Rally Ahead? Supply Deficit Meets Rising Demand

Silver Rally Ahead? Supply Deficit Meets Rising Demand

A new silver rally may be forming as supply deficits deepen and China’s demand grows. Here’s what is driving the momentum.

Detail Fed Rate Cuts 2026: How to Position Now

Fed Rate Cuts 2026: How to Position Now

Fed rate cuts in 2026 could reshape markets. See expectations, asset impact, and positioning strategies for bonds, gold, stocks, and USD.

Detail Analyzing the U.S. Labor Market Outlook for 2026

Analyzing the U.S. Labor Market Outlook for 2026

Year’s first jobs report looked reassuring. A closer breakdown, however, tells a more layered story about the direction of the labor market.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!