The Dollar Index (DXY) is an important indicator for investors who track the performance of the U.S. dollar against other major currencies in global financial markets. The index is especially used to assess the overall health of the U.S. economy and the strength of the dollar in international markets.

The movements of the Dollar Index have the power to affect many different financial assets and markets. It is closely monitored, particularly when it comes to price movements of dollar-based commodities. For example, the prices of commodities such as gold and oil are often inversely correlated with movements in the dollar index.

The Dollar Index also plays a role in the Forex market. Traders use DXY to adjust their positions while analyzing the overall strength of the U.S. dollar against other currencies.

The U.S. Dollar Index (DXY or USDX) measures the value of the U.S. dollar against other major world currencies. It calculates the weighted average value of the dollar against six different currencies.

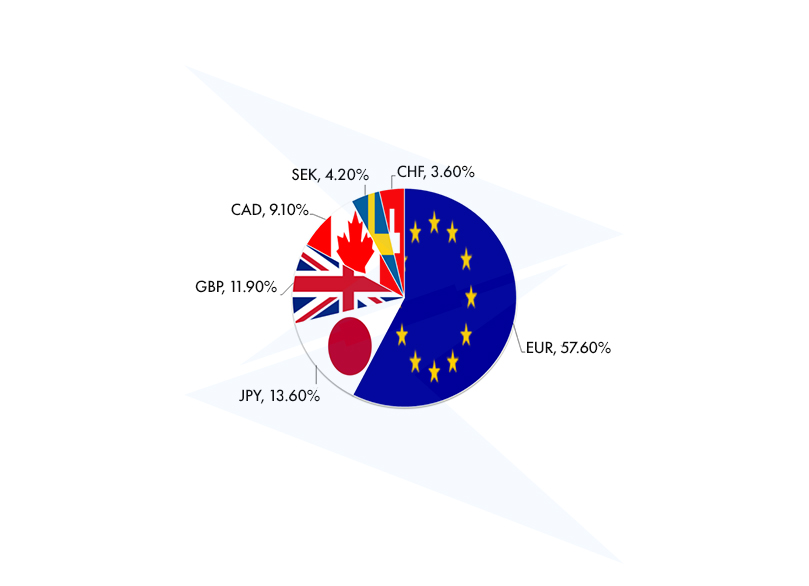

First introduced in 1973, the index is used to reflect the importance of the U.S. in global trade and the dollar's position as the world's primary reserve currency. The currencies included in the index are the Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona, and Swiss Franc.

USDX is influenced by various factors, such as exchange rates, commodity prices, and the U.S. trade balance. For example, when the dollar gains value against other currencies, DXY rises, while a weakening dollar leads to a drop in the index. Therefore, global economic developments and central bank monetary policies have a impact on the Dollar Index.

The U.S. Dollar Index was first introduced in 1973 following the end of the Bretton Woods Agreement.

The Bretton Woods system was based on fixed exchange rates globally, with the U.S. dollar pegged to gold. However, with the collapse of this system, exchange rates began to float freely, and a tool was needed to track the value of the dollar in global markets. Thus, the U.S. Dollar Index was created.

Initially, DXY was designed to measure the value of the U.S. dollar against the currencies of its most important trading partners. At first, the index was based on the currencies that reflected the U.S.’s position in global trade. However, with the introduction of the Euro in 1999, the composition of USDX changed, and the Euro took on significant weight in the index.

Throughout its history, DXY has experienced fluctuations due to major economic events and crises. In the 1980s, the U.S. dollar appreciated against other currencies, causing the index to peak. After the global financial crisis of 2008 and in the years that followed, DXY displayed a volatile pattern influenced by global economic instability and central bank policies.

In recent years, the index has generally fluctuated between 90 and 110, and as of October 2024, it is trading around 102.

The U.S. Dollar Index consists of six major currencies that are weighed against the dollar:

The Dollar Index price is based on the weighted average value of the U.S. dollar against six major currencies. This calculation is done by multiplying each currency's exchange rate against the dollar by its corresponding weight in the index and summing the results.

The DXY formula is as follows:

In this formula, the weight of each currency in the index is represented by the negative or positive powers inside the parentheses. For example, the weight of the Euro (EUR/USD) in the index is 57.6%, which is represented by the negative power (^-0.576) in the formula. Similarly, the other currencies contribute to the index calculation in the same way.

The Dollar Index shows investors the overall strength or weakness of the U.S. dollar against other major world currencies. A rise in the DXY indicates that the U.S. dollar has gained value relative to other currencies, while a decline suggests that the dollar has lost value.

The US Dollar Index (DXY) measures the value of the USD against six major currencies: the Euro (EUR), Japanese Yen (JPY), British Pound (GBP), Canadian Dollar (CAD), Swedish Krona (SEK), and Swiss Franc (CHF). When you perform technical analysis on the DXY, you can better understand the USD's strength compared to these currencies. This information can help you predict trends in other currency pairs and markets.

Some important insights provided by the Dollar Index include:

Trading the DXY provides investors with the opportunity to assess the movement of the U.S. dollar against general market trends. It is directly or indirectly related to other transactions in the Forex market, and traders can utilize this index in various ways.

Some fundamental ways to trade the USDX include:

What affects the price of the USD Index?

The price of the Dollar Index (DXY) is influenced by several factors. These include U.S. economic data (such as growth, inflation, unemployment rates), central bank decisions (especially Federal Reserve policies on interest rates), geopolitical developments, and the relationships between the U.S. and its trading partners. Additionally, the performance of other major currencies also impacts the DXY price.

What makes the U.S. dollar strong?

The strength of the U.S. dollar is based on economic growth, low inflation, and high-interest rates. The stability of the U.S. economy and its financial system increases the demand for the dollar. Additionally, since the U.S. dollar is widely used in international trade and as a reserve currency, this further contributes to its strength.

Why was the US Dollar Index created?

The U.S. Dollar Index (DXY) was created in 1973 after the end of the Bretton Woods Agreement. Its purpose was to track the value of the U.S. dollar against other major currencies and to assess its significance in global trade. The role of the U.S. in international trade and the use of the dollar as a reserve currency necessitated the creation of such an index.

What does it mean when the DXY rises?

When the DXY rises, it indicates that the U.S. dollar is gaining strength against other major currencies. This may suggest that the U.S. economy is performing well or better than other major economies. It also reflects increased demand for the U.S. dollar in international markets.

How does the DXY affect commodity prices?

The DXY has an inverse relationship with commodity prices. When the DXY rises, the prices of commodities that are priced in U.S. dollars (such as gold and oil) tend to fall. This is because a stronger dollar makes these commodities more expensive for buyers using other currencies. Conversely, when the DXY falls, commodity prices generally rise.

How do Forex traders use the DXY?

Forex traders use the DXY to analyze the overall performance of the U.S. dollar and guide their trades in currency pairs. For example, when trading pairs like EUR/USD or GBP/USD, traders refer to the DXY's direction to gauge the dollar's strength or weakness.

How do you perform technical analysis on the DXY?

Technical analysis of the DXY involves evaluating price movements and predicting future trends using tools such as support and resistance levels, moving averages, RSI, and MACD. Traders use these technical indicators to identify trends and potential breakout points on the DXY. By reviewing historical price movements of the DXY, traders can make informed projections about future price behavior.

What is the relationship between the DXY and U.S. interest rates?

There is a strong relationship between U.S. interest rates and the DXY. When the Federal Reserve raises interest rates, the dollar typically strengthens, leading to an increase in the DXY. Higher interest rates attract foreign investment in U.S. assets, boosting demand for the dollar. Conversely, when interest rates are lowered, the dollar may weaken, resulting in a decline in the DXY.

Silver Rally Ahead? Supply Deficit Meets Rising Demand

Silver Rally Ahead? Supply Deficit Meets Rising Demand

A new silver rally may be forming as supply deficits deepen and China’s demand grows. Here’s what is driving the momentum.

Detail Fed Rate Cuts 2026: How to Position Now

Fed Rate Cuts 2026: How to Position Now

Fed rate cuts in 2026 could reshape markets. See expectations, asset impact, and positioning strategies for bonds, gold, stocks, and USD.

Detail Analyzing the U.S. Labor Market Outlook for 2026

Analyzing the U.S. Labor Market Outlook for 2026

Year’s first jobs report looked reassuring. A closer breakdown, however, tells a more layered story about the direction of the labor market.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!