Using different order types while trading, allows you to specify the conditions under which you want your trade to be executed, such as the price at which you want to buy or sell, the time frame for the trade, and more.

For instance, if you want to buy a currency pair but only if it reaches a certain price, you can set up an order type that tells the platform to wait until that price is reached before making the purchase.

This way, you don't have to constantly monitor the market and can ensure that your trade is executed under the conditions you prefer.

An order type in trading is basically an instruction you give to your broker or trading platform about how you want to buy or sell an asset. Think of it as a set of rules for executing your trade.

Using the right order type is quite important for effective trading and risk management. Here’s why:

Now, we’ll dive into the specific order types available on MetaTrader 5 and how you can use them correctly.

In trading platforms like MetaTrader 5, you'll come across several order types that cater to different market conditions.

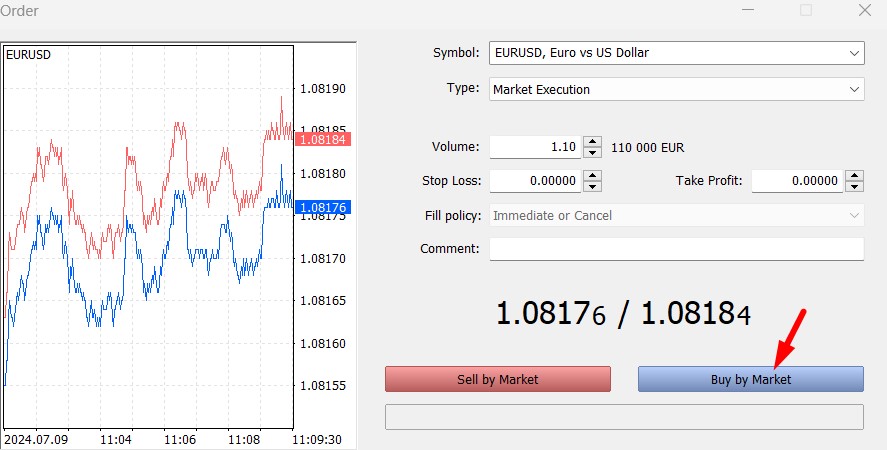

A market order is one of the simplest and most used order types in trading. It is an instruction to buy or sell an asset immediately at the current market price. Market orders are executed instantly, making them ideal for situations where the trader wants to enter or exit a position quickly without worrying about the exact price.

Market orders are typically used when you need to buy or sell an asset quickly and are less concerned about getting a specific price. Here are a few scenarios when market orders might be appropriate:

Example Scenario

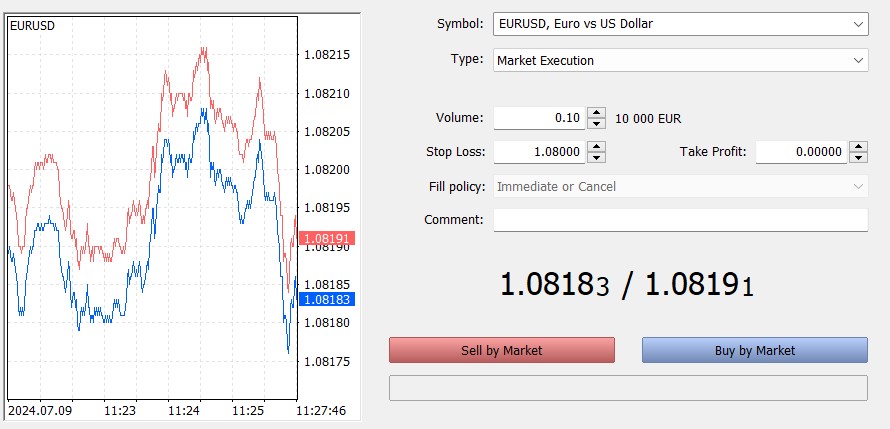

Let's say the EUR/USD is trading at 1.08281 currently. You can log into your MT5 platform, select the EUR/USD pair, and choose a market order to buy.

Since it's a market order, your order will be executed instantly at the current market price of 1.08281. Now, you hold a long position in EUR/USD at 1.08281.

If the price moves up to 1.08500, you can place another market order to sell EUR/USD at the current market price, securing a profit.

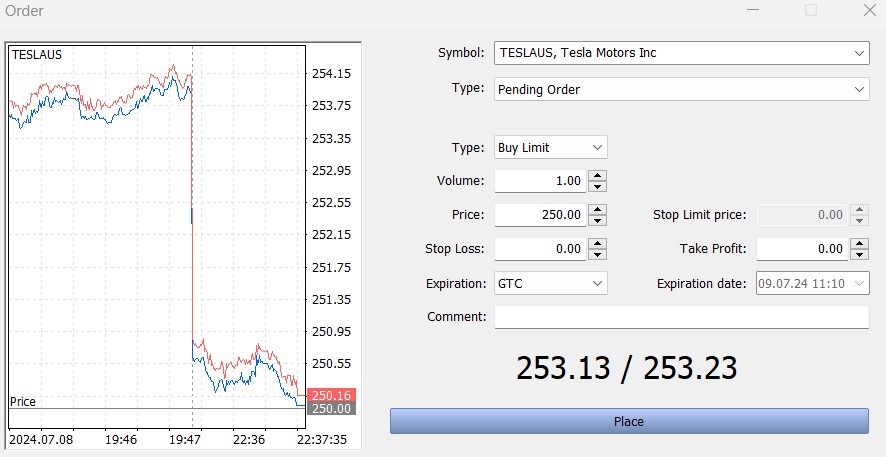

Limit orders allow traders to specify the price at which they are willing to buy or sell an asset. Unlike market orders, limit orders are only executed if the market reaches the specified price, which can help ensure a more favorable entry or exit point.

A Buy Limit order is an order to purchase an asset at or below a specified price. This type of order ensures that you don't pay more than the predetermined price for the asset.

Example Scenario:

Imagine you are interested in buying Tesla (TSLA) stock, which is currently trading at $253. However, you believe the price might drop and want to buy at a lower price. You place a Buy Limit order at $250. If the price of TSLA falls to $250, your order will be executed, and you will buy the stock at that price.

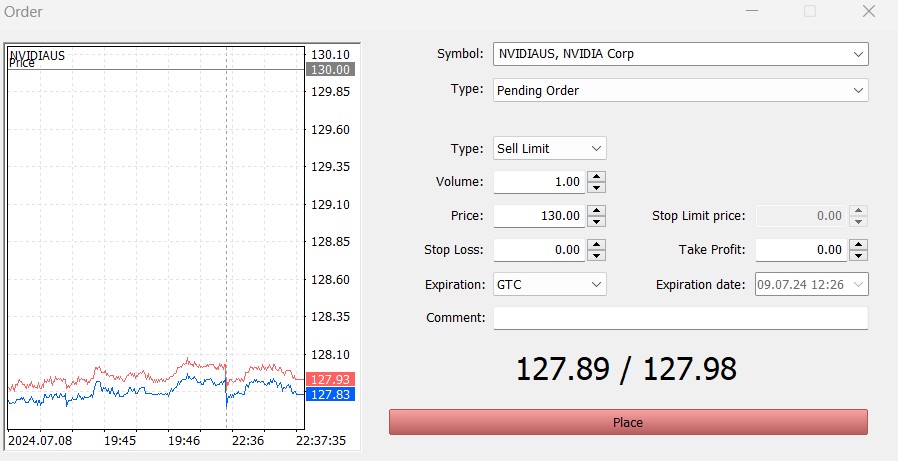

A Sell Limit order is an order to sell an asset at or above a specified price. This type of order ensures that you don't sell the asset for less than the predetermined price.

Example Scenario:

Suppose you own Nvidia (NVIDIAUS) stock, which is currently trading at $128. You want to sell it if the price rises to $130. You place a Sell Limit order at $130. If the price of the stock reaches $130, your order will be executed, and you will sell the stock at that price.

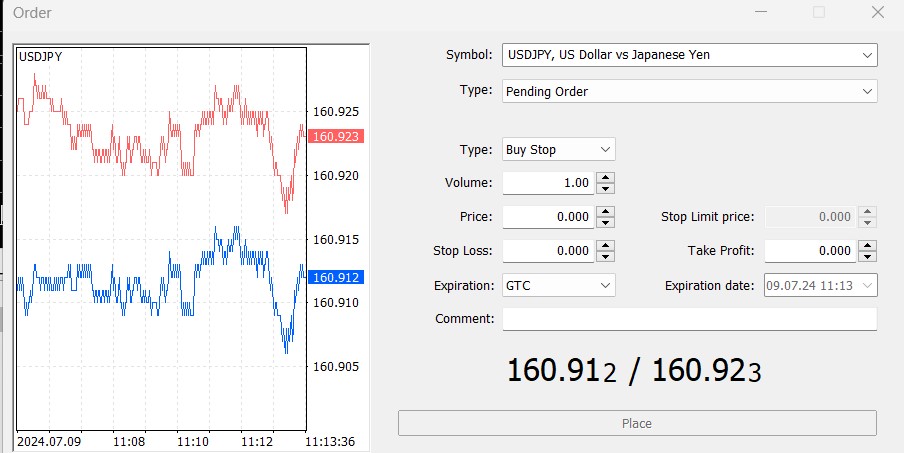

A Buy Stop order is an order to purchase an asset at a price above the current market price. This type of order is used when a trader believes that the asset's price will continue to rise after reaching a certain level.

Example Scenario:

Let's say the USD/JPY pair is currently trading at 160.00. You believe that if the price rises to 161.00, it will continue to go up. You place a Buy Stop order at 161.00. If the price reaches 161.00, your order will be executed, and you will buy USD/JPY at that price.

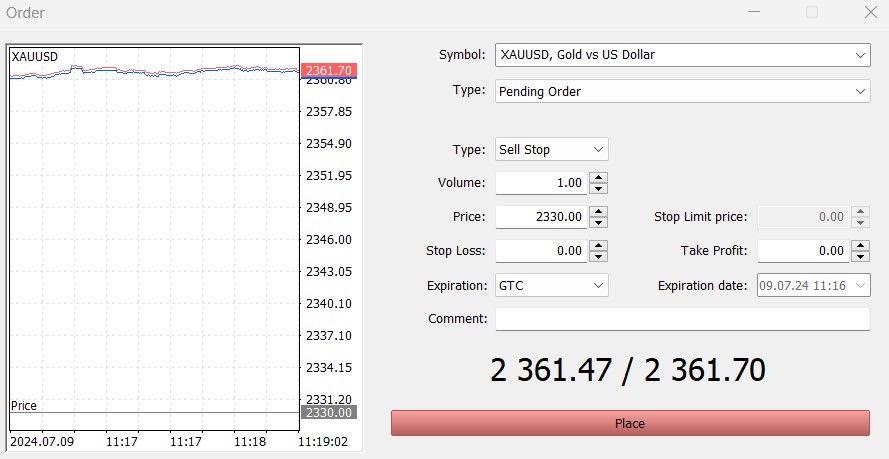

A Sell Stop order is an order to sell an asset at a price below the current market price. This type of order is used when a trader believes that the asset's price will continue to fall after reaching a certain level.

Example Scenario:

Imagine the XAUUSD (gold) is currently trading at $2,361. You believe that if the price drops to $2,330, it will continue to fall. You place a Sell Stop order at $2,330. If the price falls to $2,330, your order will be executed, and you will sell XAU/USD at that price.

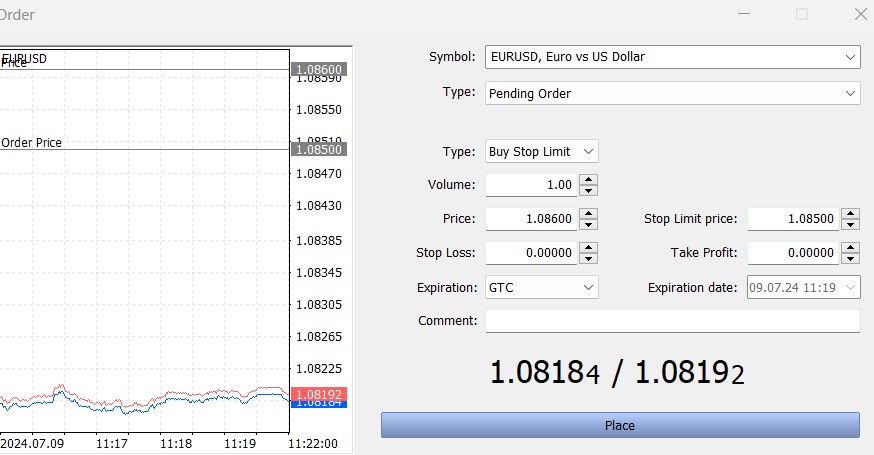

A Buy Stop Limit order combines features of a Buy Stop order and a Buy Limit order. It becomes a Buy Limit order when the specified stop price is reached.

Example Scenario:

Suppose the EUR/USD is currently trading at 1.0800, and you believe that if the price rises to 1.0850, it will continue to go up, but you don't want to pay more than 1.0860. You place a Buy Stop Limit order with a stop price of 1.0850 and a limit price of 1.0860. If the price reaches 1.0850, your order becomes a Buy Limit order at 1.0860.

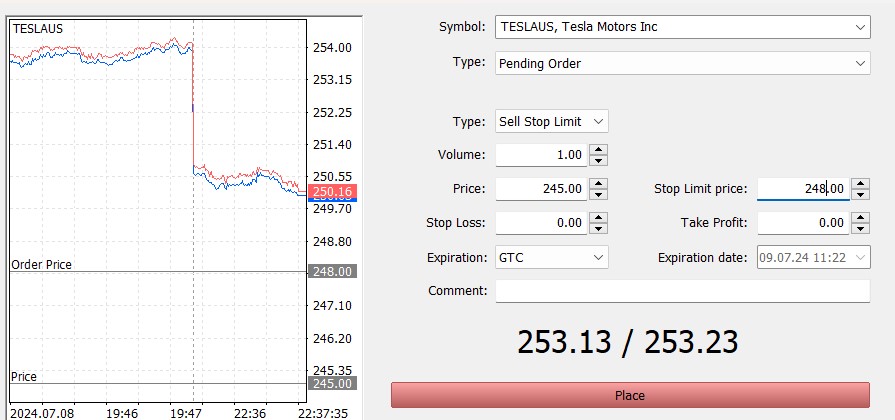

A Sell Stop Limit order combines features of a Sell Stop order and a Sell Limit order. It becomes a Sell Limit order when the specified stop price is reached.

Example Scenario:

Let's say Tesla (TSLA) is currently trading at $253. You believe that if the price drops to $248, it will continue to fall, but you don't want to sell for less than $245. You place a Sell Stop Limit order with a stop price of $245 and a limit price of $245. If the price reaches $248, your order becomes a Sell Limit order at $245.4

In addition to the primary order types, secondary order types like Stop Loss and Take Profit orders are essential for effective risk management and ensuring profitable trades. These orders help traders protect their investments and lock in profits automatically without constantly monitoring the markets.

A Stop Loss order is an instruction to sell an asset when its price reaches a certain level, designed to limit an investor's loss on a position. It helps traders avoid huge losses if the market moves against their position.

Example Scenario:

Imagine you have a long position in EUR/USD, which you bought at 1.08281. To protect yourself from a significant loss if the price drops, you place a Stop Loss order at 1.0800. If the price of EUR/USD falls to 1.0800, your Stop Loss order will be triggered, and the position will be closed, limiting your loss to a manageable level.

A Take Profit order is an instruction to sell an asset when its price reaches a predetermined level, designed to lock in profits on a position. This type of order ensures that traders secure their gains once the price hits their target.

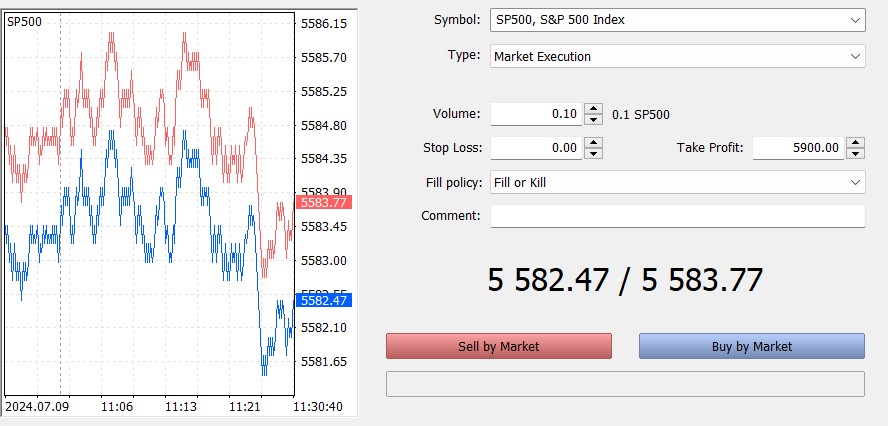

Example Scenario:

Let's say you have a long position in S&P 500 (SP500) index, which you bought at $5,500. You want to lock in profits if the price reaches $5,900. You place a Take Profit order at $5,900. If the price of TSLA rises to that price, your Take Profit order will be triggered, and the position will be closed.

Incorporating these order types into your trading strategy allows you to adapt to different market conditions, protect your capital, and secure your gains. Remember, the key to successful investing is not just about finding the right opportunities but also about managing risks.

Silver Rally Ahead? Supply Deficit Meets Rising Demand

Silver Rally Ahead? Supply Deficit Meets Rising Demand

A new silver rally may be forming as supply deficits deepen and China’s demand grows. Here’s what is driving the momentum.

Detail Fed Rate Cuts 2026: How to Position Now

Fed Rate Cuts 2026: How to Position Now

Fed rate cuts in 2026 could reshape markets. See expectations, asset impact, and positioning strategies for bonds, gold, stocks, and USD.

Detail Analyzing the U.S. Labor Market Outlook for 2026

Analyzing the U.S. Labor Market Outlook for 2026

Year’s first jobs report looked reassuring. A closer breakdown, however, tells a more layered story about the direction of the labor market.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!