Global markets retreated after Trump renewed his push to acquire Greenland and warned of new tariffs on European allies, triggering a broad selloff.

The euro climbed above 1.17 after a sharp rise in German ZEW sentiment boosted confidence in the region’s outlook, while renewed U.S.–EU trade tensions weakened the dollar. The yen stayed rangebound amid fiscal and political uncertainty in Japan, as gold and silver surged on strong safe-haven demand driven by the Greenland dispute. Sterling rebounded on dollar softness and UK jobs data, though tariff risks continue to cloud the outlook.

| Time | Cur. | Event | Forecast | Previous |

| 3.3% | 3.2% | |||

| U.S. President Trump Speaks |

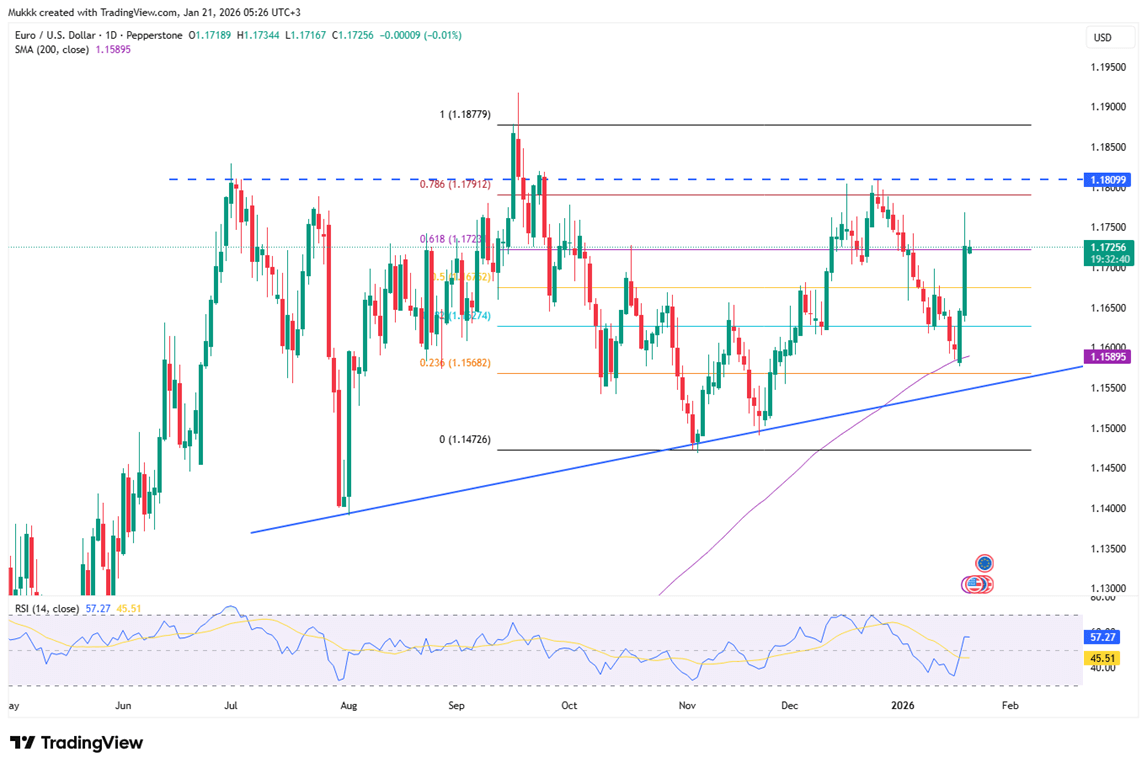

The euro climbed past $1.17 on Wednesday, fueled by a record surge in German ZEW sentiment to 59.6. This five-year high in confidence suggests growing faith in a 2026 economic turnaround. Meanwhile, the dollar weakened as President Trump intensified tariff threats toward Europe over the Greenland dispute. In response, the EU is preparing retaliatory duties on €93 billion of U.S. goods, further heightening transatlantic trade uncertainty.

Technically, 1.1680 is the key support, while resistance is seen at 1.1760.

| R1: 1.1760 | S1: 1.1680 |

| R2: 1.1800 | S2: 1.1620 |

| R3: 1.1850 | S3: 1.1570 |

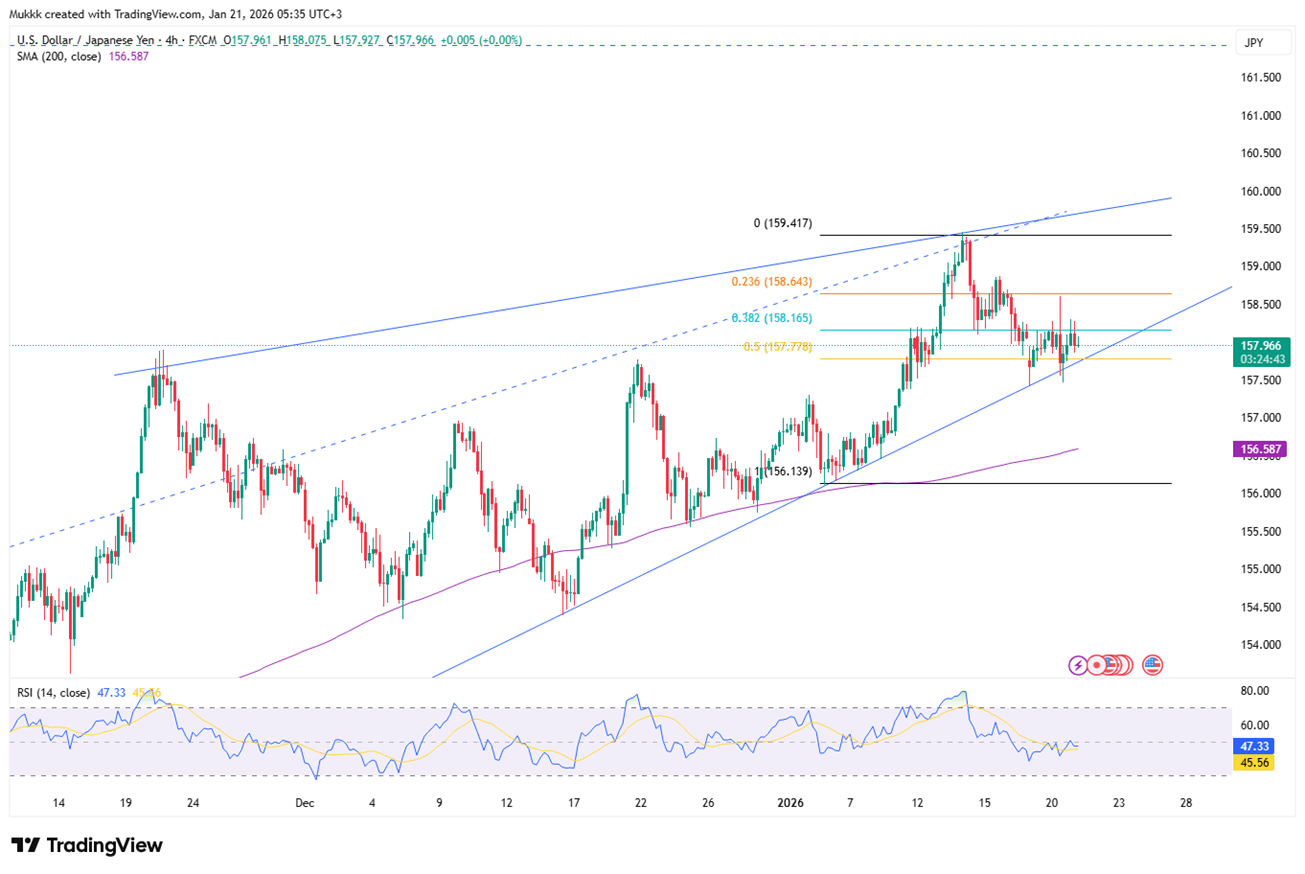

The yen hovered near 158 per dollar on Wednesday as Prime Minister Takaichi’s food tax cut proposal sparked fiscal concerns. While a softening dollar provided a cushion, uncertainty surrounds the February 8 snap election and the Bank of Japan’s upcoming rate decision. Traders remain vigilant for potential currency intervention as political and monetary outlooks collide.

Technically, resistance stands near 158.30, while support is firm at 157.40.

| R1: 158.30 | S1: 157.40 |

| R2: 158.60 | S2: 157.00 |

| R3: 158.90 | S3: 156.60 |

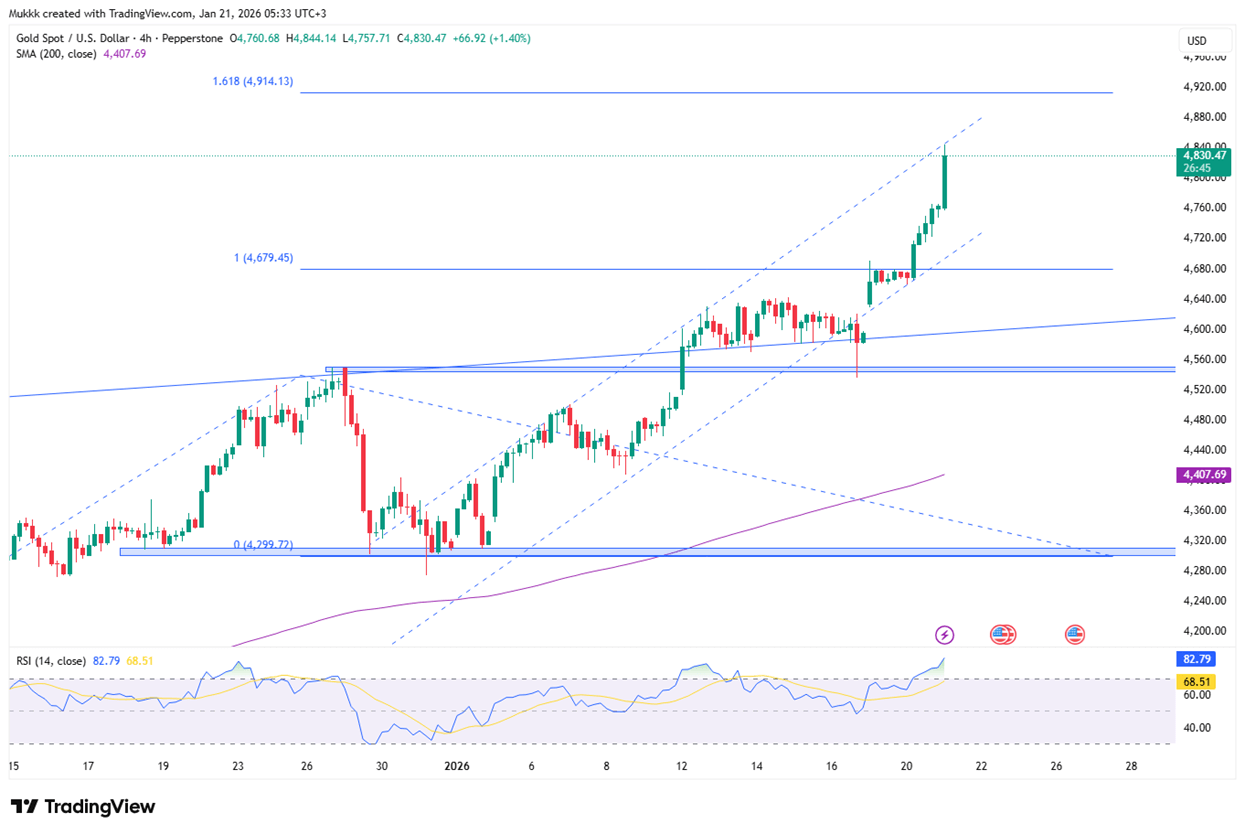

Gold soared past $4,800 on Wednesday, reaching a new all-time high as the U.S.–Europe standoff over Greenland intensified. At the Davos forum, President Trump’s renewed vows to acquire the island and his accompanying tariff threats triggered a shift into safe-haven assets. This geopolitical friction, alongside instability in Japanese bonds, reinforced gold's dominance as investors await delayed U.S. PCE data for future rate clues.

Gold sees support near $4665, while resistance is around $4870.

| R1: 4870 | S1: 4765 |

| R2: 4920 | S2: 4710 |

| R3: 5000 | S3: 4640 |

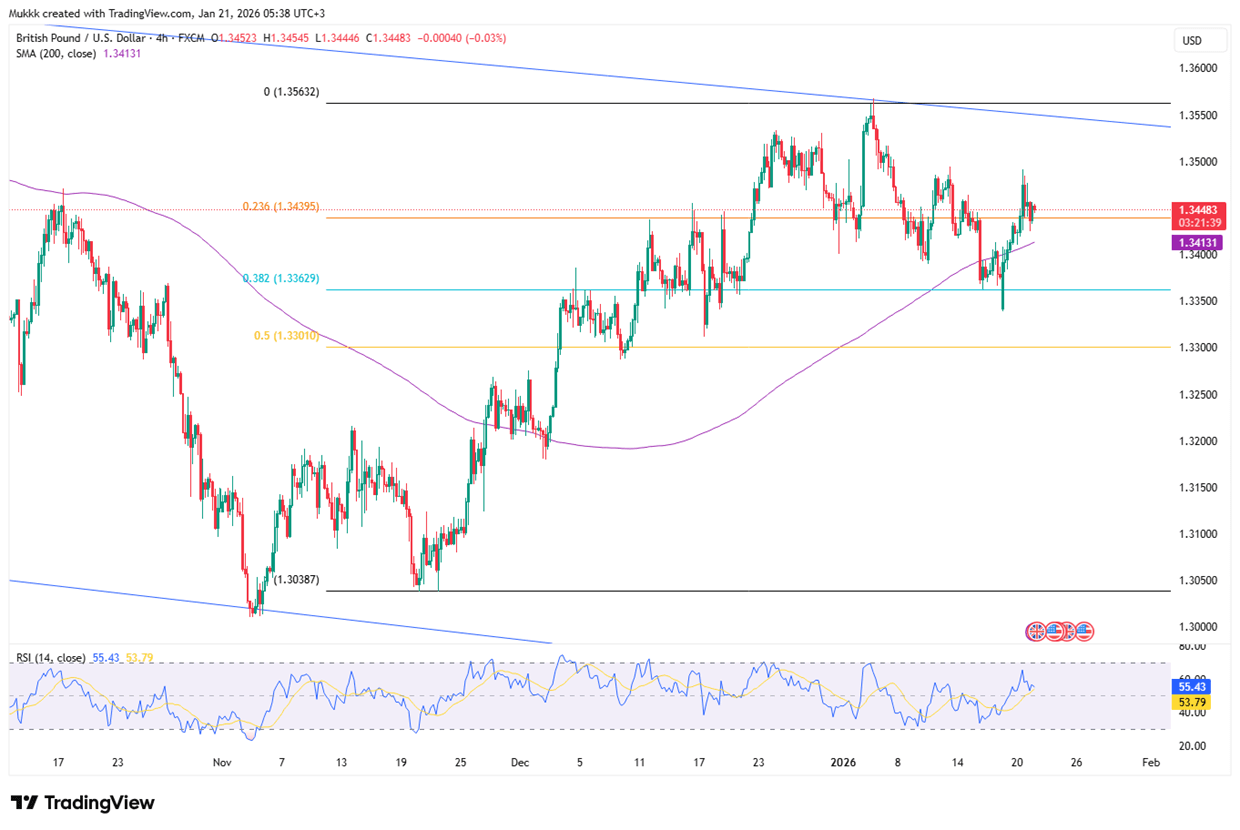

The British pound rose past $1.3400 on Wednesday, rebounding from monthly lows. While UK unemployment held at 5.1% and wage growth hit its lowest level since 2022, the dollar's broad weakness provided a lift. Investors remain cautious as President Trump’s Greenland-related tariff threats loom; any escalation is expected to disproportionately impact the UK and German economies due to their high export exposure.

From a technical view, support stands near 1.3400, with resistance around 1.3480.

| R1: 1.3480 | S1: 1.3400 |

| R2: 1.3530 | S2: 1.3350 |

| R3: 1.3570 | S3: 1.3300 |

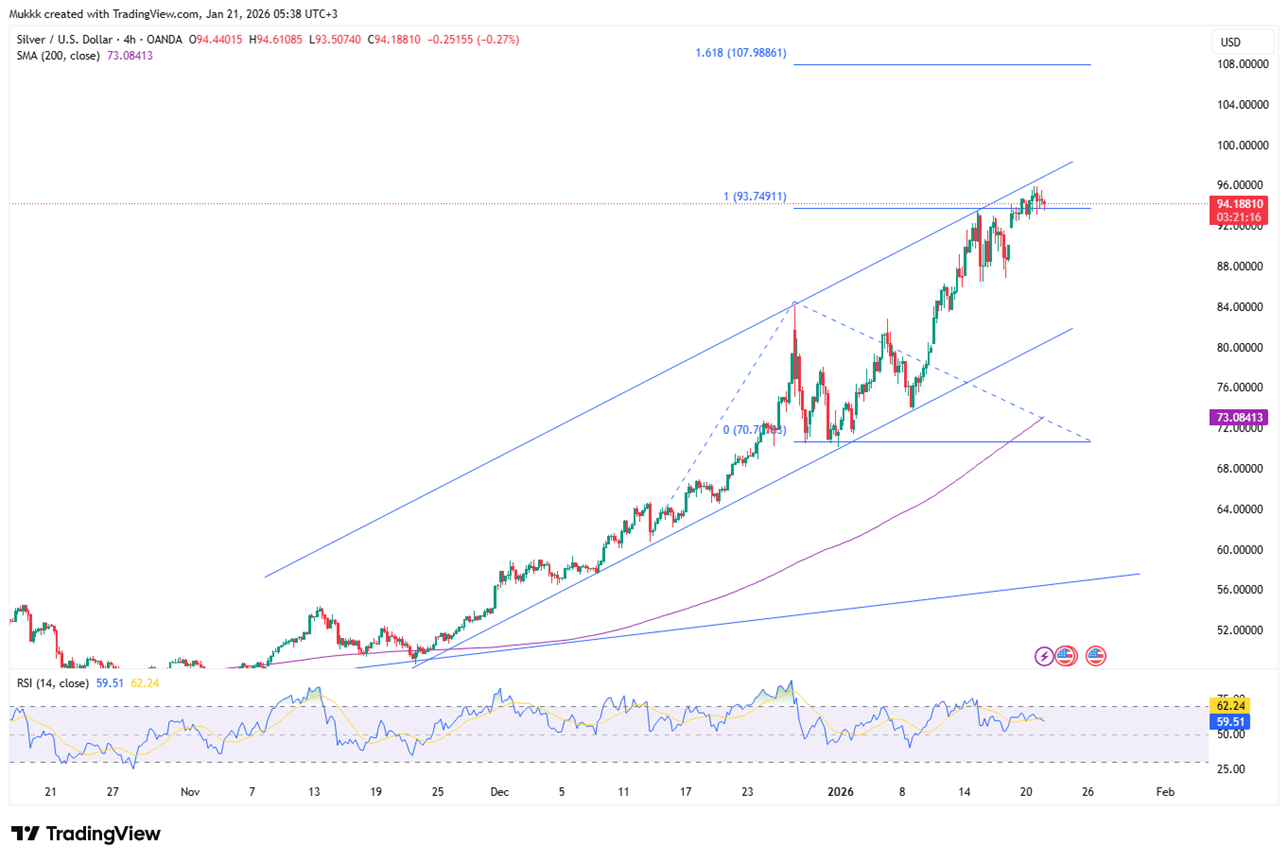

Silver opened near record highs of $95 on Wednesday, sustained by safe-haven demand as the U.S.–EU standoff intensified. President Trump signaled "no turning back" on his Greenland acquisition plans, prompting the European Parliament to halt a major U.S. trade deal. While these geopolitical rifts support silver, gains are limited by a resilient U.S. labor market, which has led traders to push back expectations for potential Federal Reserve rate cuts.

From a technical view, resistance stands near $95.80 while support is located around $92.70.

| R1: 95.80 | S1: 92.70 |

| R2: 97.20 | S2: 89.70 |

| R3: 100.00 | S3: 87.30 |

Pasar global tetap didominasi oleh risiko geopolitik karena meningkatnya konflik antara Amerika Serikat, Israel, dan Iran memicu pergeseran kuat menuju aset safe-haven. Indeks dolar mencapai 99,3 pada hari Rabu, naik untuk hari ketiga berturut-turut karena kekhawatiran konflik memicu inflasi dan menggeser ekspektasi penurunan suku bunga Fed dari Juli ke September.

Detail After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

Detail Trade Tensions Lift Safe Havens (02.26.2026)Markets remained cautious as a new 10% U.S. global tariff weighed on risk sentiment. The euro and pound stayed under pressure near recent lows, while the yen rebounded on renewed speculation around Bank of Japan tightening.

Bergabunglah dengan Channel Telegram Kami dan Berlangganan Sinyal Trading Kami secara Gratis!

Bergabunglah dengan Telegram!