EUR/USD hovered near 1.1520 on Fed hawkishness and rising Middle East tensions, while demand offered potential support to the dollar.

The yen strengthened as Japan’s core inflation hit a 16-month high, fueling expectations of further BOJ tightening. Gold slipped below $3,360 as investors sold off with geopolitical risks and limited Fed rate-cut prospects. GBP/USD steadied near 1.34 following a divided BoE vote, and silver retreated from a 13-year high.

| Time | Cur. | Event | Forecast | Previous |

| 06:00 | EUR | German PPI (MoM) (May) | -0.3% | -0.6% |

| 10:00 | EUR | Eurogroup Meetings | - | - |

| 12:30 | USD | Philadelphia Fed Manufacturing Index (Jun) | -1.7 | -4.0 |

| 14:00 | USD | US Leading Index (Jun) | -0.1% | -1.0% |

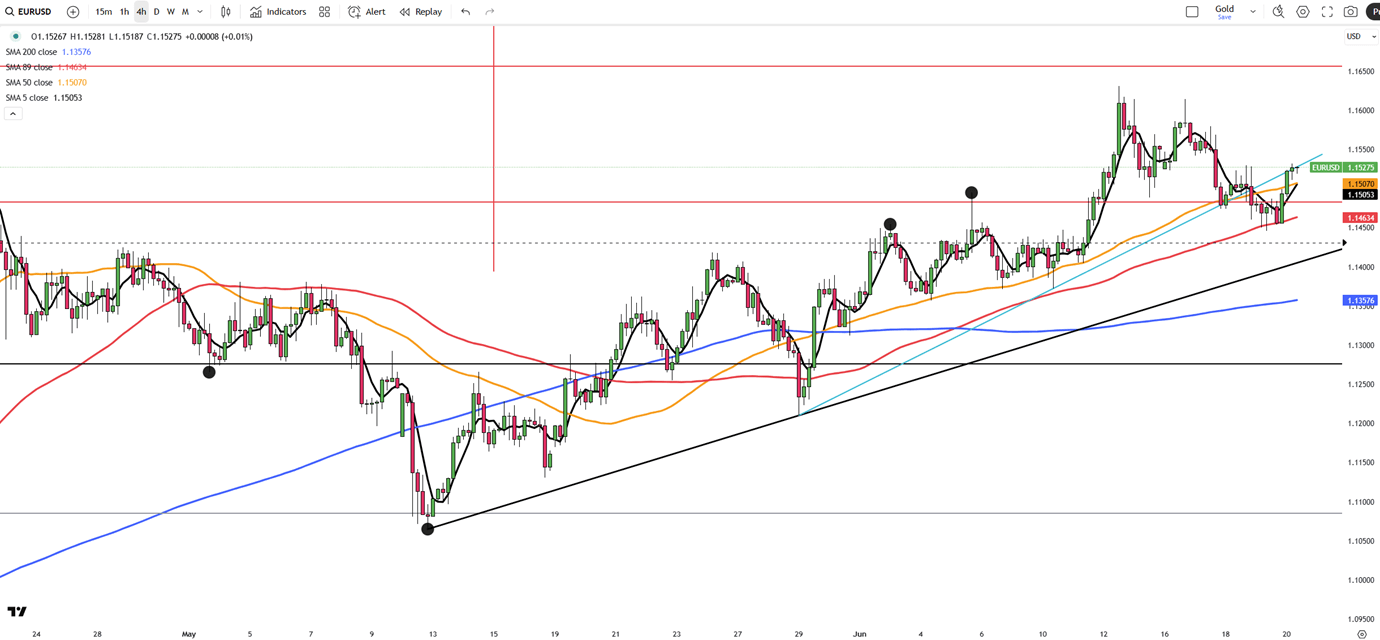

EUR/USD hovered near 1.1520 during Friday’s Asian session, extending gains for a third day as the US dollar weakened, likely due to a technical pullback. However, the greenback may rebound as safe-haven demand grows amid rising tensions between the US and Iran.

Citing senior US intelligence, The New York Times reported that Iran hasn’t yet decided to pursue nuclear weapons, despite having enriched uranium reserves. Meanwhile, the Senate Intelligence Committee Chair said President Trump is set to offer Iran one final window to negotiate before considering military action, potentially delaying any decisions for up to two weeks.

Markets are also awaiting Friday’s Monetary Policy Report from the Federal Reserve, which will provide fresh insights into the Fed’s stance. On the Euro side, the ECB’s hawkish outlook offered additional support, with President Christine Lagarde suggesting rate cuts may soon end as the central bank remains “well positioned” to handle persistent risks.

Resistance is located at 1.1530, while support is seen at 1.1450

| R1: 1.1530 | S1: 1.1450 |

| R2: 1.1590 | S2: 1.1415 |

| R3: 1.1660 | S3: 1.1390 |

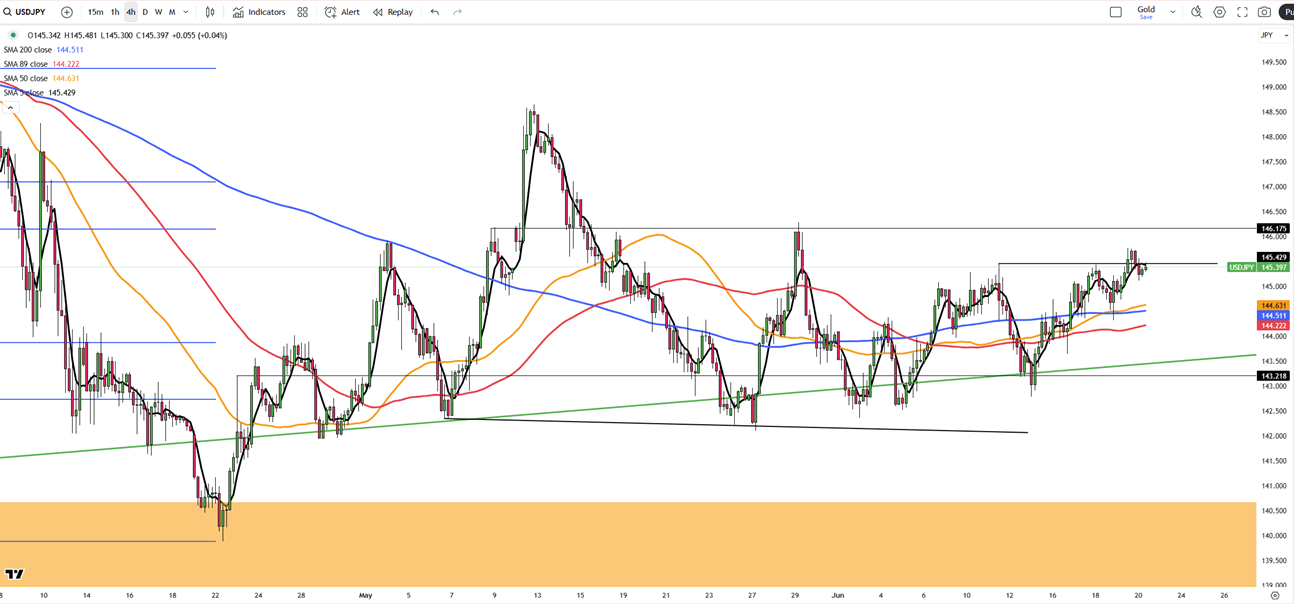

The Japanese yen traded stronger near 145 per dollar, rebounding as Japan’s core inflation rose for the third straight month to 3.7%, its highest since January 2023. The data strengthens expectations that the Bank of Japan may continue policy tightening.

Earlier in the week, the BOJ held rates at 0.5% but highlighted how rising wages are being passed on to consumers, keeping inflation elevated. Governor Kazuo Ueda emphasized a data-driven path forward, keeping the door open for more hikes if needed.

The key resistance is at $145.30, while the major support is located at $142.50.

| R1: 145.30 | S1: 142.50 |

| R2: 146.10 | S2: 142.10 |

| R3: 148.15 | S3: 141.50 |

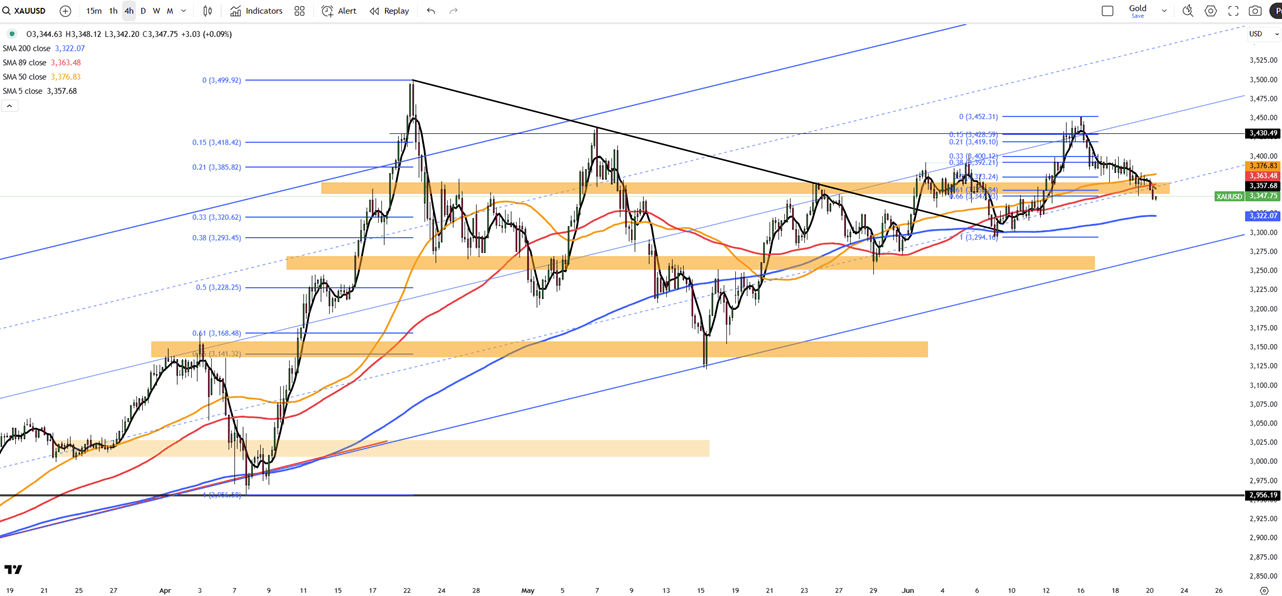

Gold dropped below $3,360 per ounce, hitting a one-week low and on track for its first weekly decline in three. Investors trimmed holdings to cover losses in other markets, with risk sentiment shaken by the intensifying conflict between Israel and Iran. Israeli strikes reportedly targeted key sites in Tehran following an Iranian missile strike on an Israeli hospital.

Uncertainty also surrounds the US response, with President Trump weighing direct military action. A decision is expected within two weeks.

Despite the Fed holding rates steady and signaling two potential cuts this year, Chair Powell cautioned that tariffs could push inflation higher. New Fed projections flagged slower growth, higher prices, and weaker job markets in 2025. This could limit rate cuts, dampening gold’s appeal as a non-yielding asset.

Resistance is seen at $3,370, while support holds at $3,316.

| R1: 3370 | S1: 3316 |

| R2: 3405 | S2: 3285 |

| R3: 3430 | S3: 3255 |

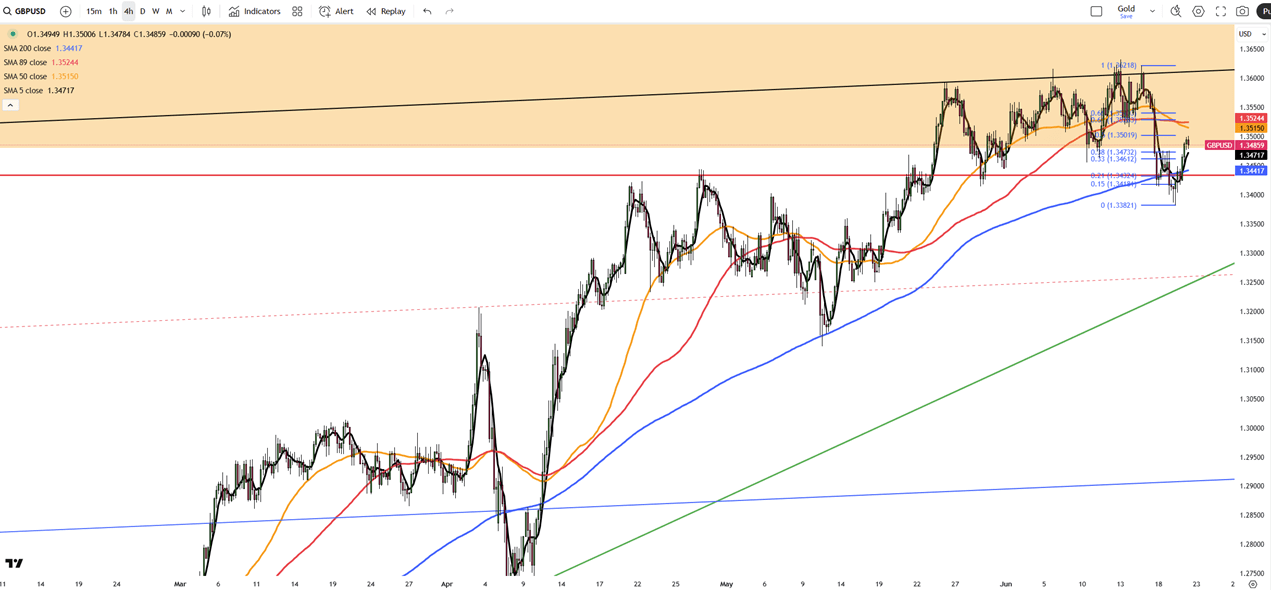

The pound steadied near 1.34 following the Bank of England’s decision to hold rates. The vote revealed deeper division than expected, with six members supporting a hold and three pushing for a 25 basis point cut, contrary to forecasts of a 7-2 split.

The BoE faces a tough balancing act as it weighs sticky inflation, geopolitical risks, and the economic drag of US tariffs.

Resistance is seen at 1.3500, while support holds at 1.3415.

| R1: 1.3500 | S1: 1.3415 |

| R2: 1.3600 | S2: 1.3380 |

| R3: 1.3700 | S3: 1.3250 |

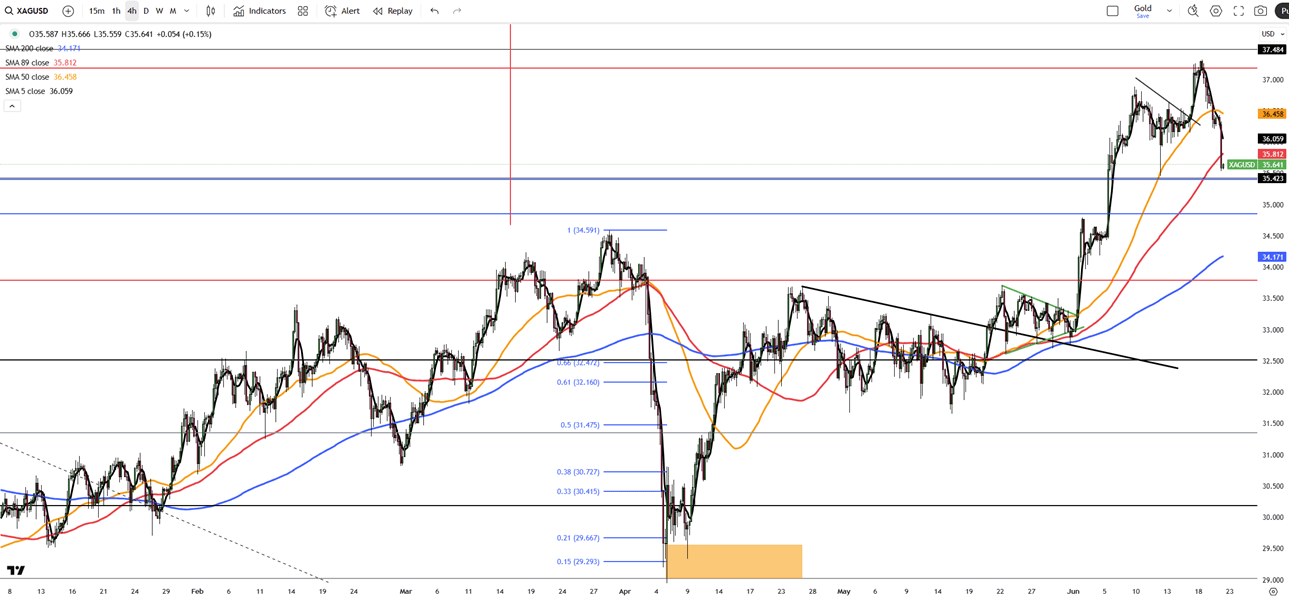

Silver fell 2% to $35.60 per ounce, marking its third straight session in the red. The decline followed a powerful rally to 13-year highs, as traders took profits and sold off precious metals to offset losses from geopolitical turmoil.

The Fed’s steady-rate stance and warning on inflation risks tied to Trump’s new tariffs also weighed on sentiment. Adding pressure, a massive metals discovery in Argentina was confirmed, estimated to contain over 80 million ounces of gold and silver, one of the largest finds in decades.

First resistance is at 37.50, while support starts at 35.40.

| R1: 37.50 | S1: 35.40 |

| R2: 39.00 | S2: 34.85 |

| R3: 41.00 | S3: 33.80 |

Global markets remain dominated by geopolitical risk as escalating conflict between the United States, Israel, and Iran fuels a strong shift toward safe-haven assets. The dollar index hit 99.3 Wednesday, rising for a third day as conflict concerns fueled inflation and shifted Fed rate cut expectations from July to September.

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!