Markets moved cautiously on Friday as the dollar strengthened on the back of robust U.S. data. EUR/USD held near $1.1679, capped by its 20-day moving average despite modest gains this month.

The yen weakened toward 150, pressured by upbeat GDP and jobless claims. Gold slipped to $3,740 and silver retreated below $45 as dollar demand trimmed safe-haven flows. Meanwhile, the pound fell to seven-week lows with inflation concerns clouding the Bank of England’s outlook.

| Time | Cur. | Event | Forecast | Previous |

| 09:30 | EUR | ECB President Lagarde Speaks | ||

| 12:30 | USD | Core PCE Price Index (MoM) (Aug) | 0.2% | 0.3% |

| 12:30 | USD | Core PCE Price Index (YoY) (Aug) | 2.9% | 2.9% |

| 14:00 | USD | Michigan Consumer Sentiment (Sep) | 55.4 | 58.2 |

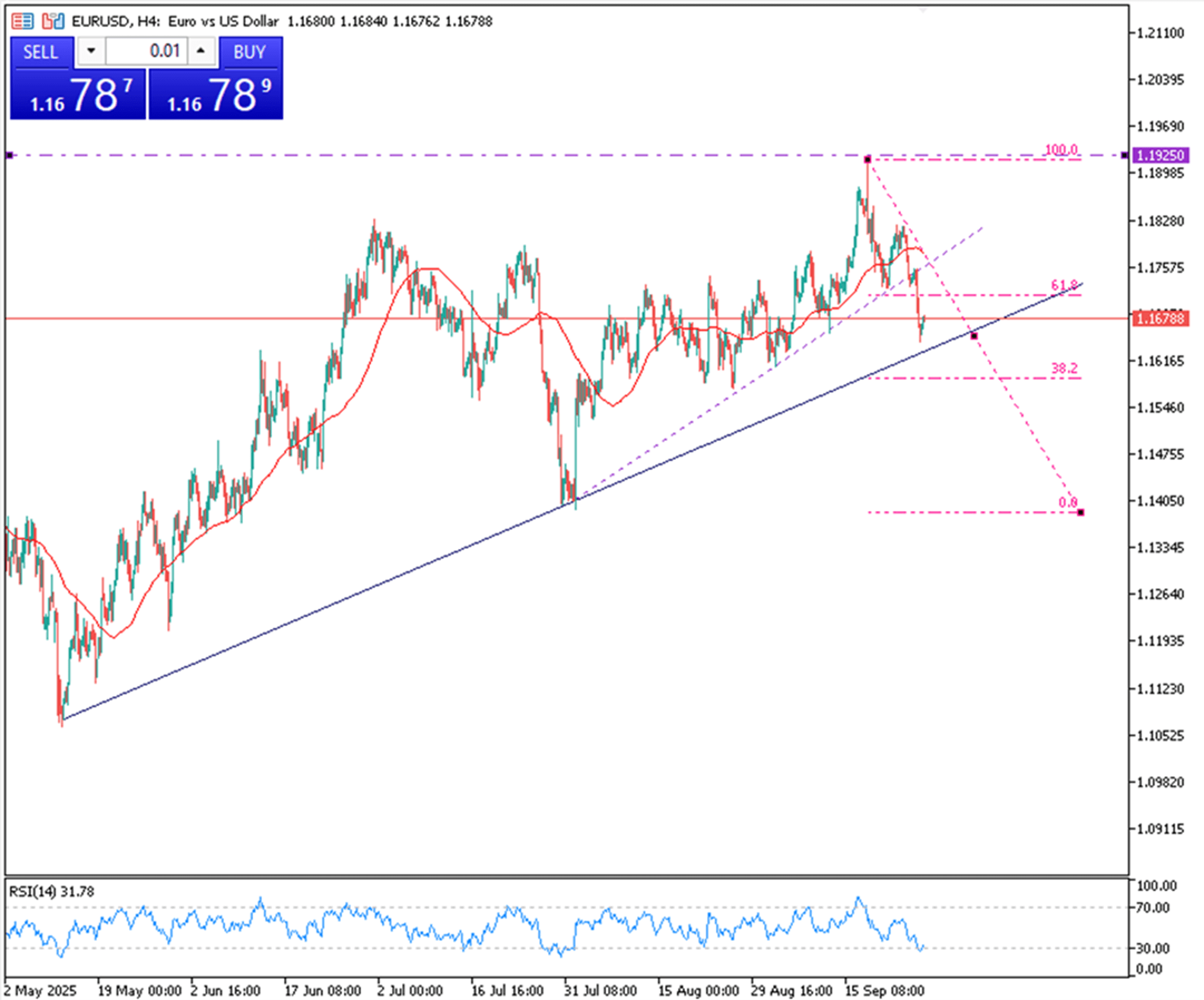

On Friday, the euro traded at $1.1679 in Asia, staging a modest rebound amid shifting technical signals. The pair came under pressure after reversing from the $1.1700 high, where an ‘evening star’ pattern triggered downside momentum. Despite gaining 0.27% over the past month and 4.62% year-to-date, the euro closed Thursday in the $1.1660s, remaining capped by the 20-day moving average at 1.1735, a key resistance level.

From a technical perspective, 1.1640 acts as a near-term support level, with a break lower potentially paving the way toward 1.1570. On the upside, resistance is seen at 1.1760, followed by 1.1825.

| R1: 1.1760 | S1: 1.1640 |

| R2: 1.1825 | S2: 1.1570 |

| R3: 1.1920 | S3: 1.1520 |

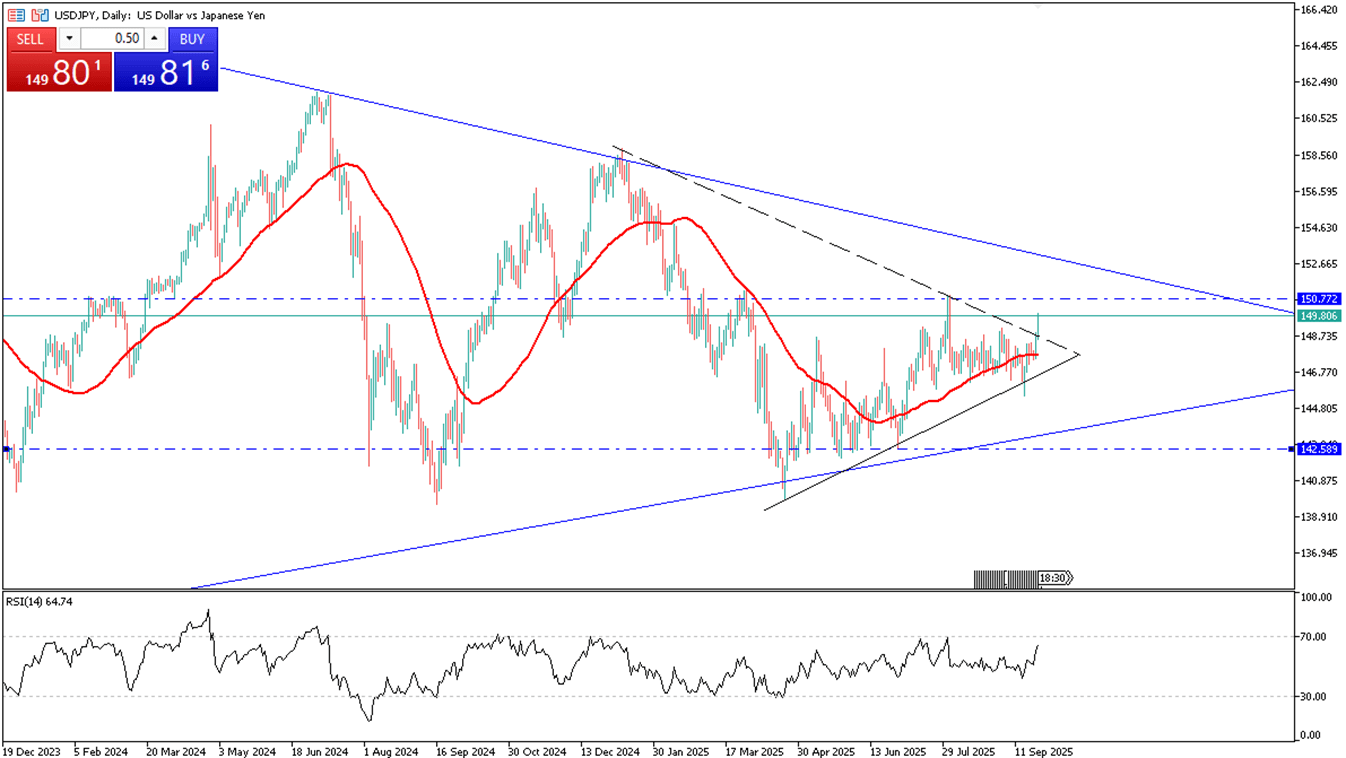

The yen traded near 150 per dollar on Friday, its weakest in nearly two months, pressured by dollar strength after upbeat US data reduced bets on deeper Fed cuts. Weekly jobless claims fell to 218K, underscoring labor market resilience, while Q2 GDP growth was revised to 3.8% annually, the fastest pace in almost two years.

Resistance is at 150.20 while support holds at 147.80.

| R1: 150.20 | S1: 147.80 |

| R2: 150.90 | S2: 145.20 |

| R3: 154.50 | S3: 142.30 |

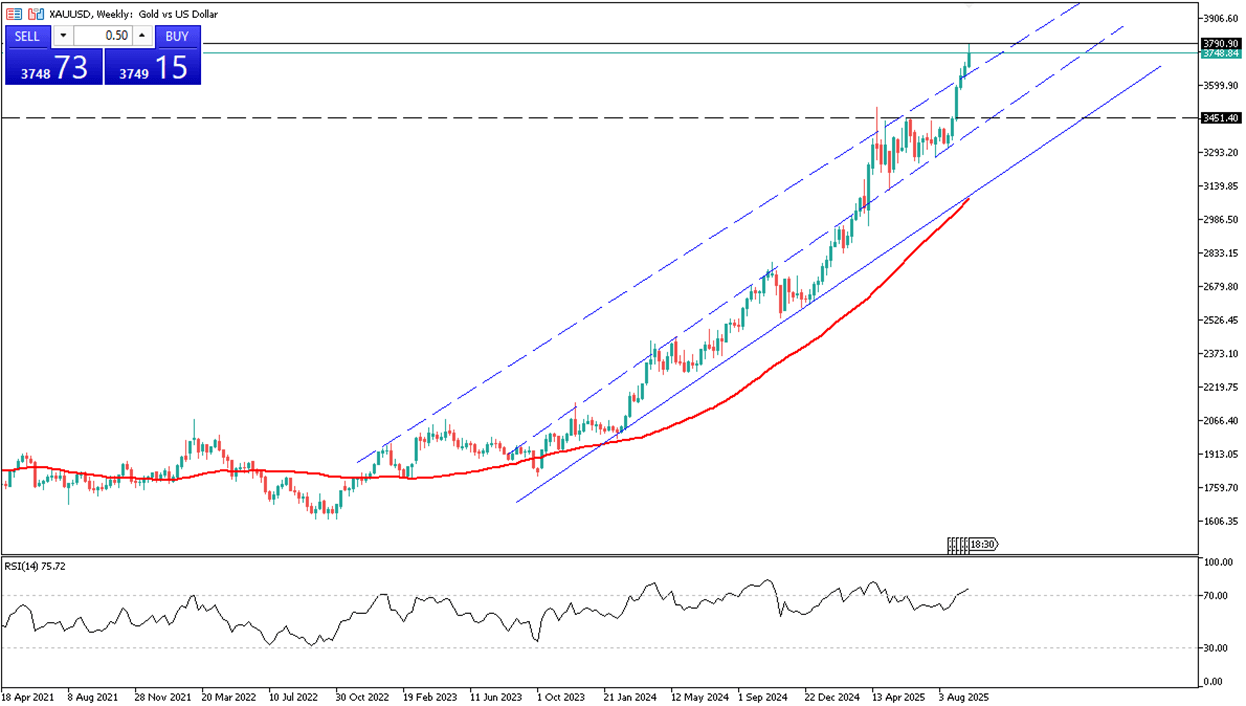

Gold prices retreated to around $3,725 on Friday as stronger U.S. economic data boosted the dollar and tempered expectations for a Fed rate cut ahead of next week’s key inflation report. Weekly jobless claims declined, while Q2 GDP was revised higher, reflecting robust consumer spending and business investment. Following these developments, the probability of a Fed rate cut in October eased from 90% to 85%.

From a technical perspective, holding above $3,750 keeps the outlook constructive. Resistance is seen at $3,790 (all-time high), followed by $3,810 and $3,850. On the downside, the $3,720–$3,725 zone serves as the first support area.

| R1: 3790 | S1: 3720 |

| R2: 3810 | S2: 3600 |

| R3: 3850 | S3: 3550 |

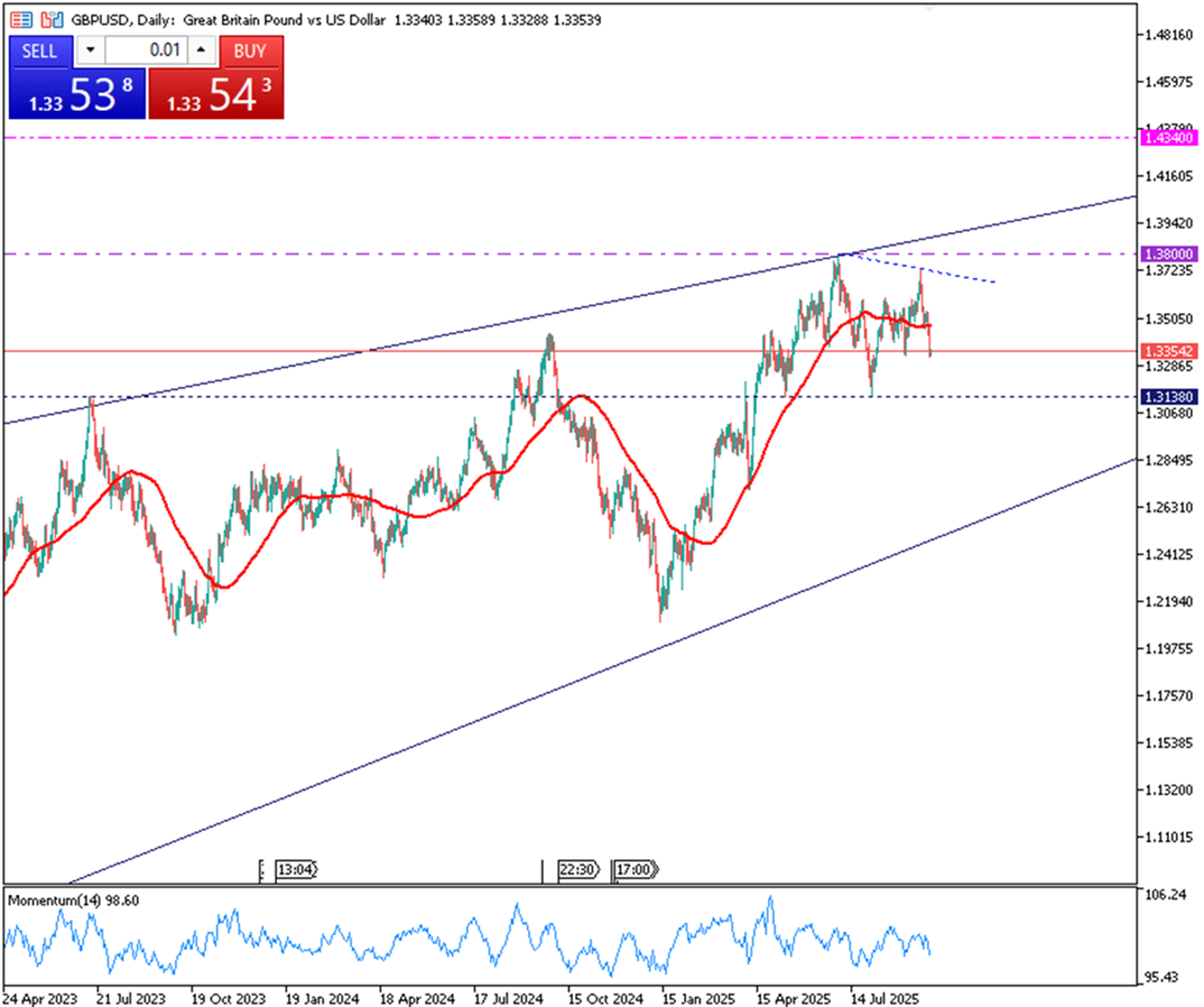

The pound slipped to around 1.3350, its lowest in seven weeks, as investors assessed inflation risks and the BoE outlook. Policymaker Megan Greene urged caution on rate cuts, favoring a pause in November, while Governor Bailey signaled more easing is needed. The mixed signals add uncertainty, with UK inflation at 3.8% in August, expected to edge toward 4%, and unlikely to return to target before 2027.

Technically, 1.3310 serves as the first support level, with a break lower exposing the critical 1.3260 zone. On the upside, resistance is seen at 1.3495, followed by 1.3540.

| R1: 1.3495 | S1: 1.3310 |

| R2: 1.3540 | S2: 1.3260 |

| R3: 1.3775 | S3: 1.3140 |

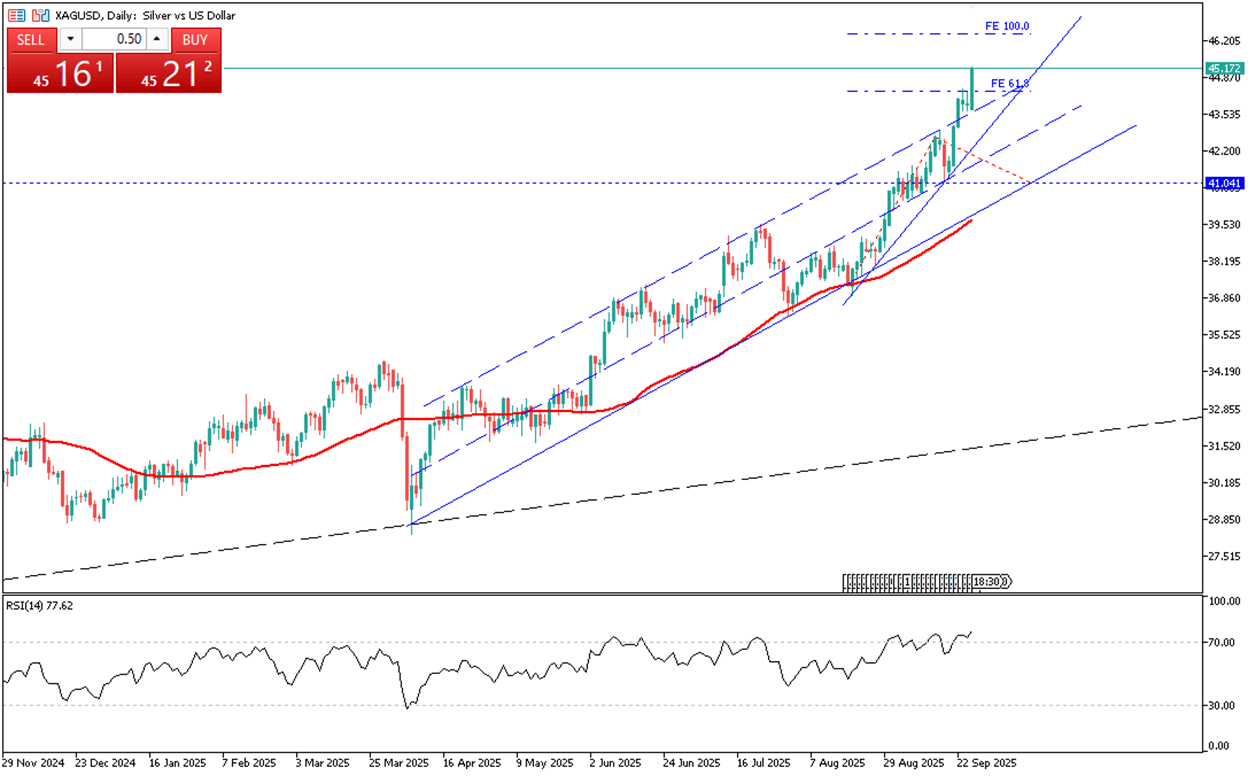

Silver continues to trade around $45 per ounce after slightly pulling back from its 14-year high on Friday. The main reasons are the strengthening of the dollar following strong U.S. economic data and reduced expectations for deeper interest rate cuts by the Federal Reserve. Data released on Thursday showed weekly jobless claims falling to 218,000, indicating a resilient labor market. In addition, Q2 GDP growth was revised up to 3.8% annualized, marking nearly the fastest growth rate in the past two years. While markets still expect a quarter-point Fed cut in October, the total interest rate cut expectation for the rest of the year has decreased from 43 basis points to 39 basis points.

From a technical perspective, if silver holds above $45.25, it could target $46.05, with a further potential upside towards $48. On the downside, the main support level to watch is $43.65.

| R1: 44.05 | S1: 43.65 |

| R2: 48.00 | S2: 42.50 |

| R3: 50.00 | S3: 40.00 |

Bond Market Pushback Takes Center Stage

Bond Market Pushback Takes Center StageMarkets are almost fully pricing in another Federal Reserve rate cut this week, yet the US bond market continues to move in the opposite direction.

Detail Central Bank Expectations Reset the Tone (8-12 December)

Central Bank Expectations Reset the Tone (8-12 December)Traders adjusted positioning before the Federal Reserve’s December decision and evaluated fresh signals from the ECB, BoE and BOJ.

Detail Futures Stall, 10-Year Yield Pushes Above 4.1% (12.08.2025)US stock futures were flat on Monday ahead of the Fed’s meeting, with markets pricing an 88% chance of a 25 bp cut on Wednesday.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!