The U.S. dollar strengthened on Monday as optimism grew that the record government shutdown may soon end, following reports of bipartisan Senate support for a temporary funding deal.

The euro slipped toward 1.1550, while the pound eased ahead of BoE remarks. The yen stayed weak near 153.90 as the Bank of Japan maintained a cautious policy stance. Meanwhile, gold climbed above $4,050 on renewed Fed rate-cut bets, and silver surged past $49, supported by weaker U.S. data and safe-haven demand.

| Time | Cur. | Event | Forecast | Previous |

| 13:30 | USD | FOMC Member Daly Speaks | ||

| 18:00 | USD | 3-Year Note Auction | 3.576% |

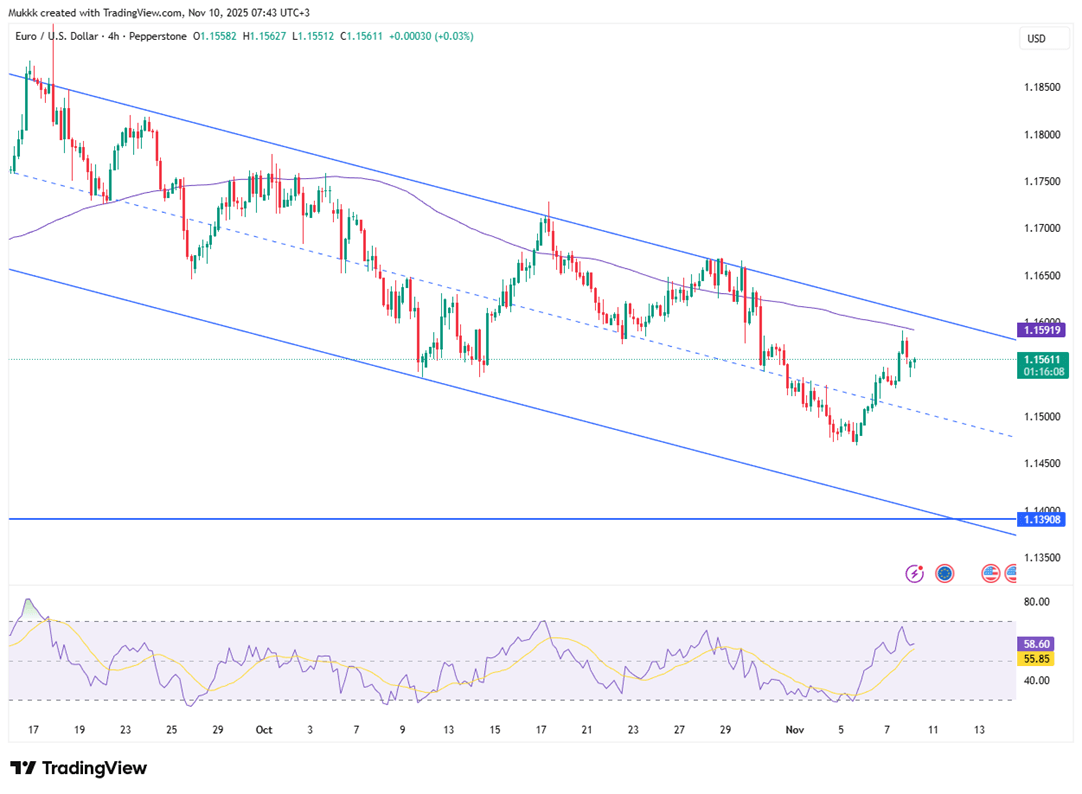

EUR/USD fell to around 1.1550 in early Monday trading after three days of losses, as the U.S. Dollar strengthened on hopes the record government shutdown may soon end. Bloomberg reported that centrist Senate Democrats backed a deal to reopen the government and fund key departments. Treasury Secretary Scott Bessent noted the growing economic impact but said inflation pressures were easing and prices should decline soon.

Technically, 1.1490 is the key support, while resistance is seen at 1.1600.

| R1: 1.1600 | S1: 1.1490 |

| R2: 1.1670 | S2: 1.1430 |

| R3: 1.1710 | S3: 1.1360 |

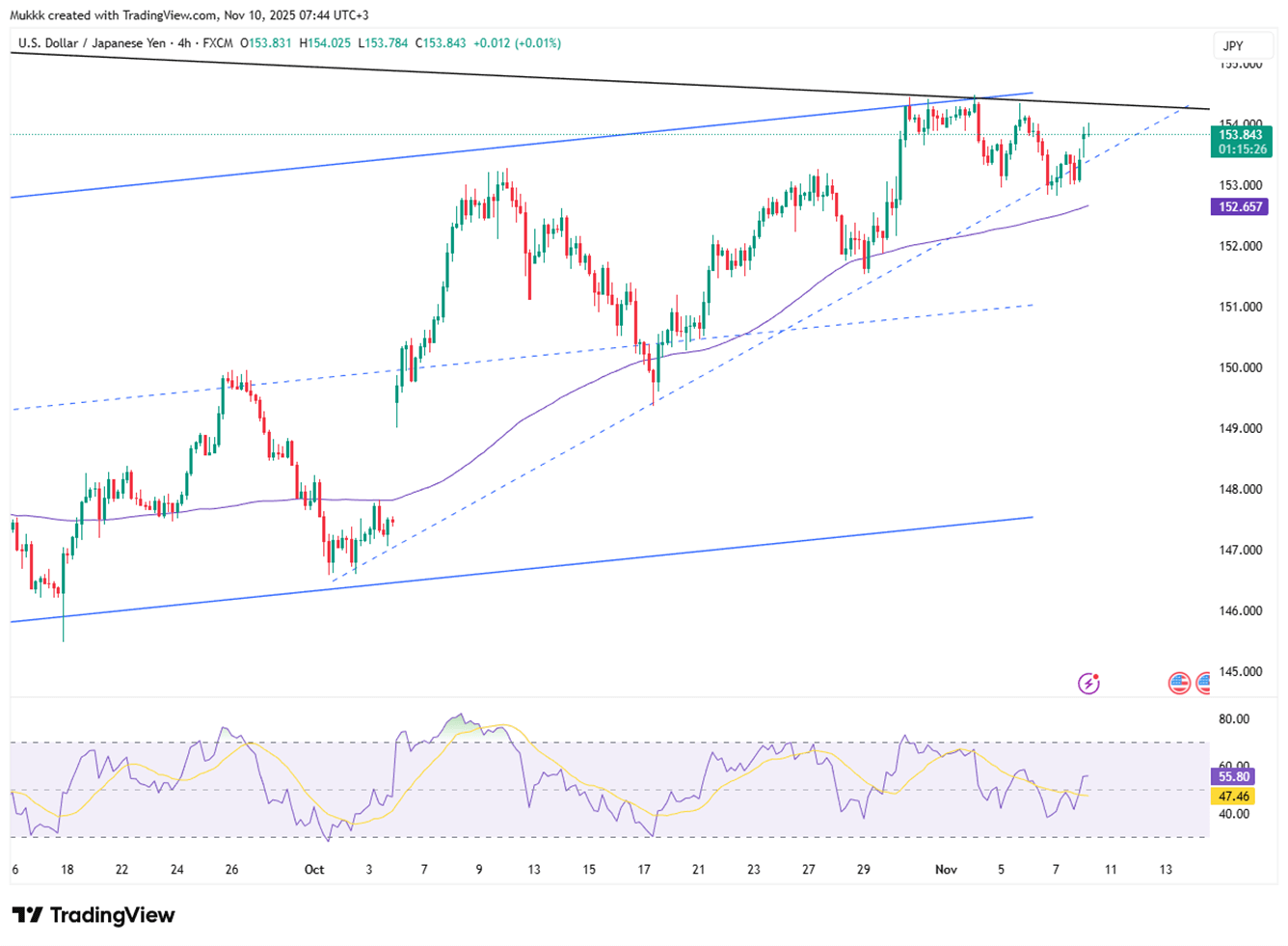

USD/JPY hovered near 153.90, close to its eight-month peak of 154.49, as the Yen stayed under pressure amid uncertainty over the Bank of Japan’s policy outlook. BoJ board member Junko Nakagawa said decisions will remain cautious given global trade risks, noting that corporate profits could soften from tariffs but may recover with improving wages and consumption. The BoJ’s latest summary reflected ongoing uncertainty while hinting at possible adjustments if economic and price conditions improve.

Technically, resistance stands near 154.40, while support is firm at 152.50.

| R1: 154.40 | S1: 152.50 |

| R2: 155.20 | S2: 151.60 |

| R3: 156.20 | S3: 150.70 |

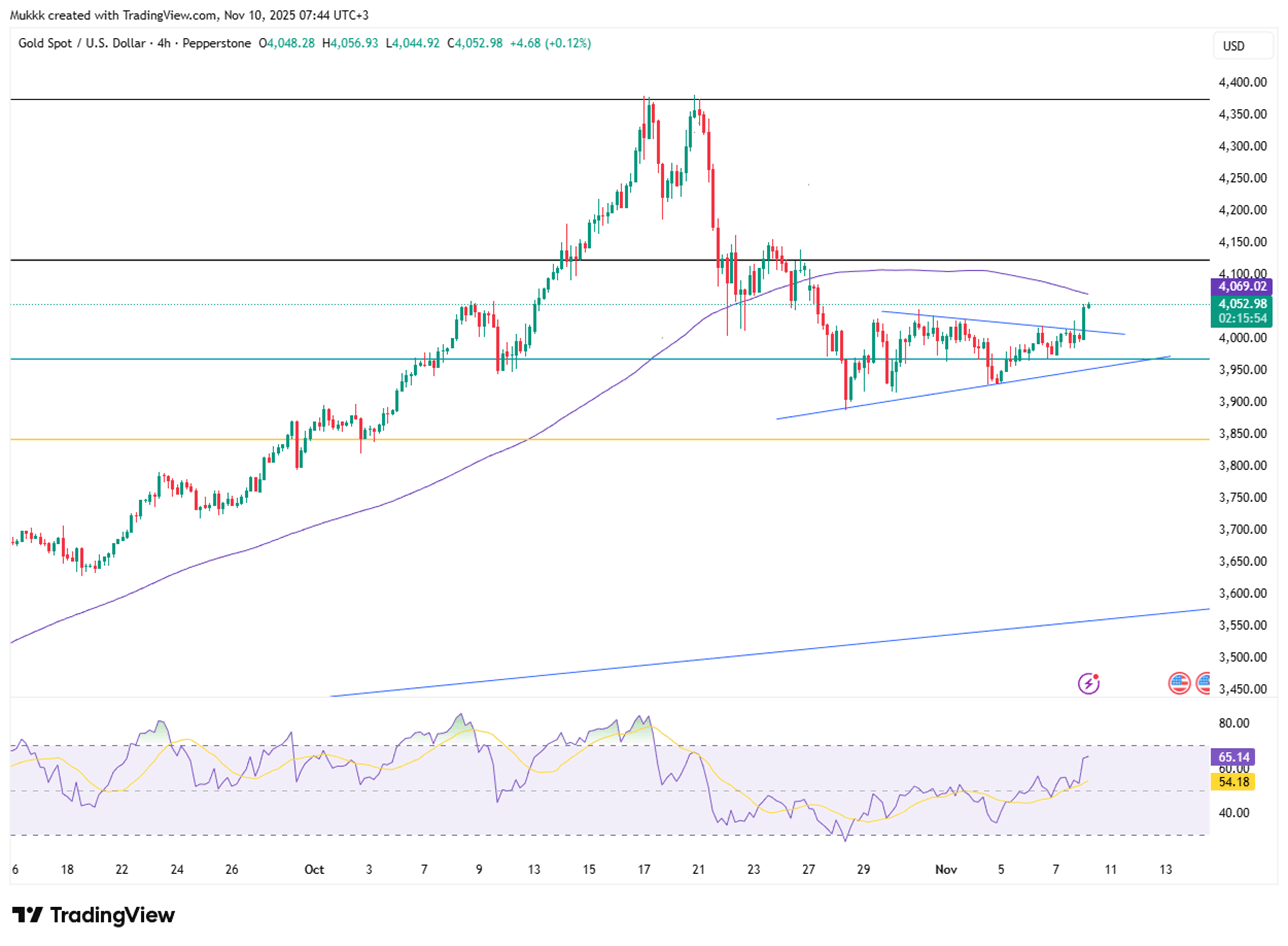

Gold (XAU/USD) rose above $4,050 in early European trading Monday, supported by rising expectations of a U.S. rate cut following weak private payrolls and soft University of Michigan sentiment data. Lower rates tend to reduce the opportunity cost of holding gold. However, optimism over a possible U.S. government shutdown resolution and easing U.S.–China trade tensions could cap further upside. Investors now await Thursday’s CPI and Friday’s Retail Sales data for clearer direction.

From a technical perspective, support is around 4040, and resistance is at 4070.

| R1: 4070 | S1: 4040 |

| R2: 4095 | S2: 4025 |

| R3: 4140 | S3: 3935 |

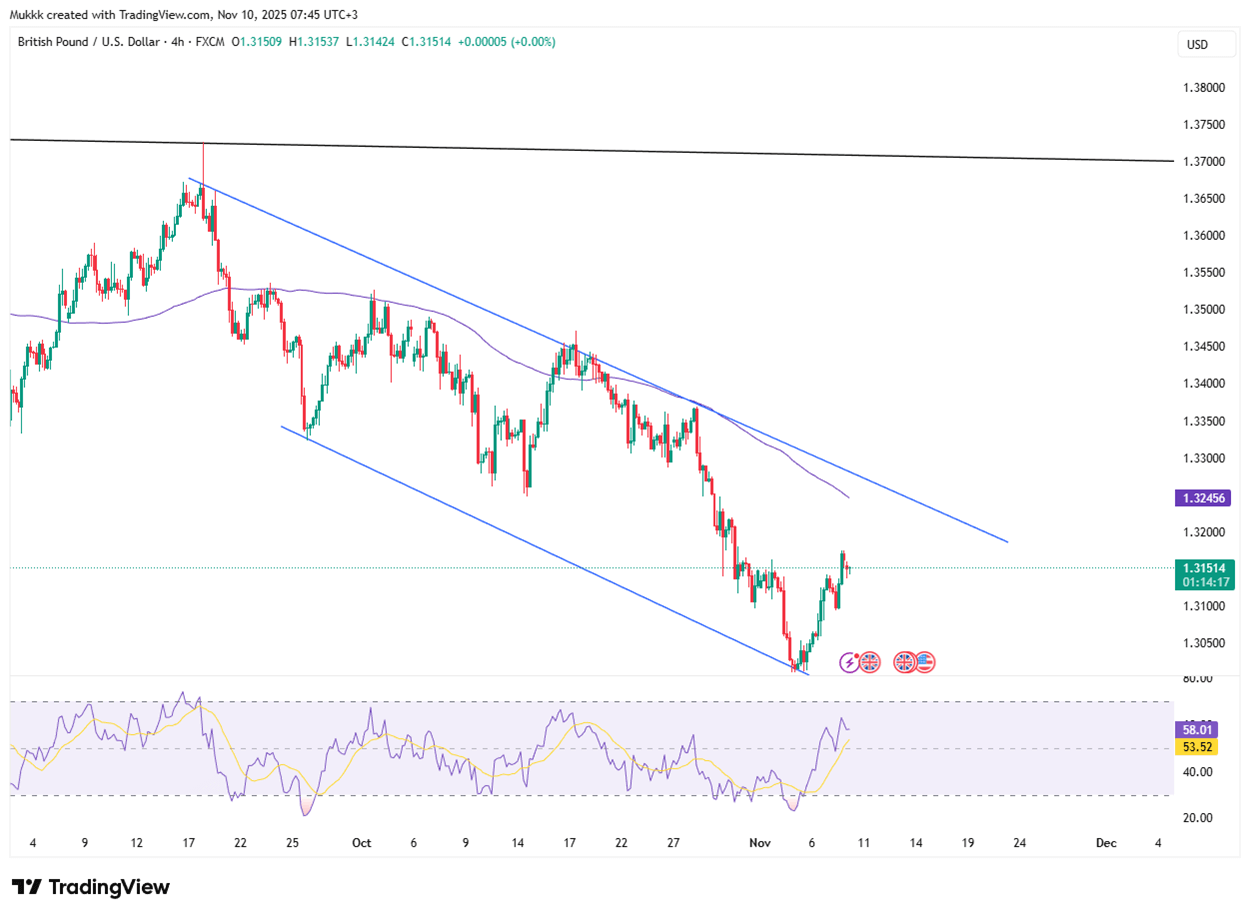

GBP/USD slipped toward 1.3150 in early Asian trading Monday as the U.S. Dollar strengthened amid optimism that the prolonged government shutdown may soon be resolved. Bloomberg reported that Senate Democrats back a deal to reopen key departments, lifting the Dollar. Traders now await remarks from BoE’s Clare Lombardelli. Despite Dollar strength, softer U.S. labor data has reinforced expectations of a December Fed rate cut, with markets pricing roughly a 66% chance of a 25 bps move.

From a technical view, support stands near 1.3050, with resistance around 1.3190.

| R1: 1.3190 | S1: 1.3050 |

| R2: 1.3260 | S2: 1.2990 |

| R3: 1.3350 | S3: 1.2870 |

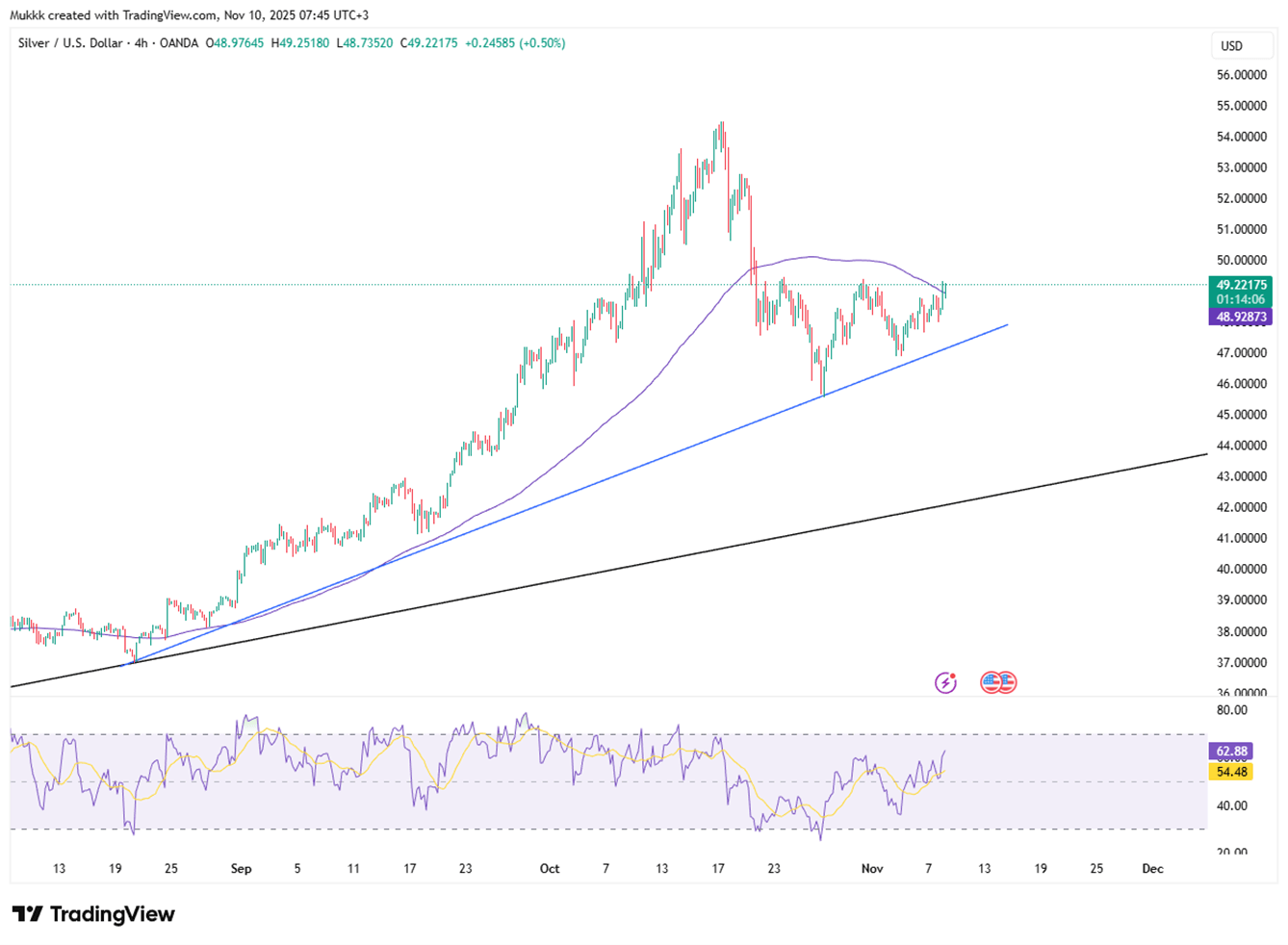

Silver rose above $49 per ounce on Monday, reaching a three-week high as U.S. economic concerns deepened and a weaker dollar increased demand for precious metals. The University of Michigan’s sentiment index fell to 50.3, its second-lowest on record, while private data showed a loss of 153,000 U.S. jobs in October, the biggest for the month in 22 years, largely due to cost-cutting and AI-related layoffs. Markets remain divided on a December Fed rate cut, with odds at about 67% for a 25 bps reduction.

From a technical view, resistance stands near $50.00, while support is located around $47.70.

| R1: 50.00 | S1: 47.70 |

| R2: 52.50 | S2: 45.70 |

| R3: 54.40 | S3: 44.00 |

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

Detail March Starts With Geopolitical Turmoil (2-6 March)

March Starts With Geopolitical Turmoil (2-6 March)Global markets began the week in a state of high alert following coordinated US and Israeli strikes on Iran over the weekend, which resulted in the death of Supreme Leader Ayatollah Ali Khamenei.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!