The dollar weakened on Thursday after Fed minutes revealed policymakers see rate cuts as likely later this year, pushing Treasury yields lower and lifting the euro and pound.

Gold rose near $3,320 on safe-haven demand, while the yen gained as trade tensions escalated following Trump’s confirmed tariffs on Brazil and Japan. Silver extended losses despite dovish Fed signals, pressured by a stronger dollar and rising yields. Markets remain cautious amid mixed U.S. data and global trade uncertainties.

| Time | Cur. | Event | Forecast | Previous |

| 06:00 | EUR | German CPI (MoM) (Jun) | 0.0% | 0.1% |

| 12:30 | USD | Initial Jobless Claims | 236K | 233K |

| 17:00 | USD | 30-Year Bond Auction | 4.844% | |

| 20:30 | USD | Fed's Balance Sheet | 6,660B |

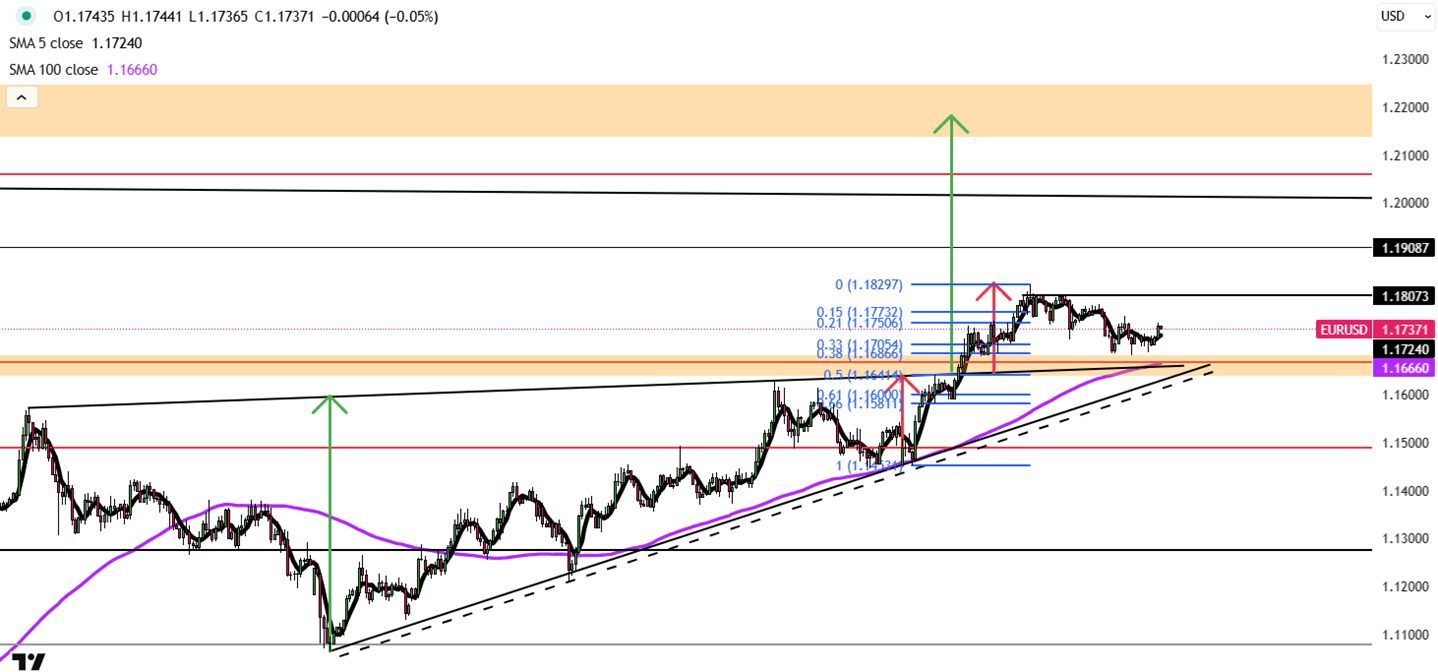

The EUR/USD pair rose 0.2% to $1.1747 on Thursday, supported by broad U.S. dollar weakness after Treasury yields fell and the Fed's June minutes signaled most policymakers view rate cuts as appropriate later this year. While Trump’s new tariff threats had limited impact beyond Brazil, easing geopolitical concerns and improving risk sentiment supported the euro, which gained as markets shifted focus away from aggressive U.S. trade actions.

Resistance for the pair is at 1.1750, while support is at 1.1685.

| R1: 1.1750 | S1: 1.1685 |

| R2: 1.1810 | S2: 1.1600 |

| R3: 1.1830 | S3: 1.1545 |

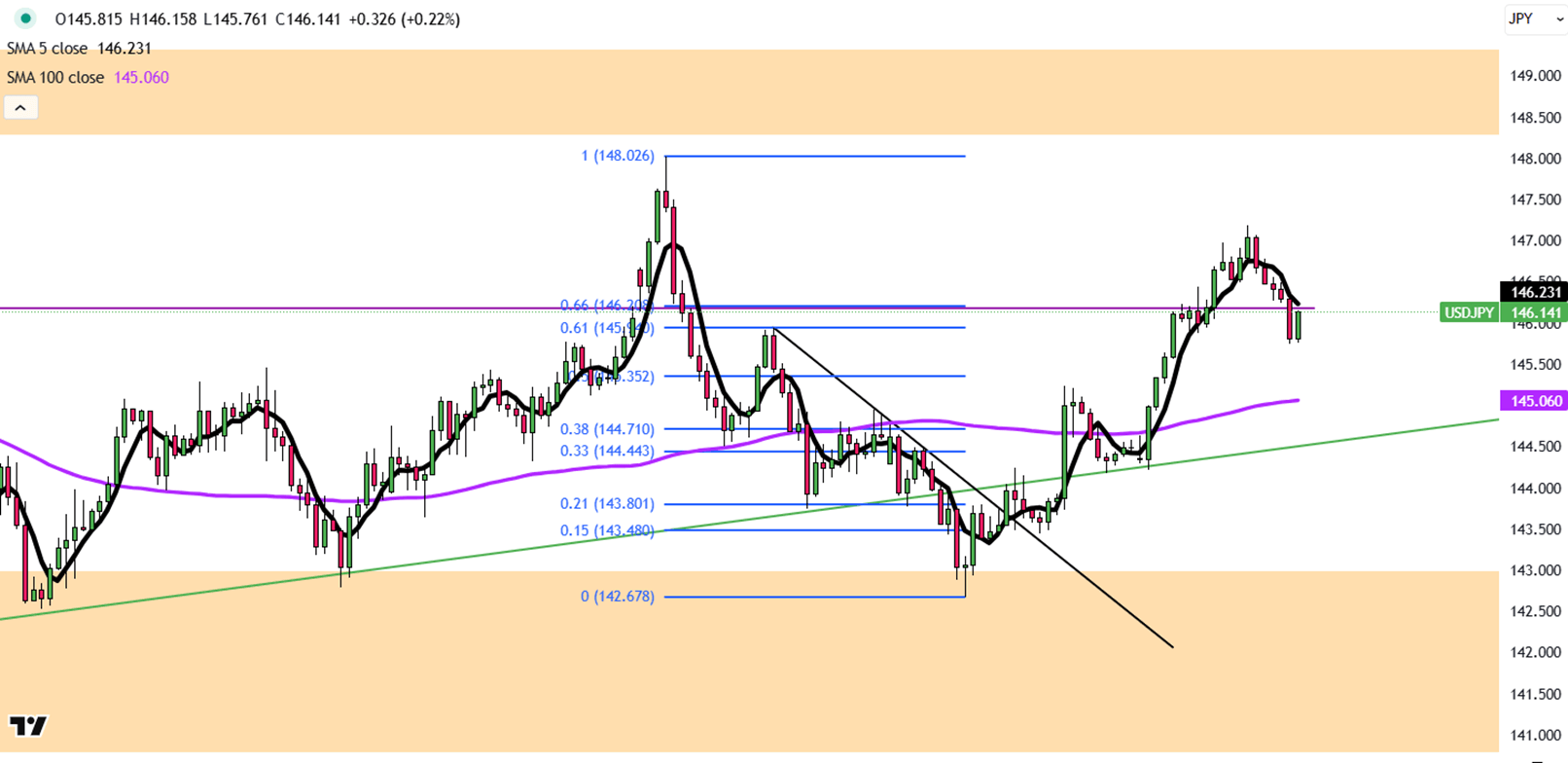

The Japanese yen rose to around 146 per dollar on Thursday, extending gains as U.S. Treasury yields fell and the dollar weakened. Rising trade tensions added to risk aversion after Trump announced a 50% tariff on Brazilian imports and confirmed a 25% tariff on Japanese goods from August 1. U.S.-Japan talks stalled over Japan’s rice market protections. PM Ishiba criticized the tariffs but hopes for continued dialogue, as analysts warn of GDP impacts.

Resistance is at 147.00, with major support at 144.85.

| R1: 147.00 | S1: 144.85 |

| R2: 148.15 | S2: 143.55 |

| R3: 148.65 | S3: 142.40 |

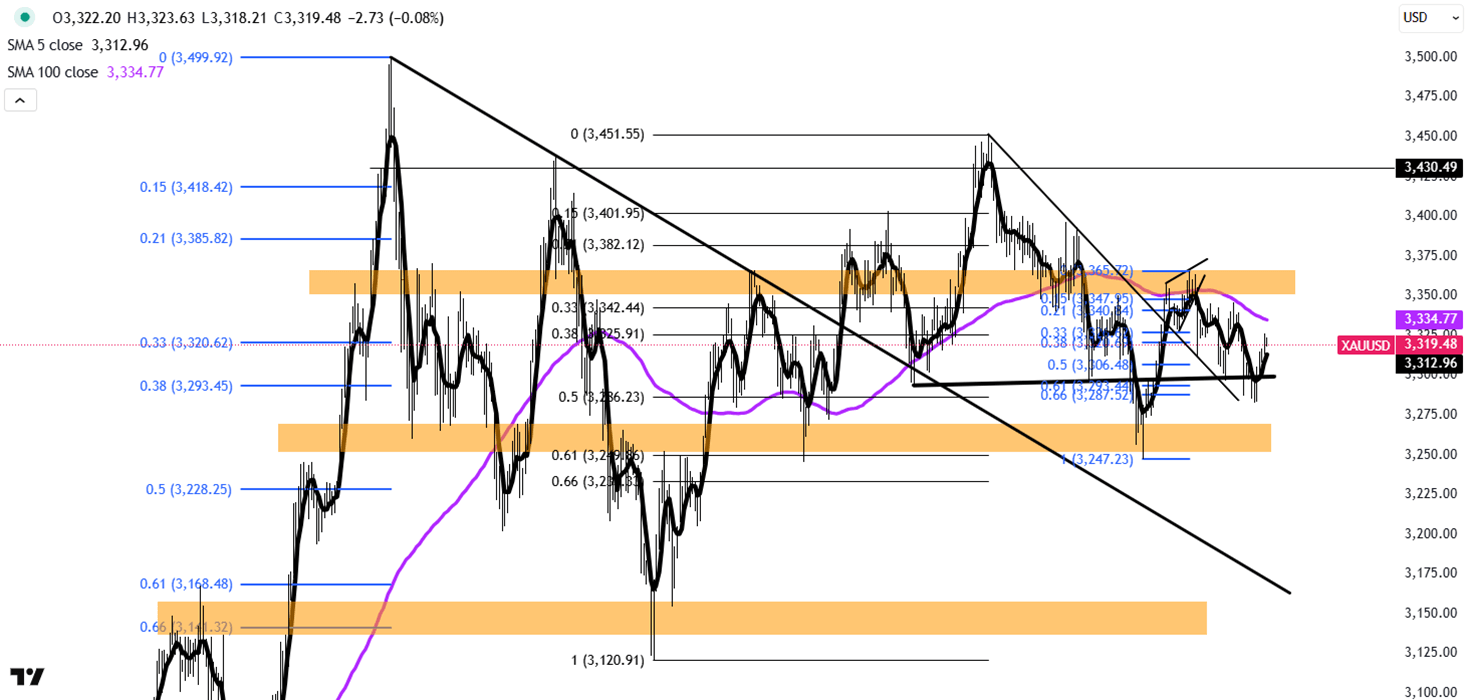

Gold climbed to around $3,320 per ounce on Thursday, extending gains as a weaker U.S. dollar and trade tensions supported demand. Investors evaluated new tariff warning letters from President Trump targeting Brazil, raising concerns about broader disruptions. Meanwhile, the Fed’s June minutes showed officials divided on rate cuts, with views ranging from immediate easing to no cuts this year, maintaining a cautious, data-driven stance amid mixed economic signals.

Resistance is at $3,365, while support holds at $3,285.

| R1: 3365 | S1: 3285 |

| R2: 3395 | S2: 3250 |

| R3: 3430 | S3: 3205 |

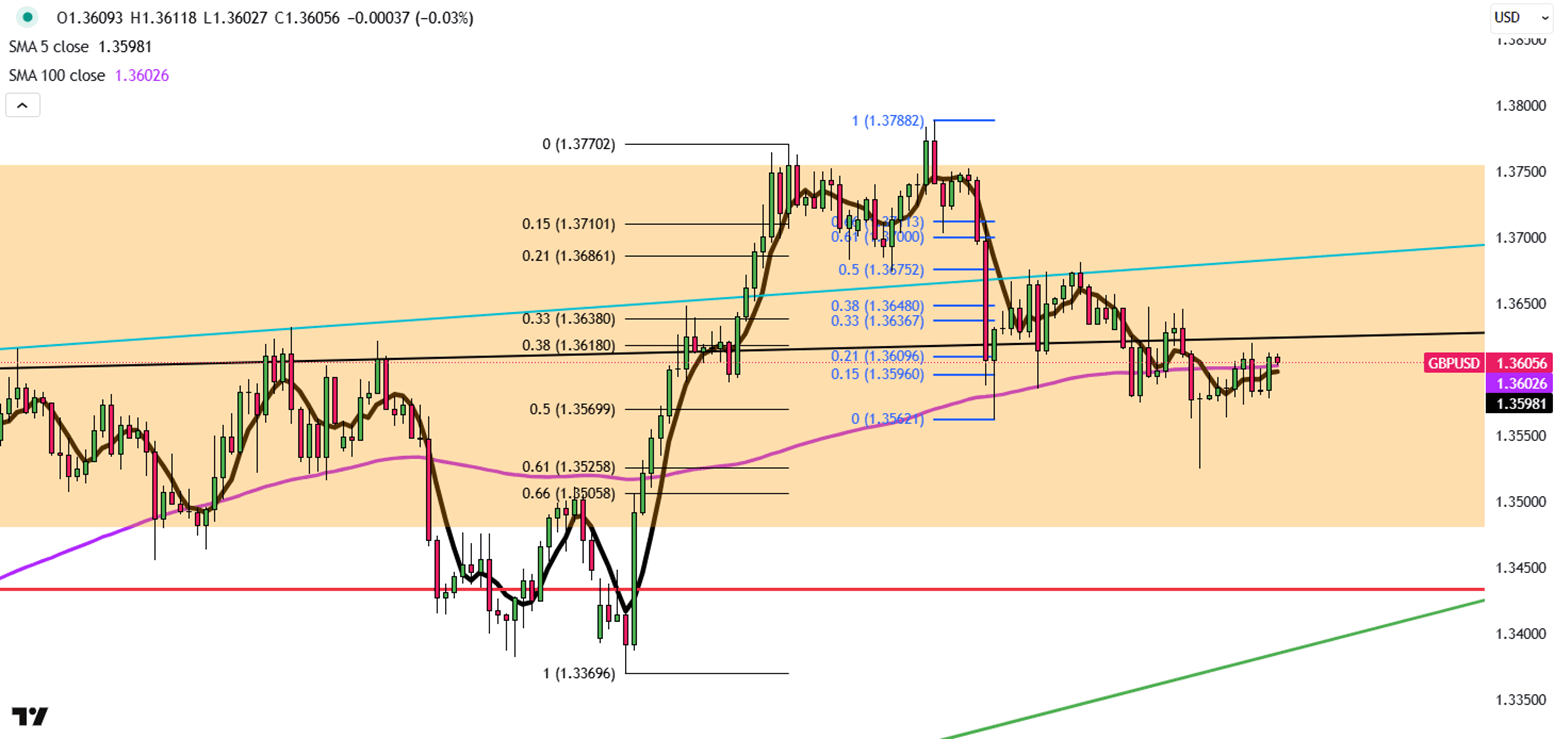

GBP/USD rose 0.15% to around 1.360 on Thursday, supported by a weaker U.S. dollar after Treasury yields fell and Fed minutes signaled possible rate cuts later this year. Despite the U.K. government’s recent welfare policy reversal and concerns over rising public debt, the pound gained as market focus shifted to global risk appetite and dollar softness, though fiscal uncertainty in the U.K. may cap further gains.

Resistance is at 1.3600, while support holds at 1.3500.

| R1: 1.3600 | S1: 1.3500 |

| R2: 1.3700 | S2: 1.3430 |

| R3: 1.3760 | S3: 1.3380 |

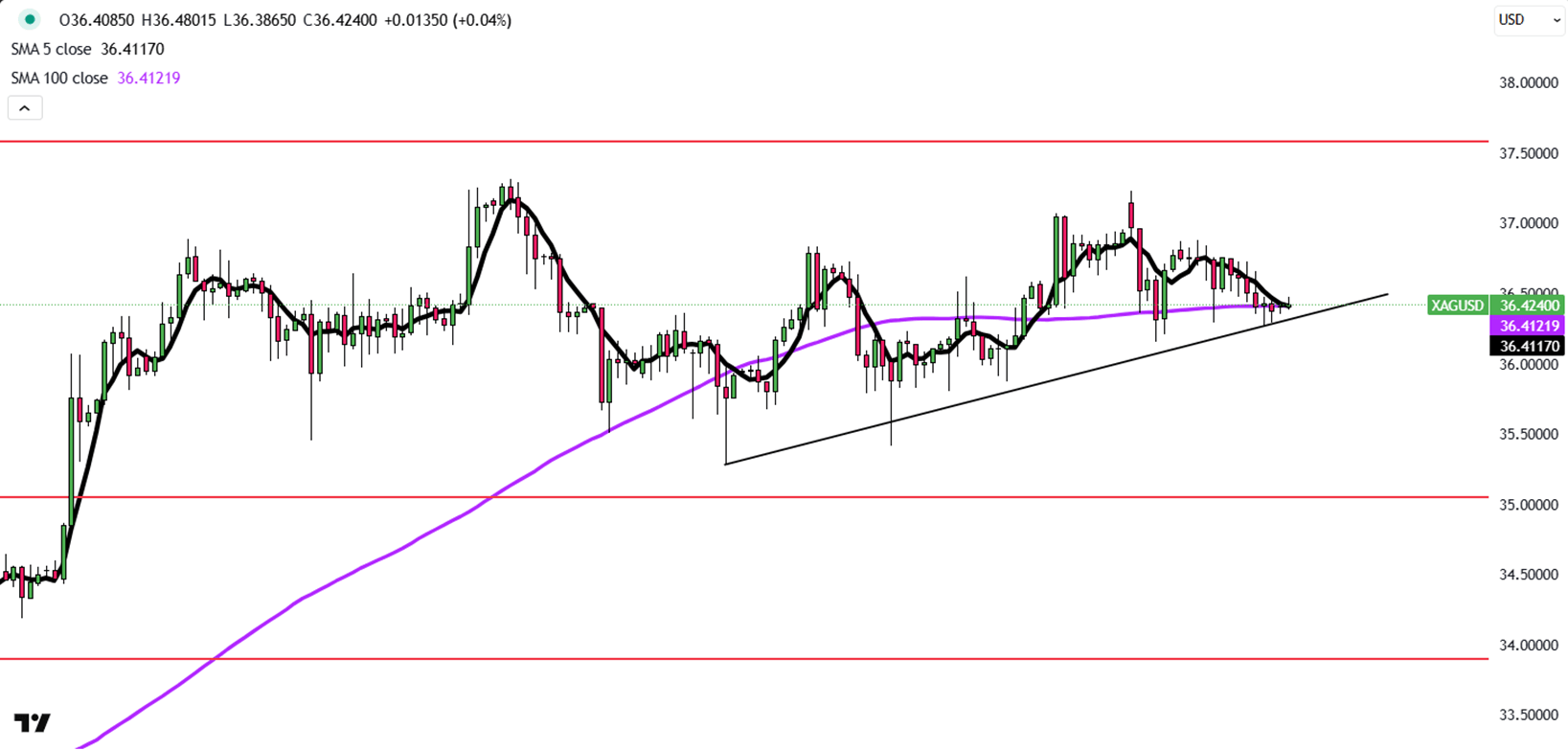

Silver traded below $36.50 per ounce on Thursday, extending losses as FOMC minutes suggested a possible Fed rate cut later this year, though officials were divided on timing. Dovish signals provided some support, but a stronger U.S. dollar and rising Treasury yields weighed on demand for non-yielding assets. Renewed trade tensions, with Trump confirming new tariffs on copper and potential duties on pharmaceuticals, added caution and limited gains in precious metals.

Resistance is at 37.50, while support holds at 35.40.

| R1: 37.50 | S1: 35.40 |

| R2: 39.00 | S2: 34.85 |

| R3: 41.00 | S3: 33.80 |

Currency markets remained volatile as ongoing Middle East tensions continued to shape global sentiment.

Hormuz Blockade Rattles Markets (09 - 13 March)

Hormuz Blockade Rattles Markets (09 - 13 March)Global sentiment was dominated this week by the second week of the war with Iran and the effective blockade of the Strait of Hormuz, driving Brent crude prices above $100/barrel. Despite a catastrophic US labor report showing a loss of 92,000 jobs in February, safe-haven demand pushed the US Dollar Index to 99.1. The energy shock has ignited fears of "stagflation," particularly in Europe and Japan, as soaring fuel costs threaten to reverse recent disinflationary trends.

Detail Oil Shock Drives Dollar Higher (03.09.2026)Global markets opened the week under pressure as escalating Middle East tensions and disruptions in the Strait of Hormuz pushed oil prices above $100 per barrel.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!