The US dollar weakened Thursday as concerns mounted over Fed independence following Trump’s comments about replacing Chair Powell. EUR/USD advanced, supported by dollar softness despite dovish ECB signals.

The yen gained on easing geopolitical risks, while gold held steady ahead of US data. GBP/USD extended its rally on risk appetite and UK labor signals. Silver remained strong on Fed cut bets and industrial demand.

| Time | Cur. | Event | Forecast | Previous |

| 12:30 | USD | Continuing Jobless Claims | 1,950K | 1,945K |

| 12:30 | USD | Core PCE Prices (Q1) | 3.40% | 2.60% |

| 12:30 | USD | Durable Goods Orders (MoM) (May) | 8.60% | -6.30% |

| 12:30 | USD | GDP (QoQ) (Q1) | -0.20% | 2.40% |

| 12:30 | USD | Initial Jobless Claims | 244K | 245K |

| 18:30 | EUR | ECB President Lagarde Speaks | ||

| 23:30 | JPY | Tokyo Core CPI (YoY) (Jun) | 3.30% | 3.60% |

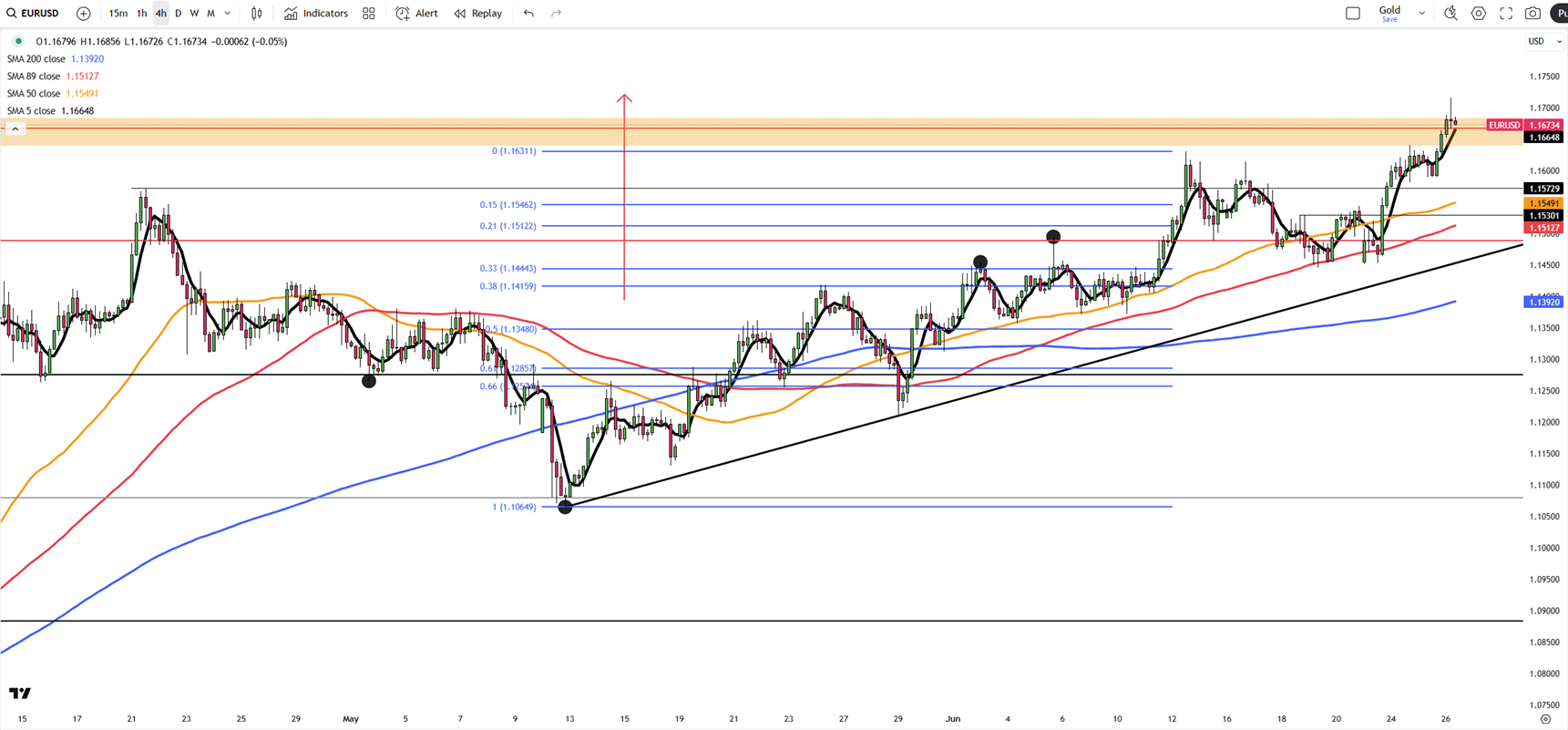

EUR/USD rose toward 1.1690 in Thursday’s Asian session as the US dollar weakened on concerns over Fed independence. Markets await the final US Q1 GDP reading later today. President Trump said he is considering candidates to replace Fed Chair Powell, including Warsh, Hassett, Bessent, Malpass, and possibly Waller, raising fears of political influence on Fed policy and weighing on the dollar.

In Europe, ECB officials remain cautious amid geopolitical risks and Trump’s tariffs. ECB’s Villeroy said further rate cuts are possible, a dovish signal that may limit euro gains.

Resistance is located at 1.1715, while support is seen at 1.1630

| R1: 1.1715 | S1: 1.1630 |

| R2: 1.1800 | S2: 1.1550 |

| R3: 1.1900 | S3: 1.1450 |

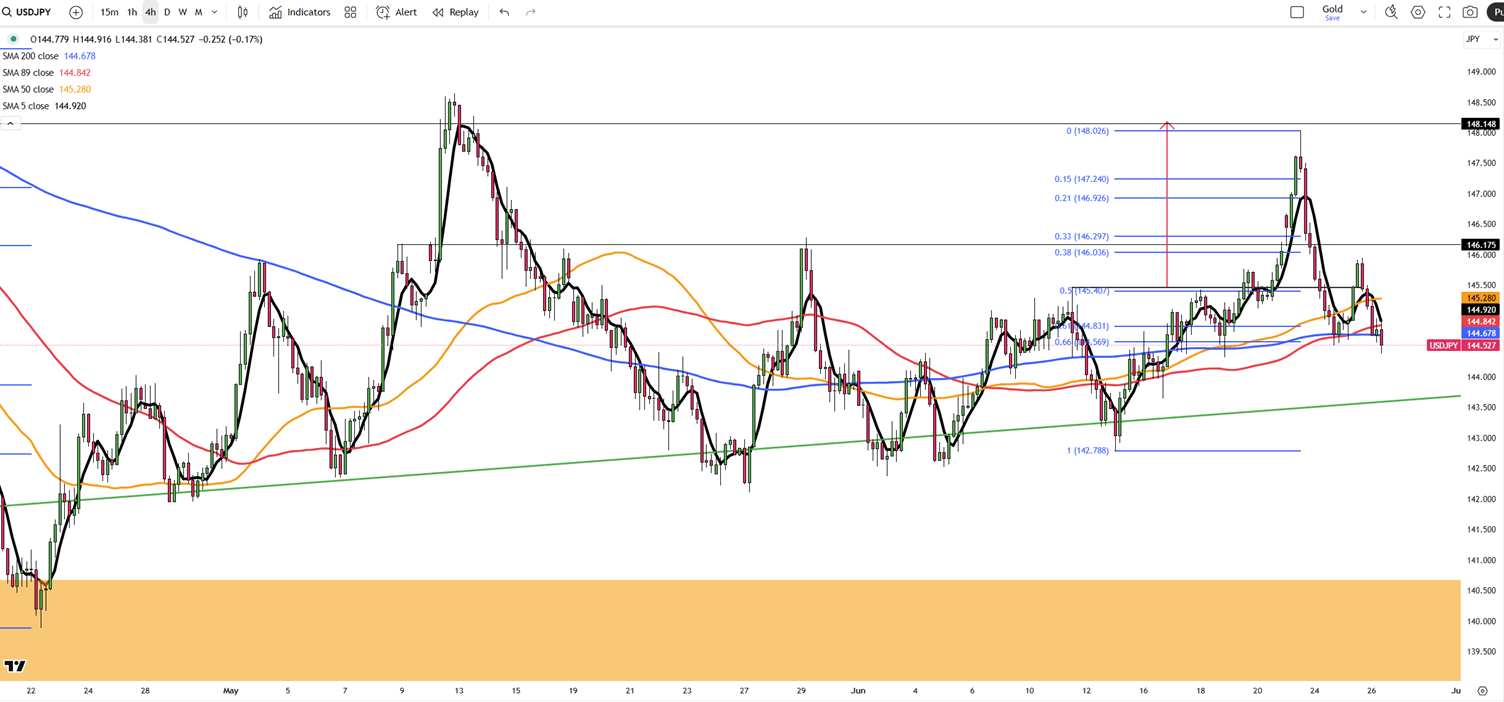

The yen rose past 145 on Thursday, rebounding as the US dollar weakened on easing Middle East tensions and renewed Fed rate cut expectations. Sentiment improved with US-Iran talks planned next week and the Israel-Iran ceasefire holding. Fed Chair Powell said rate cuts would have continued without tariff-driven inflation.

The BoJ’s latest summary showed a cautious stance, with future hikes dependent on meeting growth and inflation forecasts amid global uncertainties.

The key resistance is at $145.70 meanwhile the major support is located at $143.55.

| R1: 145.70 | S1: 143.55 |

| R2: 146.20 | S2: 142.45 |

| R3: 147.00 | S3: 141.00 |

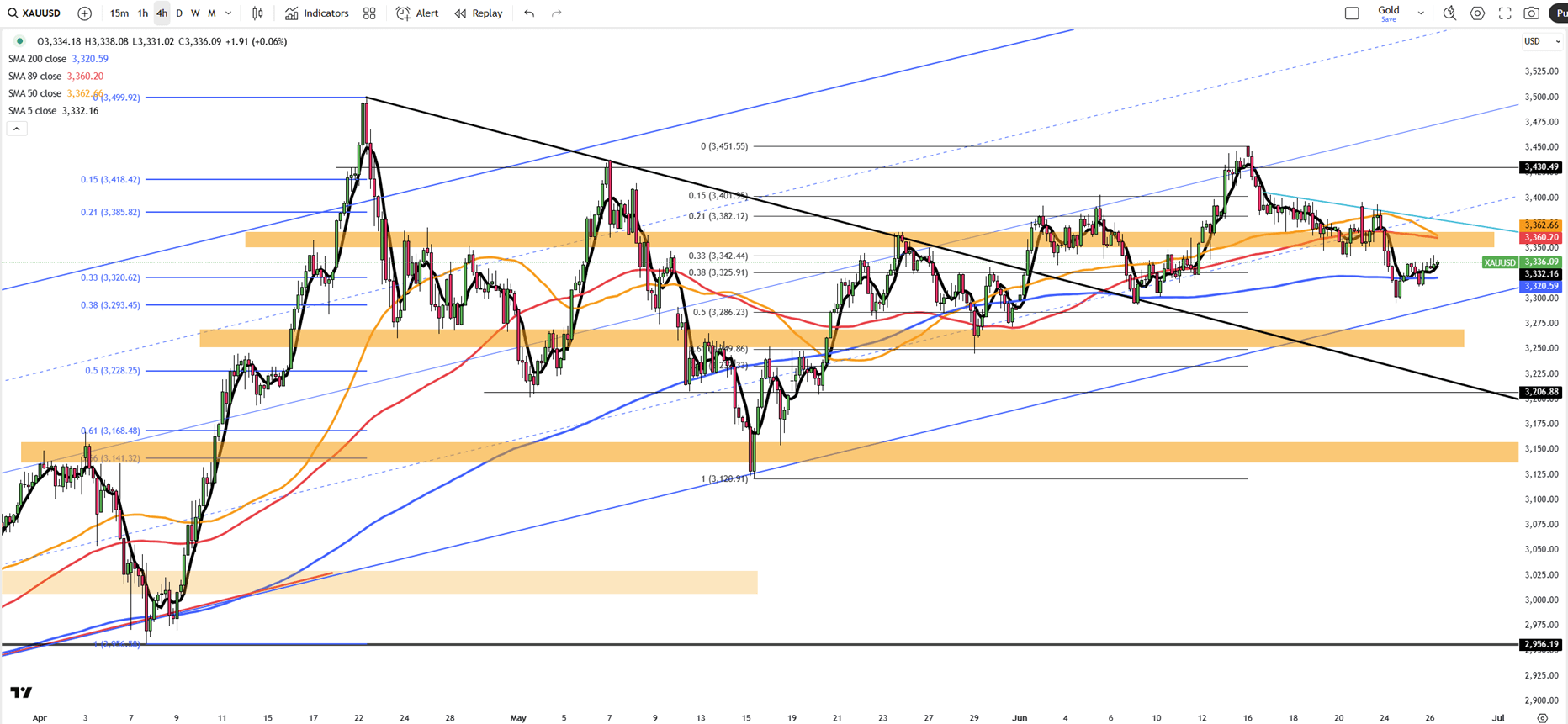

Gold held above $3,330 on Thursday as investors awaited key US data for Fed policy clues and monitored geopolitical developments. Upcoming US-Iran talks aim to ease nuclear tensions, weighing on safe-haven demand, though doubts remain over the Iran-Israel ceasefire’s durability. Fed Chair Powell stayed cautious, saying the Fed can handle tariff-driven inflation but isn’t ready to cut rates yet. Weak June consumer confidence raised concerns about jobs and trade, supporting rate cut expectations.

Markets now await final Q1 GDP and jobless claims on Thursday, followed by PCE data on Friday.

Resistance is seen at $3,355, while support holds at $3,285.

| R1: 3355 | S1: 3285 |

| R2: 3385 | S2: 3235 |

| R3: 3430 | S3: 3205 |

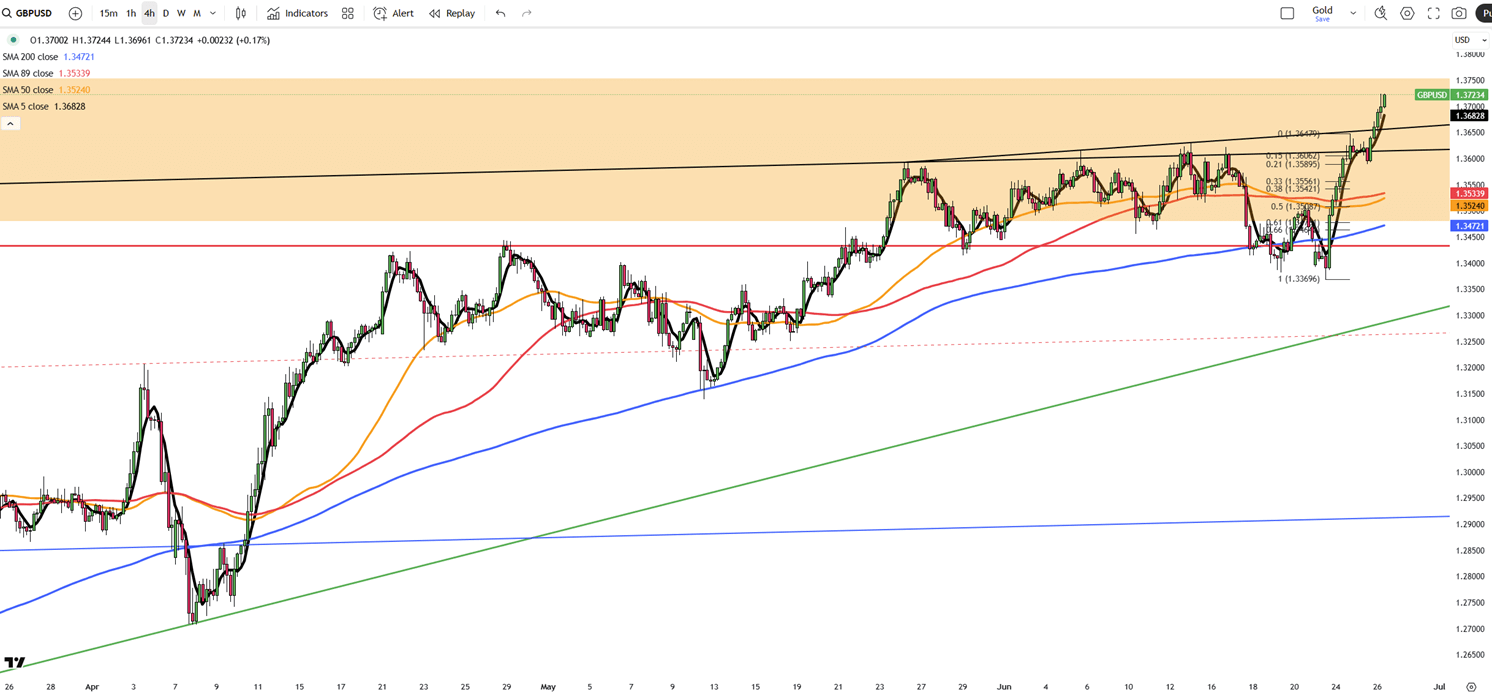

GBP/USD rose for a fourth session, trading near 1.3710 and hitting 1.3724, its highest since January 2022, supported by improved risk sentiment amid the Israel-Iran ceasefire.

Trump confirmed a US-Iran meeting next week but questioned its value, citing damage to Iran’s nuclear sites. He may replace Fed Chair Powell by September, with Warsh and Hassett among the candidates. Powell warned tariffs could fuel both short- and long-term inflation, advising caution on cuts.

In the UK, BoE Governor Bailey noted signs of labor market softening, including slower wage growth and rising employer social security costs.

Resistance is seen at 1.3760, while support holds at 1.3660.

| R1: 1.3760 | S1: 1.3660 |

| R2: 1.3835 | S2: 1.3590 |

| R3: 1.3900 | S3: 1.3500 |

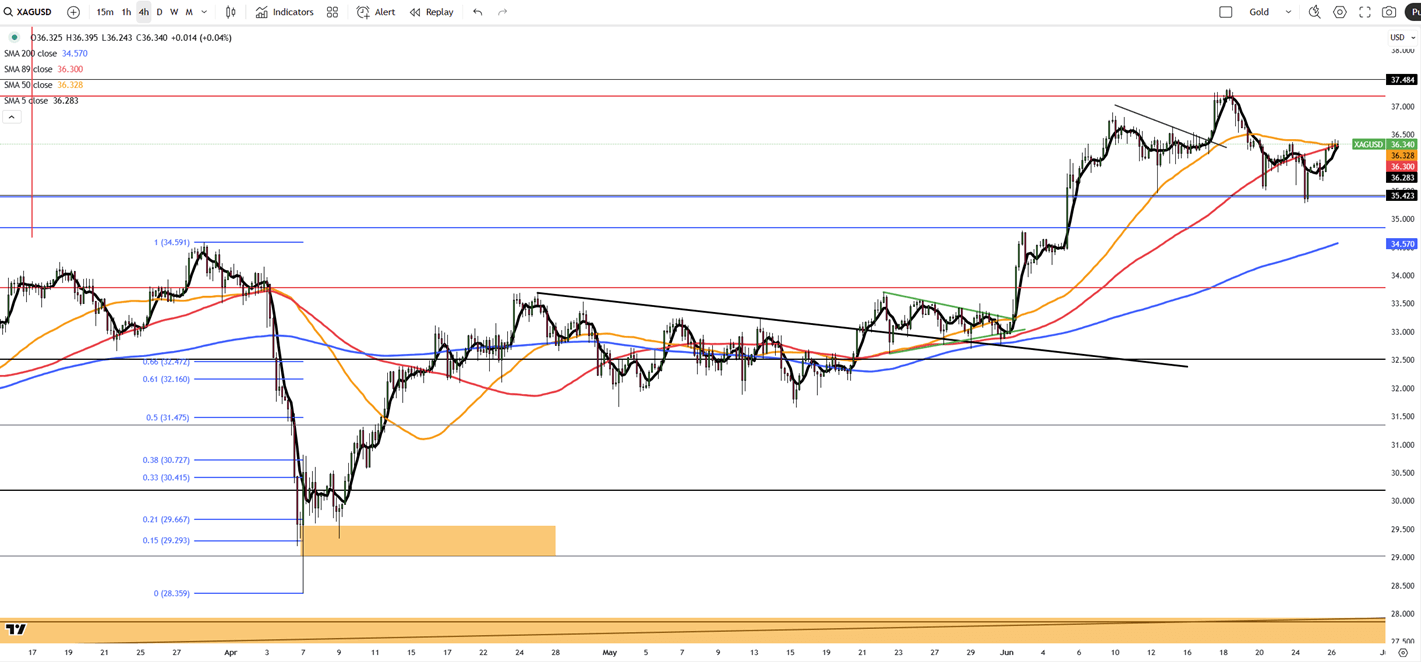

Silver held above $36.20 on Thursday after a near 1% gain, supported by a weaker dollar and lower Treasury yields amid rising Fed rate cut expectations. Fed Chair Powell said rates should stay on hold due to tariff-driven inflation but noted easing would have continued otherwise.

US-Iran talks are set for next week, with the ceasefire holding. Silver also gained from strong industrial demand and ongoing supply issues, outperforming gold in June with a 10% rise versus gold’s 1% gain.

Resistance is seen at 37.50, while support holds at 35.40.

| R1: 37.50 | S1: 35.40 |

| R2: 39.00 | S2: 34.85 |

| R3: 41.00 | S3: 33.80 |

Global markets on Friday leaned cautiously constructive as traders positioned for a possible Fed rate cut next week, persistent tightness in precious metals, and rising expectations of a BOJ shift.

Detail Dovish Wave Lifts Metals as Yen Tightens (12.04.2025)Markets on Thursday leaned toward a dovish global outlook, lifting precious metals and reshaping major currency moves.

Detail Gold Climbs, Yen Recovers on Soft US Signals (12.03.2025)Rate-cut expectations overtook Wednesday trading.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!