Markets traded cautiously in Friday’s Asian session ahead of the key U.S. Nonfarm Payrolls report. The euro rebounded to 1.1670 as traders awaited Eurozone Q2 GDP, with expectations of 1.4% YoY growth, while the U.S. dollar weakened on rising Fed cut bets after soft labor data.

The yen held near 148.50, with focus on NFP for confirmation of labor market cooling. Gold stayed near record highs at $3,352, supported by safe-haven demand, while silver advanced to $40.85, both underpinned by expectations of Fed easing. The pound steadied above $1.34, though fiscal uncertainty limited upside.

| Time | Cur. | Event | Forecast | Previous |

| 12:30 | USD | Average Hourly Earnings (MoM) (Aug) | 0.3% | 0.3% |

| 12:30 | USD | Nonfarm Payrolls (Aug) | 75K | 73K |

| 12:30 | USD | Unemployment Rate (Aug) | 4.3% | 4.2% |

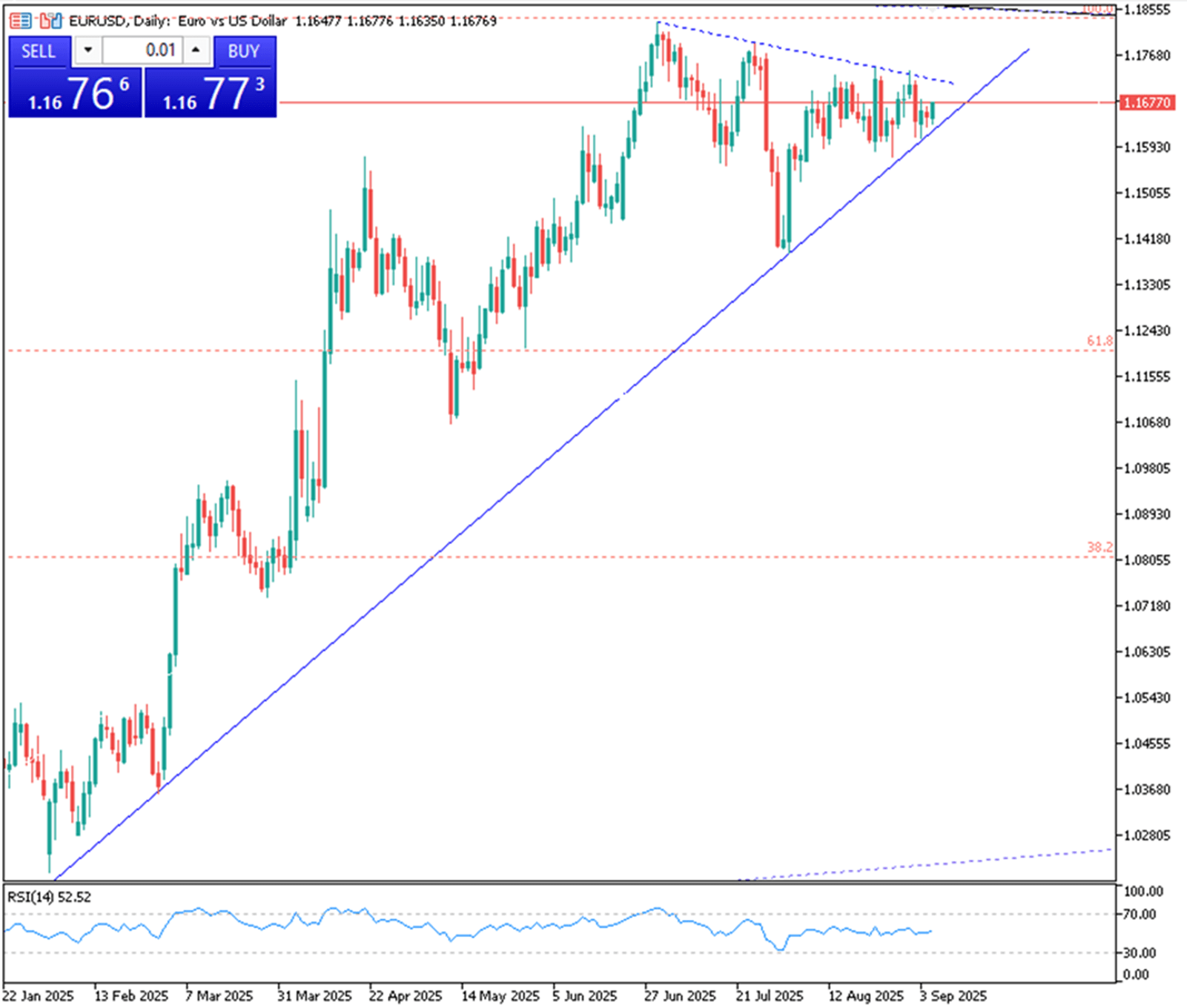

EUR/USD trades near 1.1670 in Friday’s Asian session, rebounding from prior losses. The Euro is supported ahead of Eurozone Q2 GDP data, expected at 1.4% YoY and 0.1% QoQ. A cautious ECB stance, with Schnabel and Šimkus signaling no urgency for further cuts, also lends support. Meanwhile, the US Dollar weakens as Fed cut bets rise after soft US jobs data, with CME FedWatch showing over a 99% chance of a 25 bps September cut.

Resistance is at 1.1730, while support is at 1.1620.

| R1: 1.1730 | S1: 1.1620 |

| R2: 1.1795 | S2: 1.1550 |

| R3: 1.1835 | S3: 1.1390 |

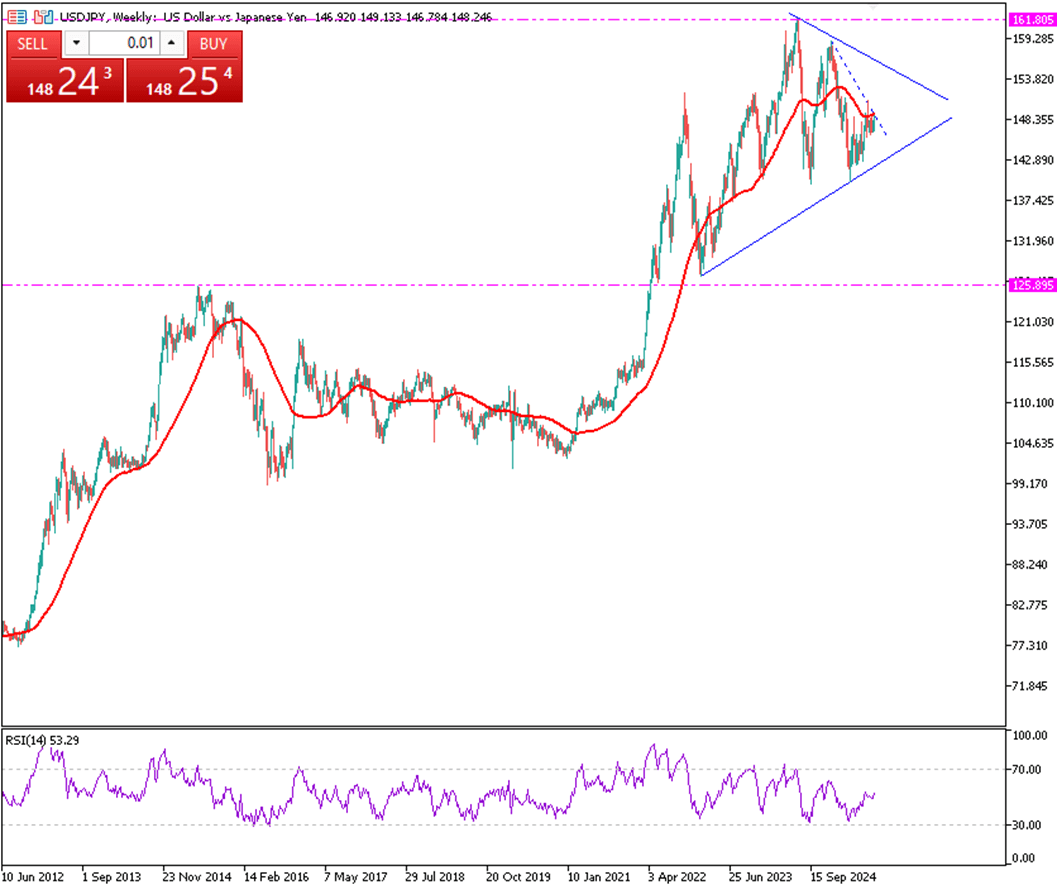

USD/JPY held near 148.50 in early Asian trade Friday as markets awaited the August NFP report. Thursday’s rise in jobless claims and weak ADP payrolls pointed to a cooling labor market, increasing Fed cut expectations. CME FedWatch now shows nearly a 100% chance of a 25 bps September cut, up from 87% a week ago, weighing on the dollar.

Resistance is at 149.30, with support at 147.20.

| R1: 149.30 | S1: 147.20 |

| R2: 150.90 | S2: 145.60 |

| R3: 154.50 | S3: 142.75 |

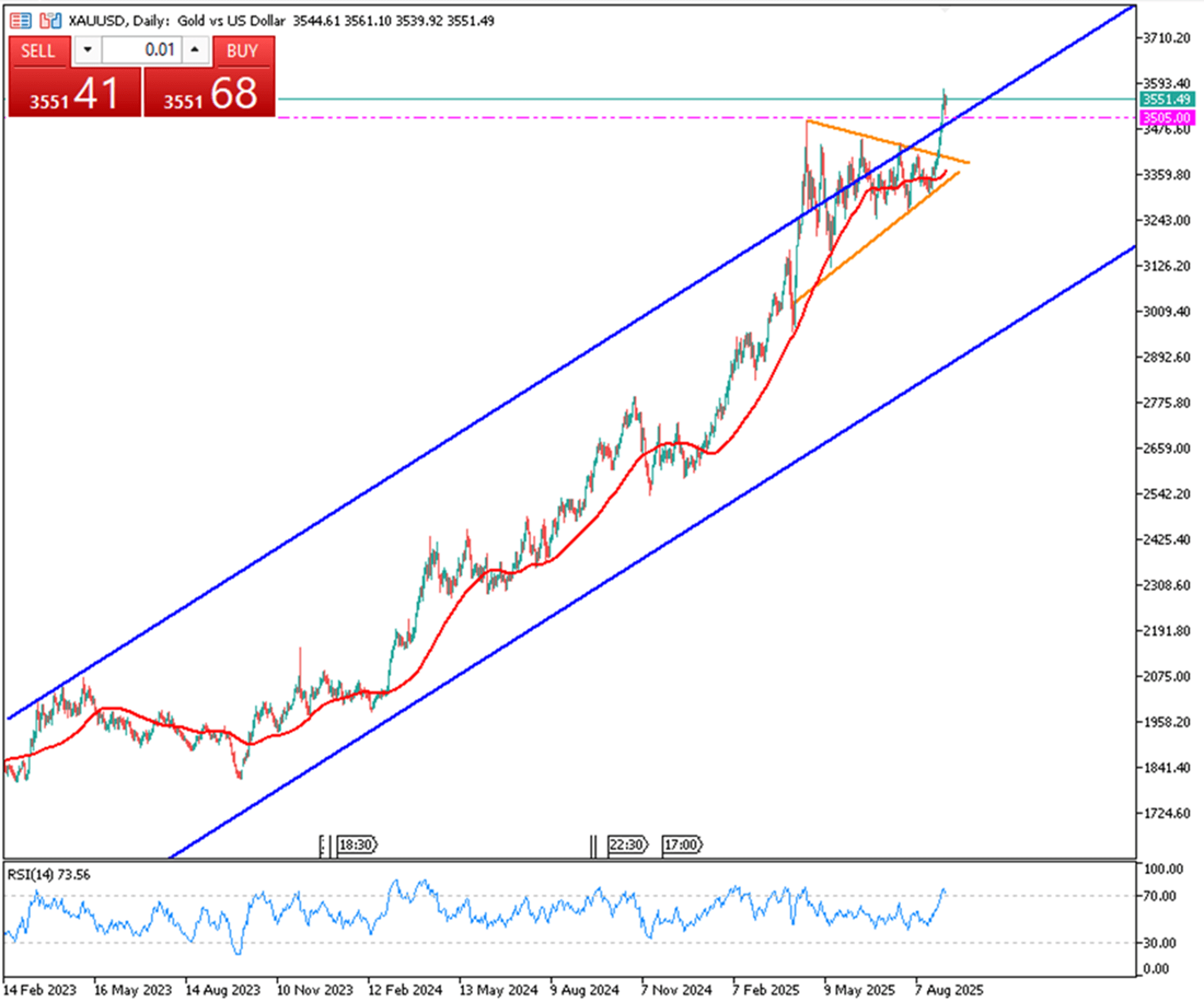

Gold edged higher in Friday’s Asian session, extending its rebound from $3,500 and staying near record highs. The metal is supported by expectations of Fed rate cuts starting in September and trade-related safe-haven demand, though gains are capped by firm equities and overbought conditions. Traders await the U.S. NFP report for fresh direction on policy and gold’s outlook.

Resistance is at $3,585, with support at $3,500.

| R1: 3585 | S1: 3500 |

| R2: 3635 | S2: 3460 |

| R3: 3670 | S3: 3405 |

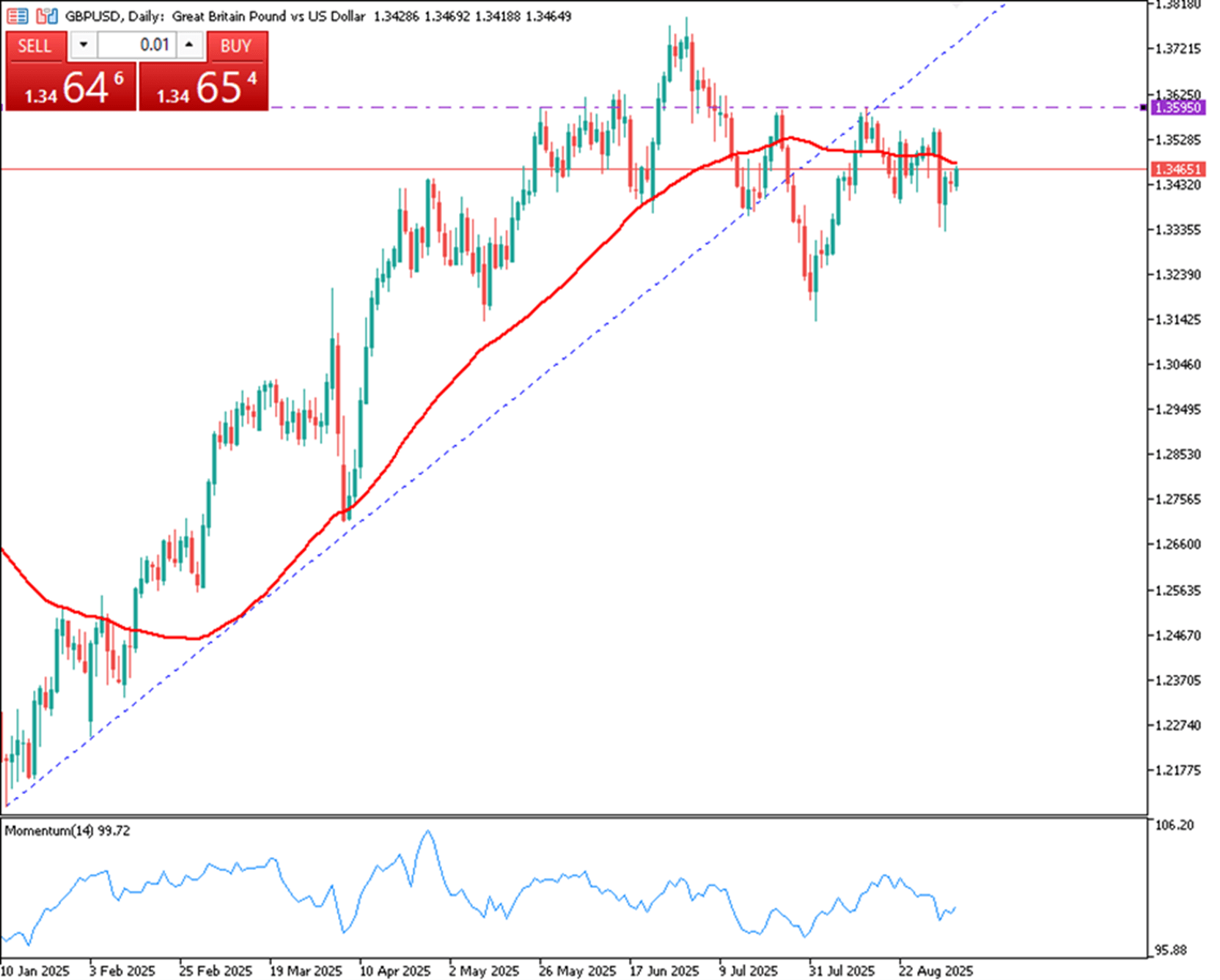

The British pound steadied above $1.34 as bond volatility eased and traders awaited U.S. NFP data. Weak U.S. labor figures supported Fed cut bets, while the pound faced pressure from UK fiscal uncertainty ahead of November’s budget. BoE Governor Andrew Bailey signaled caution, noting more doubt over the timing of cuts. Markets now expect the BoE to hold rates until at least April.

Resistance is at 1.3525, with support at 1.3330.

| R1: 1.3525 | S1: 1.3330 |

| R2: 1.3595 | S2: 1.3270 |

| R3: 1.3700 | S3: 1.3140 |

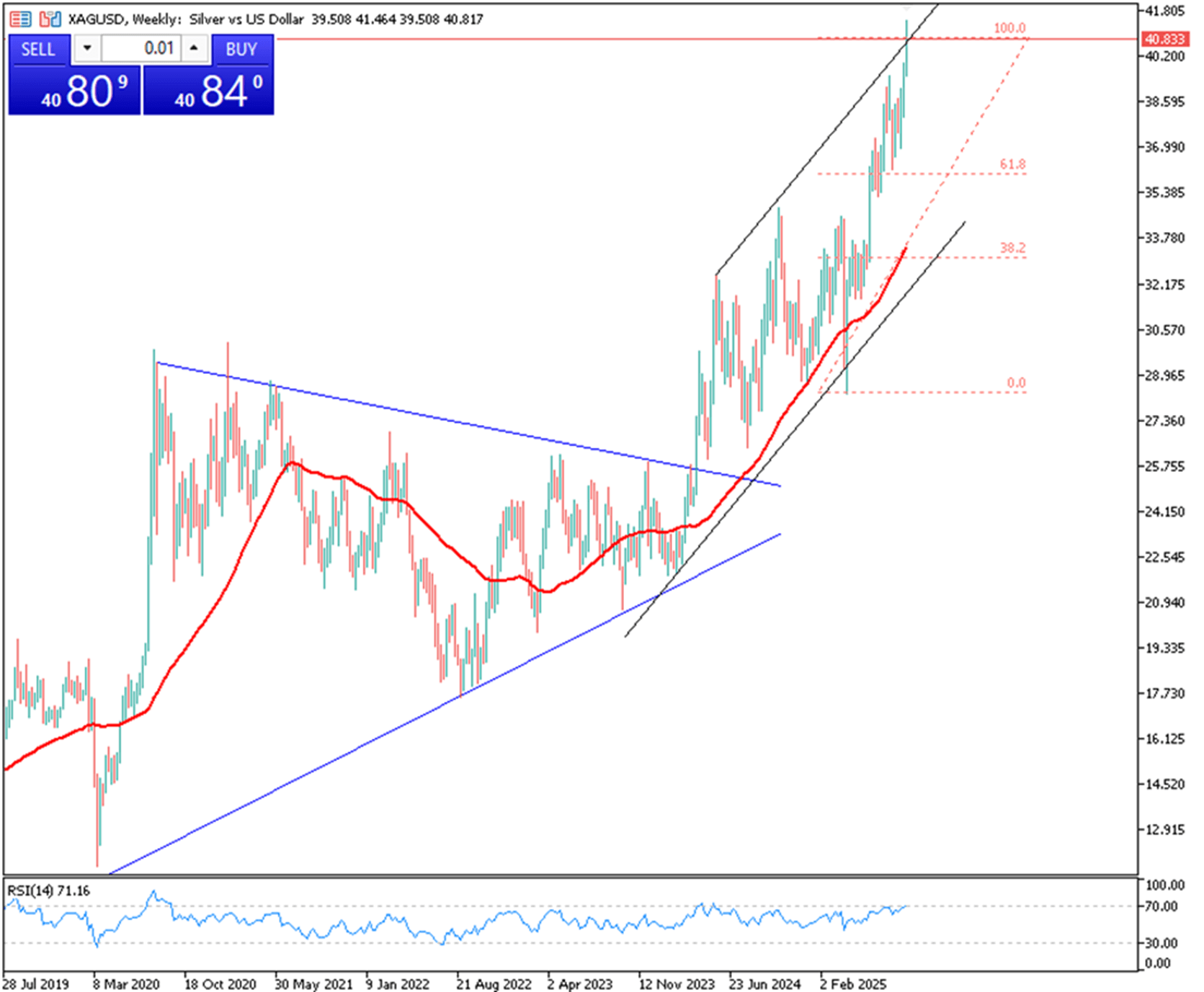

Silver edged up to $40.85 in Friday’s Asian session, supported by a weaker dollar and stronger Fed cut bets. Softer U.S. data, including higher jobless claims and weak ADP payrolls, signaled a cooling labor market and increasing demand for non-yielding assets. Investors now await the U.S. NFP report for further policy clues.

Resistance is at $41.30, with support at $40.20.

| R1: 41.30 | S1: 40.20 |

| R2: 42.50 | S2: 39.75 |

| R3: 43.65 | S3: 39.00 |

Bond Market Pushback Takes Center Stage

Bond Market Pushback Takes Center StageMarkets are almost fully pricing in another Federal Reserve rate cut this week, yet the US bond market continues to move in the opposite direction.

Detail Central Bank Expectations Reset the Tone (8-12 December)

Central Bank Expectations Reset the Tone (8-12 December)Traders adjusted positioning before the Federal Reserve’s December decision and evaluated fresh signals from the ECB, BoE and BOJ.

Detail Futures Stall, 10-Year Yield Pushes Above 4.1% (12.08.2025)US stock futures were flat on Monday ahead of the Fed’s meeting, with markets pricing an 88% chance of a 25 bp cut on Wednesday.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!