The U.S. dollar regained strength on Friday after solid retail sales and jobless claims data reduced near-term Fed rate cut expectations. The euro fell to $1.16, its lowest in nearly a month, while the pound slipped to an eight-week low near $1.339

The yen rebounded to 148 per dollar as Japan’s inflation remained elevated, fueling speculation about the Bank of Japan tightening. Gold dipped below $3,340, on track for its first weekly decline in three weeks, while silver bounced back toward $38 amid mixed signals on Fed policy and ongoing trade tensions. Markets are watching for further developments as President Trump confirmed new tariff plans and reiterated his support for Fed Chair Powell

| Time | Cur. | Event | Forecast | Previous |

| 08:15 | EUR | German Buba President Nagel Speaks | - | - |

| 12:30 | USD | Michigan 1-Year Inflation Expectations | - | %5.0 |

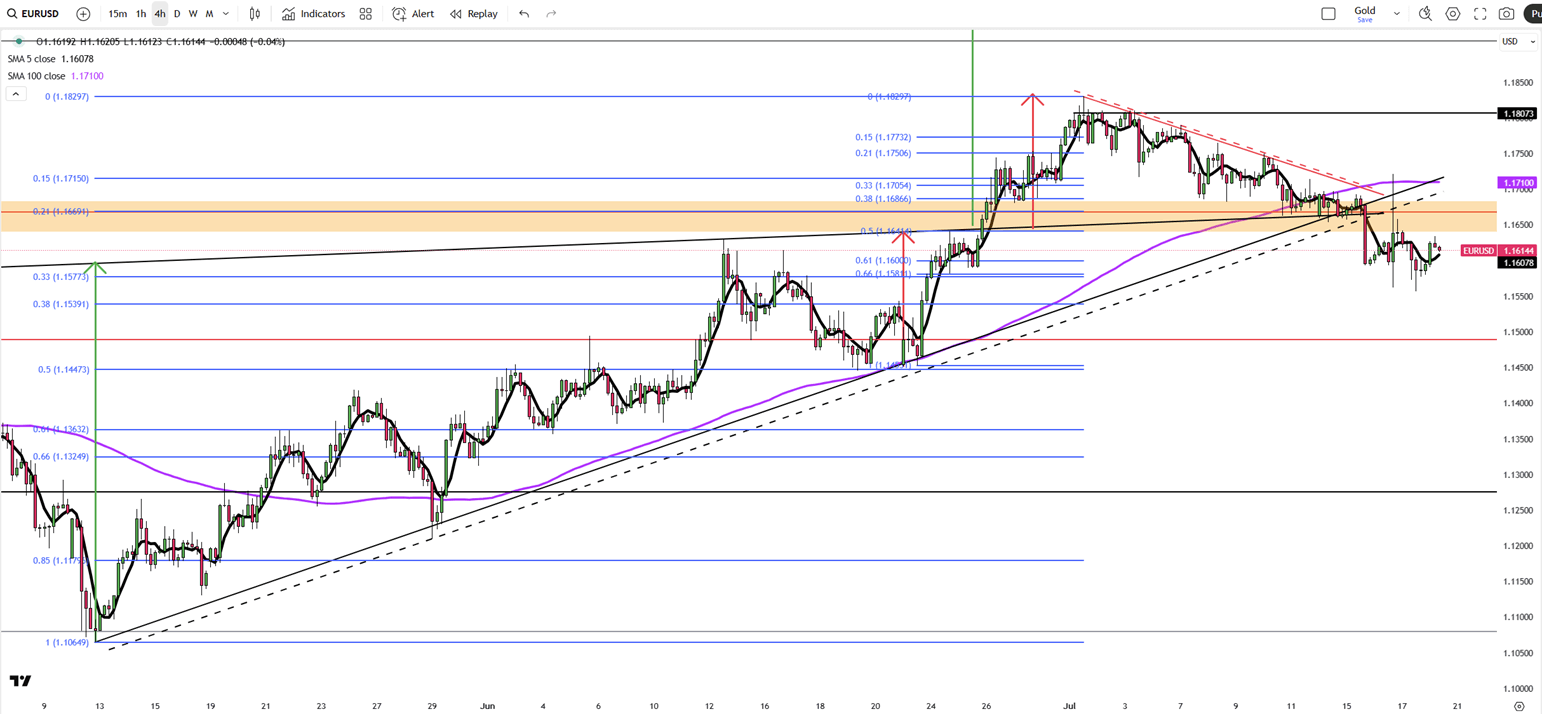

The euro declined to $1.16 on Thursday, reaching its lowest level in almost a month as the U.S. dollar regained strength. The dollar’s rise followed solid U.S. inflation data and President Trump’s comments suggesting he will keep Fed Chair Jerome Powell in place, reducing expectations for near-term Fed rate cuts. Meanwhile, markets continued to monitor U.S.-EU trade negotiations ahead of the August 1 deadline.

Resistance for the pair is at 1.1670, while support is at 1.1580.

| R1: 1.1670 | S1: 1.1580 |

| R2: 1.1700 | S2: 1.1540 |

| R3: 1.1750 | S3: 1.1500 |

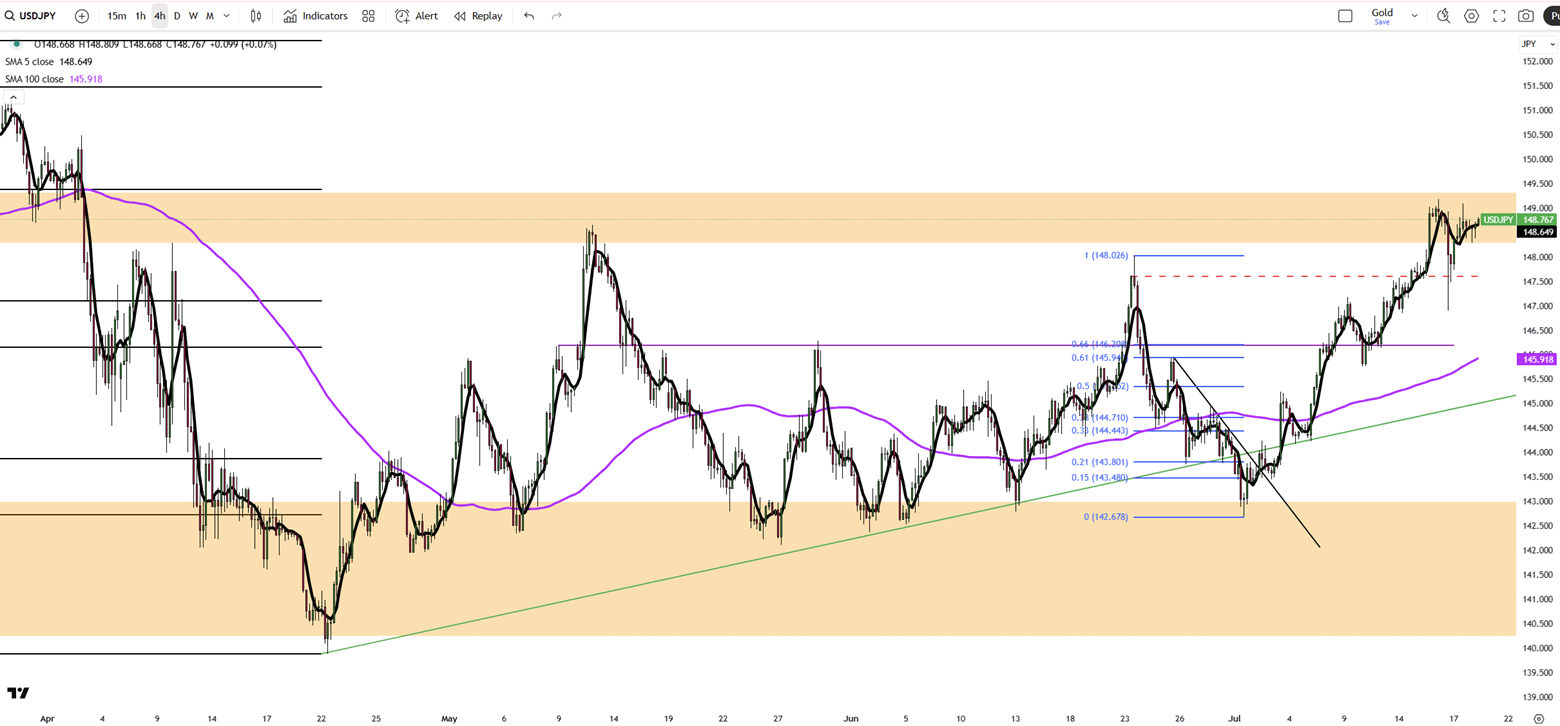

The yen rose to around 148 per dollar on Friday, recovering from the previous day’s decline as markets assessed fresh inflation figures. Japan’s inflation eased slightly to 3.3% in June from 3.5% in May but remained above the Bank of Japan’s 2% target for the 39th straight month. This persistent overshoot has intensified speculation about possible policy tightening by the central bank.

| R1: 149.30 | S1: 147.50 |

| R2: 141.50 | S2: 146.15 |

| R3: 155.00 | S3: 145.30 |

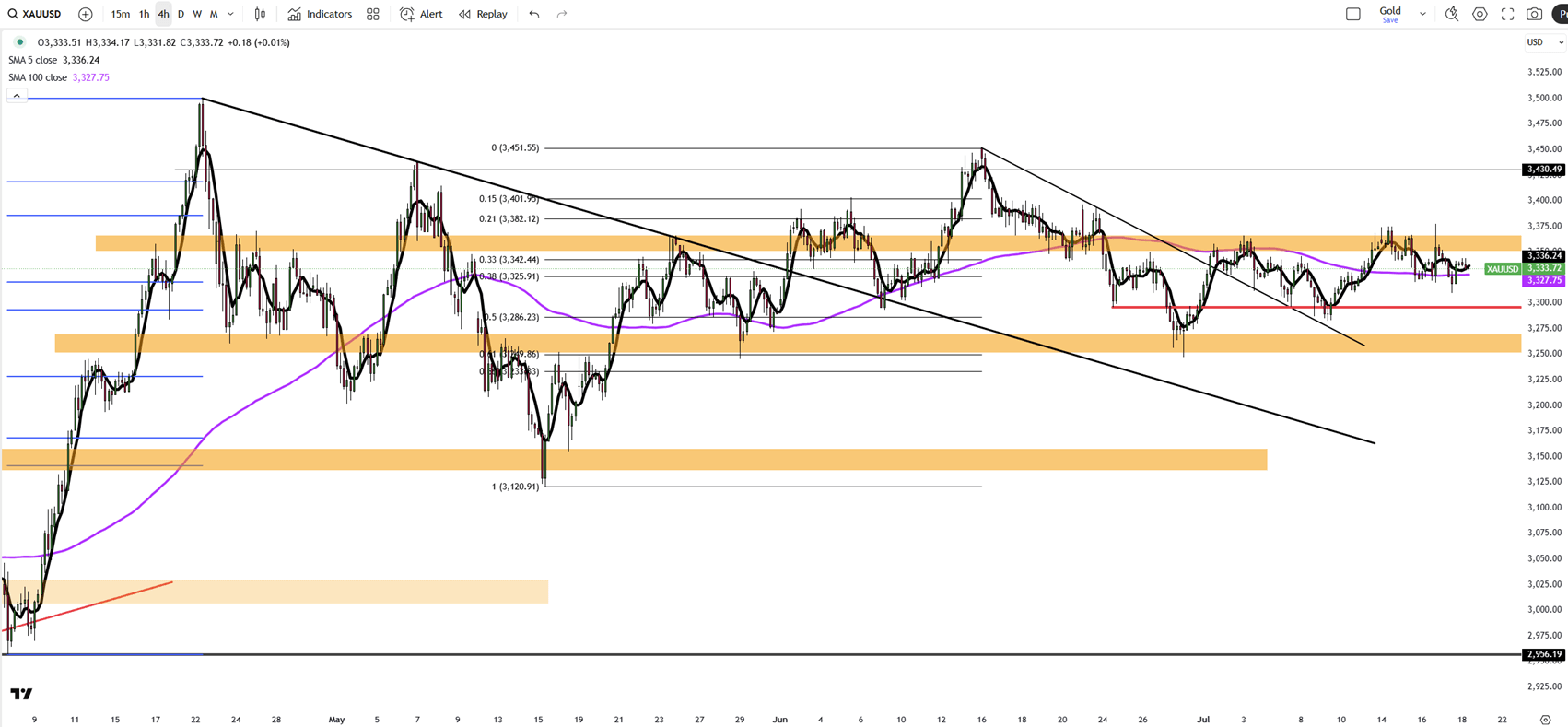

Gold remained below $3,340 per ounce on Friday and was on track for its first weekly decline in three weeks. The metal faced pressure after stronger U.S. data, including a rebound in retail sales and a sharp drop in jobless claims, reduced the immediate need for Federal Reserve rate cuts. Fed Governor Adriana Kugler backed keeping rates steady for now, pointing to economic resilience, while San Francisco Fed President Mary Daly maintained her outlook for two cuts in 2025.

Resistance is at $3,370, while support holds at $3,320.

| R1: 3370 | S1: 3320 |

| R2: 3400 | S2: 3295 |

| R3: 3430 | S3: 3250 |

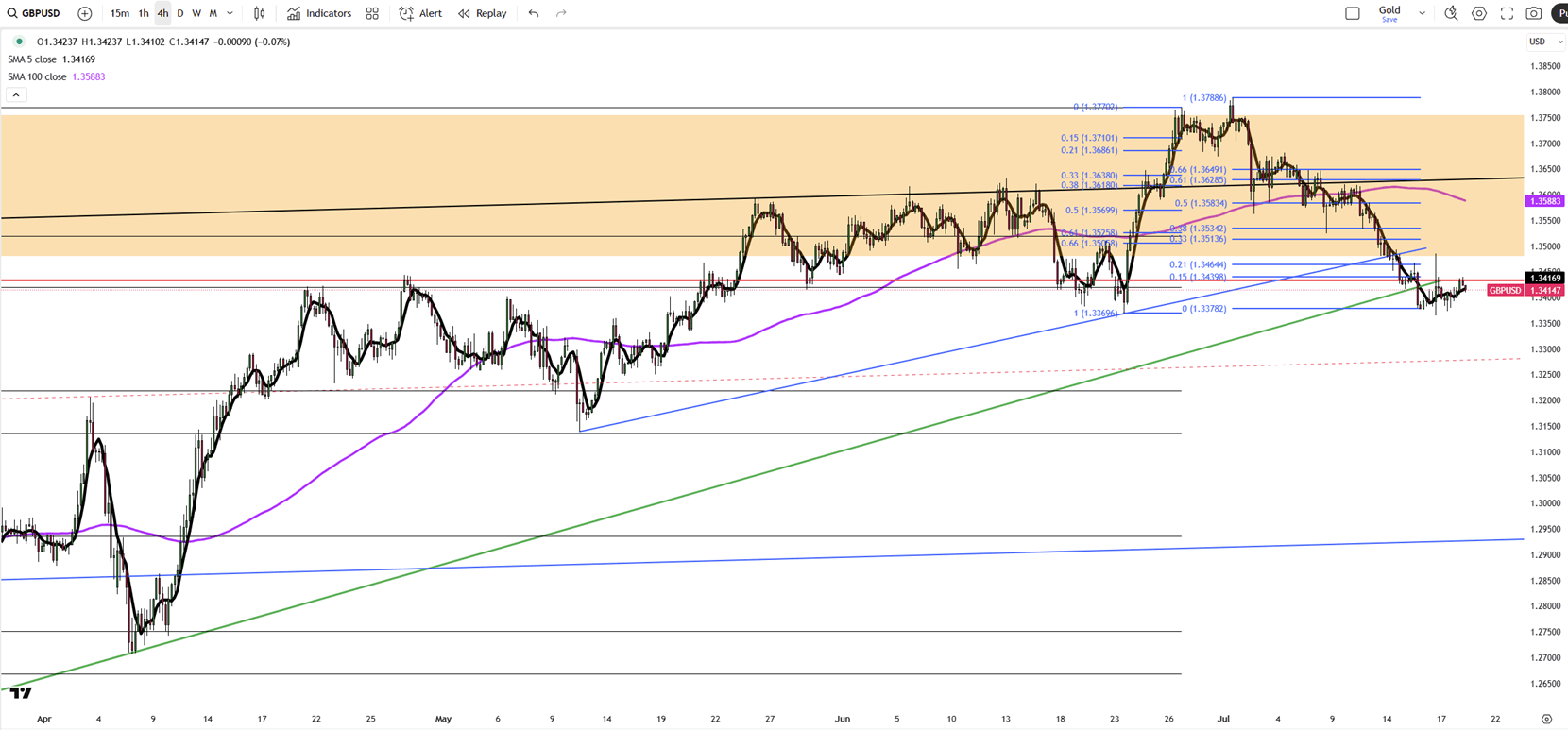

The British pound held near $1.339 on Friday, its lowest level in eight weeks, as the U.S. dollar strengthened. The dollar reached a three-week high after President Trump confirmed he would not remove Fed Chair Jerome Powell, despite continued criticism of the Fed’s careful stance on rate cuts. In the UK, markets are closely reviewing recent employment and inflation data. While the labor market shows signs of weakness, updated tax records suggest the slowdown may not be as severe as previously thought.

Resistance is at 1.3535, while support holds at 1.3380.

| R1: 1.3535 | S1: 1.3380 |

| R2: 1.3580 | S2: 1.3270 |

| R3: 1.3630 | S3: 1.3140 |

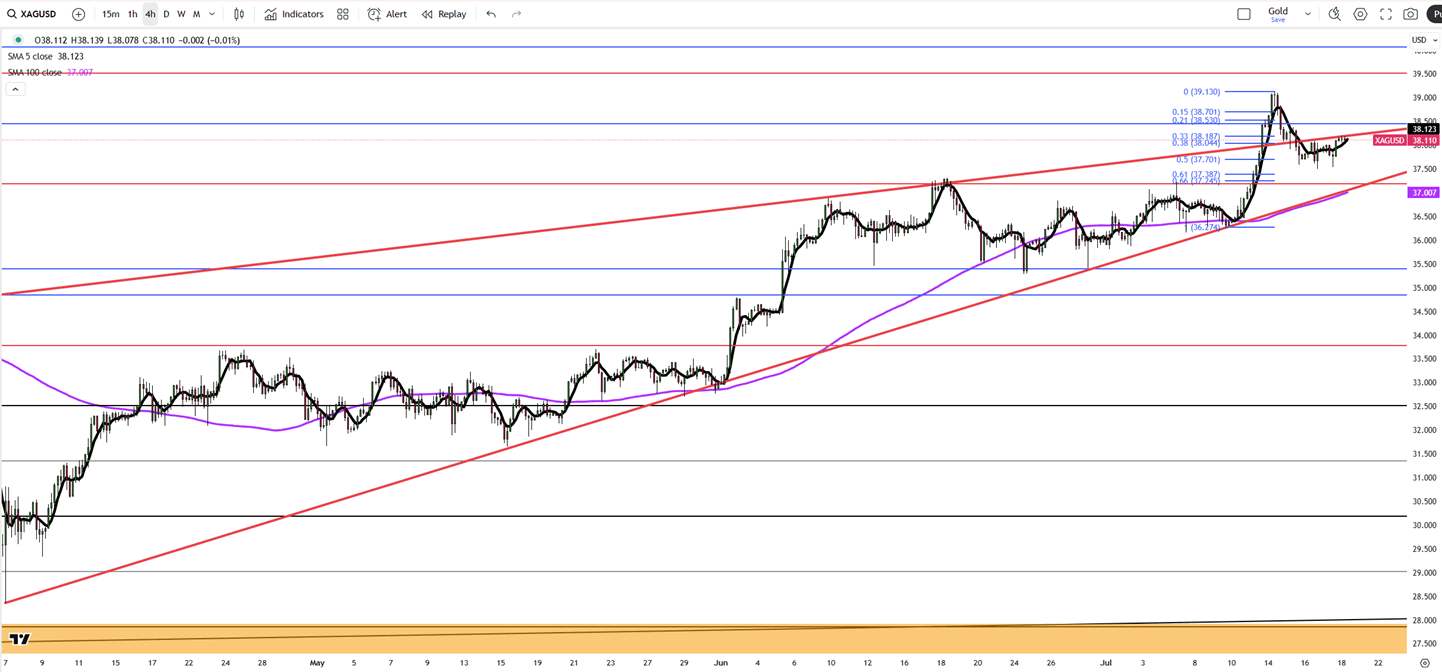

Silver rebounded toward $38 per ounce on Friday, recovering from a two-day decline as the U.S. dollar and Treasury yields eased. The move reflected shifting sentiment on Fed policy and trade conditions after earlier losses sparked by inflation data that reduced hopes for near-term rate cuts.

U.S. stock futures edged higher following record closes for the S&P 500 and Nasdaq, driven by strong retail sales, lower jobless claims, and optimism in AI-related tech stocks after Taiwan Semiconductor’s positive forecast. On monetary policy, Fed officials remain divided: Mary Daly expects two rate cuts this year, while Adriana Kugler urges caution due to tariff-driven inflation. President Trump reinforced trade tensions by sending letters to over 20 partners setting new tariffs between 20% and 40%.

In corporate updates, United Airlines expects stronger earnings in the second half of 2025, and Chevron signaled higher future cash flow as production in its top U.S. oil field nears a plateau.

Resistance is at 38.50, while support holds at 37.20.

| R1: 38.50 | S1: 37.20 |

| R2: 39.50 | S2: 36.85 |

| R3: 40.10 | S3: 35.50 |

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

Detail March Starts With Geopolitical Turmoil (2-6 March)

March Starts With Geopolitical Turmoil (2-6 March)Global markets began the week in a state of high alert following coordinated US and Israeli strikes on Iran over the weekend, which resulted in the death of Supreme Leader Ayatollah Ali Khamenei.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!