EUR/USD extended its advance toward 1.1780, maintaining a strong bullish structure despite momentum nearing overbought levels.

The Yen gained on renewed intervention warnings and Rehabilitation of Fed cut expectations, while gold surged to fresh highs after a strong monthly performance driven by geopolitical risks and easing prospects. Sterling climbed to a ten-week high on broad Dollar softness, and silver rallied to a record $70 as safe-haven demand intensified.

| Time | Cur. | Event | Forecast | Previous |

| 13:30 | USD | Core PCE Price Index (MoM) (Oct) | 0.2% | |

| 13:30 | USD | GDP (QoQ) (Q3) | 3.2% | 3.8% |

| 20:00 | USD | CB Consumer Confidence (Dec) | 91.7 | 88.7 |

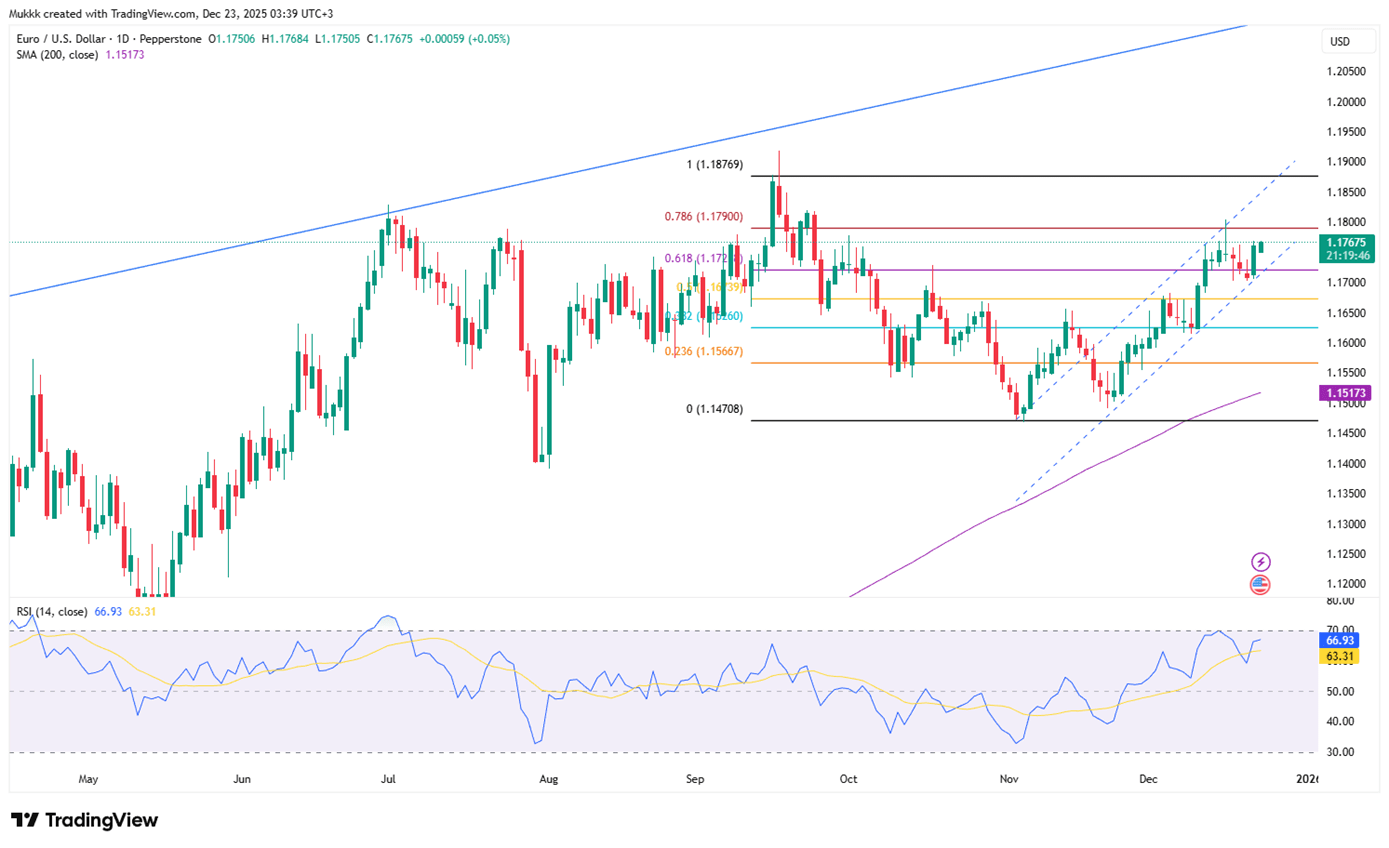

EUR/USD extends its rally for a second day, hovering near 1.1780 during early Asian trade. The daily chart confirms a strong bullish trend within a steady ascending channel. Currently, the 14-day RSI is at 68.9, nearing overbought territory and showing strong demand. This elevated RSI reading suggests further gains might be capped if overbought signals intensify.

Technically, 1.1700 is the key support, while resistance is seen at 1.1800.

| R1: 1.1800 | S1: 1.1700 |

| R2: 1.1840 | S2: 1.1630 |

| R3: 1.1890 | S3: 1.1570 |

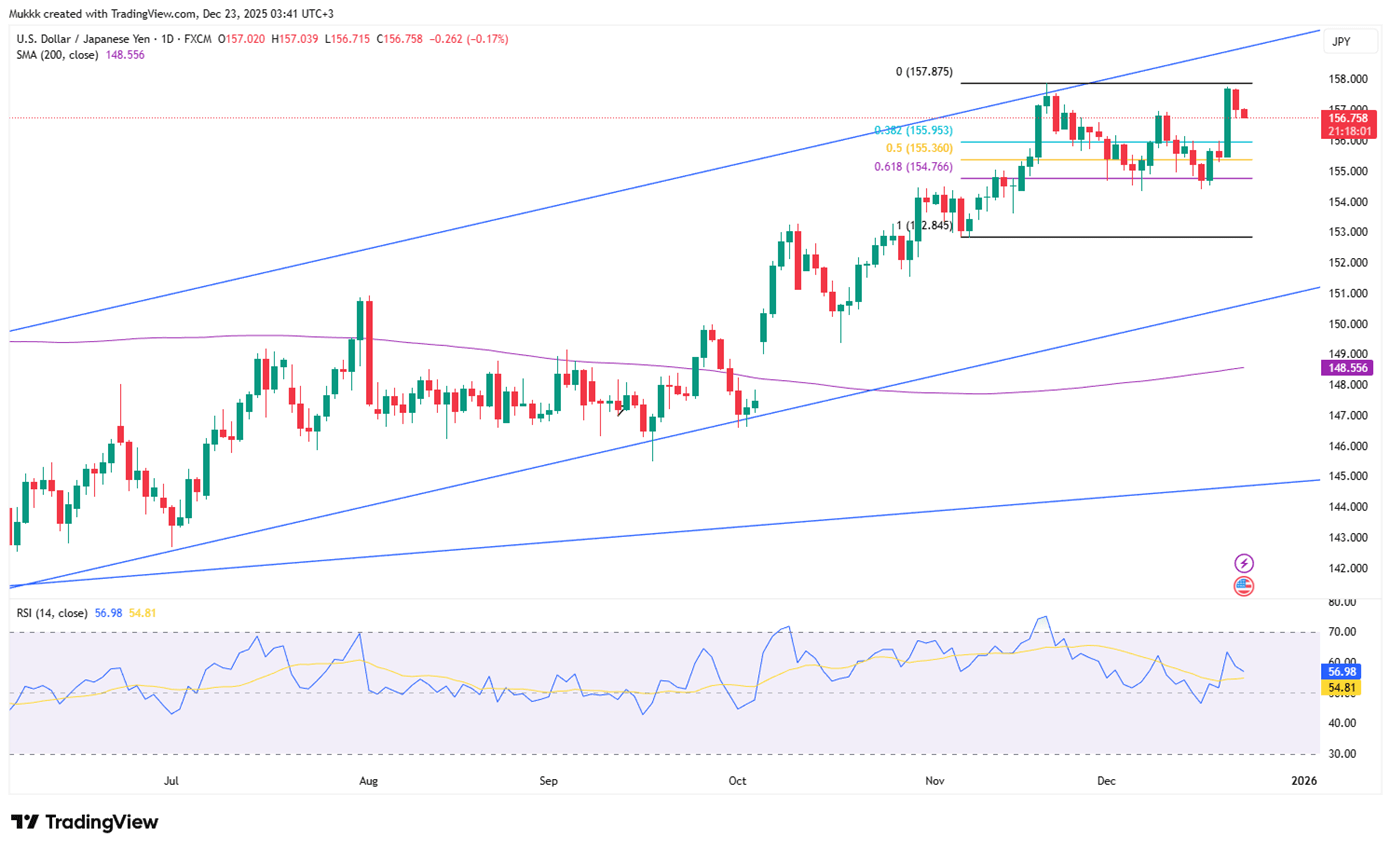

The Japanese yen rose to 156 per dollar as the greenback weakened and officials signaled potential intervention. Markets anticipate two US rate cuts next year, pressuring the dollar. Top diplomat Atsushi Mimura warned of "appropriate" action against one-sided moves, matching Finance Minister Satsuki Katayama’s concerns over rising import costs and household strain. Investors are now focused on upcoming comments from BOJ Governor Kazuo Ueda for further policy direction.

Technically, resistance stands near 156.50, while support is firm at 154.60.

| R1: 156.50 | S1: 154.60 |

| R2: 156.80 | S2: 153.70 |

| R3: 157.60 | S3: 152.80 |

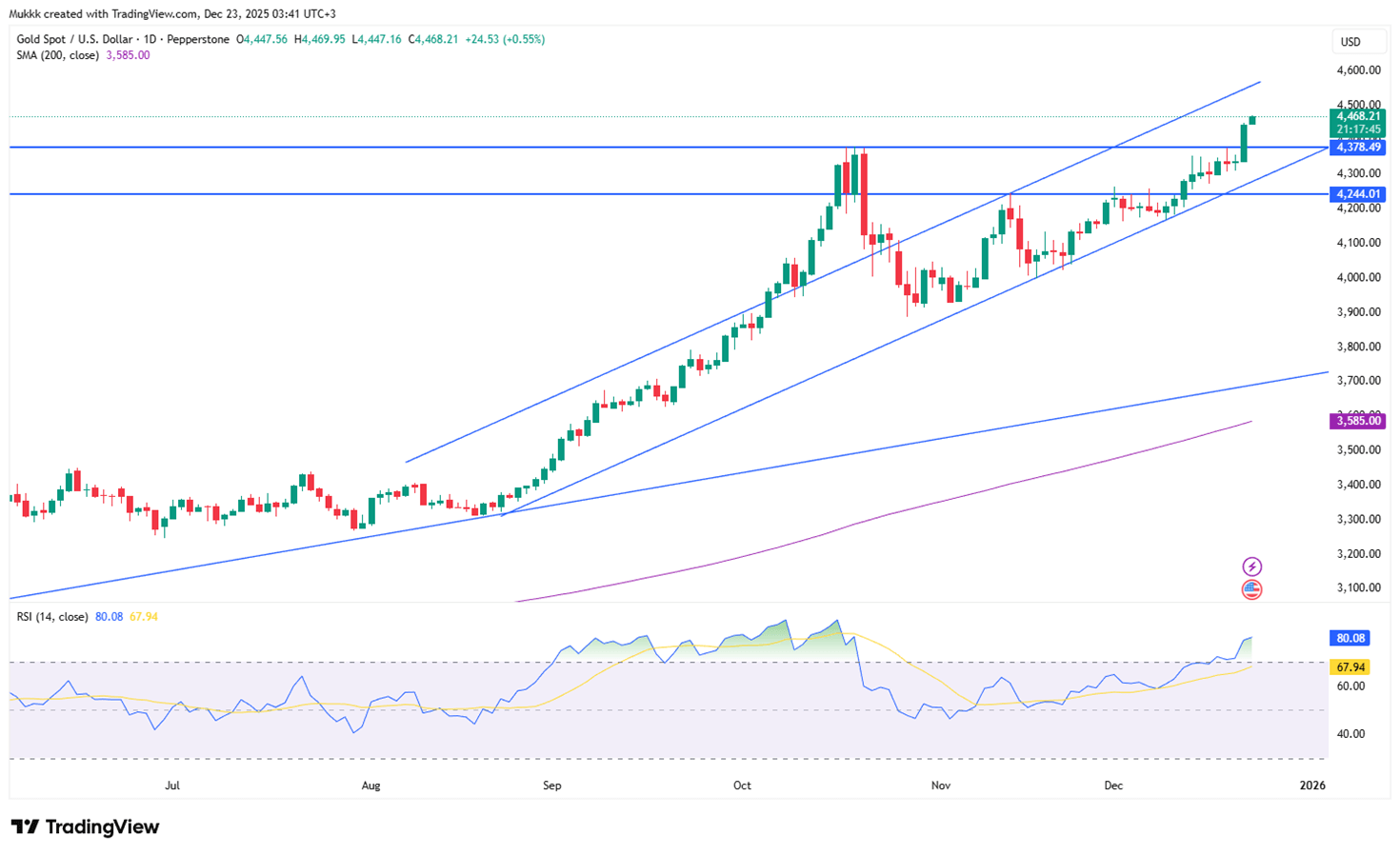

Gold (XAU/USD) reached a fresh peak during early European sessions, rising 10% this month and nearly 70% throughout 2025. Heightened geopolitical risks and macro instability persist in driving safe-haven interest. Anticipation of additional Fed rate reductions further aids gold by reducing the opportunity cost of holding the metal. Nevertheless, strong US GDP or other upbeat economic reports might strengthen the USD and weigh on gold prices temporarily.

Gold sees support near $4430, while resistance is around $4500.

| R1: 4500 | S1: 4430 |

| R2: 4550 | S2: 4380 |

| R3: 4600 | S3: 4350 |

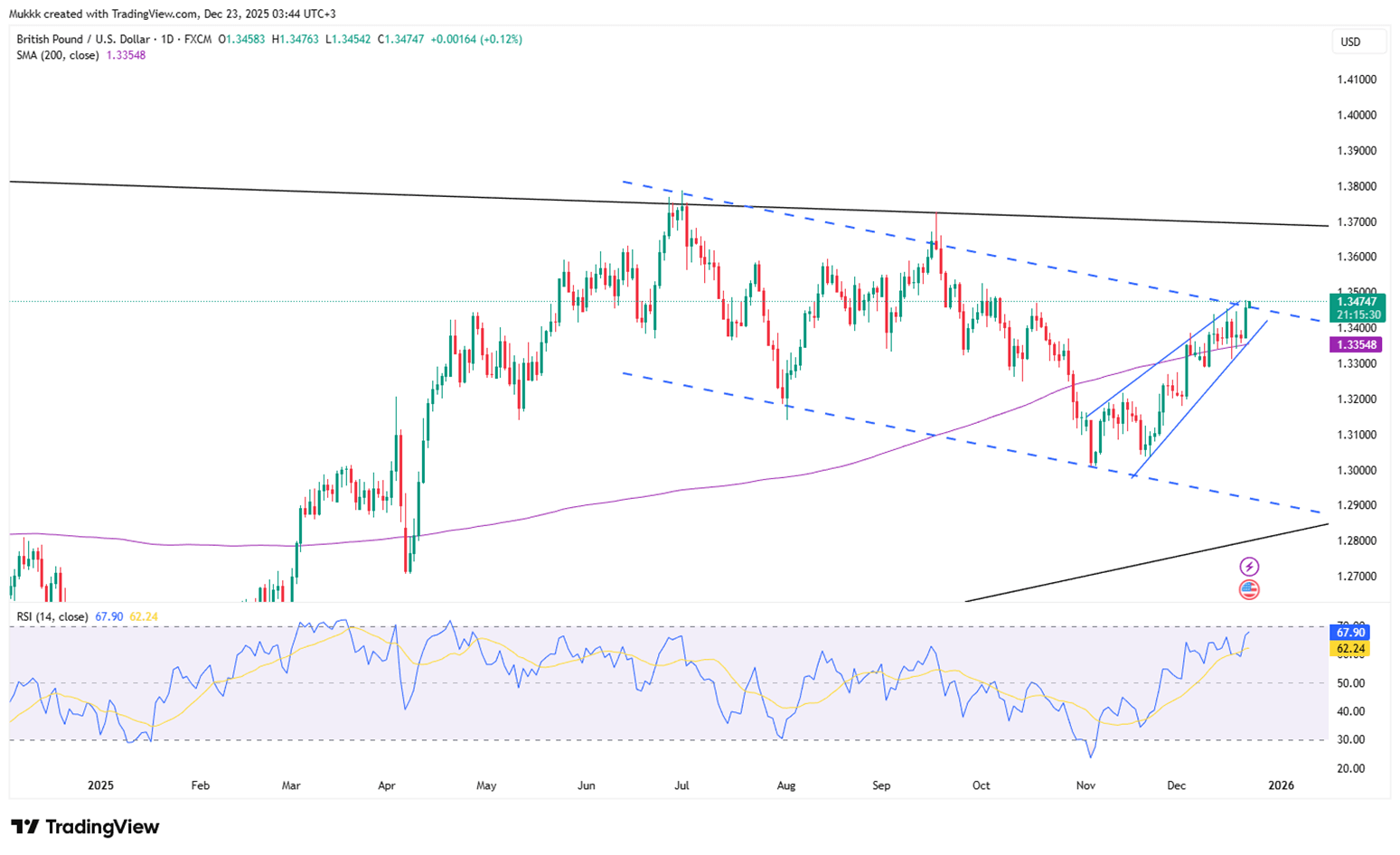

GBP/USD climbed to a ten-week peak as widespread US Dollar weakness supported the Pound during a shortened holiday week. Investors largely overlooked the Bank of England’s most recent rate reduction, prioritizing general policy uncertainty instead. Simultaneously, the Federal Reserve’s third straight rate cut weighed on the USD. Market focus shifts to US ADP employment and Q3 GDP figures, which are anticipated to reveal weakening labor markets and decelerating economic growth.

From a technical view, support stands near 1.3310, with resistance around 1.3500.

| R1: 1.3500 | S1: 1.3310 |

| R2: 1.3540 | S2: 1.3260 |

| R3: 1.3600 | S3: 1.3200 |

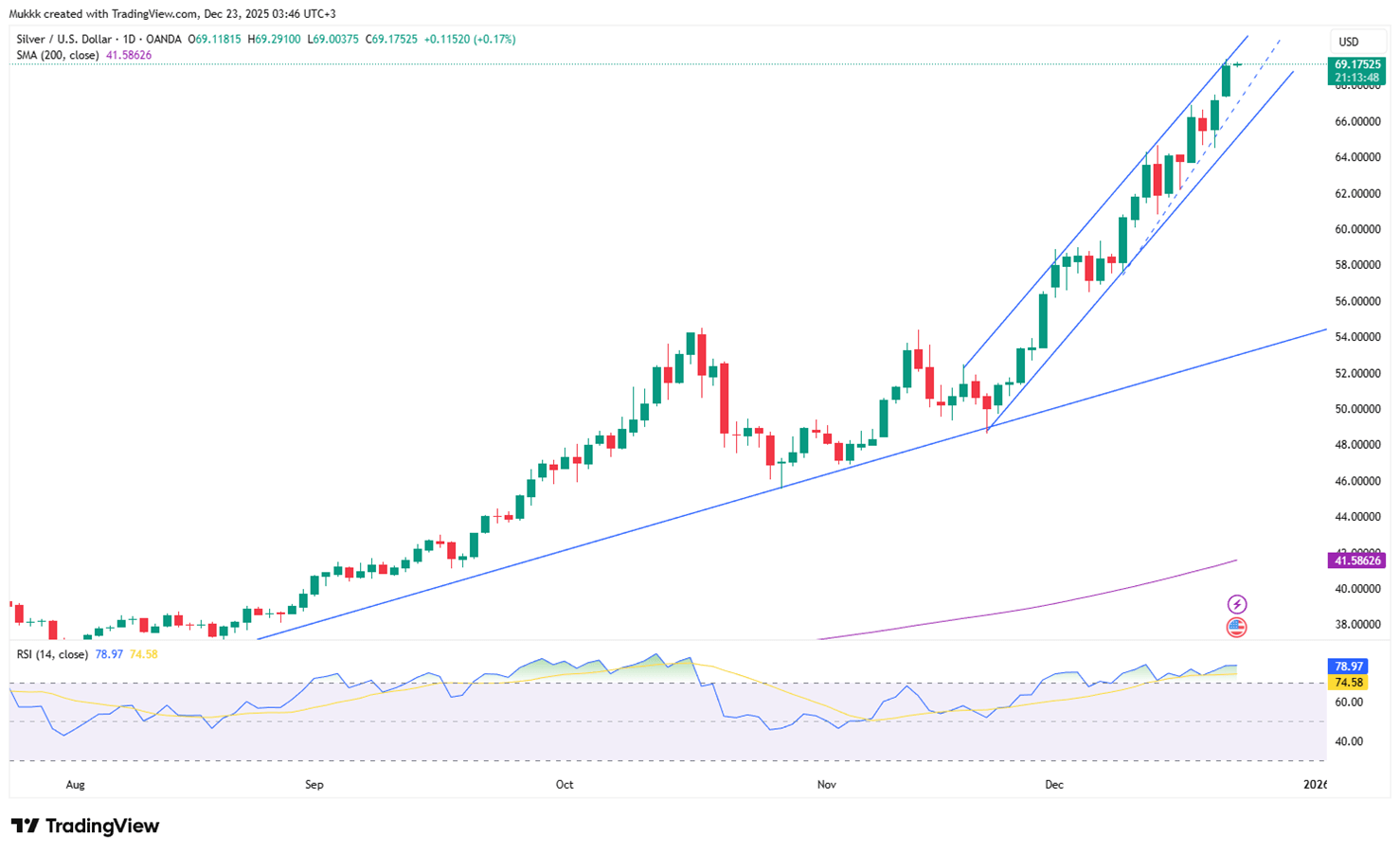

Silver (XAG/USD) reached a historic peak near $70.00 in Asian trade, fueled by intense safe-haven demand. Tensions between the US and Venezuela, plus Ukrainian strikes on Russian energy, drove investors toward precious metals. Fed Governor Stephen Miran’s warning that rates must drop to avoid a recession further supported sentiment, supporting the outlook for non-yielding assets like silver.

From a technical view, resistance stands near $70.00 while support is located around $68.50.

| R1: 70.00 | S1: 68.50 |

| R2: 72.50 | S2: 67.00 |

| R3: 75.00 | S3: 64.50 |

Trump Signals Extended Military Campaign

Trump Signals Extended Military CampaignGeopolitical tensions in the Middle East have intensified following recent remarks from Donald Trump suggesting that the ongoing military campaign against Iran may last longer than anticipated. While Trump stated that early operational objectives were achieved ahead of schedule, he acknowledged that broader strategic goals could require additional time and sustained military pressure.

Detail US DST Change March 8 2026

US DST Change March 8 2026Daylight Saving Time will change in the United States on Sunday, March 8, 2026. The trading schedule for various financial instruments will be adjusted to align with U.S. exchange hours.

Detail Dollar Leads Risk-Off (03.06.2026)Global markets remained under pressure as escalating Middle East tensions and rising energy prices strengthened the US dollar and unsettled major currencies.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!