The euro and British pound extended their rallies on Thursday amid mounting concerns over the U.S. fiscal outlook, following Moody’s downgrade of the U.S. credit rating.

Gold and silver gained for the fourth and third consecutive sessions, respectively, supported by safe-haven flows and geopolitical tensions. The Japanese yen strengthened to a two-week high, while the dollar index slipped below 99.50 as investors digested tax policy risks and upcoming PMI releases.

| Time | Cur. | Event | Forecast | Previous |

| 07:30 | EUR | Germany Manufacturing PMI | 49.1 | 48.4 |

| 08:00 | EUR | Euro Area Composite PMI | 49.2 | 49 |

| 08:30 | GBP | United Kingdom Manufacturing PMI | 45.4 | 46 |

| 12:30 | USD | Initial Jobless Claims | 231.0K | 229K |

| 13:45 | USD | S&P Global Manufacturing PMI | 50.3 | 50.2 |

| 18:00 | USD | Fed Williams Speech |

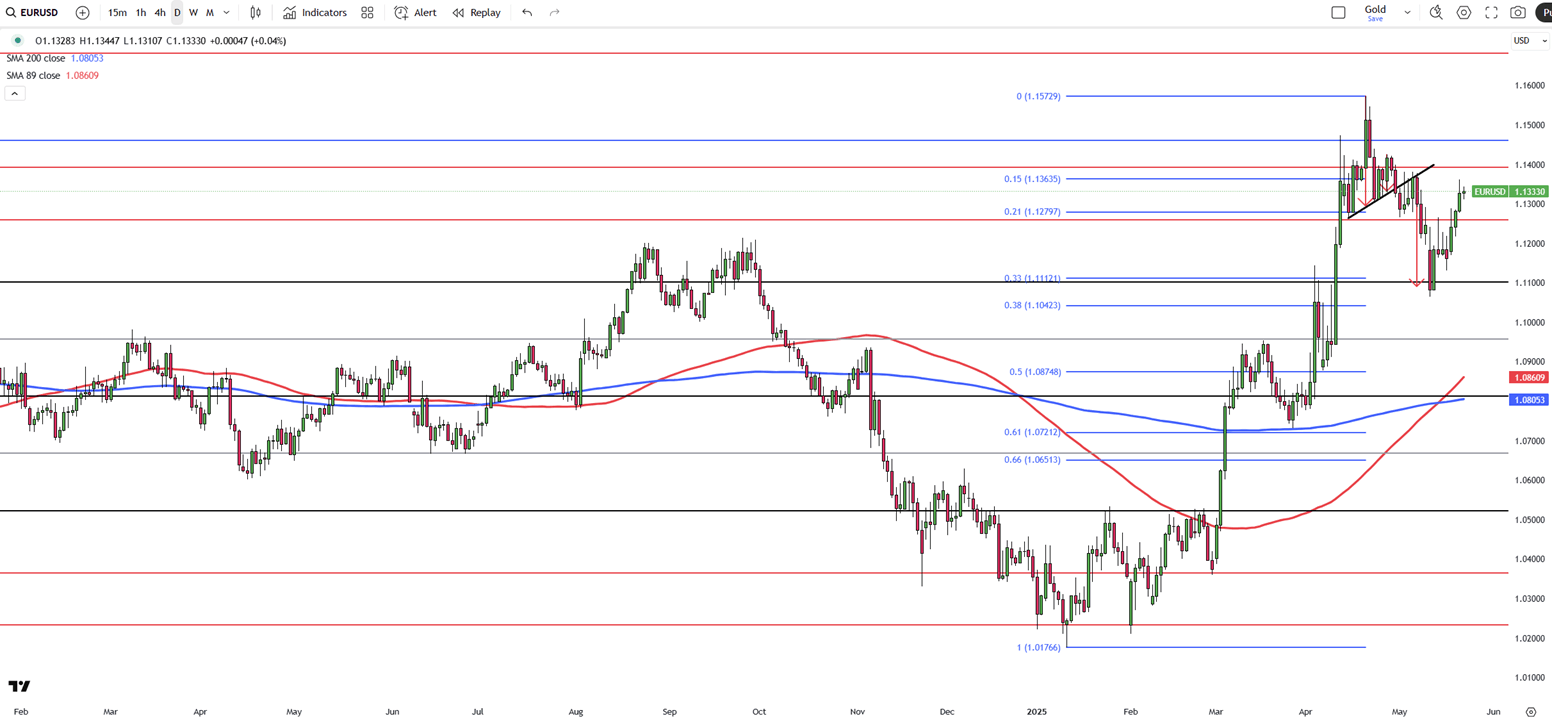

EUR/USD trades near 1.1340 during Asian hours, close to two-week highs, extending gains for a fourth session ahead of Eurozone PMI data expected to show improved growth for May.

The U.S. dollar remains under pressure as markets await Thursday’s S&P Global PMI. Moody’s downgraded the U.S. credit rating to Aa1, matching earlier cuts by Fitch and S&P, citing rising debt, projected to reach 134% of GDP by 2035, and a nearly 9% deficit.

Trump’s tax-cut plan cleared the House Rules Committee, but the DXY still trades lower near 99.50.

The key resistance is located at 1.1390, and the first support stands at 1.1260.

| R1: 1.1390 | S1: 1.1260 |

| R2: 1.1460 | S2: 1.1100 |

| R3: 1.1580 | S3: 1.1050 |

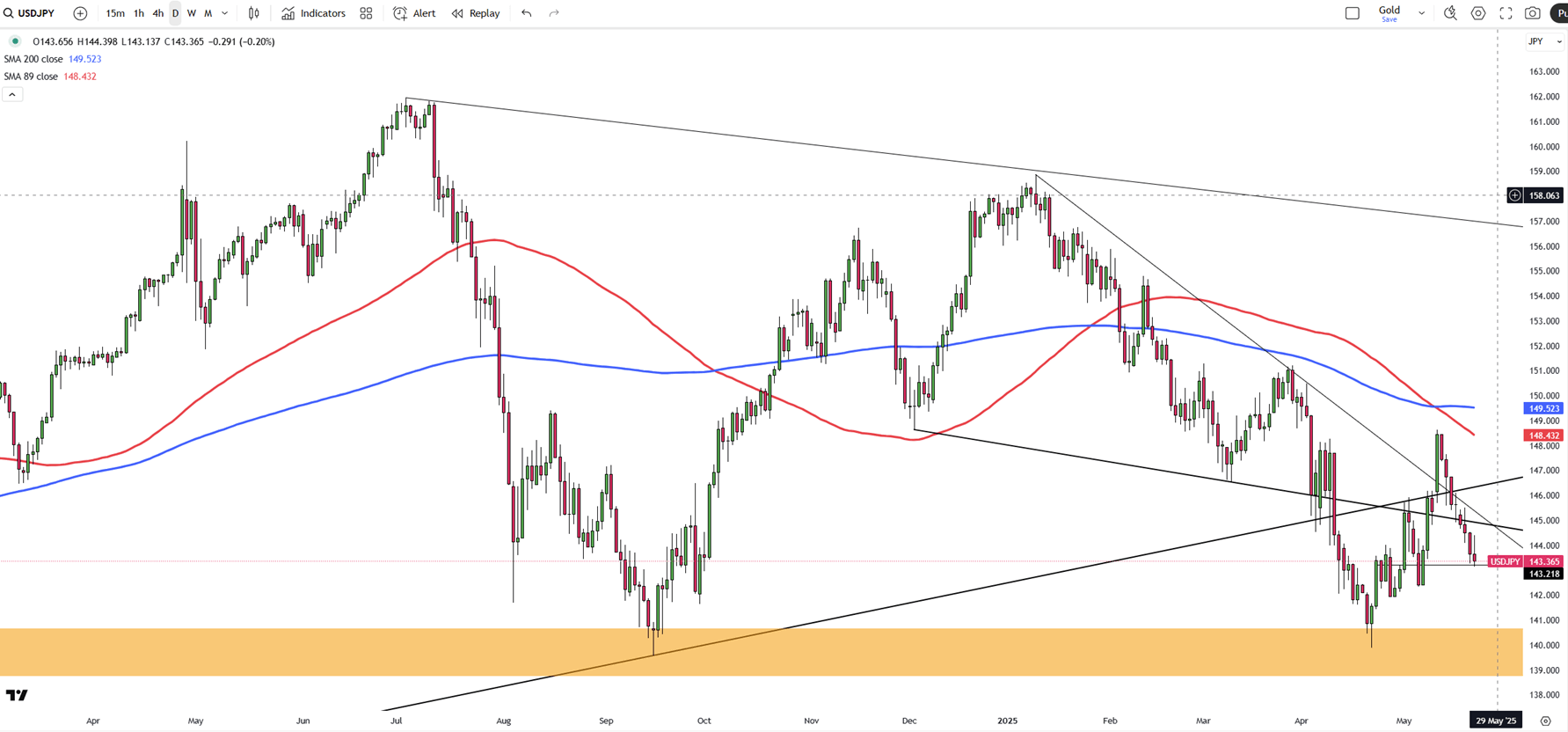

The Japanese yen strengthened to around 143 per dollar on Thursday, its highest in over two weeks, as concerns over the U.S. fiscal outlook pressured the dollar. Fears that Trump’s proposed tax cuts could add over $3 trillion to U.S. debt weighed on investor confidence.

Japan’s Finance Minister Kato said he did not discuss currency levels with Treasury Secretary Bessent at the G7 summit.

Domestically, core machinery orders surged 13% in March, beating expectations of a 1.6% drop, while May PMI data showed continued weakness in both manufacturing and services.

| R1: 148.60 | S1: 139.70 |

| R2: 149.80 | S2: 137.00 |

| R3: 151.20 | S3: 135.00 |

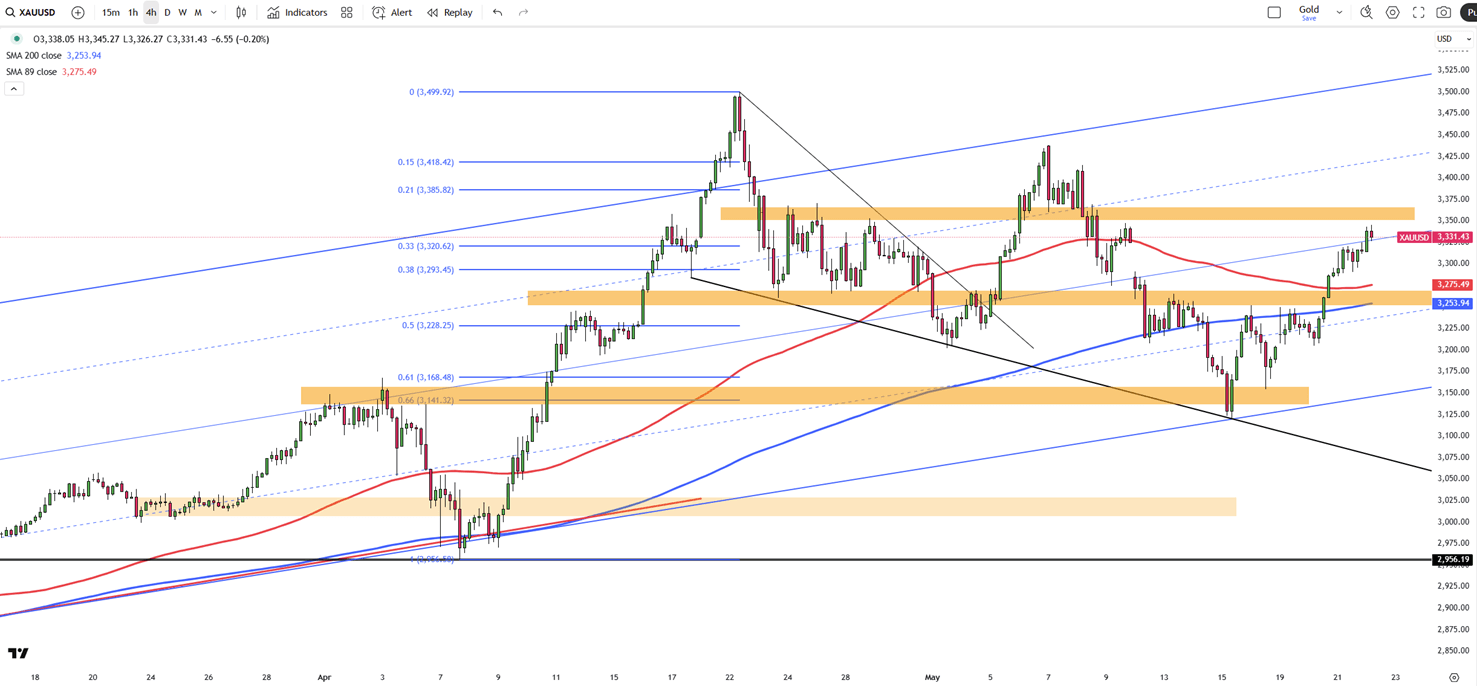

Gold rose toward $3,340 per ounce on Thursday, marking its fourth straight gain and nearing a two-week high. Safe-haven demand grew amid U.S. fiscal concerns, following a budget proposal that may deepen the deficit and Moody’s credit downgrade. Geopolitical tensions and Trump’s reduced involvement in Russia-Ukraine talks also supported prices. China’s April gold imports jumped 73%, hitting an 11-month high.

The first critical support for gold is seen at $3250, and the first resistance is located at $3370.

| R1: 3370 | S1: 3250 |

| R2: 3440 | S2: 3150 |

| R3: 3500 | S3: 3025 |

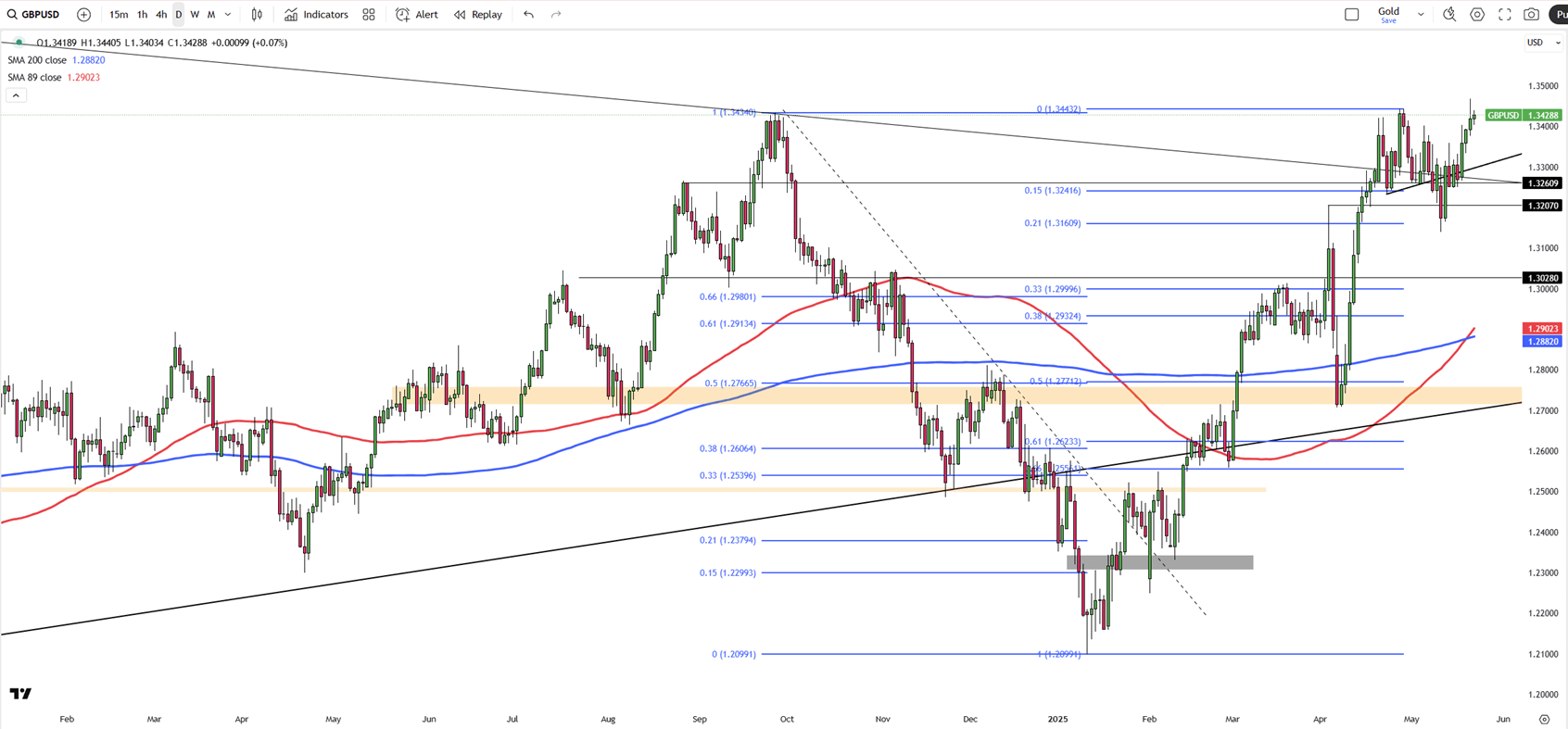

GBP/USD extended its gains for a fourth consecutive session, trading near 1.3430 during Thursday’s Asian session. The pair’s upward movement is largely supported by continued weakness in the U.S. Dollar, following Moody’s downgrade of the U.S. credit rating from Aaa to Aa1, in line with earlier downgrades by Fitch in 2023 and S&P in 2011.

Moody’s cited projections that U.S. federal debt could surge to 134% of GDP by 2035, up from 98% in 2023, with the budget deficit potentially widening to nearly 9% of GDP. Key concerns include rising interest payments, growing social expenditures, and weakening tax revenues.

The first critical support for GBP/USD is seen at 1.3450 and the first resistance is located at 1.3250.

| R1: 1.3450 | S1: 1.3250 |

| R2: 1.3550 | S2: 1.3150 |

| R3: 1.3700 | S3: 1.3000 |

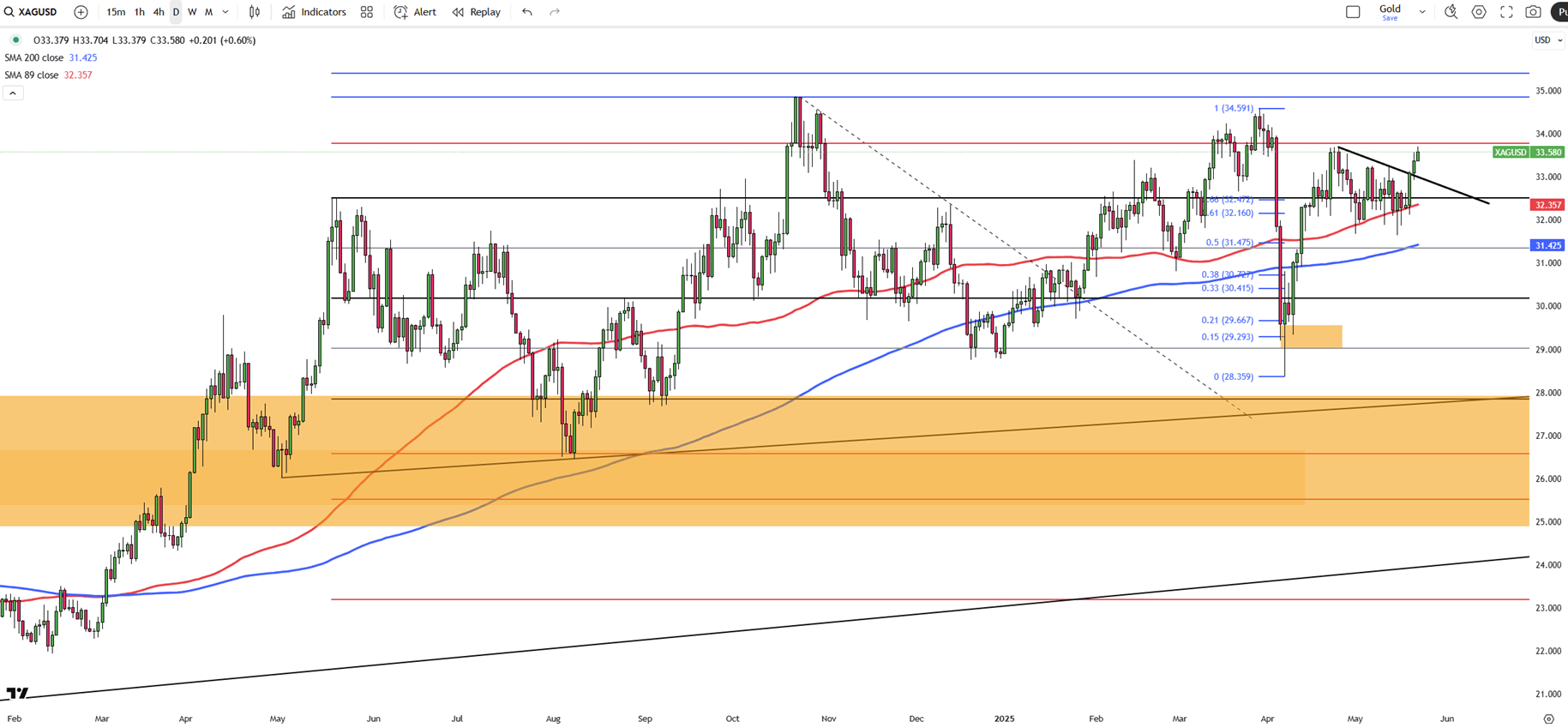

Silver (XAG/USD) climbed to around $32.60 per ounce on Thursday during Asian trading, recording its third consecutive gain as safe-haven demand increased amid rising U.S. fiscal concerns and global tensions.

Moody’s recent downgrade of the U.S. credit rating to Aa1, citing growing debt and deficits, added pressure on the Dollar. Ongoing unrest in the Middle East and Israel’s military actions in Gaza also supported precious metal prices. Meanwhile, Ukraine is preparing to urge the EU next week to seize Russian assets and target oil buyers, as U.S. sanctions appear to be losing momentum.

The first critical support for Silver is seen at 33.80, and the first resistance is located at 32.30.

| R1: 33.80 | S1: 32.30 |

| R2: 34.20 | S2: 31.40 |

| R3: 34.90 | S3: 30.20 |

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

Detail March Starts With Geopolitical Turmoil (2-6 March)

March Starts With Geopolitical Turmoil (2-6 March)Global markets began the week in a state of high alert following coordinated US and Israeli strikes on Iran over the weekend, which resulted in the death of Supreme Leader Ayatollah Ali Khamenei.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!