EUR/USD advanced toward $1.14 as U.S. fiscal concerns weighed on the dollar, while the yen touched a one-month high on inflation surprises and risk aversion.

Gold held firm near $3,340 with geopolitical caution and budget deficit worries. The British pound rallied past $1.357 on strong retail sales and Trump’s tariff delay, and silver edged down slightly on profit-taking, despite sustained interest and increased physical demand.

| Time | Cur. | Event | Forecast | Previous |

| 12:30 | USD | Durable Goods Orders (MoM) (Apr) | -7.9% | 9.2% |

| 14:00 | USD | CB Consumer Confidence (May) | 87.1 | 86.0 |

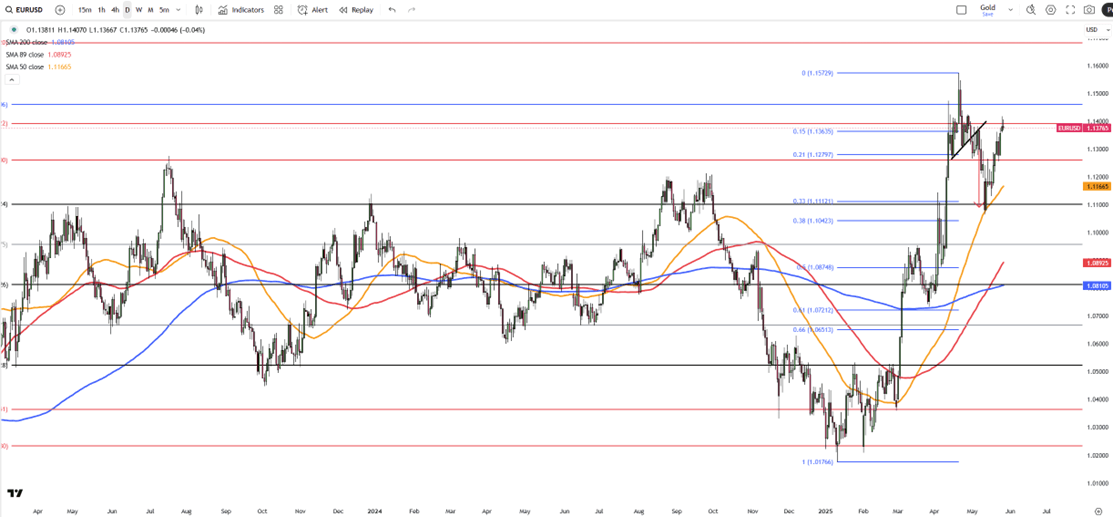

EUR/USD climbed to $1.1395, approaching a one-month high as the dollar softened amid mounting U.S. fiscal concerns and uncertainty over Trump’s tax-and-spending bill. Risk sentiment improved after Trump delayed a planned 50% tariff on EU goods, easing fears of a transatlantic trade clash. The euro also gained from ECB President Lagarde’s remarks that it could strengthen as a global currency if EU institutions were reinforced.

Resistance is at 1.1425, with additional levels at 1.1460 and 1.1580. Support begins at 1.1260, followed by 1.1100 and 1.1050.

| R1: 1.1425 | S1: 1.1260 |

| R2: 1.1460 | S2: 1.1100 |

| R3: 1.1580 | S3: 1.1050 |

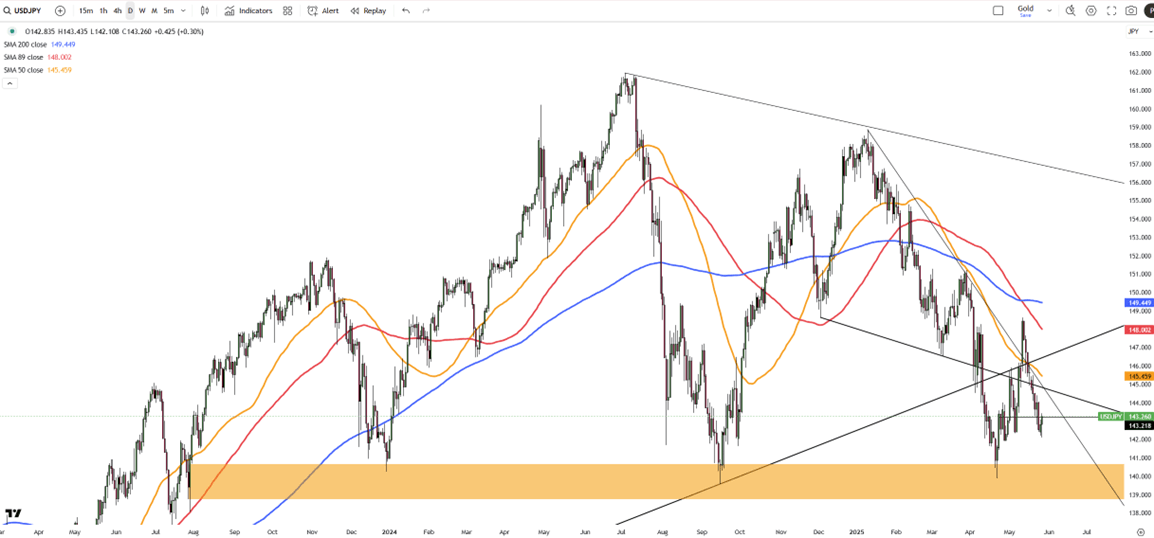

The Japanese yen strengthened toward 142 per dollar on Tuesday, its highest in four weeks, driven by safe-haven inflows and weak dollar sentiment tied to Trump’s fiscal plan. Worries over a widening U.S. deficit weighed on the greenback, while speculation of a 25% iPhone tariff added to trade conflicts. Domestically, expectations for more BoJ tightening rose after core inflation surprised at 3.5%, a two-year high.

Resistance stands at 148.60, with further levels at 149.80 and 151.20. Support is found at 139.70, then 137.00 and 135.00.

| R1: 148.60 | S1: 139.70 |

| R2: 149.80 | S2: 137.00 |

| R3: 151.20 | S3: 135.00 |

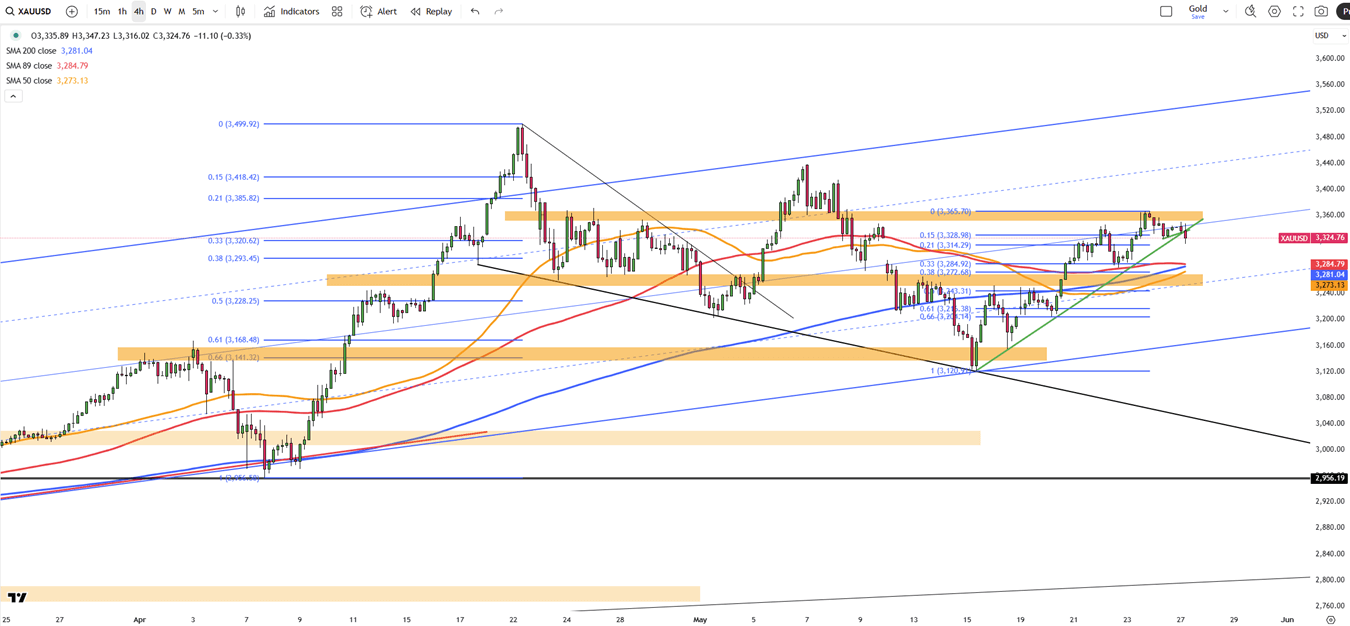

Gold remained steady at nearly $3,340 per ounce on Tuesday, with demand easing slightly due to renewed trade optimism after Trump pushed back EU tariffs to July 9. The EU pledged to speed up negotiations, lifting risk sentiment. However, worries over U.S. fiscal health, global trade dynamics, and geopolitical tensions kept markets cautious. Investors now await the FOMC minutes and PCE inflation data for policy cues.

Support is seen at $3,270, while resistance is located at $3,370. Further levels include $3,150 and $3,025 below, and $3,440 and $3,500 above.

| R1: 3370 | S1: 3270 |

| R2: 3440 | S2: 3150 |

| R3: 3500 | S3: 3025 |

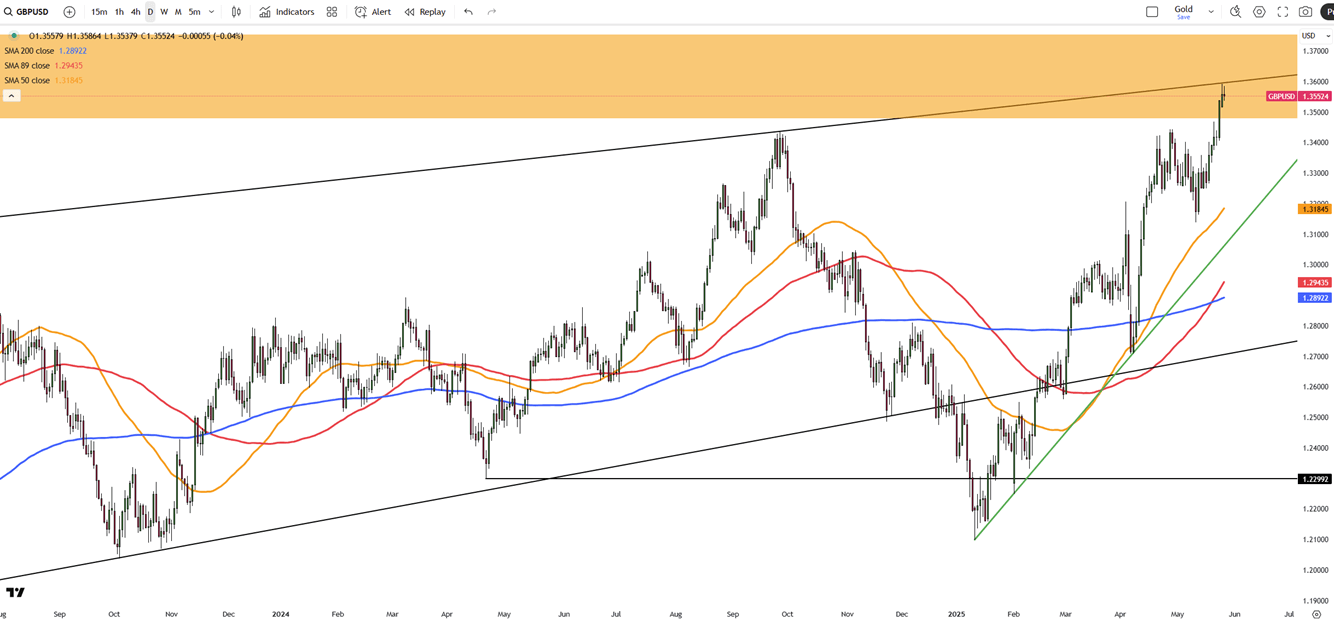

GBP/USD advanced above $1.357, hitting its highest level since February 2022, as Trump’s delay of the 50% EU tariff boosted global sentiment. The pound also gained from promising April data, with retail sales rising 1.2%, marking the fourth monthly gain. Inflation stayed high at 3.5%, adding uncertainty over the BoE’s next move. Markets now price in a 50% chance of a rate cut by August, with another possible by year-end.

Support lies at 1.3425, with resistance at 1.3600. Other key levels are 1.3850 and 1.3750 above, and 1.3165 and 1.2890 below.

| R1: 1.3600 | S1: 1.3425 |

| R2: 1.3750 | S2: 1.3165 |

| R3: 1.3850 | S3: 1.2890 |

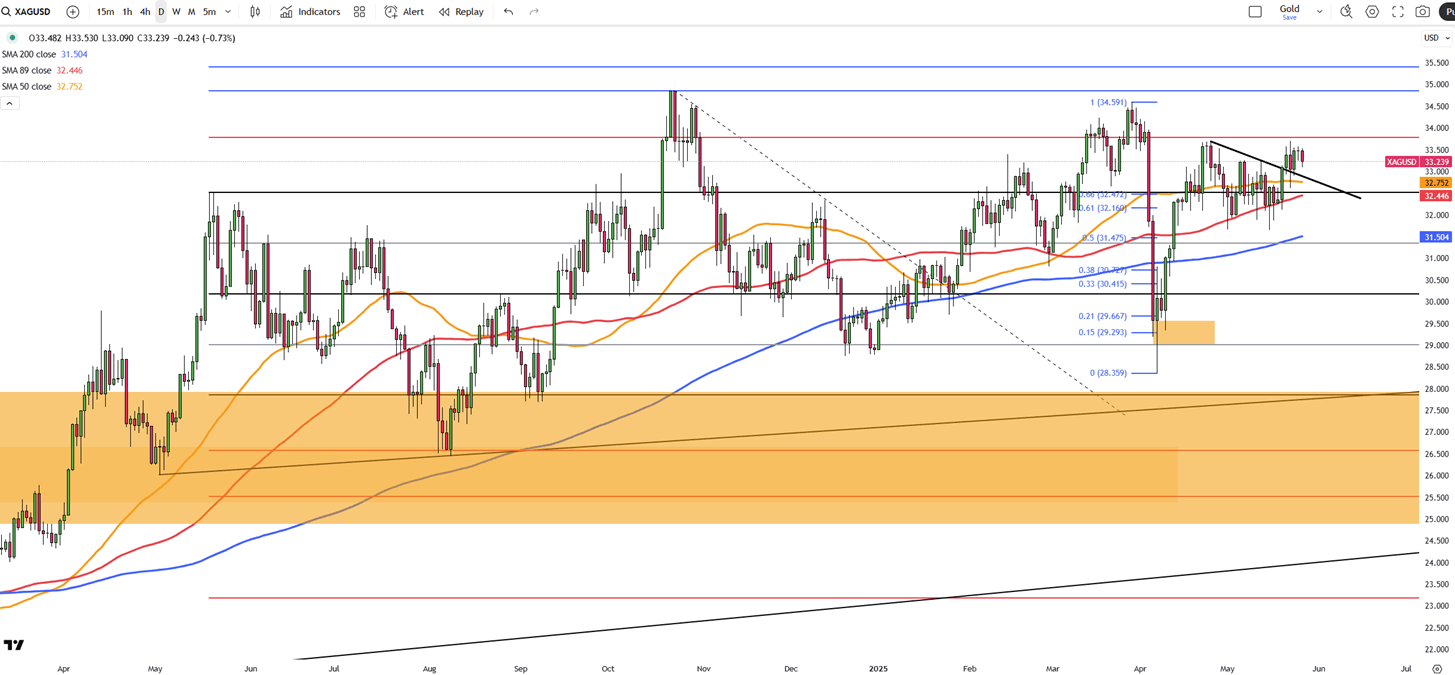

Silver eased to $33.31 per ounce, pulling back slightly as investors booked profits after recent gains. The retreat came even as the dollar remained weak and geopolitical tensions, including the conflict in Ukraine, persisted. While momentum slowed, physical demand, especially from Asia, continues to provide a firm base for silver.

Support is at $32.30, with resistance at $33.80. Additional levels include $34.20 and $34.90 above, and $31.40 and $30.20 below.

| R1: 33.80 | S1: 32.30 |

| R2: 34.20 | S2: 31.40 |

| R3: 34.90 | S3: 30.20 |

Global markets remain dominated by geopolitical risk as escalating conflict between the United States, Israel, and Iran fuels a strong shift toward safe-haven assets. The dollar index hit 99.3 Wednesday, rising for a third day as conflict concerns fueled inflation and shifted Fed rate cut expectations from July to September.

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!