The Euro, Yen, and silver all experienced significant movements on Tuesday.

The Euro weakened against the US dollar due to German deflation and expectations of further monetary easing by the ECB. The Japanese Yen fell to a three-month low against the dollar, raising concerns about intervention by Japanese authorities. Silver prices surged to a 12-year high on the back of safe-haven demand and rising industrial demand.

Time (GMT) | Event | Asset | Survey | Previous |

13:15 | BoE Gov Bailey Speaks | GBP | ||

| 14:00 | ECB President Lagarde Speaks | EUR | ||

15:00 | ECB's Lane Speaks | EUR |

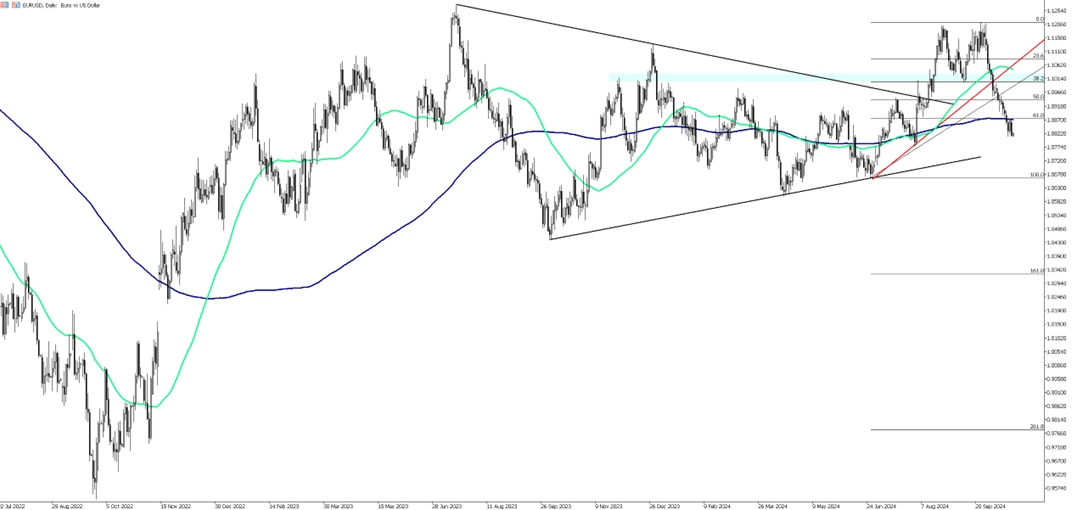

The EUR/USD pair entered a bearish consolidation phase during the Asian session on Tuesday, fluctuating around the 1.0820 level, just above its lowest point since early August reached the previous day. The near-term sentiment appears firmly bearish, indicating that the path of least resistance for spot prices is likely downward. Data released on Monday revealed that producer prices in Germany, the Eurozone's largest economy, declined for the first time in seven months in September, with the annual rate of deflation accelerating. This development has increased expectations for further monetary easing by the European Central Bank (ECB). Additionally, ECB policymaker Gediminas Simkus suggested that the ECB may need to lower its key interest rate further below the "natural" level if inflation continues to decline. This outlook could further weaken the euro, particularly in the context of a strong U.S. dollar, reinforcing the negative sentiment for the EUR/USD pair.

In the pair, the first support level is at 1.0810. If this level is breached, the next supports to watch will be 1.0770 and 1.0740. On the upside, the first resistance is at 1.0830; if this level is surpassed, the next targets will be 1.0875 and 1.0920.

| R1: 1.0830 | S1: 1.0810 |

| R2: 1.0875 | S2: 1.0770 |

| R3: 1.0920 | S3: 1.0740 |

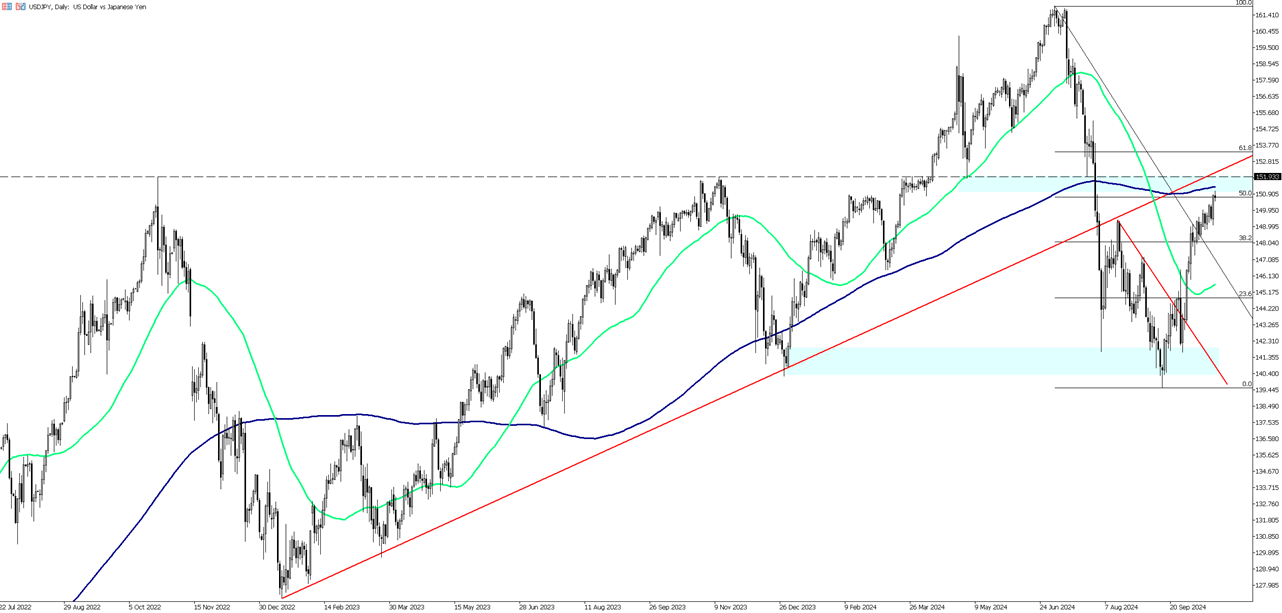

The Japanese yen fell to around 151 per dollar on Tuesday, marking its lowest point in nearly three months and crossing the critical 150 per dollar threshold that could trigger another intervention from Japanese authorities. While Japan's Deputy Chief Cabinet Secretary Aoki refrained from commenting on the currency fluctuations, top currency diplomat Atsushi Mimura emphasized last week that they are watching exchange rate movements and consider excessive volatility undesirable. Earlier this year, Japanese authorities intervened in the market when the yen dipped below 160 per dollar, and the 150 level is now being viewed as a potential new benchmark. The yen began its decline in mid-September amid rising uncertainty regarding the Bank of Japan's interest rate policies. Additionally, the local currency faced pressure from a strengthening dollar, driven by robust U.S. economic data and increasing speculation about a potential Trump presidency.

The first resistance level is at 151.50. If this level is surpassed, the next targets will be 153.20 and 154.30. On the downside, the initial support is at 150.15; if this level is breached, the next support to watch will be 148.60 and 147.20.

| R1: 151.50 | S1: 150.15 |

| R2: 153.20 | S2: 148.60 |

| R3: 154.30 | S3: 147.20 |

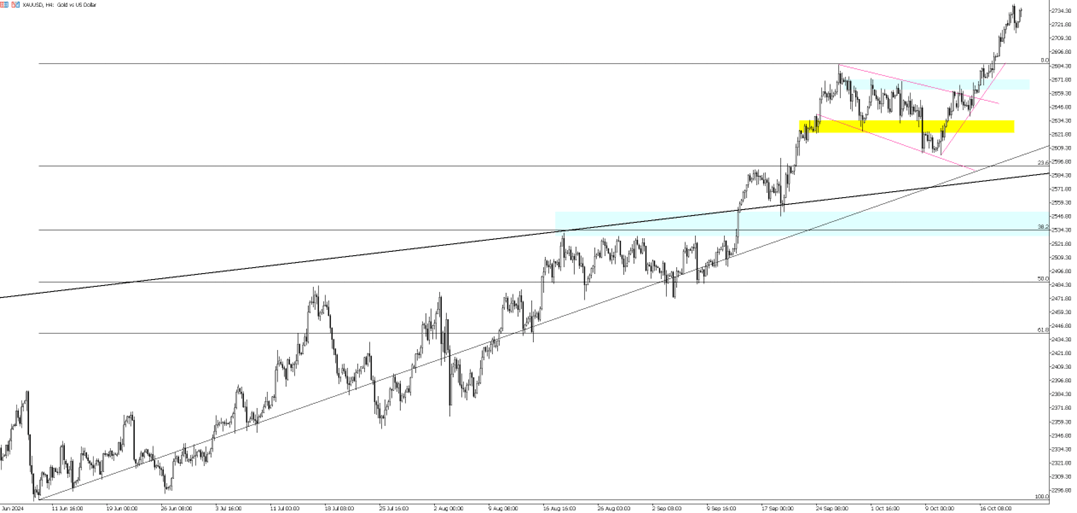

Gold climbed to around $2,730 per ounce on Tuesday, reaching record levels due to its appeal as a safe-haven asset. Recent reports indicate that Israel has targeted sites linked to Hezbollah's financial operations in Beirut, raising concerns about escalating conflict. Additionally, the prospect of Israel retaliating against Iran is resurfacing following a drone breach that exploded near Prime Minister Netanyahu's residence. The approaching U.S. election is also heightening demand for safe-haven investments. Concurrently, monetary easing from major central banks is supporting gold's upward trend, with the People's Bank of China and the European Central Bank recently lowering their key lending rates. Traders are also weighing differing opinions among Federal Reserve officials regarding the future of U.S. monetary policy; Kansas City Fed President Jeffrey Schmid advocates for a slower pace of rate cuts, while San Francisco Fed President Mary Daly argues for more cuts to safeguard the labor market.

Technically, the first support level is at 2,685. If this level is breached, the next supports to watch will be 2,640 and 2,605. On the upside, the initial resistance is at 2,750; if this level is surpassed, the next targets will be 2,770 and 2,800.

| R1: 2750 | S1: 2685 |

| R2: 2770 | S2: 2640 |

| R3: 2800 | S3: 2605 |

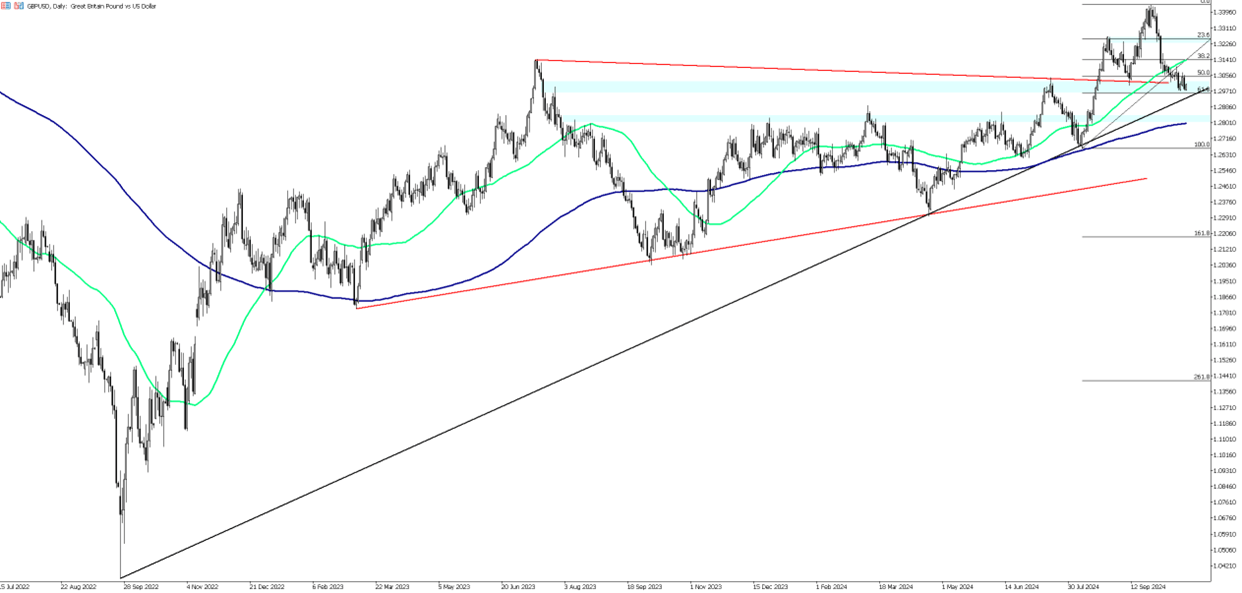

The GBP/USD pair dipped on Monday, starting the trading week with a new test below the 1.3000 mark, as traders showed caution ahead of a busy week filled with central bank appearances and updates on global Purchasing Managers Index (PMI) figures. Pound Sterling traders will be eyeing Bank of England (BoE) Governor Andrew Bailey’s speech on Tuesday. His comments will be delivered later in the day at the Bloomberg Global Regulatory Forum in New York during the early US market session. On Thursday, the global PMI figures will be released, beginning with the UK data. Market forecasts suggest a slight decrease in UK activity, with October’s Services PMI expected to drop to 52.2 from 52.4 in the previous month.

For GBP/USD, the initial support lies at 1.2965, followed by 1.2900 and 1.2830 below. On the upside, the first resistance is at 1.3050, with subsequent levels at 1.3100 and 1.3160 if the pair breaks above this resistance.

| R1: 1.3000 | S1: 1.2965 |

| R2: 1.3100 | S2: 1.2900 |

| R3: 1.3160 | S3: 1.2830 |

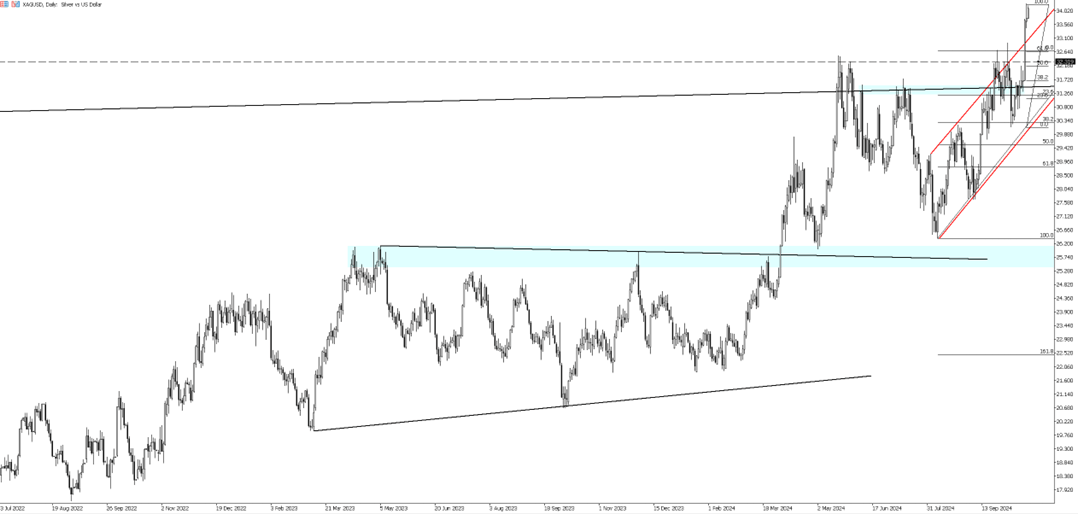

Silver maintained its recent upward trend, reaching around $34 per ounce on Tuesday, its highest level in nearly 12 years. This surge is fueled by uncertainties surrounding the U.S. election, ongoing tensions in the Middle East, and increased demand for safe-haven assets like precious metals. Anticipation of stronger industrial demand for silver, particularly due to its role in solar panel production as the world pivots towards cleaner energy, has also supported price gains. Additionally, China, the largest consumer of metals, has implemented several stimulus measures to stimulate economic growth. Earlier this week, the People's Bank of China cut its one- and five-year loan prime rates by 25 basis points, bringing them to 3.1% and 3.6%, respectively. On Friday, the PBOC took further steps to strengthen China’s equity market and indicated that it may lower banks' reserve requirements again before the year concludes.

From a technical standpoint, the initial resistance level to monitor is 34.30. If silver breaks above this level, the next resistance levels to watch will be 34.90 and 35.20, respectively. On the downside, the initial support level is at 33.40, with subsequent support levels at 32.90 and 32.30.

| R1: 34.30 | S1: 33.40 |

| R2: 34.90 | S2: 32.90 |

| R3: 35.20 | S3: 32.30 |

Bond Market Pushback Takes Center Stage

Bond Market Pushback Takes Center StageMarkets are almost fully pricing in another Federal Reserve rate cut this week, yet the US bond market continues to move in the opposite direction.

Detail Central Bank Expectations Reset the Tone (8-12 December)

Central Bank Expectations Reset the Tone (8-12 December)Traders adjusted positioning before the Federal Reserve’s December decision and evaluated fresh signals from the ECB, BoE and BOJ.

Detail Futures Stall, 10-Year Yield Pushes Above 4.1% (12.08.2025)US stock futures were flat on Monday ahead of the Fed’s meeting, with markets pricing an 88% chance of a 25 bp cut on Wednesday.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!