The euro held near 1.1870 as markets turned cautious ahead of key US inflation data, which is expected to shape near-term Federal Reserve policy expectations.

Strong US labor figures continue to support the dollar and cap further euro gains, though the ECB’s calm stance on recent currency strength has helped limit downside pressure. The yen remains set for its strongest weekly advance in months on election optimism and intervention vigilance, while gold and silver stabilized as investors reassessed risk after a broad selloff. Sterling lagged peers following weak UK growth data that reinforced expectations of future Bank of England rate cuts.

| Time | Cur. | Event | Forecast | Previous |

| U.S. Consumer Price Index (CPI) MoM (MoM) (Jan) | 0.3% | 0.3% | ||

| U.S. Consumer Price Index (CPI) YoY (YoY) (Jan) | 2.5% | 2.7% | ||

| U.S. Core Consumer Price Index (CPI) MoM (MoM) (Jan) | 0.3% | 0.2% |

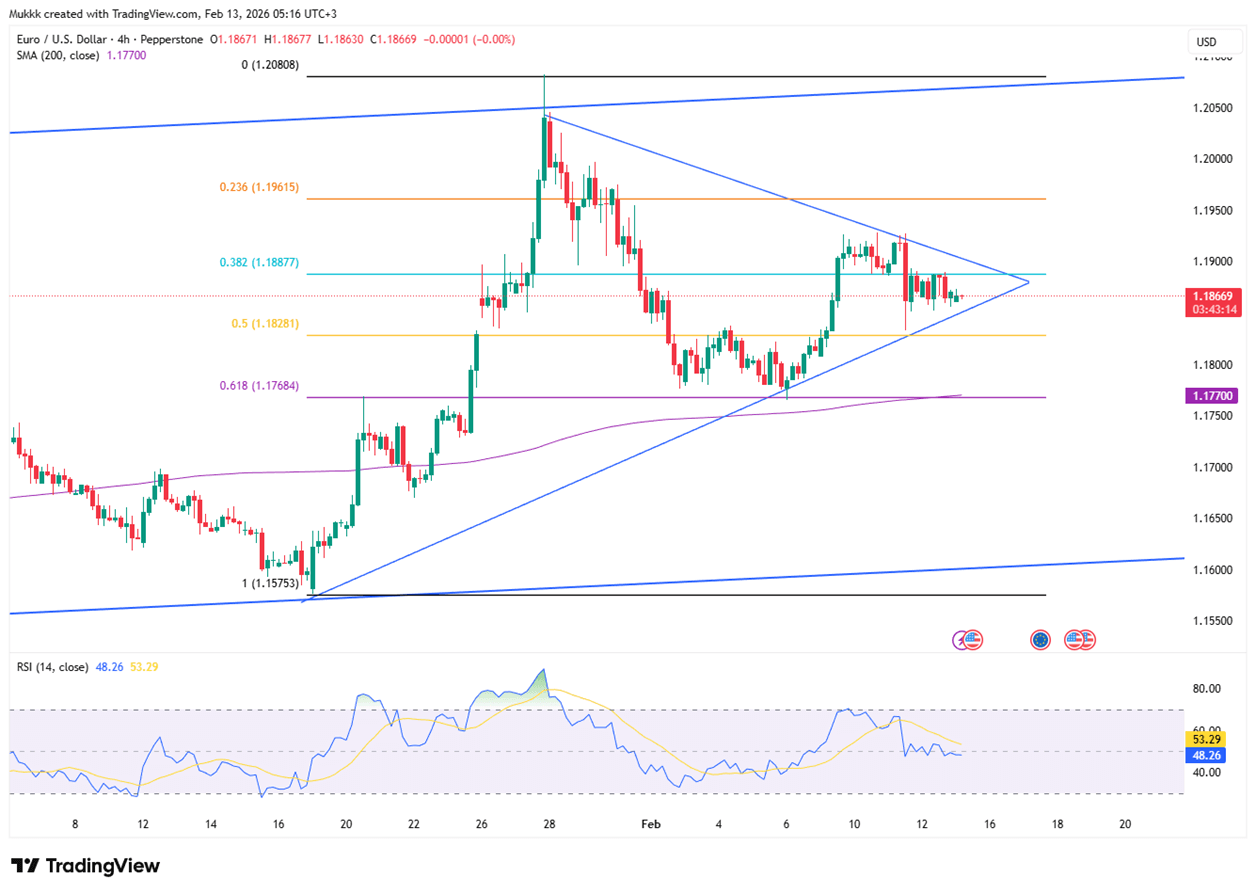

The euro traded around 1.1870 as investors awaited U.S. inflation data for fresh market direction. Recent gains were capped by strong U.S. employment figures, which strengthened the dollar and lowered expectations for an immediate Federal Reserve rate cut. However, the currency found support from the European Central Bank’s relaxed attitude toward its recent climb. President Christine Lagarde further stabilized sentiment by advising policymakers to remain calm regarding short-term data fluctuations while the broader inflation outlook continues to improve.

For EUR/USD, the nearest resistance is at 1.1920, while the closest support level stands at 1.1840.

| R1: 1.1920 | S1: 1.1840 |

| R2: 1.1970 | S2: 1.1780 |

| R3: 1.2000 | S3: 1.1730 |

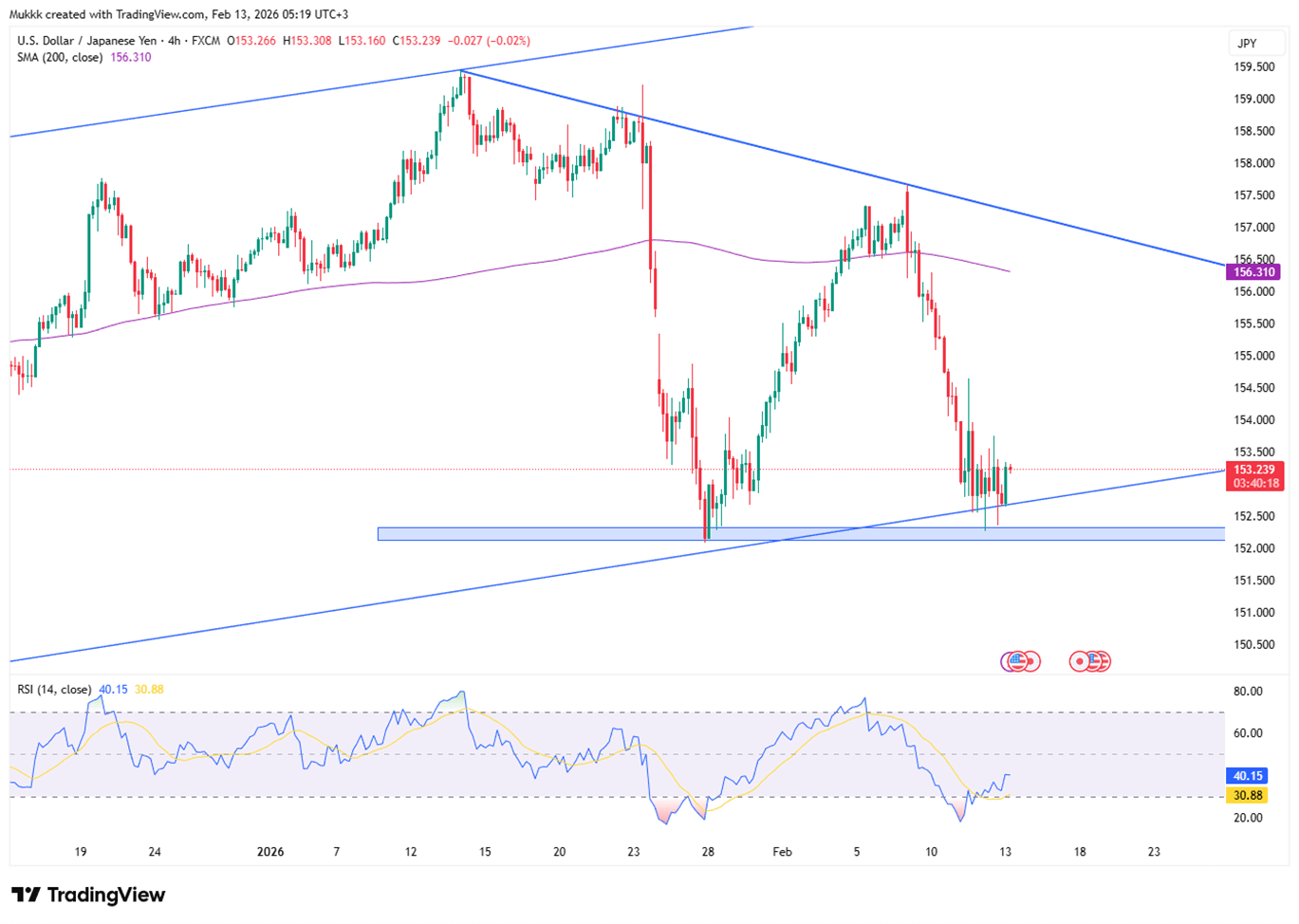

The Japanese yen eased past 153 per dollar on Friday, yet it remains positioned for its strongest weekly rally since late 2024. Market confidence stems from Prime Minister Sanae Takaichi’s clear electoral victory and her plans for fiscal expansion. Her strategy focuses on stimulus and tax cuts funded by subsidies rather than new debt, lowering political risk. While yen momentum slowed slightly, currency official Atsushi Mimura confirmed that authorities remain highly alert to volatile exchange rate fluctuations.

Technically, resistance stands near 153.70, while support is firm at 152.50.

| R1: 153.70 | S1: 152.50 |

| R2: 154.50 | S2: 151.70 |

| R3: 155.60 | S3: 150.50 |

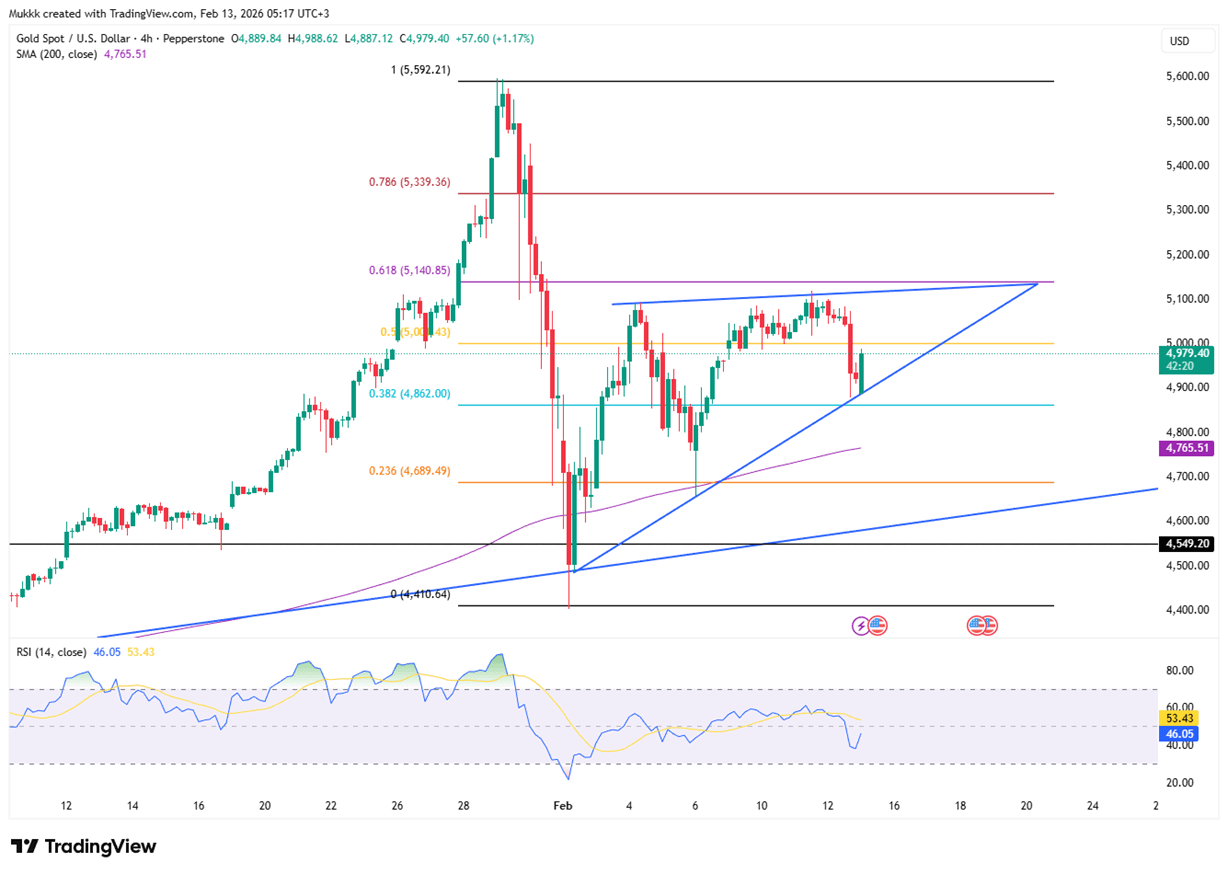

Gold rose to approximately $4,960 per ounce on Friday, reclaiming some ground after a sharp 3% decline in the previous session. Thursday’s steep decline was driven by a broad market selloff, forcing investors to liquidate bullion for cash amid heightened risk aversion and algorithmic trading. Market focus has now shifted to today's U.S. inflation data, which will likely influence Federal Reserve policy. Despite recent volatility and a slight weekly loss, steady central bank demand and geopolitical risks continue to provide a solid floor for prices.

Gold sees support near $4885, while resistance is around $5000.

| R1: 5000 | S1: 4485 |

| R2: 5085 | S2: 4820 |

| R3: 5200 | S3: 4750 |

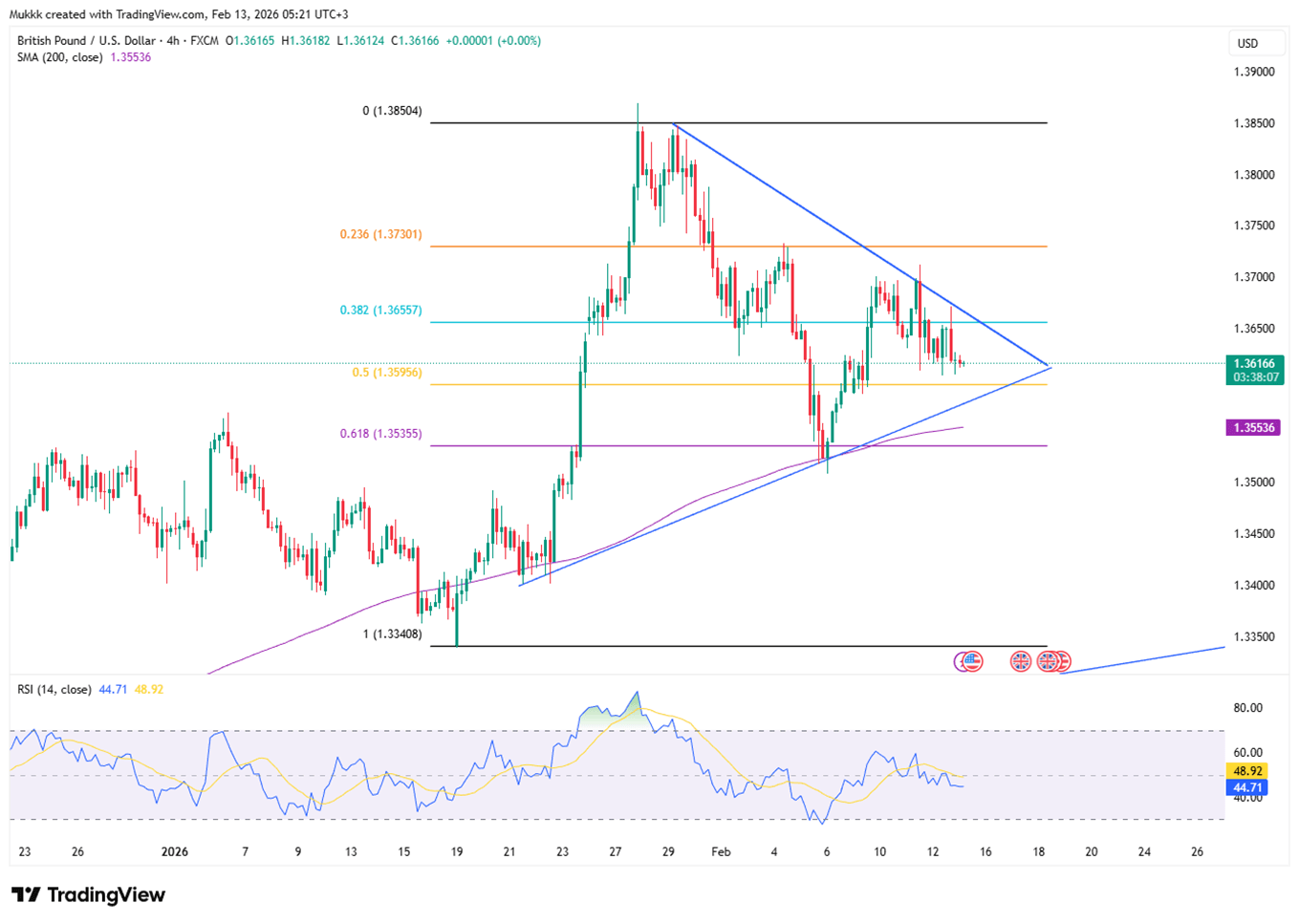

Sterling stayed near $1.36 as markets reacted to disappointing UK economic data. Official figures revealed only 0.1% growth for the final quarter of 2025, dragging annual growth to its lowest level since mid-2024 at 1.0%. Shrinking industrial and construction activity pointed to a stalling recovery, increasing political pressure on Prime Minister Keir Starmer. These weak results have strengthened expectations for Bank of England rate cuts, despite the recent decision to hold rates at 3.75%.

From a technical view, support stands near 1.3600, with resistance around 1.3670.

| R1: 1.3670 | S1: 1.3600 |

| R2: 1.3750 | S2: 1.3560 |

| R3: 1.3820 | S3: 1.3500 |

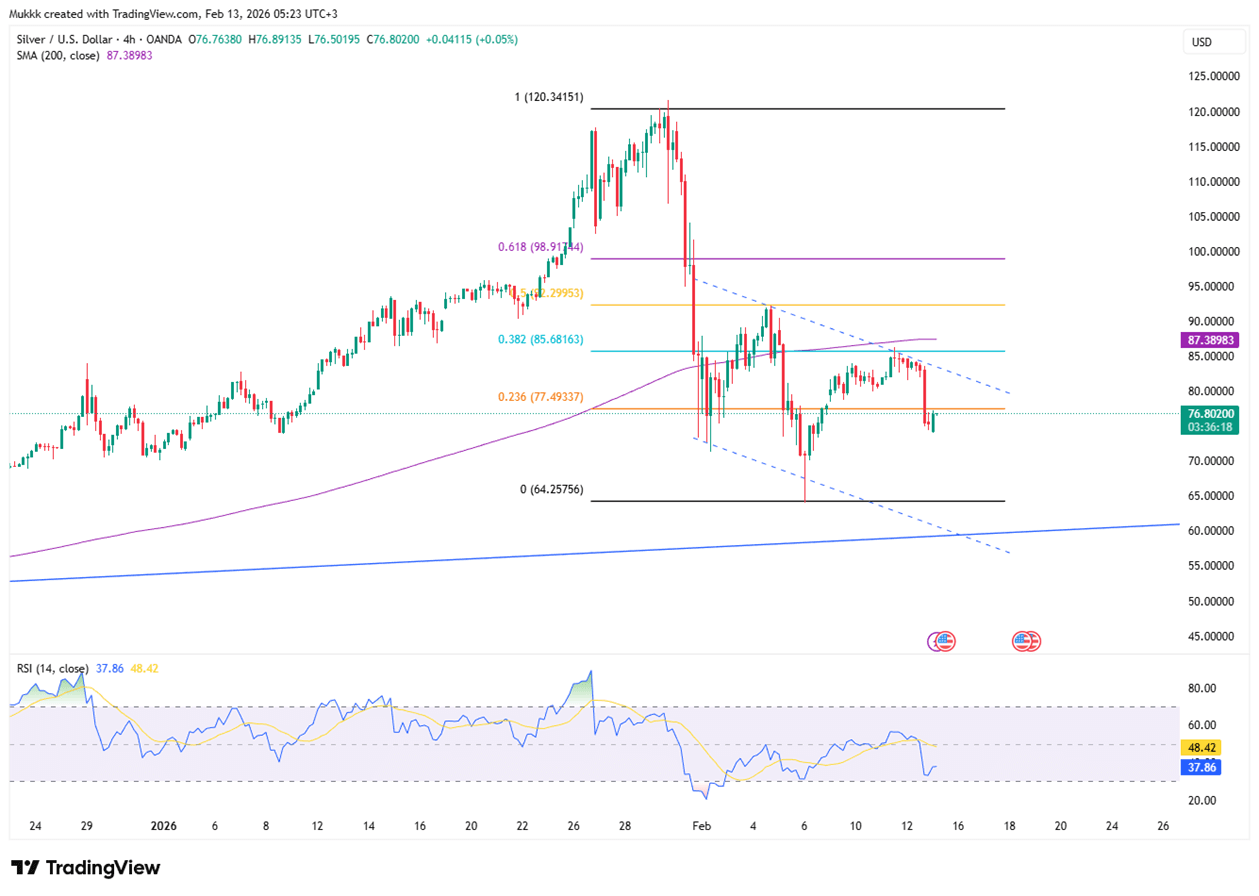

Silver traded around $77 per ounce on Friday, holding steady despite being on track for a third consecutive weekly decline. A sharp broad-based selloff on Thursday, which lacked a singular catalyst, appeared to be driven by equity losses and algorithmic trading. Investors are now awaiting U.S. inflation data for further direction. While strong employment figures have shifted rate cut bets from June to July, silver maintains underlying support from safe-haven demand and long-term currency concerns.

From a technical view, resistance stands near $79.50 while support is located around $75.80.

| R1: 79.50 | S1: 75.80 |

| R2: 82.30 | S2: 72.50 |

| R3: 85.00 | S3: 70.00 |

Markets traded with a mixed tone as currencies and metals reacted to central bank signals and fresh data. The euro held firm near $1.185, supported by the ECB’s comfort with currency strength and confidence that inflation is on track, alongside expectations of a less dovish policy mix later this year.

UK Workforce Growth Stalls

UK Workforce Growth StallsRecent figures from the Office for National Statistics show that the UK labor market entered 2026 on a softer footing.

Detail Markets Keep Cautious in Thin Trade (02.17.2026)Global markets opened cautiously in thin trading, with the euro holding near $1.185 after the ECB signaled comfort with its strength, sterling steady around $1.36 ahead of key UK data, and the yen firming toward 153 on BoJ rate-hike speculation.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!