EUR/USD rebounded near 1.1330 as Treasury yields fell and traders awaited Eurozone GDP data.

The yen strengthened while gold hovered near $3,300, supported by deficit worries and Middle East tensions. GBP/USD climbed on upbeat UK consumer and retail data, despite mixed PMIs. Meanwhile, silver stabilized above $33, supported by fiscal anxiety and strong industrial demand from renewable energy sectors in China and Europe.

| Time | Cur. | Event | Forecast | Previous |

| 06:00 | EUR | German GDP (QoQ) (Q1) | 0.4%(Act) | -0.2% |

| 06:00 | GBP | Retail Sales MoM | 1.2%(Act) | 0.1% |

| 17:00 | USD | New Home Sales (Apr) | 649K | 742K |

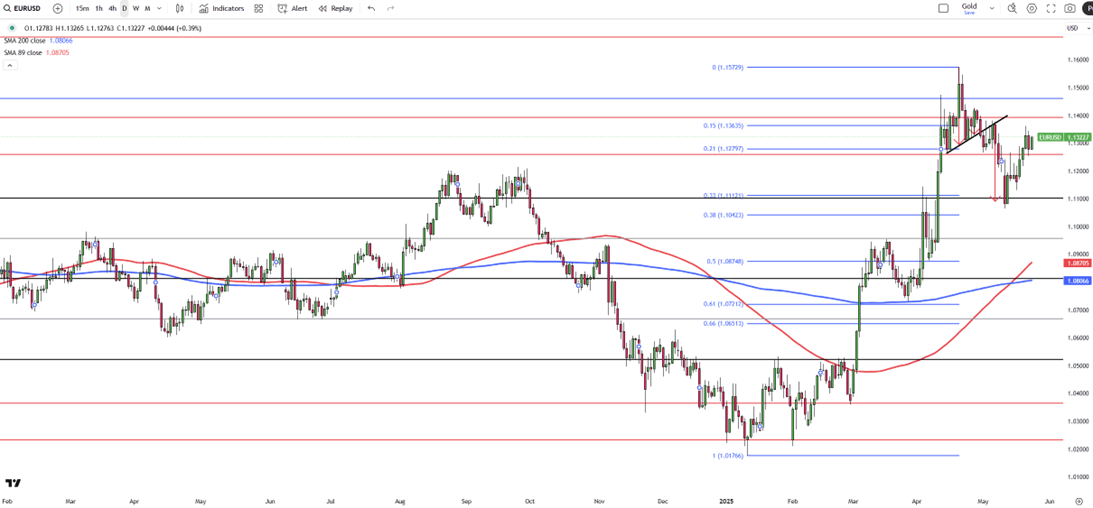

EUR/USD climbed to around 1.1310 during Friday’s Asian session, rebounding as U.S. Treasury yields declined, the 30-year yield slipped from its 19-month high of 5.15%, weighing on the dollar. The recovery follows the House passing Trump’s fiscal bill, which revived deficit worries. Earlier, strong U.S. PMI figures (Composite: 52.1, Manufacturing & Services: 52.3) had briefly strengthened the dollar.

Fed Governor Waller hinted at possible rate cuts if tariffs stabilize, while Trump renewed threats of higher tariffs on the EU. On the European front, ECB officials expect inflation to return to near 2% by end-2025, though growth remains subdued. Eurozone PMIs showed services at 48.9 and manufacturing at 49.4. Focus now shifts to Germany’s GDP release.

Resistance is at 1.1390, with higher levels at 1.1460 and 1.1580. First support lies at 1.1260, followed by 1.1100 and 1.1050.

| R1: 1.1390 | S1: 1.1260 |

| R2: 1.1460 | S2: 1.1100 |

| R3: 1.1580 | S3: 1.1050 |

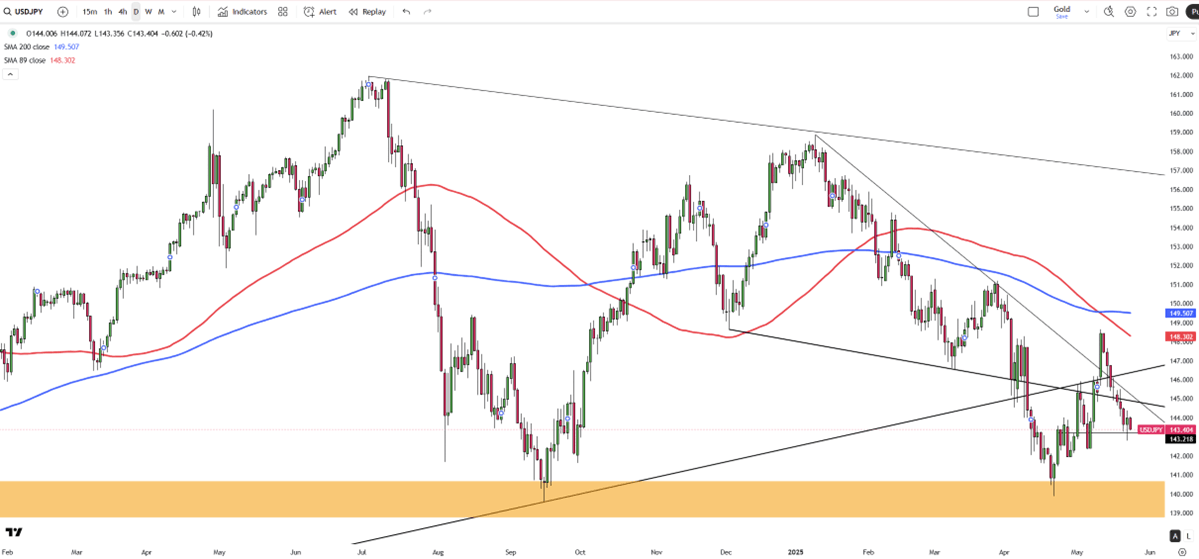

The Japanese yen firmed to around 143.6 per dollar, heading for a weekly gain of over 1% as inflation data came in stronger than expected. Core inflation surged to 3.5%, its highest in more than two years, while headline inflation held at 3.6%, reinforcing expectations that the BoJ may maintain its tightening stance.

The yen also benefited from continued dollar weakness tied to U.S. fiscal worries. Earlier, Japan’s Finance Minister Katsunobu Kato denied discussing exchange rates with U.S. Treasury Secretary Bessent at the G7 summit, dismissing rumors of joint currency intervention.

USD/JPY faces resistance at 148.60, with further upside levels at 149.80 and 151.20. Key support lies at 139.70, then 137.00 and 135.00.

| R1: 148.60 | S1: 139.70 |

| R2: 149.80 | S2: 137.00 |

| R3: 151.20 | S3: 135.00 |

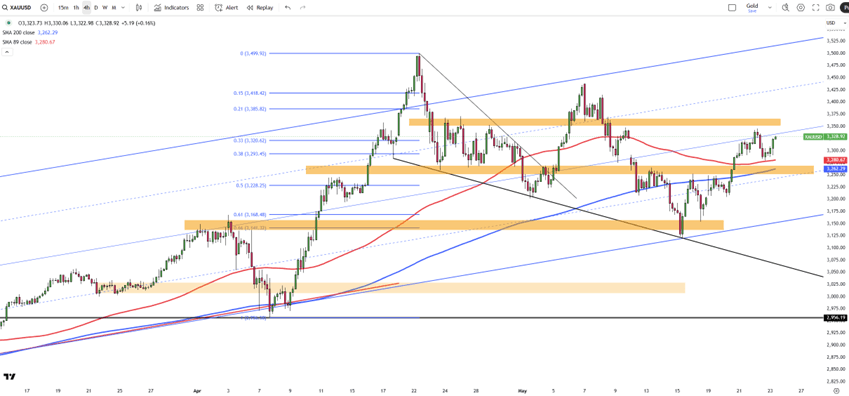

Gold hovered around $3,300 per ounce, aiming for a weekly gain as demand held firm. Worries over U.S. fiscal health remained front and center following the House’s approval of Trump’s budget plan, which the CBO projects will add nearly $4 trillion to the national debt.

Moody’s downgrade of the U.S. credit rating due to debt and servicing costs added to concerns. Geopolitical tensions, including the threat of Israeli strikes on Iranian nuclear sites and no direct Russia-Ukraine peace talks, also supported gold earlier in the week.

Resistance is at $3,370, with further levels at $3,440 and $3,500. Key support begins at $3,250, followed by $3,150 and $3,025.

| R1: 3370 | S1: 3250 |

| R2: 3440 | S2: 3150 |

| R3: 3500 | S3: 3025 |

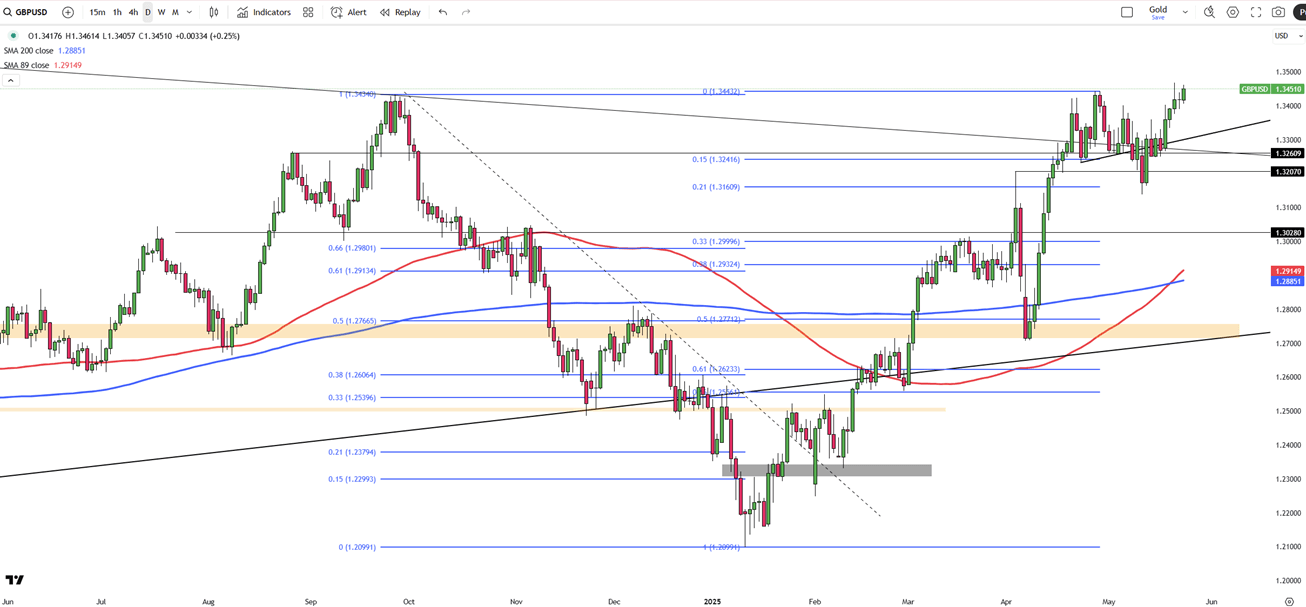

GBP/USD edged up by 0.25% in Friday’s Asian session, nearing 1.3450, after upbeat UK retail sales and consumer confidence data lifted sentiment. The GfK index rose to -20 in May, beating forecasts, while April retail sales surprised to the upside.

However, PMI data showed divergence as manufacturing fell to 45.1 (vs. 46.0 expected), while services ticked up to 50.2 from 49.0.

The pound also benefited from a weaker U.S. dollar as Treasury yields retreated from 19-month highs. Trump’s budget bill, which includes tax breaks on tips and U.S.-made car loans, passed narrowly and is projected to add $3.8 billion to the deficit.

Resistance is at 1.3470, followed by 1.3550 and 1.3700. Key support lies at 1.3250, then 1.3150 and 1.3000.

| R1: 1.3470 | S1: 1.3250 |

| R2: 1.3550 | S2: 1.3150 |

| R3: 1.3700 | S3: 1.3000 |

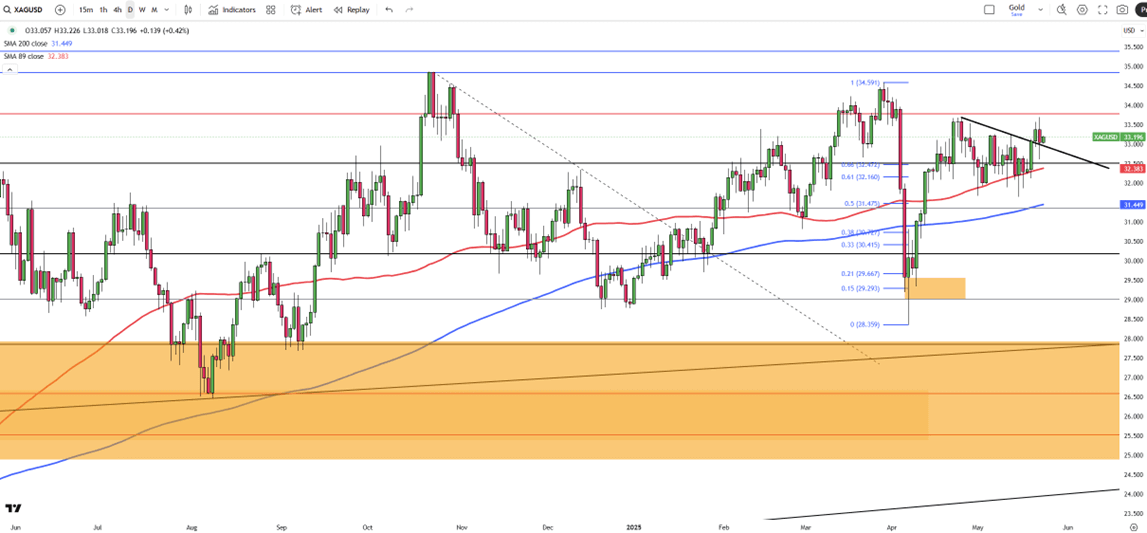

Silver (XAG/USD) traded near $33.10 on Friday, rebounding from losses as safe-haven interest returned amid U.S. fiscal concerns. Trump’s proposed tax bill, passed in the House, is expected to increase the deficit by $3.8 billion, adding pressure to the dollar and supporting precious metals.

While broader economic and trade uncertainty weighed on industrial metal demand, silver remained supported by strong industrial use. China’s wind and solar capacity surged to nearly 1,500 GW in Q1 2025, with photovoltaic power up by 60 GW. In Europe, solar output rose 30% year-over-year.

Moody’s downgrade of the U.S. credit rating, citing a potential rise in federal debt to 134% of GDP by 2035, further increased silver’s appeal.

Key resistance is at $33.80, with further levels at $34.20 and $34.90. Support is found at $32.30, followed by $31.40 and $30.20.

| R1: 33.80 | S1: 32.30 |

| R2: 34.20 | S2: 31.40 |

| R3: 34.90 | S3: 30.20 |

Currency markets remained volatile as ongoing Middle East tensions continued to shape global sentiment.

Hormuz Blockade Rattles Markets (09 - 13 March)

Hormuz Blockade Rattles Markets (09 - 13 March)Global sentiment was dominated this week by the second week of the war with Iran and the effective blockade of the Strait of Hormuz, driving Brent crude prices above $100/barrel. Despite a catastrophic US labor report showing a loss of 92,000 jobs in February, safe-haven demand pushed the US Dollar Index to 99.1. The energy shock has ignited fears of "stagflation," particularly in Europe and Japan, as soaring fuel costs threaten to reverse recent disinflationary trends.

Detail Oil Shock Drives Dollar Higher (03.09.2026)Global markets opened the week under pressure as escalating Middle East tensions and disruptions in the Strait of Hormuz pushed oil prices above $100 per barrel.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!