EUR/USD remains in a firm uptrend despite a minor pullback, supported by sustained euro demand and broad dollar weakness. The Yen softened on rising fiscal risks in Japan, while gold eased from recent highs as the dollar rebounded.

Sterling moved sideways ahead of the BoE meeting, and silver surged to fresh record levels on expectations of Fed rate cuts in 2026.

| Time | Cur. | Event | Forecast | Previous |

USD | U.S. President Trump Speaks | |||

GBP | BoE Interest Rate Decision (Dec) | 3.75% | 4.00% | |

EUR | Deposit Facility Rate (Dec) | 2.00% | 2.00% | |

| ECB Interest Rate Decision (Dec) | 2.15% | 2.15% | ||

| Core CPI (MoM) (Nov) | 0.3% | 0.2% | ||

| CPI (MoM) (Nov) | 0.3% | 0.3% | ||

| CPI (YoY) (Nov) | 3.1% | 3.0% | ||

| Initial Jobless Claims | 224K | 236K | ||

| Philadelphia Fed Manufacturing Index (Dec) | 2.5 | -1.7 | ||

| ECB Press Conference |

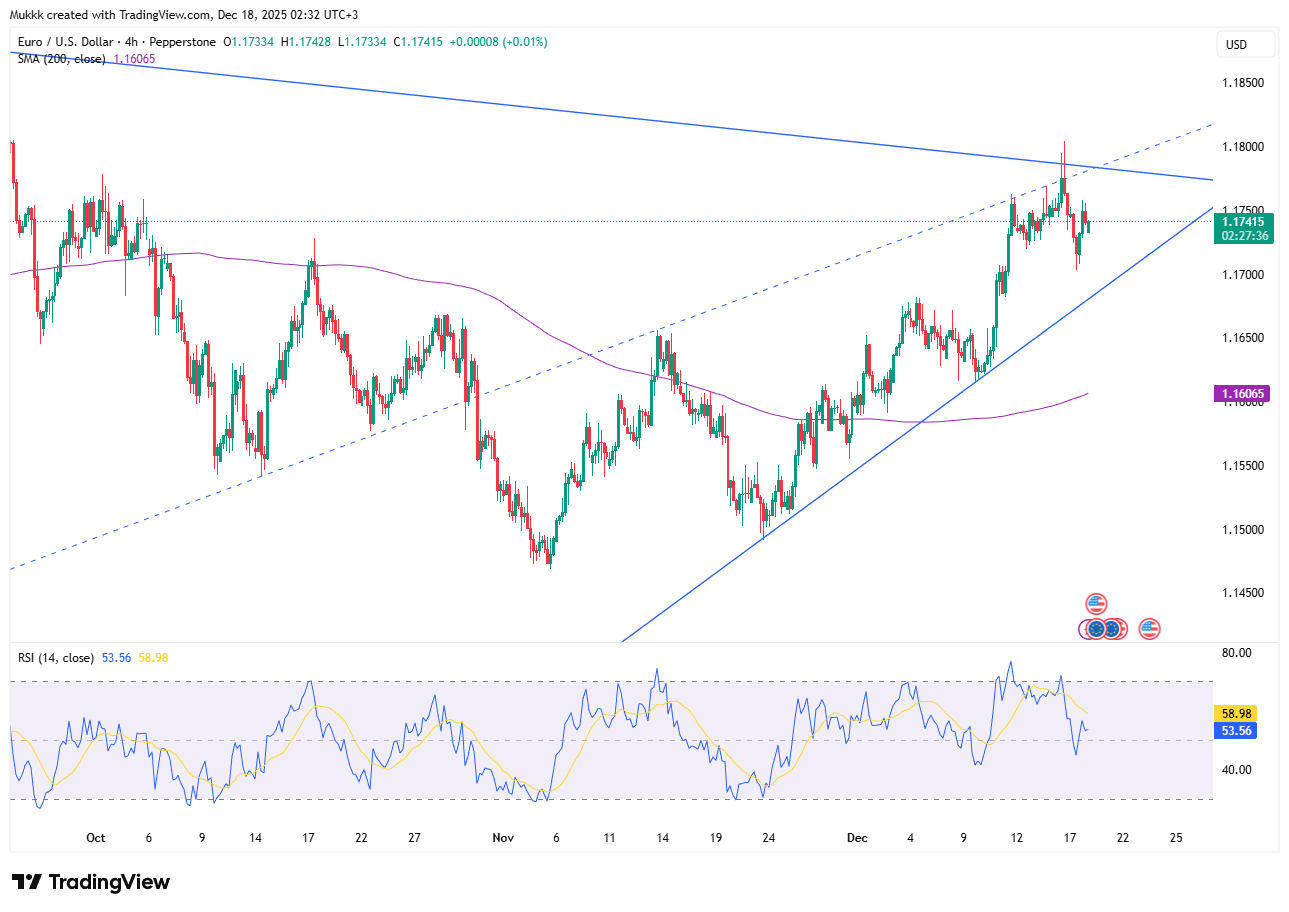

EUR/USD edged down to 1.1740 on Thursday, a slight 0.01% dip from the previous session. Despite this minor daily pullback, the euro maintains a solid upward trend against the US dollar. Over the last month, the pair appreciated by 1.75% as euro demand stayed high amid dollar weakness. On a yearly basis, the exchange rate has risen by 13.29%, underlining the broad bullish momentum seen throughout the past twelve months.

Technically, 1.1700 is the key support, while resistance is seen at 1.1780.

| R1: 1.1780 | S1: 1.1700 |

| R2: 1.1840 | S2: 1.1630 |

| R3: 1.1890 | S3: 1.1570 |

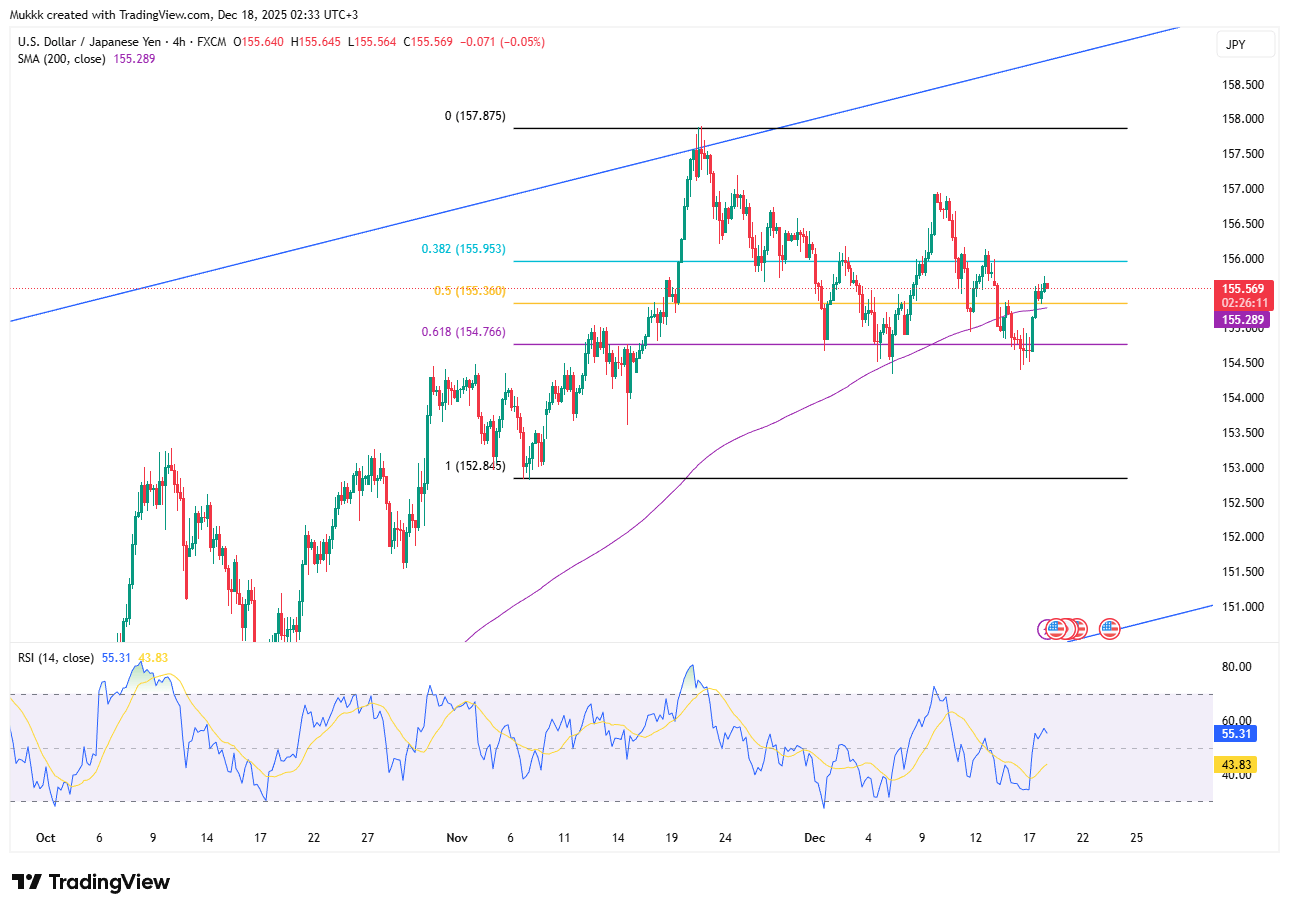

The Yen weakened toward 156 per Dollar as Japan's fiscal outlook worsened. Pressure mounted after PM Sanae Takaichi confirmed aggressive spending plans, fueling debt concerns. Markets expect the Bank of Japan to raise rates by 25 bps to 0.75%, leaving investors focused on Governor Ueda's guidance. Meanwhile, the Yen remains soft as traders await critical US inflation data and clarity on future Federal Reserve policy shifts.

Technically, resistance stands near 156.50, while support is firm at 154.60.

| R1: 156.50 | S1: 154.60 |

| R2: 156.80 | S2: 153.70 |

| R3: 157.60 | S3: 152.80 |

Gold slipped below $4,350 as a firmer dollar triggered profit taking near seven week highs. Support remains strong due to a weak jobs report and expectations for 2026 Fed rate cuts. Meanwhile, tensions in Venezuela continue to drive safe haven interest. Traders are now awaiting US CPI and jobless claims data for the next major price catalyst.

Gold sees support near $4285, while resistance is around $4380.

| R1: 4380 | S1: 4285 |

| R2: 4430 | S2: 4240 |

| R3: 4470 | S3: 4195 |

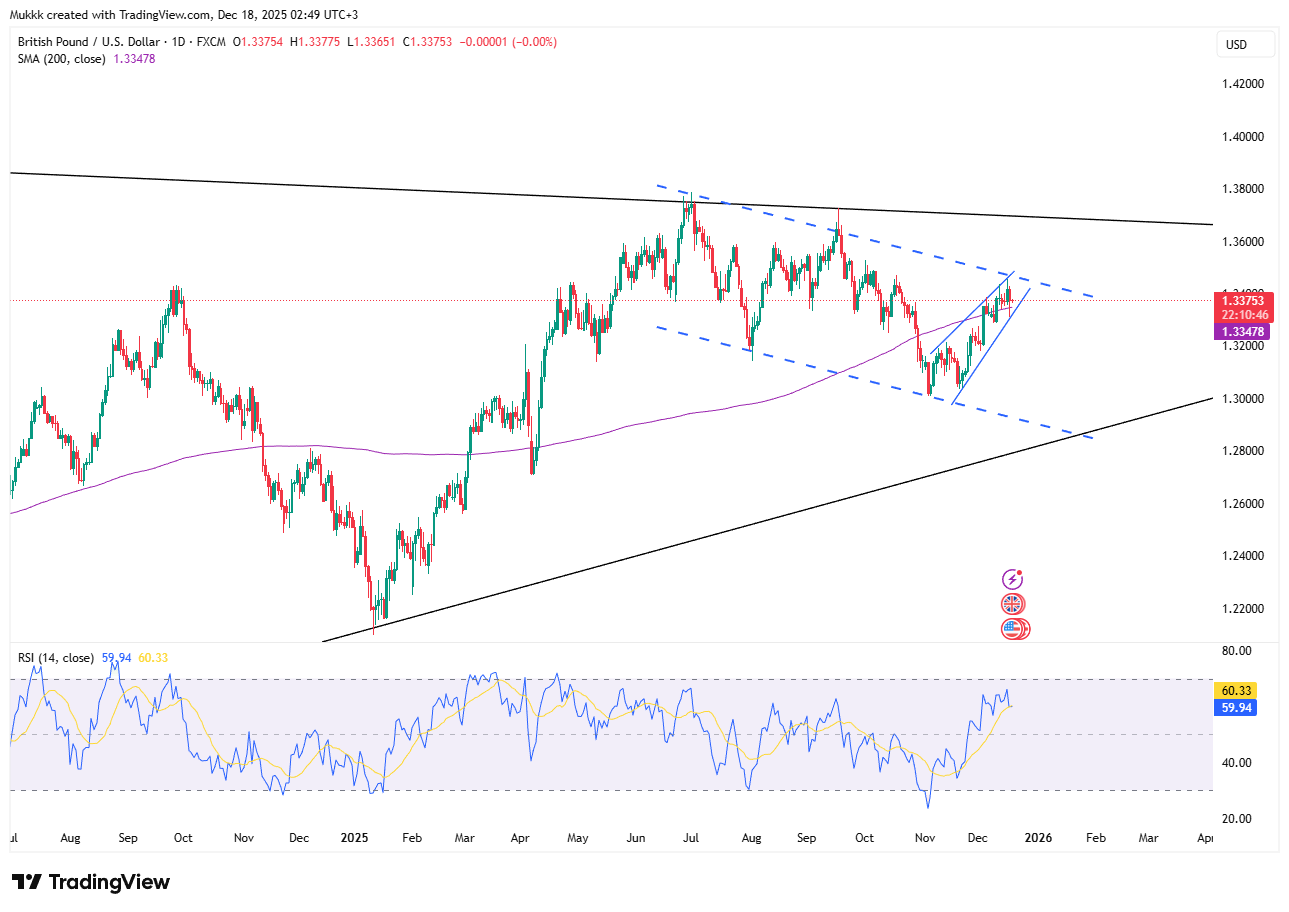

GBP/USD trades sideways near 1.3370 as investors prepare for the Bank of England’s final policy meeting of 2025. Markets anticipate a 25 bps rate cut to 3.75% following a larger than expected drop in November inflation. Headline CPI slowed to 3.2%, an eight month low, while core pressures also faded. These figures, combined with upcoming US inflation data, keep the Pound in a tight range.

From a technical view, support stands near 1.3310, with resistance around 1.3430.

| R1: 1.3430 | S1: 1.3310 |

| R2: 1.3500 | S2: 1.3260 |

| R3: 1.3540 | S3: 1.3200 |

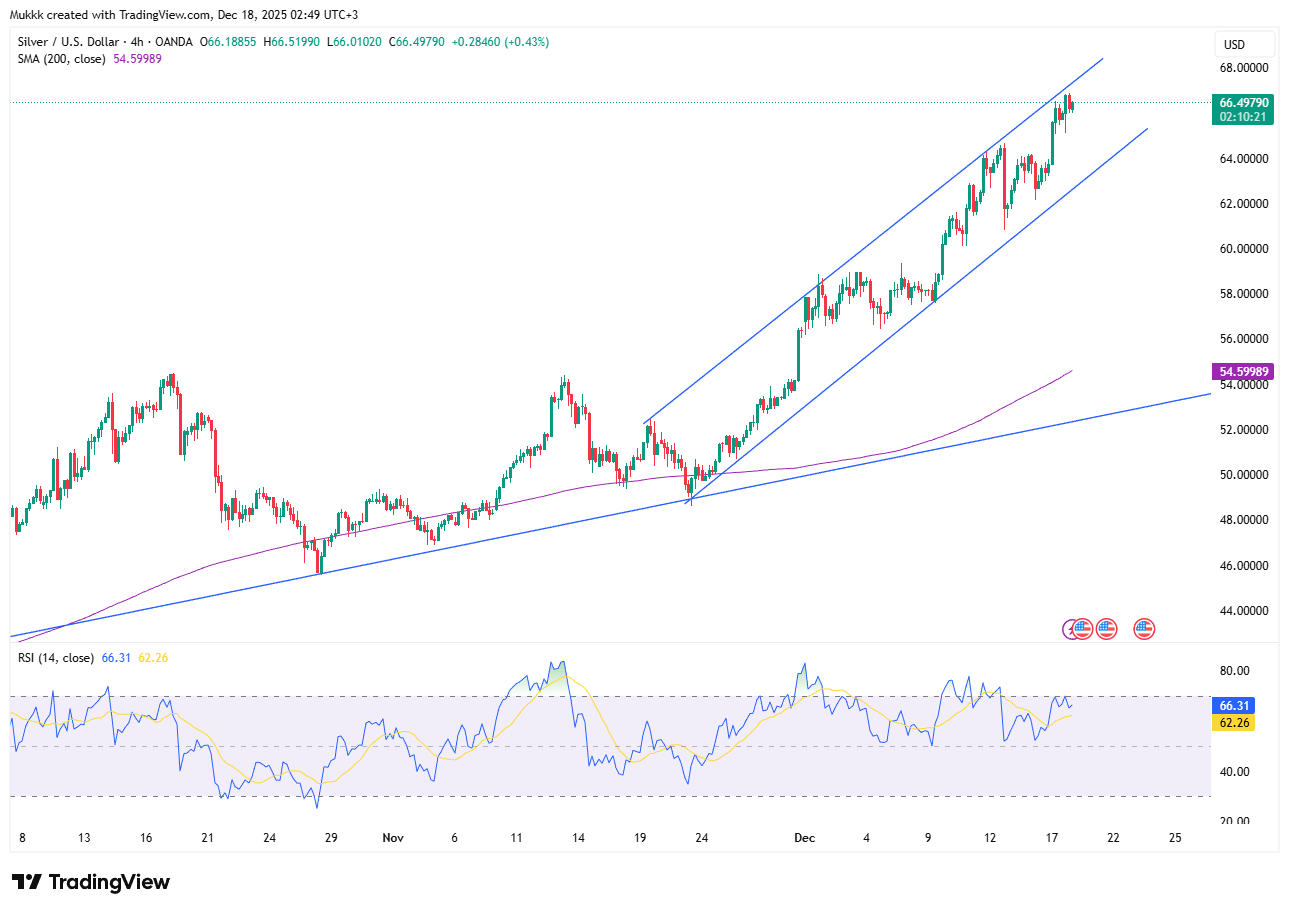

Silver prices surged past $66 per ounce to new record highs as investors bet on two Federal Reserve rate cuts in 2026. The rally intensified following remarks from Fed Governor Christopher Waller, a leading candidate for the central bank chairmanship. Waller argued that U.S. borrowing costs remain too restrictive and should be one percentage point lower. He warned that job growth has stalled near zero, necessitating a gradual easing cycle next year to protect the softening labor market.

From a technical view, resistance stands near $67.00 while support is located around $64.50.

| R1: 67.00 | S1: 64.50 |

| R2: 68.50 | S2: 62.80 |

| R3: 70.00 | S3: 60.90 |

The euro held above 1.17 near multi-month highs as stable ECB policy, improved growth forecasts, and softer US inflation supported the single currency.

Global commodity markets rose on geopolitical tensions, with Brent crude holding near $62 per barrel as US intervention in Venezuelan oil and Black Sea infrastructure attacks offset rising US inventories.

EUR/USD extended its advance toward 1.1780, maintaining a strong bullish structure despite momentum nearing overbought levels.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!