EUR/USD held near 1.0820 as higher U.S. yields and German fiscal suspense weighed on the euro.

The yen weakened toward 150 after disappointing Japanese business activity data, despite expectations for future BOJ rate hikes. Gold dipped to $3,015 on peace hopes in Ukraine but remained supported by Fed rate cut prospects and Gaza tensions. GBP/USD steadied at 1.2915 on dollar weakness and UK stability, while silver traded near $33.06, with gains capped by a strong dollar and weak industrial outlook from China.

| Time | Cur. | Event | Forecast | Previous |

| 13:45 | USD | S&P Global Manufacturing PMI (Mar) | 51.9 | 52.7 |

| 13:45 | USD | S&P Global Services PMI (Mar) | 51.2 | 51.0 |

| 17:45 | USD | FOMC Member Bostic Speaks |

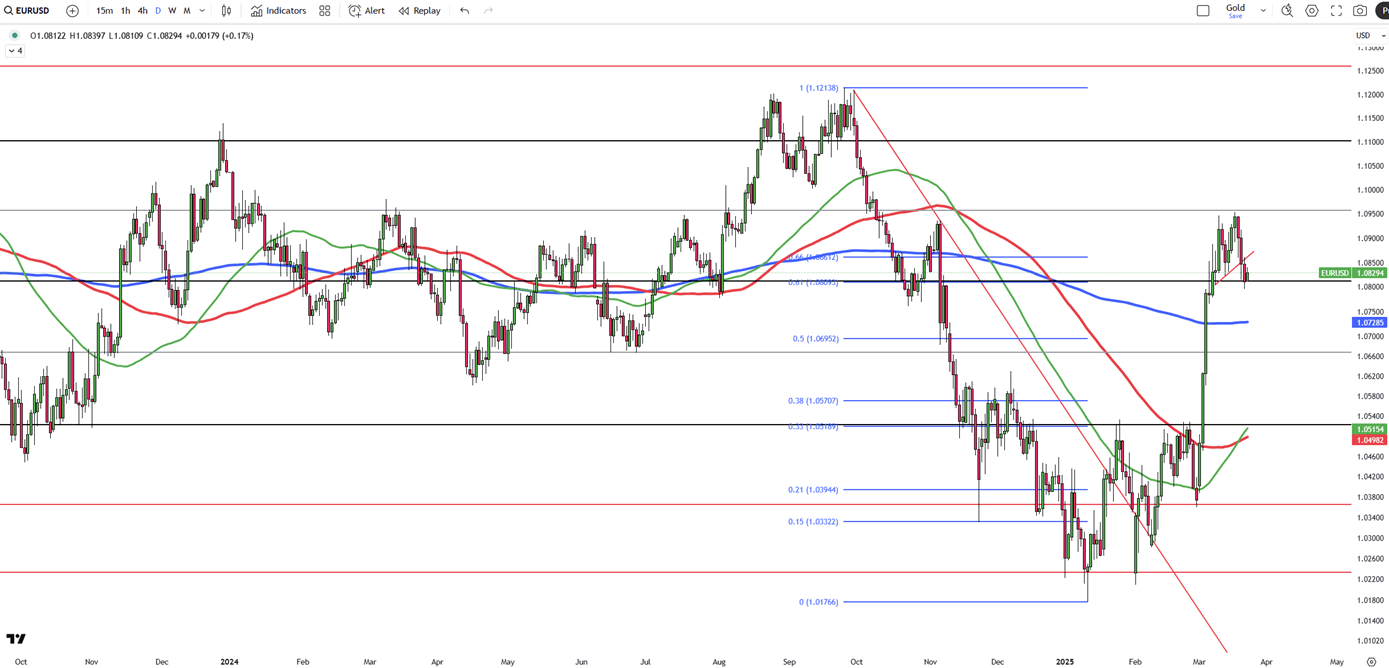

EUR/USD is trading around 1.0820 on Monday, rebounding slightly from last week’s low of 1.0795. The euro has pulled back from its recent high of 1.0955 with uncertainty over Germany’s fiscal policy and rising global trade tensions.

Caution persists before the April 2 announcement of new U.S. tariffs, which could weigh on the eurozone. Despite the modest recovery, the euro remains under pressure from stronger U.S. Treasury yields and demand for the dollar.

Key resistance is at 1.0860, followed by 1.0950 and 1.1000. Support stands at 1.0800, with further levels at 1.0730 and 1.0670.

| R1: 1.0860 | S1: 1.0800 |

| R2: 1.0950 | S2: 1.0730 |

| R3: 1.1000 | S3: 1.0670 |

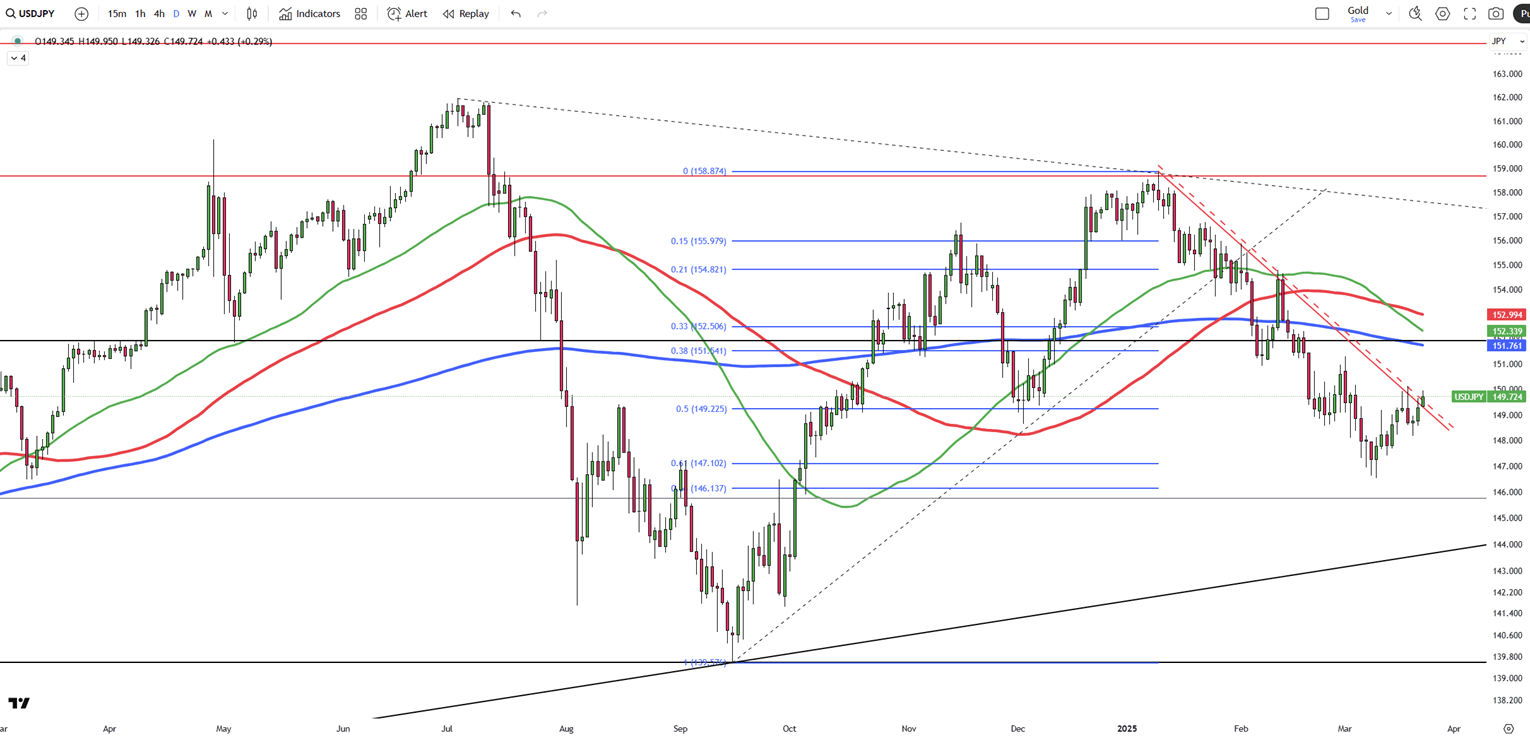

The Japanese yen weakened toward 150 per dollar, extending losses as disappointing business activity data overshadowed the BOJ’s hawkish stance. Japan’s private sector contracted in March for the first time in five months, with manufacturing shrinking for a ninth month and services slipping into negative territory.

While the BOJ kept its policy rate at 0.5% last week and maintained a careful tone before Trump’s predicted April 2 tariff announcement, the central bank is still expected to raise rates later this year due to steady inflation and wage growth. Ongoing external pressures also continued to weigh on the yen.

Key resistance is at 150.30, with further levels at 152.00 and 154.90. Support stands at 147.00, followed by 145.80 and 143.00.

| R1: 150.30 | S1: 147.00 |

| R2: 152.00 | S2: 145.80 |

| R3: 154.90 | S3: 143.00 |

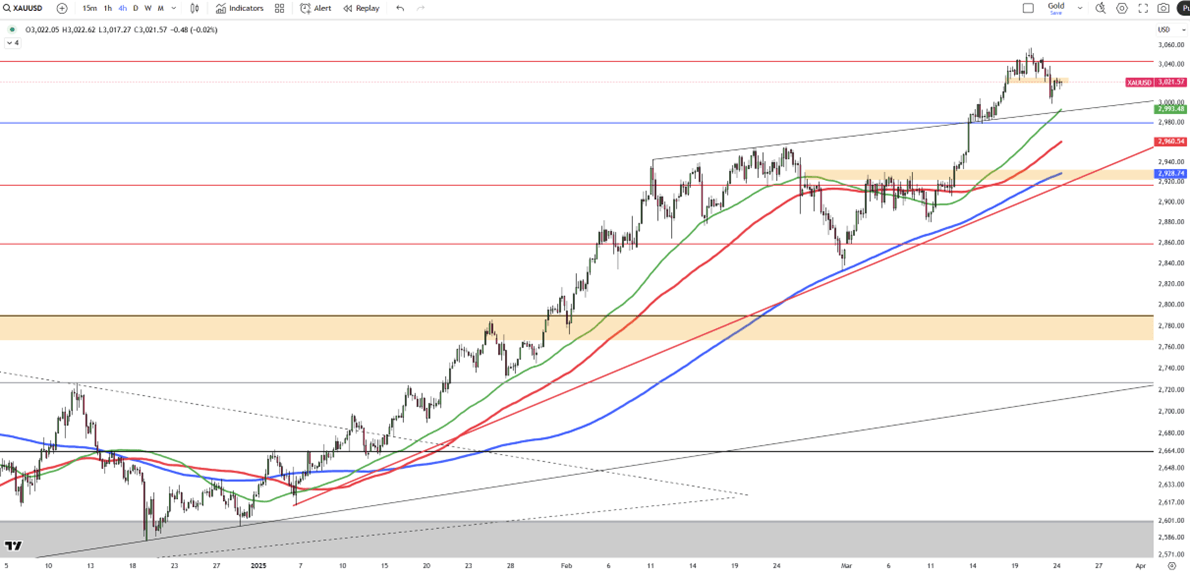

Gold dipped to around $3,015 per ounce as hopes for a Russia-Ukraine peace deal grew after talks between Ukrainian and U.S. officials. Further negotiations with Russia are expected later today.

Despite the drop, gold remains supported by the tension over U.S. tariffs and Fed rate cut expectations. The Fed kept rates steady last week while signaling two potential cuts this year. Meanwhile, geopolitical pressures remain high as Israel resumed airstrikes on Hamas targets in Gaza.

Key resistance stands at $3082, with further levels at $3100 and $3,150. Support is at $3000, followed by $2,980 and $2,916.

| R1: 3082 | S1: 3000 |

| R2: 3100 | S2: 2980 |

| R3: 3150 | S3: 2916 |

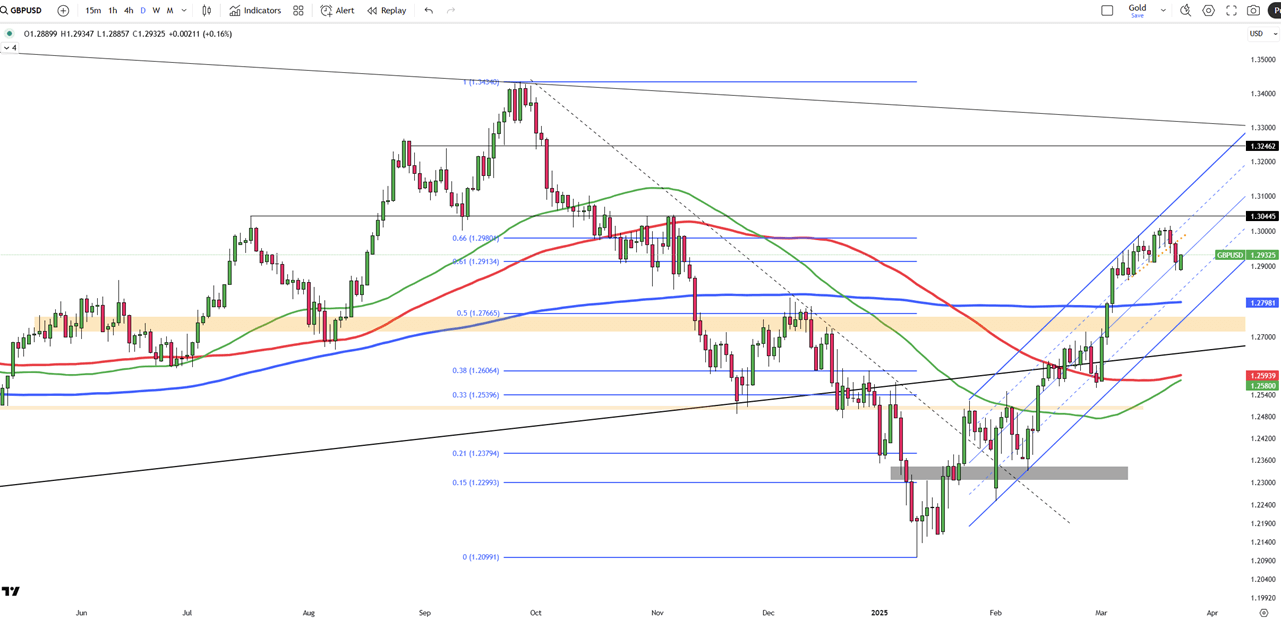

GBP/USD is trading around 1.2915, supported by a weaker U.S. dollar and steady investor sentiment. The pound benefits from political stability and steady UK economic expectations with the focus on the upcoming April 2 U.S. tariff announcement. The pair is rebounding from recent lows but remains range-bound as traders await new drivers, especially from U.S. trade actions and global growth indicators.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

| R1: 1.3050 | S1: 1.2860 |

| R2: 1.3100 | S2: 1.2800 |

| R3: 1.3150 | S3: 1.2715 |

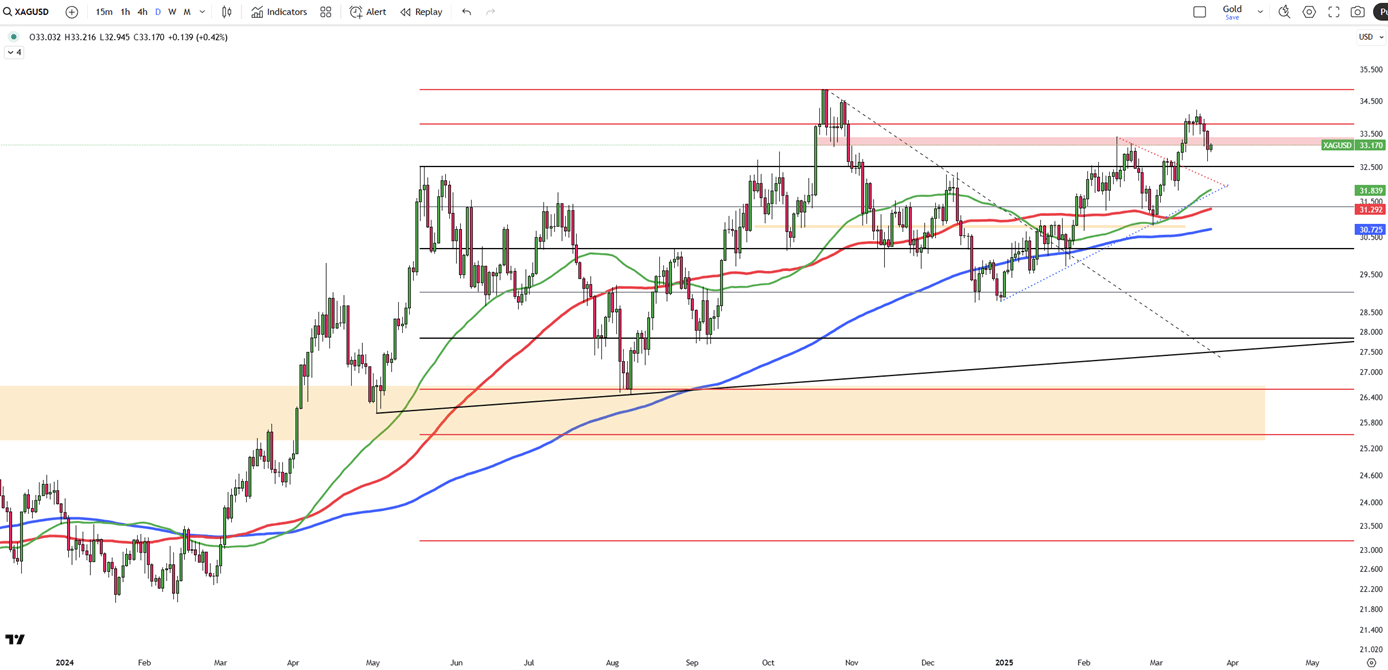

Posting a modest rebound after last week’s dip, silver currently trades around $33.06 per ounce. The recovery is limited as easing geopolitical tensions compete with the pressure from a strong U.S. dollar. Demand stays strong due to tariff uncertainty and inflation risks, but weak industrial outlook, mainly from China, and hopes for a Russia-Ukraine ceasefire are limiting silver’s gains. Still, tightening supply and global economic concerns are helping keep silver near five-month highs.

If silver breaks above $33.75, the next resistance levels are $34.05 and $34.85. On the downside, support is at $33.10, with further levels at $32.50 and $32.15 if selling pressure increases.

| R1: 33.75 | S1: 33.10 |

| R2: 34.05 | S2: 32.50 |

| R3: 34.85 | S3: 32.15 |

Russia-Ukraine peace efforts remain stalled.

Detail Trump Pressures Fed as Dollar Slips After Cut (12.11.2025)The Federal Reserve ended 2025 with a 25-bps cut to 3.50-3.75%, maintaining guidance for one cut in 2026.

Detail Fed Day Takes Shape, Chair Decision Nears (12.10.2025)Income strategies are under pressure as lower yields reduce the appeal of short-term Treasuries, pushing investors toward riskier segments such as high yield, emerging-market debt, private credit, and catastrophe bonds.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!