The euro and silver climbed on Monday as weak U.S. jobs data increased expectations for a September Fed rate cut. Nonfarm payrolls came in far below forecasts, while prior months saw downward revisions. The soft data pushed odds of a rate cut to 75%, weakening the dollar and lifting risk-sensitive assets.

The pound rebounded after six days of losses, while gold pulled back slightly after Friday’s sharp rally. Meanwhile, the Japanese yen slipped to a four-month low as new U.S. tariff measures added pressure.

| Time | Cur. | Event | Forecast | Previous |

| 17:00 | USD | Factory Orders (Jun) | -4.9% | 8.2% |

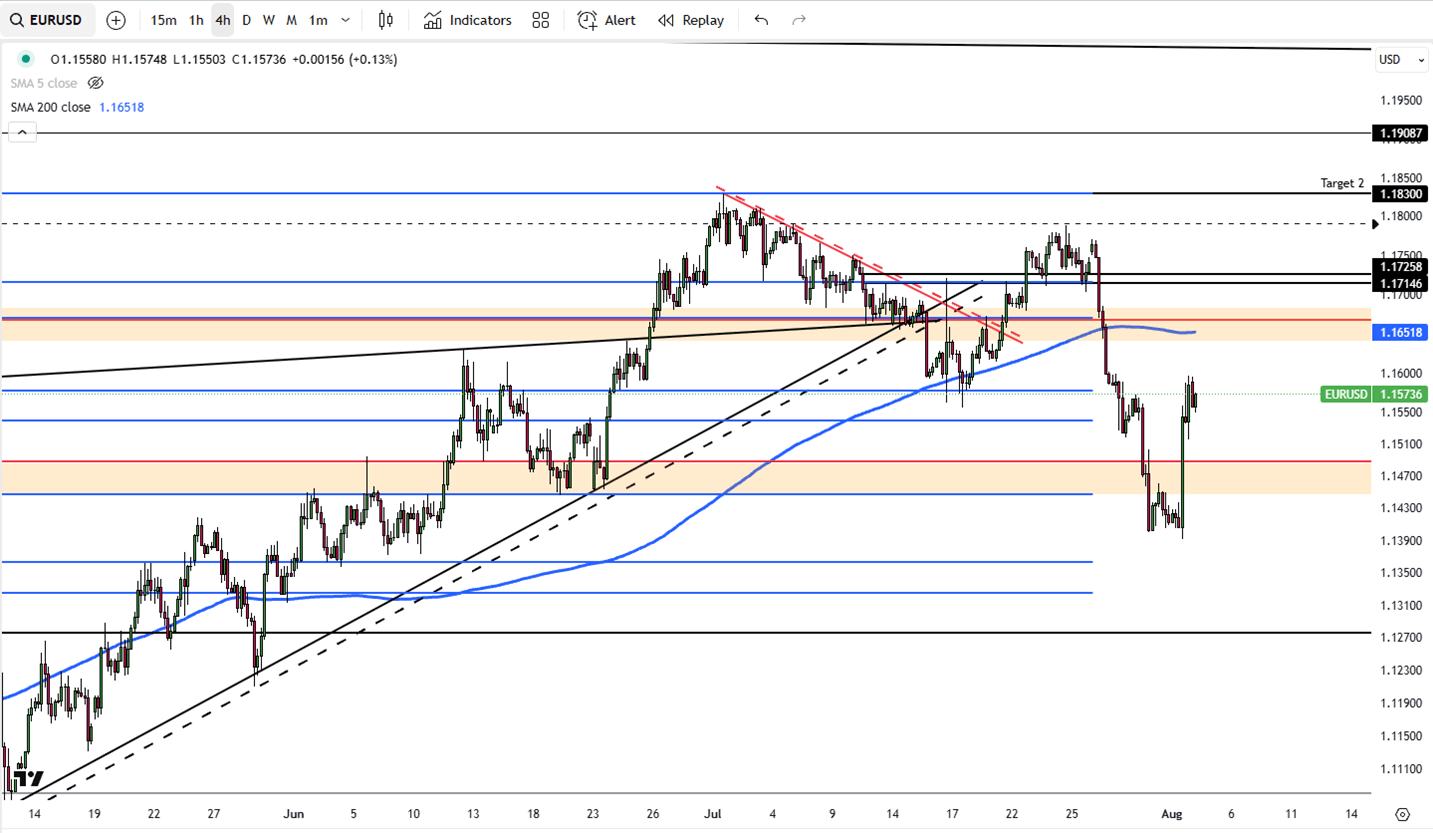

The euro rose back above $1.15 after hitting a seven-week low of $1.139, supported by a weaker U.S. jobs report. July’s nonfarm payrolls increased by just 73,000, well below the 100,000 estimate, and figures from earlier months were revised downward. This lifted the chances of a Fed rate cut in September to 75%, up from 45%. Meanwhile, the ECB is under less pressure to ease policy, as eurozone inflation held at 2.0% in July, slightly above the expected 1.9%. Still, markets now price in a 60% chance of a 25 basis point cut by December, up from 50%. New U.S. tariffs on EU exports also weighed on sentiment.

EUR/USD faces resistance at 1.1660, with support at 1.1500.

| R1: 1.1660 | S1: 1.1500 |

| R2: 1.1725 | S2: 1.1350 |

| R3: 1.1830 | S3: 1.1275 |

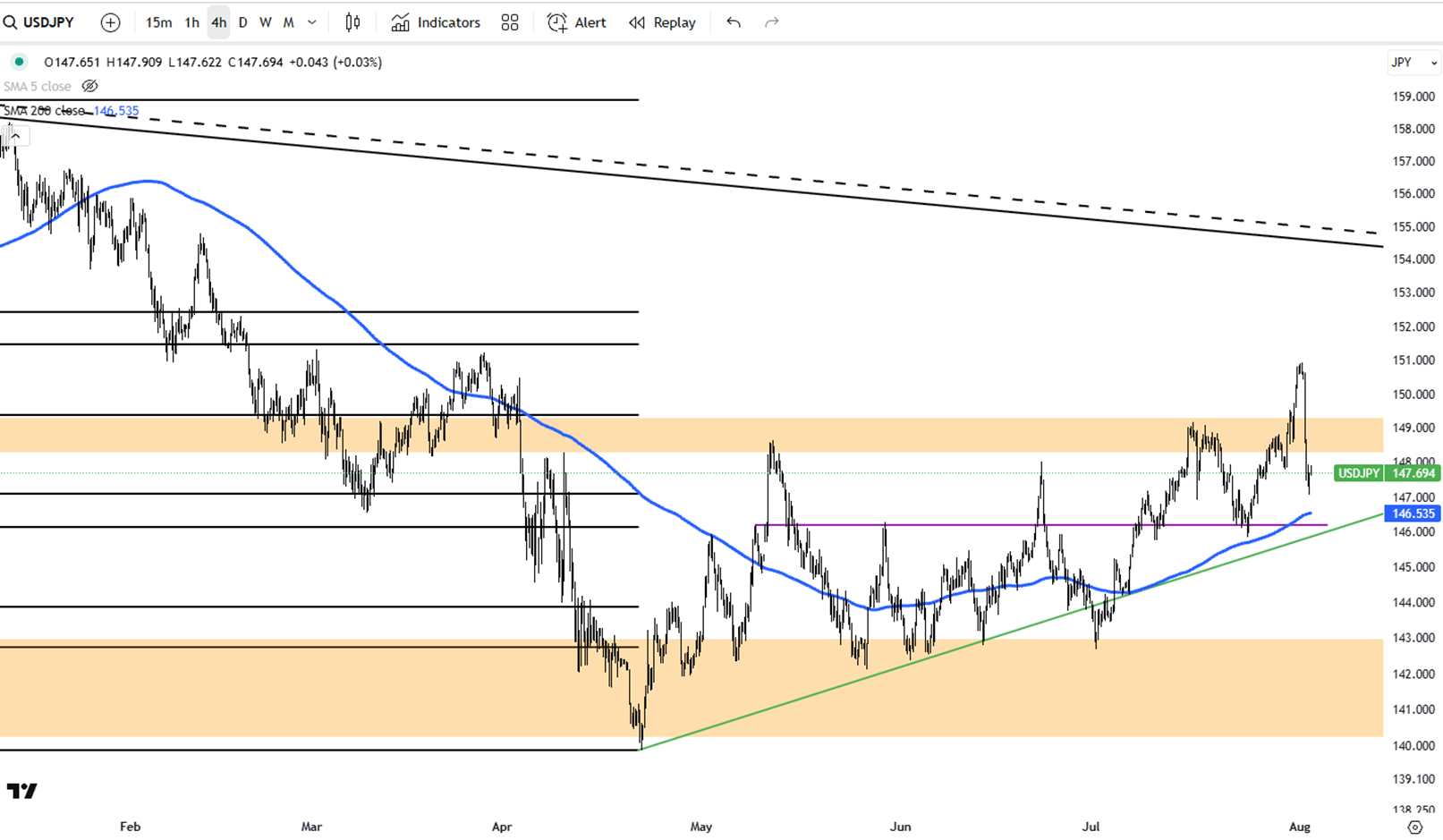

The Japanese yen hovered around 150.7 per dollar on Friday, marking its lowest level in four months, as the dollar stayed firm following President Trump’s latest tariff announcements. He confirmed a 10% global tariff, introduced tariffs of up to 41% on countries without trade agreements, and set a 40% tariff on transshipped goods, intensifying trade tensions and rising demand for the dollar. The Bank of Japan held interest rates steady but raised its inflation outlook, while cautioning about short-term inflation fluctuations and ongoing global trade risks. Weaker external demand and restrictive U.S. monetary policy also added pressure on the yen.

The pair is seeing resistance at 148.50, with support at 146.00.

| R1: 148.50 | S1: 146.00 |

| R2: 151.50 | S2: 143.00 |

| R3: 152.40 | S3: 140.00 |

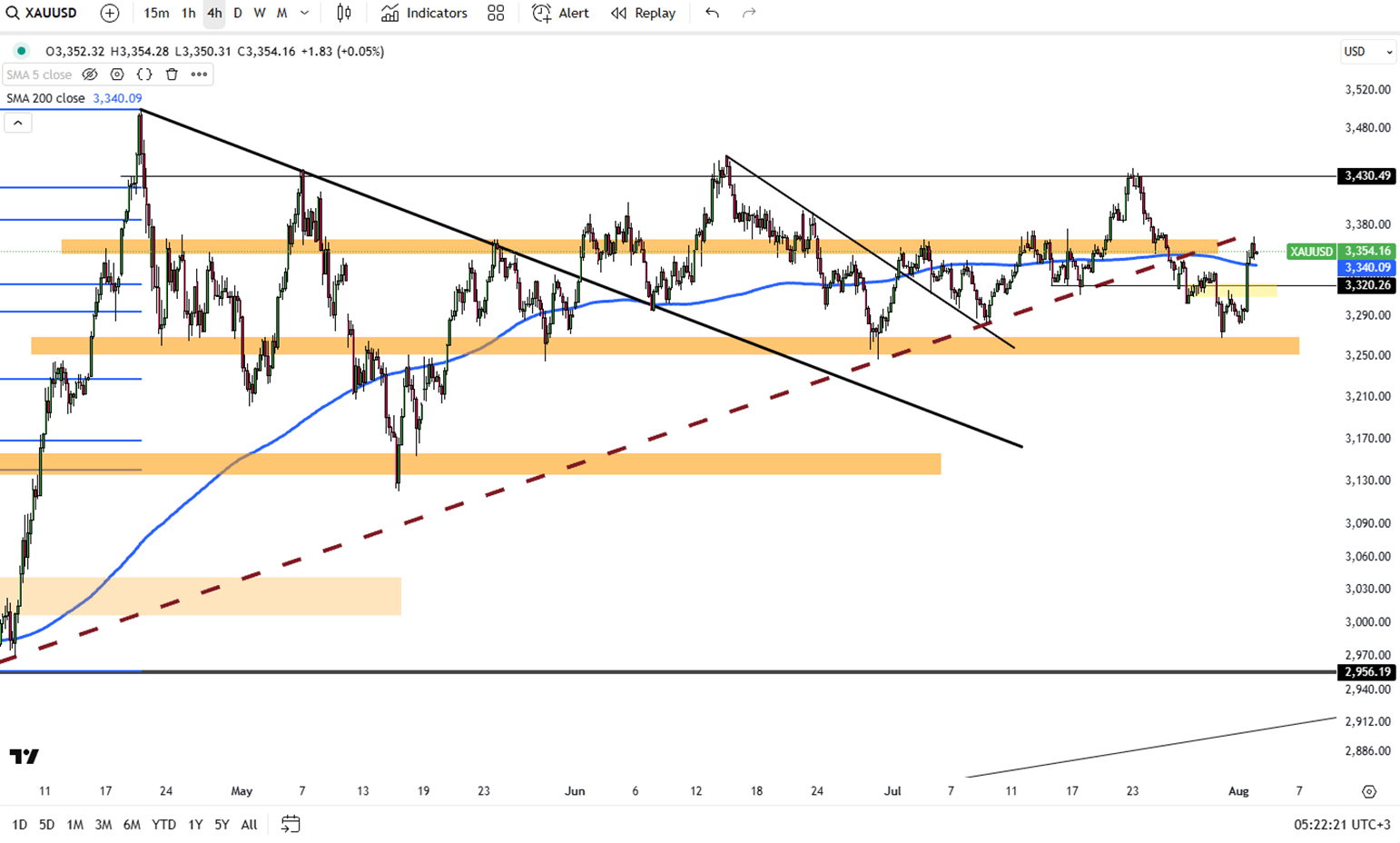

Gold eased to around $3,360 per ounce on Monday after rising 2.2% on Friday, marking its strongest daily gain since early June. The rally was driven by safe-haven demand following President Trump’s announcement of wide-ranging tariffs, ranging from 10% to 41%, on imports from several countries starting August 7. Softer U.S. jobs data also strengthened expectations for a Fed rate cut in September. Investors are now weighing these factors against the Fed’s policy direction.

Gold is testing resistance at $3,367, with support at $3,320.

| R1: 3367 | S1: 3320 |

| R2: 3430 | S2: 3270 |

| R3: 3500 | S3: 3250 |

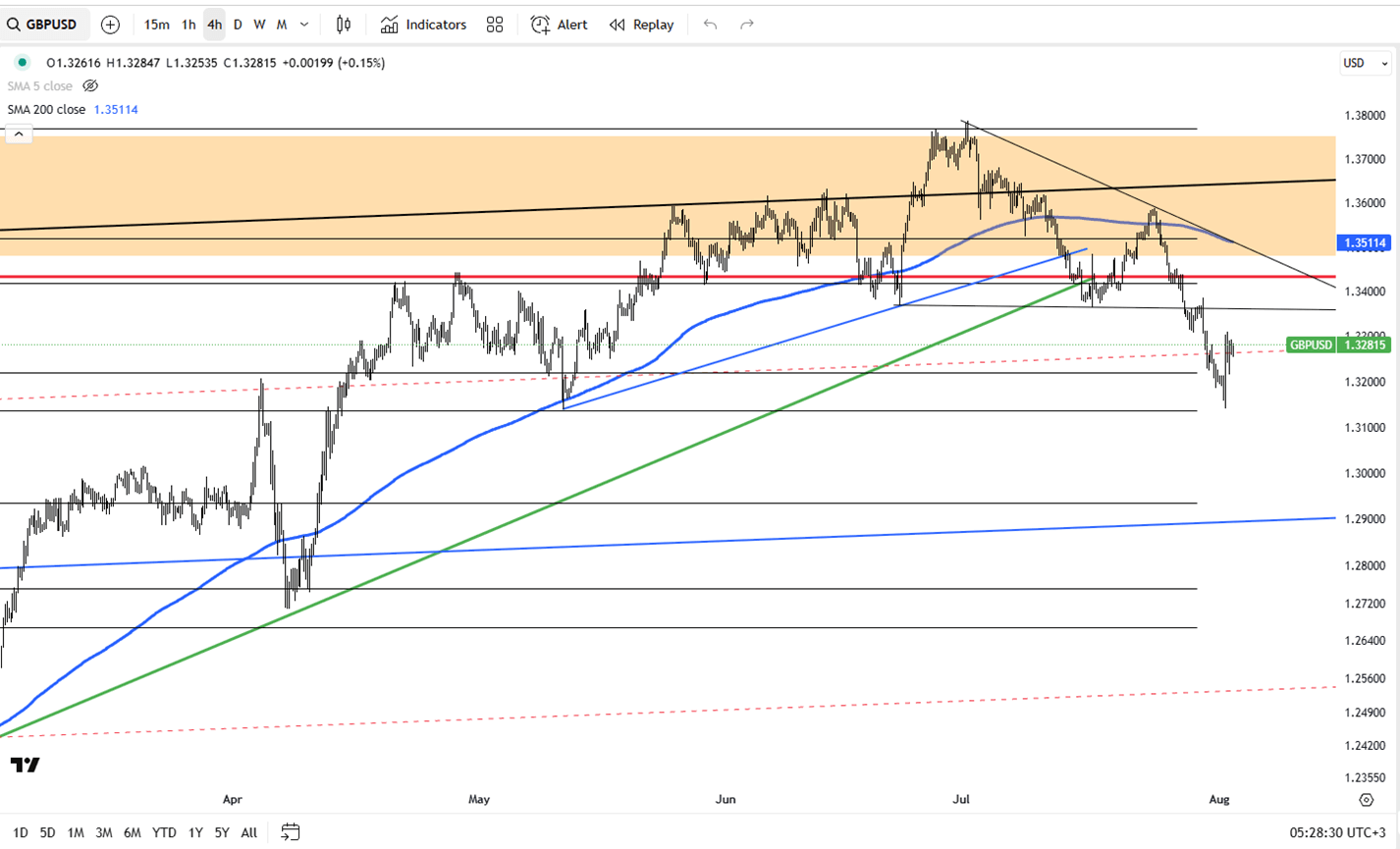

GBP/USD moves higher, climbing above 1.3250 after six consecutive days of losses. The recovery is supported by a softer U.S. dollar, as disappointing Nonfarm Payrolls and Manufacturing PMI figures ease pressure and help the pair regain part of its recent decline.

The pair faces resistance at 1.3310, with initial support at 1.3270.

| R1: 1.3310 | S1: 1.3270 |

| R2: 1.3480 | S2: 1.3140 |

| R3: 1.3600 | S3: 1.3000 |

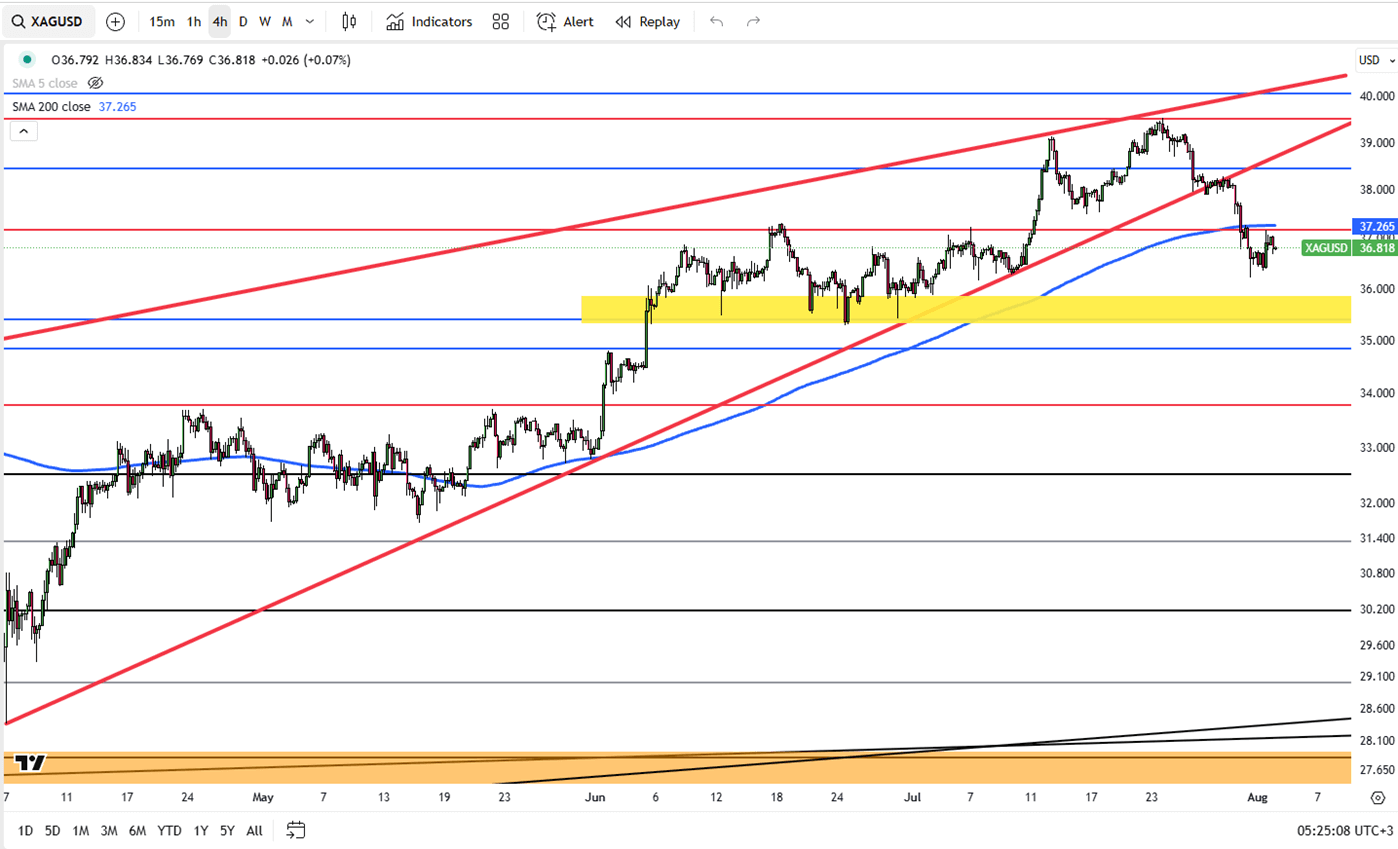

Silver gained more than 1%, moving above $37 per ounce, supported by growing expectations of a Fed rate cut in September after a weaker U.S. jobs report. July added only 73,000 jobs, well below the 100,000 estimate, and previous data was revised down. This raised the likelihood of a rate cut to 75%. At the same time, persistent inflation concerns and rising trade tensions, driven by Trump’s new tariffs of up to 41%, added to market uncertainty and increased demand for precious metals.

Silver faces resistance at $37.40, with support at $36.25.

| R1: 37.40 | S1: 36.25 |

| R2: 39.50 | S2: 35.50 |

| R3: 40.10 | S3: 33.90 |

Russia-Ukraine peace efforts remain stalled.

Detail Trump Pressures Fed as Dollar Slips After Cut (12.11.2025)The Federal Reserve ended 2025 with a 25-bps cut to 3.50-3.75%, maintaining guidance for one cut in 2026.

Detail Fed Day Takes Shape, Chair Decision Nears (12.10.2025)Income strategies are under pressure as lower yields reduce the appeal of short-term Treasuries, pushing investors toward riskier segments such as high yield, emerging-market debt, private credit, and catastrophe bonds.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!