Markets traded cautiously positive on Thursday, driven by rising expectations of a December Fed rate cut. EUR/USD broke above 1.1600 for a fourth session higher, while GBP/USD climbed past 1.3250 after the OBR reported downgraded growth but £22B in fiscal headroom.

Gold held near $4,150 and silver hovered just under $53 as rate-cut odds surged to about 85%. The yen strengthened past 156 per dollar on renewed intervention speculation.

| Time | Cur. | Event | Forecast | Previous |

| United States - Thanksgiving Day |

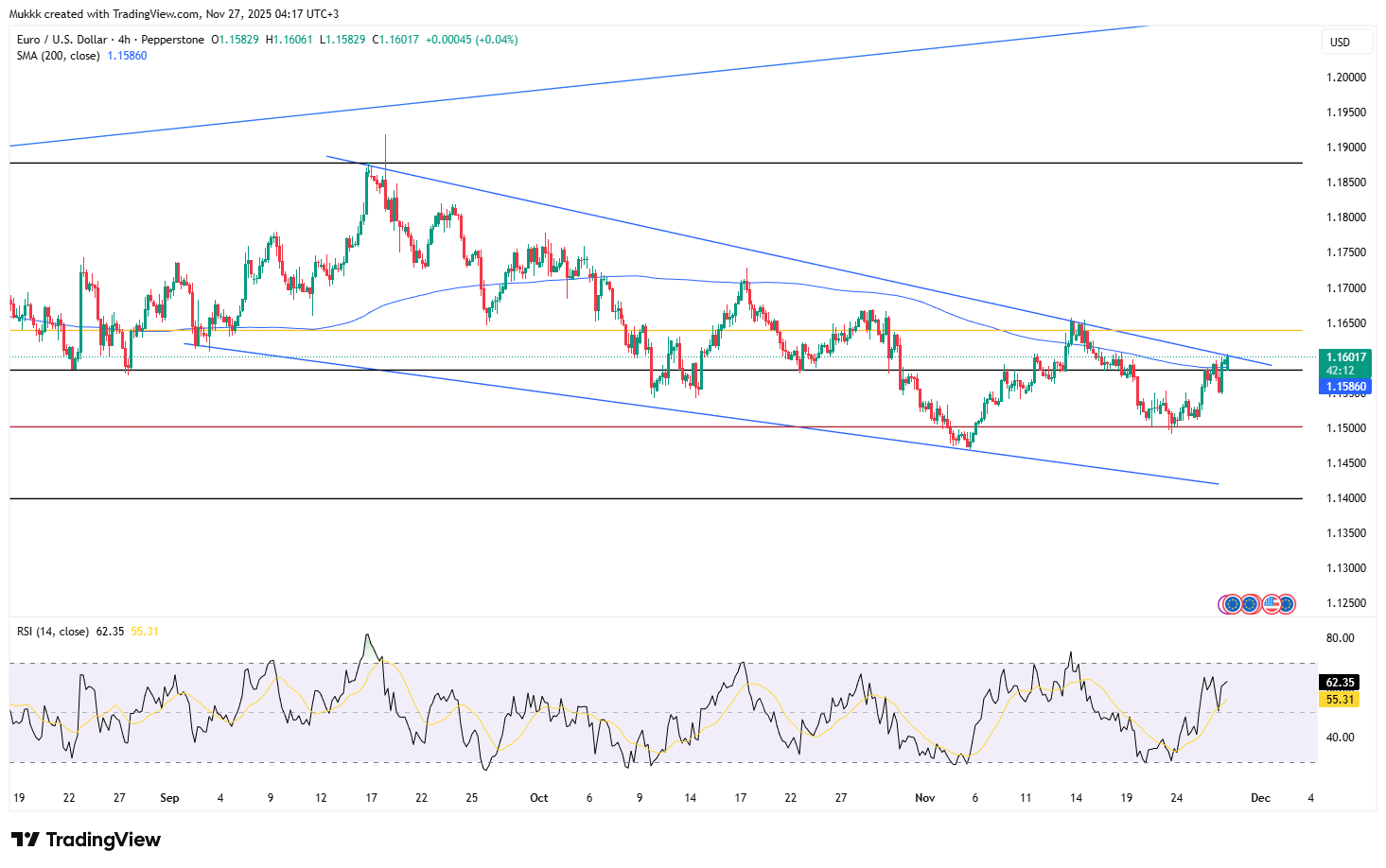

EUR/USD rose for a fourth straight session on Thursday, pushing above 1.1600 to its highest level in roughly ten days during Asian hours. The ECB is widely expected to keep rates unchanged through 2026, backed by steady growth and inflation near target. Officials described policy as “in a good place,” though some warned that price pressures in groceries and services remain sticky, with Joachim Nagel highlighting the need for continued caution.

Technically, 1.1510 is the key support, while resistance is seen at 1.1625.

| R1: 1.1625 | S1: 1.1510 |

| R2: 1.1670 | S2: 1.1420 |

| R3: 1.1750 | S3: 1.1390 |

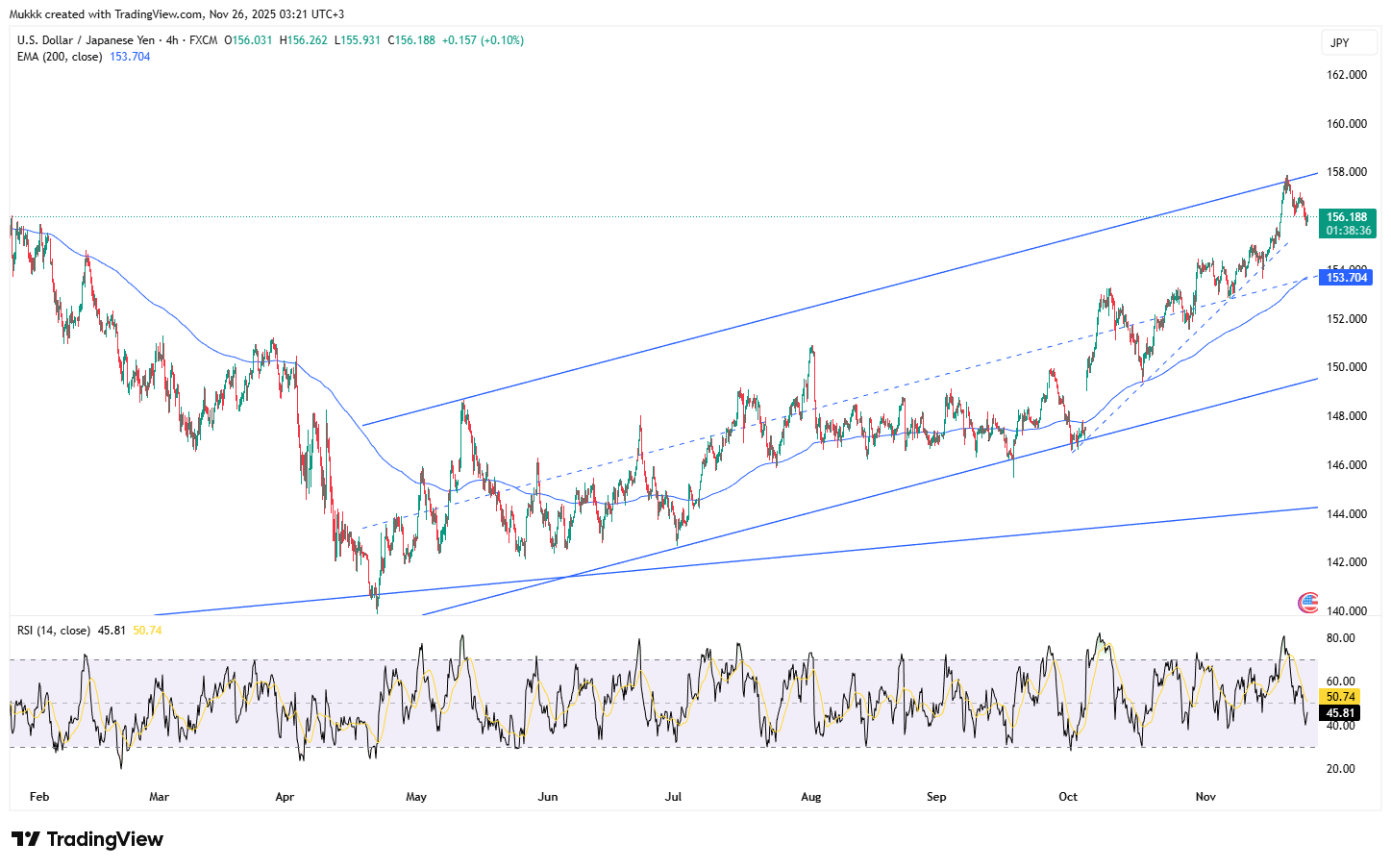

The Japanese yen climbed past 156 per dollar on Thursday, recovering the previous session’s losses as investors kept a close watch for potential currency intervention by authorities. With the US Thanksgiving holiday creating a possible opening for action, traders noted that even the threat of intervention has been enough to limit the yen’s latest weakness.

Technically, resistance stands near 157.95, while support is firm at 155.20.

| R1: 157.95 | S1: 155.20 |

| R2: 160.15 | S2: 153.65 |

| R3: 161.20 | S3: 151.60 |

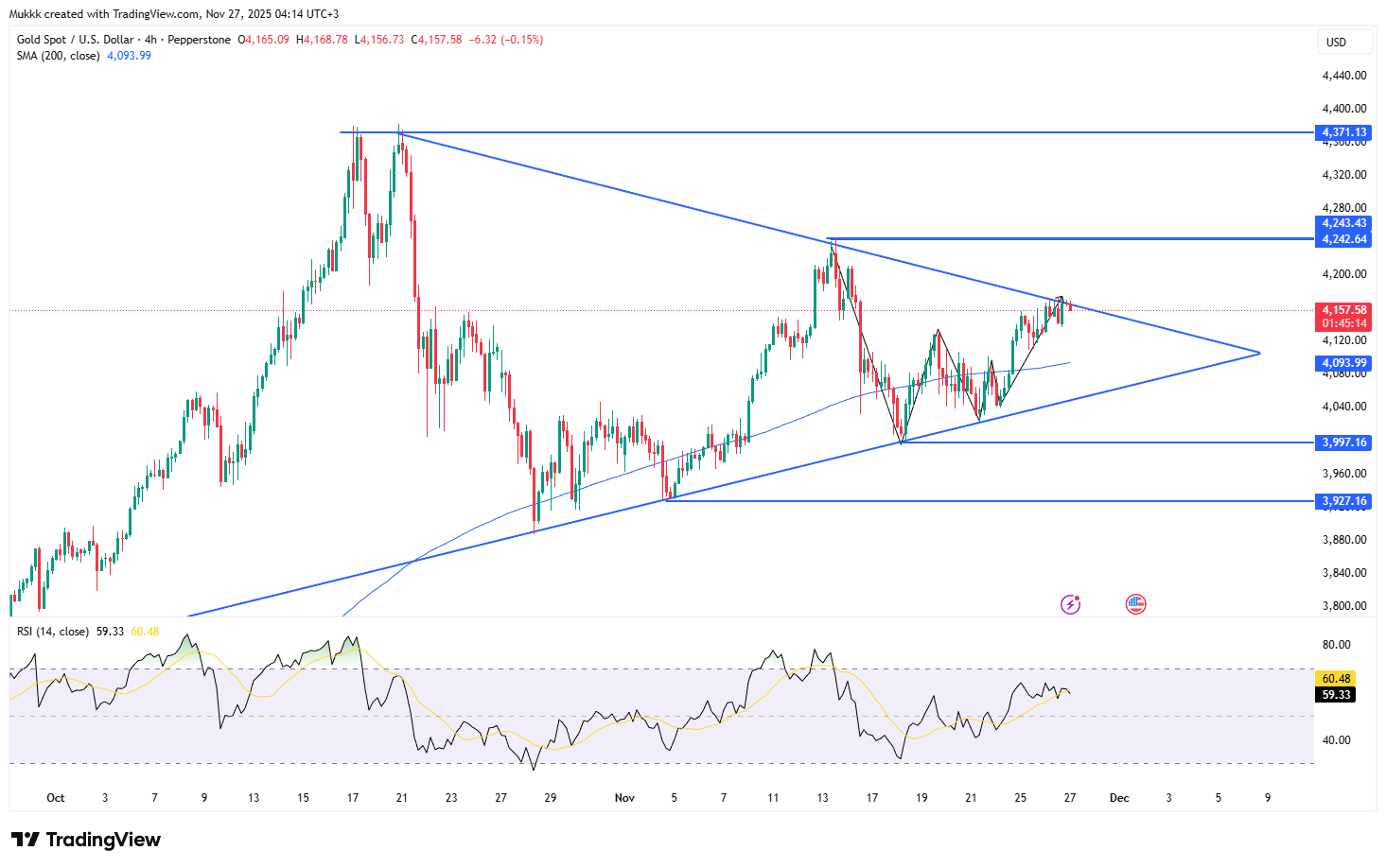

Gold eased toward $4,150 per ounce on Thursday but remained close to a two-week high as markets continued to price in a potential Fed rate cut next month. Expectations of policy easing strengthened further after reports suggested President Donald Trump’s economic adviser Kevin Hassett is the frontrunner for the next Fed chair, raising speculation that US policy could turn more accommodative.

From a technical view, support is seen near $4090, while resistance is positioned around $4200.

| R1: 4200 | S1: 4090 |

| R2: 4240 | S2: 4010 |

| R3: 4380 | S3: 3950 |

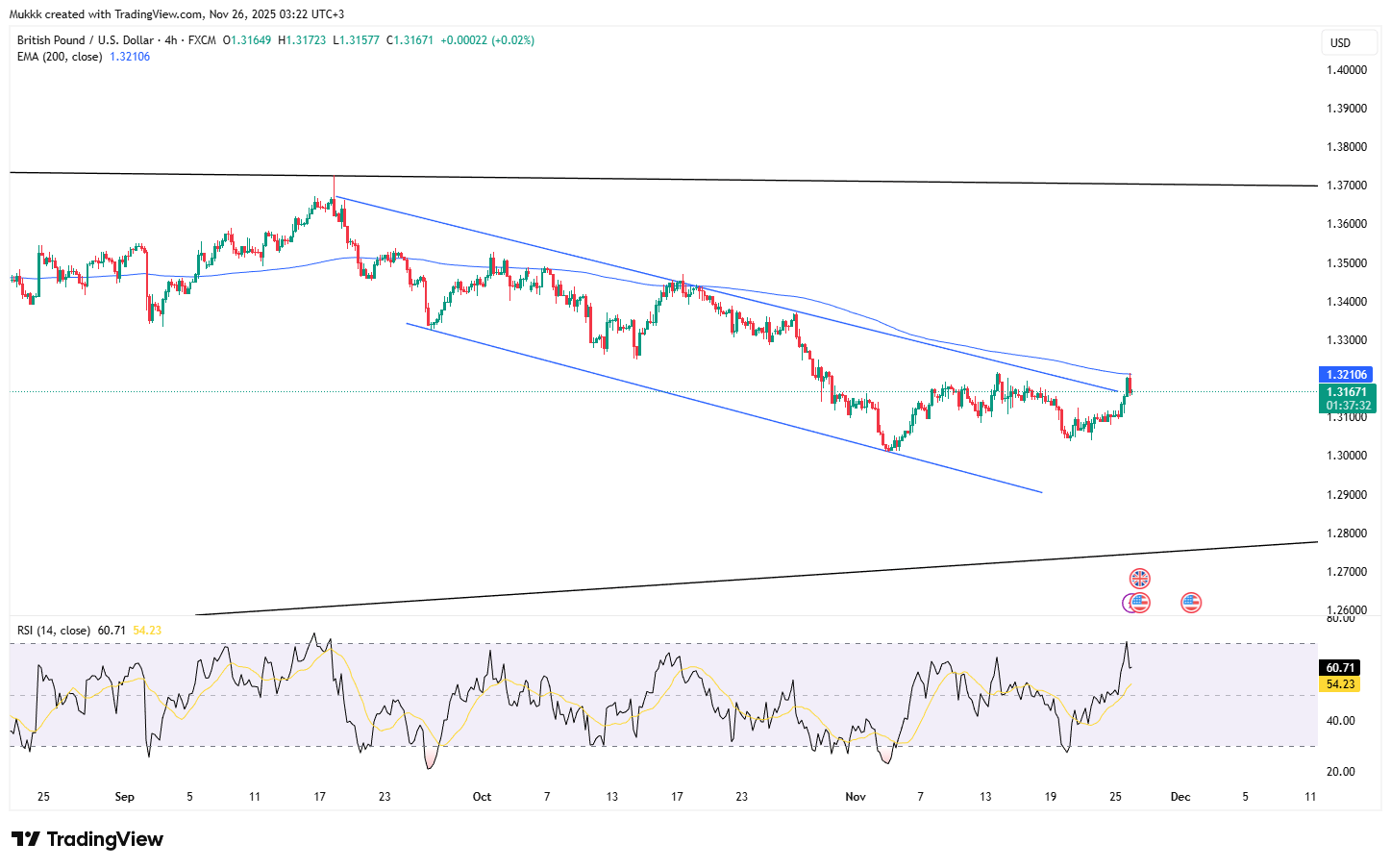

GBP/USD rose for a fifth consecutive session in Asian trade on Thursday, gaining around 0.10% and moving beyond 1.3250. The pair is now nearing key long-term moving averages, bringing major resistance zones into view. Sentiment improved after the Office for Budget Responsibility report, which showed weaker growth expectations but a stronger £22 billion fiscal buffer, prompting renewed buying interest in the Pound.

From a technical view, support stands near 1.3180, with resistance around 1.3290.

| R1: 1.3290 | S1: 1.3180 |

| R2: 1.3360 | S2: 1.3050 |

| R3: 1.3500 | S3: 1.2890 |

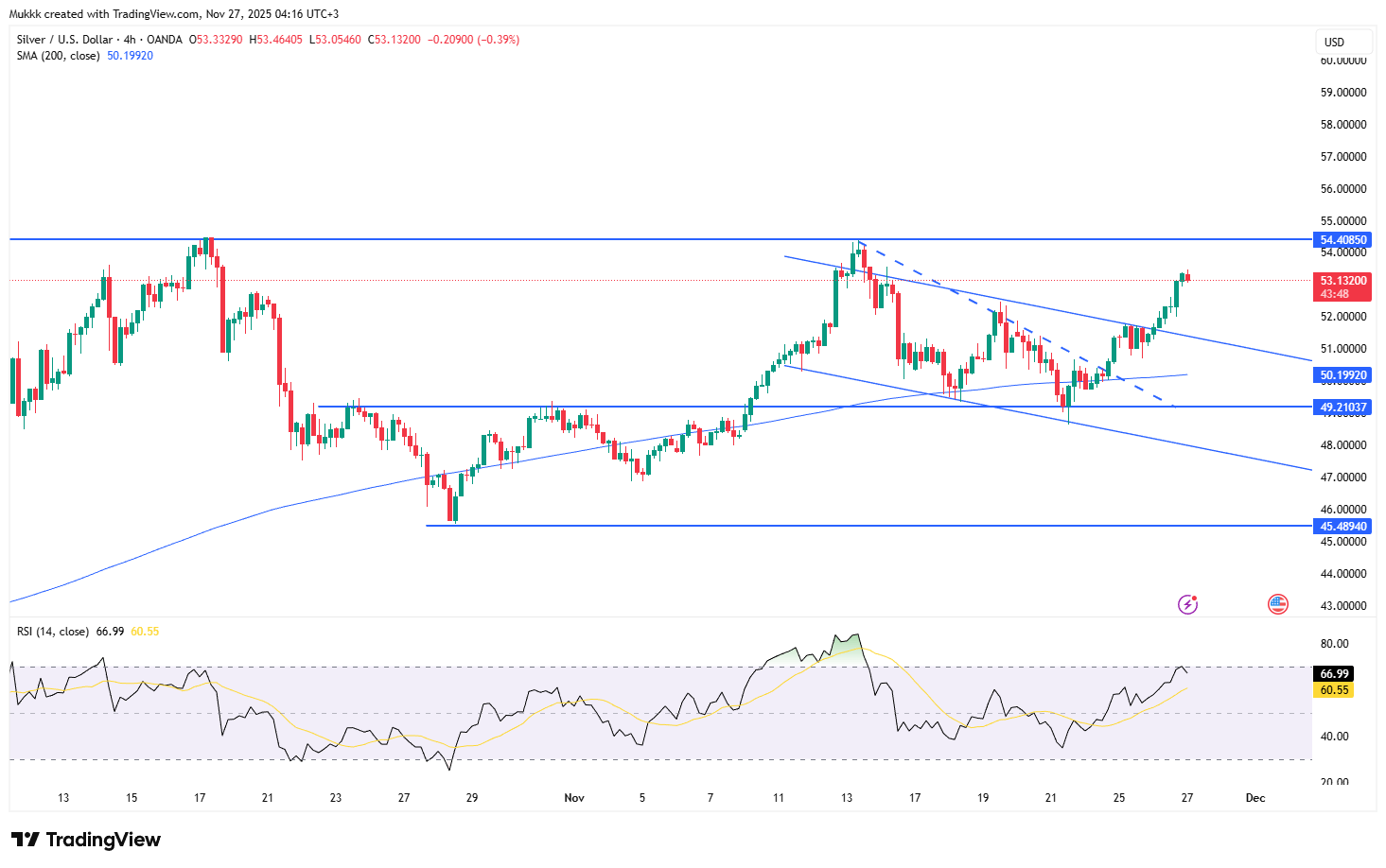

Silver held just below $53 per ounce on Thursday, trading near record levels as expectations for further Federal Reserve easing increased strongly. Markets now price about an 85% chance of a 25 bp cut in December, compared with roughly 30% a week earlier, and investors are also looking for three additional cuts by late 2026.

Technically, resistance is seen around $53.50, with support near $51.50.

| R1: 53.50 | S1: 51.50 |

| R2: 54.20 | S2: 50.75 |

| R3: 56.00 | S3: 48.90 |

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

After Khamenei: Who Will Lead Iran Next?

After Khamenei: Who Will Lead Iran Next?Following the death of Supreme Leader Ali Khamenei, Iran has entered a pivotal transition phase. Senior officials in Tehran are acting swiftly to uphold the existing structure of the Islamic Republic, prioritizing continuity to head off potential internal instability. Despite these efforts, the sudden leadership vacuum has sparked intense political and military maneuvering behind the scenes.

Detail March Starts With Geopolitical Turmoil (2-6 March)

March Starts With Geopolitical Turmoil (2-6 March)Global markets began the week in a state of high alert following coordinated US and Israeli strikes on Iran over the weekend, which resulted in the death of Supreme Leader Ayatollah Ali Khamenei.

DetailThen Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!