Markets are focused on upcoming US economic data as expectations for Federal Reserve rate cuts continue to impact currencies and commodities. The EUR/USD pair trades around 1.1130, with key support and resistance levels highlighted amid anticipation of the Q2 GDP and jobless claims reports. The USD/JPY remains under pressure near 144.50, influenced by dovish Fed signals and potential BoJ rate hikes. Gold has climbed above $2,510, bolstered by rate cut expectations and rising Chinese imports, while GBP/USD has dropped below 1.3200, reflecting fading bullish momentum. Silver is trading around $29.40, pressured by a stronger dollar, with market attention on forthcoming economic data to gauge the Fed’s rate cut decision.

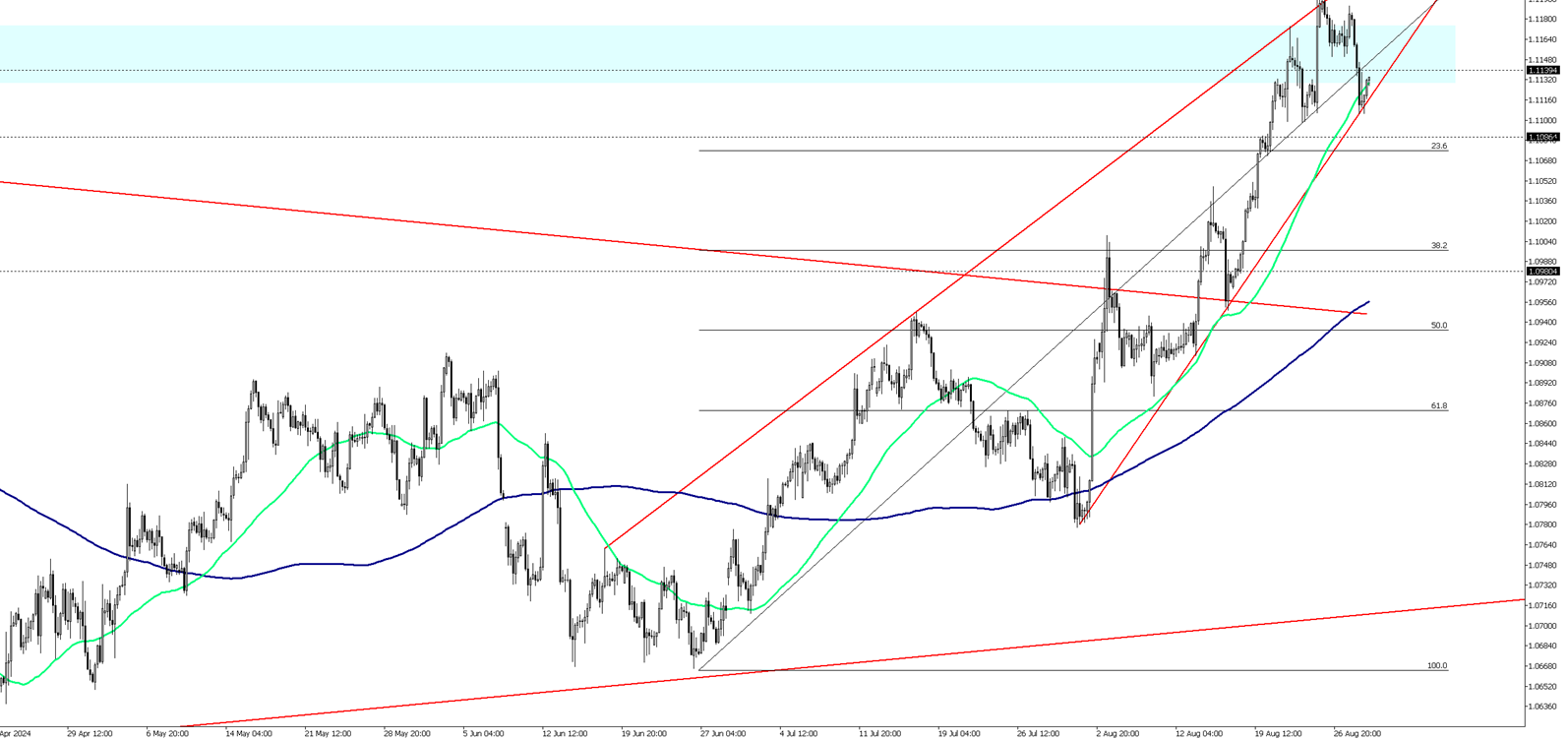

On Thursday, the dollar index traded near 101 after gaining 0.5% in the previous session and the EUR/USD pair trades at 1.1130. Investors are awaiting key US economic data to assess the Federal Reserve's monetary policy direction. Today's releases include the second estimate for Q2 GDP and the latest initial jobless claims, with the Fed’s preferred inflation measure, the PCE price index, due on Friday. Despite this, the dollar index remained close to its lowest levels in 13 months, as expectations mount for the Fed to begin interest rate cuts in September. Fed officials have hinted at imminent rate reductions due to easing inflation and growing labor market concerns, with Fed Chair Jerome Powell stating at Jackson Hole last week that it’s time to adjust policy restrictiveness. Markets are forecasting around 100 basis points in total rate cuts for the year.

In the pair, which has been trading sideways since the beginning of the week, the first support level is at 1.1100. If this level is breached, the next supports to watch will be 1.1060 and 1.1000. On the upside, the first resistance is at 1.1150; if this level is surpassed, the next targets will be 1.1200 and 1.1250.

| R1: 1.1150 | S1: 1.1100 |

| R2: 1.1200 | S2: 1.1060 |

| R3: 1.1250 | S3: 1.1000 |

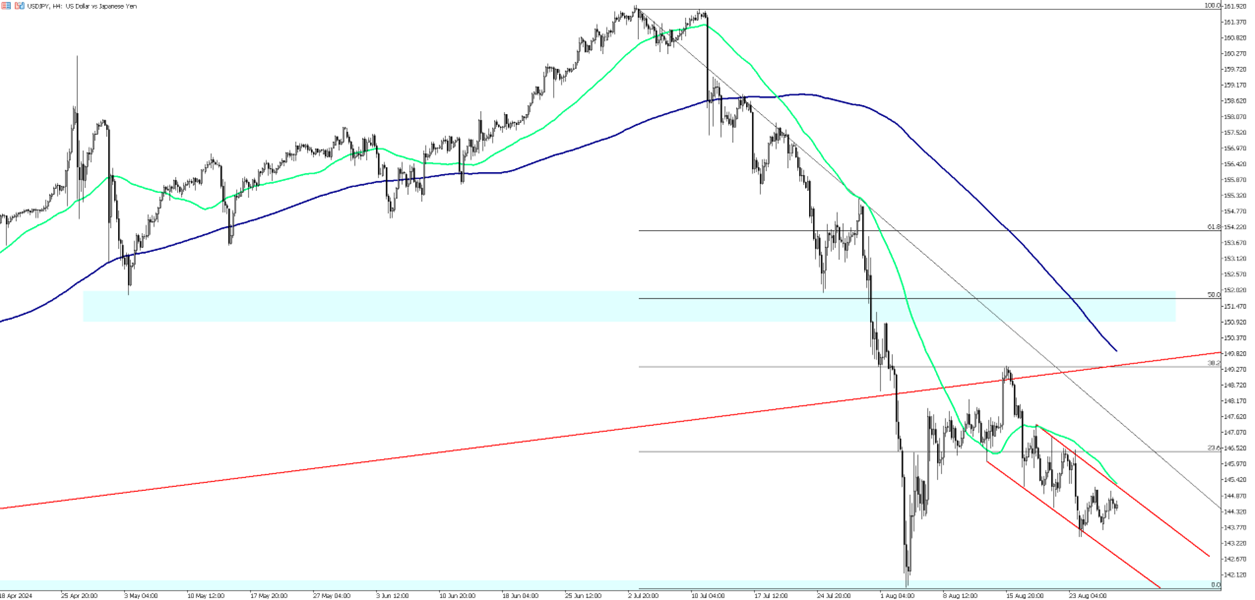

On Thursday, the USD/JPY pair remains under pressure around 144.50 as dovish Federal Reserve comments weigh on the US Dollar. Investors are awaiting the second estimate of US Q2 GDP growth, expected at 2.8%. Bank of Japan Deputy Governor Ryozo Himino indicated that the BoJ will continue rate hikes if inflation stays on track, echoing BoJ Governor Kazuo Ueda's recent remarks. Most economists expect the BoJ to raise rates again this year, likely starting in December. Meanwhile, dovish Fed comments have led markets to fully price in a 25 basis point rate cut in September, with a 36.5% chance of a deeper cut, according to the CME FedWatch Tool.

From a technical perspective, the first resistance level is at 145.15. If this level is surpassed, the next targets will be 145.75 and 146.30. On the downside, the initial support is at 144.30; if this level is breached, the next support levels to watch will be 143.75 and 143.00.

| R1: 145.15 | S1: 144.30 |

| R2: 145.75 | S2: 143.75 |

| R3: 146.30 | S3: 143.00 |

On Thursday, gold climbed above $2,510 per ounce, nearing record highs as expectations of Federal Reserve interest rate cuts continued to encourage the metal. Investors are awaiting further details on the scale of these cuts. Later today, the second estimate for Q2 GDP and the latest initial jobless claims will be released, with the PCE price index report, the Fed's preferred inflation gauge, due on Friday. According to the CME FedWatch Tool, traders are pricing in a 63.5% chance of a 25 basis point cut and a 36.5% chance of a 50 basis point reduction for the anticipated September rate cut. Markets are also anticipating a total of 100 basis points in rate cuts for the remainder of the year, which would lower the opportunity cost of holding non-interest-bearing assets. Additionally, official data showed that China’s net gold imports via Hong Kong rose by 17% in July, marking the first increase since March.

Technically the first support level is at 2,510. If this level is breached, the next supports to watch will be 2,495 and 2,470. On the upside, the initial resistance is at 2,525; if this level is surpassed, the next targets will be 2,550 and 2,585.

| R1: 2525 | S1: 2510 |

| R2: 2550 | S2: 2495 |

| R3: 2585 | S3: 2470 |

On Wednesday, the GBP/USD pair fell back below 1.3200 as immediately bullish momentum faded. Investors have adopted a partial risk appetite while waiting for the Federal Reserve's anticipated rate-cutting cycle to begin in September. With limited UK economic data this week, the Pound Sterling is influenced by broader market sentiment. US GDP figures, scheduled for release on Thursday, are expected to show Q2 annualized growth holding steady near 2.8%, causing minimal movement in the markets. The key focus will be on the US Personal Consumption Expenditure (PCE) price index report due on Friday. Investors are keenly awaiting this data to see if inflation continues to ease or if it rises enough to affect the Fed's planned rate cut on September 18.

For GBP/USD, the initial support lies at 1.3170, followed by 1.3130 and 1.3100 below. On the upside, the first resistance is at 1.3230, with subsequent levels at 1.3265 and 1.3300 if the pair breaks above this resistance.

| R1: 1.3230 | S1: 1.3170 |

| R2: 1.3265 | S2: 1.3130 |

| R3: 1.3300 | S3: 1.3100 |

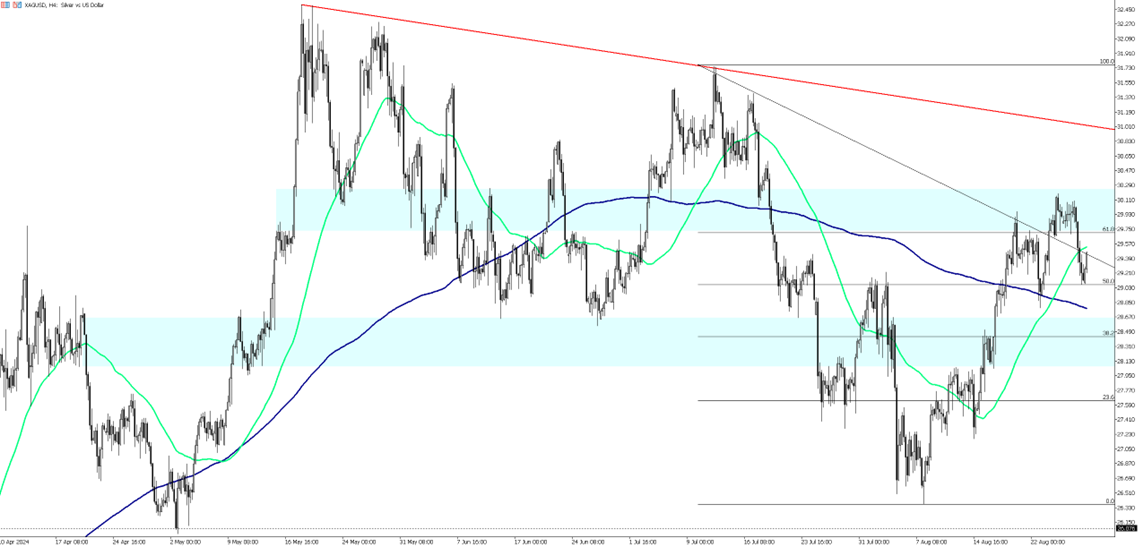

Following the dollar's strength yesterday, silver, like other assets negatively correlated with the dollar, faced selling pressure and is trading around $29.40 on Thursday morning. The direction of both the market and silver will be influenced by US economic data released later today. Jobless claims will provide insights into the labor market, while the GDP data will help determine whether the Fed’s rate cut will be 25 or 50 basis points.

From a technical perspective, silver is currently trapped within a narrow range. The first resistance level to watch is at 29.65. If silver breaks above this level, the next resistance levels to watch will be 30.00 and 30.30, respectively. On the downside, the initial support level is at 29.15, with subsequent support levels at 28.75 and 28.50.

| R1: 29.65 | S1: 29.15 |

| R2: 30.00 | S2: 28.75 |

| R3: 30.30 | S3: 28.50 |

The dollar index stabilized near 98.8 Thursday as a reported U.S. submarine sinking of an Iranian warship near Sri Lanka and the sixth day of the U.S.–Israeli campaign fueled fears of a prolonged, inflationary conflict.

Global markets remain dominated by geopolitical risk as escalating conflict between the United States, Israel, and Iran fuels a strong shift toward safe-haven assets. The dollar index hit 99.3 Wednesday, rising for a third day as conflict concerns fueled inflation and shifted Fed rate cut expectations from July to September.

A US court rejected Trump's tariff refund delay as the Dollar (98.5) and 10 year yield (4.04%) held gains amid Middle East escalation and inflation fears.

Then Join Our Telegram Channel and Subscribe Our Trading Signals Newsletter for Free!

Join Us On Telegram!